- 0xResearch

- Posts

- Who controls access?

Who controls access?

Coinbase and Jupiter redraw crypto’s trading stack

Hi all, and happy Monday.

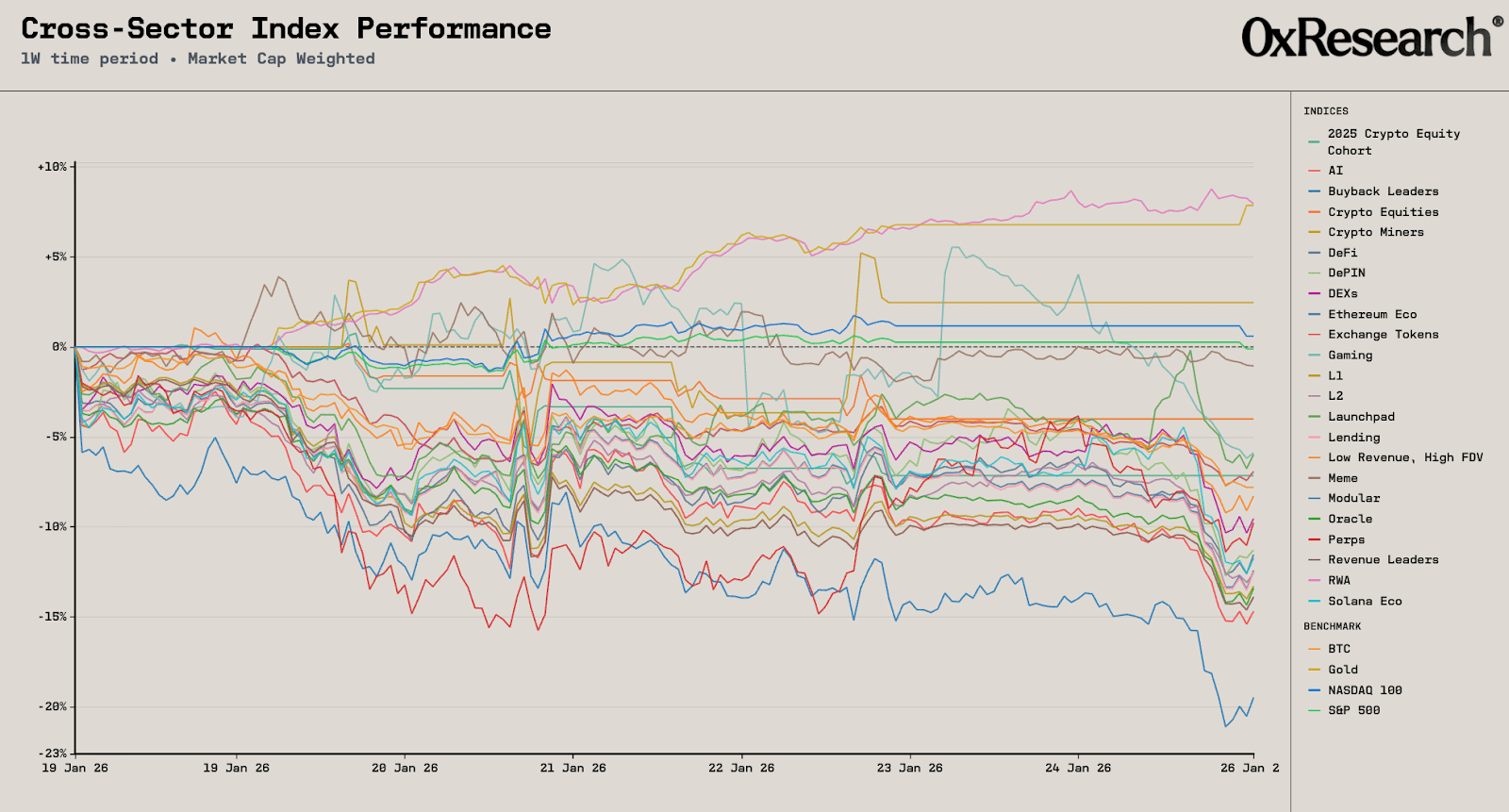

Crypto de-risked broadly last week, with pressure concentrated in high-beta onchain sectors.

Separately, Coinbase’s integration of Jupiter routing highlights a broker-vs-venue dynamic where centralized frontends increasingly rely on onchain execution. If this model scales, access shifts away from listings and toward routing, liquidity and fee optimization.

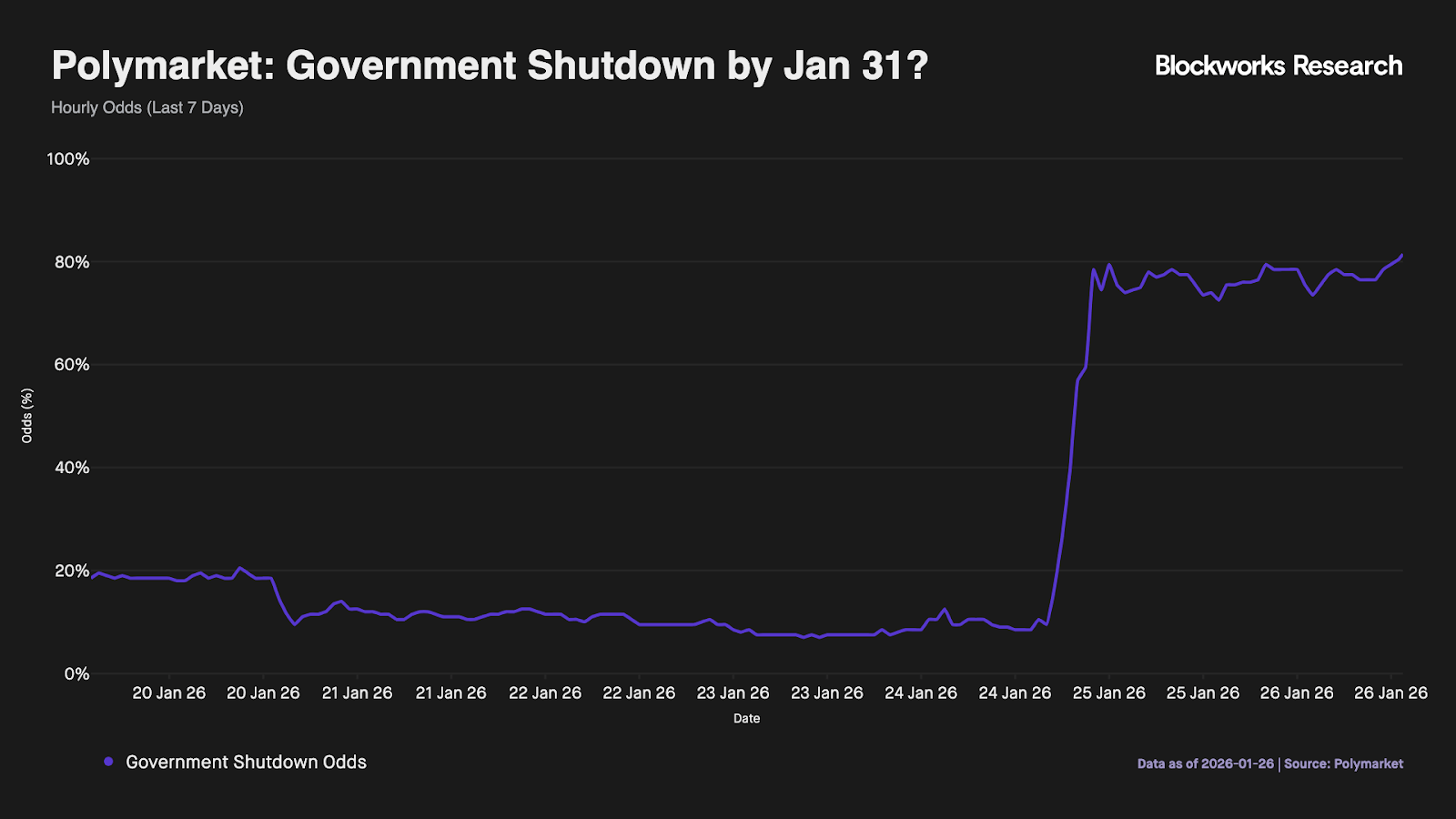

BTC fell 7.8% over the past week, underperforming both traditional risk and safe havens: Gold rallied 7.9%, the NASDAQ 100 gained 0.6%, and the S&P 500 was roughly flat (-0.1%). One reason for Gold’s continued outperformance is the worsening political backdrop and a strengthening debasement trade: On Polymarket, the odds of a US government shutdown by Jan. 31 rose from 9% to 81%.

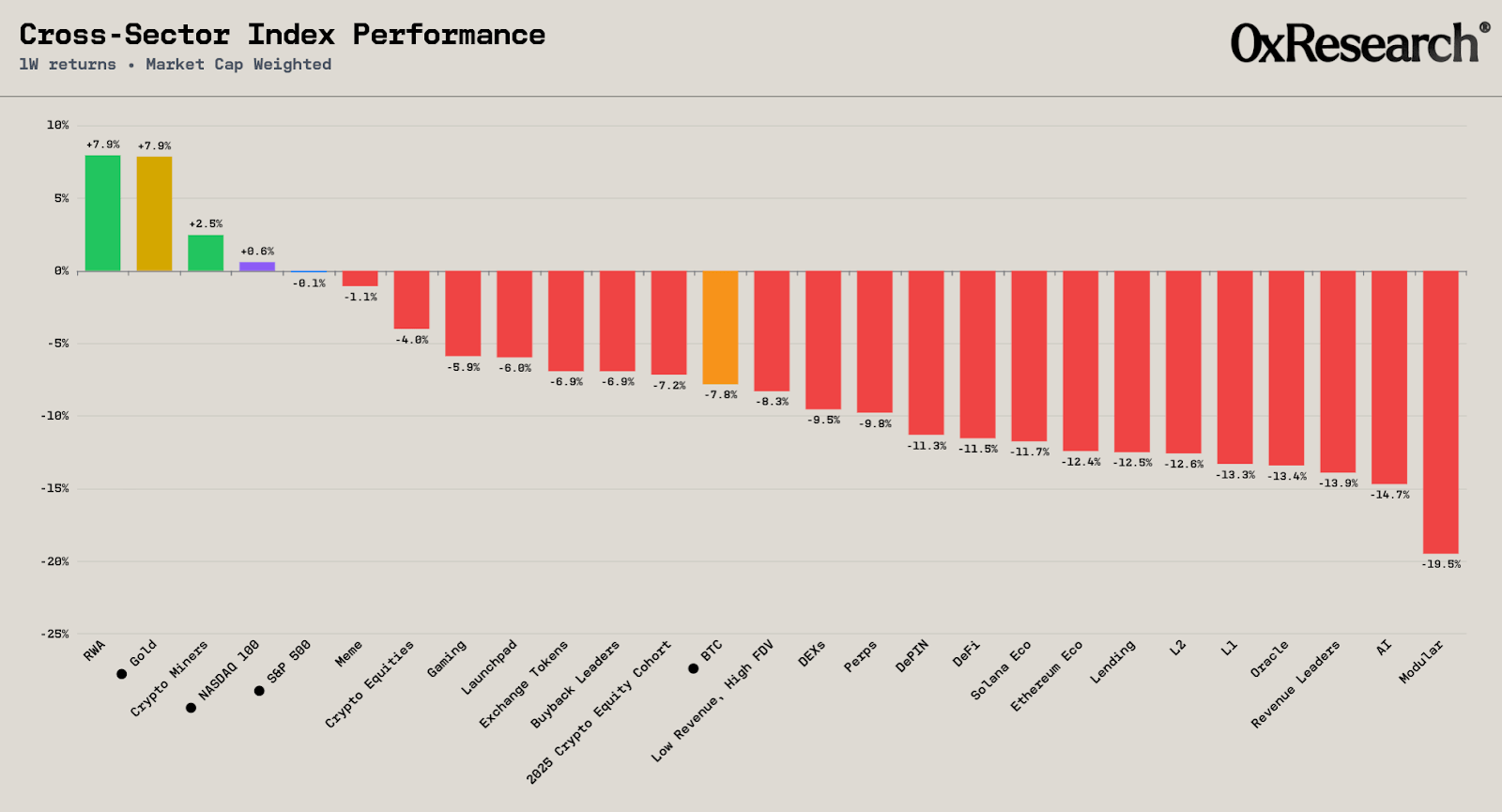

Within crypto-adjacent equities, the Crypto Miners sector (+2.5%) was one of the few bright spots, likely reflecting equity-style flows and lagged sensitivity versus direct token beta.

Within crypto, the week was defined by broad de-risking in high-duration bets, not a nuanced rotation. RWA (+7.9%) was the standout on the crypto side, while Crypto Equities (−4.8%) held up better than onchain sectors. The heaviest pressure concentrated in core trading and “growth narrative” buckets, with DEXs and Perps both down ~10%. The biggest capitulation showed up in Modular (−19.5%), with AI also weak at −14.7%.

— Shaunda

Jupiter’s new gateway

The lines between centralized and decentralized exchanges are officially blurring. Coinbase’s latest move to embed Jupiter’s routing engine directly into its onchain trading stack is now live. This is less about a single integration and more about a fundamental shift in market distribution.

Hurdles for retail participation in DeFi have been the friction of self-custody, the complexity of onchain mechanics, and the lack of trust in unfamiliar interfaces. By embedding Jupiter, Coinbase effectively becomes a “premium frontend” for the entire Solana ecosystem. Rather than the slow, manual process of listing individual tokens on a centralized order book, Coinbase is now using onchain rails to grant its users instant access to thousands of Solana-native assets.

This reflects a “broker-vs-venue” crossroads we’ve seen elsewhere: Coinbase is leaning into its strength as a high-margin distribution layer (onboarding, compliance and UI), while Jupiter serves as the back-end execution engine.

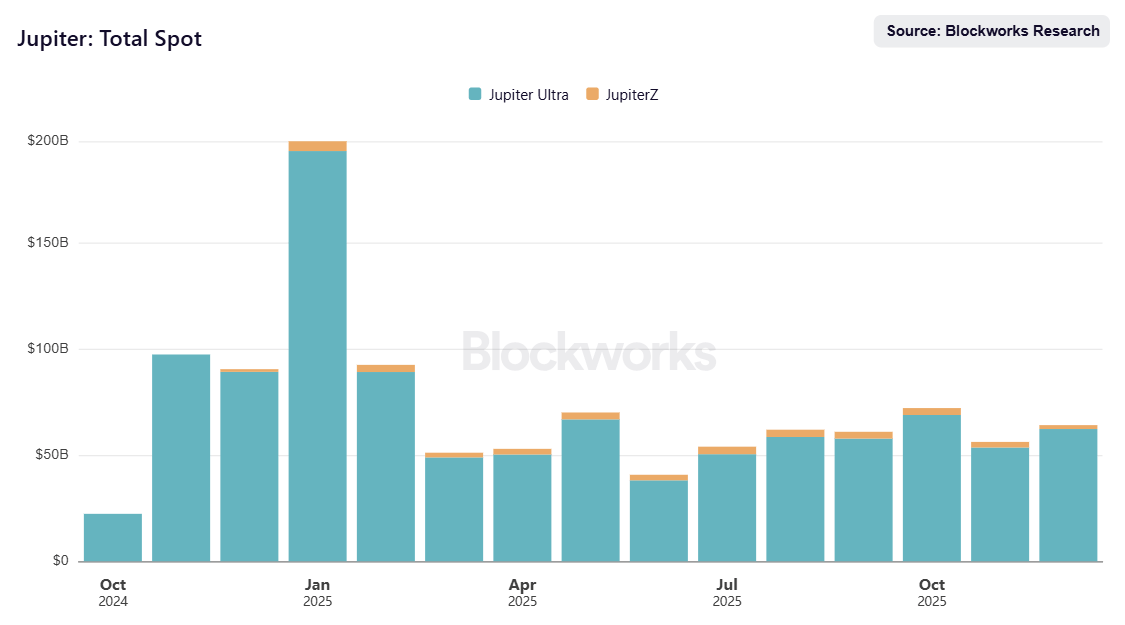

Jupiter already sits at the heart of Solana, processing roughly $60 billion in monthly spot volume. By tapping into Coinbase’s massive user base, which handles $80–$100 billion in monthly volume, Jupiter’s “aggregator-as-a-service” model enters a new phase of scale.

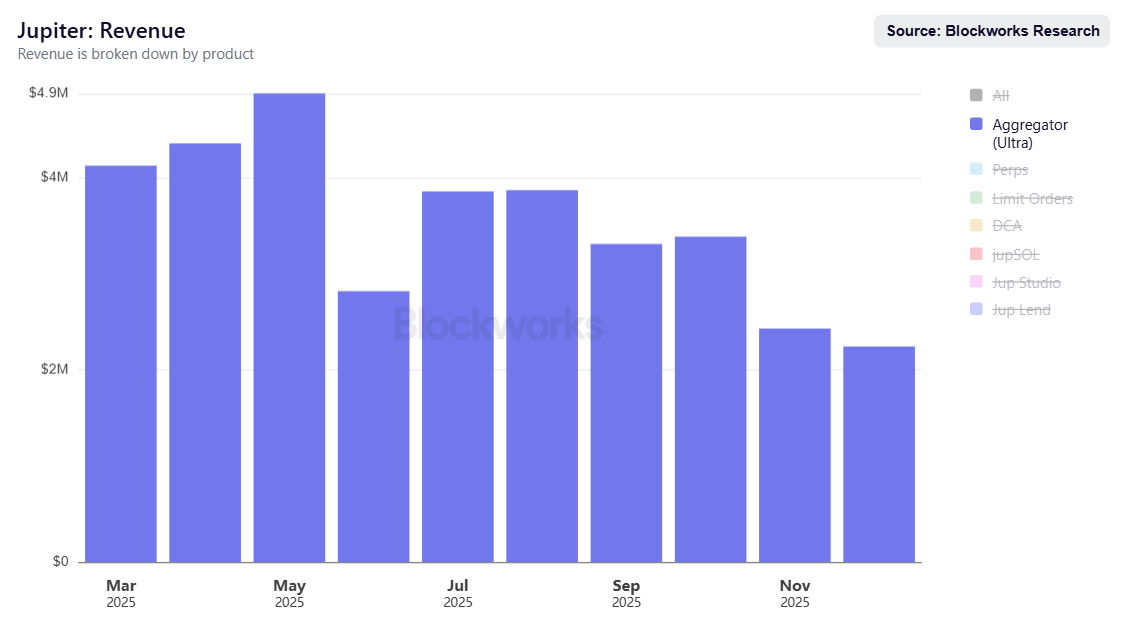

Jupiter currently generates approximately $2–4 million in monthly revenue from its “ultra” aggregator offering. More volume through high-intent retail interfaces like Coinbase provides a clear path to monetize this further through execution fees and routing optimization.

We are moving toward a market where infrastructure, not listings, drives access. Expect CEXs and other fintechs to act increasingly as frontends to onchain liquidity.

— Marc

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.

a16z’s Justin Thaler argues that while the threat of quantum computing is real, the timeline for a “cryptographically relevant” machine is likely a decade-plus away, despite misleading corporate milestones.

The report makes a vital distinction between encryption, which faces immediate “Harvest now, decrypt later” risks and requires a swift move to hybrid post-quantum schemes, and digital signatures (the backbone of blockchains), which are not retroactively vulnerable and should be migrated more deliberately to avoid the performance costs and implementation bugs of immature code.

For Bitcoin, the challenge is less about physics and more about social coordination: Its slow governance and millions of abandoned, vulnerable coins mean planning must start now, even if the “quantum apocalypse” remains a distant horizon.

Santiago Santos argues that the true “alpha” for stablecoins lies not in fighting the consumer credit-card duopoly, but in revolutionizing the $25 trillion B2B cross-border payment market.

While entrenched reward incentives anchor consumer checkout, B2B commerce remains plagued by a 3–4% “invisible tax” of wire fees, FX spreads, and 5-day settlement delays that trap billions in working capital. By shifting to stablecoin rails, facilitated by 2025’s legislative clarity (the GENIUS Act) and mature off-ramp infrastructure like Stripe’s Bridge, mid-market distributors can realize a 13–19% EBITDA improvement through “just-in-time money.”

The thesis is simple: Don't wait for shoppers to change their habits; instead, optimize the back-office infrastructure where faster velocity and lower friction translate directly into bottom-line operational alpha.

Onchain lending is currently in “Phase 4” of its cycle, with capital exiting as yields fall below the risk-free rate (SOFR), but a fundamental shift is brewing for 2026.

Rather than relying on volatile crypto-market beta or unsustainable token subsidies to drive demand, protocols like Aave, Kamino and Morpho are pivoting toward modular architectures and institutional-grade features, including fixed-term loans, whitelisting and the onboarding of real-world collateral like tokenized HELOCs and securities. These upgrades aim to solve “cash drag” and capital inefficiency, potentially inducing a new wave of borrow demand that pushes rates back above SOFR.

As valuation multiples compress toward fintech equivalents and protocol KPIs grow despite price declines, the sector is setting up for a “big swing” opportunity where growth is driven by structural utility rather than reflexive speculation.