- 0xResearch

- Posts

- Narrative and nostalgia

Narrative and nostalgia

AI pumps as TCG quietly prints

Hi all, happy Tuesday.

Markets were quiet on the surface, with both BTC and gold slipping and no US equities open to anchor sentiment. But under the hood, AI tokens caught a strong bid after OpenAI signaled a deeper move into personal agents.

We unpack the sector rotation below, and then zoom in on the surprising resilience of the trading-card game (TCG) market and Collector Crypt’s accelerating growth.

BTC drifted lower to near $68,900 (−0.5%) and gold slipped to near $5,015, while US markets were closed due to Presidents’ Day. Both are negative on the week, with gold off roughly −2% and BTC down about −1%, a rare stretch where neither traditional nor crypto safe havens are catching a bid.

With no macro catalysts on the calendar and US markets dark, the AI narrative trade trade filled the vacuum. OpenAI announced it hired Peter Steinberger, creator of the open-source agent framework OpenClaw, to lead its personal AI agent push. Steinberger confirmed OpenClaw will transition to a foundation with OpenAI's backing, stating “the future is going to be extremely multi-agent.”

Cross-sector, the BWR AI Top 10 index surged 7.6%, its strongest session since early January. Memes (+4.5%), DEX tokens (+3.6%), and Solana Eco (+2.6%) also posted gains. Perps reversed from early weakness to close slightly positive. Gaming (−0.4%) and Privacy (−1.4%) were the only sectors in the red.

Within the AI basket, VVV (+147%) and Diem, the wrapped claim on inference capacity backed by locked VVV, put in strong rallies over the last week. On Monday, TAO led at +12.8%, followed by VIRTUAL (+9.8%) and AR (+8%). The rally was concentrated in Bittensor-ecosystem names and agent-adjacent tokens rather than broad AI infrastructure like FET or NEAR, which finished flat. Virtuals Protocol added fuel by rolling out a revenue-incentive program allocating up to $1 million/month to agents generating real economic value, a shift from purely fee-based incentives.

With US markets reopening Tuesday and Fed member Mary C. Daly speaking at 2:30 p.m. ET, the test is whether this narrative bid holds once macro re-enters the frame.

— Daniel

DAS NYC's lineup is bringing the biggest names in finance to the stage.

Don't miss the institutional gathering of the year — this March 24−26.

Gotta catch ‘em all

While broader crypto remains sluggish and TradFi volatility stays elevated, the TCG market continues to show surprising resilience.

Just today, Logan Paul’s ultra-rare Pikachu Illustrator card sold for $16.5 million at auction. The broader Pokemon Index is up 53.7% over the last six months, reinforcing the strength of high-end collectibles even as risk assets wobble.

Capital is now rotating into adjacent franchises as collectors and speculators look for the next breakout category. One Piece has emerged as the frontrunner, with its index up 108% over the last six months, driven by strong cultural relevance among younger audiences.

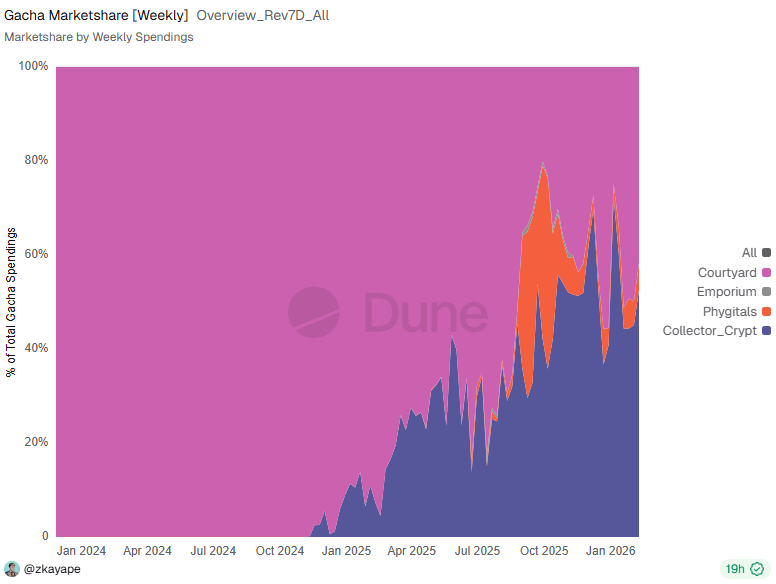

One of the clearest beneficiaries has been Collector Crypt. While the TCG narrative has cooled from its September 2025 peak in terms of mindshare, the underlying numbers tell a different story. Collector Crypt’s weekly gacha volumes continue to trend higher, and their market share within Web3 TCG has grown from 30% in September to around 50% today, with peaks of 70% in certain weeks.

January growth was mainly driven by the launch of $1,000 Pokemon packs with higher-value chase cards. Higher-priced packs offer bigger upside per pull, which appeals to users already spending $4,000 to $8,000 per day. The team also recently launched a $250 One Piece gacha on February 8th, and since launch it has generated $3.2 million in volume, accounting for roughly 25% of total gacha volume that week.

Inventory depth was previously a bottleneck, with machines occasionally going offline due to restocking constraints; that issue appears largely resolved. Total tokenized RWA value on the platform has expanded from $7.9 million in September 2025 to $17 million by mid-January 2026, and machines are now rarely offline. The team’s sourcing network has scaled alongside demand, including during the January spike, which strengthens their operational moat.

A key efficiency metric is average buybacks-per-card before redemption. The higher the recycling rate, the more times Collector Crypt earns spread on the same asset. To break even, a $250 pack needs to recycle 9x; a $1,000 pack needs 12.4x. Current averages sit at 20.5x, well above breaking even.

If you annualize January’s run rate, net revenue (amount users spend on gacha − cost incurred by Collector Crypt to buyback cards) reaches $46.8 million, placing the CARDS token at roughly a modest 2x P/S multiple. That assumes momentum holds, but even on more conservative expectations, it still warrants enough for the CARDS token to be on your watch list.

— Kunal

This piece argues that most prediction market parlays are priced too simply. Traders usually multiply probabilities and assume each event is independent, but many events are connected.

Using Fed rate decisions as an example, it shows the Fed tends to move in streaks, repeating holds, cuts or hikes for several meetings in a row. That means betting on the same action happening again is often more likely than the naive math suggests, while betting on sudden reversals is often overpriced. Historical tests show this gap can be meaningful.

The broader point is simple: When events influence each other, basic multiplication underprices continuation and overprices sharp changes.

The author argues that ERC 8004 is being misunderstood as an agent-specific standard, when it is actually a general trust-and-discovery layer for the broader machine economy.

While it can support AI agents, the spec is designed to register and evaluate any service, such as MCP tool servers, oracles, APIs and DeFi infrastructure. Its registries for identity, reputation and validation are generic primitives that track uptime, performance and verifiable outputs for any endpoint, not just autonomous agents. Framing it narrowly limits what gets built.

The real opportunity is a shared, onchain trust layer that lets agents and other systems discover, compare and route to the best services across ecosystems.