- 0xResearch

- Posts

- Retail flow premium

Retail flow premium

Spreads live where retail trades

GM and happy Friday the 13th.

DeFi ripped higher in an otherwise risk-off tape, with Ethereum ecosystem names sharply outperforming as Aave’s new Aave Will Win Framework put full revenue accrual back in focus.

Meanwhile, the copper/gold ratio remains pinned near cycle lows, reinforcing that macro is still defensive.

Today’s deep dive asks a simple question with big implications: Is prediction-market flow inherently more monetizable than perp flow because it is structurally more retail and less efficient?

A sharp rotation into DeFi drove the session today. Lending (+6.8%), DeFi (+5.8%) and Perps (+5.3%) led, while BTC (−1.2%) lagged behind. Macro offered no tailwind, with the S&P 500 (−1.4%) and Nasdaq 100 (−1.6%) both being sold off; Crypto Equities (−7.1%) was one of the worst performers.

The standout split is Ethereum Eco (+6.4%) vs. Solana Eco (−4.2%), a nearly 11% spread.

Within the Ethereum Eco index, AAVE (+6.9%) and ENA (+6.1%) led the charge, with ENA peaking intraday before AAVE surged into the close. Other names, including CRV, LDO, MORPHO and PENDLE, clustered in the 1% to 5% range. UNI was the clear outlier, drawing down as much as 6% before staging a partial recovery. The catalyst for AAVE appears to be the Aave Will Win Framework, a new alignment proposal that directs 100% of product revenue to the Aave DAO treasury under a token-centric model.

On the macro side, the copper/gold ratio continues to remain near all-time lows. The ratio is a classic proxy for economic health: Copper tracks industrial demand, gold tracks risk-off sentiment and debasement concerns. When gold outpaces copper this aggressively, it signals that markets are pricing in sluggish growth and that the effects of monetary policy have yet to filter through to the underlying economy.

Historically, a reversal in this ratio — in which copper begins to outperform gold — has been one of the more reliable signals for risk-on environments. That dynamic was present in both 2017 and 2021, periods where, after liquidity conditions loosened, growth expectations repriced higher, and crypto markets rallied.

Until this ratio inflects, the macro backdrop favors defensive positioning over high-beta crypto exposure.

That said, these conditions don’t last forever. Every prior trough in the copper/gold ratio eventually gave way to a reflationary impulse, and when it arrived, the move was fast. Patience in risk-off regimes has historically been well-rewarded for the long-term optimist who is positioned before the turn.

— Sam

Brought to you by:

Submit a x402, AP2/A2A, ERC-8004 or agentic commerce agent or project for your chance to win a share of $50,000 in the SF Agentic Commerce x402 Hackathon presented by SKALE, Google Cloud, Coinbase Developer Platform, Virtuals, Pairpoint by Vodafone, and Edge & Node.

Registration is now open! Submit your build from February 11–13.

The ability to trade non-crypto assets, real-world events, and social trends in a market devoid of attractive tokens has benefitted not only equity perps but also prediction markets.

Combined 2025 volume across Polymarket and Kalshi reached $21.2B, roughly four times 2024’s $5.2B. January 2026 alone cleared $7.2B, implying an $86B annualized pace if sustained.

The market is effectively a duopoly: Polymarket printed $10.5B in 2025 ($19.9B all-time); Kalshi matched it at $10.4B ($16.5B all-time).

Source: DefiLlama

With limited investable alternatives within the crypto space, private capital has followed the growth. Kalshi’s reported $1B Series E valued the company at $11B, while Polymarket’s cumulative funding sits around $2.3B, with its previous round implying a $9B valuation.

Similarly, the scale of these markets has drawn new entrants. Robinhood reported prediction-market revenues reaching $435M annualized as of Q4, up 3.8x from $115M a quarter prior.

Hyperliquid’s HIP-4 “Outcomes” introduces fully collateralized, fixed-range contracts that replicate prediction-market and bounded options payoffs without leverage or liquidation mechanics.

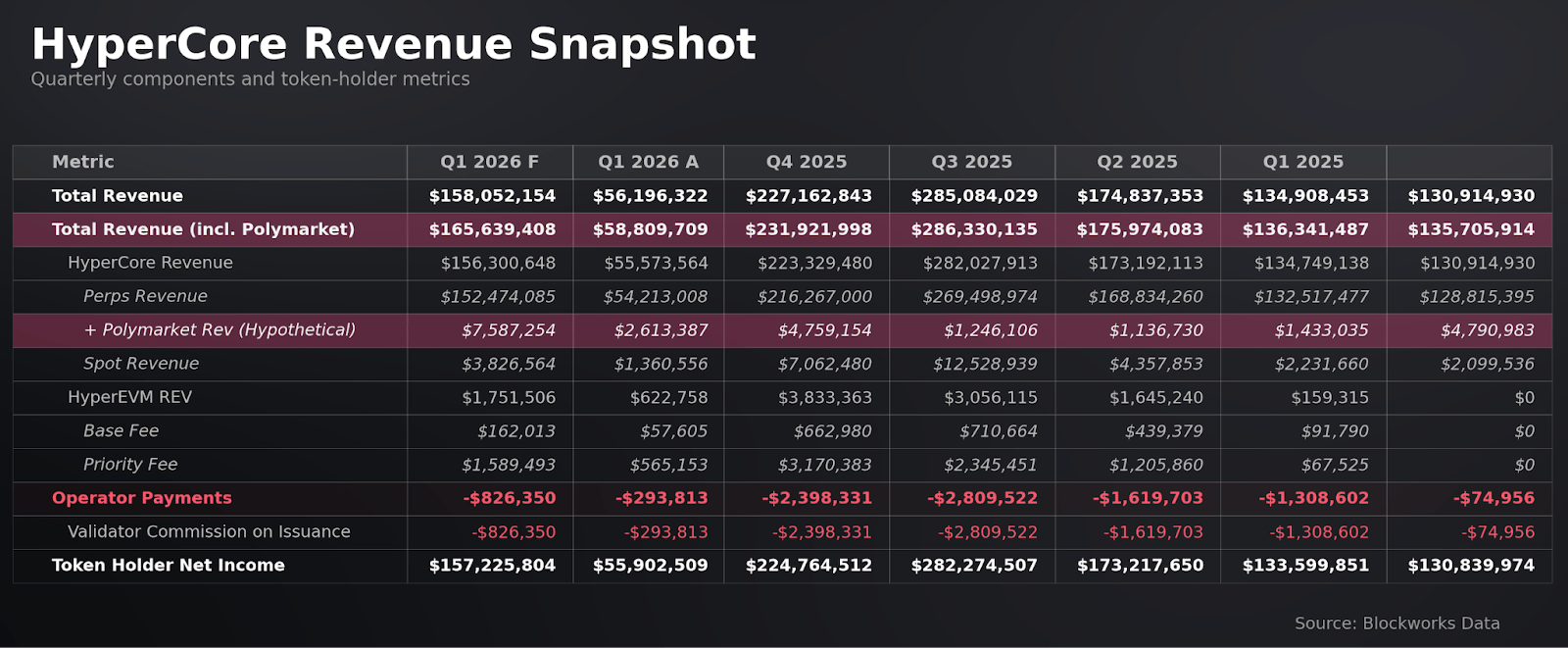

Given our coverage of Hyperliquid, we ran napkin math on what prediction-market volume would mean for the platform. Even if Hyperliquid had captured 100% of Polymarket’s volume, the incremental revenue would represent only a 5% uplift to Hyperliquid's Q1 2026 forecast ($7.5M). On its face, this suggests either Polymarket is overvalued or Hyperliquid is undervalued.

But Robinhood’s numbers complicate that assumption. $435M in annualized prediction market revenue from a single quarter implies a fundamentally different unit economics profile. The numbers raise a new question: Is prediction-market flow more monetizable, dollar for dollar, than perpetual-futures flow?

To understand this, we need to understand the role of an exchange. An exchange standardizes contracts, enforces collateral and settlement, and matches buyers with sellers while maintaining a transparent price-discovery process. Its business is not taking risk, but monetizing the intermediation of order flow between traders and liquidity providers.

Market makers, the entities that do take on risk, profit by trading against uninformed flow and exploiting inefficiencies. They want retail capitulation, not Jane Street unloading systematically. The distinction is simple: Good flow is uninformed and predictable; toxic flow is informed and adversarial. A market maker buying from a retail user on Coinbase and hedging on Binance captures a spread. A market maker on the wrong side of an informed arbitrageur loses it.

The extent to which market makers value this flow is visible in payment for order flow (PFOF). Brokers like Robinhood offer zero-commission trading but route orders to wholesale market makers who pay for the privilege of executing them. The wholesaler profits because retail flow carries lower adverse selection, allowing reliable spread capture. In 2021, the 12 largest US brokerages earned roughly $3.8B in PFOF; Robinhood alone collected ~$974M, over 77% of its net revenue.

This is where Hyperliquid’s weakness surfaces.

The right mental model for exchange value capture is not users or volume, but the amount of inefficiency being monetized. Exchanges like Polymarket, Coinbase and Kalshi spend heavily on marketing to attract price-insensitive retail demand — Coinbase’s Super Bowl commercial is the template — and monetize that flow at significantly higher fee rates. Hyperliquid, by contrast, has captured predominantly institutional-sized flow, particularly on BTC/ETH, where the market is hyper-competitive and maker fees sit below 1bp.

Prediction markets sit on the opposite end of this spectrum. They are viral platforms that attract retail flow and package complex financial derivatives into simple, intuitive contracts. The result is high-quality, monetizable order flow by design.

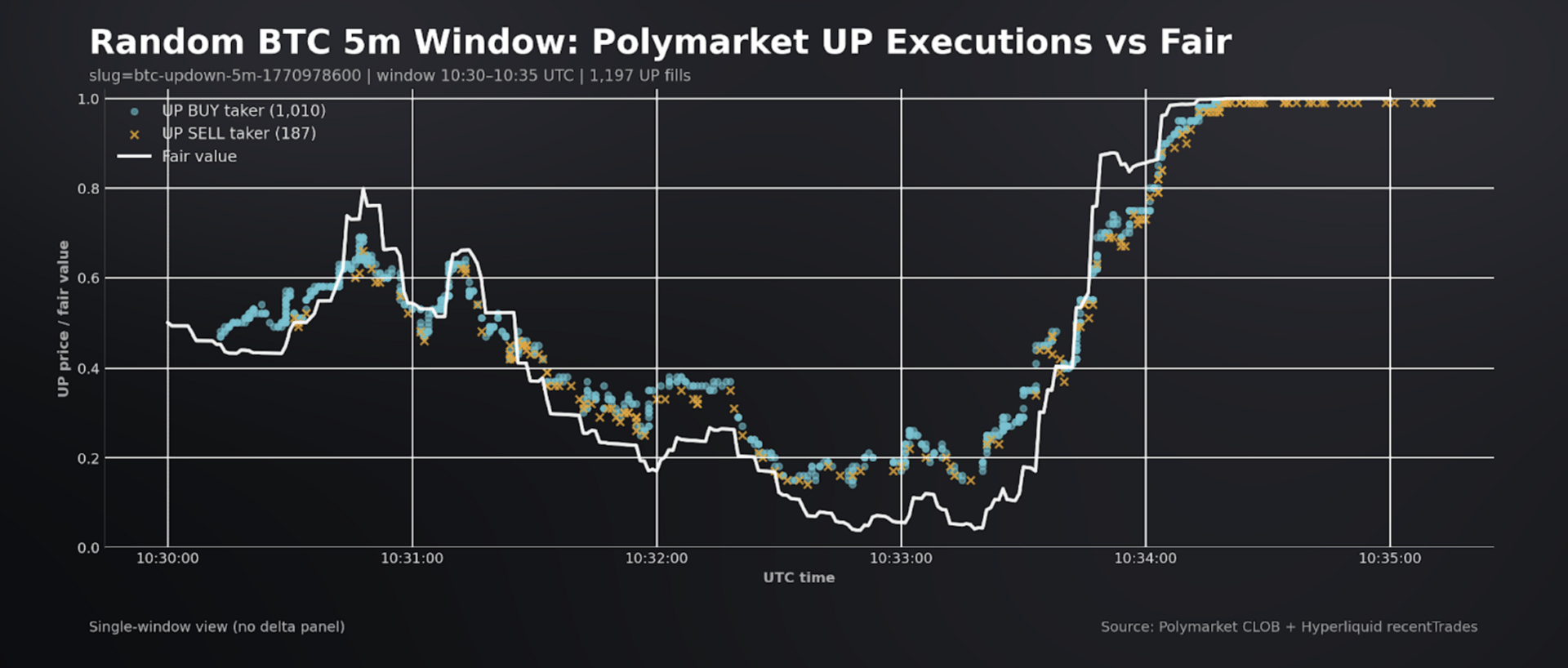

Our microstructure analysis of Polymarket’s 5-minute BTC markets illustrates the gap directly. These binary contracts trade far less efficiently than Hyperliquid perps: Across the last 12 windows, Polymarket UP fills showed roughly $123.9K in gross dislocation per $1M notional versus fair value, compared to ~$9 per $1M on Hyperliquid, a 13,600x difference.

Source: Polymarket CLOB + Hyperliquid recent trades

In practice, this means market makers can harvest substantially wider spreads on Polymarket despite lower absolute volumes, and are willing to pay substantially higher fees for access to that flow.

The same dynamic extends beyond crypto markets — Polymarket’s sports, politics and event verticals aggregate similarly predictable, price-insensitive demand.

— Shaunda

Theia published their 2025 annual investor letter detailing the firm’s formalized prediction-driven investment process, which they call the Theia Underwriting Engine.

The framework integrates five phases: moat analysis (using Helmer’s 7 Powers and Porter’s 5 Forces adapted for crypto), fundamental multiple calculation from first principles rather than comps, probabilistic forecasting measured by informational “edge” over consensus, Kelly Criterion-based position sizing, and Bayesian dynamic updating.

Theia highlights Maple and MetaDAO as key 2025 winners identified through this process, and emphasizes AI-assisted workflow acceleration across a four-person team focused on liquid digital asset fundamentals.

Lightspeed published a podcast episode featuring Tristan Frizza, co-founder of Bullet (formerly Zeta Markets), discussing the architecture of Bullet’s next-gen Solana perps exchange.

Frizza details Bullet’s design as a ZK rollup/network extension that offloads execution from the Solana L1 to achieve sub-millisecond order matching, using Celestia for data availability and Succinct's zkVM for provable execution. Key design decisions include multi-asset margin with integrated spot and lending and cancel prioritization for market makers to combat toxic MEV flow. The existing ZEX token will migrate to a new Bullet token.

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.