- 0xResearch

- Posts

- Prop AMMs expand to Base

Prop AMMs expand to Base

Tessera and ElfomoFi have $100M in combined volumes

Hi all, happy Tuesday!

After last week’s turbulence, Monday was relatively quiet. BTC held near $70,000, while miners outperformed.

Below, we unpack what’s driving the move, then shift onchain to an emerging development: Prop AMMs are beginning to show up on Base.

After last week's turbulence, Monday was a breather at the benchmark level.

BTC held near $70,000, essentially flat on the day, while the S&P 500 and Nasdaq both nudged up 0.1% and gold added 0.2%. Nothing dramatic up-top, but the calm masked a sharp rotation under the surface.

Crypto Miners surged 9.7% to lead all indices, followed by Gaming (+6.6%), the 2025 Crypto Equity Cohort (+5.6%), and Memes (+4.6%). Crypto Equities also posted solid gains at +3.8%. On the other end, Perps fell 3.3%, Solana Eco lost 2.5%, AI dropped 2.3%, and DeFi slid 1.6%.

The pattern: Equities-adjacent crypto and risk-on plays led, while DeFi infrastructure names lagged — a clean reversal from last week’s perps-led tape.

The Miners move is worth unpacking. Morgan Stanley initiated coverage on Cipher Mining and TeraWulf with overweight ratings on Monday, setting price targets that imply both stocks could more than double from current levels. The thesis: Both companies are pivoting from BTC mining to AI and HPC data centers, monetizing their existing power infrastructure for compute rather than hash rate. That adds to a growing sell-side consensus behind the miner-to-data-center trade.

That Miners posted the session's best returns on a day BTC was flat tells you where the repricing is happening. The market is treating these names as scarce AI infrastructure, not BTC beta. Whether this equities-adjacent rotation sticks or fades with the next BTC directional move will define the tone for the rest of the week.

— Daniel

Brought to you by:

Submit a x402, AP2/A2A, ERC-8004 or agentic commerce agent or project for your chance to win a share of $50,000 in the SF Agentic Commerce x402 Hackathon presented by SKALE, Google Cloud, Coinbase Developer Platform, Virtuals, Pairpoint by Vodafone, and Edge & Node.

Registration is now open! Submit your build from February 11–13.

Prop AMMs expand to Base

Prop AMMs have largely remained a Solana-only phenomenon, with many wondering why they haven’t taken off on EVM chains.

Optimus (0xOptimus) from Flashbots has written about the core technical constraint: Prop AMMs need frequent oracle updates that land with high-priority execution.

On Solana, transaction ordering is driven by priority fee per compute unit (CU). Since oracle update transactions are roughly ~100x less compute-intensive than swaps, a prop AMM can refresh internal pool parameters many times per second and still win top-of-block placement at a relatively low cost. This condition is crucial, since there’s a race to update quotes before a taker can pick them off.

But on the EVM, gas usage (analogous to CUs in Solana) for oracle updates is high, which means higher priority fees are required to ensure updates are top-of-block. Moreover, since the gas usage ratio between oracle updates and swaps is much smaller than on Solana, it is relatively cheaper for a toxic taker to outbid the prop AMM and pick them off.

Beyond this technical constraint, we also need to consider order-flow dynamics:

Solana is unique in that aggregators dominate flow. Why would a trading firm build a prop AMM on an EVM chain if there’s not enough flow from any DEX aggregator to justify the cost?

On Solana, memecoins have also created persistent demand for intermediate hops (SOL to USDC, or vice versa). By contrast, chains like Base or Arbitrum historically haven’t had as much of this retail flow, so the trading environment would be far more adversarial (bot-heavy).

With all that said, it appears that at least a couple of market makers have found ways to make prop AMMs work on an EVM chain.

Our data team recently identified two prop AMMs active on Base. The first is Tessera, a Wintermute-associated prop AMM that expanded from Solana, with onchain data suggesting it began operating in early November 2025. The second is ElfomoFi (yes, that’s the actual name), which appears to have gone live in January 2026.

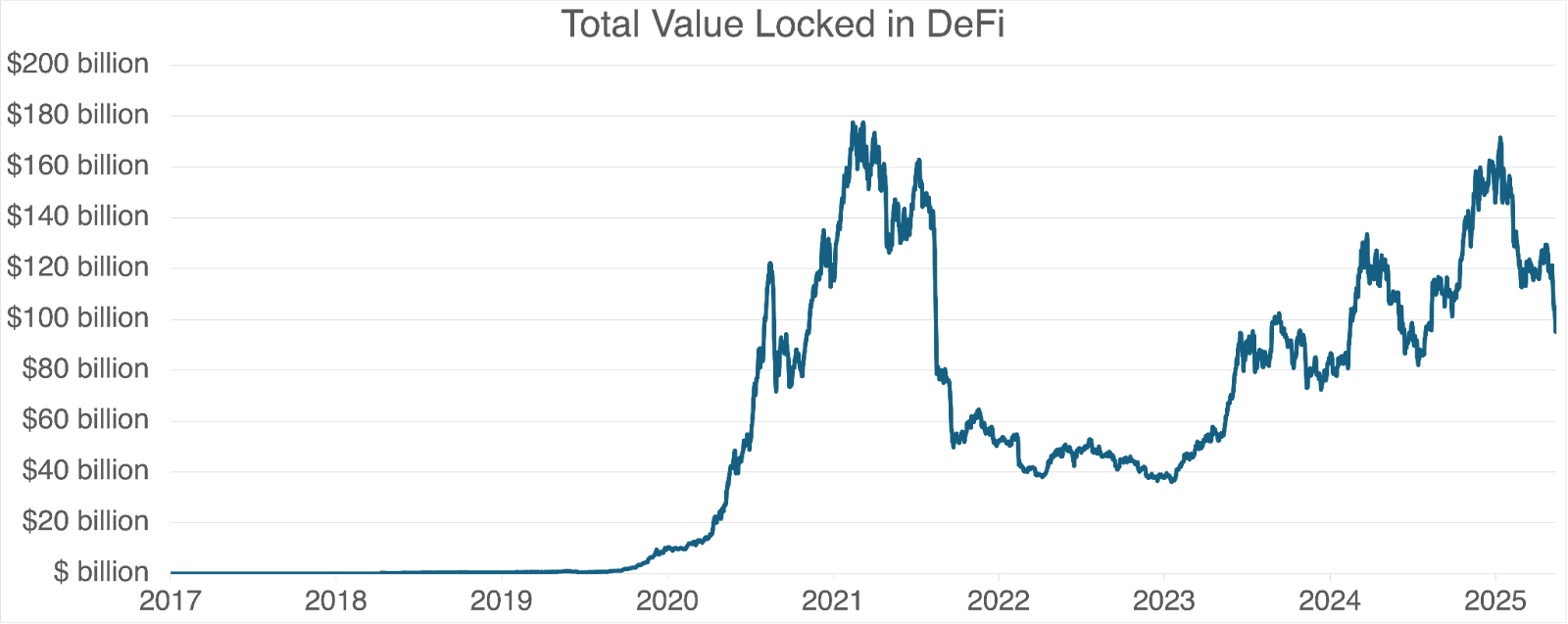

The chart above shows both prop AMMs saw a sizable increase in daily trading volume in late January, with combined volumes surpassing $100 million on Jan. 30. While the exact driver remains unclear, the timing coincides with an uptick in market volatility, which typically supports higher trading activity.

Below, we overlay prop AMM volumes on Base with median transaction fees, showing a clear correlation between the two.

Looking at volume composition, Tessera derives the majority of its volume from the WETH/USDC and cbBTC/USDC pairs. About 67% of its total volume comes from WETH/USDC and 29% from cbBTC/USDC, with the remaining 4% split across less liquid tokens.

On its part, ElfomoFi derives all of its volume from the WETH/USDC pair, with no other active pools. Prop AMM volume composition on Base exhibits a similar pattern to Solana, with volume concentrating in highly-liquid pairs.

While we don’t yet have full visibility into their routing and update mechanics, their emergence is a fascinating onchain development. It will be worth monitoring whether prop AMM volumes on Base continue to trend higher over the coming weeks and months — and whether the landscape proliferates, as it did on Solana. If volumes keep rising, a natural follow-up research piece would be to examine prop AMM markouts, which provide a measurement of execution quality and adverse selection.

— Carlos

Multicoin published an updated investment thesis built around a simple premise: Blockchains are the “first-principles correct” infrastructure for moving money, programming and coordinating capital formation, and running global financial markets.

They argue that the past decade shows finance and payments are areas where crypto has real PMF (DeFi, stablecoins, exchanges, payment rails), and that regulatory shifts plus stablecoin growth are pushing crypto from being an experiment to becoming our default financial rails.

From this lens, they outline eight investment themes they believe will drive the next decade of crypto and permissionless finance.

Chris Dixon argues that crypto is in its “financial era,” but that doesn’t mean non-financial use cases or the broader read-write-own thesis have failed. Blockchains’ core innovation is a new way to coordinate people and capital (and increasingly AI agents) at internet scale, and it’s natural that this first shows up in finance.

He says years of scams and regulatory hostility have poisoned sentiment around tokens, which is why clear market structure policy (like CLARITY, analogous to what GENIUS did for stablecoins) is the key unlock for the next wave of applications. Framing crypto as a multi-decade “long game” similar to AI and the early internet, Dixon argues that today’s messy, frustrating groundwork is precisely what makes tomorrow’s “obviously useful” phase possible.

Daniel Barabander from Variant argues that onchain options have lagged; this is because early designs couldn’t protect LPs from arbitrage and relied on fully collateralized shorts, killing both capital efficiency and retail appeal. With better infra now available (cheap blockspace, app-specific sequencing, onchain margin engines), protocols can finally defend LPs from “bad” orderflow and support more capital-efficient structures.

Barabander’s article says the remaining challenge is go-to-market: Target hedgers (especially miners) by meeting them in existing custody setups and offering protocol ownership, and target retail with simple, novel products like packaged long/short volatility trades instead of competing head-on with perps. If protocols solve both sides — LP protection and price-insensitive flow — he thinks options can become a core onchain primitive rather than a niche side market.

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.