- 0xResearch

- Posts

- 📱 TON’s EVM chain goes live

📱 TON’s EVM chain goes live

DeFi comes to Telegram...sort of

Brought to you by:

TAC has launched its public mainnet and native TAC token, promising to connect Ethereum’s DeFi ecosystem with Telegram’s 1+ billion users. By offering an EVM-compatible layer-1 linked to TON, TAC wants to make deploying blue-chip Ethereum apps easier while bootstrapping liquidity through major exchange listings and incentives.

— Macauley

Hyperliquid:

Source: Hypeburn

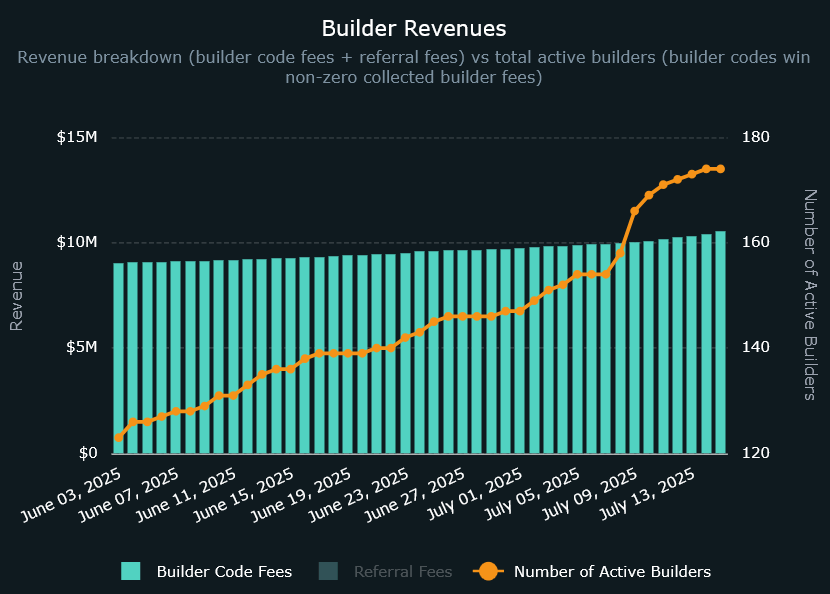

174 active builders are plugged into Hyperliquid as of today, skimming $10.5m in builder code fees — of all which goes straight to themselves.

Builder codes are a core plank of Hyperliquid’s growth strategy, and are what some believe will enable Hyperliquid to “scale distribution faster than any competing exchange.”

Builder codes let external builders (wallets, frontends, bots, DEXs) tap into Hyperliquid’s onchain order-routing logic and tack on a fee — a maximum of 0.1% for perps and 1% on spot — for any flow directed to Hyperliquid. Think old school CEX referral links, except it’s a continuous revenue stream enforced onchain by smart contracts — coming at no extra revenue cost to Hyperliquid.

As of July 14, trading bots dominate the use of builder codes. The largest is pvp.trade, with $7.3m in cumulative revenues, followed by Axiom ($902k) and Okto ($684k). Phantom Wallet’s announcement last week to integrate Hyperliquid perps for its 15m monthly active users marks the biggest rollout of builder codes.

Brought to you by:

Katana is a DeFi chain built for higher sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn KAT tokens: Pre-deposit with turtle club

TON seeks EVM dapps, liquidity

TAC, which launched its mainnet today, is betting it can solve one of Telegram’s biggest blockchain challenges: getting Ethereum’s DeFi builders to care about TON at all. The new purpose-built layer-1 offers an EVM-compatible bridge to Telegram’s ecosystem and is listing its $TAC token on major exchanges alongside Telegram Wallet support.

TAC is not an official Telegram project, but an independent blockchain built to integrate with the TON ecosystem and tap into Telegram’s massive user base without being developed or controlled by Telegram itself.

At its core, TAC targets a specific problem: TON’s native virtual machine (TVM) and smart contract language (FunC) remain bespoke and less accessible to Ethereum’s vast developer ecosystem. By introducing an EVM-compatible chain directly integrated with TON, TAC offers a pragmatic bridge for blue-chip Ethereum DeFi apps to deploy to Telegram’s billion-plus user base without rewriting its entire codebase.

This goal shaped every step of TAC’s pre-launch strategy. The project ran an “$800 million Summoning Campaign” on Turtle Club — the same liquidity launchpad trusted by projects like Polygon-backed Katana — to bootstrap deep liquidity before mainnet launch.

It’s worth noting that a year ago, the TAC team announced collaboration with Polygon Labs to build a TON layer-2 using Polygon CDK. The idea was for the planned rollup to eventually run as an EVM-compatible layer on top of TON itself. But that’s evidently been shelved. By contrast, the newly launched TAC chain is a sovereign layer-1 built on Cosmos SDK, bridging to TON via a dedicated cross-chain adapter.

TAC’s fee model also reflects this bridging complexity. As co-founder Marco Monaco explained to Blockworks:

“MiniApps are built with our SDK, [where] transactions simulate the EVM gas cost and convert it in real-time in TON with an oracle. This TON is attached to the user's transaction, sent to the TON Adapter…picked up by a network of sequencers and relayed to the TAC EVM side, where there is a network-level paymaster that sponsors the TAC gas fees. We then convert the collected TON into TAC and refill the paymaster.”

This approach abstracts away gas payment friction for end-users while creating sustained buy-pressure for the TAC token, as TON collected from users is systematically converted.

On the staking side, TAC uses standard Cosmos-style delegated proof-of-stake (DPoS), offering yields in the 8-10% APY range, not counting transaction fees. Monaco clarifies these rewards are not artificially boosted beyond the protocol’s inflation schedule.

“[TAC emissions] run at around 5% inflation per year, with a staking ratio of 60%,” Monaco said.

TAC security is to be bolstered by Babylon bitcoin staking — the network is targeting to be among the first BSNs (bitcoin secured networks) based on Comsos, Monaco said.

This dual-staking approach means validators must bond TAC while facing the risk of slashed BTC collateral enforced via Babylon’s SPV-based slashing system on Bitcoin itself.

“It's of utmost importance for us…a layer-1 with a token trading at [a few hundred million dollars] FDV can't secure 1b TVL on the network. So Bitcoin security is critical to be able to secure the TVL onchain.”

The validator set at launch features reputable infrastructure players such as ValidationCloud, P2P, Kintsugi, NodeStake, Chorus One and Animoca.

From a security perspective, TAC has taken care to avoid common launch pitfalls. The EVM implementation underwent a fresh Halborn audit in late May 2025 — just before launch — which found no critical or high-severity issues and verified fixes for minor bugs. Earlier audits by Halborn, Trail of Bits and Quantstamp covered the TON Adapter and proxy contract layers, reinforcing TAC’s claim of professional-grade security.

Still, the design reflects clear trade-offs. As an external EVM-compatible layer connected via cross-chain bridging and “state mirroring,” TAC introduces extra trust assumptions and sequencing complexity. Its sequencer network, for example, remains “distributed, but not decentralized” at launch.

Ultimately, TAC’s mainnet debut is a major milestone for TON’s evolution from a payments-focused chain into a more mature DeFi-capable platform. It may be an indirect bridge — and certainly not without friction — but it’s also a pragmatic one that gives Ethereum developers a path to tap Telegram’s enormous audience without abandoning EVM tools and code. Whether that bridge will be widely used and sticky remains the big question ahead. The whole thing feels a bit Rube Goldbergian to me.

Correction: Clarified Babylon-based dual staking is not live at mainnet launch.

Aptos exhibits increasing utilization of its high performance environment, evidenced by DEX volumes and app revenue reaching new all-time highs in June. Aptos is further positioning its technical stack as best-in-class amongst high-performance L1s to settle high-volume financial use cases. With a consensus design approaching theoretically optimal, a growing ecosystem of core DeFi primitives and deepening stablecoin liquidity, Aptos is set to support much higher utilization of network resources.

Fantasy.top comes to Base

The once upon a time viral SocialFi trading‑card game Fantasy.top is packing its bags to head to Base today. Users will be able to migrate all assets and card NFTs from Blast via an in-app bridge.

Fantasy is coming to Base

Fantasy Top is officially migrating to Base, teaming up with the most active Layer 2 to become the leading social experience in the ecosystem.

The bridge opens tomorrow (7/15) at 1PM UTC. Stay tuned!

Please note: the game will enter maintenance mode

— fantasy.top (@fantasy_top_)

4:17 PM • Jul 14, 2025

Fantasy.top is a “fantasy league” trading card game which lets players bet on the social media engagement of Crypto Twitter influencers.

Users buy card packs via a dutch auction to assemble a five-card deck of “heroes.” The decks are used to participate in tournaments that dish out ETH, Blast Gold and point rewards.

Trading of cards is then frozen until the end of the trading competition, where off-chain oracles take a snapshot of each influencer’s social media metrics to determine winners. Influencers themselves receive a percentage fee of pack sales and trading fees.

At its peak, Fantasy.top was one of the top fee-generating protocols in DeFi, pulling in more than $10m in fees. Based on Dune, Fantasy.top still had ~2000 active weekly players at the end of May 2025. Blast seems to have abandoned its project. TVL is down to $88m from its peaks of $2.3b, and its official Twitter account hasn’t posted a development update since early May.

— Donovan Choy

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 PM EST

|

|