- 0xResearch

- Posts

- Robinhood bets on crypto rails

Robinhood bets on crypto rails

Prediction markets, tokenized stocks, testnet and more

GM and happy Thursday!

Equities continue to outperform crypto as the bear persists, with crypto miners being handsomely rewarded for their pivots to AI.

Below, we unpack Robinhood’s chain moving to testnet, HOOD Q4 earnings, and prediction market traction. Enjoy!

Registered securities are winning on the week, as crypto miners show the highest returns at +10.3%. Similarly, crypto equities, the Nasdaq, and S&P 500 all show positive returns. Unfortunately, tokens still underperform, with BTC down −7.7% on the week and longer-tail crypto indices doing even worse. While equity markets maintain their resilience, crypto’s bear persists.

Among crypto miners, WULF and CIFR lead, recording gains of 26% and 23%, respectively, on the week. Morgan Stanley initiated coverage on these two names and gave each an overweight rating, citing AI data-center infrastructure leases as a tailwind. Equity markets continue to reward miner pivots from crypto to AI, reaffirming that the hot ball of money is elsewhere.

ETF flows show tepid interest, with weekly inflows flipping green after a 3-week stretch of outflows. Interestingly, Jan. 17−23 was the most negative week for the crypto ETF complex since February 2025. These vehicles will likely need to set their floor in AUM before an uptrend can resume.

Across the board, animal spirits and risk appetite are scant in crypto, with shinier objects to be found in registered securities servicing the AI cycle. Bodies may continue to float to the surface after the market dislocations of 10/10 and 2/5 may have taken many players out. Blockfills, an institutional crypto trading firm, temporarily halted client withdrawals yesterday, offering one such warning of this.

As the majors BTC, ETH and SOL remain in high-timeframe downtrends, and longer-tail alts are faring even worse, price- and time-based capitulation may bring us even lower towards the realized price of $55,000 BTC.

The bear is an opportunity for sobriety and level-setting on the things that matter on longer time horizons. The tails are fatter than perceived and often mispriced, and optimists win eventually.

— Luke

Brought to you by:

Submit a x402, AP2/A2A, ERC-8004 or agentic commerce agent or project for your chance to win a share of $50,000 in the SF Agentic Commerce x402 Hackathon presented by SKALE, Google Cloud, Coinbase Developer Platform, Virtuals, Pairpoint by Vodafone, and Edge & Node.

Registration is now open! Submit your build from February 11–13.

Robinhood flipped the switch on a public testnet for Robinhood Chain, an Arbitrum-based Ethereum L2 that’s explicitly framed as “financial-grade” infrastructure for tokenized assets. The chain was initially teased with limited public information in mid-2025, and management confirmed a path to mainnet in 2026.

This is most exciting from a distribution standpoint. Robinhood exited Q4 with 27 million funded customers and $324 billion in platform assets, while Gold subscribers hit 4.2 million. If Robinhood Chain becomes the settlement layer under the Robinhood app and Robinhood Wallet, it has a credible shot at being one of the largest retail-facing onchain rails.

Public messaging has emphasized composability with Ethereum tooling, plus early integrations from core infra providers (Alchemy, Chainlink, LayerZero, TRM). Robinhood is also putting capital behind builder activity, including a $1 million developer program, indicating that the company plans to curate an ecosystem of third-party applications rather than a walled garden.

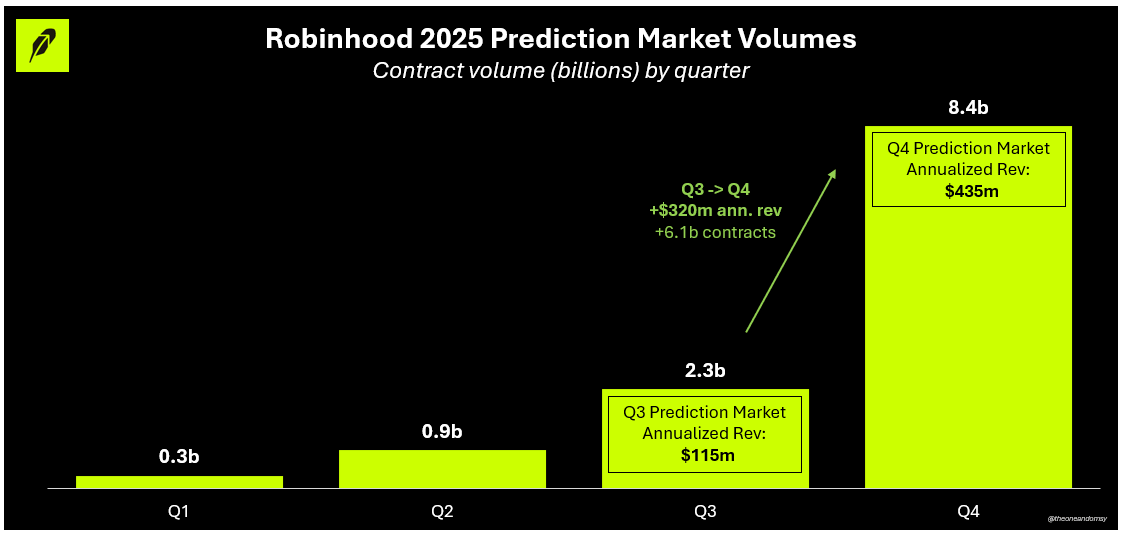

Zooming out, the chain launch fits cleanly into what Robinhood highlighted in its Q4 results: “other transaction revenue” was $147 million in Q4 (up 300%+ YoY) and the company pointed to 12 billion event contracts traded in 2025 (with 8.5 billion in Q4 alone). Instead of leaving market structure to third parties, Robinhood formed a joint venture with Susquehanna that acquired 90% of MIAXdx, a CFTC-regulated derivatives exchange and clearinghouse, to build an independent prediction-market venue. Taken together, this creates a coherent vertical integration arc: distribution (app) + venue (exchange/clearing) + settlement rail (chain).

The main question is product reality versus narrative. If “financial-grade” translates into a heavily-permissioned environment, composability and DeFi liquidity become thinner. Getting to public testnet this fast suggests Robinhood is treating tokenization rails as a core roadmap item.

— Nick

In this episode of Bits and Bips, Nic Carter argues that Bitcoin faces a serious governance test, particularly around quantum-computing risk. He contends that Bitcoin developers are moving too slowly to address potential quantum threats and warns that if they fail to act, large institutions like BlackRock — now deeply invested via ETFs — could effectively “fire the devs” and force change, leading to a more corporate, centralized governance structure.

Carter also suggests that many foundational Bitcoin narratives have weakened over time and that institutional concerns, even if premature, are already slowing adoption. Beyond Bitcoin, he declares that the VC-driven, flashy-token era is largely over, predicting that the future of crypto lies in more durable, cash-flow-generating businesses rather than speculative token launches.

Crucible Capital’s “Building a Datacenter Part II” is a useful systems-level map of where the next leg of AI infrastructure spend is going, away from “more generation” and toward “better power delivery and heat removal.” The authors argue Nvidia’s push toward 800V direct current inside the facility is the inflection, because today’s AC-heavy power chains require multiple AC↔DC conversions that can leak ~10% to 20% of power, just as rack densities move from legacy 10kW to 50kW into the 100kW to 1MW+ regime. Power and cooling already represent ~35% of data center capex and the majority of opex, so this shift matters for anyone underwriting AI infra economics.

We liked the section on second-order ripple effects in particular. 800V pushes new power electronics, new storage stacks, and new rack designs. It is a reminder that “AI factory” buildouts are increasingly constrained by electrical and thermal engineering rather than just silicon supply chains.

The piece closes with the operational reality that liquid cooling becomes mandatory at these densities. Cooling is already a meaningful contributor to data-center failures, and the value of monitoring and maintenance software rises: A $40 million+ 1MW cluster becomes an asset you have to preserve like a balance sheet, not a rack of servers. With Nvidia’s Rubin Ultra timeline pulling the whole supply chain forward, it’s a clean primer on which components, vendors and failure modes will matter most in the 2026 to 2027 capex cycle.

Proph3t argues that token buybacks below net asset value (NAV) are value-accretive and effectively reduce dilution for long-term holders. He believes buybacks also help mitigate rug risk by allowing markets to reallocate capital away from underperforming projects when tokens trade at steep discounts to treasury value.

While critics say buybacks promote short-term thinking and hurt growth, he contends that markets already discipline founders, and that discounted prices signal inefficient capital allocation. However, he acknowledges that buybacks create uncertainty around founder runway, and he proposes structural tweaks — like higher approval thresholds or limited proposal windows — to make the system more founder-friendly.

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.