- 0xResearch

- Posts

- 🔂 The return of Zora

🔂 The return of Zora

Content coins are in

Zora was an NFT marketplace in 2022. Then it launched its L2 chain in 2023. Then a mobile app in 2024. This year, it’s back on Base as a memecoin launchpad on a social network. Phew! Running a startup is tough.

— Donovan

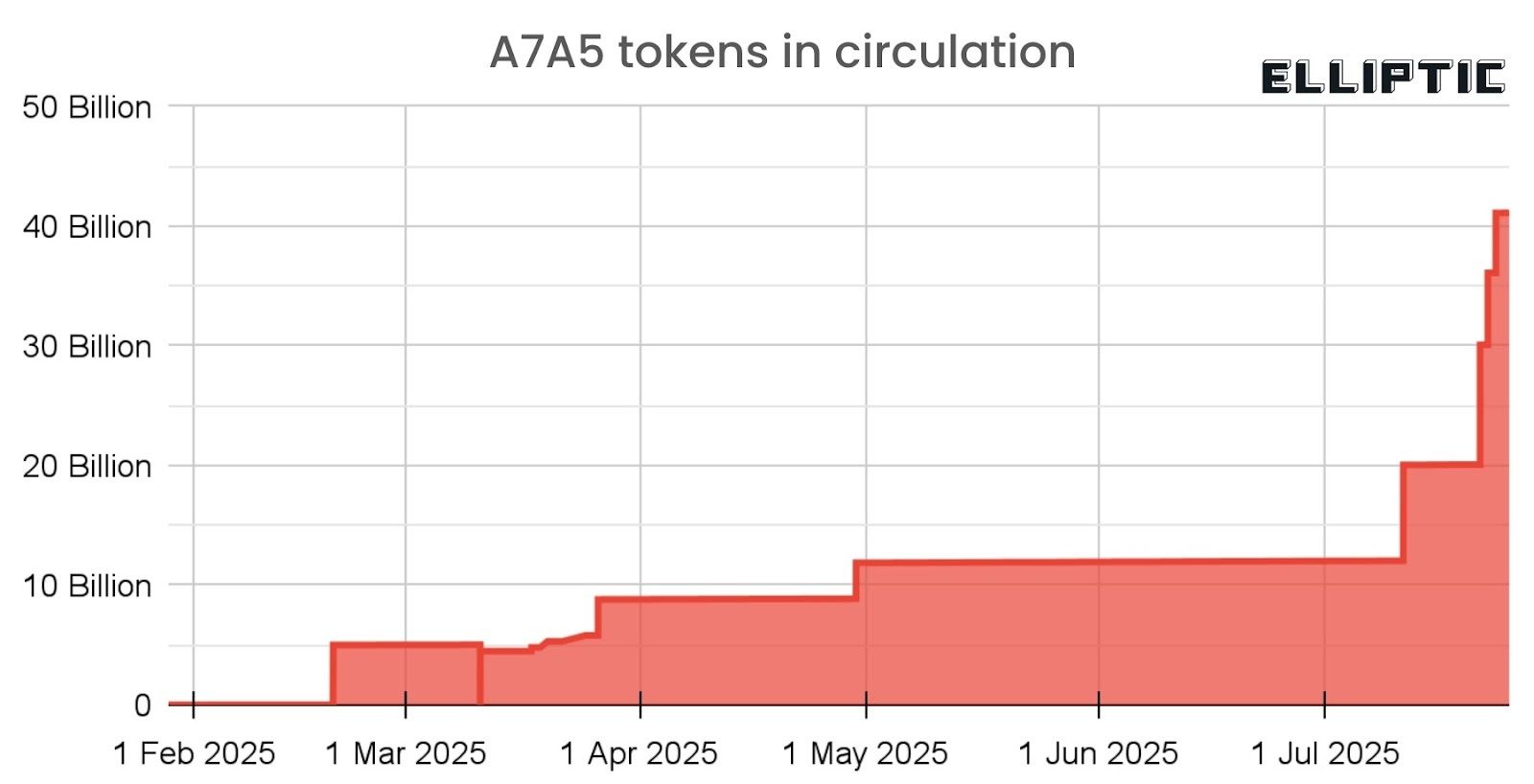

Ruble-backed stablecoin surges past 40b (around $500m):

Source: Elliptic

A7A5, a ruble-denominated stablecoin, has exploded in circulation over the past month. It jumped from just over 17 billion to more than 42 billion tokens (or about $500m), as shown in Elliptic’s latest chart. The spike follows a steady but modest climb from February through June — before issuance suddenly accelerated in July.

According to Elliptic’s report, released today, A7A5 now processes over $1 billion in daily transfers, driven by a mix of Russia-based centralized exchanges and cross-border payments activity. While A7 LLC, a Moscow-based firm suspected of being behind the stablecoin, maintains a low profile, the scale and timing of A7A5’s growth suggest state-aligned motivations, Elliptic says.

The sharp growth in token issuance, coupled with elevated transaction volumes, should be a flashing red signal for regulators, who have largely overlooked the ruble stablecoin sector. A7 LLC is sanctioned by the UK and the EU, but not yet by the US via OFAC.

Elliptic notes that A7A5 is increasingly used to bypass traditional rails: “There is strong evidence that the A7A5 stablecoin is being used to evade sanctions and facilitate illicit finance.” Traders can offramp via Tether’s USDT with liquidity facilitated by exchanges that deal in A7A5, according to an Elliptic spokesperson.

“There's not a lot that Tether can do — the liquidity is enabled by the exchanges,” the spokesperson told Blockworks. “The official issuer of A7A5 is the Kyrgyz company Old Vector LLC.”

Crypto has no shortage of short-term hype cycles. The best protocols buck the trends and build sustainable ecosystems for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable. Tune in live to ask the speakers a question!

📅 July 31 | 12 pm ET

Zora is back

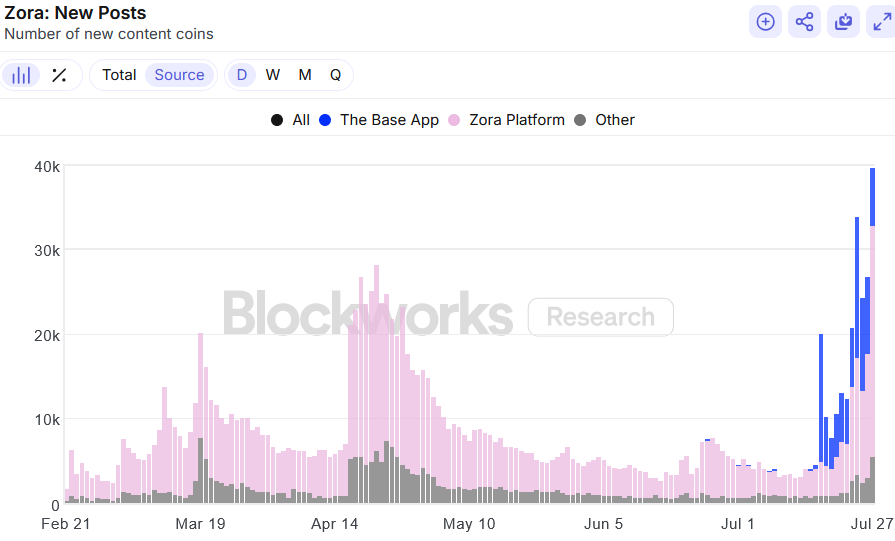

The last time Zora was in the limelight, the protocol was seeing an all time-high of 20-25k tokens created daily.

That was in April, just before the ZORA token generation event — a “for fun only” token that was universally panned by the Crypto Twitter commentariat.

The ZORA token dumped immediately on launch, daily tokens created cratered to less than 5k, and price had largely stagnated until last week.

Now it’s back. ZORA is today trading 227% up on the week, and its mobile app is climbing ranks on the iOS App Store.

Nearly 40k tokens were created yesterday, the highest in the protocol’s history. About 15-50% of the tokens (denoted in blue below) are coming from Base App, Coinbase’s newly rebranded wallet app.

The economics of Zora

Zora is not a difficult product to understand.

It’s Pump.fun with a social network. Or think Instagram, but tokenized into oblivion.

Here’s roughly how it works:

You are a social media influencer, and you post cool stuff on Zora. Each of your posts are tokenized as an ERC-20 token with a 1 billion supply. You receive 1% (10 million).

People think your post will go viral, so they buy it (via Uniswap under the hood), and you earn a 1% cut of the trading fee paid in ZORA. That’s the first revenue stream for creators.

These trades are paired against your “Creator Coin,” which is basically your profile tokenized when you sign up on Zora. Your username is the ticker.

Every Creator Coin has a 1 billion supply, 50% of which is immediately tradable.

The other half vests linearly to you over five years. But here’s the catch: It only pays out to you when someone really likes you and trades your Creator Coin. That’s the second revenue stream for creators.

You quickly see how the incentives line up.

Make cool content, people buy your tokenized posts, you earn 1% trading fees. Become super popular, people speculate on your Creator Coin, your market cap grows, you get paid out more.

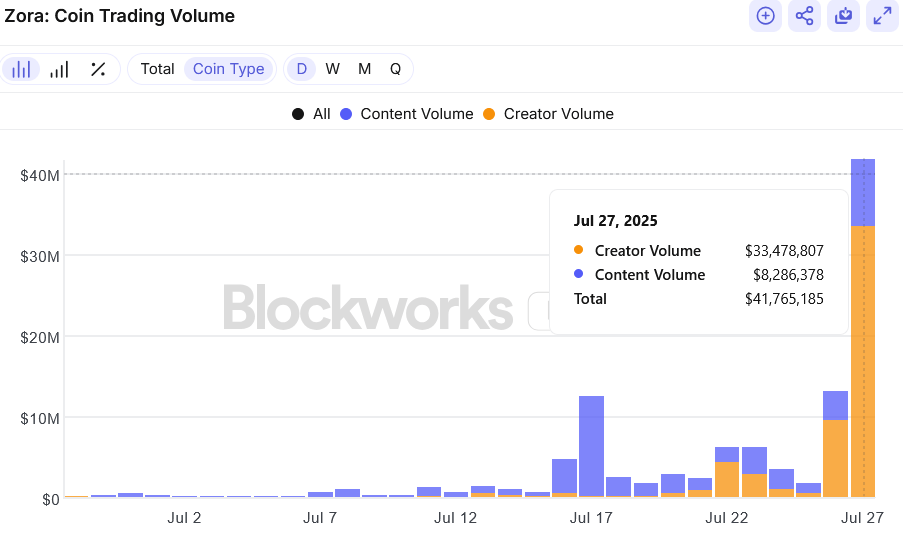

Most Zora trading volume is coming from Creator Coins — about $33m yesterday.

I imagine that is quite lucrative for content creators.

Consider JACOB, the Creator Coin of Zora co-founder Jacob Horne. It’s the second-largest Creator Coin, with a $6.2m market cap today.

At a linear vesting rate of 500m tokens over five years, that’s 273,973 tokens vested a day. Or about $3,397 in daily value at a $6.2m market cap.

Contrast that with a typical Instagram creator who takes years to build a 50k following, and gets paid something like $100-$500 for a sponsored post, based on Shopify’s estimates.

Zora draws a lot of comparisons to Pump for the way that it both attracts speculators to trade on low-cap tokens.

The key distinction is that Zora is attempting to anchor this activity to a native social network, betting that a durable network effect will sustain engagement.

(Pump appears to be moving in a similar direction with Twitch‑style livestreaming.)

That may explain Zora’s decision to deploy on Base, despite having already developed its own OP-stack L2 chain in 2023.

Zora’s revenue-sharing tokenomics is undoubtedly superior to traditional social networks. But without a genuinely organic social graph — and that is the most daunting task of them all — it’s hard to see Zora maintaining its momentum.

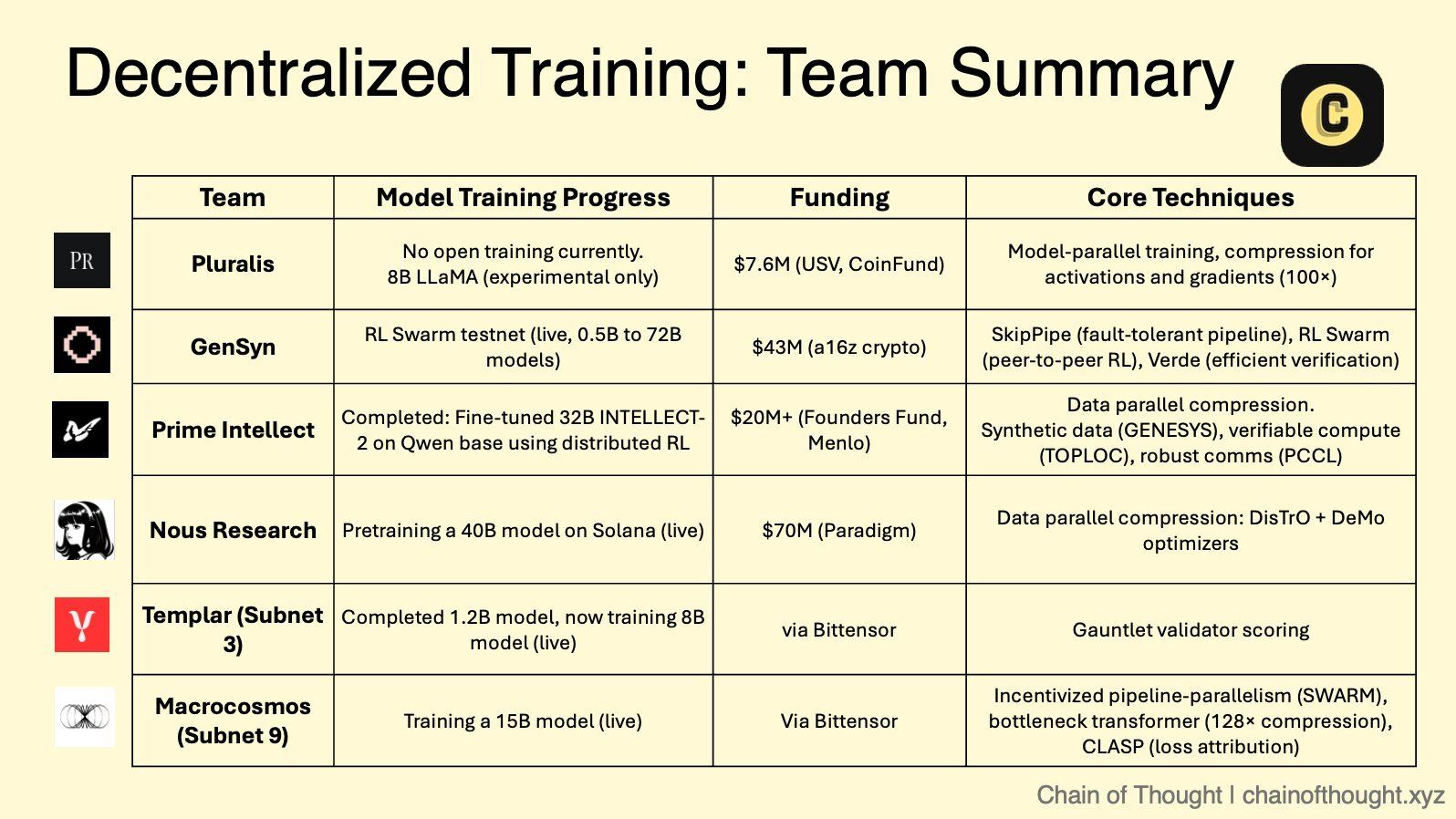

Decentralized AI, distributed power

Decentralized AI training is rapidly moving from fringe experiment to foundational infrastructure. Teams like Gensyn, Nous and Prime Intellect are pushing the boundaries of distributed compute, each with distinct architectures — Reinforcement Learning (RL) swarms, compression-aware frameworks and synthetic data pipelines.

Pluralis introduced "Protocol Learning," where models are co-trained but never fully assembled, ensuring privacy and contributor sovereignty. Gensyn’s global ML cluster taps underused GPUs worldwide, while Nous is building a community-led 40B model with Solana-based training.

Prime Intellect's 32B INTELLECT-2 model, trained with distributed RL, proves frontier models can be built using globally distributed, decentralized infrastructure. Meanwhile, Bittensor’s subnets (Templar and Macrocosmos) specialize in validation and incentivized co-training, respectively.

Source: ChainOfThought.xyz

The thesis is: Decentralization enables massive scale, resilience and democratized access at a time when rising inference costs threaten to recentralize power. As open-source Qwen 3 Coder rivals Claude Sonnet 4, the AI stack is being rebuilt in public, onchain and across the globe.

|

|