- 0xResearch

- Posts

- Weekend brain fuel

Weekend brain fuel

Stablecoin yield, crypto cards, interoperability

Hey all, happy Friday. It was a mixed week for crypto, with BTC ending higher but sharp divergence across sectors. DePIN and Gaming led a surprising rebound after a rough year, while L2s, RWAs and the treasury trade continued to grind lower as flows stayed choppy. As always, we’ve rounded up some weekend reads on stablecoin yield, payments infrastructure, interoperability and last year’s fastest-moving narratives.

With a shortened equity trading week due to the holidays, the focus shifts to crypto performance over the past week. BTC finished the week up 1.6%, though performance across altcoins remains highly fragmented.

The biggest movers may come as a surprise. DePIN and Gaming led all sectors with gains of 13.1% and 12.6%, respectively. These have been two of the weakest performers in 2025, down -79.5% and -81.3% on the year, making the rebound notable.

DePIN strength was driven by FIL and RENDER, which rose 22% and 13% on the week and together account for 49% of the index. Gaming followed a similar pattern, with IMX up 11%, doing most of the heavy lifting for the sector.

On the downside, L2s and RWAs lagged, falling -2.67% and -0.84% over the week. L2 weakness was led by MNT and ZORA, down -5.7% and -6.4%. At the same time, other L2 names such as OP, ARB, and ZK posted gains between 10% and 20%, highlighting sharp divergence within the sector. RWAs were pressured by a pullback in Gold after its strong run this year, with PAXG and XAUT both down around -3.4%.

Flows remain choppy. On Dec. 31, ETFs saw $417.8M of outflows, nearly offsetting the $428.2M of inflows recorded the day prior.

Digital asset treasuries continue to feel the strain, with mNAV multiples compressing further. MSTR and BMNR now trade at mNAV levels of 0.69 and 0.85, underscoring the pressure on the treasury trade as the new year begins.

— Kunal

Crypto’s premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: 0XNL for $100 off.

On Monday’s 0xResearch livestream, we covered:

Liquid staking as infrastructure: The panelists discussed liquid staking as a foundational primitive rather than a terminal product, positioning Kinetiq’s staking stack as a wedge into broader DeFi markets. They examined how staking liquidity was designed to enable secondary products, capital mobility and onchain market expansion rather than standalone yield extraction.

Risk isolation by product design: The team analyzed Kinetiq’s emphasis on isolating risk across product lines, particularly separating baseline liquid staking from higher risk offerings like exchange specific liquid staking tokens. They noted this architecture aimed to prevent risk contagion between users with different risk tolerances.

kmHYPE and exchange specific staking: Omnia examined the launch of kmHYPE as an exchange specific liquid staking token that tied user exposure to Hyperliquid-style market activity. He discussed how gating access through KNTQ ownership aligned incentives between traders, stakers and protocol revenue.

Token roles and incentive alignment: The panelists discussed the distinct roles of kHYPE and kmHPYE, noting kHYPE as the core liquid staking asset and kmHYPE as a mechanism to access exchange revenue and new market launches. They analyzed how this structure linked token utility directly to protocol cash flows.

DEX competition and market vision: The panelists discussed the view that onchain perpetual and spot markets could increasingly compete with centralized exchanges. They examined Kinetiq’s ambition to support non-crypto native markets such as equities and FX through decentralized infrastructure.

HIP-3 auctions and community governance: The panelists discussed upcoming HIP-3 auctions as a key mechanism for community participation and capital allocation. They examined how governance and token ownership were framed as drivers of long-term ecosystem growth rather than passive holding.

Find the full livestream on YouTube, Spotify, Apple Podcasts and X.

This summary was generated with assistance from AI tooling.

Blockworks Research finds that Neutrl brings institutional-grade OTC arbitrage into a stablecoin wrapper, offering market neutral yields that are less reliant on funding cycles than existing synthetic dollars. Early traction and double-digit sNUSD yields suggest strong demand, supported by deep token unlock pipelines and privileged OTC access via STIX. The core upside rests on scalable deployment into hedged OTC deals, while risks center on execution, counterparty performance and liquidity management. If yields hold as TVL grows, Neutrl could mirror early Ethena dynamics in a more structurally defensive form. Read more

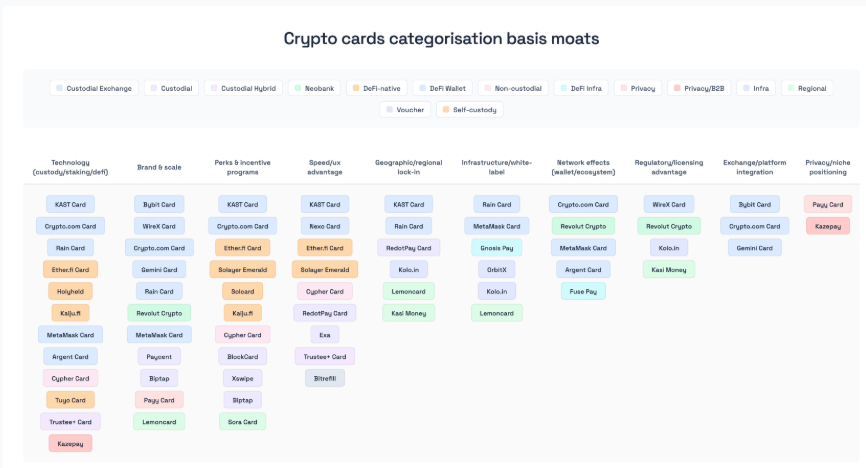

Polaris Fund finds that crypto cards and neobanks have reached a real inflection point where value is shifting away from rewards and branding toward infrastructure, compliance and liquidity control. The analysis shows that durable moats come from owning primitives like regulated access, programmable liquidity and deep integrations, not cashbacks. Infra rail providers and DeFi native card models capture the most leverage through recurring fees and aligned economics, while CeFi distributors face margin compression. As regulation tightens, scale will increasingly favor players that control licensing, settlement and compliance workflows rather than consumer-facing incentives. Read more

LayerZero finds that 2025 marked the shift of interoperability from a theory into core infrastructure for crypto. Data shows tokenized assets and stablecoins increasingly distributed across many chains, with interoperability accelerating asset velocity, capital mobility and global access. Rather than chains competing in isolation, crypto now functions as a connected network where value moves freely to where demand exists. Adoption of message-based transfers and open primitives reduced costs and friction, making cross-chain activity feel more like software than finance. Interoperability is no longer the bottleneck, but the default layer enabling scale. Read more

Tiger Research finds that 2025 was defined by rapid narrative cycles that generated attention faster than they could be validated, leading to widespread fatigue and skepticism. Most narratives faded quickly, but a subset translated into real use cases that pushed the market forward, particularly where retail access was simple and intuitive. Memecoins showed how quickly users can onboard, but also how fragile engagement is without retention. Experiments like InfoFi highlighted incentive-driven growth but exposed quality and trust issues. The clearest progress came where crypto demonstrated product-market fit, including stablecoins, prediction markets and payment rails, showing that durable value emerges only when narratives align with real utility. Read more

— Kunal