- 0xResearch

- Posts

- Silver broke first

Silver broke first

Volatility hid in plain sight

This week looked calm if you only glanced at the closes. It wasn’t. Precious metals went through tail-level dislocations, crypto spot de-risked hard, and the only place that consistently held a bid was leverage.

Today’s note breaks down why the indices were misleading, why perps decoupled, and how Hyperliquid’s silver contract quietly became one of the most important stress tests of onchain market structure to date.

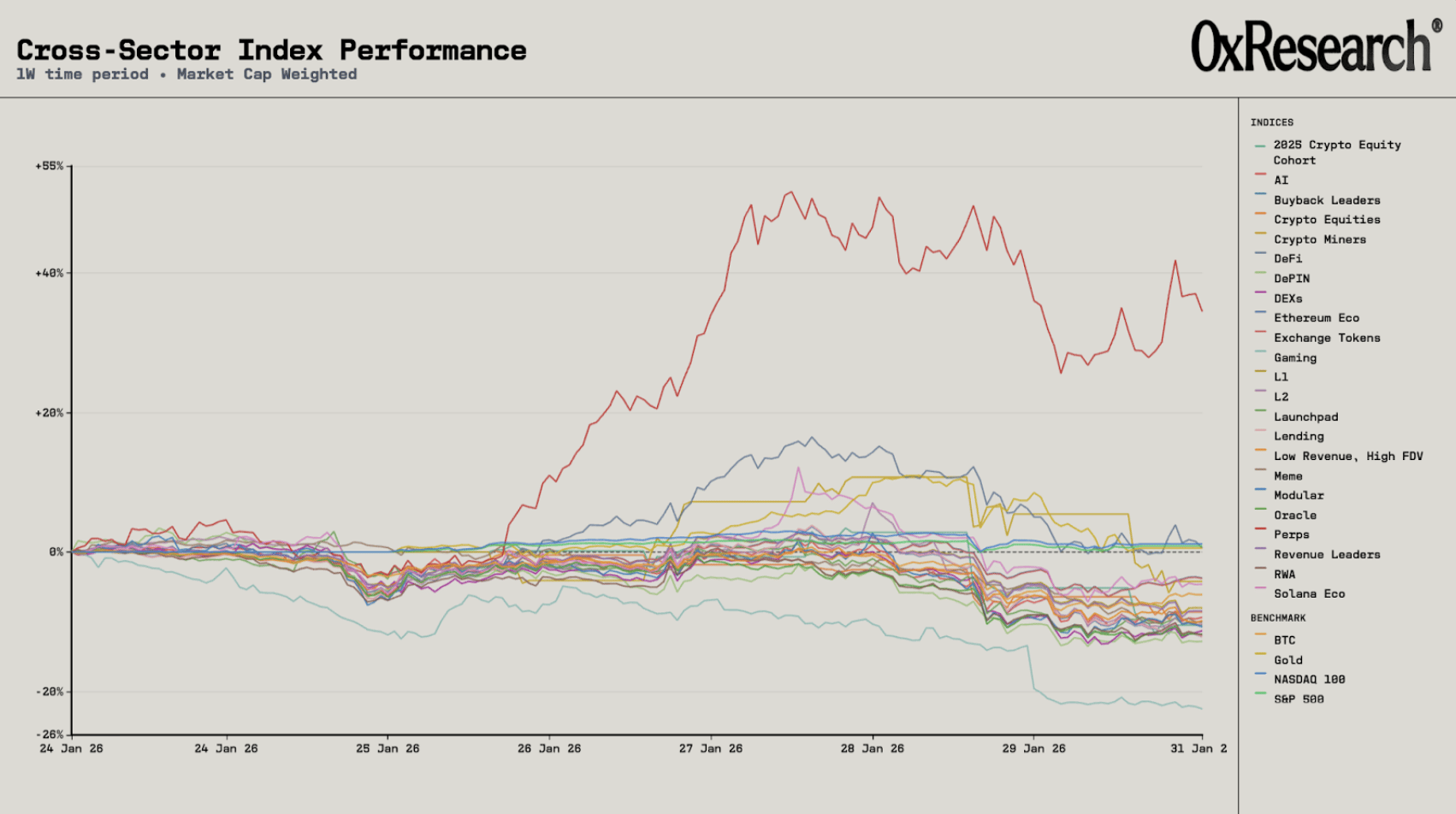

Weekly closes in the NASDAQ 100 (+1.17%), S&P 500 (+0.89%), and gold (+0.57%) make the week look tidy, but they compress a lot of intraperiod violence. The period was defined by tail-risk price action in precious metals: Gold logged a roughly 9.8% one-day drop on Jan. 30 (its steepest since 1983), while silver fell about 30% on the day and was still down roughly a third from the prior week’s highs, with the selloff amplified by forced de-risking into higher CME margin requirements and the Warsh-to-Fed headlines.

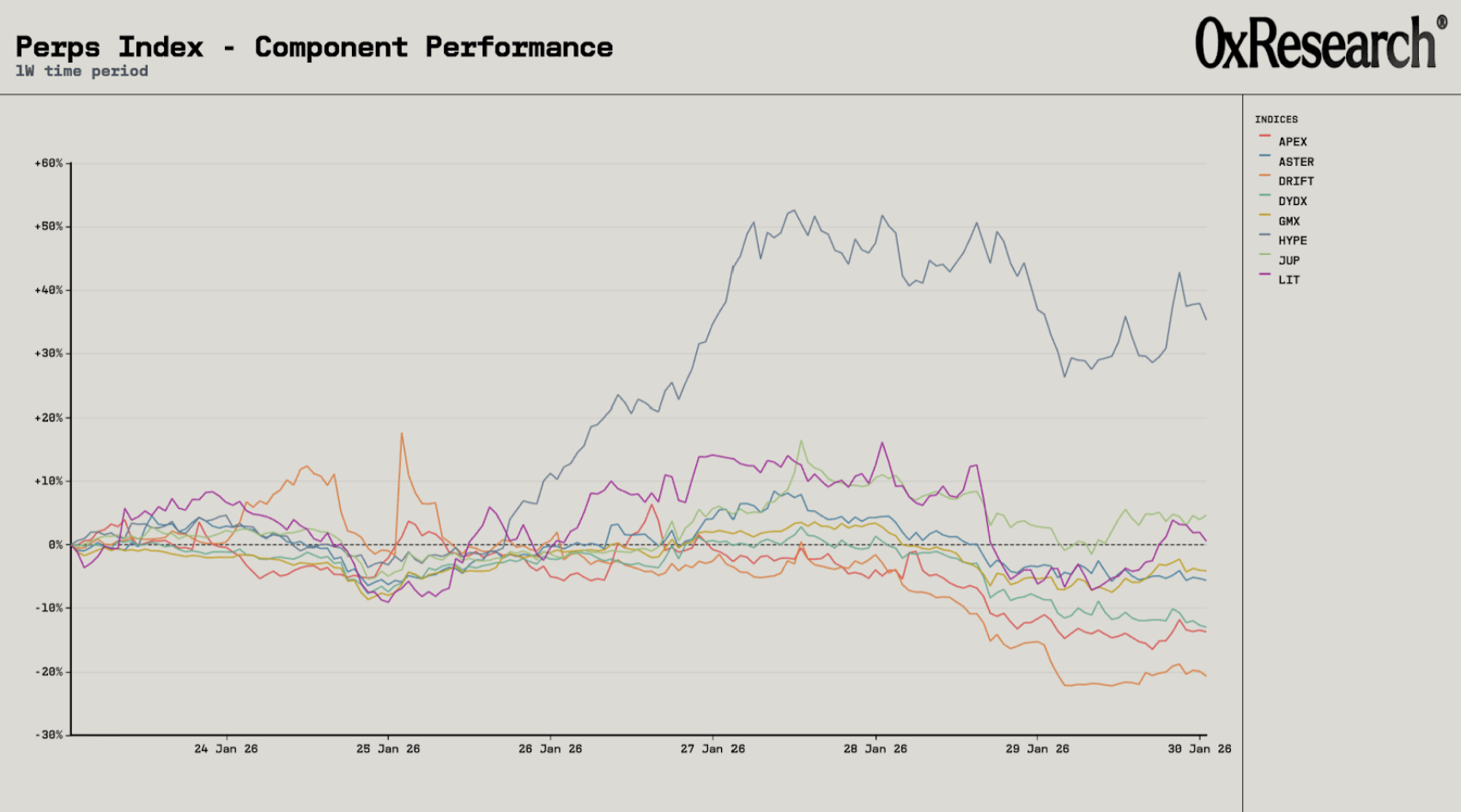

In the crypto basket, everything was offered this week except perps. Perpetuals were up +34.47% while every major spot-linked bucket finished red: BTC −6.10%, L1s −8.01%, exchange tokens −3.79%, and DeFi −12.16%. High-beta cohorts were hit hardest (low-revenue, high-FDV −9.85%; memes −10.10%; gaming −22.49%).

The setup is straightforward: broad spot de-risking across crypto, with a single standout bid in perpetuals.

While a notable pocket of strength, the run-up in perpetuals is not necessarily surprising given current market dynamics.

First, perps are one of the few verticals still generating meaningful, observable cash flow. Hyperliquid posted roughly $68.7M of gross protocol income in January 2026 (primarily perp fees), up from about $60.3M on the prior trailing-30-day view.

Second, that revenue base is starting to look less purely “crypto beta” as the venue expands beyond crypto perps into equities and commodities, while monetization diversifies through builder codes and HIP-3 dynamics.

Third, the near-term supply overhang was lighter than the market was positioned for: The February 2026 team distribution was reduced to roughly 140,000 HYPE, a low single-digit millions unlock at spot that is comparable to a strong single day of protocol revenue.

Layer on incremental optionality from reports that Hyperliquid is testing native prediction markets on testnet, and it is easier to see why HYPE and the perp complex traded unusually uncorrelated this week.

— Shaunda

Brought to you by:

Submit a x402, AP2/A2A, ERC-8004 or agentic commerce agent or project for your chance to win a share of $50,000 in the SF Agentic Commerce x402 Hackathon presented by SKALE, Google Cloud, Coinbase Developer Platform, Virtuals, Pairpoint by Vodafone, and Edge & Node.

Registration is now open! Submit your build from February 11–13.

Hyperliquid’s silver stress test

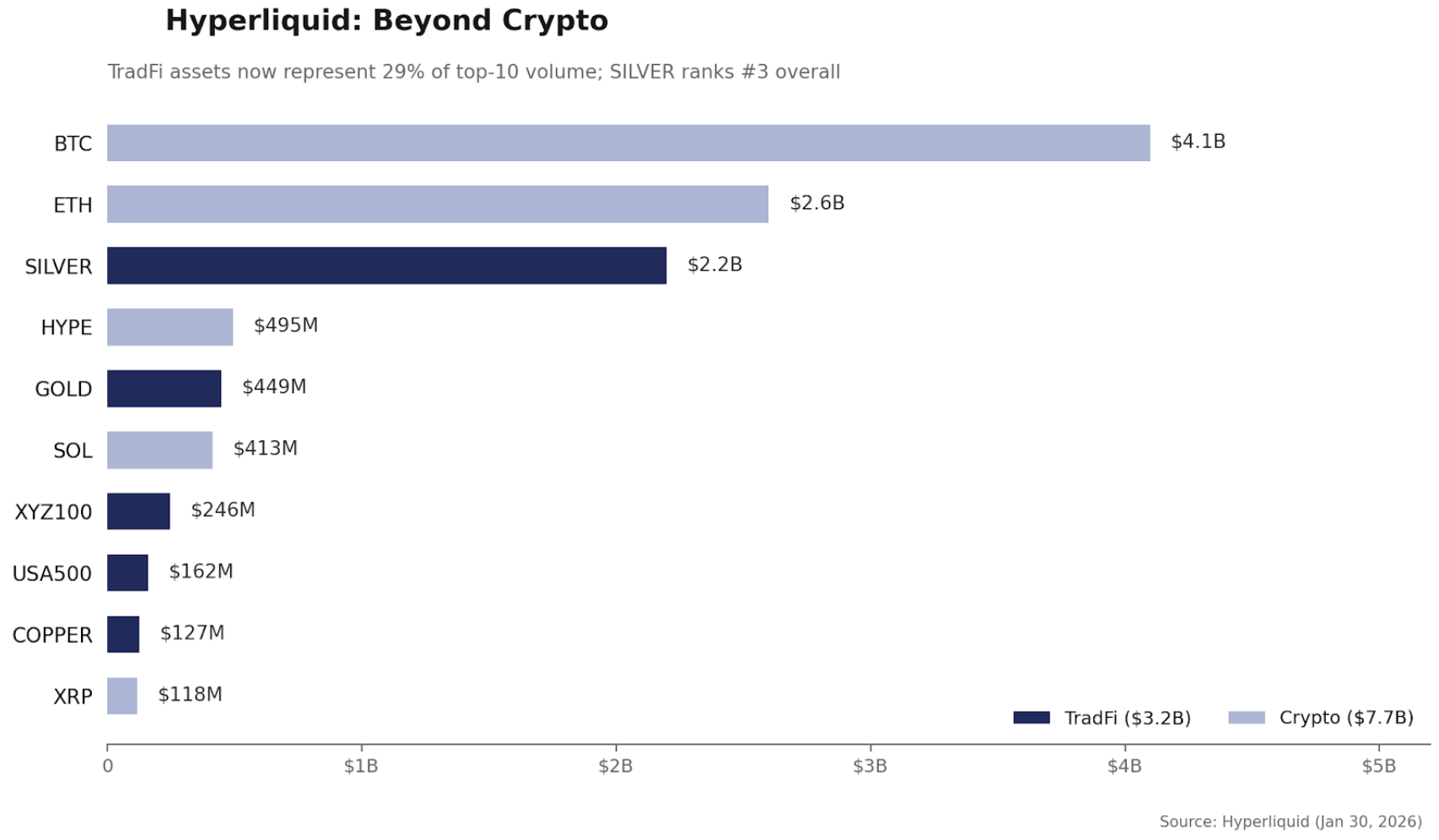

HIP-3 equity and commodity perpetuals have been scaling quietly. Daily volume expanded 12x over 66 days to $4.8B, with TradFi-linked contracts now accounting for 31% of venue volume. On Friday, silver was the third most-traded contract on all of Hyperliquid, behind only BTC and ETH — clearing $2.2B in a single session. Last Friday, five of the top 10 contracts by volume were non-crypto assets. The composition of the venue has shifted materially: During stress, commodities and equities became headline markets rather than peripheral listings.

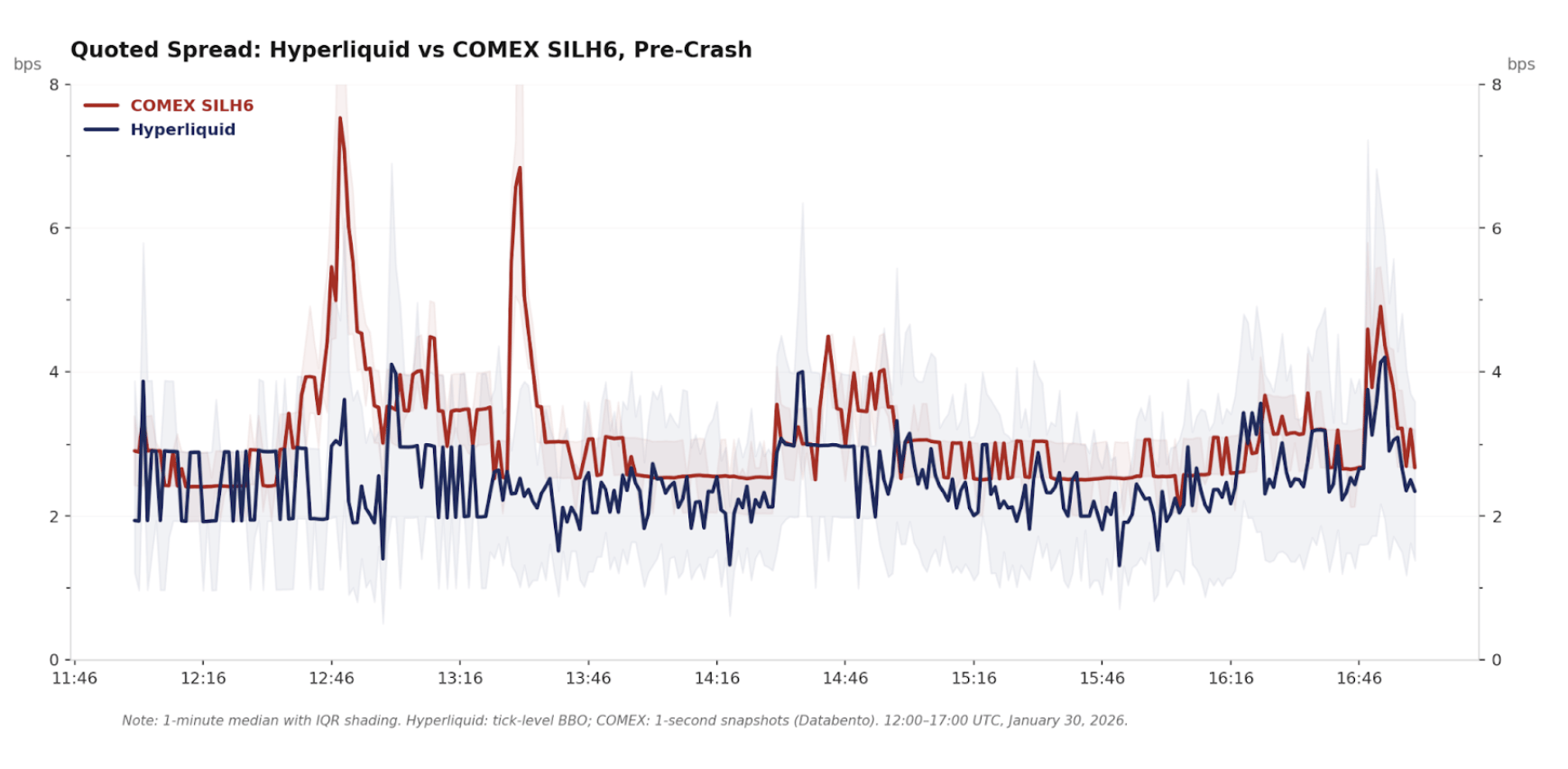

More interesting than the volume is the market quality behind it. Pre-crash, Hyperliquid's silver perp quoted a median spread of 2.4 bps — tighter than COMEX SILH6's 3.0 bps — without designated market makers, formal liquidity obligations, or exchange-mandated quoting programs.

Execution quality was within half a basis point of the institutional benchmark for the median trade. The book was structurally symmetric, with bid/ask ratios near 1.0 across all depth bands. The structural gap was depth — COMEX carried roughly 57x more resting liquidity — but for the retail and mid-sized flow that dominates the venue, Hyperliquid was competing with COMEX on the metrics that matter most: spread, execution cost and price accuracy.

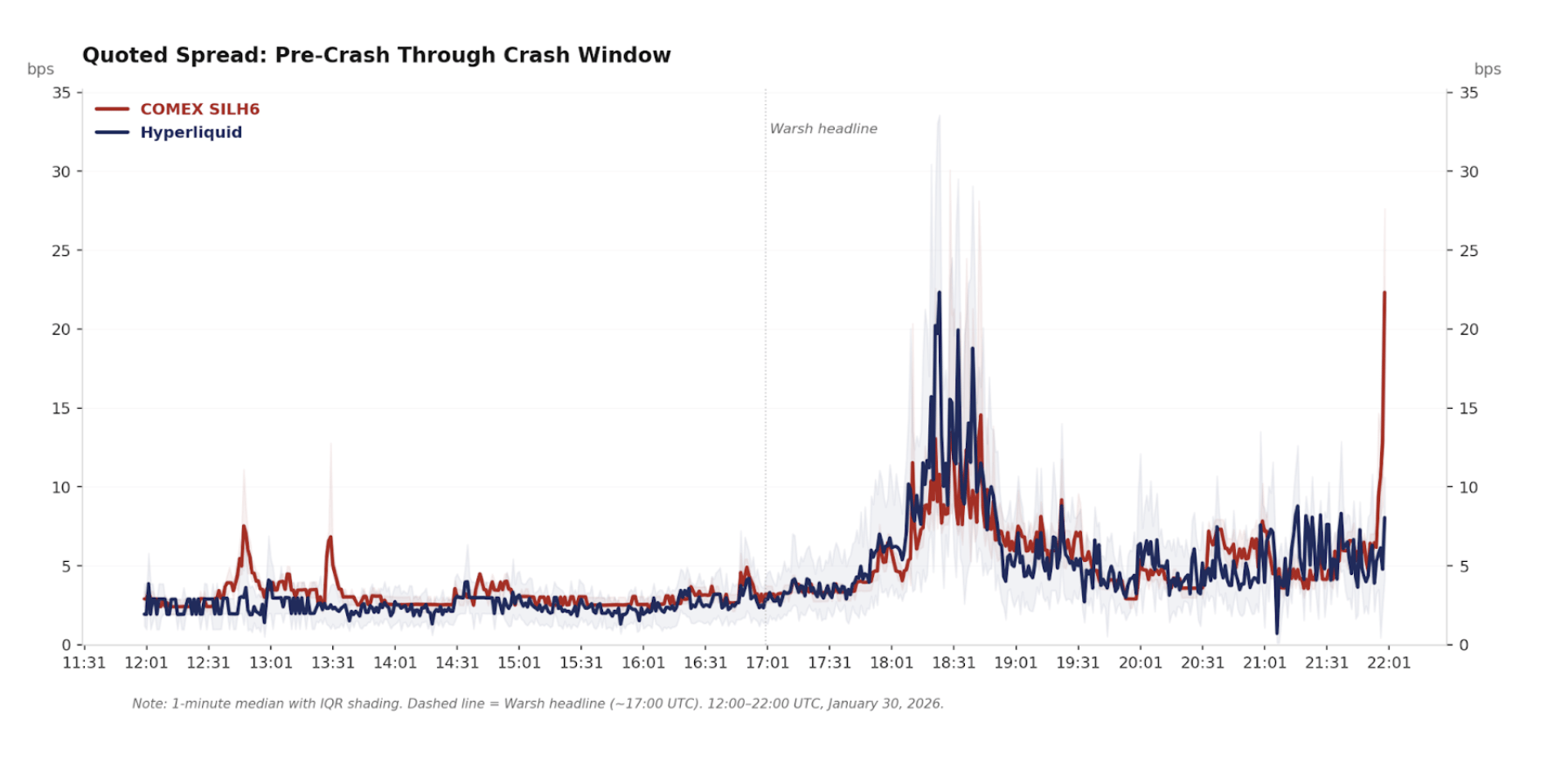

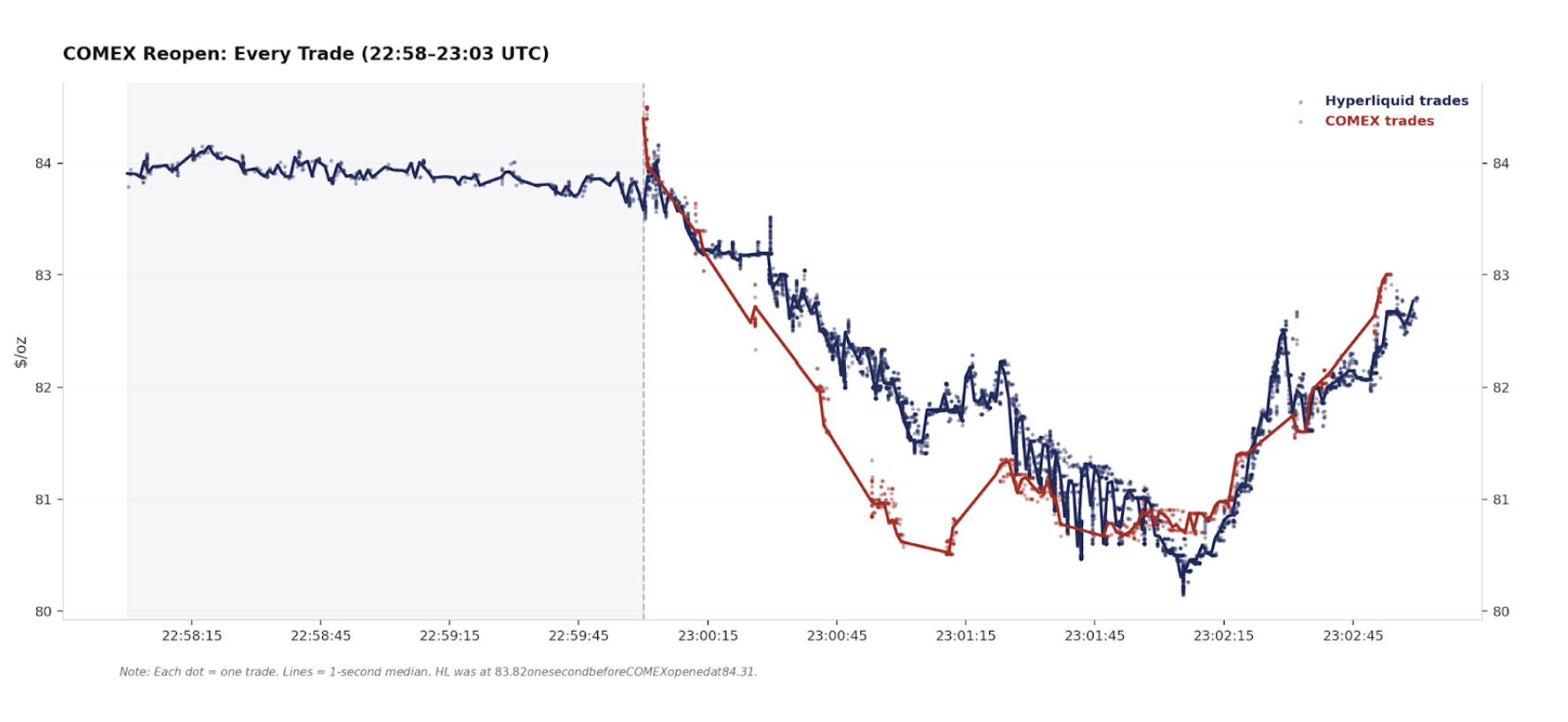

Then silver had its worst day since 1980. Trump’s nomination of Kevin Warsh to head the Federal Reserve triggered a 31% crash and a liquidation cascade across futures, ETFs and perpetuals simultaneously. Hyperliquid's silver perp absorbed the full drawdown without a trading halt, circuit breaker or failed settlement. Spreads widened from 2.4 bps to 5.1 bps, roughly proportional to COMEX’s own deterioration (3.0 to 4.8 bps). The HL–COMEX basis peaked at 463 bps but self-corrected in under 20 minutes through the funding mechanism alone. The orderbook thinned but held $1.07M within ±50 bps even at the peak of the crash. Both venues found the same bottom at the same time.

At 22:00 UTC Friday, COMEX closed. Hyperliquid didn’t. Over the next 49 hours, the perp processed 175,000 trades and $257M in notional — the only silver-derivatives venue in the world still accepting orders. Weekend spreads compressed to 0.93 bps, tighter than either venue had quoted pre-crash. Price drifted 2.5% lower through the weekend. The oracle kept publishing, the funding rate settled near zero, and market makers quoted tighter spreads than they had during normal weekday hours.

When Globex reopened Sunday night, COMEX's first print was $84.40. Hyperliquid was already trading at $83.82. COMEX overshot by roughly 60 bps and corrected within one second. Two days of low-volume continuous trading had produced a more accurate forward-looking price than the institutional benchmark's own reopening auction

— Shaunda

This paper argues that Hyperliquid collapses the traditional tradeoff between centralized-exchange performance and decentralized-finance sovereignty by vertically integrating a high-performance trading stack into a purpose-built Layer 1.

It maps the protocol’s architecture across HyperBFT consensus, the HyperCore trading state machine, and the HyperEVM execution environment, then shows how governance via HIP-1/2/3 progressively expands the design from token standards and liquidity bootstrapping to permissionless, builder-deployed perpetual markets.

PIP-3 marks Pear Protocol’s transition from a yield-oriented token model to a capital-structure-driven framework designed to directly align protocol usage with $PEAR value accrual.

With Pear now operating as a live, high-throughput order management layer clearing roughly $5M in daily notional, the proposal sunsets ETH revenue distributions in favor of a 70/30 split that routes the majority of protocol fees into sustained $PEAR buybacks, permanent burns, and liquidity support, while retaining a treasury buffer for continued expansion.

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.