- 0xResearch

- Posts

- Same game, new players

Same game, new players

Celebrity coins steal headlines, liquidity again

Brought to you by:

BTC and ETH are slipping, but retail’s potentially back with spot volumes surging and search trends spiking. Meanwhile, Kanye’s YZY memecoin ripped and halved within hours, with Hyperliquid once again proving itself a worthy challenger to CEXs by being the fastest to list perps for the launch. From retail FOMO to celebrity tokens, the market’s reminding us just how frothy things are getting.

Is retail here to buy our bags?

The weakness in the market continues, with BTC and ETH down 7.5% and 9.5%, respectively, over the last seven days. With majors showing a first real sign of correction in weeks, it’s an apt time to ask if the local top could be in. One segment of the market I like to watch is retail interest. When retail participation surges, it often signals that the crowd is in, which historically marks the local top in markets.

The first key indicator is weekly spot volume on CEXs. Last week, spot volumes reached $465 billion, approaching levels seen in January and March this year when the market was hitting new highs. Since most retail users trade through CEXs given the ease of onboarding, elevated volumes here provide a clear signal of growing retail engagement.

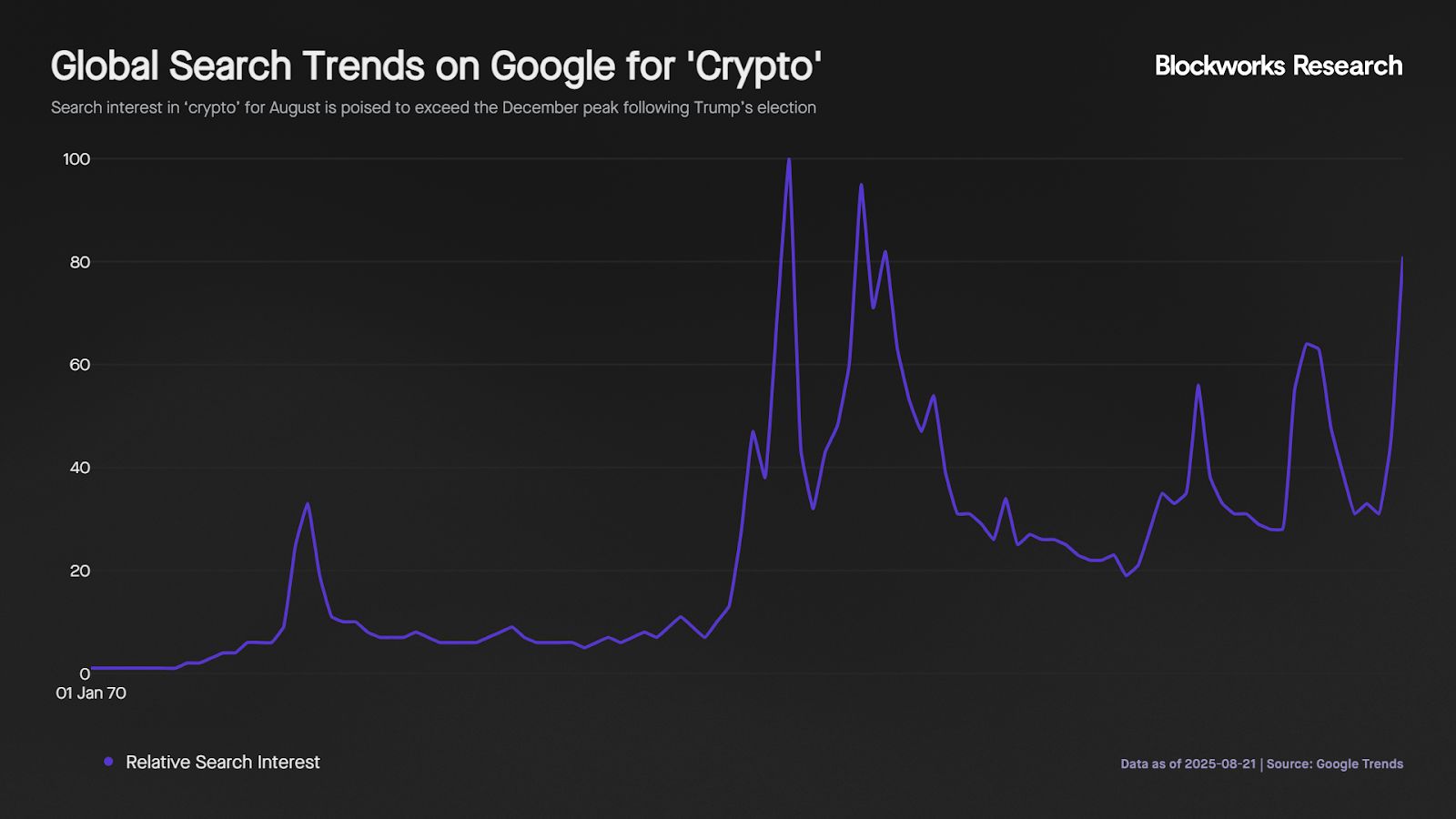

Search trends offer another powerful lens into retail sentiment. Interest in terms like “Crypto”, “Ethereum”, and “Altcoins” is climbing sharply, set to reach levels last seen at the peak of the 2021 bull market.

Even anecdotal signals matter. I am noticing more friends asking how to get started in crypto, which always catches my attention. While retail adoption is positive for the long term, sudden FOMO-driven spikes in these indicators often reflect emotional, late-stage buying from people chasing quick gains.

— Kunal

Brought to you by:

Katana is a DeFi chain built for real sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn boosted yield and KAT tokens: Deposit directly into vaults on the katana app and start earning on your ETH, BTC, USDC, and more.

YZY Season

If we needed any more signs that the market is frothy, Kanye West just dropped his own memecoin, YZY. The token was seeded as a single-sided LP (no USDC paired), and onchain data shows wallets flagged as insiders were actively buying before the wider market had access.

Like most recent celebrity launches, YZY ran up quickly, leaving little room for most participants to capture gains. It now sits at roughly a $150 million circulating market cap, down from a peak of $310 million. That’s already below Melania’s $610 million peak, suggesting markets are becoming wiser — or simply more tired — of the celebrity memecoin trade.

Notably, Hyperliquid was the fastest venue to list YZY, already processing $90 million in perp volume. With Phantom now integrating Hyperliquid builder codes, Solana users can trade the newest memecoins with leverage almost instantly.

In (potentially) unrelated news, US Federal Judge Jennifer L. Rochon lifted in Manhattan a prior asset freeze on about $57.6 million of USDC tied to the $LIBRA token case. The freeze had been imposed in a class action against promoter Hayden Davis, former Meteora CEO Ben Chow, and KIP Protocol and co-founder Julian Peh. The court said plaintiffs had not shown “irreparable harm,” so the temporary restraining order was vacated, though the lawsuit itself continues.

— Shaunda

Decentralised.co covers how the GENIUS Act and blockchain rails unbundle banks, shifting deposits to apps and platforms for user trust. With stablecoins, compliance-as-code and portable balances, finance becomes embedded everywhere. The future bank may be a social feed or app, leaving many traditional institutions facing Borders-like obsolescence.

Alea Research dives into Heaven’s core design choices, exploring its permissionless launches with permissioned fees, the God Flywheel and how the platform aligns creators, communities and $LIGHT token holders in a vertically integrated Solana launchpad.

Keyrock and Bitso trace how stablecoins collapse SWIFT, prefunding and netting into a single programmable rail, turning trapped liquidity into high-velocity capital. With regulation (CLARITY, GENIUS Acts), DeFi-based credit and onchain FX, stablecoins are set to move $1 trillion+ annually by 2030, capturing 12% of global cross-border flows and reshaping monetary policy as they reach 10% of US money supply.

Investors routinely pay $200 for assets worth $100 in public markets. Anyone would call it irrational. The data tells a different story. This report analyzes 33 publicly traded bitcoin-focused companies (both pure bitcoin treasuries and bitcoin miners) across global markets. The report aims to replace anecdotal explanations with data driven insights, quantifying the range of market cap/NAV ratios and pinpointing the concrete factors that separate premium DATs from discounted ones.

It’s the summer of DATs and the party is going strong.

But when October rolls around, everyone will be looking to DAS: London to hear from these meta-defining voices on where things stand and where they’re headed.

Get your ticket today with promo code: 0X100 for £100 off

|

|