- 0xResearch

- Posts

- 🟣 T-0 To ETF Deadline

🟣 T-0 To ETF Deadline

Decision day! Bitcoin ETF issuers hold their breath.

It’s decision day folks! After yesterday’s false start, we should finally have an answer from the SEC on the Ark 21Shares Bitcoin ETF proposal — and presumably all the rest too.

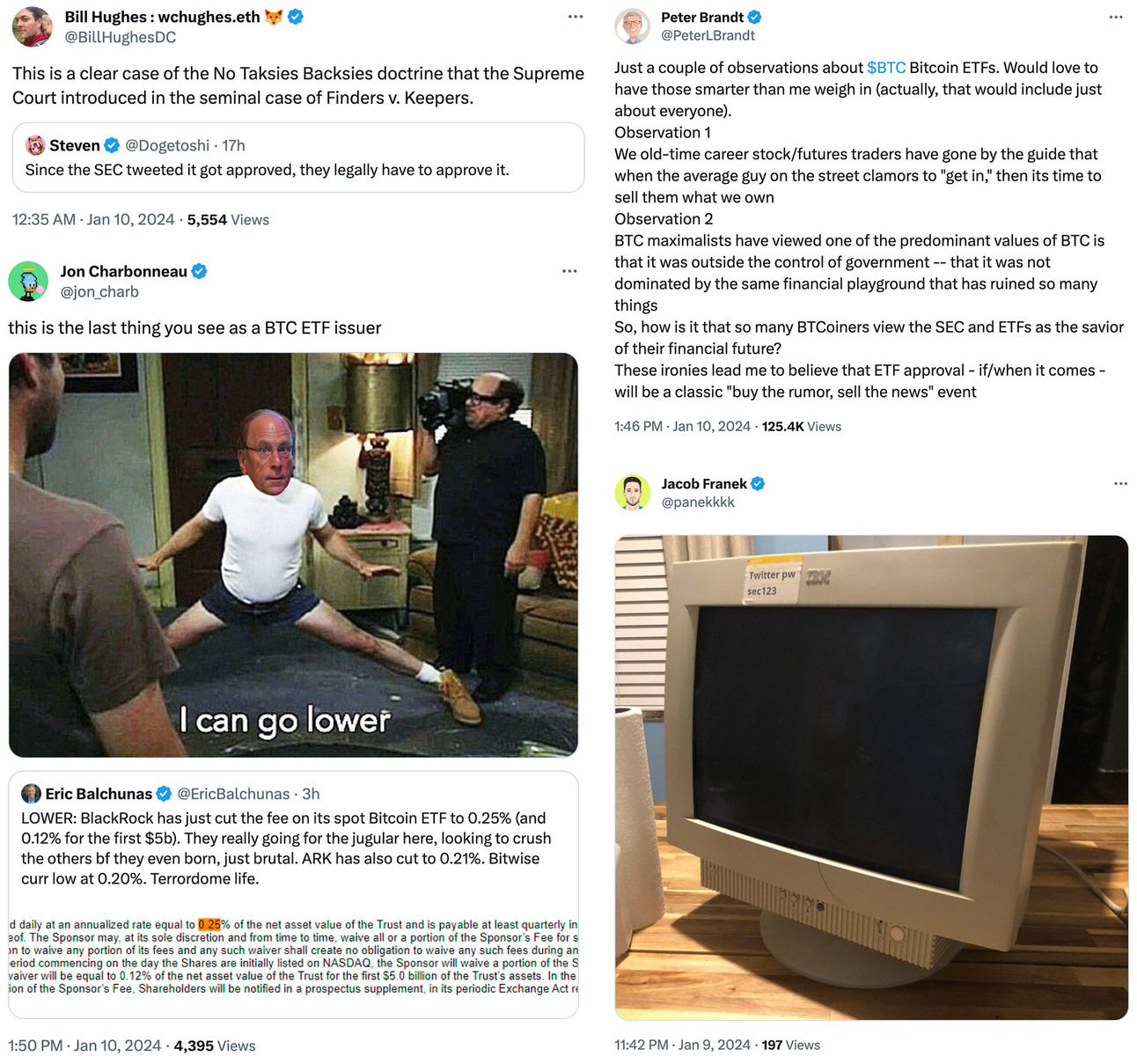

Pandemonium ensued on Crypto X, late Tuesday, after the SEC’s official account published and then deleted a post announcing the approval of the pending ETFs.

Bitcoin spiked up to just shy of $48,000, then plummeted to below $45,000 within the span of 20 minutes after SEC Chair Gary Gensler warned that the agency’s X account had been “compromised.”

As of Wednesday morning in New York, bitcoin was actually trading lower than its lowest point in yesterday’s volatility. Many analysts have predicted that the approval itself will be a “sell the news” event, and some traders may be front-running that expectation today.

Still, with trading of actual shares possible as soon as tomorrow — if the approval goes through — we would expect to see some actual money flowing into bitcoin as a result.

In the weeks and months leading up to the Jan. 10 deadline, most expectations were that ETFs wouldn’t be able to actually list for weeks after approval, as is common practice. But ETF issuers and the SEC have accelerated that timeframe, according to reports.

In that case, traders would be closing their longs at the same time the biggest financial firms are opening up the marketing spend for their new products in a cutthroat race to gather AUM.

And competition is most definitely intense: Issuers have been playing a game of “how low can you go” with their proposed fees ever since Monday, with another round of discounting giving consumers multiple sub 0.4% fee options as of Wednesday morning.

BlackRock was the latest to cut its fees to the bone, planning to charge just 12 bips for the first year or $5 billion (whichever comes first) and then 0.25% afterward.

Ether notably surged alongside the fake approval tweet Tuesday, but continues to trade higher, poking its head above $2,400 for the third time in as many weeks. It’s up nearly 10% against bitcoin since yesterday’s shakeout.

Other crypto assets have fared worse, as TOTAL3 — the total crypto market cap excluding bitcoin and ether — remains in a downtrend since the peaking Jan. 2 at $534 billion.

As usual, one would expect the rest of the market to take its cues from bitcoin, so it’s back to watching the SEC’s EDGAR system like a Valkyrie. A decision is expected between 4 pm and 6 pm ET.

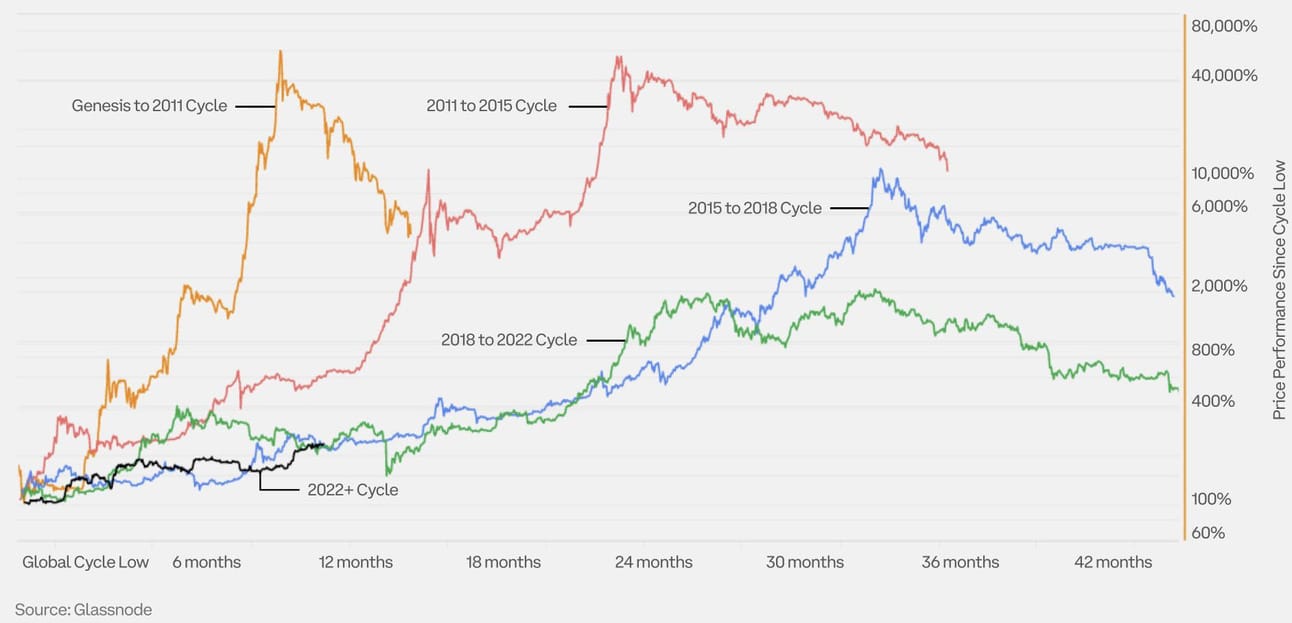

The first bitcoin block was mined just over 15 years ago, and since then, crypto’s ups and downs have tended to follow the predictable 4-year cycle of Bitcoin’s halving, with each new reduction in issuance propelling the asset to ever higher highs and higher lows.

Glassnode charted the pattern, across time and percentage change, to illustrate how they compare at a glance. For the past three cycles, market peaks have come between about 24 and 34 months after the cycle low, while the percentage gain from the cycle low has been progressively falling — though still far outpacing all other asset classes.

It’s been just over a year since the current cycle’s 2022 low, with BTC up nearly 200% since then.

If past is prologue, as they say, we’re still early.

Listen up, newsletter readers! You get a first look at Blockworks Research’s new MakerDAO dashboard, before it hits the mainstream.

Among other things, we’re tracking Maker’s Monthly Annualized Revenues and Net Income which roughly doubled in Q4 2023, thanks in large part to the healthy contribution from Maker’s US Treasury bill portfolio.

The DAO clocked just a hair shy of $195 million in RWA-related income in November en route to its highest net income figure since January 2022, at $161 million.

There’s a wealth of information available on the dashboard — everything from estimates of MakerDAO’s price-to-sales and price-to-earnings multiples, to a color-coded chart of all the DAOs expenses.

The insights, views and outlooks presented in the report are not to be taken as financial advice. Blockworks Research analysts are not registered broker/dealers or financial advisors. Blockworks Research analysts may hold assets mentioned in this report, further outlined in the Firm’s Financial Disclosures.