- 0xResearch

- Posts

- Should we kill max supply?

Should we kill max supply?

Considering a 45% reduction of HYPE’s total supply

Brought to you by:

Hi all, happy Tuesday. The week started red with BTC trading 3% lower, while no component in our index registered positive returns during Monday’s session. Another interesting proposal entered Hyperliquid discussions, introducing many material changes to HYPE’s current token allocation and supply structure. The proposal renews discussion on an important topic: How can we design better tokens?

Monday brought abysmal price action across the board — no single index we monitor registered positive gains. Notably, Solana Ecosystem tokens were among the hardest hit in the selloff, down -8.9%. This outperformance to the downside comes after last week’s large upside moves, where Solana Ecosystem tokens like Drift and Kamino each saw gains in excess of 20% on the week, following speculation that DATCOs like FORD would begin deploying their holdings on the protocols. Cash flows were no savior in this selloff, as the Revenue index fell -7.8% while No Revenue fell only -4.5%.

— Luke

Where does the next big bid come from? BTC at $112K is nearly flat from the end of May, and ETH is flat from the start of August. SOL, too, has retraced most of its September gains that followed the DATCO purchases and the frontrunning of these flows. At large, momentum has stalled and majors remain rangebound and in consolidation.

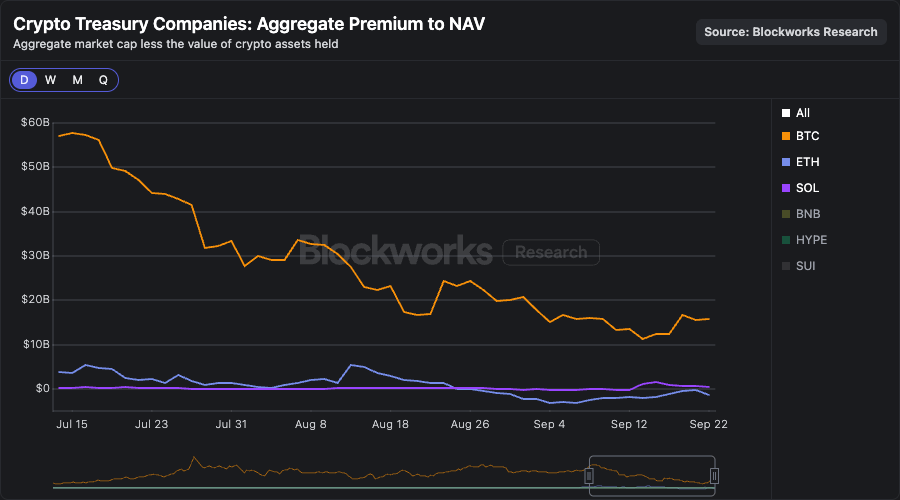

Coupled with the consolidation in majors, the aggregate premium to NAV across BTC, ETH, and SOL DATCOs has remained in a persistent decline. BTC DATCOs still hold a premium of $15 billion, attributable almost entirely to MSTR, while ETH and SOL DATCOs stand at -$231 million and $564 million, respectively. The premium remaining on SOL DATCOs is largely attributable to Forward Industries, which will sell into this premium with its recently announced $4 billion ATM share offering. At large, the premiums for DATCOs to sell shares into is dwindling, suggesting a deceleration in the level of purchases made by these buyers compared to recent months.

Amid shrinking premiums, the share of each of these majors held by DATCOs still remains in an uptrend, with 2-4% of the supply of each of these assets now parked in these vehicles. These vehicles will likely now need to seek differentiation in their operational strategies away from the ATM. New strategies could involve convertible note issuances, preferred shares or credit strategies across TradFi and DeFi venues.

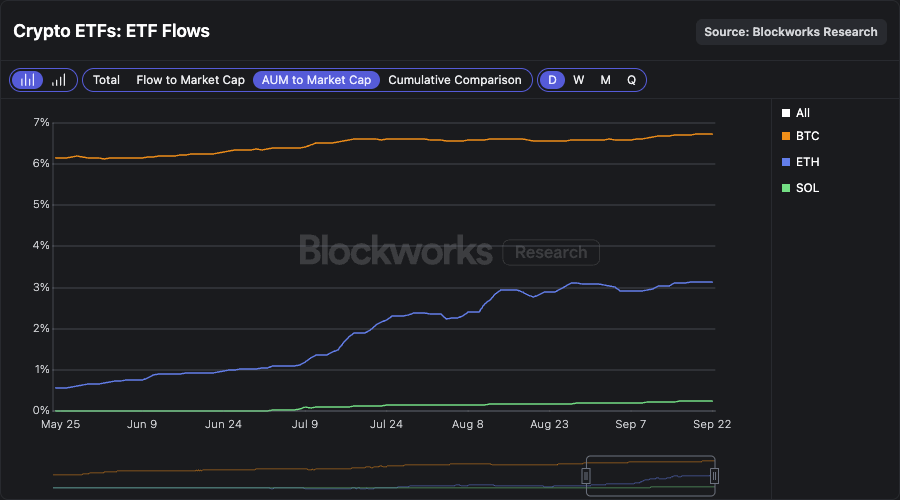

ETFs have maintained steady positive flows throughout September. These instruments now hold 6.73% of the BTC supply, 3.15% of the ETH supply and only 0.25% of the SOL supply. Perhaps the catalyst that remains on the near horizon is the pending approval of SOL ETFs under the ‘33 Act, slated for Oct. 16. These new ETF offerings would be more tax efficient, have better distribution from issuers like Fidelity and Bitwise and likely include in-kind creations, redemptions and staking. With these advantages, we view it as likely that SOL ETFs approved under the ‘33 Act can attract multiples more in AUM than the $250 million already exhibited in the REX-Osprey SSK.

Less than a month away, this pending ETF approval could renew big money interest in the space with an entirely new product to speculate on.

— Luke

Brought to you by:

Katana was built by answering a core question: What if a chain contributed revenue back into the ecosystem to drive growth and yield?

We direct revenue back to DeFi participants for consistently higher yields.

Katana is pioneering concepts like Productive TVL (the portion of assets are actually doing work), Chain Owned Liquidity (permanent liquidity owned by Katana to maintain stability), and VaultBridge (putting bridged assets to work generating extra yield for active participants).

Fixing supply metrics: Should we kill max supply?

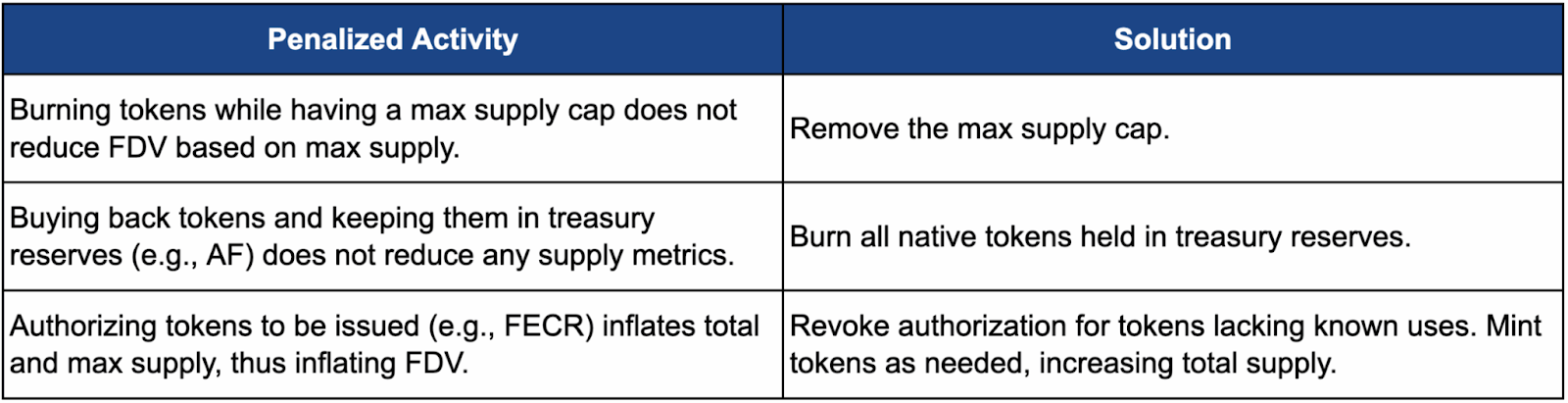

Yesterday, Jon Charbonneau and Hasu published a proposal to implement the following changes to Hyperliquid's economic model:

Future Emissions & Community Rewards (FECR): Revoke authorization for all unminted HYPE currently allocated to FECR.

Assistance Fund (AF): Burn all HYPE currently held in the AF. Burn all HYPE acquired by the AF on an ongoing basis.

Max Supply: Remove the max supply cap of 1 billion HYPE. Ongoing token issuance (e.g., for staking emissions or community rewards) would now increase the total supply.

Although the changes have not been officially proposed as a Hyperliquid Improvement Proposal (HIP), they would result in a 45% reduction in HYPE’s total supply should they be implemented at some point. Importantly, the authors highlight that this would have no impact on existing HYPE token holders’ relative ownership of protocol economics, Hyperliquid’s ability to fund value accretive initiatives or how these decisions are made. The core motivation of the proposal is that this move would improve valuation legibility to outsiders considering an investment in HYPE, arguing that the market currently penalizes excess supply.

While a Hyperliquid proposal is in the spotlight once again, it sets an important precedent for the industry at large, regardless of the outcome. More specifically, I hope this brings back attention to one of the most senseless practices by founders in the industry today: putting a hard cap on token supplies. As pointed out by the authors, this practice is a vestige of BTC’s 21 million hard cap and unnecessarily self-constrains growth initiatives.

Consider what would happen if traditional companies had self-imposed hard caps beyond authorized shares. One immediate consequence is that a lot of mergers and acquisitions would not go through or be severely constrained by companies' ability to negotiate. In 2006, Google acquired YouTube in a stock-for-stock deal valued at $1.65 billion. In connection with the acquisition, Google issued an aggregate of 3.2 million shares. In 2012, Facebook was cleared by the state of California to issue 23 million shares to complete its $1 billion Instagram acquisition ($300 million in cash and the rest in stock). It's unclear if Google and Facebook would have been able to complete these value-accretive acquisitions had they been unable to issue new shares.

For what it's worth, many people in the crypto industry have articulated this issue, with some projects already moving away from the hard cap practice. MetaDAO, a crowdsale and governance platform for early-stage crypto projects to engage in futarchy, is a noteworthy example. When a new project completes its raise on MetaDAO, 10 million tokens are sent out proportionally to everyone who participated in the ICO. However, there is explicitly no hard cap on supply. Founders can raise a futarchy proposal to the DAO to mint more tokens, and the traders will determine the outcome on a conditional market.

The industry, and particularly new projects, will gradually move away from the "max supply" idea. Ironically, this change is mainly an accounting annoyance, but it would benefit both investors and founders. On the one hand, it significantly simplifies valuation models and helps outsiders better determine the actual value of tokens with a large non-outstanding supply. On the other hand, it gives founders the option to fund value-accretive initiatives and not be constrained by cash at hand.

— Carlos

Justin Bons of Cyber Capital and Haonon Li of Codex join Lisa Chin on Unchained to debate whether stablecoin/payment-focused chains should build as Ethereum L2s or launch their own L1s. They weigh neutrality, security assumptions and the practicality of achieving “stage-2” rollup decentralization. Guests argue that transaction finality and credible neutrality are critical for real-world payments, while warning that chain and stablecoin proliferation could fragment liquidity and impair user experience.

Felipe Montealegre of Theia published an article on X that projects the displacement of knowledge workers by LLMs in the coming years. He projects that up to 29.5 million knowledge-sector jobs could be replaced over the next 20 years due to impacts from LLMs. The focus is on what this means in the short- to medium-term, emphasizing that these changes are driven by advances in automation and AI systems.

Vitalik published a blog post arguing that “low-risk DeFi”, encompassing payments, savings tools, fully-collateralized lending and simple synthetics, should become Ethereum’s stable revenue engine, akin to search and ads being the largest revenue generator for Google despite all the things Google (Chrome, AI, Pixel phones, Go language, etc.). He contends this can financially sustain public goods while preserving Ethereum’s cultural values, and urges minimizing governance and operational risk. He also highlights basket-currency “flatcoins” as a solution to reduce USD dependence. The core argument is that a conservative DeFi stack can drive durable fees and broad adoption without compromising decentralization ideals.

Crypto is changing TradFi derivatives and rate markets as we know them.

DAS: London will feature all the builders driving this change.

Get your ticket today with promo code: 0X100 for £100 off.

📅 October 13-15 | London

|

|

Turn referrals into returns 💎

When the alpha's this good, you have to share. Use the 0xResearch referral program to onboard your friends while banking the rewards:

📣 15 referrals: A free ticket to Blockworks’ Digital Asset Summit