- 0xResearch

- Posts

- Ranger’s ICO

Ranger’s ICO

A big buyer returns

Hi all, happy Tuesday! Today, we break down two drivers shaping the early-week narratives. First, we look at Strategy stepping back in as a visible treasury bid for BTC, but with a very different financing backdrop compared to 2024-2025 (compressed mNAV and higher marginal funding costs). Second, we cover Ranger’s ICO kicking off today (Jan. 6-10) and why it’s a meaningful catalyst for MetaDAO, looking at both near-term AMM volumes and the bigger question of whether launch cadence and revenue can reaccelerate into 2026.

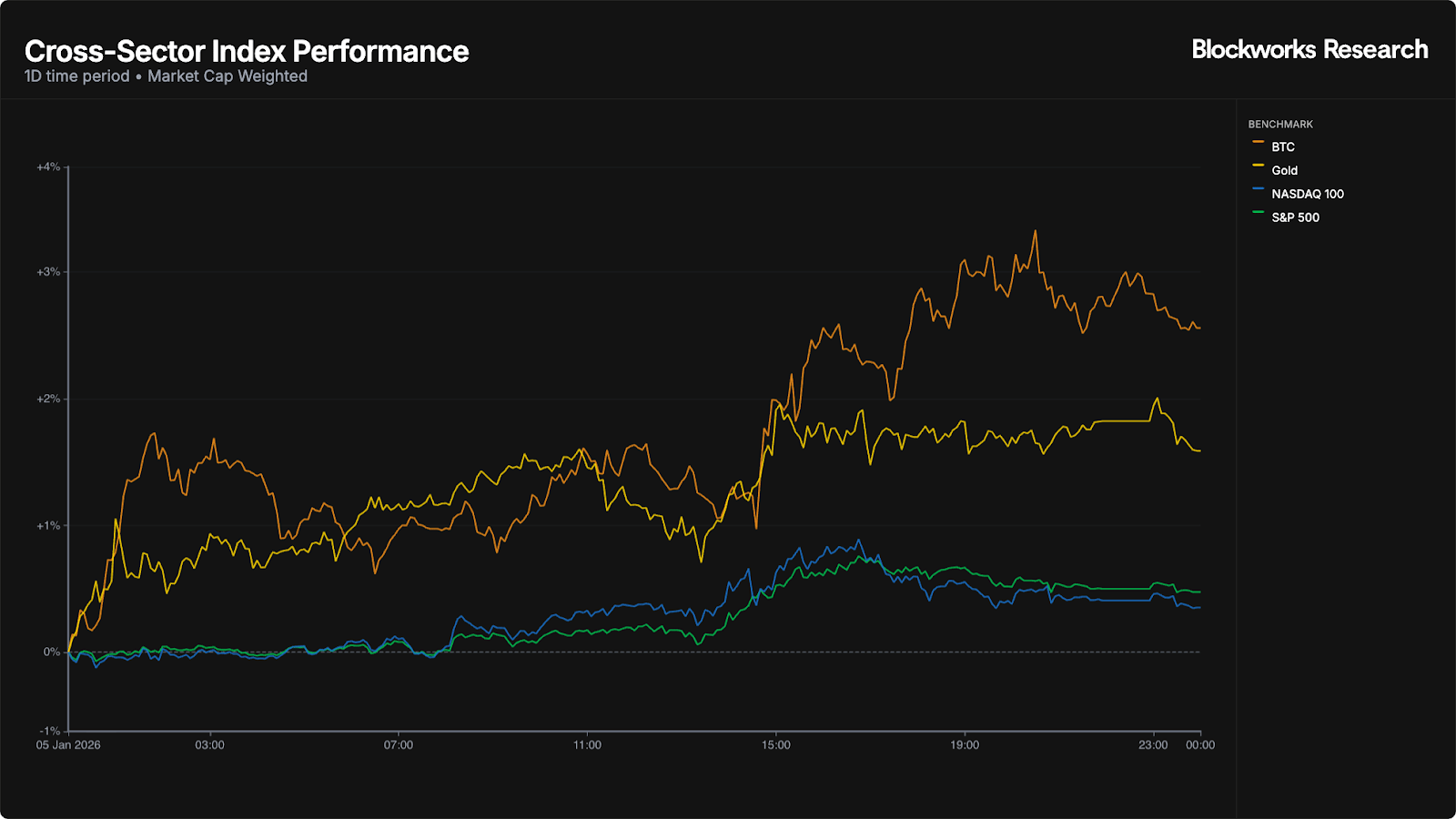

Bitcoin led the tape over the last 24 hours, up about +2.6%, outpacing Gold (+1.6%) and a much quieter move in US equities (S&P 500 +0.5%, Nasdaq 100 +0.4%). After a long period of underperformance in 2025, the year is off to a good start with the marginal buyer showing up in BTC first, ahead of broader risk assets.

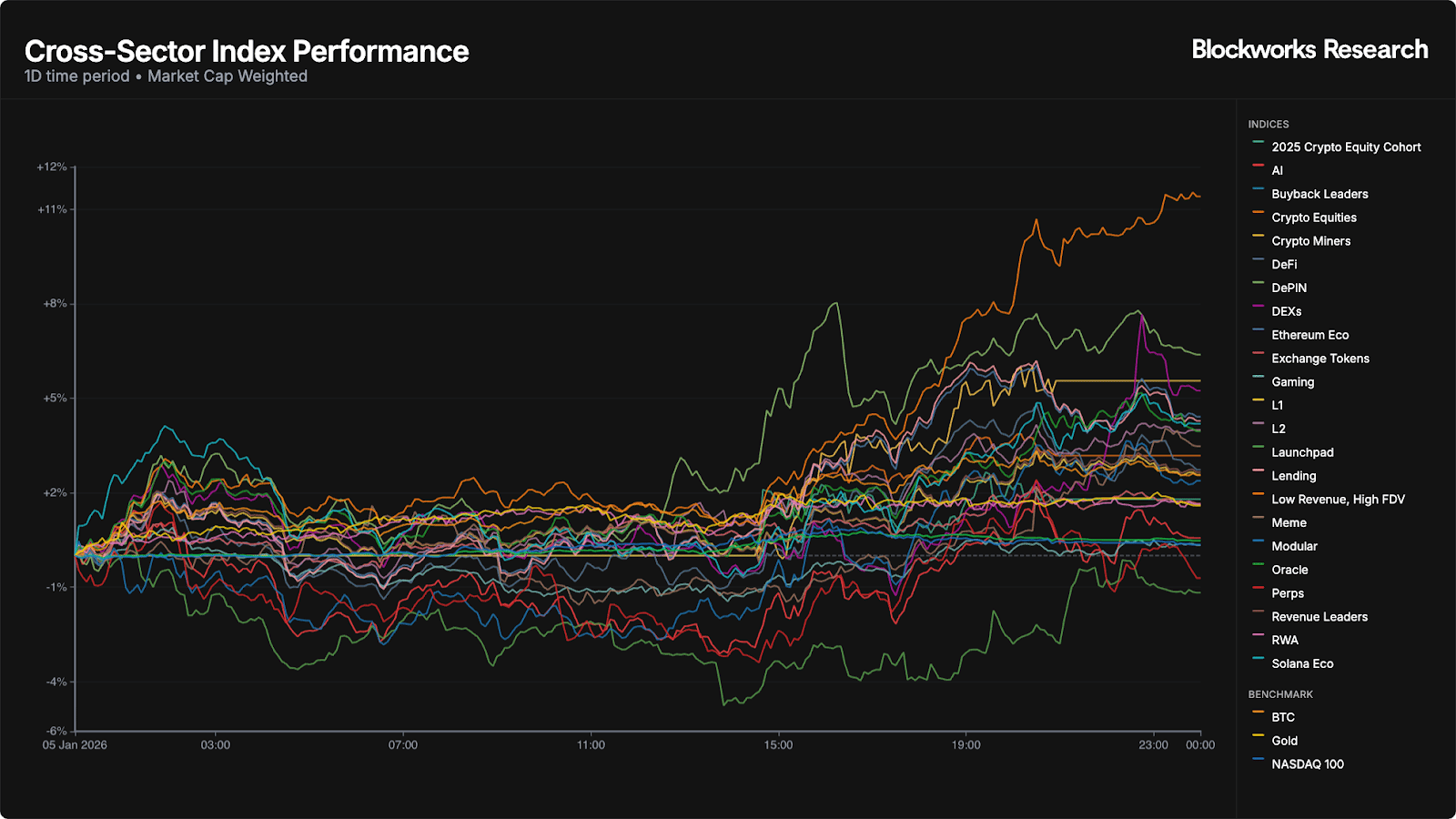

Broader beta was green across the complex, but leadership skewed decisively toward the frothier end of the spectrum. Low Revenue, High FDV led by a wide margin (+11.4%), followed by DePIN (+6.4%), Crypto Miners (+5.6%), and DEXs (+5.2%). BTC was up +2.6%, closer to the middle of the pack, while the more fundamental baskets like Revenue Leaders (+2.7%) lagged the high-beta bounce. The only real laggards on the day were Perps (-0.7%) and Launchpad (-1.2%).

Intuitively, it feels like when old coins, High FDV or memes are pumping hardest, it signals late-cycle froth rather than durable demand, and this is backed up by data. In the Speculative vs. BTC spread framework, when speculative baskets lead BTC on a trailing basis, BTC's average seven-day forward returns compress sharply: roughly 0.3% when Speculative leads by 5-10%+, vs. 1% when BTC is leading.

— Shaunda

One near-term tailwind is that Saylor's Strategy stepped back in, turning the treasury bid back on. At the end of December, Strategy raised cash but barely deployed it into BTC. On Dec. 29-31, it sold 1,255,911 MSTR shares for $195.9M net proceeds, yet bought only 3 BTC. In early January, deployment resumed: Jan. 1-4 saw another 735K shares sold for $116.3M net, and 1,283 BTC bought for $116M (avg $90,391/BTC), bringing holdings to 673,783 BTC.

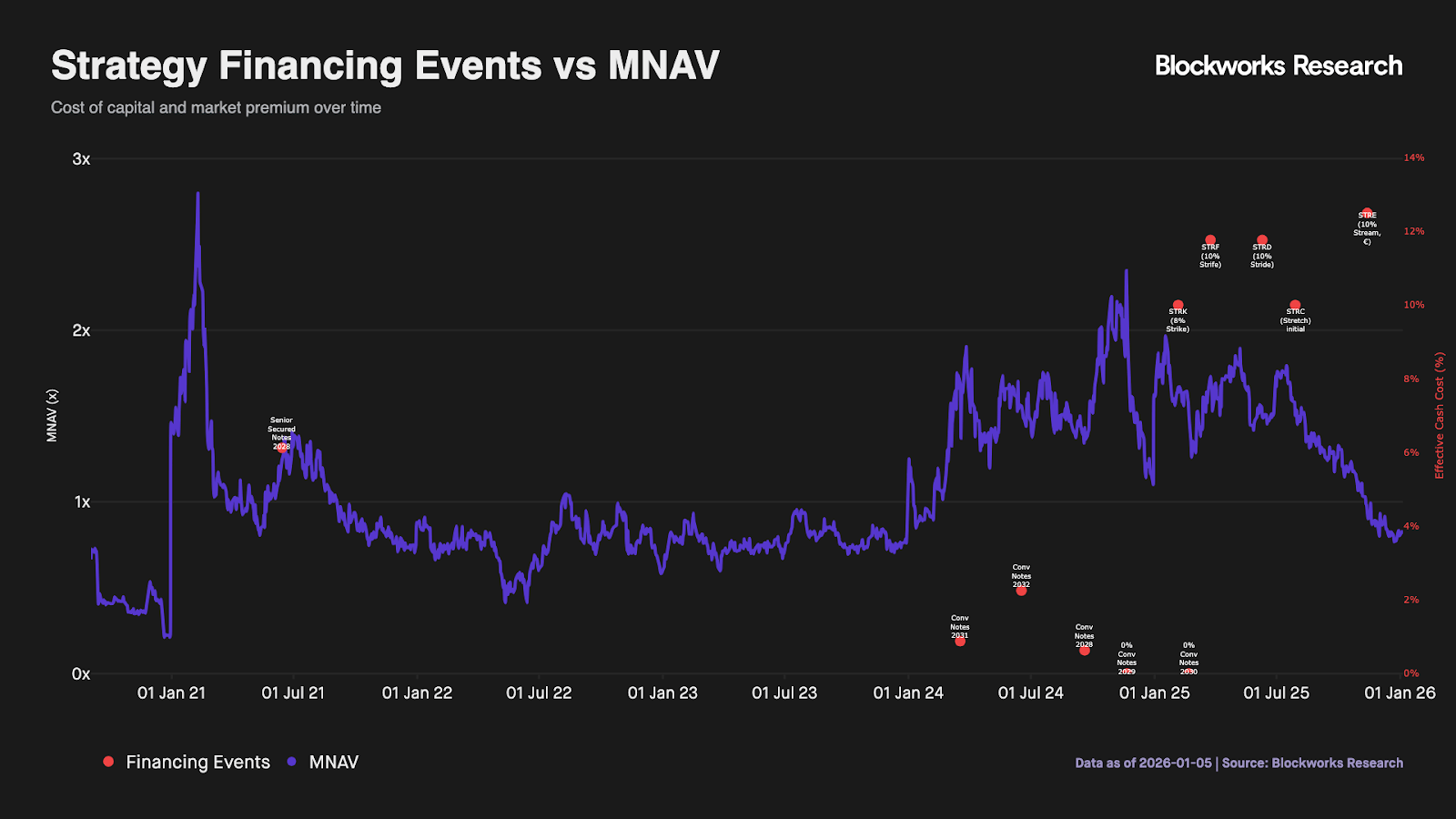

The bigger signal sits in the financing backdrop. In 2024 through early 2025, Strategy funded itself cheaply via convertible debt (cash coupons 0.625% to 2.25%, then multiple 0% converts). That playbook works best when MSTR trades at a premium to Bitcoin NAV (mNAV > 1) because of the equity optionality.

However, by mid-to-late 2025, that premium compressed and flipped to a discount (mNAV < 1), making equity-linked financing harder to place and common issuance mechanically dilutive to BTC-per-share. As a result, the financing shifted toward high-cash-cost preferred, often issued below par, printing roughly 10% to 12.5% effective cash cost on proceeds. STRC's dividend rate has been stepped up from 9% (August 2025) to 11.0% (January 2026) to keep the channel open.

Interestingly, Strategy is still funding buys by issuing common via the ATM even at an mNAV discount, accepting short-term dilution to keep accumulating and maintain liquidity. When mNAV is below 1 and marginal funding costs are double-digit, scaling purchases becomes both more dilutive and more expensive. That makes Strategy a less reliable, less price-setting buyer compared to prior premium regimes. It will still matter as a sentiment marker, but unless the premium reopens, its flow is more likely to be episodic clips than a sustained engine for the tape.

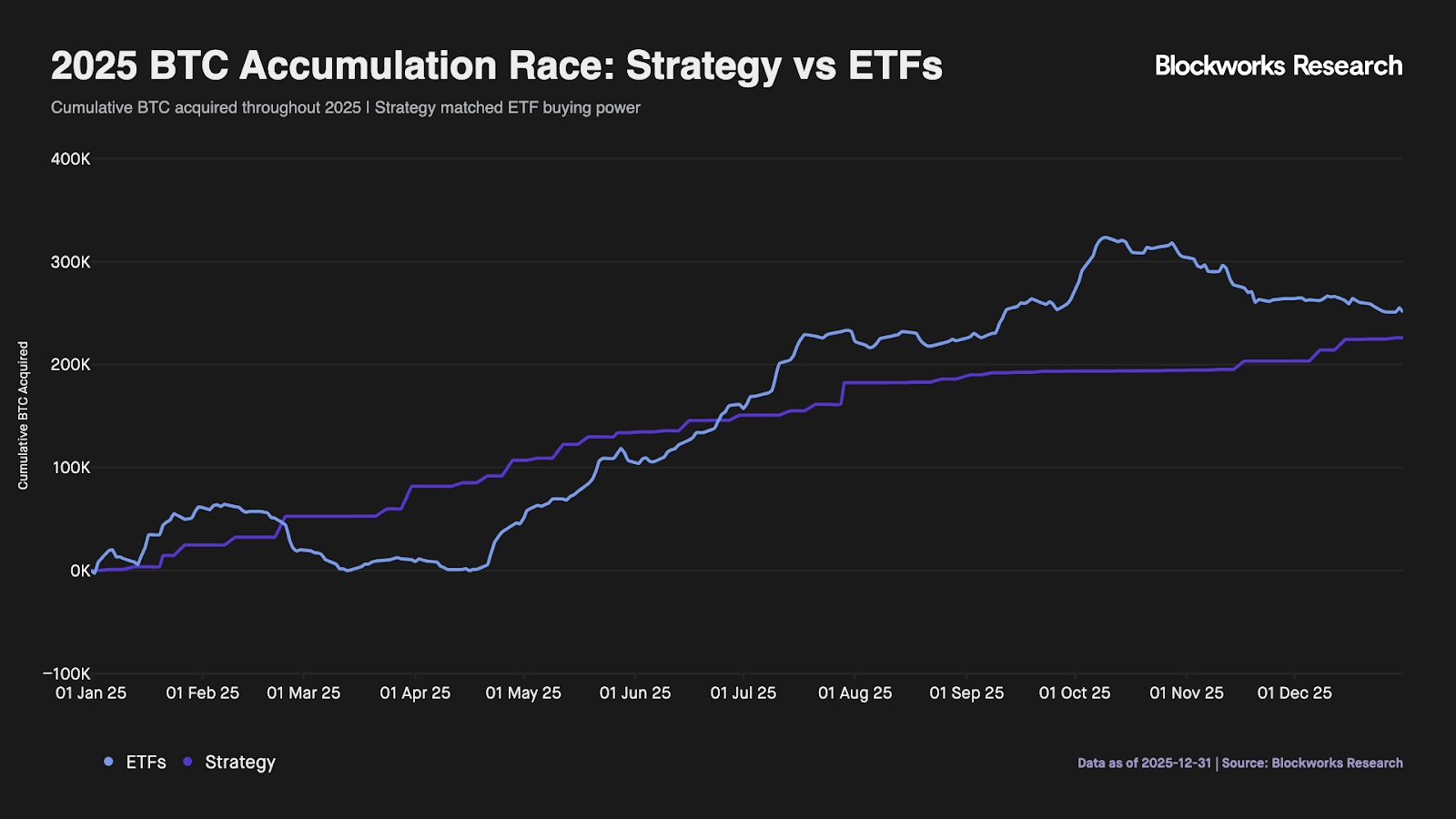

Zooming out, 2025's marginal bid was essentially a two-horse race: spot ETFs and Strategy. On the accumulation chart, Strategy's cumulative purchases tracked in the same range as ETFs for much of the year, meaning Strategy was comparable in flow impact to the ETF complex at points.

The setup for 2026 looks materially weaker. With mNAV compressed and financing shifting toward double-digit preferred costs plus dilutive ATM common issuance, Strategy's bid becomes harder to scale without worsening BTC-per-share dilution. Strategy is still a sentiment marker, but the buying pressure should be more muted and episodic, leaving ETF flows and broader crypto risk appetite as the more reliable price-setting forces.

— Shaunda

Crypto’s premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: 0XNL for $100 off.

Ranger’s ICO, MetaDAO’s momentum

Ranger’s ICO begins today and will run through Jan. 10. For context, Ranger is a full-stack trading terminal with three core products. First is Ranger Perps, a perps aggregator for Solana-based venues like Jupiter Perps, Drift, and Flash Trade, with Hyperliquid support in the works. Second is Ranger Spot, a meta-aggregator that routes across other aggregators like Jupiter and DFlow for optimal price execution. The third pillar is Ranger Earn, a newer product that offers curated access to institutional-grade yield strategies through Ranger’s vault infrastructure.

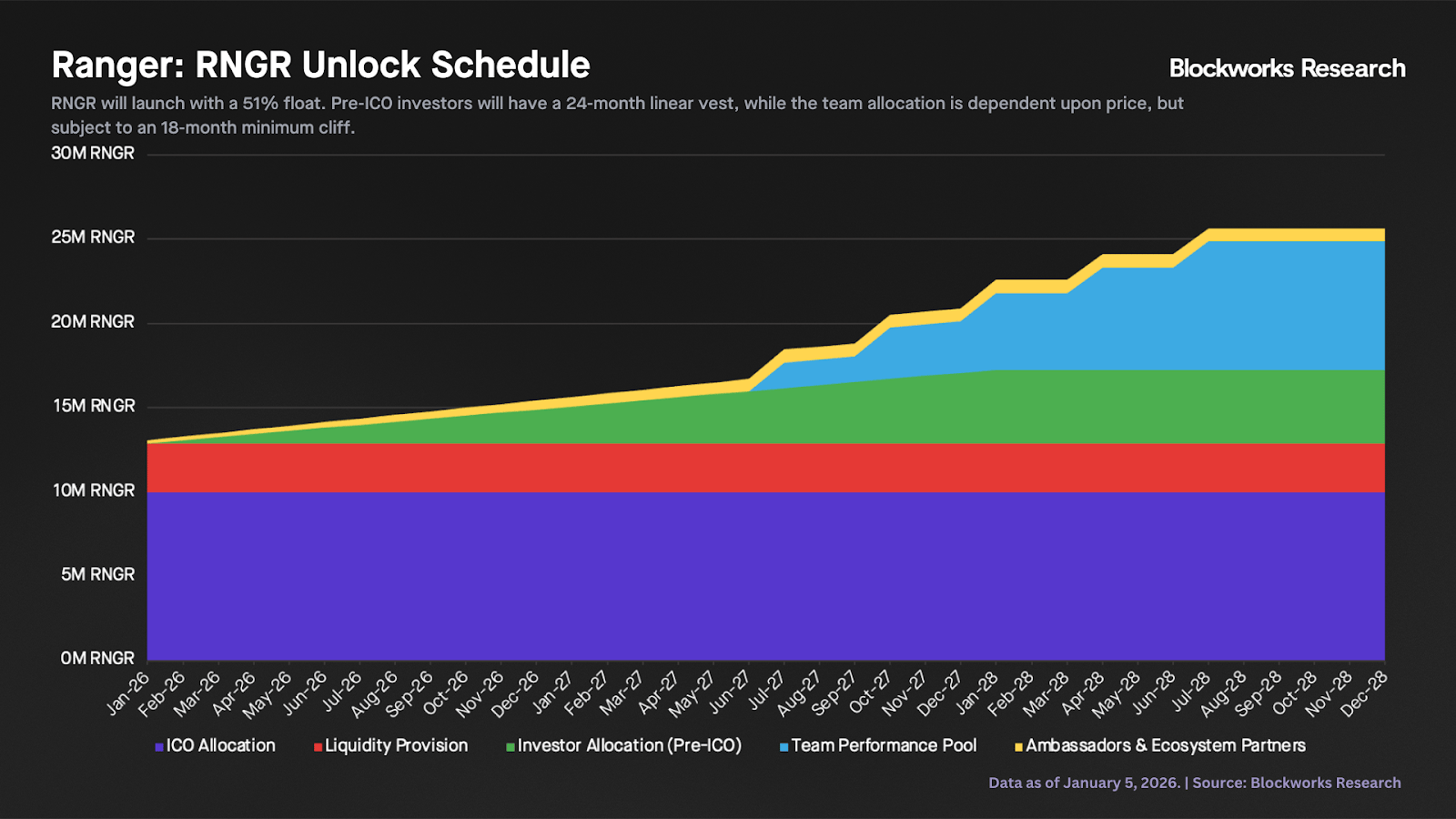

Ranger is seeking a minimum raise of $6M and is selling 39% of the total RNGR supply in the ICO. Proceeds from the raise will be held in a token holder-governed treasury, with the team receiving a fixed monthly stipend of $250K. The Ranger ICO marks an important milestone for MetaDAO: It’s the first token sale on the platform to include a project with existing pre-ICO investors. The table below shows RNGR’s supply distribution.

ICO participants who receive an allocation will be 100% liquid at TGE (no vesting), while pre-ICO investors will follow a 24-month linear unlock schedule with no cliff. Notably, the team allocation will be tied to price performance: up to 7.6M RNGR (30% of total supply) becomes unlockable for the team via five milestone tranches triggered at 2x / 4x / 8x / 16x / 32x of the ICO price. Each milestone must be maintained via a three-month TWAP, and there is a minimum 18-month cliff before any team tokens can unlock.

The chart below shows RNGR’s unlock schedule. The team performance pool is an estimate based on the parameters above, but realized unlocks will ultimately depend on RNGR’s sustained price performance post-ICO.

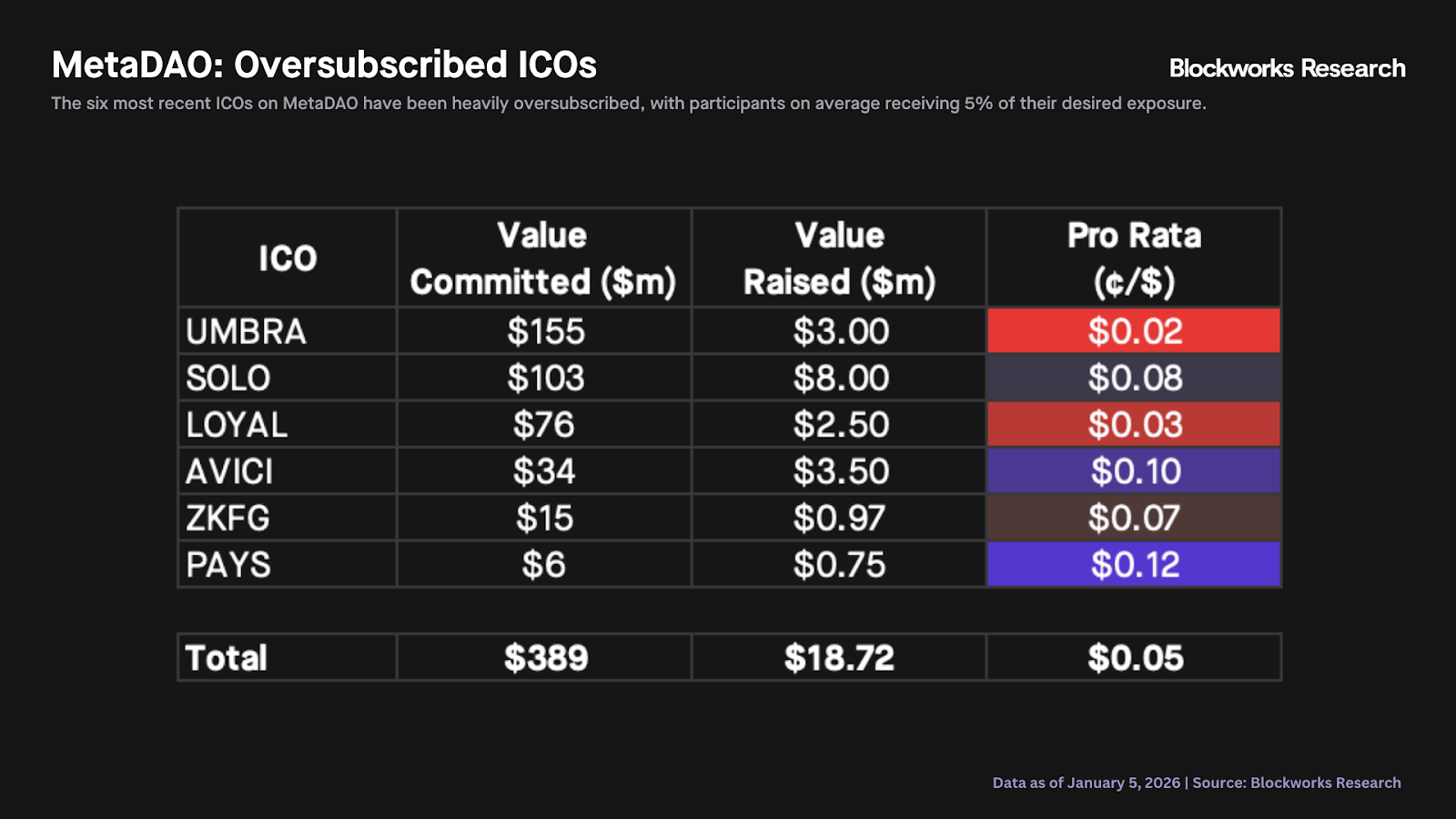

The last six MetaDAO ICOs have been heavily oversubscribed, with allocations settled pro rata. This allocation mechanism favors whales, who can afford to overcommit capital to secure a meaningful allocation. As the chart below shows, across the past six MetaDAO ICOs, participants have received an average of ~5% of their desired exposure.

Ranger will guarantee point holders access to the ICO via a dedicated allocation bucket, directly addressing the oversubscription dynamic above. I’m constructive on this structure: It rewards early users and contributors through preferential access rather than giving away 10-30% of supply via an airdrop, which can introduce unnecessary sell pressure and weaker alignment. In this regard, any allocation not taken by point holders will roll over and be pro-rated to public ICO buyers.

While the Ranger ICO is compelling on its own (and likely worth participating in, particularly for points holders), the bigger story, in my view, is what it means for MetaDAO: a catalyst that could reaccelerate launch cadence and revenue to start the year.

MetaDAO monetizes ICOs through swap fees on its Futarchy AMM and its LP position on Meteora. The Futarchy AMM charges a 0.5% fee on volume, which was originally split evenly between MetaDAO and the project raising (e.g., 0.25% to MetaDAO, 0.25% to Ranger). On Dec. 28, after mutual agreement with teams, the split was retroactively adjusted so that the full 0.5% now accrues to MetaDAO.

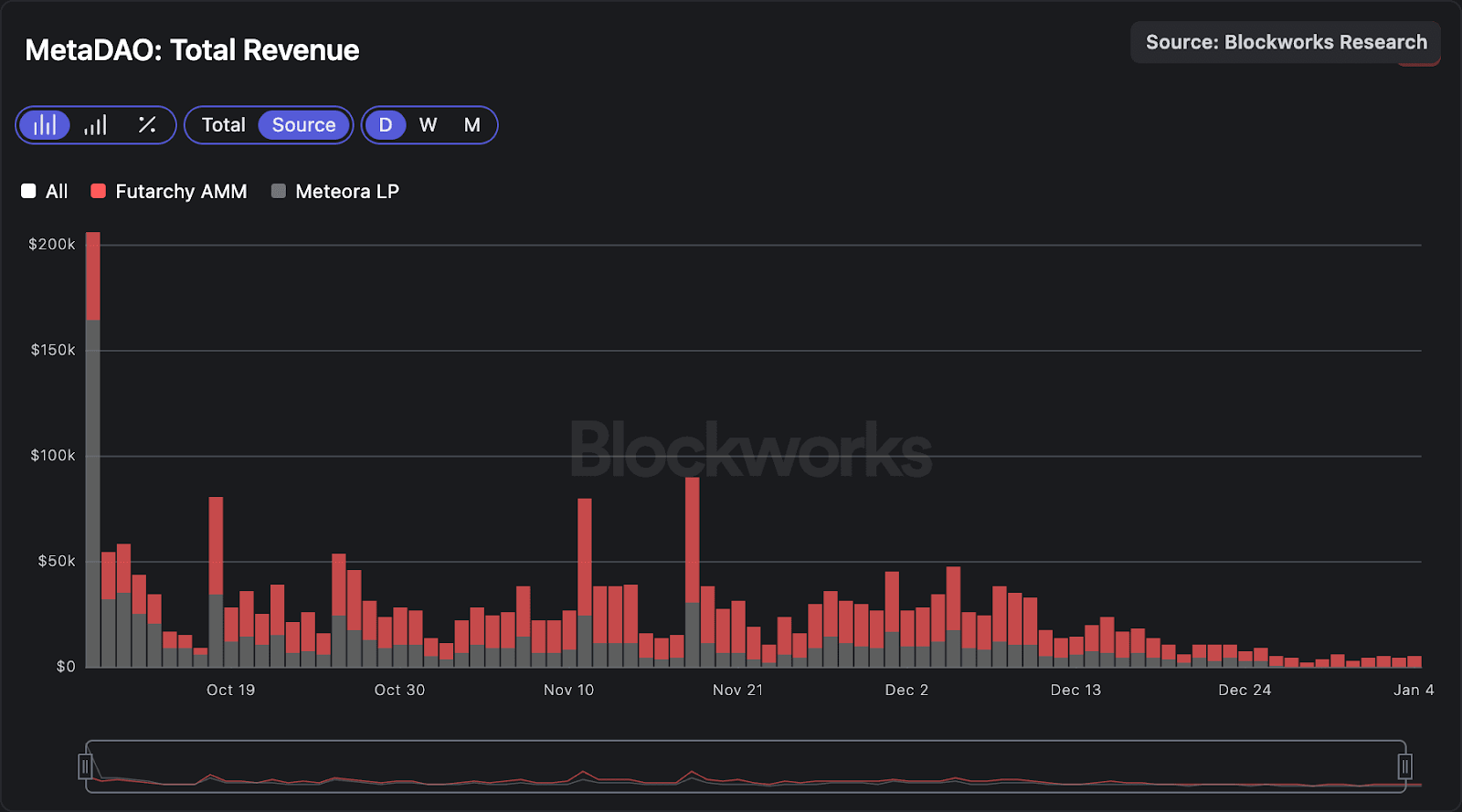

Since the Futarchy AMM went live on Oct. 10, 2025, MetaDAO has generated about $2.4M in revenue, with roughly 60% coming from the Futarchy AMM and 40% from its Meteora LP position.

That said, MetaDAO’s revenues have declined sharply since mid-December as ICO activity slowed. Today, MetaDAO’s ICOs remain curated, placing far more weight on founder quality, credibility and long-term alignment than on simply maximizing the number of launches. This approach was necessary to validate the product, but it has come with a clear tradeoff: Without a steady stream of new launches, it’s difficult for revenues to increase, and MetaDAO has fallen short on cadence over the past few weeks.

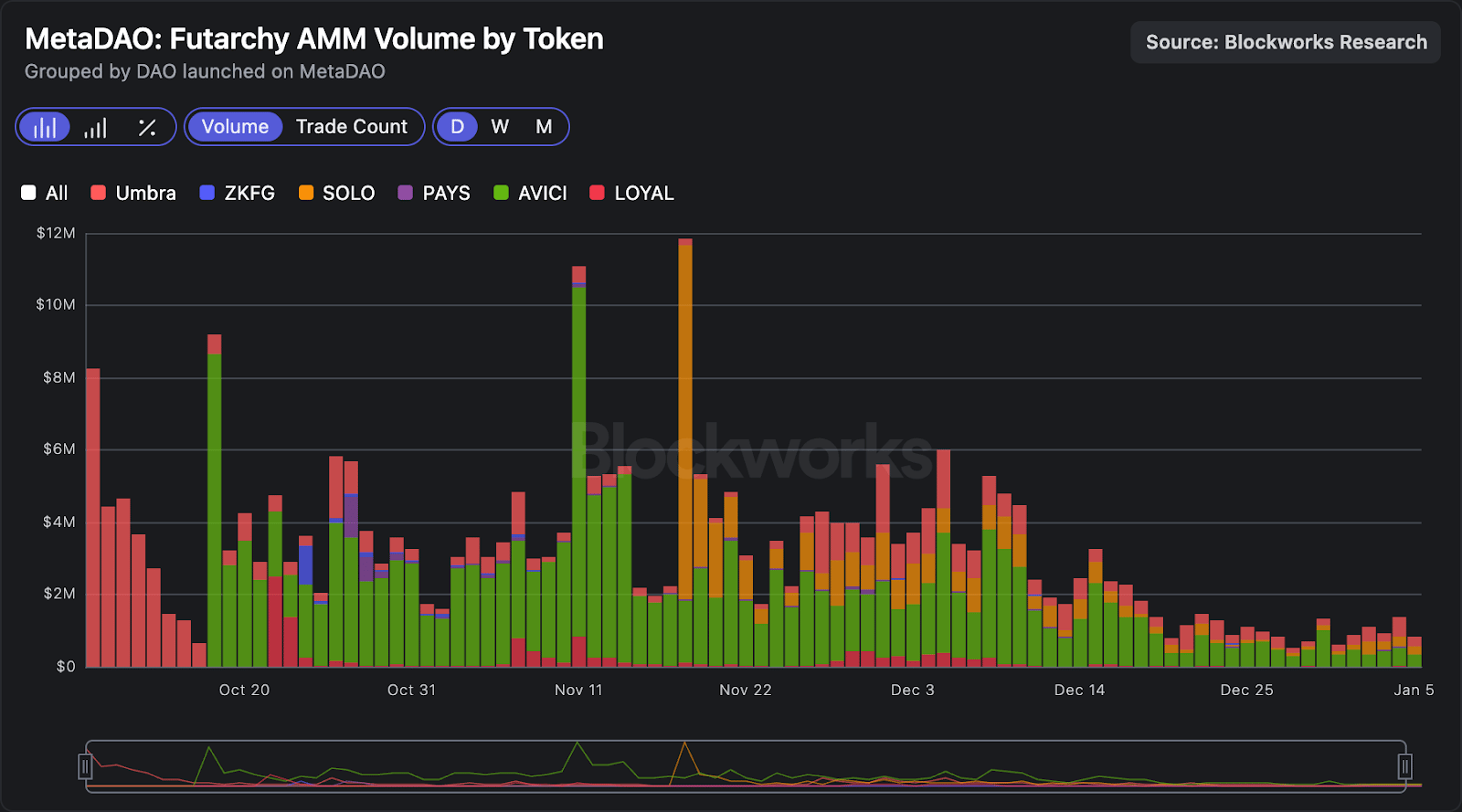

The chart below highlights why. Token volumes tend to be highest around TGE and the days immediately following, meaning sustained Futarchy AMM volumes, and by extension, revenues, are highly dependent on new launches coming through the pipeline.

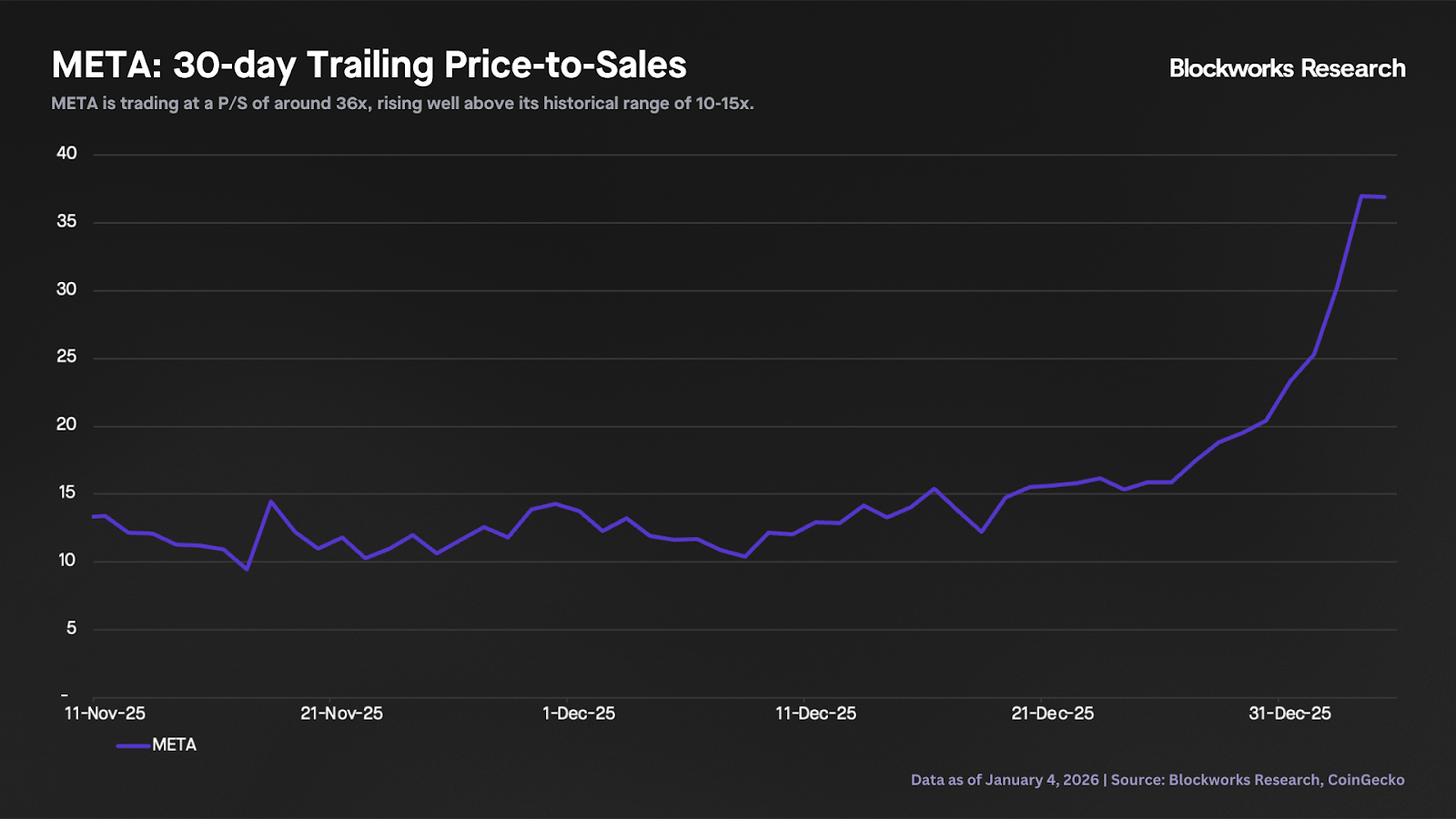

Despite declining daily revenue, META has performed remarkably well, rallying roughly 40% over the past week. As a result, META’s 30-day trailing P/S has increased to ~36x, well above its prior two-month range of ~10-15x.

Markets are forward-looking, though, and I expect META’s P/S to compress back toward its historical range over the coming weeks and months as revenue reaccelerates (i.e., not through a price decline, but through higher trailing revenues).

The near-term catalysts are twofold. First is Ranger’s ICO, which will likely be oversubscribed and lead to a spike in Futarchy AMM volumes post-TGE. Second is the Omnibus proposal, which passed last night and will a) migrate roughly ~90% of META liquidity from Meteora DAMM v1 into the Futarchy AMM and b) burn roughly ~60K META (about $550K at current prices). Capturing trading volumes from RNGR and META should increase Futarchy AMM revenue in the near term.

Beyond the next few days and into the coming months, I expect MetaDAO’s revenues to trend higher as launch cadence accelerates by an order of magnitude. Two catalysts stand out: permissionless launches and Colosseum’s STAMP.

MetaDAO has debated in public comms whether to preserve a fully curated (permissioned) model or experiment with permissionless launches. The latter, despite the risk of lower-quality projects, is a necessary experiment to increase throughput and validate the platform’s scalability, and is probably the direction the team will ultimately pursue.

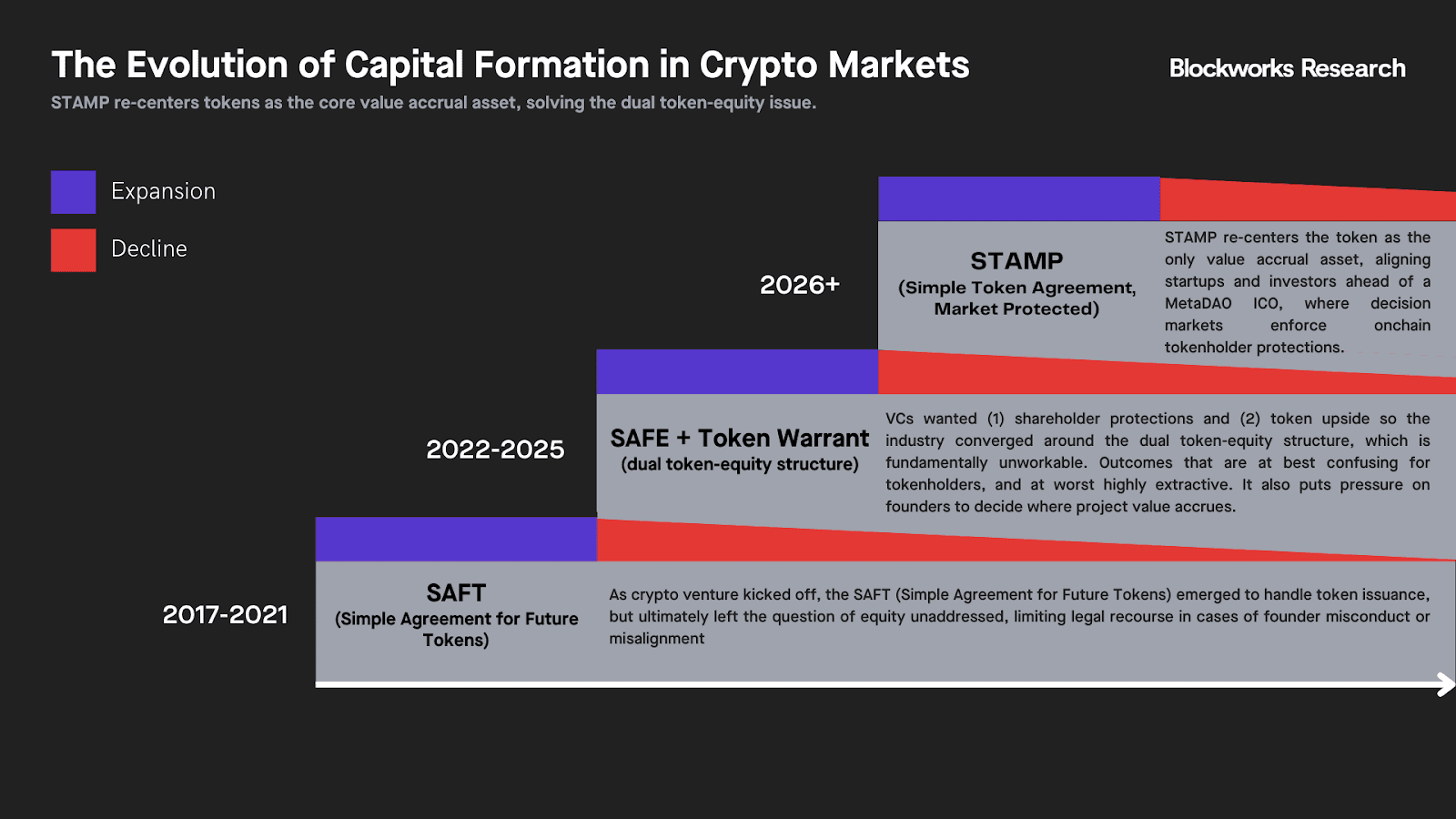

Finally, I think the market is underpricing what Colosseum’s STAMP could mean for MetaDAO. Colosseum sits upstream of Solana’s startup funnel, spanning hackathons, an accelerator and a venture fund. Many of the ecosystem’s top teams trace their roots back to hackathons (e.g., Jito, Kamino, Drift, Exponent, Hylo). STAMP effectively plugs MetaDAO into that deal flow, creating a steadier pipeline of high-quality launches to complement permissionless ICOs and normalize launch cadence over time.

In conclusion, Ranger and the Omnibus proposal may help reaccelerate revenues in the near term, but permissionless launches and STAMP are what could ultimately drive a tenfold increase in MetaDAO’s ICO cadence (and, by extension, volumes and revenue) over the coming months.

— Carlos

Corey Hoffstein chats with Annanay Kapila about perpetual futures and their impact on traditional markets. Annanay, founder of QFEX, a perpetual exchange focused on US equities, indices, commodities and FX, shares insights from proprietary trading firms and discusses resistance from market intermediaries. They explore the design and applicability of perpetual futures, continuous trading, risk management and funding rates. The episode also covers regulatory challenges, leverage implications and corporate actions.

Felix Jauvin published an article on token buybacks, arguing that crypto’s dual equity-token structures were a byproduct of the Gensler regulatory era. Founders were forced to split equity (Labs) and “useless governance coins” (foundations), leaving investors with down-only tokens that had no clear equity rights, thus pushing attention toward memecoins. With regulation (e.g., CLARITY Act) finally improving and a “revenue meta” emerging, Jauvin warns that copying Hyperliquid-style, programmatic high-percentage buybacks is a mistake. In TradFi, buybacks are just tax-efficient dividends used by mature firms after funding high-ROIC growth. He frames today’s obsession with buybacks as a blunt workaround for the lack of real equity claims in most tokens and argues the industry should instead fix equity rights around protocols so investors can let teams reinvest profits, knowing they have a legal claim on terminal value.

Jito introduced IBRL Explorer, a public tool that uses slot-level Solana data to measure validator block-building quality and expose previously invisible “timing games” in block construction. The piece defines optimal behavior as building on-time, streaming transactions evenly through each slot and voting early, then shows that many validators instead “late pack” transactions and votes, or extend slot times. Late packing delays state propagation, increases execution variance and undermines Solana’s streaming design. IBRL’s v1 score combines slot time and vote/non-vote packing into a composite metric that surfaces these behaviors and has already revealed issues like latency-driven late packing in certain Asian data centers. It’s intended as an evolving, community-facing standard for validator transparency rather than a final verdict on any single operator.