- 0xResearch

- Posts

- Will perpetuals fees compress?

Will perpetuals fees compress?

Market is rangebound as perps competition heats up

Hi all, happy Wednesday. Markets continue to chop, but strength has been found near recent lows. Perpetuals competition continues, and we discuss its implications on fee structures and Hyperliquid’s dominance.

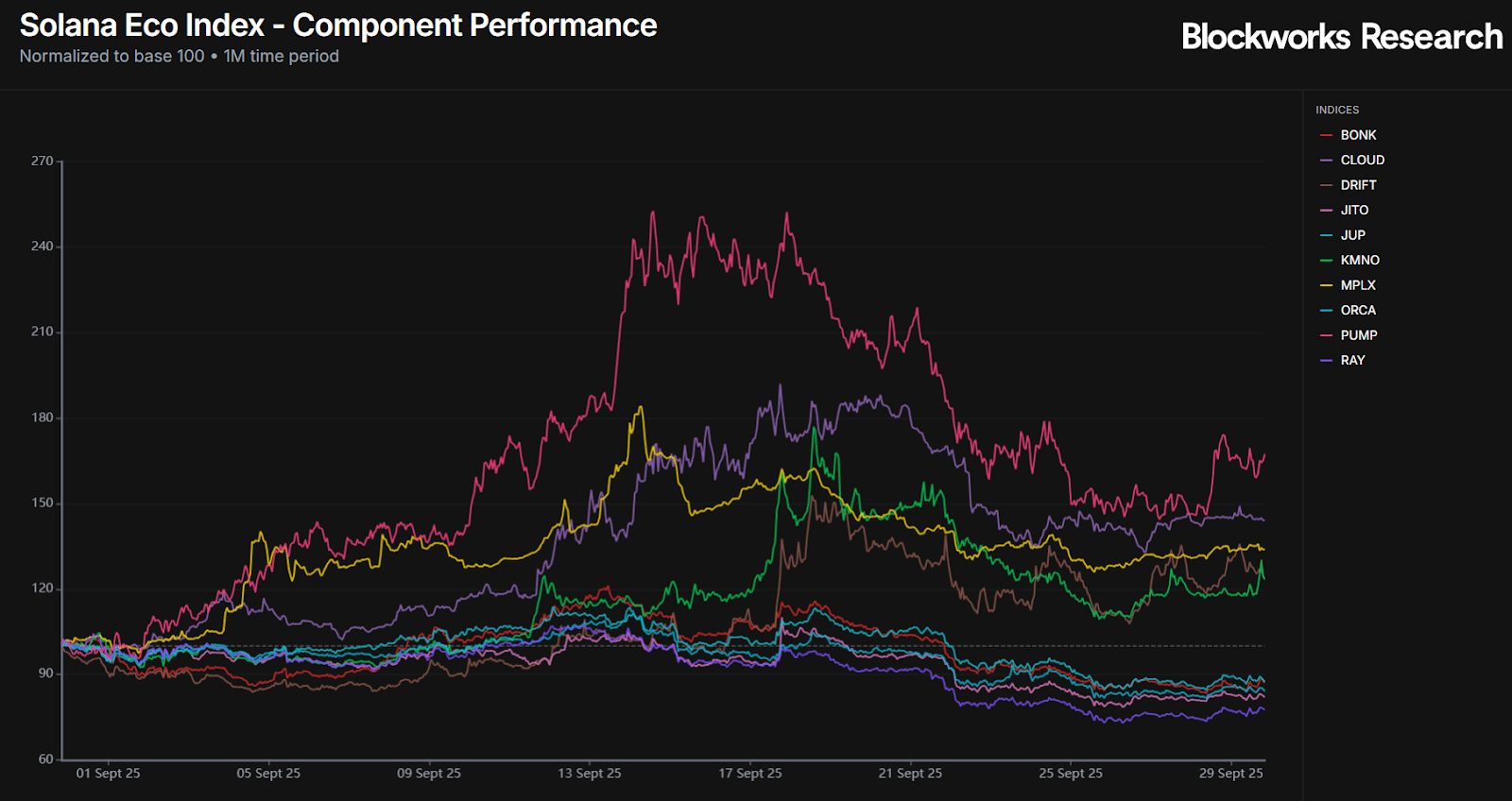

It’s Oct. 1, and the month of September 2025 highlighted a clear divergence between outperforming sectors and those struggling to find footing. While some indices like L2s and Gaming posted strong gains (up 36% and 16%, respectively), others such as Launchpad and Solana Ecosystem remained under heavy selling pressure, closing the month significantly lower (down 20% and 18%, respectively).

Even within the L2 index, the story is one of divergence, with only MNT and IMX positively ending the month while other L2s fell by up to 20%.

The Solana Ecosystem was also mixed. CLOUD, DRIFT, KMNO, MPLX, and PUMP all exhibited a strong performance, but the index was dragged down by the tokens with larger market caps, such as JITO, JUP and RAY.

— Marc

In September 2025, digital asset treasury companies (DATCOs) steadily accumulated SOL, pushing aggregate holdings to over 14 million tokens by month-end. This buildup, driven by entities (primarily FORD), coincided with heightened market volatility as SOL’s price swung between $190 and $250. Despite these fluctuations, treasury allocations remained consistent, underscoring a strong conviction in SOL’s long-term prospects.

Similarly, September marked a strong month of inflows for Solana-focused ETFs, with over $110 million in net inflows. Not a single day of outflows and several standout spikes, most notably around mid-September when single-day inflows exceeded $25 million. This pattern highlights growing investor conviction in SOL’s role within diversified crypto portfolios as ETF products continue to attract capital even during periods of price retracement.

However, SOL’s share among crypto ETFs remains marginal, highlighting its position as an emerging contender rather than a core holding within ETF structures. While still small in proportion, SOL’s flows demonstrate that it’s gaining a foothold in regulated products, a sign of investor appetite broadening beyond the two established leaders and a potential indicator of future diversification trends within crypto ETFs. Look out for the other upcoming SOL ETFs that will add some additional buy pressure.

— Marc

Perpetuals competition continues

Over the past month, we’ve seen increasing popularity in perpetual DEXs: both in their tokens (ASTER and APEX) as well as a variety of platforms, which have seen increased volumes due to farming activity (Lighter, Pacifica etc.). With the Hyperliquid airdrop worth billions of dollars, most participants are focused on being early to the “next Hyperliquid,” akin to how the L1 trade played out last cycle, where participants wanted to have the chance to be early again.

One key critique that has come up against Hyperliquid is that it is now losing its lead. On first glance, this appears to be true. While Hyperliquid maintained strong positioning with $9.19 billion in average daily volume, Aster's explosive entry caused Hyperliquid's market share to compress from 56.1% to 13.7% among leading perpetuals DEXs.

However, volume metrics can be easily gamed. Open interest is much more expensive to fake and provides a more reliable indicator of genuine platform usage. By this measure, Hyperliquid remains the dominant platform for perpetual trading with over $13.1 billion in open interest, displaying a notably healthy OI/volume ratio of 1.61.

OI on competitors is much lower. Lighter has $5.39 billion average daily volume over the past month, $1.37 billion in OI as of today, with a OI/volume ratio of 0.181. Aster has an OI/volume ratio of just 0.02.

One key differentiator for Hyperliquid will be how it responds to impeding competitors. In the early days, Ethereum dismissed Solana as a competitor, claiming it was ephemeral activity. That wasn’t the case. Dismissing Lighter and Aster as doing well only because they are being farmed heavily would be a mistake; the tide can shift quickly. Lighter has a strong working product (albeit without the listing velocity and UI of Hyperliquid) and Aster has Binance and CZ’s backing.

Another interesting potential implication here is if we see fee compression for perpetual DEXs. Lighter has 0 fees for both makers and takers. We saw a shift toward zero fees on traditional brokerages and exchanges, as brokerages needed to compete with those offering zero fees. It will be interesting to see if Hyperliquid will have to offer zero fees as well.

Crypto is changing TradFi derivatives and rate markets as we know them.

DAS: London will feature all the builders driving this change.

Get your ticket today with promo code: 0X100 for £100 off.

📅 October 13-15 | London

We published a research report on DoubleZero's mainnet launch and SEC regulatory clearance. The report highlights that DoubleZero launched mainnet-beta with 21.5% of Solana validators already operating on the network, significantly exceeding adoption projections. The SEC issued a landmark no-action letter confirming that 2Z and similar DePIN tokens are not securities when compensating network participants for actual work performed. DoubleZero aggregates dark fiber infrastructure to deliver 30-70% lower latency than public internet across 70+ dedicated fiber links spanning 26 cities. The token generation event is scheduled for Oct. 2, with the protocol positioned as critical infrastructure for high-performance blockchain ecosystems.

Bridge, backed by Stripe, has launched Open Issuance, a platform for businesses to create and manage their own stablecoins. Instead of relying on a few issuers, companies can now customize reserves, cut fees and tap into a shared liquidity network for seamless swaps. Early adopters include Phantom, launching its CASH stablecoin for 15 million+ users, alongside USDH and coins from MetaMask and others, empowering firms to own their digital money strategies with more control and efficiency.

This article explores the technical mechanics of both systems, their fundamental trade-offs and why the most sophisticated trading applications are leading the charge back to CLOBs — not as a rejection of DeFi's innovations, but as its natural evolution toward institutional readiness.

Titan, a Solana-based DEX aggregator, is building an “Interactive Brokers for internet capital markets” by connecting to 40+ protocols and using a custom optimization algorithm to guarantee best execution. After a private beta with billions in volume and backing from Galaxy and others, Titan is rolling out an API, onchain limit orders and composable RFQ. The team’s vision: instant, cross-asset swaps from memecoins to equities, with millisecond settlement and consistently better prices than competitors.

|

|

Turn referrals into returns 💎

When the alpha's this good, you have to share. Use the 0xResearch referral program to onboard your friends while banking the rewards:

📣 15 referrals: A free ticket to Blockworks’ Digital Asset Summit