- 0xResearch

- Posts

- Not all green

Not all green

BTC up, L1s down amid messy flows

Hi everyone. As the week wraps up, we’re sharing a few weekend reads that cut through the noise. This week we cover Daylight’s approach to energy-backed tokens, Solana’s fast-growing lending markets, why perps aren’t replacing options, and what’s missing from most crypto valuation frameworks.

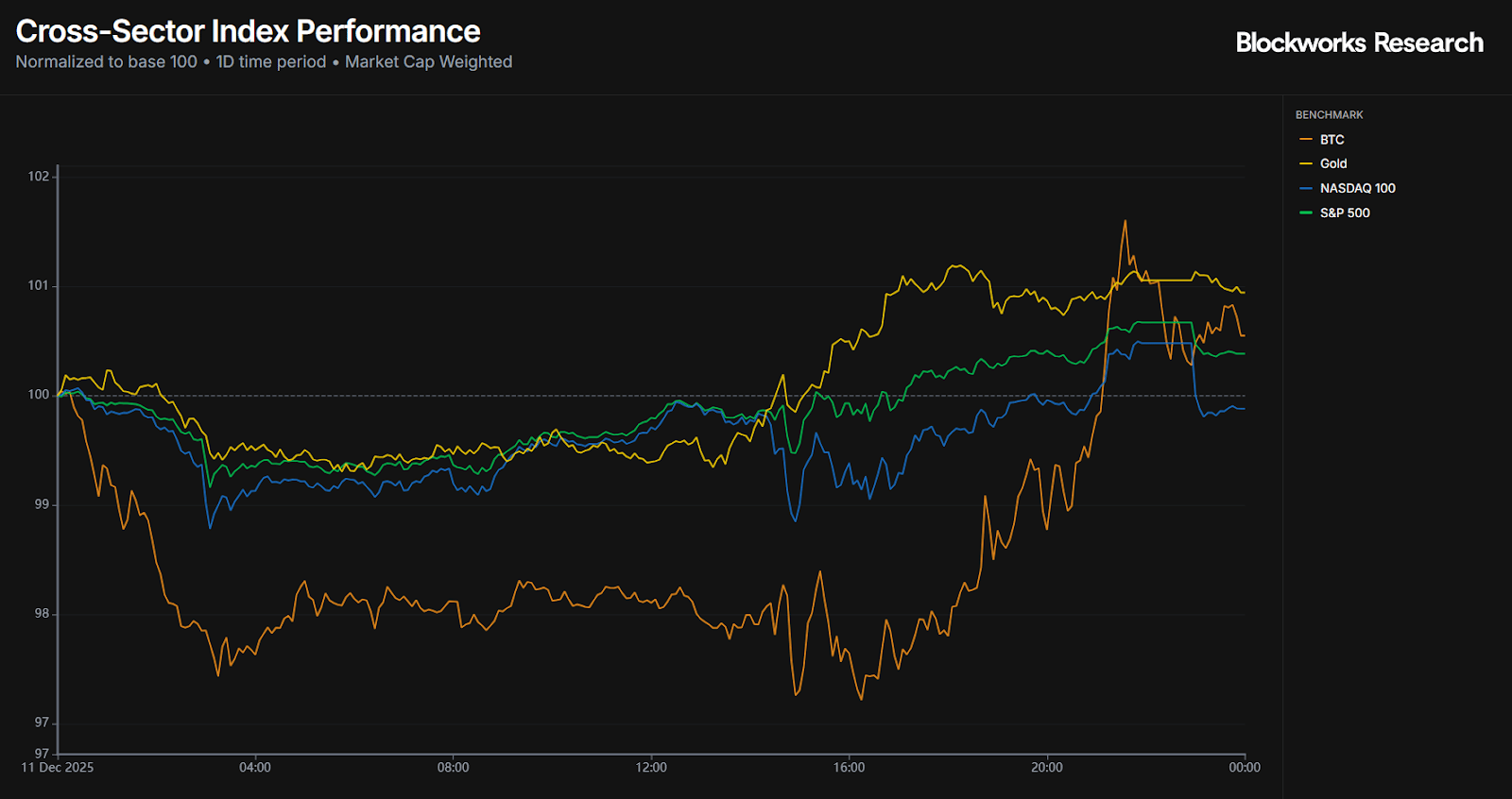

Performance across major assets diverged yesterday. Gold, BTC, and the S&P 500 posted gains of 0.95%, 0.55%, and 0.39%, respectively, while the tech-heavy Nasdaq slipped -0.12%.

The divergence was driven largely by Oracle, whose shares fell -11% after disappointing quarterly revenues and higher spending guidance. That miss reignited concerns around the durability of the AI trade and sparked a rotation out of tech and into lagging parts of the market, pushing the Dow Jones Industrial Average to fresh highs.

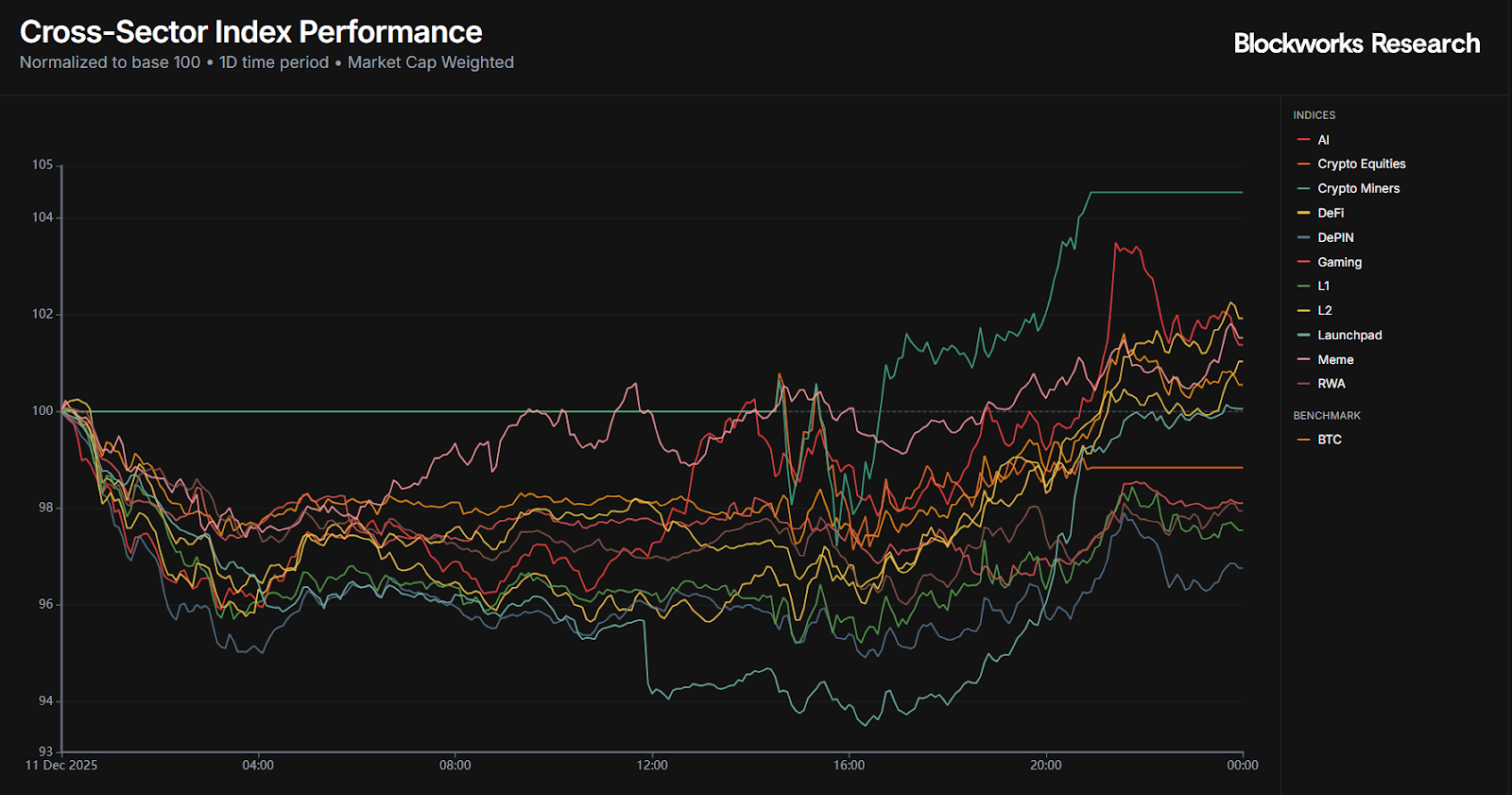

Crypto sector performance echoed the uneven tape. Despite renewed skepticism around AI, Crypto Miners were the standout performers, rising 4.5% on the day. IREN, which makes up 24% of the index, gained 4.4% and helped lead the move. DeFi followed with a 1.93% gain, driven by strength in AAVE, ENA, and HYPE, which together account for 44% of the index and all closed higher.

On the downside, DePIN continued to struggle, falling -3.2%. The sector was dragged lower by FIL and GRASS, which dropped -6.2% and -7.2%, respectively. L1s were another surprise laggard, down -2.5% on the day. Even with BTC in the green, most L1 constituents finished lower, with SEI and BERA both posting losses of -9%.

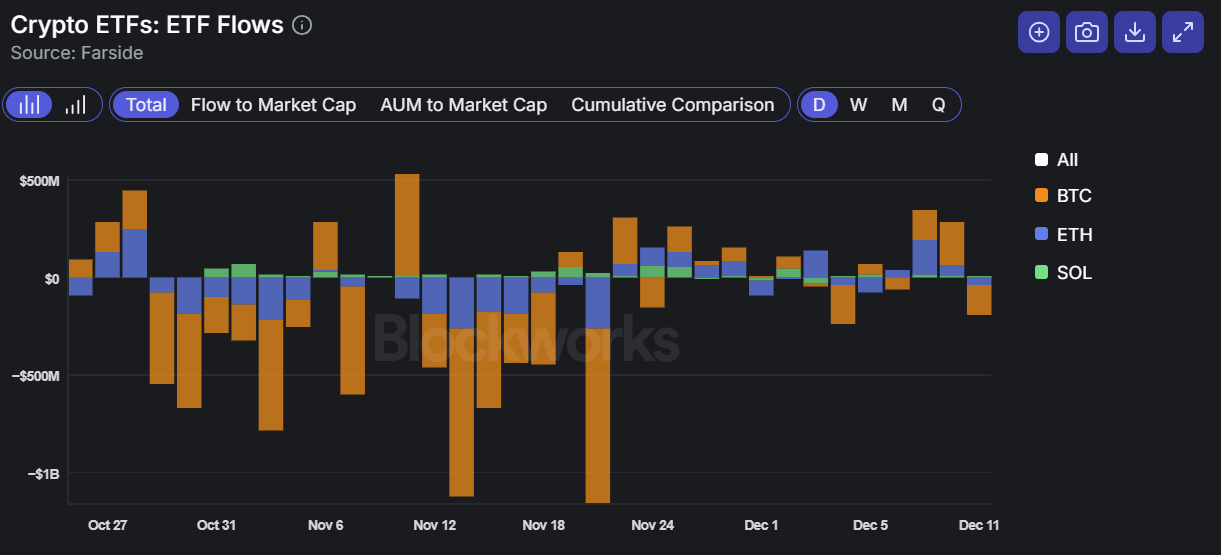

Flows remain a headwind. After a strong $346.2M day of ETF inflows on Dec. 9, momentum faded again with both BTC and ETH ETFs seeing outflows of -$154.2M and -$42.3M, respectively, yesterday. The lone bright spot continues to be SOL ETFs, which are still attracting low single- to low double-digit millions in daily inflows.

— Kunal

How are DeFi and traditional rails actually converging?

Join this live Roundtable to hear voices from Blockdaemon, Aave, and Circle hash it out!

Takeaways from Monday’s 0xResearch livestream:

Market stagnation and sentiment: The hosts discussed subdued trading conditions across BTC and ETH, comparing current activity to late 2022 post FTX, with limited volatility and compressed ranges despite modest price rebounds. The team noted reduced speculative participation and weaker short term trading opportunities.

Bitcoin accumulation by corporates: The hosts examined continued BTC accumulation by Strategy, highlighting how balance sheet driven demand contrasts with muted retail flows and reinforces a divide between long-term holders and inactive traders.

Token launches and post TGE performance: The team analyzed recent ICOs and TGEs, noting that many tokens retraced toward sale prices shortly after listing due to constrained liquidity and limited follow through demand. The hosts discussed how weak secondary performance is shaping more conservative launch expectations.

Shift toward longer-term trading strategies: The hosts discussed a structural shift away from short-term flipping toward longer horizon positioning as volatility declined. The team noted increased emphasis on valuation discipline, narrative durability and timing over momentum driven strategies.

Hyperliquid vs. Lighter competition: The hosts examined Hyperliquid’s role as a leading perp DEX and discussed Lighter as an emerging competitor experimenting with alternative trading architectures. The team noted that marginal improvements in execution quality, liquidity depth and UX are now critical in the perp DEX landscape.

Launchpads and MetaDAO experimentation: The team discussed MetaDAO’s launch model as an iteration on traditional ICO mechanics, emphasizing clearer price discovery and distribution. The hosts expressed skepticism that complex launch structures materially improve long-term token performance without sustained demand.

Prediction market normalization risk: The hosts analyzed prediction markets’ diminishing differentiation as financialization increases and access broadens. The team noted that founder-led communication and distribution are becoming more important as novelty fades and long-term value capture becomes less certain.

Look for the full podcast on YouTube, Spotify, Apple Podcasts and X.

This summary was generated with assistance from AI tooling.

As global financial institutions prioritize the adoption of blockchain rails to improve financial services and products, Chainlink’s infrastructure will continue to play a critical role in underpinning the growth of onchain finance.

Chainlink’s product offerings have evolved into the only platform offering a comprehensive set of solutions to meet the broad set of feature requirements necessary for institutional adoption of onchain finance. This infrastructure stack enables a new wave of onchain-native applications that are compliant, secure, and enterprise-ready.

Blockworks Research finds that Daylight Energy built real marketplace revenue and operating scale before adding a protocol layer, prioritizing utility over token speculation. Its system uses GRID as a stable settlement asset backed by energy capacity commitments and sGRID to pass through cash flows from residential solar and battery assets. Homeowners interact through simple subscriptions, while onchain verification handles dispatch and payments in the background. Daylight already operates across multiple US states with installed solar and batteries generating PPA and grid service revenue, positioning the protocol to aggregate distributed energy at scale while meeting the reliability needs of traditional power markets. Read more

RedStone finds that Solana has evolved into a leading hub for institutional grade onchain finance, with lending markets emerging as the core growth engine. Solana’s money markets now hold about $3.6B in TVL, up roughly 33% year over year, driven by intense competition and rapid iteration. Protocols like Kamino, Jupiter Lend, Drift, and Loopscale offer diverse lending designs, from curated vaults to order book credit, while risk managers like Gauntlet oversee over $140M in deployed strategies. Growing stablecoin supply, real world asset tokenization and deepening liquidity signal a maturing DeFi stack ready for larger capital flows. Read more

The author argues that perps have not replaced options, but merely filled an early gap in crypto market structure. Perps succeeded because they were simple, low friction and easy to deploy on immature blockchain infrastructure, not because they were economically superior. Their linear design quickly compresses spreads and margins, limiting long-term upside. Options, by contrast, introduce multiple dimensions like time, volatility and convexity that create persistent inefficiencies and higher revenue potential. TradFi shows this clearly, where the most profitable firms are options market makers. As onchain infrastructure matures, options are positioned to become the dominant derivative primitive. Read more

Aquanow talks about why debates over valuing blockchains with price-to-sales ratios miss the real issue. The problem is not which multiple to use but the lack of standardized measurement and enforceable rights in crypto. Unlike equities, tokens do not represent clear claims on cash flows, and metrics like revenue and fees vary widely in meaning across protocols. Without consistent accounting standards, disclosures and data definitions, comparisons are inherently fragile. Aquanow argues that real progress will come from better onchain data infrastructure and reporting standards, which are the true prerequisite for credible valuation and broader institutional adoption. Read more