- 0xResearch

- Posts

- Risk-off mode

Risk-off mode

Market pain continues

Brought to you by:

Hi all, happy Tuesday! Markets kicked off the week in full risk-off mode as Fed cut doubts, liquidity stress and “AI bubble” fears dragged equities and crypto lower. BTC and most sectors are firmly in the red. Against that backdrop, we zoom in on one of the few bright spots: Near Intents’ rapid growth as a cross-chain liquidity hub, driven by ZEC demand and its Zashi integration.

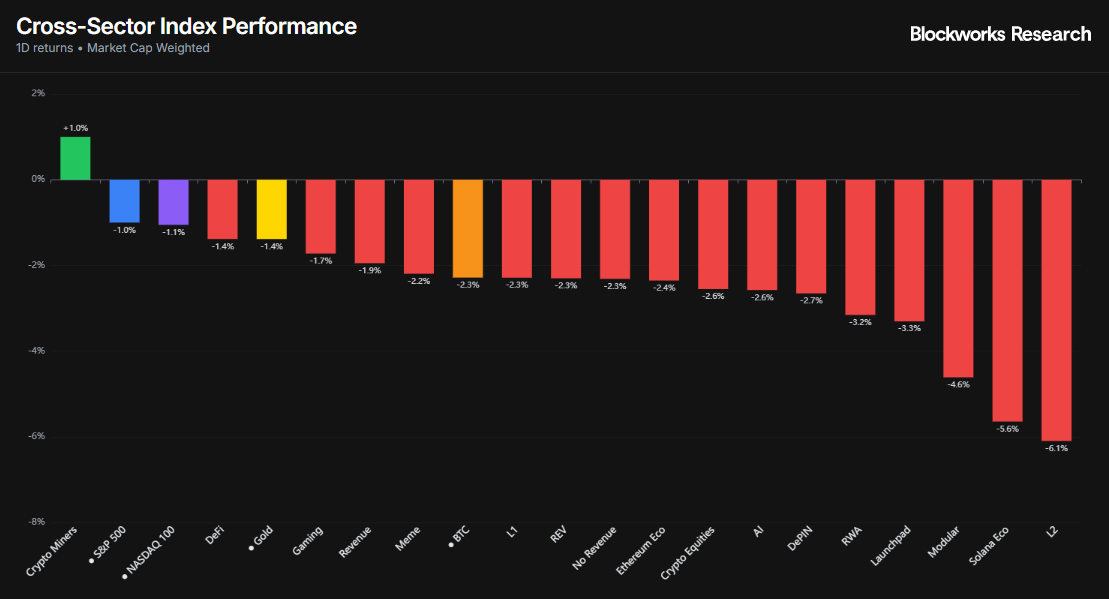

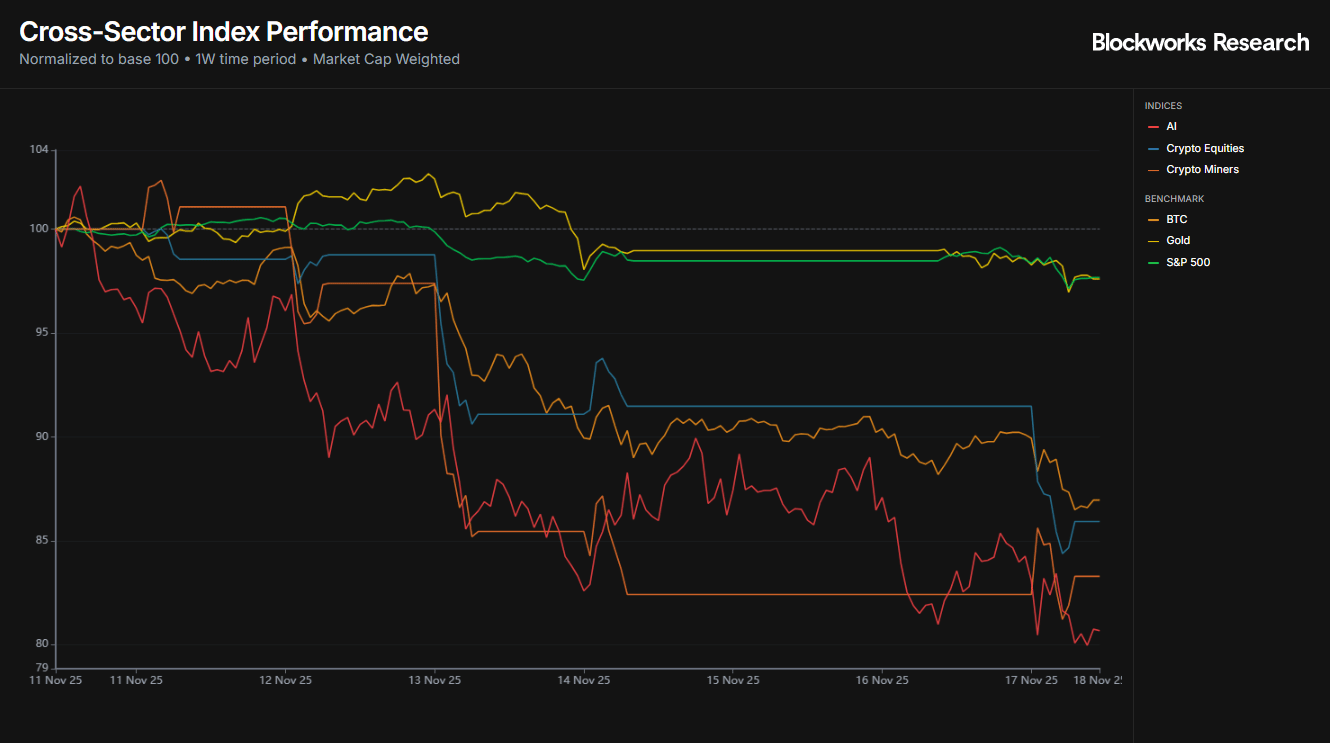

Markets retreated on Monday amid renewed uncertainty over Federal Reserve rate cuts, softer real-economy prints and broadening rhetoric that we are in an “AI bubble.” The S&P 500 and Nasdaq 100 dipped 1% and 1.1%, respectively, pressured by tech sector weakness. Gold was also down 1.4%, with bitcoin down 2.3% to now sitting just above $90K.

It was a risk-off day across the board, with virtually every major sector in the red except bitcoin miners, which managed a modest +1.0% gain. The hardest-hit pockets were L2 tokens (−6.1%) and the Solana ecosystem (−5.6%), hurt by broader DeFi deleveraging. L1s (−2.3%) tracked our REV index lower at roughly the same pace, while AI (-2.6%), DePin (-2.7%), and RWAs (-3.2%) were marginally worse off.

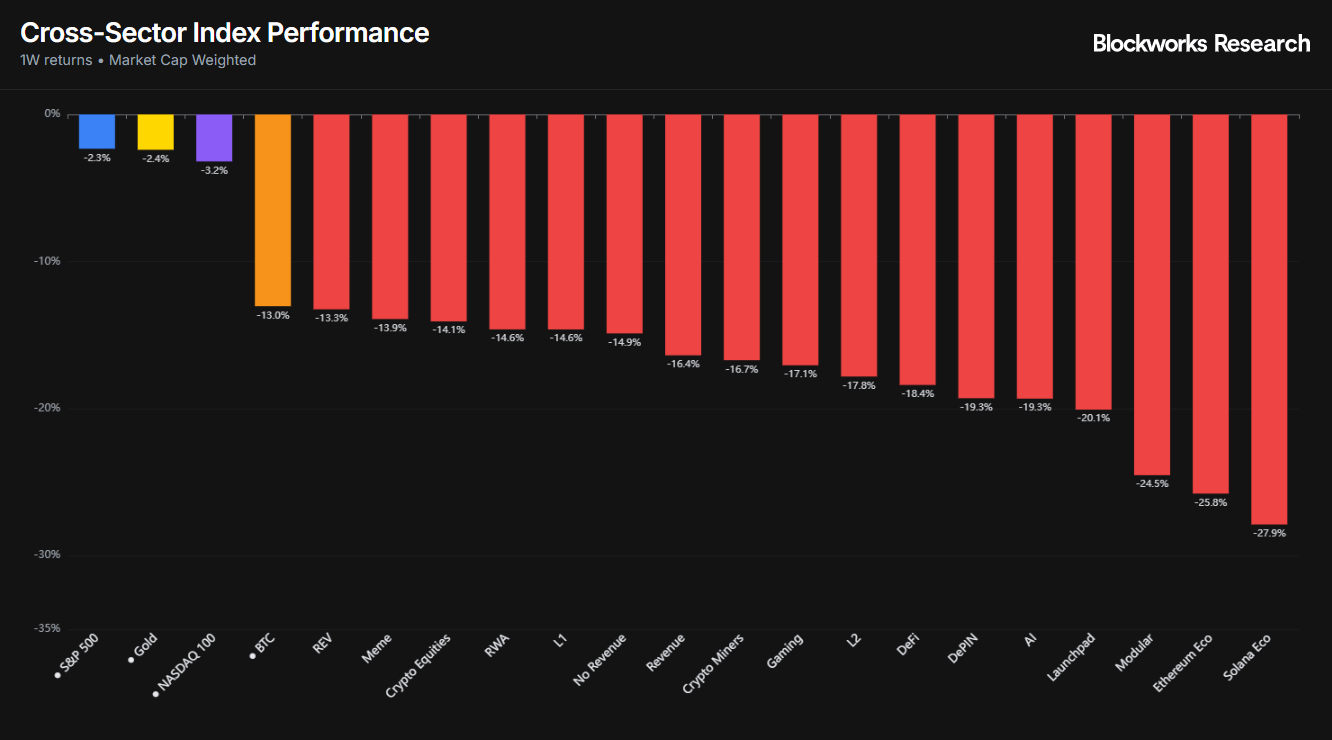

None of our indexes have held up on a one-week view, underscoring crypto's status as the most reflexive asset class amid escalating macro headwinds. BTC is down 13% over the period, holding up the best among crypto investments. Network fundamentals are deteriorating, with our REV index sliding 13.3% as Ethereum and Solana ecosystem tokens crater 25-30%.

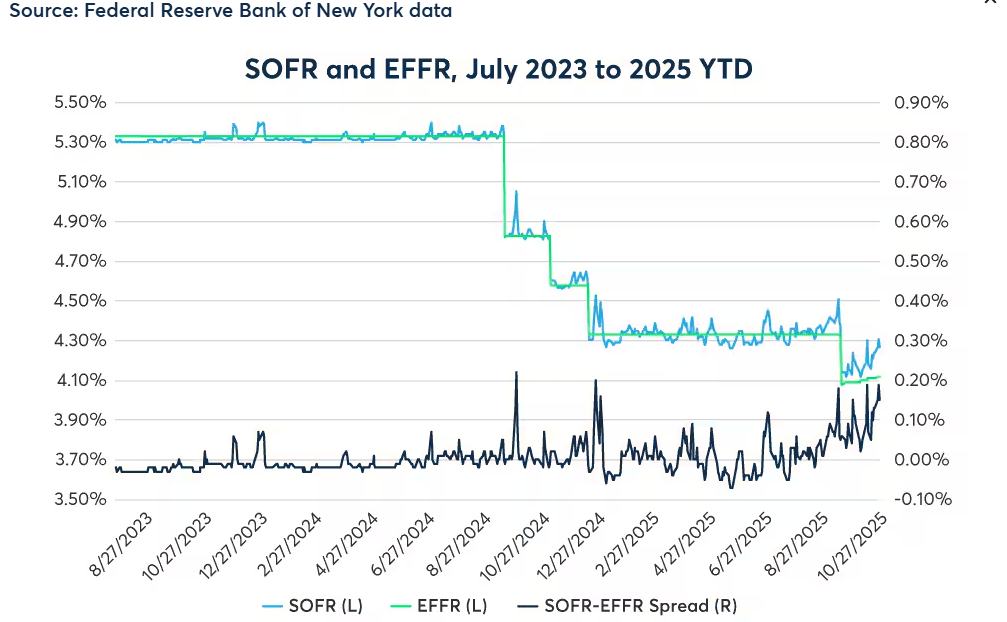

When dollars get scarce, the most speculative asset classes, crypto first among them, always take the hardest and fastest hit. An example of liquidity stress is the widening positive spread (SOFR > EFFR) being a sign of low levels of cash in overnight money markets. This means when cash gets scarce, people are desperate enough to pay more than the Fed’s rate to get their hands on dollars overnight.

Broader macro themes remain tense. With the government shutdown resolved, TGA drawdowns should provide some liquidity relief as the government reopens. Debate continues on QT ending and how much a pivot to Fed balance-sheet expansion will actually increase liquidity and support risk assets. On more fundamental data, Nvidia earnings hit Wednesday, and the delayed September jobs report arrives Thursday following the six-week government shutdown.

— Sam

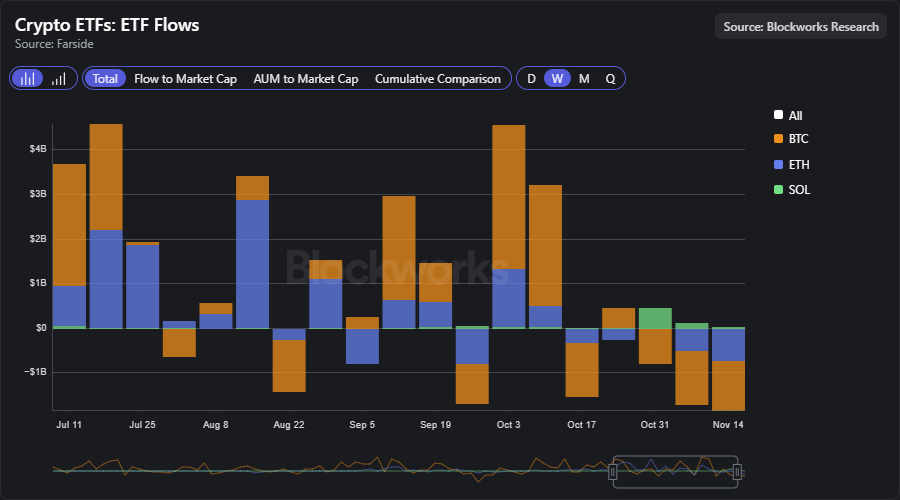

Bitcoin ETFs have flipped to heavy outflows in November, with roughly $3 billion in outflows over the last three weeks as institutional investors de-risk amid macro weakness and liquidity stress. ETH spot ETFs saw ~$1.2 billion outflows over the last three weeks. Meanwhile, Solana ETFs pulled in nearly $650 million, helped by new ETF launches.

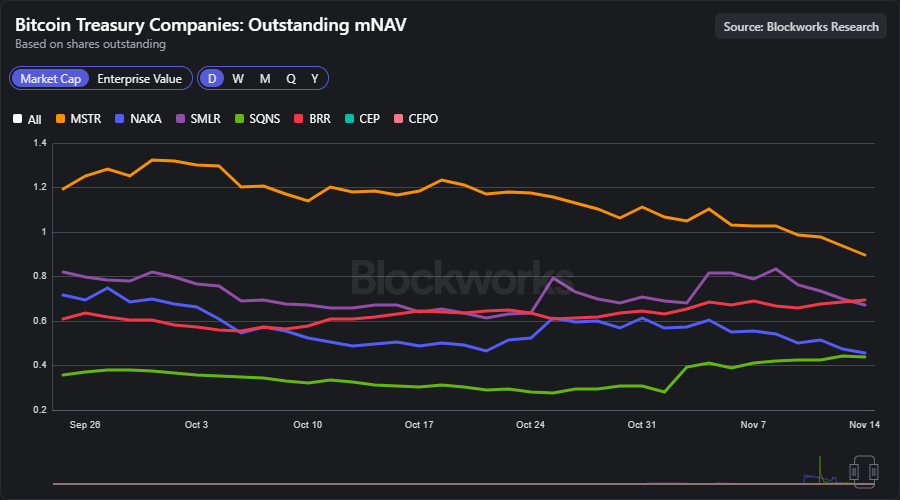

Even perennial outperformers like Strategy (MSTR) are cracking under the pressure, its their mNAV ratio dipping below 1.0, now trading at around 0.9x, a stark inversion from the 2-3x premiums in the early 2025 surge. All other bitcoin treasury companies are now trading materially below NAV, with mNAV ratios ranging from 0.7x to nearly 0.4x.

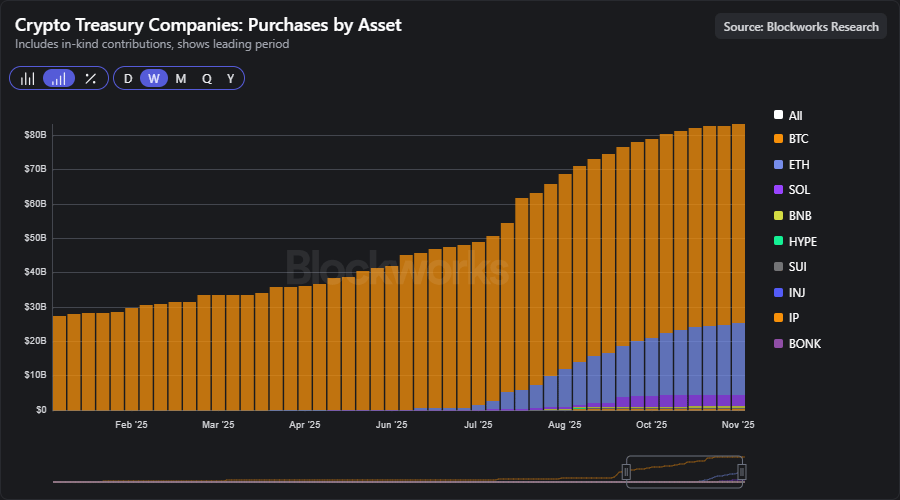

Corporate crypto treasury accumulation has slowed dramatically in November amid compressed equity premiums that curb fundraising for buys. The fading momentum raises questions around whether persistent mNAV discounts will lead these firms to sell crypto assets.

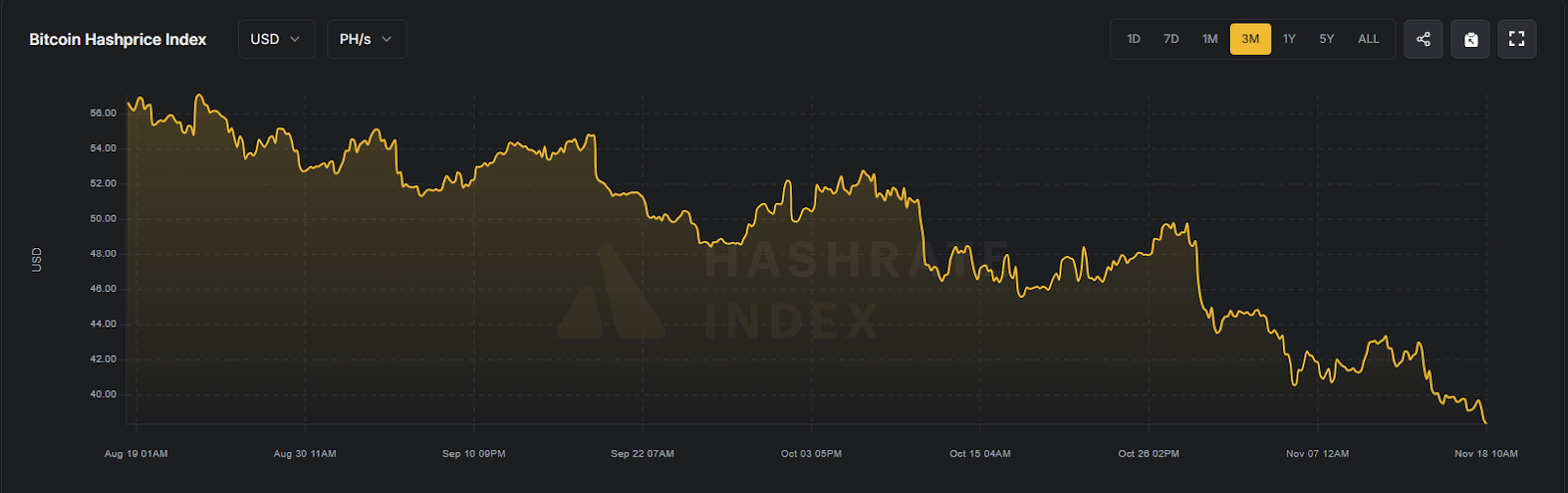

Bitcoin miners aren't faring any better, with hashprice collapsing to ~$38 per PH/s as network hashrate climbs back to 1,100 EH/s despite falling BTC prices. The sole bright spot is rising volatility driving network activity higher, pushing fees to ~1.2% of block rewards, up from last month's 0.5% lows.

Miners’ cash flows are still tied to collapsing BTC hashprice, driving a one-week selloff of ~17%. The drop was amplified by rising “AI bubble” chatter, with our AI index down ~20%. We see that as noise, with the dip presenting an opportunity as they transform into critical AI infrastructure players (see our report Bitcoin Miners: The Megawatt Trade).

— Sam

Brought to you by:

Katana is a DeFi chain built for real sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn boosted yield and KAT tokens: Deposit directly into vaults on the katana app and start earning on your ETH, BTC, USDC, and more.

Near Intents: The cross-chain liquidity hub

The Near Intents product was introduced as part of the core Near Protocol in November 2024. For context, intents are an order type in which a user specifies a desired outcome, rather than a specific path of execution. This order type tasks external agents, referred to as “solvers” or “fillers,” to identify some transaction that returns the desired outcome, usually in exchange for a fee. Leveraging Near’s chain abstraction stack and the intent solver network, Near Intents allows trading of hundreds of assets across various chains from a single account or by any agent, without the need for bridging or wrapping assets.

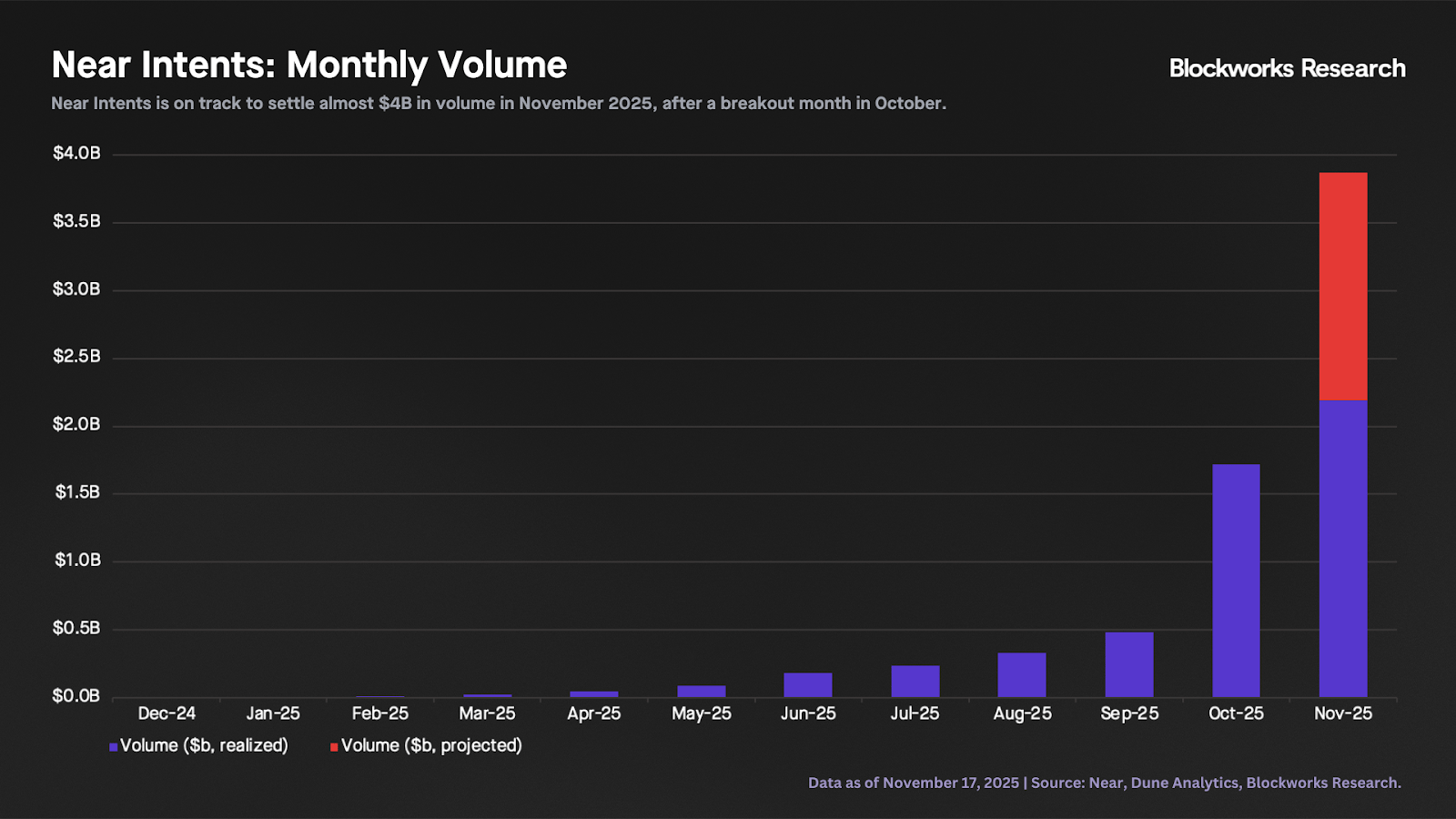

After steady but slow monthly growth, October marked a breakout month for Near Intents. As shown in the chart below, the protocol processed $1.72 billion in volume in October, a 256% MoM increase. November has already surpassed that with $2.19 billion in volume as of Nov. 17, putting Near Intents on track to settle nearly $4 billion this month.

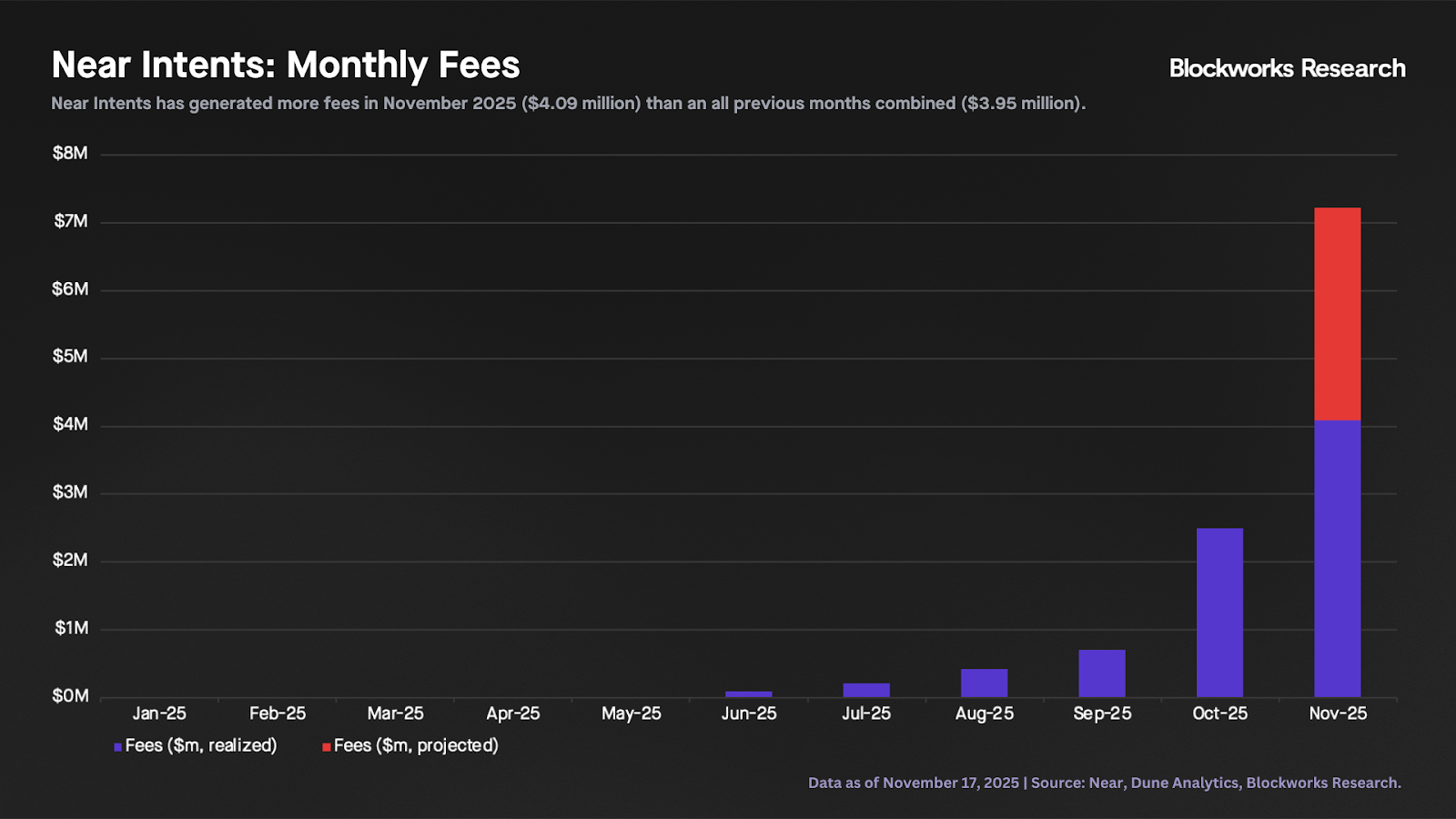

Looking at fees, the growth over the past two months is even more dramatic. Near Intents has generated $4.09 million in fees in November 2025, surpassing the $3.95 million of cumulative fees from inception to October 2025, with nearly two weeks still left in the month. If current activity levels persist, Near Intents is on pace to generate around $7 million in fees in November.

Near Intents’ primary catalyst for its exponential growth in recent months was its Zcash support and Zashi integration. Zashi, the most popular Zcash mobile wallet, allows users to perform decentralized cross-chain swaps from other crypto assets into ZEC within the wallet. Yesterday, Zashi introduced an update to the Near Intents integration that unlocks private swaps, allowing users to directly convert any Near-supported asset (e.g., BTC, ETH, USDC) into shielded ZEC. Previously, Zashi only supported swaps to a transparent address, requiring users to manually shield their ZEC afterward. Moreover, a swap from ZEC to other assets would return a small refund to a transparent address even if executed from a shielded one, establishing a link between both addresses. With yesterday’s update, this issue is now fixed.

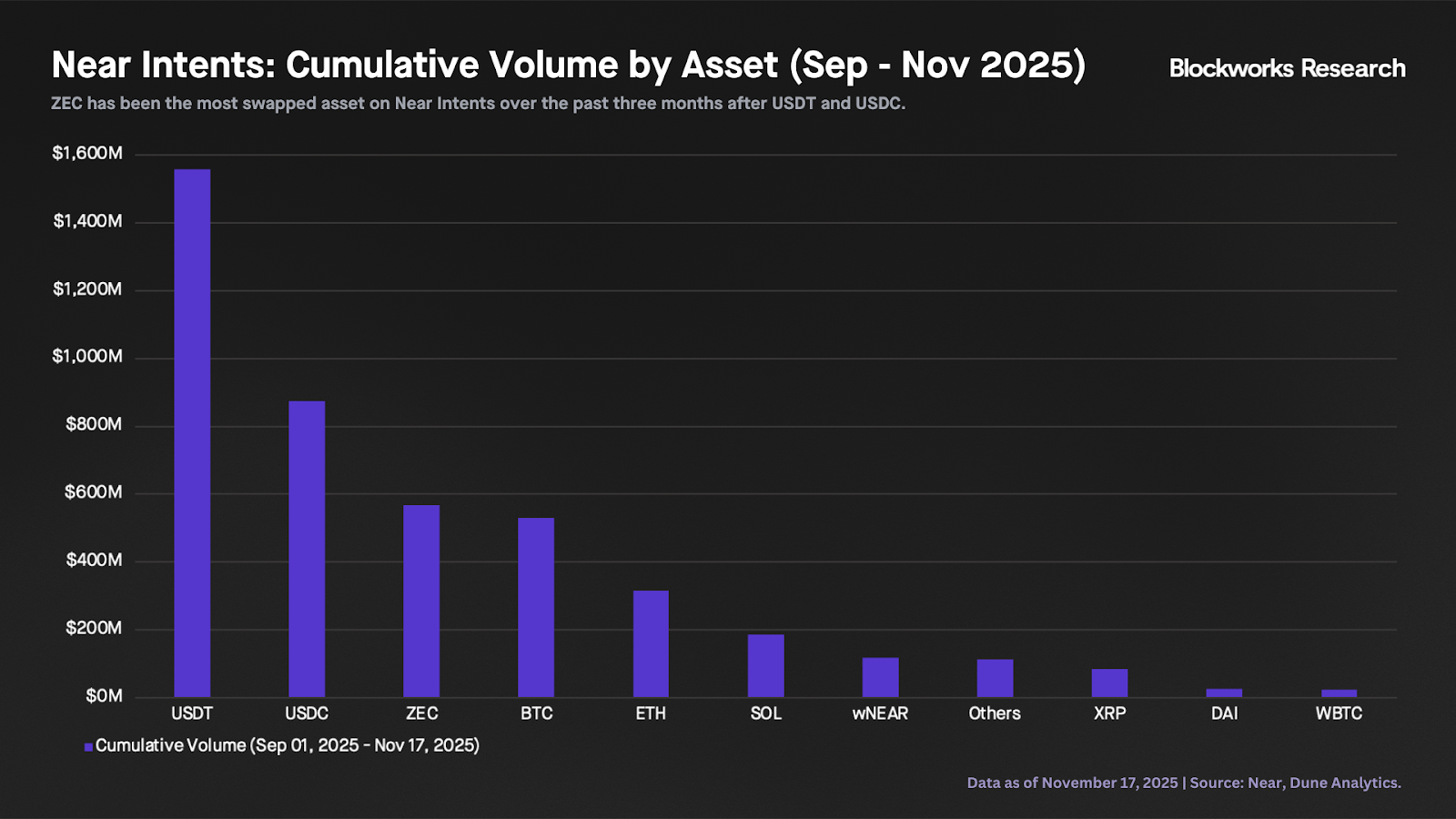

The chart below shows the cumulative volume of Near Intents by asset since Sept. 1, 2025. ZEC is the most swapped asset behind USDT and USDC, with $569 million in cumulative volume. A key question is whether Near Intents’ recent activity spike is a temporary effect of ZEC buying demand or the start of more durable growth. The surge in attention could ultimately seed a stickier user base for permissionless swapping across a broader set of blockchains and assets.

— Carlos

Annanay Kapila, CEO and founder of QFEX, joined Gwart to talk about his journey from high-frequency trading at Flow Traders and Tower to building a revolutionary exchange platform. He argues that crypto exchanges have been leaders in innovation because they've been able to work outside the regulatory purview and design things from scratch. Discussion also centers around how crypto market structure solves traditional finance inefficiencies, Kapila’s Y Combinator experience, regulatory strategy, 100x leverage mechanics, prediction markets and why sports betting actually works.

Kyle Harrison published an article arguing that Y Combinator has evolved into a kind of “startup manufacturing” machine optimized for venture-scale outcomes, pushing founders to “build what’s fundable” rather than simply “make something people want.” The piece traces YC’s shift in mission from ideas like “One Million Jobs” to ambitions such as backing the “first 10 person, $100B company,” and explains how its batch structure, standard terms and investor pipeline effectively define what qualifies as fundable. Harrison argues that as bulge bracket and top-tier VCs increasingly align with YC’s pattern-matching, the ecosystem channels capital toward software-like, hyper-scalable businesses while underfunding slower-growing, niche, or capital-intensive companies, and he urges founders to be intentional about whether to design their narrative and business model to fit that venture-scale funnel or deliberately opt out of it.

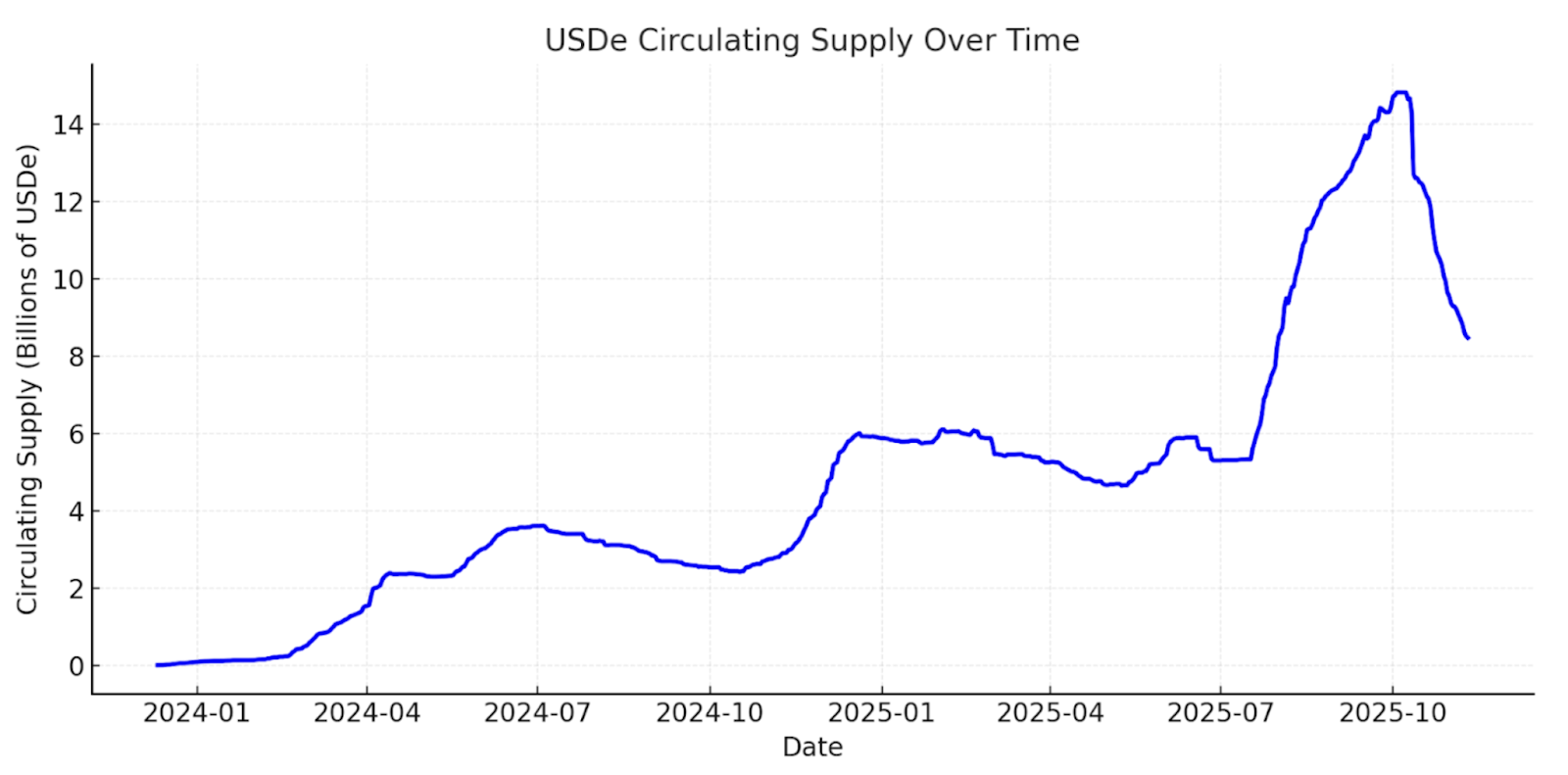

Vishal Kankani from Multicoin Capital published an investment thesis on ENA, laying out the case for Ethena as the leading synthetic dollar protocol and a credible challenger to the USDT/USDC duopoly. Kankani argues that Ethena sits at the intersection of three structural tailwinds (stablecoins, perpification, and tokenization), and that expanding perp open interest (including future tokenized equity perps) and fintech integrations with DEX perps will massively increase the capacity of the basis trade. The post highlights Ethena’s ~$600 million in cumulative revenue, resilient performance through the Bybit hack and the Oct. 10 liquidation event, and outlines how a future fee switch could direct protocol earnings to ENA once USDe supply again surpasses $10 billion. He concludes ENA is a levered bet on synthetic dollars becoming a major share of the multi-trillion-dollar stablecoin market.