- 0xResearch

- Posts

- Solana's SKR defies the sell-off

Solana's SKR defies the sell-off

The phone token launches up 60% as BTC slides 4.6%

Hi all, and happy Wednesday.

Solana added another token to its ecosystem with the Solana Mobile SKR token. Despite the wider crypto-market pullback, the SKR token is up 60% since launch.

We also discuss Pendle’s tokenomics change.

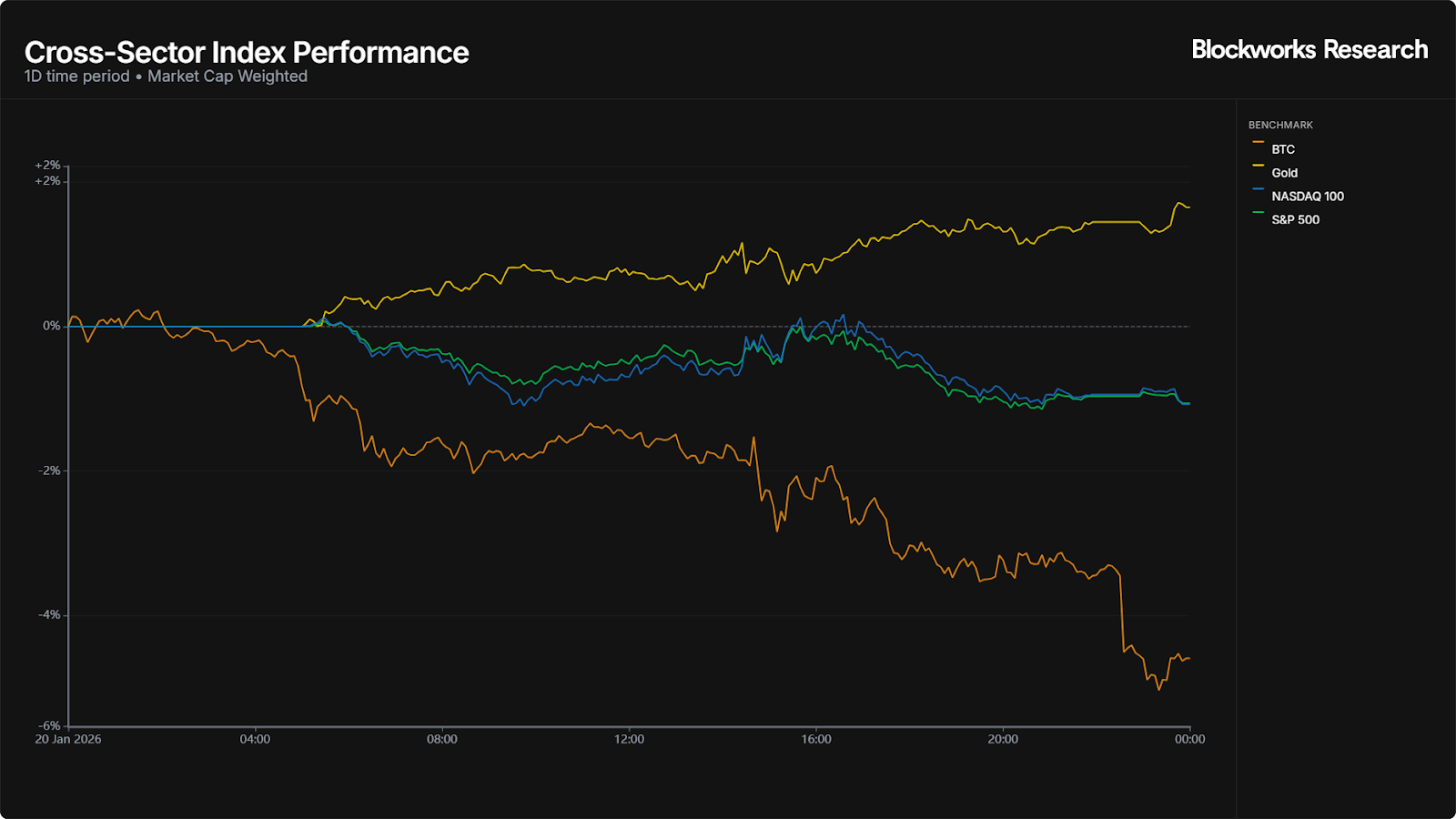

Risk assets faced a broad selloff over the last 24 hours as the market grappled with heightened geopolitical uncertainty.

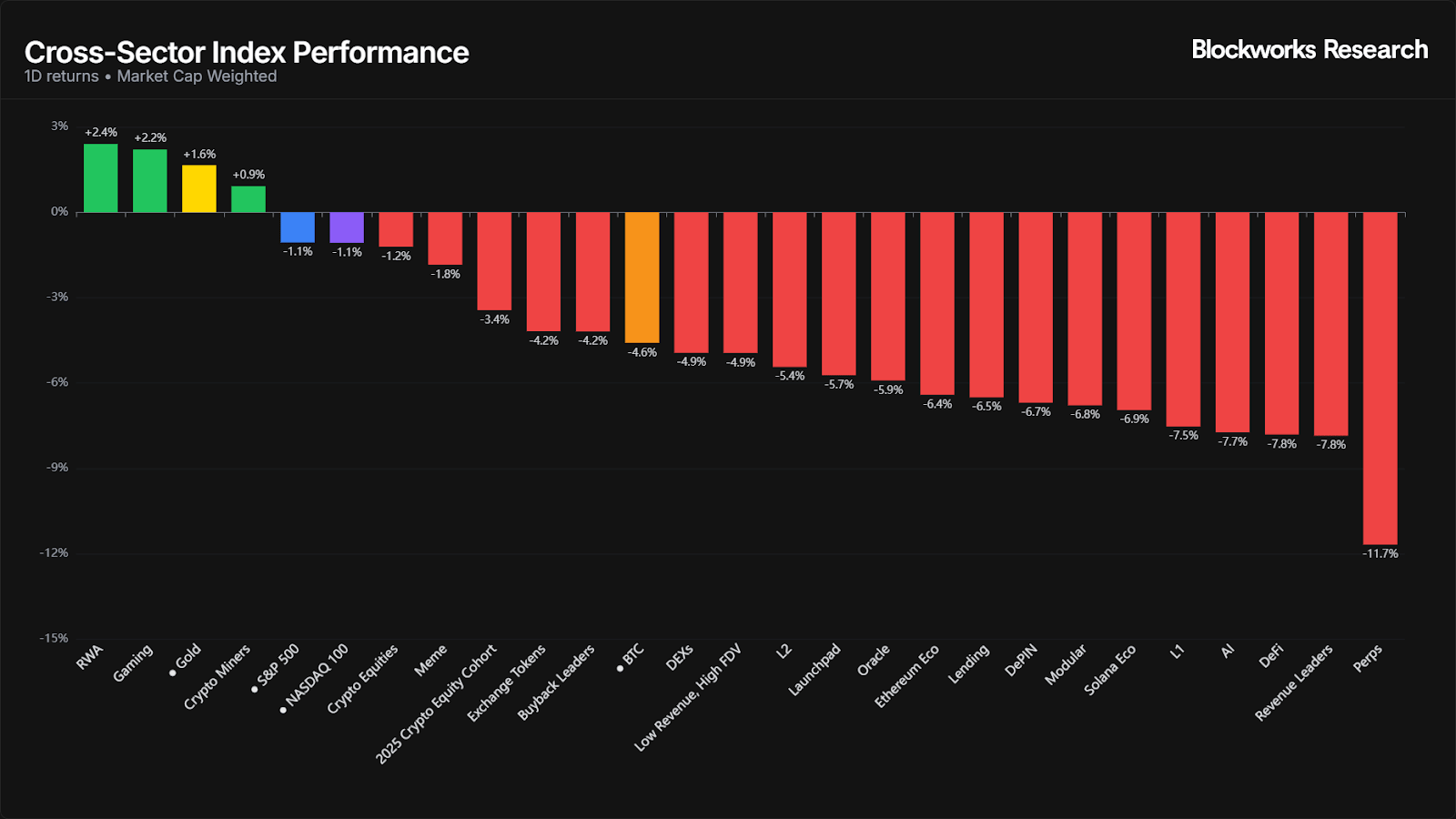

BTC fell 4.6%, leading a sharp decline across the crypto complex that saw nearly every major sector finish in the red. In stark contrast, Gold acted as the primary beneficiary of the flight to safety, climbing 1.6% to be one of the few green spots on the board. Traditional equities also felt the pressure, with the S&P 500 and NASDAQ 100 both sliding 1.1%.

In summary, BTC continues to behave like a high-beta risk asset during equity stress, while defensive flows still favor gold. This leaves BTC upside vulnerable and downside sensitivity intact.

Within the crypto ecosystem, the "risk-off" sentiment triggered significant drawdowns in high-beta sectors. Perps (-11.7%) and Revenue Leaders (-7.8%) were the hardest hit, followed closely by DeFi (-7.8%) and AI (-7.7%). Interestingly, Gaming (+2.2%) and RWA (+2.4%) managed to decouple from the broader market, posting positive 1D returns despite the surrounding carnage.

The intraday chart highlights a clear divergence that began in the early morning hours of Jan. 20. While Gold maintained a steady upward trajectory throughout the day, BTC experienced two distinct legs down: one during the London open, and a more severe flush during the US afternoon session, briefly touching the -6% mark before a marginal recovery.

— Marc

The Solana Mobile ecosystem announced the official launch and airdrop of the Seeker (SKR) token. Aimed at rewarding early believers in Solana’s second-generation hardware, the token saw volatile price discovery in its first few hours of trading, typical of ecosystem launches.

The market reaction was immediate. After listing on major exchanges like Gate.io, Bybit, and KuCoin, SKR hit an all-time high of $0.01499 before retracing. At the time of writing, the token is trading around $0.0115, up over 100% from its early morning lows of $0.0054.

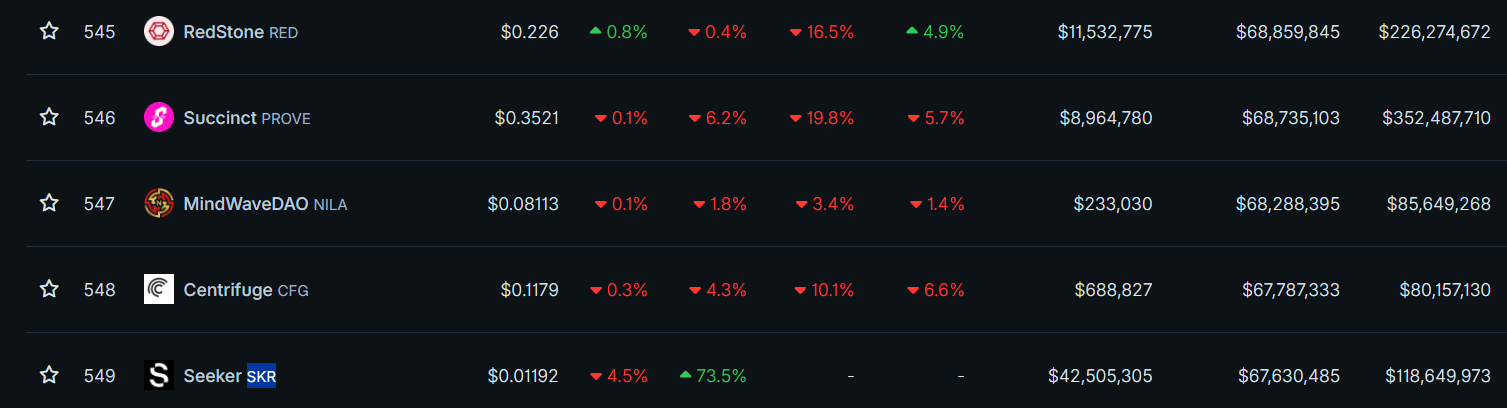

With a circulating supply of 5.7 billion, the current market cap sits at approximately $66 million, and a FDV of $116 million. This suggests that the market is pricing Seeker similarly to Centrifuge (CFG), Redstone (RED) and Succinct (PROVE), three other projects with high ambition and which compete in emerging categories.

The token itself provides select dapp access, staking rewards and governance rights within the hardware-anchored ecosystem. By tethering the token to a physical consumer product and strategic carrier partnerships, the project seeks to bridge the gap between niche crypto users and a broader demographic.

However, SKR faces steep uphill challenges, most notably the immense difficulty of competing against established mobile giants and the high "hardware adoption risk" inherent in the consumer electronics market. These hurdles, compounded by regulatory uncertainties and the potential for price instability due to aggressive token unlock schedules, mean that SKR's long-term success is strictly dependent on the actual market penetration and shipping execution of the Seeker device.

Notably, the Saga (Solana’s first-gen phone) was originally a commercial struggle. For much of 2023, it was viewed as a “luxury flop,” with only 2,500 units sold. It wasn't until the end of the year, when the value of the included 30 million BONK airdrop skyrocketed to over $1,000, that the remaining Saga inventory sold out instantly as an arbitrage play.

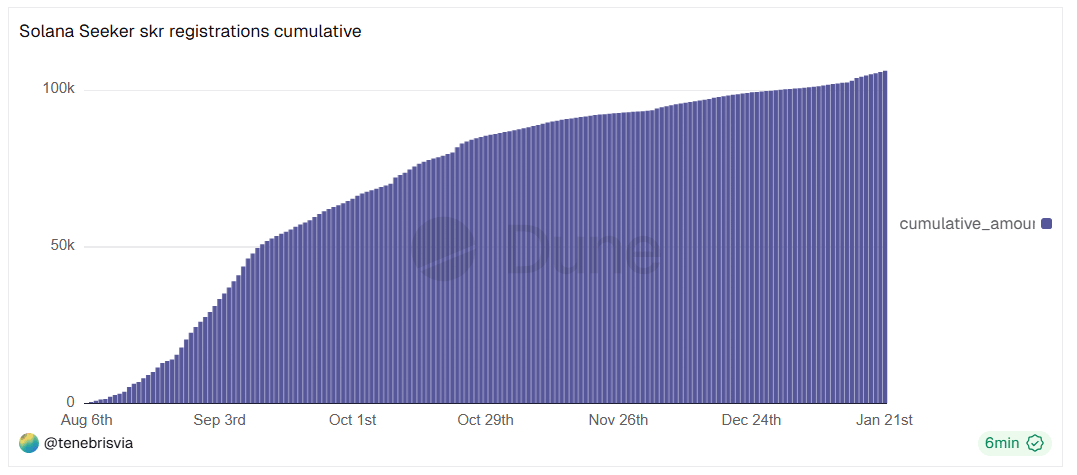

By contrast, the Seeker phone skipped the “struggle phase” entirely by lowering the barrier to entry. At half the original price of the Saga (which was $1,000), the Seeker’s massive 150,000-unit install base is what gives the SKR token its initial weight. As of Jan. 21, 2026, there were over 100,000 .skr domain registrations.

This project will live and die on its active user bases — developers and customers alike. The hope is that this classic chicken-and-egg problem between devs and users will be solved by the introduction of a token. This leaves the tokenomics (optics, utility and value accrual) playing a key role.

— Marc

Pendle fixes tokenomics

Pendle introduced sPENDLE, its new tokenomics model replacing vePENDLE, yesterday. The transition is set to take full effect on Jan. 29, when new vePENDLE locks will be paused and a snapshot will be taken for existing holders.

Historically, vePENDLE has underperformed, despite Pendle's 60x revenue growth over the past two years; the ve-model introduced several frictions that limited broader adoption.

The multi-year lock requirement was meant to signal commitment, but the expected efficient market among pools and voters never materialized.

Non-transferability also cuts holders off from composability, one of DeFi's most powerful features.

The weekly vote-to-earn system required deep DeFi knowledge to optimize, concentrating rewards among a small subset of sophisticated users while discouraging casual participants.

This showed up in the numbers: only 20% of PENDLE supply ever engaged with vePENDLE, the lowest participation rate among veToken models. On the emissions side, while Pendle's overall fee efficiency exceeded 1 (revenue greater than emissions), a per-pool breakdown revealed that over 60% of pools were actually unprofitable, with positive overall efficiency driven by a small minority of high-performing pools.

sPENDLE addresses these issues by replacing the multi-year lock with a liquid staking token that has a 14-day withdrawal period (or instant redemption for a 5% fee). Up to 80% of protocol revenue will now flow into PENDLE buybacks distributed to active sPENDLE holders, simplifying participation considerably. The manual gauge voting system is being replaced with an algorithmic emissions model expected to cut overall emissions by around 30% while improving allocation efficiency. For existing vePENDLE holders, a loyalty bonus offers boosted sPENDLE of up to 4x based on remaining lock duration at the snapshot, decaying linearly to 1x by the end of their lock period.

At Blockworks Research, we’ve been PENDLE bulls historically, with some minor concerns around Pendle’s TVL coming in mostly from farming programs (such as Ethena and USDai), and we view this tokenomics change positively. You can read our latest report on Pendle (published Jan. 15) here.

As AI risks creating a “closed” web of paywalls and opaque algorithms, crypto offers a “credibly neutral” infrastructure to manage persistent data context, verify human identity against deepfakes, and coordinate autonomous agents. From DePIN networks that democratize access to computing power to micropayment protocols that fairly compensate content creators, these 11 use cases illustrate how blockchain can act as a stabilizing layer for the AI revolution.

By turning intellectual property into programmable assets and enabling “vibe-coded” software to stay in sync, this technology ensures that the next generation of AI services remains open, interoperable and aligned with human interests, rather than just corporate bottom lines.

The era of “Info Finance” has arrived, as prediction markets transition from niche betting sites into foundational financial infrastructure. Following a breakout 2024, platforms like Polymarket and Kalshi have proven that financial incentives can aggregate the "wisdom of crowds" more effectively than traditional polling.

Beyond simple speculation, these markets are evolving into composable financial primitives: traders now use prediction shares as collateral for loans, leverage event outcomes up to 10x, and hedge crypto airdrop valuations against “short squeezes.” While liquidity remains the primary bottleneck, the integration of AI agents is poised to solve this by efficiently pricing “micro-markets” where human attention is too expensive.

As the sector matures, the focus is shifting from simply predicting if an event will happen to using Impact and Decision Markets to price what those events mean for global assets and governance.

Blockworks Research published a report on Pendle, positioning Pendle as the dominant yield-stripping platform with ~90% market share and $3.5B TVL. It highlights a self-reinforcing flywheel benefiting traders, asset issuers, and money markets simultaneously.

A major focus is Boros, Pendle's new interest rate swap platform for funding rate hedging, which hit $240 million open interest in December. Near-term catalysts include Boros adoption, Ethena's whitelabel program, tokenomics upgrades (now realized with sPENDLE), and potential CeFi partnerships.