- 0xResearch

- Posts

- The onchain reinsurance opportunity

The onchain reinsurance opportunity

Bringing crypto rails to a $750B industry

Hey all, happy Friday!

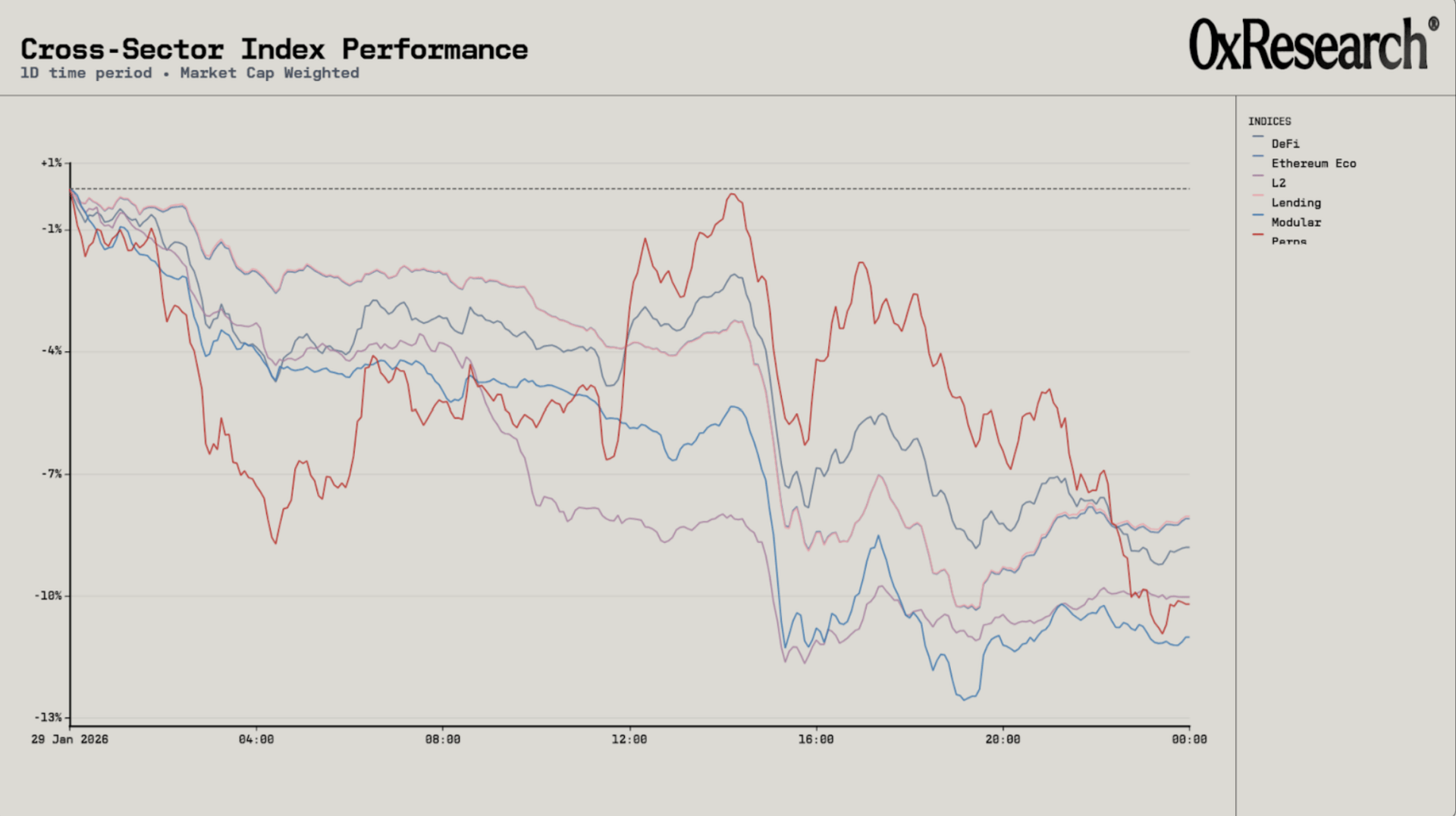

Yesterday’s session was a masterclass in the “deleveraging tape,” as crypto assets across the board faced a persistent grind lower, pinned by restrictive Fed messaging and a defensive shift in global risk appetite.

While the majors bleed, the search for uncorrelated yield continues. This week, we dive into the world of reinsurance, a $750B global industry that operates independently of market cycles, and how protocols are bringing it onchain.

Crypto bled through the session yesterday, with selling pressure broad-based and persistent across majors and beta pockets alike. The overall market experienced a steady grind lower from the open that accelerated into the afternoon, leaving most sectors pinned near the lows into the close rather than meaningfully bouncing.

The biggest outlier was perps, which saw the most violent intraday swings. Perps initially sold off hard, then snapped back aggressively midday, then rolled over again into the latter part of the session. That kind of whipsaw is typical of a market being driven by positioning and liquidations rather than fundamental re-rating — a “deleveraging tape” where rallies are more about shorts-covering than fresh risk coming in.

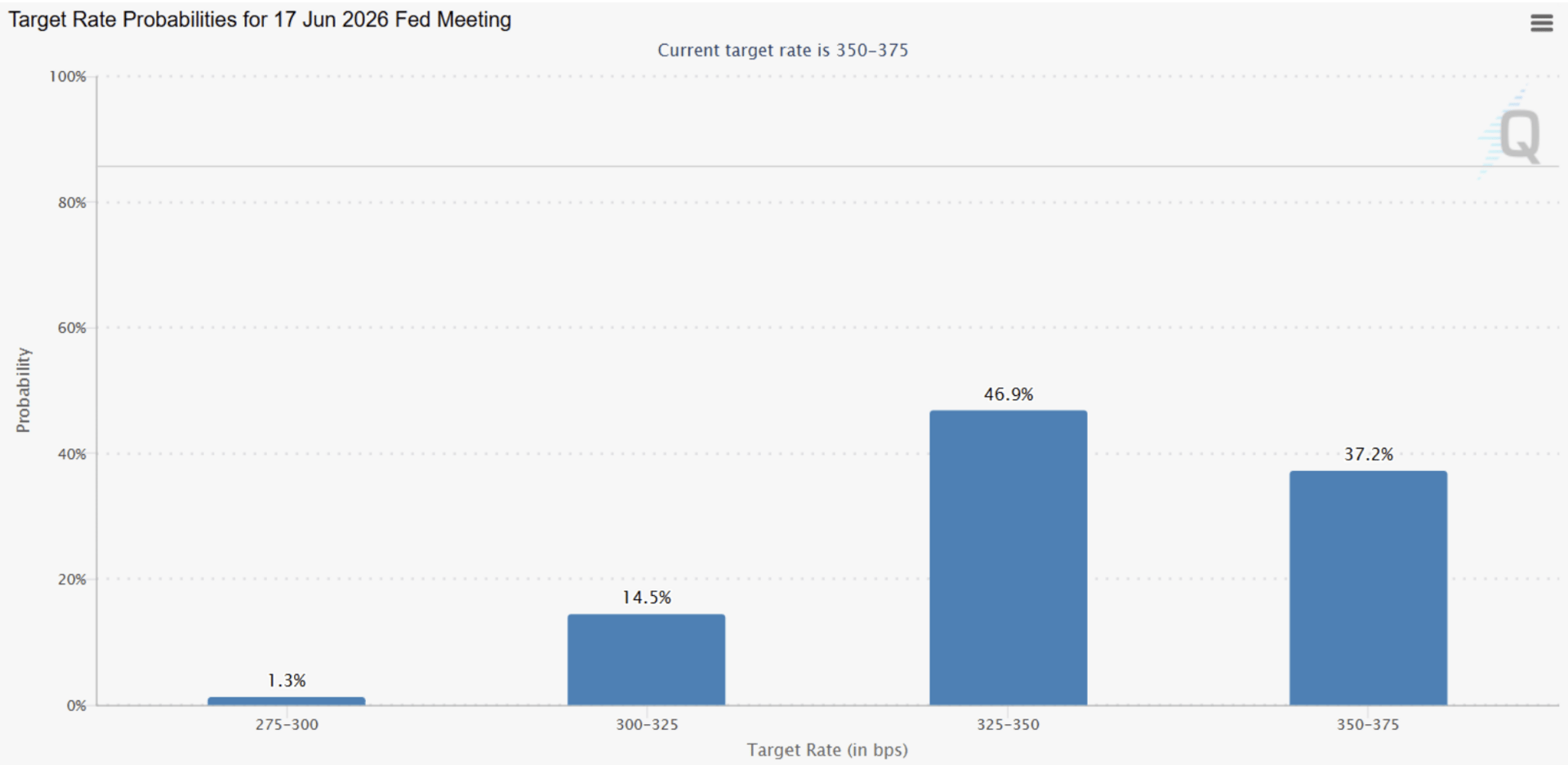

Macro-wise, the move fits neatly into a risk-off impulse driven by the Fed’s latest messaging, which kept rates restrictive and the tone cautious on inflation progress. Markets are increasingly sensitive to any signal that policy may stay “higher for longer,” and crypto, still behaving like a high-beta expression of liquidity conditions, took the hit alongside other duration-sensitive assets. The market isn’t expecting another cut until June 2026, and even then, there may be considerable uncertainty.

Source: FedWatch

At the same time, US earnings season is keeping cross-asset volatility elevated. With megacap prints dictating index-level direction, risk appetite is being repriced in real time. Strong results are helping pockets of equities hold up, but guidance uncertainty and rate sensitivity are capping upside and keeping positioning defensive. In that environment, crypto has struggled to sustain rebounds, and yesterday’s sector-level drawdowns reflect broader unwillingness to add risk until macro and earnings volatility clears.

— Marc

Onchain reinsurance

Reinsurance, the business of insuring insurers, represents a $700 to $750B global market that has historically been defined by opaque negotiations, slow settlement cycles, and extremely high barriers to entry. A handful of crypto protocols are now attempting to introduce DeFi capital into this traditionally closed world.

The value proposition: Reinsurance returns are driven by event-based risks (natural disasters, accidents, mortality patterns) rather than economic or market cycles, making them largely uncorrelated with most markets.

For DeFi, this represents an opportunity to access stable, real-world income streams. Reinsurance remains among the smallest DeFi verticals by TVL. The large gap between market opportunity and current onchain penetration explains the protocol launches targeting this space.

The protocol Re has emerged as one of the most scaled onchain reinsurers to date. According to its transparency dashboard, the protocol shows $396M in TVL, comprising $116M in onchain capital, $65M offchain capital, and $215M in premium receivables (the total expected premium income from contracts already signed). In 2025, the protocol underwrote over $103M in ceded premium across deals covering categories such as commercial auto, commercial liability and workers' compensation. Combined ratios across these lines range from 91% to 95%.

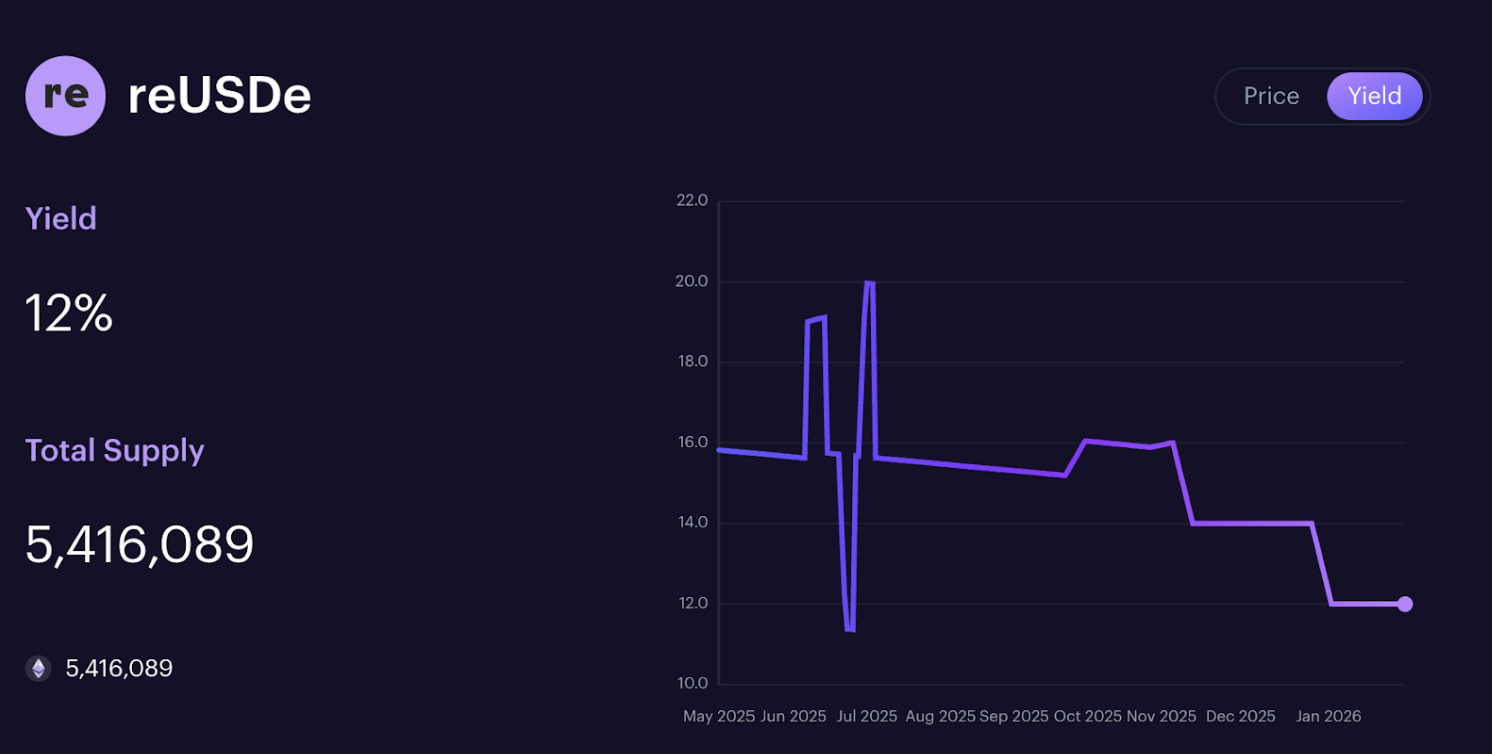

For context, a 91% combined ratio means Re Protocol pays out 91 cents in claims and expenses for every dollar of premium collected, keeping 9 cents as profit. Its tokenized products target yields of 15% to 23% for reUSDe (the higher risk insurance alpha product) and 6% to 9% for reUSD (the lower risk basis plus product). However, current live yields sit at 12% for reUSDe and 7.6% for reUSD.

OnRe operates on Solana and is regulated by the Bermuda Monetary Authority. Its flagship product, ONyc, is a yield-bearing token backed by a pool of stablecoin deposits that are deployed into diversified reinsurance contracts across specialty lines. OnRe targets 10% to 12% from underwriting performance plus additional yield from stablecoin collateral, but according to its transparency dashboard the current 12-month APY sits at 9.3%, comprising 3.8% from collateral and 5.5% from underwriting returns. Notably, AUM has grown from around $12M in June 2025 to approximately $94M today.

Both Re Protocol and OnRe are delivering yields below their marketed targets, and the issue appears to be that capital has scaled faster than deployment. For example, OnRe’s transparency dashboard shows a visible split between “Liquidity Buffer” (58.4%) and “Active Underwriting” (41.6%), suggesting a meaningful portion of capital is not yet deployed into reinsurance contracts. Idle capital earns only the base stablecoin yield, rather than the higher underwriting returns. This drag has been compounded by compressed Ethena funding rates, meaning the fallback yield on undeployed capital is now much lower than it was when these protocols launched.

Note that these tokens represent claims on pools of insurance risk, and the NAV can decline if claims exceed premiums. Depositors seeking the higher yields take on first-loss risk and would absorb underwriting losses if claims exceed premiums. Liquidity is somewhat constrained: Primary redemptions are currently gated to quarterly windows, though secondary markets provide 24/7 exit options but potentially at a discount to NAV. And as both protocols have demonstrated, if capital scales faster than deployment capacity, returns get diluted.

— Sam

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.

Blockworks Advisory’s Anastasiia published a research thread analyzing how traditional finance interest rates transmit into DeFi lending markets.

Using stablecoin lending data from March 2022 to Jan. 2026, the analysis finds that SOFR rate changes pass through to DeFi via pool utilization, with USDC showing a 0.91 passthrough coefficient (91bp per 100bp SOFR change) versus USDT's 0.54.

The difference stems not from capital flows but from protocol-specific rate curve designs. USDC exhibits a textbook kinked curve at 85% utilization, while USDT shows an inverted structure at 45%, demonstrating that stablecoin lending markets are heterogeneous despite sharing the same peg.

The latest episode of Lightspeed features Danny and Carlos discussing three main topics. First, they analyze the Solana Seeker phone’s SKR token airdrop, noting that most users received enough to cover their device cost, while questioning whether the token functions as a distribution mechanism or conveys meaningful ownership.

Second, they examine signs of memecoin activity revival, with pump.fun graduation rates hitting levels not seen since September 2025, though they caution against declaring the trenches definitively “back.”

Third, they discuss the growing competition among tokenized stock platforms on Solana, highlighting the New York Stock Exchange’s announced 24/7 trading plans as potential validation of the internet capital markets thesis.

President Trump’s SEC and CFTC leaders say they’re prepared to move forward with new crypto rules, even after Congress hit a snag on major legislation. SEC Chair Paul Atkins and CFTC Chair Michael Selig said the agencies are close to signing a formal cooperation agreement and will outline how they plan to divide oversight, potentially with the SEC focusing on tokenized securities and the CFTC overseeing crypto assets treated more like commodities.

The push comes as the Senate’s CLARITY Act was delayed after Coinbase withdrew support over stablecoin rewards provisions, leaving both crypto and banking industries uncertain ahead of the midterms. Unlike the Biden-era approach centered on enforcement, the regulators say they want clearer guidance, including possible “innovative exemptions” to help new crypto products reach market faster.