- 0xResearch

- Posts

- Solana's social contract

Solana's social contract

SIMD-326: A look inside Solana governance

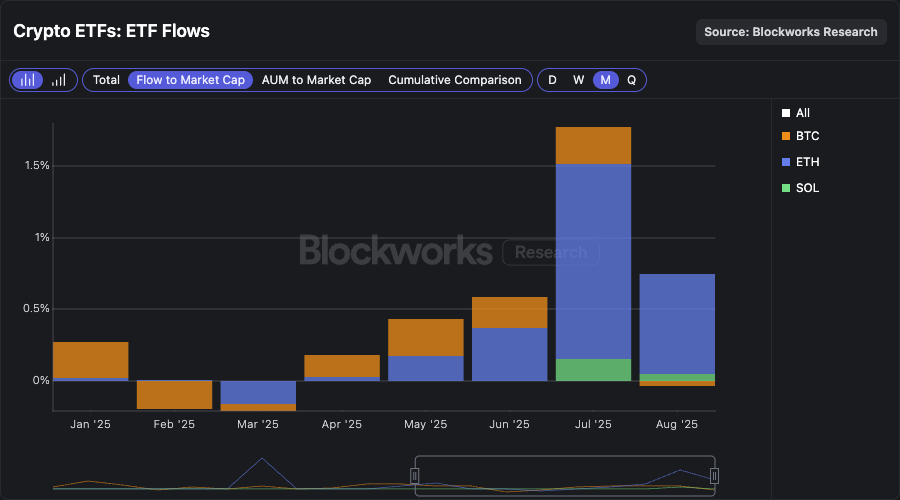

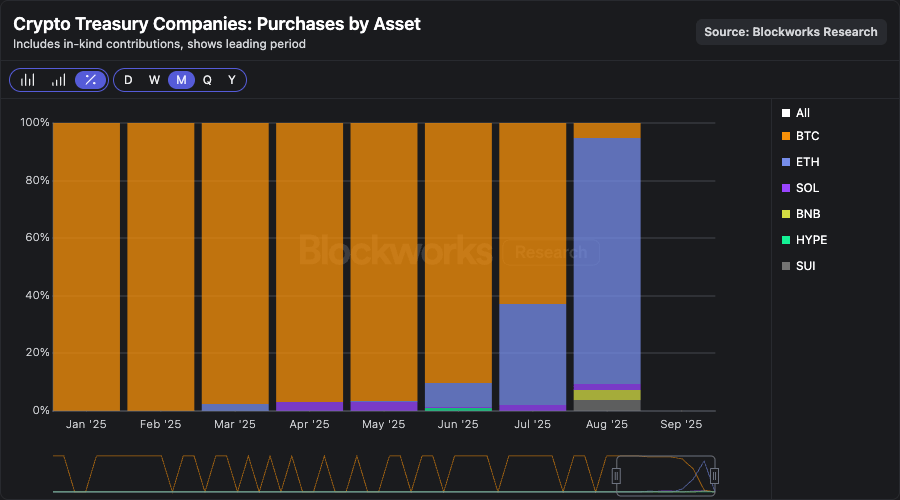

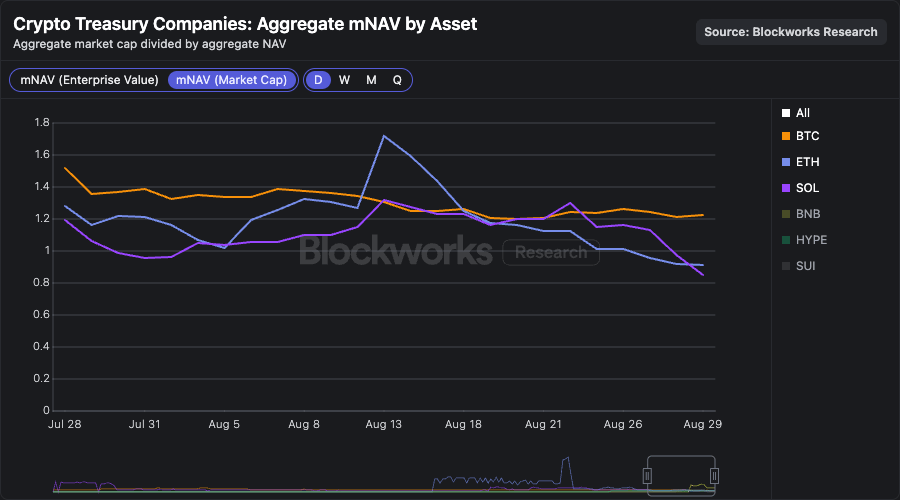

Hi all, happy Tuesday. The turn of the month presents a good opportunity to review some higher timeframe metrics. While ETH stole the show in August for ETF inflows and DATCO purchases, compressing mNAVs suggest the ATM window may be temporarily closed. However, recent capitalization for SOL DATCOs, coupled with the pending Oct. 16 approval of SOL ETFs, suggest Solana may be positioned for relative outperformance. To compliment this, we dive into Solana’s governance model and the recent approval of the much anticipated Alpenglow consensus upgrade.

September opened with continued selling pressure over the weekend, with BTC trading down to $107,300 and remaining in a low timeframe downtrend. However, both ETH and SOL are showing relative strength compared to BTC, supported in part by positive flows from both ETFs and DATCOs. The end of August and turn of the month come with monthly closes, offering a good opportunity to review these higher-timeframe KPIs.

Looking at ETF flows, August was a highly positive month for ETH ETFs, continuing on the momentum from July’s blockbuster metrics. In August, ETH ETFs added $3.87 billion in net inflows, equal to 0.7% of the supply. SOL ETFs showed positive inflows, but at a meager level. SOL ETFs added $53 million in net inflows, equal to 0.05% of the supply. Breaking the trend from the latter two, BTC ETFs exhibited net outflows in August, with $750 million leaving the products, equal to 0.034% of the supply. ETF flows continue to mirror the relative price performance of the majors, suggesting we remain in a flows-based market.

Mirroring August’s strong inflows for ETH ETFs, ETH DATCOs stole the show in the past month. ETH accounted for 85% of the purchases made by DATCOs in August, followed by BTC at 5% and SOL at 2%.

While the purchases made in August by ETH DATCOs were sizable, a persistent negative trend in mNAVs remains in place across the sector for all assets. The aggregate mNAV of ETH and SOL DATCOs is now beneath one, suggesting that the window for ATM issuance, which accounted for 73% of gross financing proceeds in Q2 2025, is now closed for the time being. BMNR and SBET, the two largest ETH DATCOs, closed last Friday at an mNAV of 0.98. Similarly, the two largest SOL DATCOs, UPXI and DFDV, closed Friday with mNAVs of 1.05 and 0.9. With the ATM window temporarily closed, the big bid on majors from DATCOs may be temporarily absent, suggesting that flows into the majors may not be as rosy as what was exhibited in the two months past.

However, the past week saw an estimated $2.8 billion in capital raised or planned to raise for the purpose of SOL DATCOs. With this capitalization yet to hit the spot market, SOL may be positioned for relative outperformance, bolstered by these DATCOs and the pending approval of 17 SOL ETFs, estimated to occur by Oct. 16. To read more about how these structural flows present tailwinds for SOL, check out our recent note by Carlos here.

— Luke

If SQL and protocol deep-dives are your playground, this is it.

Join Blockworks as a Data Analyst and help us set the standard for protocol analytics. Build dashboards, shape frameworks, and help the industry see past the noise.

Apply now or pass it along to the Dune wizard in your group chat.

How does Solana’s governance work?

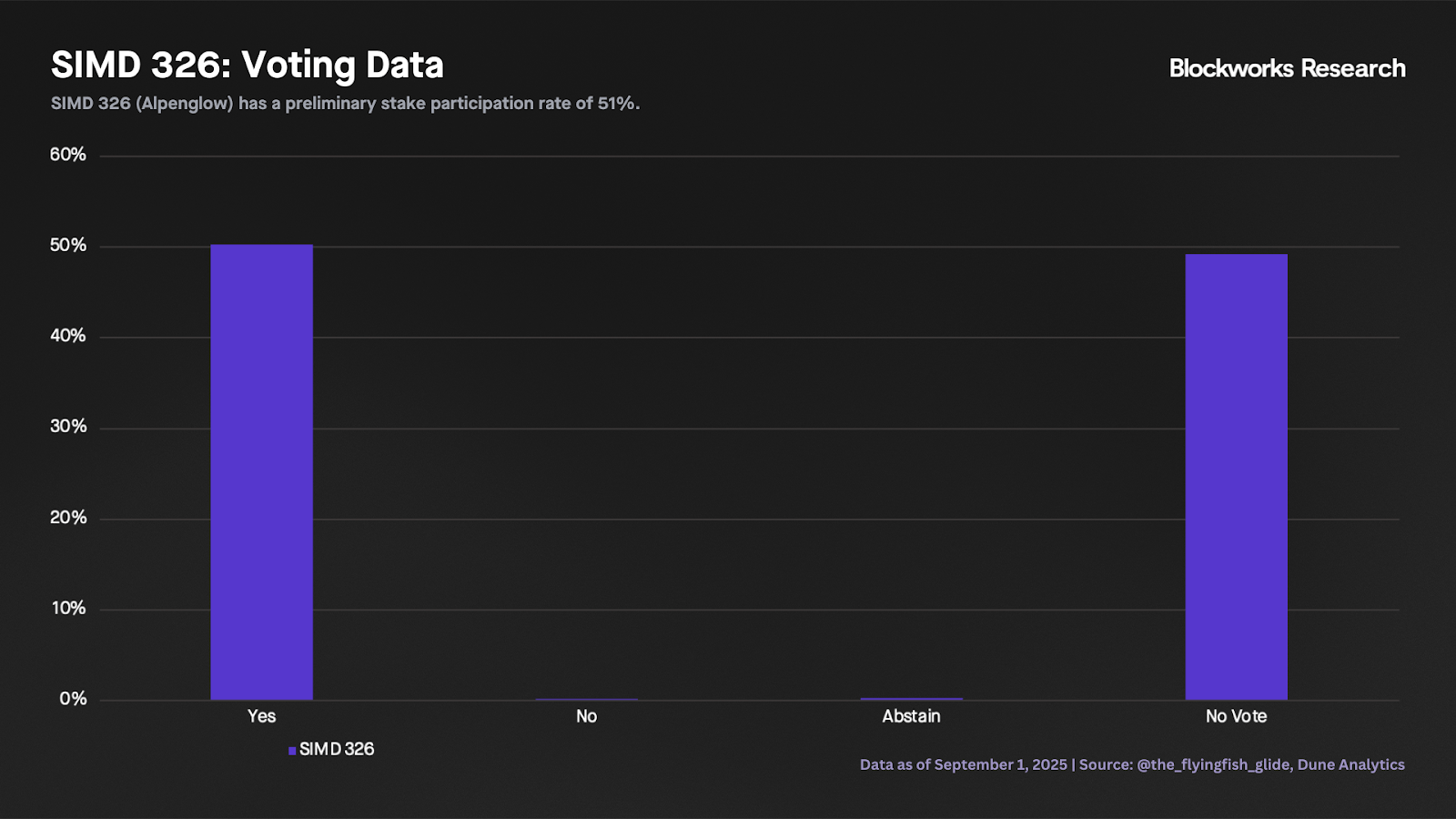

In Thursday's newsletter, we dove deep into SIMD-326 (Alpenglow), which proposes a new consensus protocol for Solana. The headline impact of Alpenglow is a 100x reduction in Solana's finality time, from ~12.8 seconds to around 150ms. A validator signaling vote for SIMD-326 took place between epochs 840 (starting Aug. 27) and 842 (ending today), with a preliminary stake participation rate of 51% as of writing.

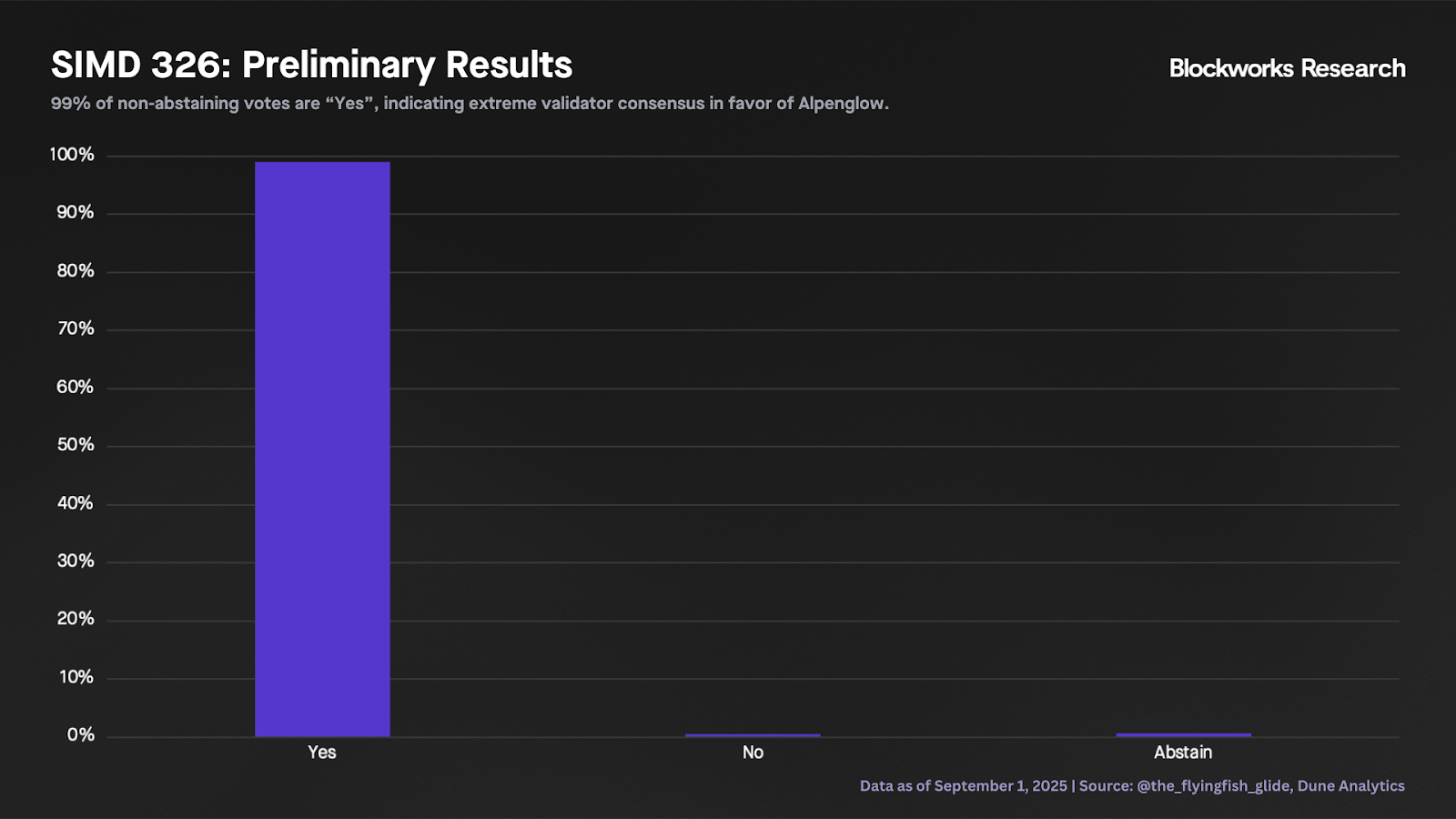

SIMD-326 will pass, with ~99% of non-abstaining votes in favor. With Alpenglow's voting period coming to a close, it's a good time for a refresher on how Solana governance works. Solana's onchain governance is meant to signal community sentiment rather than automatic enforcement of changes. In other words, social consensus is the final arbiter, with the real decision point resting with validators and developers who must collectively agree to deploy and run the new software. A key stakeholder in this process is the Anza team, which must design and roll out changes in the Agave client via feature gates.

With this context in mind, all Solana Improvement Documents (SIMDs) formally begin as written proposals on Solana’s GitHub. In this stage, the community and core contributors can openly discuss and adjust variables before a SIMD goes into a vote, implement it without requiring one, or outright reject it before that happens. Forum discussions play a crucial role in Solana governance by enabling structured, thoughtful debate on proposals and their potential effects.

Solana’s onchain governance model is akin to a representative democracy in the sense that validators vote on behalf of stakers, who are free to delegate their staked SOL to any validator. Each validator’s voting power is proportional to the stake delegated to them, and validators can even split their vote weight among distinct options if they choose (Yes, No, or Abstain). Typically, the voting period for any given SIMD lasts three epochs (around six days).

Finally, Solana requires two parameters for a SIMD vote to pass. The first is the quorum threshold: At least 33% of the total stake must participate (including abstains) for the vote to be valid. The second requirement is the supermajority: At least two-thirds of non-abstaining votes must be "Yes" for the proposal to pass. SIMD-326 received overwhelming support compared to more contentious proposals, such as SIMD-96 (which discontinued the burn on priority fees), SIMD-123 (which will implement an in-protocol way to distribute priority fees), and SIMD-228 (the infamous failed inflation reduction proposal).

— Carlos

Jordi Alexander, the founder of Selini Capital, breaks down why the concept of retirement is obsolete in a world of AI, fiat dilution and exponential wealth creation, explaining how crypto is the cleanest hedge we have. Topics covered include reasons traditional retirement planning is dead, the 15% fiat dilution destroying savings, crypto vs. stocks in the new economy, escaping "survival mode" and building judgment as well as preparing for AI's impact on labor and wealth.

Infra from Raydium published a think piece with a first-principles exploration of different approaches to token buybacks. His core argument is that while programmatic at-the-market buybacks offer transparency and alignment signaling, their reflexive nature creates timing inefficiencies worth exploring through alternative execution methods. Instead, he proposes “maker” buybacks (e.g., posting bids/LPing), temporal smoothing of revenue and value-based triggers to make purchases counter-cyclical. The article weighs transparency against execution efficiency and suggests hybrid approaches, citing case studies that demonstrate the return of value to token holders.

Stablewatch and Castle Labs published an article exploring the question of which blockchain network will house and facilitate the bulk of stablecoin activity. The article compares six upcoming networks on various features, including architecture, interoperability, privacy, TradFi integrations and fees. It highlights designs such as selective privacy, native cross-chain transfers, bank connectivity and dollar-denominated gas as table stakes, profiling Plasma, Codex, 1Money, Arc and others. The conclusion is that winning rails will optimize for compliance, instant finality and enterprise APIs over generic DeFi composability.

|

|