- 0xResearch

- Posts

- Solana ecosystem strength

Solana ecosystem strength

Sanctum leads the pack of Solana DeFi tokens

Brought to you by:

Hi everyone. Crypto markets are ending the week on a muted note, with BTC giving back part of its rebound and equities largely flat ahead of next week’s FOMC meeting. Against this backdrop, Solana ecosystem tokens showed remarkable relative strength. Below, we also share a few weekend reads worth your time.

BTC retraced part of its recent rebound on Thursday, closing down -1.38%, though it remains up nearly 10% from Monday’s $84K intraday low. As seen below, the S&P 500 and gold were flat on the day, while the Nasdaq slipped -0.14%.

On the macro front, Kevin Hassett now appears to be the frontrunner for Fed chair, with Polymarket pricing his nomination at roughly 75%. Currently the director of the national economic council and a close Trump ally, Hassett’s appointment would mark a clear shift toward tighter alignment between Fed policy and the administration’s economic agenda. As for the current Fed, a December rate cut is almost certain just five days ahead of the final FOMC meeting of the year, with the CME FedWatch tool assigning an 87% probability to a 25 bps cut.

Regarding cross-sector performance, the only three crypto-related indices that were positive on the day were Miners (+6.1%), Solana Eco (+1.8%), and Crypto Equities (+0.9%). Even with Thursday’s bounce, the Miners index is still down 28% over the past 30 days, making it the worst-performing index after Memecoins (-33%).

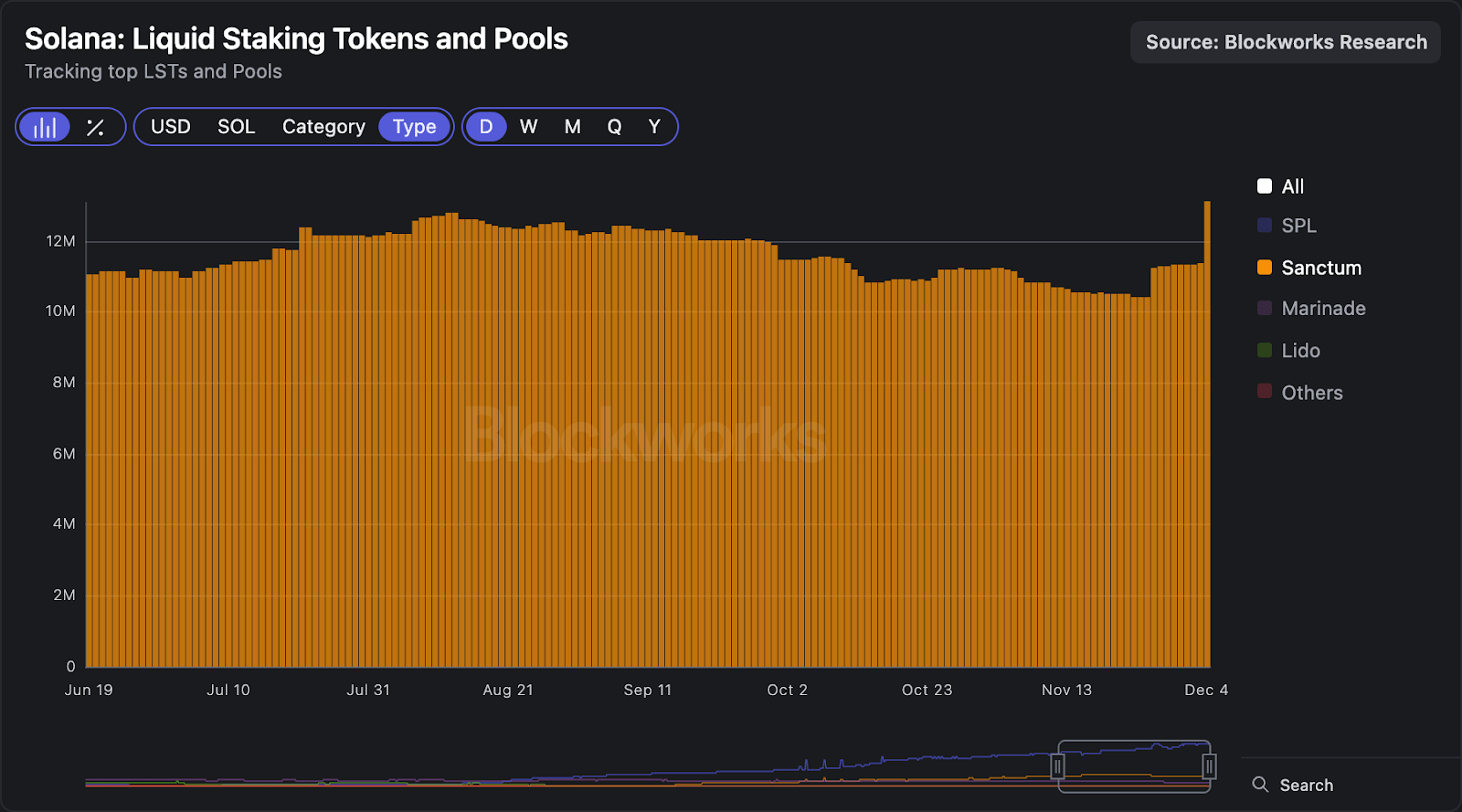

Looking at Solana ecosystem tokens, amongst the top 10 components on our index, CLOUD (Sanctum) was the best-performer yesterday (+13%). The move comes after Forward Industries launched its own LST (fwdSOL) powered by Sanctum earlier this week. Back in May, DeFi Dev Corp. launched dfdvSOL, also using Sanctum’s infrastructure.

Instead of natively staking SOL and losing liquidity, an LST enables Solana DATCOs to earn staking yield while distributing their liquidity into other DeFi applications to expand yield earnings. Working with Sanctum, DATCOs can easily design and deploy their own LSTs to fulfill their mandate of increasing SOL per share. The Forward Industries team has bootstrapped fwdSOL with ~25% of their SOL holdings (represented by over 1.7M fwdSOL), leading to an all-time high of 13.1M SOL locked in Sanctum LSTs.

— Carlos

Brought to you by:

Every market speaks a different language. But they all understand Chainlink. This is how $867 trillion in tokenized assets speak blockchain.

Our latest report outlines why Wall Street is adopting Chainlink as the industry-standard oracle platform.

See why the world’s largest financial institutions are choosing Chainlink.

Takeaways from Monday’s 0xResearch livestream:

Crypto’s “commodity era” vs. fundamentals: The hosts frame much of crypto as commodity-like (no cash flows, highly cyclical), but note a slow shift toward valuing a smaller set of protocols on real revenues and business models.

TradFi flows are fading: They discuss how recent price strength was heavily flow-driven (ETF and digital asset treasury vehicles), and how some DATCOs can become sellers when trading below NAV, removing a key marginal buyer.

Variant’s core lens: Alana frames crypto’s growth story as three compounding S-curves: asset creation, asset accumulation, and asset utilization. She notes that the middle S-curve (accumulation) is gated by prerequisites like custody, market structure and security.

Institutional accumulation beyond BTC is slower than expected: Alana says BTC ETF adoption looks extraordinary, but ETH and altcoin accumulation lags due to custody and operational constraints. In turns, this lag drives demand for proxies and “adjacent infrastructure” rather than spot buying.

Market cap concentration persists because of “lindy + belief” dynamics: Top assets stay dominant due to brand or memetic awareness, institutional comfort and underwriting frameworks. Alana expects more dispersion only if tokens increasingly trade based on fundamentals (i.e., actual earnings).

DEX dominance rose significantly in 2024-25, catalyzed by token creation: DEXs barely gained market share over CEXs from 2021 to early 2024, then accelerated as new tokens (memecoins, long-tail assets) forced wallet adoption. Once onboarded, users trade majors onchain too, pushing CEXs to integrate DEX rails (e.g., Coinbase/Base).

Since stablecoin proliferation is inevitable, interoperability becomes the opportunity: Alana expects many branded stablecoins, with defensibility shifting toward distribution and liquidity integrations. New “stablecoin-enabled markets” and interoperability layers (e.g., unified liquidity pools, stablecoin FX, last-mile offramps) become key startup arenas.

Look for the full podcast on YouTube, Spotify, Apple Podcasts and X.

This summary was generated with assistance from AI tooling.

Charlie from Felix published a piece on onchain price discovery arguing that legacy markets are structurally inefficient because they’re open only a fraction of the week, forcing information to accumulate off-hours and then reprice via gaps, volatility spikes and thin after-hours liquidity that disproportionately harms retail traders. The piece points to evidence that much of the equity premium is earned “overnight,” that extended-hours trading is low-volume with wider spreads, and that geographic and private market fragmentation further worsens price discovery. The author proposes bringing markets onchain, enabling continuous 24/7 trading with near-instant settlement and transparent ownership. He highlights emerging equity perps venues built on Hyperliquid infrastructure as a concrete path to always-on global price discovery. Read more

Etheralize, Nethermind and L2Beat published a report on the Ethereum L2 landscape. The piece argues that L2s are where scalability and customization converge for high-volume finance. The report lays out the institutional pitch for L2s, highlighting control over execution, privacy and confidentiality (e.g., zk-based selective disclosure), compliance-ready design and order-of-magnitude cost reductions. The report also explains the L2 design space (optimistic vs. zk rollups, data-availability tradeoffs). It concludes with a practical framework for choosing between public and private L2 deployments, illustrated with case studies from JPMorgan, Visa and Société Générale. Read more

Zuccy (@0xzuccy) published an investment report on Avici, a Solana-based neobank. The author argues Avici can differentiate its neobank offering by pairing crypto-funded cards and virtual USD/EUR accounts with planned zk-based trust scores that enable unsecured loans and mortgages backed by onchain capital. The piece highlights early traction, including 8,290 MAUs, 5,700 activated cards, and roughly $600K in monthly spend volumes. Despite limited public data, the author outlines Avici’s current revenue model (card sales, interchange and on/off-ramp fees), noting that the protocol generated about $30K in revenue in October. The report discusses the AVICI token sale on MetaDAO (no team allocation, ~$2.6M treasury), maps the competitive landscape and highlights lending and the monetization of the trust-score SDK as key catalysts. The conclusion is that Avici may be undervalued relative to larger crypto “neobank” tokens, but it needs clearer token value accrual and sustained KPI growth to justify a re-rating. Read more

The IMF published a paper outlining the rapid growth of stablecoins. The paper notes that the market cap of stablecoins has doubled over the past two years, largely driven by crypto trading. However, it argues that future demand could expand into payments and broader asset tokenization if adequate legal and regulatory frameworks develop. It highlights potential upsides (more efficient, competitive payments via tokenization) but emphasizes substantial risks to macro-financial stability, operations, financial integrity and legal certainty. Such risks include currency substitution and higher capital-flow volatility, especially in high-inflation countries or those with weaker institutions. The paper reviews an evolving but still fragmented regulatory landscape, noting IMF/FSB policy recommendations and stressing that stablecoins’ global nature makes international coordination essential as they integrate further into the financial system. Read more

Crypto's premier institutional event is returning to NYC this coming March 24-26.

Ticket prices will increase soon, so lock yours in today!