- 0xResearch

- Posts

- Silver rips, Hyperliquid wins

Silver rips, Hyperliquid wins

There’s always a bull market somewhere

Hi all, happy Wednesday!

Hyperliquid holds on to its crown as HIP-3 volumes skyrocket for perp listings of silver, gold and the Nasdaq 100. HYPE is ripping alongside this, up nearly 50% on the week.

We also break down DoubleZero’s recent growth metrics and how its stake adoption and distribution resemble Jito’s early days.

Optimism returns as most risk asset indices show strength over the past week. With a modest rise in BTC (+0.9%), longer-tail sectors outperform, with Perps and DeFi putting in double-digit returns. While the green on the screen is a nice reprieve after last week’s selloff, momentum remains in metals, with gold up 8% and silver up 27% since last week’s open.

Hyperliquid has found its way of winning here, reflected in the price action. HYPE leads every major index and asset, up 47% on the week.

Crypto exchange volumes, and in turn their business fundamentals, historically track changes in crypto prices. When prices are up, people want to trade more; when they are going down, people want to trade less. The risk to the pure crypto-exchange model, from a cyclicality perspective, is that most tokens are for selling and designed to go down (see Q4 2025).

Hyperliquid, instead, offers a departure from this. By listing perps on things that go up, rather than down, Hyperliquid can capitalize on trading volumes on the bull market that is always somewhere. Now, it’s metals: The SILVER perp market on Hyperliquid traded over $1.4B in volume over the trailing 24 hours, putting it as the third-most traded asset on the exchange, behind just BTC and ETH. Similarly, XYZ100 (i.e., Nasdaq 100) and GOLD are the 7th and 8th top markets by trailing 24-hour volume, with a combined $324M in open interest. Three of the top 10 markets on Hyperliquid by 24-hour volume are builder-deployed perpetuals for offchain assets.

The surge in volumes coming from HIP-3 markets and the assets listed within offers an exercise in dreaming big again. With open interest on HIP-3 markets nearing $1B and daily volumes pushing $1.7B, the fundamentals are up and to the right, signaling growing demand for this product offering that may at some point become a deca-trillion dollar opportunity. The fundamental shift comes paired with a large Tornado Cash-linked wallet ceasing its HYPE sell pressure, in addition to Hyperliquid Strategies (the largest HYPE DAT, $PURR) deploying its capital, creating a rapid favorable shift in supply and demand flows.

Perhaps a P/E multiple of 8x on a circulating market cap basis discounted too heavily the upside prospects of this growing business vertical, and the token continues to re-rate higher.

— Luke

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.

DoubleZero: The Jito playbook

While most of crypto’s innovation is happening at the application layer, a few of the most interesting new projects today are still at the infrastructure layer. One that has quietly made meaningful progress recently is DoubleZero.

DoubleZero offers an alternative to the public internet. It’s a high-performance physical-infrastructure network designed to deliver low-latency connectivity with predictable performance. By stitching together private links from independent providers, DoubleZero creates a dedicated “fast lane” that can avoid the jitter and packet loss common on public networks, eliminating latency bottlenecks for high-performance networks like Solana.

Notably, 40.25% of Solana mainnet stake is already connected to DoubleZero. To underscore the significance of this growth, it helps to compare DoubleZero’s adoption curve with Jito’s. After launching in late October 2022, the Jito client took roughly 364 days to reach 40% of Solana mainnet stake. By contrast, from DoubleZero’s private testnet launch on March 5, 2025, it took about 264 days to reach the same threshold.

Adoption started more gradually, with DoubleZero taking longer to clear the early milestones (10% and 20%). But once DoubleZero went live on mainnet on Oct. 2, 2025, the curve steepened: It jumped from 20% to 30% in just 12 days, then reached 40% stake only 45 days later, materially faster than Jito’s progression through the same milestones.

While DoubleZero’s stake share has largely plateaued since crossing 40% in late November, the protocol’s fundamentals have continued to improve elsewhere. DoubleZero began charging fees in epoch 859 (Oct. 4–6, 2025), taking a flat 5% fee of block signature rewards and priority fees. Since then, fee revenue per epoch has trended steadily higher, with epoch 916 (Jan. 24-26, 2026) posting an all-time high of 395 SOL (about $50k at current prices) in revenue. Today, roughly 10% of fees are directed toward 2Z burns, with that share potentially rising over time (up to 50%).

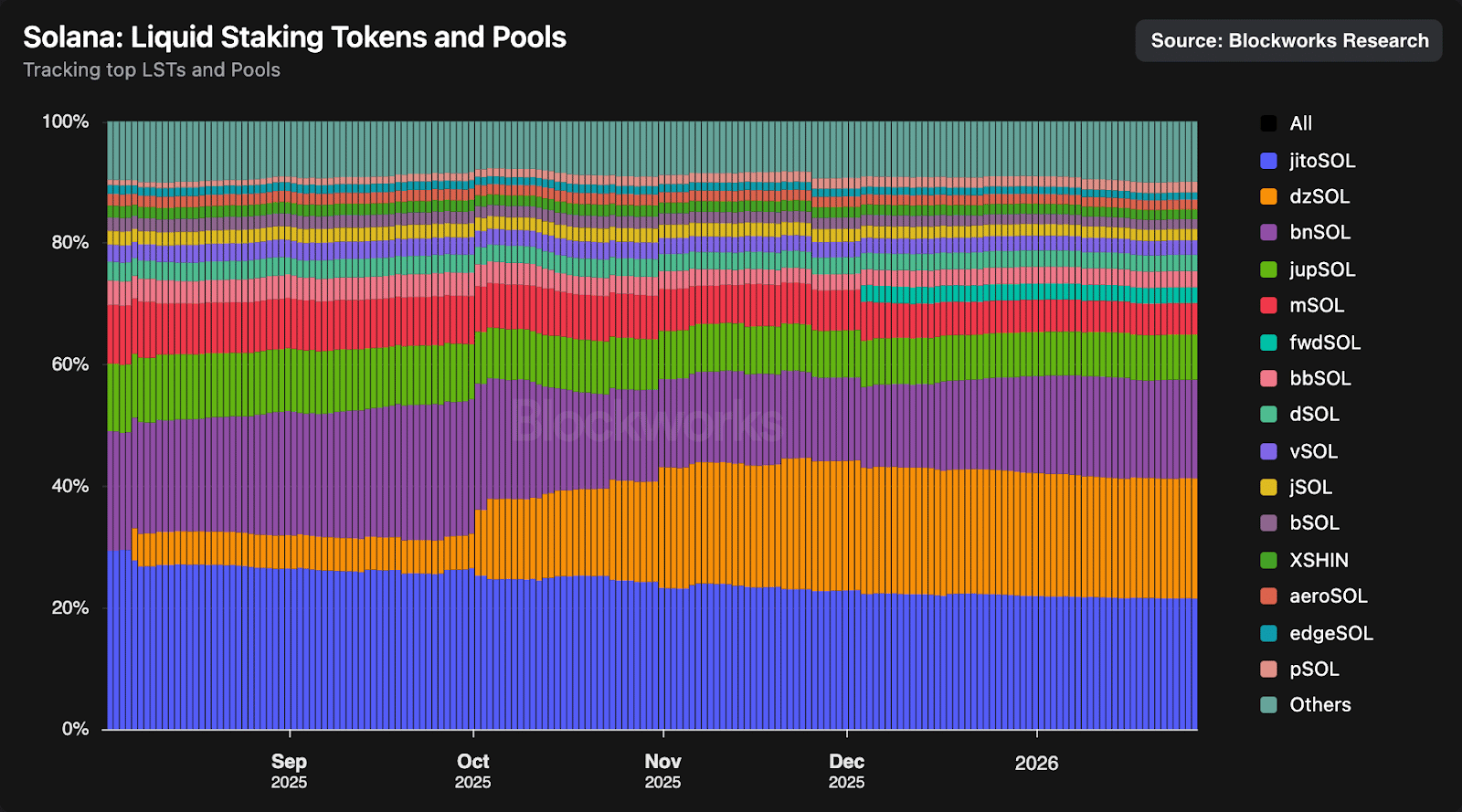

Even so, DoubleZero’s main focus appears to remain on stake growth, and the example of Jito once again offers a useful parallel for how the protocol is building distribution. Jito’s LST, JitoSOL (launched Oct. 31, 2022), helped bootstrap stake and accelerate adoption of the Jito client in its early days. DoubleZero has pursued a similar playbook with dzSOL (launched Jul. 30, 2025) to recreate that flywheel. As shown below, dzSOL is now Solana’s second-largest LST, trailing only JitoSOL by a small margin (21.5% vs. 19.8% market share).

Going forward, a key difference is the competitive backdrop. These days, Jito faces rising pressure from alternative clients on the block-building side, including Firedancer and Harmonic. DoubleZero, at least today, faces no direct competition. That resembles Jito’s early years, when limited competition helped it scale toward near 100% mainnet stake, giving DoubleZero a cleaner runway if it can keep expanding coverage and performance.

— Carlos

Ren from Electric Capital argues that most coordination problems naturally centralize into platforms, and that open protocols are rare, fragile exceptions.

Using a 2D lens of asset heterogeneity (how unique things are) and verification cost (how hard they are to check), plus a third axis of interaction frequency, he shows why brokers, bazaars and platforms are usually more stable than protocols. Protocols only really thrive in low-heterogeneity, low-verification markets (like TCP/IP, HTTP, Bitcoin), where trust can be replaced by cheap, standardized checks.

But they face a “friction paradox”: Cryptographic trust reduces verification cost while increasing user friction (keys, gas, signatures), and no central actor is paid to smooth that away. As a result, platforms with capital and UX control often absorb or outcompete protocols (Gopher, XMPP, RSS, OpenID), and only a few simple, early, well-timed protocols have escaped this gravitational pull back toward centralization.

Benedict Brady from Meridian describes a future in which products like Meridian mostly improve themselves. Agents decide what to build and then ship it. Coding agents take clean tickets and turn them into pull requests. Other agents watch logs, telemetry, and user chats to surface bugs and new feature ideas. Humans set the goals, taste, and guardrails.

Over time, the system runs a tight loop: Notice a need, spec it, build it, and ship it – with far less human work in the middle.

Alejandra Martínez from Foundation Capital published a piece on Solana’s Seeker mobile push. She argues that we’re in the era of “opinionated L1s,” where chains compete on apps, UX and distribution, with Solana best positioned to win this game on mobile.

She notes that players like BNB, Base, Tempo, Arc and Hyperliquid show how owning both rails and distribution beats being a neutral backend, and that Solana’s Internet Capital Markets vision only works if it starts on phones.

Solana Labs already has a foothold with Solana Mobile and SKR, and she argues it should go further by shipping first-party mobile apps (DEX, perps, payments) that showcase Solana while still staying permissionless for third-party builders. In her view, the next five years will be decided by which core teams make the right, opinionated product bets at the top of the stack.