- 0xResearch

- Posts

- 🔜 The ZK endgame is nigh

🔜 The ZK endgame is nigh

Boundless network launches

Brought to you by:

Another day, another zk launch. Today I’m looking at the launch of RISC Zero’s new Boundless network. Strap in for the zk endgame.

— Donovan

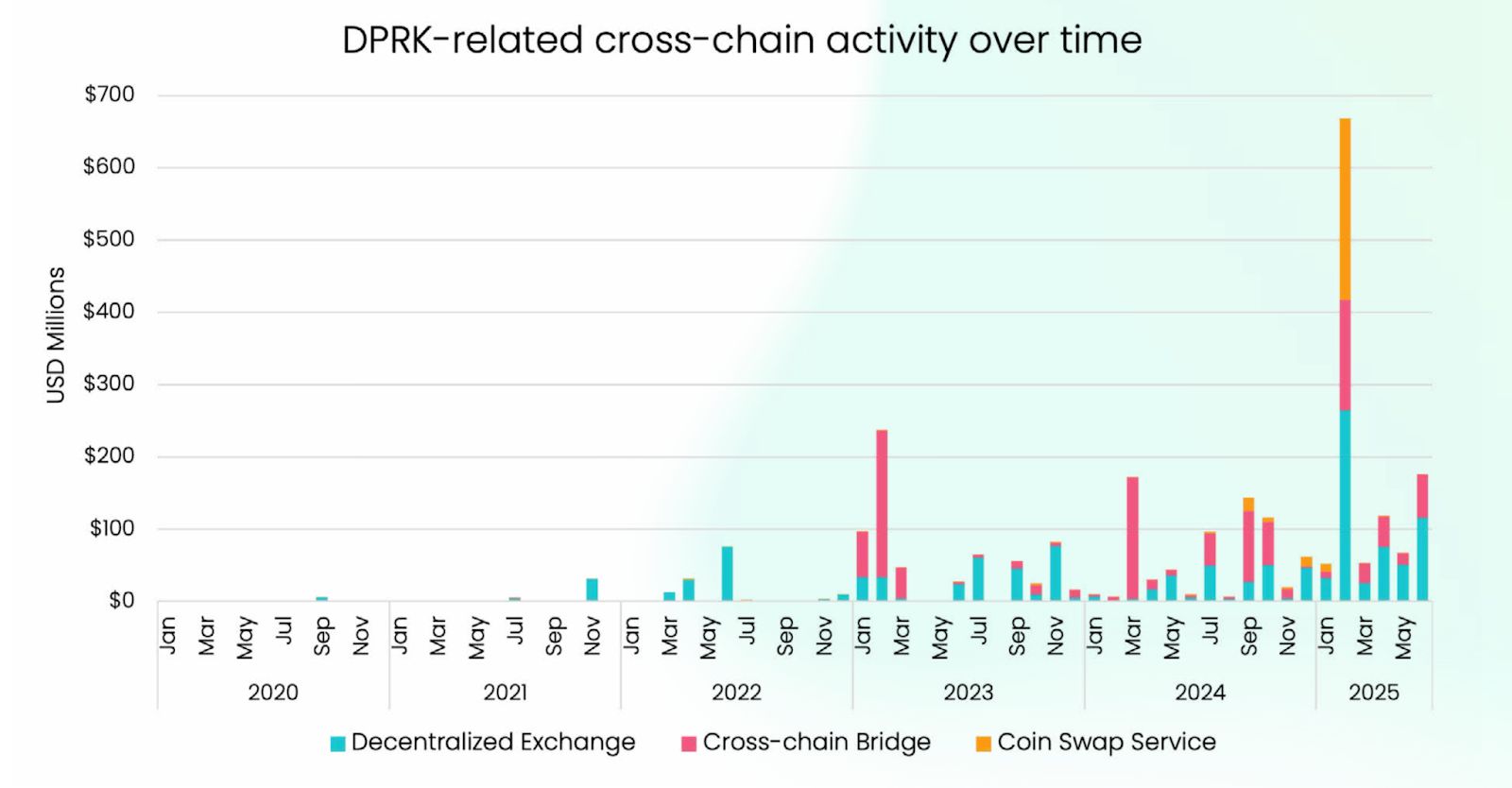

DPRK’s cross-chain laundering underscores blockchain’s traceability:

Source: Elliptic

In a report published today by Elliptic, the onchain intelligence firm’s data shows DPRK-linked cross-chain laundering spiking sharply in early 2025, with February alone topping $650 million. That’s of course dominated by the aftermath of February’s $1.4 billion Bybit hack.

The chart makes clear how North Korea’s hackers have turned to DEXs, bridges and coin swap services to move stolen funds across chains.

But despite these obfuscation attempts, blockchain analysis remains highly effective for tracking illicit flows. As Elliptic notes, since its first report on illicit flows in 2022, “over $2.7 billion of our $21.8 billion estimation — around 12% — can be attributed to North Korean crypto hacks.” It underlines the scale of sanctions-evasion risk, but also the transparency of the blockchain. Spikes in laundering activity can be pinpointed and attributed, proving that public blockchains continue to offer critical information for law enforcement and sanctions monitoring, even as criminal methods evolve.

You don’t need expansive and rare leaks of sensitive legal data like the Panama Papers to follow the money onchain.

Brought to you by:

Katana is a DeFi chain built for higher sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn KAT tokens: Pre-deposit with turtle club

RISC Zero’s Boundless is live

The incentivized testnet (mainnet beta) of RISC Zero’s Boundless network went live on Base yesterday.

Boundless is not a new blockchain. Boundless is a marketplace for zero-knowledge virtual-machine (zkVM) proofs — sometimes called a proof market — that can deploy to any network and settle proofs anywhere.

Who needs it?

Any chain or application that wants to process heavy computation onchain, but whose existing virtual environment is ill-suited to leverage zk technology. Boundless lets teams do so without making radical changes to their architecture. Just like how Chainlink brought price feeds to each chain, Boundless brings verifiable compute.

Here’s how the network roughly works:

Chains/apps request and submit computation tasks to the Boundless network running auctions on its contracts.

“Provers” (miners) on the Boundless network running CPUs/GPUs claim these jobs to perform the expensive computation off-chain.

To accept tasks, provers stake ZKC tokens to lock a proof request. These tokens are slashable, so there’s an economic mechanism to keep work honest.

When provers finish the job, a tiny, mathematically verifiable zero-knowledge proof (ZKP) receipt is settled on the host chain.

Because verifying a tiny-sized proof on Ethereum or a rollup costs only a minimal amount of gas, the base chain never feels the heat from the underlying computation — even if that computation took minutes, ran on a cluster with GPUs or touched gigabytes of data.

Boundless’ CEO Shiv Shankar reminded me of the prohibitive costs of running zk computation onchain, which can go reach thousands of dollars.

“Today, anyone is able to do that massive computation with a zkVM for less than $30. This sort of boundless mindset is what we are bringing to every chain. Elastic unlimited computation [is] available to you at any point in time,” he said.

The Boundless explorer shows 363 active provers processing jobs today, though the team told me they anticipate at least a thousand GPUs proving soon.

Boundless architecture

Unique to Boundless’ network is its self-developed cryptographic primitive called “proof of verifiable work” (PoVW).

Traditional proof-of-work pays bitcoin miners for hashes, Boundless’ PoVW pays for useful zkVM cycles.

PoVW tags pieces of verifiable metadata — or “work receipts” — to each proof as a record of how much computation went into it. This lets Boundless pay the hundreds of provers on its network in proportion to the actual compute delivered, as well as detect fraudulent proofs.

This contrasts to the off-chain auction bidding that Succinct uses, or the time-based quotes that Kalypso uses.

Today’s adoption

Early adopters to Boundless include teams like EigenLayer, Celestia, Taiko, Lido and more.

Teams are using Boundless provision of verifiable compute for a variety of purposes.

For instance, EigenLayer is using Boundless to power its AVS slashing logic, Celestia is using it to prove the validity of its data availability on any chain, the Taiko based rollup uses it as part of its multi-prover setup, and Lido leverages Boundless for a zk-based staking oracle.

Although Boundless ships with its own RISC Zero zkVM, the network is proof system agnostic.

Support for competing zkVMs, such as Succinct’s SP1, ZKsync’s Boojum or Jolt, is on the roadmap, allowing developers to switch tooling without leaving the marketplace.

Boundless’ full mainnet launch and Token Generation Event are slated for late 2025.

Aptos exhibits increasing utilization of its high performance environment, evidenced by DEX volumes and app revenue reaching new all-time highs in June. Aptos is further positioning its technical stack as best-in-class amongst high-performance L1s to settle high-volume financial use cases. With a consensus design approaching theoretically optimal, a growing ecosystem of core DeFi primitives and deepening stablecoin liquidity, Aptos is set to support much higher utilization of network resources.

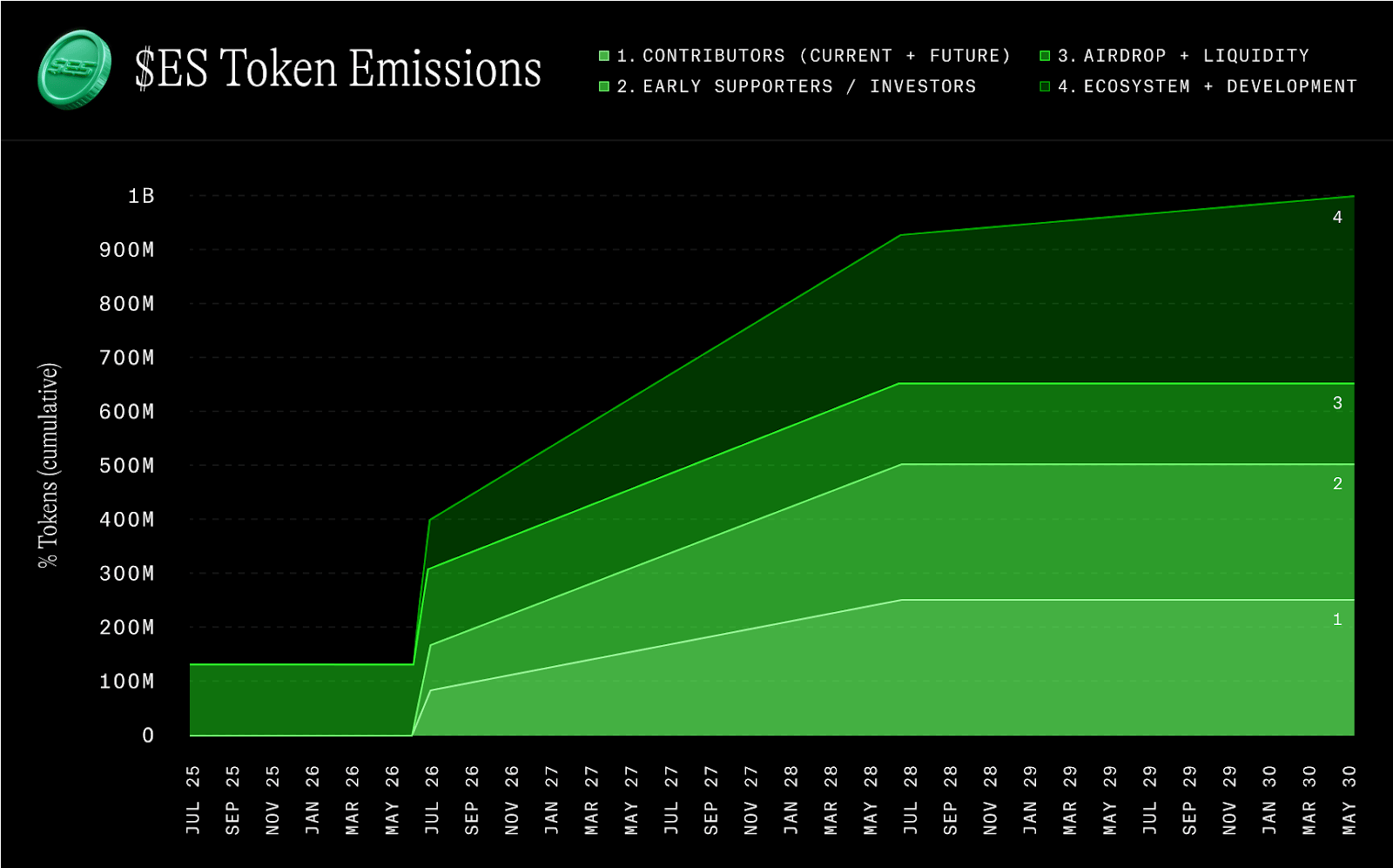

Eclipse ES airdrop breakdown

Eclipse’s long-awaited ES token dropped today, with claims open for 30 days.

The drop was fairly limited to Eclipse-specific activity. Eligibility was based on Turbo Tap onchain activity (every tap, swap, LP add scored “grass” but not 1:1 with tokens), Discord OG roles (targeting real contributors only), and Twitter engagement filtered for genuine users (using Kaito).

The team made efforts to exclude Sybil farmers using bots or auto-clickers.

“After School Club” (ASC) NFT holders also get an automatic TGE drop — no claim needed. ASC was the official genesis NFT collection for Eclipse and the only NFT-based source of airdrop allocation.

Eclipse insists insiders were not able to snipe the community’s share based on unfair knowledge of the eligibility criteria.

“Eclipse Labs employees have signed documentation barring them from claiming any $ES airdrop,” Eclipse Labs posted to X in June.

Of the 1 billion ES total: 15% are allocated to airdrop and liquidity, 35% for ecosystem growth, 19% for contributors and 31% for early backers.

Employee (contributors) and investor tokens (early backers) are locked for one year, then will vest linearly over three years.

Source: Eclipse Foundation

ES isn’t just a governance meme; it’s gas for the Eclipse chain, enabling MEV redistribution votes, fraud-proof bonding, custom sequencing rules and staking for native emissions.

As of 11:30 am ET, ES is trading at around $0.34, giving the network an FDV of $340 million — of which $55 million are circulating.

— Macauley Peterson

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 PM EST

|

|