- 0xResearch

- Posts

- Risk back on the table

Risk back on the table

Kalshi raises a billion dollars

Today, we break down the BTC move over the past week, how ETFs have seen net inflows for the first time in nearly four weeks, and application and chain revenue. We also look into who President Trump's next Federal Reserve chair nominee might be.

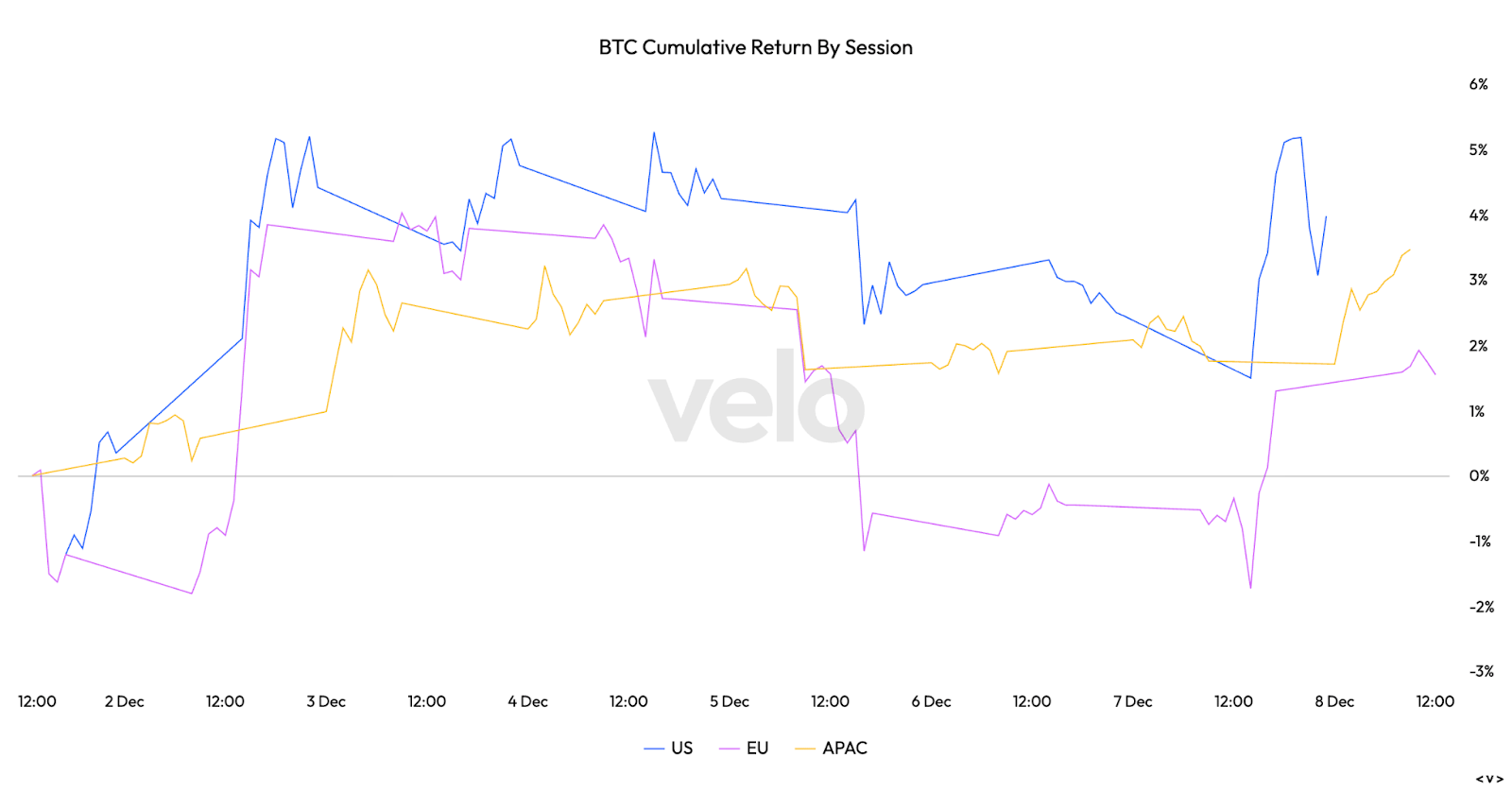

BTC bounced off $85K lows, and is back up to $92K. Over the past three weeks, BTC has increased 5%, with significant volatility throughout. In particular, BTC has been underperforming through the EU session, while outperforming in the US and APAC sessions.

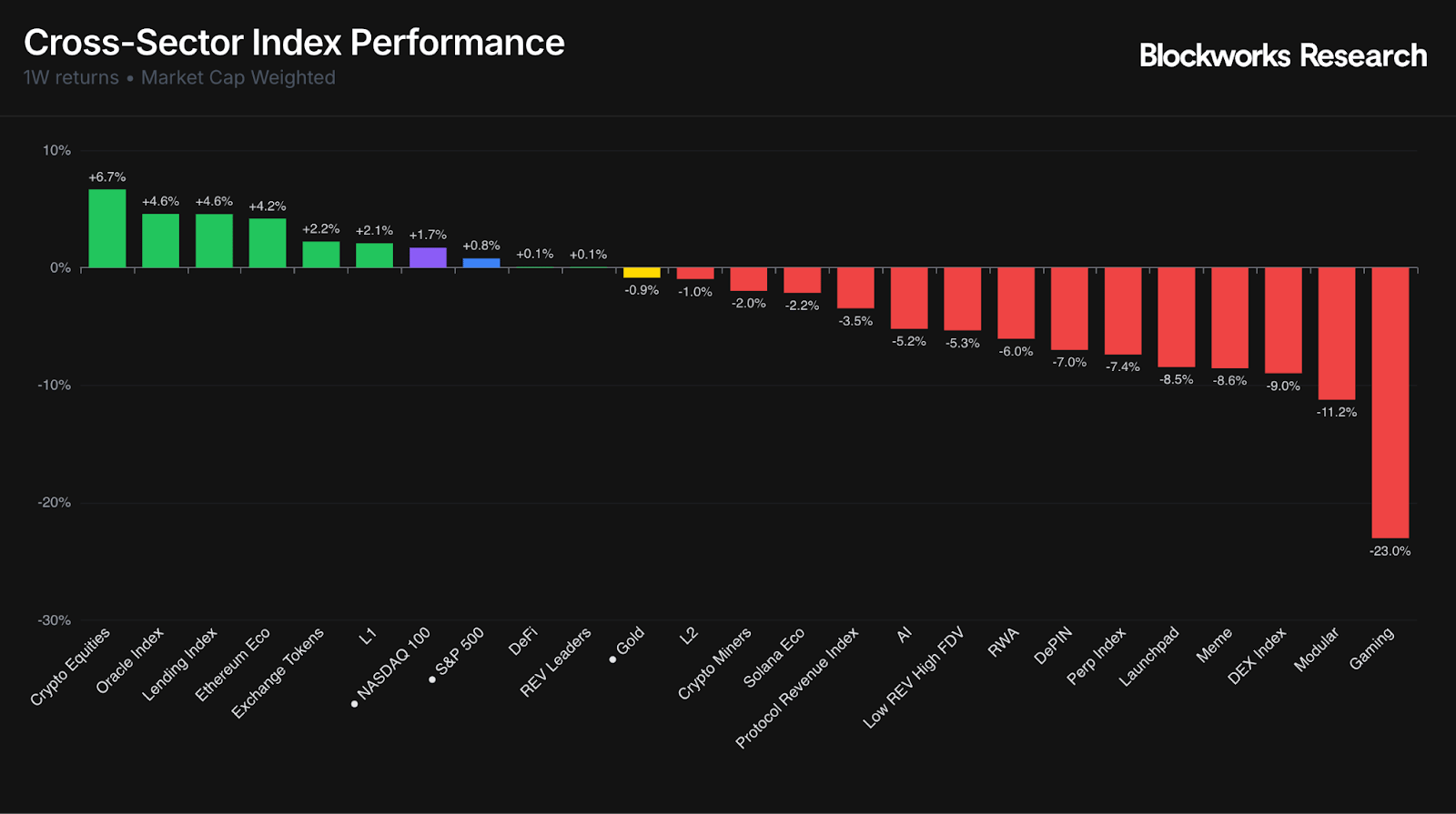

Over the past week, oracles, lending and Ethereum ecosystem tokens performed well, with each up just over 4%. Crypto equities performed the best, up 6.7%, primarily due to outperformance by HOOD.

The Nasdaq 100 (+1.70%) and S&P 500 (+0.78%) continue to grind up, while Gold underperforms slightly (-0.85%).

In terms of worst-performing, gaming has outperformed significantly toward the downside, with -23% returns over the past week. LGCT was the worst performer, and declined in price by -75% over the past week.

How are DeFi and traditional rails actually converging?

Join this live Roundtable to hear voices from Blockdaemon, Aave, and Circle hash it out!

Takeaways from Friday's 0xResearch livestream:

Market sentiment and positioning: We examined current crypto market conditions, noting that assets are now priced closer to bear market scenarios than three months ago, though not yet fully reflecting a prolonged downturn. James expressed limited conviction in either direction, viewing bitcoin at $90,000 as uninspiring for rotation.

Crypto valuation frameworks: We analyzed the challenge of valuing BTC, ETH and SOL, concluding these assets trade more like commodity supercycles than traditional beta-hold assets. Noah emphasized that cash-flowing DeFi protocols allow for narrower valuation bands, while L1s remain fundamentally difficult to price.

HumidiFi token launch concerns: We discussed HumidiFi's ICO, noting that the public sale was botted by four addresses due to lack of KYC or address restrictions. Noah estimated the prop AMM business is worth less than $50 million based on trading capital returns, yet the token will likely trade higher, suggesting a pseudo-meme coin extraction play.

Tokenomics transparency evolution: We explored how market expectations have shifted post-Hyperliquid, with investors now demanding explicit value accrual mechanisms. Pump.fun's shift from 25% to 100% revenue buyback illustrates how token holders are forcing accountability through price pressure.

Prediction markets skepticism: We examined Kalshi's $1 billion raise at $11 billion valuation, noting that 90%+ of prediction market volume remains sports gambling. James questioned TAM expansion assumptions, while Noah argued the valuation requires high confidence in both sports betting penetration and traditional finance integration.

Gambling market dynamics: We noted Flutter Entertainment and DraftKings have a ~$50 billion combined market cap, making aggressive prediction market valuations dependent on either material market share capture or expansion into new financial products beyond sports betting.

Watch the full episode on YouTube, Spotify, Apple Podcasts or X.

This summary was generated with assistance from AI tooling.

Charts of the week

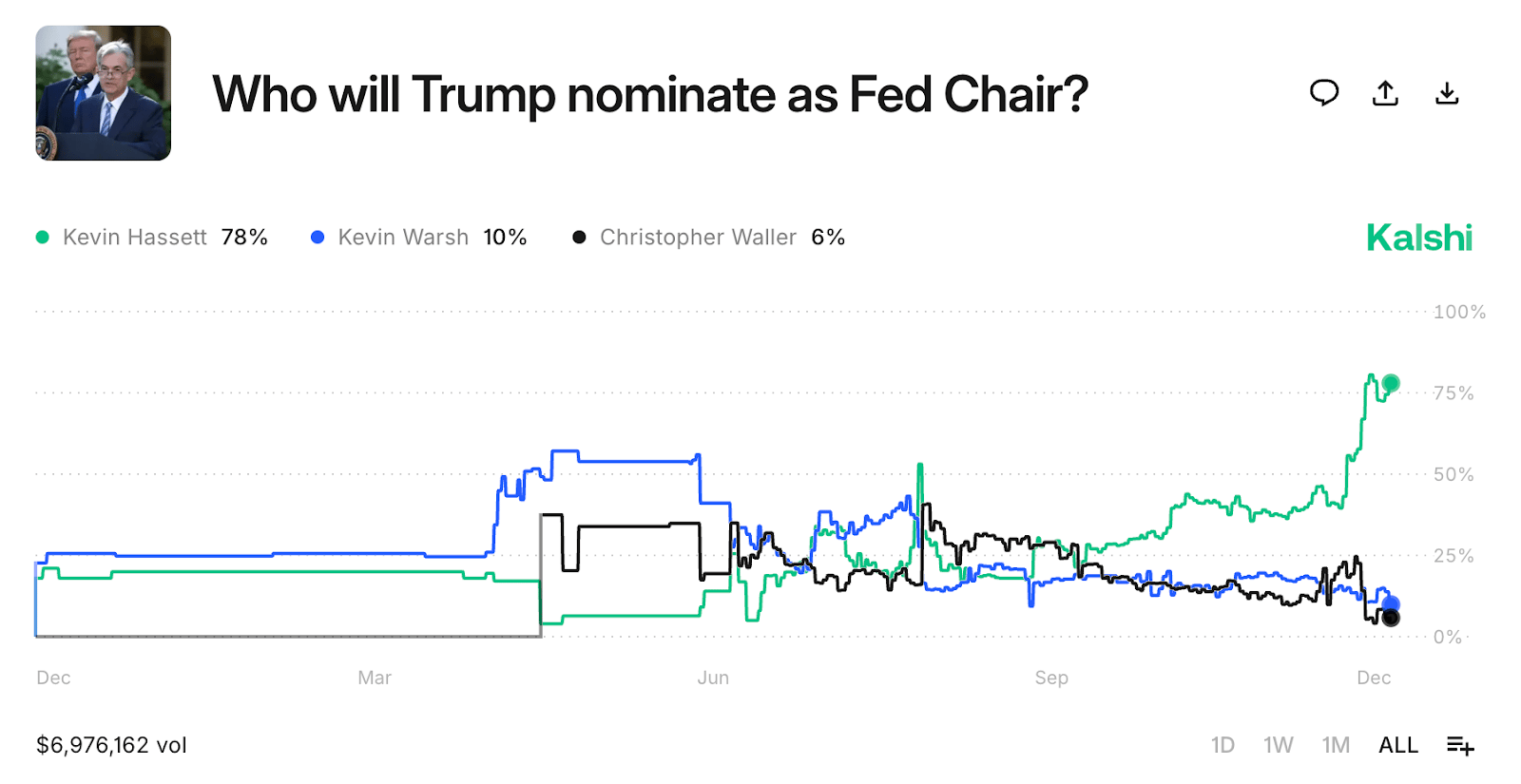

Odds have surged (up to 78% on Kalshi) that Kevin Hassett will be President Trump's next Federal Reserve chair nominee, an announcement Trump recently confirmed is imminent. Hassett, a close White House ally, is favored because he aligns with the president's demand for much lower interest rates to provide cheaper consumer loans and mortgages.

Bitcoin ETF flows reversed sharply in November, posting significant net outflows after a steady run of inflows from May through October. The month saw roughly $3.46B in redemptions, completely erasing the $3.42B in new inflows seen last month and the worst outflows since February 2025 ($3.56B). The reversal highlights how quickly sentiment deteriorated despite months of strong accumulation. The alignment between ETF flows and price action remained intact, with November’s outflows closely mirroring BTC’s double-digit monthly decline.

The first week of December has been the first positive net inflow week for BTC ETFs since the last week of October, with $70.2M in net BTC ETF inflows. Ethereum and Solana ETFS have both seen higher net inflows this past week, at $312M and $108M, respectively.

In terms of network revenue, we’re seeing similar figures to what we saw the week prior, with Hyperliquid leading the charge with 35% of all network revenues, followed by Tron (20%) and Solana (15%). Noticeably, BNB revenue is still at lows following the highs it put in October, and the majority of that has been captured by Hyperliquid and Solana.

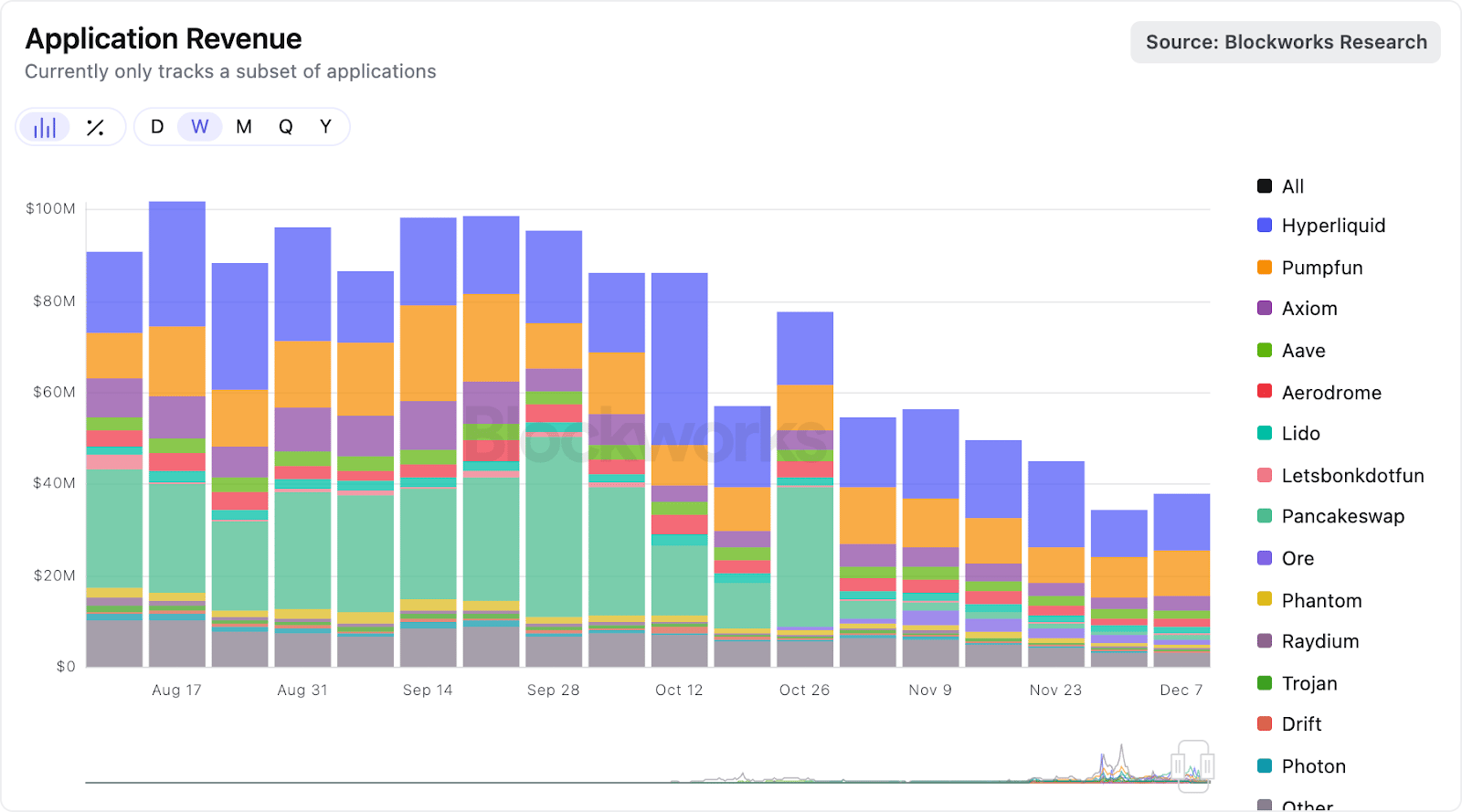

Application revenue has stopped declining (now at 38M, 10% higher than last week), following four weeks of net decline across all tracked applications. Hyperliquid continues to lead the way (35%), followed by Pump.fun (25%) and Axiom (8%).

Helius’ Lostin and Ichigo proposed SIMD411, which aims to accelerate Solana’s emission schedule by doubling the disinflation rate from -15% to -30%, keeping the 1.5% terminal inflation unchanged. This simple, predictable parameter change would bring inflation from ~4.14% today to 1.5% in ~3.1 years (early 2029), rather than ~6.2 years (early 2032). If implemented, SIMD411 would cut 22.3M SOL ($2.9B) in emissions after six years vs. the current inflation path, reducing the “leaky bucket” sell pressure.

Decentralized AI coordination directly targets a structural mismatch in crypto via applications designed to minimize trust and single points of failure. Within this landscape, Allora represents a differentiated attempt to move beyond static ensemble methods.

Competing approaches like Bittensor’s subnet marketplaces and Numerai’s stake-weighted ensembles highlight that there is no consensus architecture for decentralized intelligence. Instead, the sector is experimenting with how to measure contribution, how to allocate rewards, and how to trade off decentralization, performance, and coordination overhead.