- 0xResearch

- Posts

- Morgan Stanley’s SOL bet

Morgan Stanley’s SOL bet

Meanwhile, LayerZero faces a valuation puzzle

Hi all, happy Wednesday! Today’s note covers two key developments across markets and infrastructure. First, there’s Morgan Stanley’s move to file for spot crypto ETFs, signaling growing institutional confidence in regulated crypto products. Then there’s a deep dive into LayerZero, which has emerged as the dominant interoperability layer by volume and integrations but continues to trail peers when it comes to monetization efficiency and revenue capture.

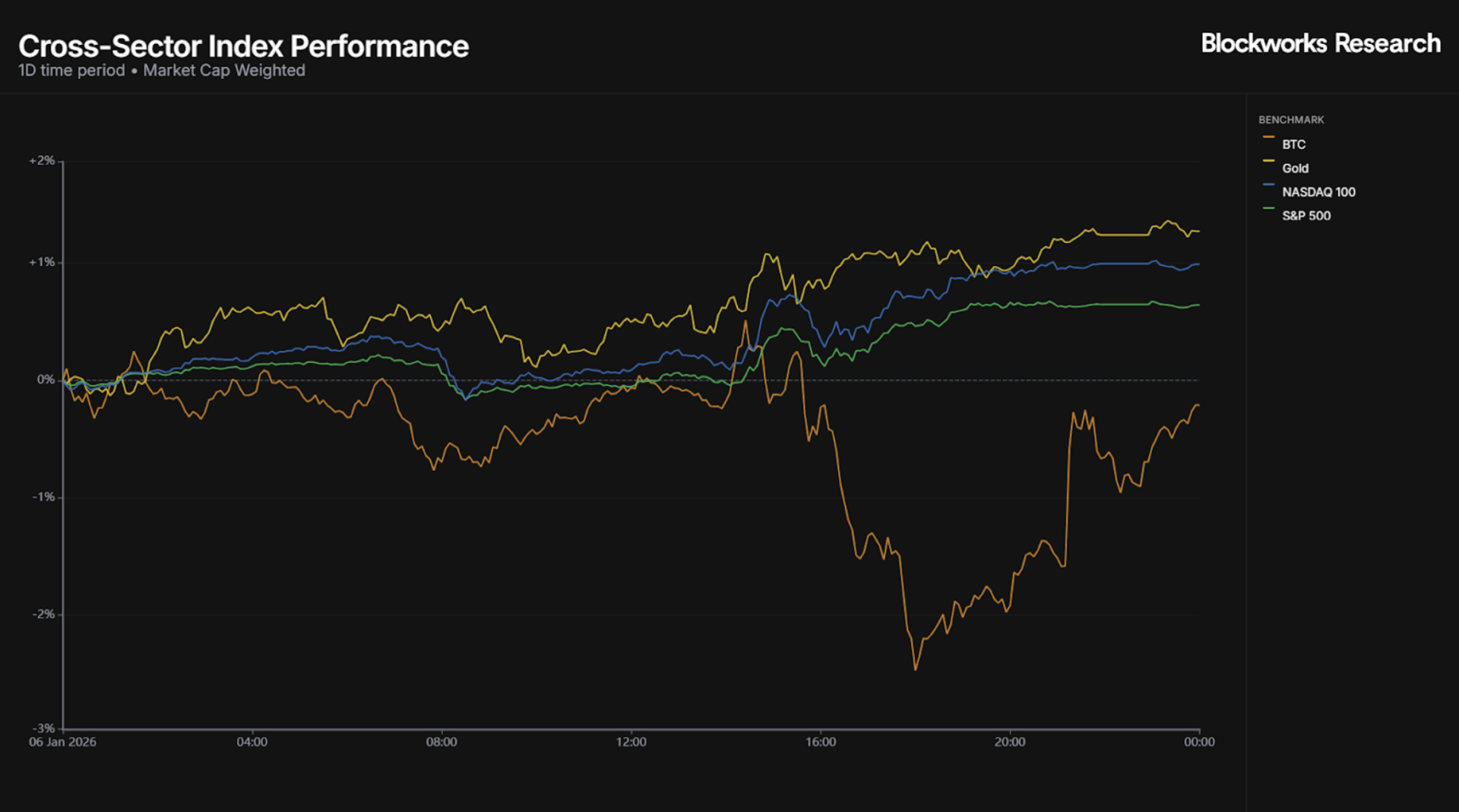

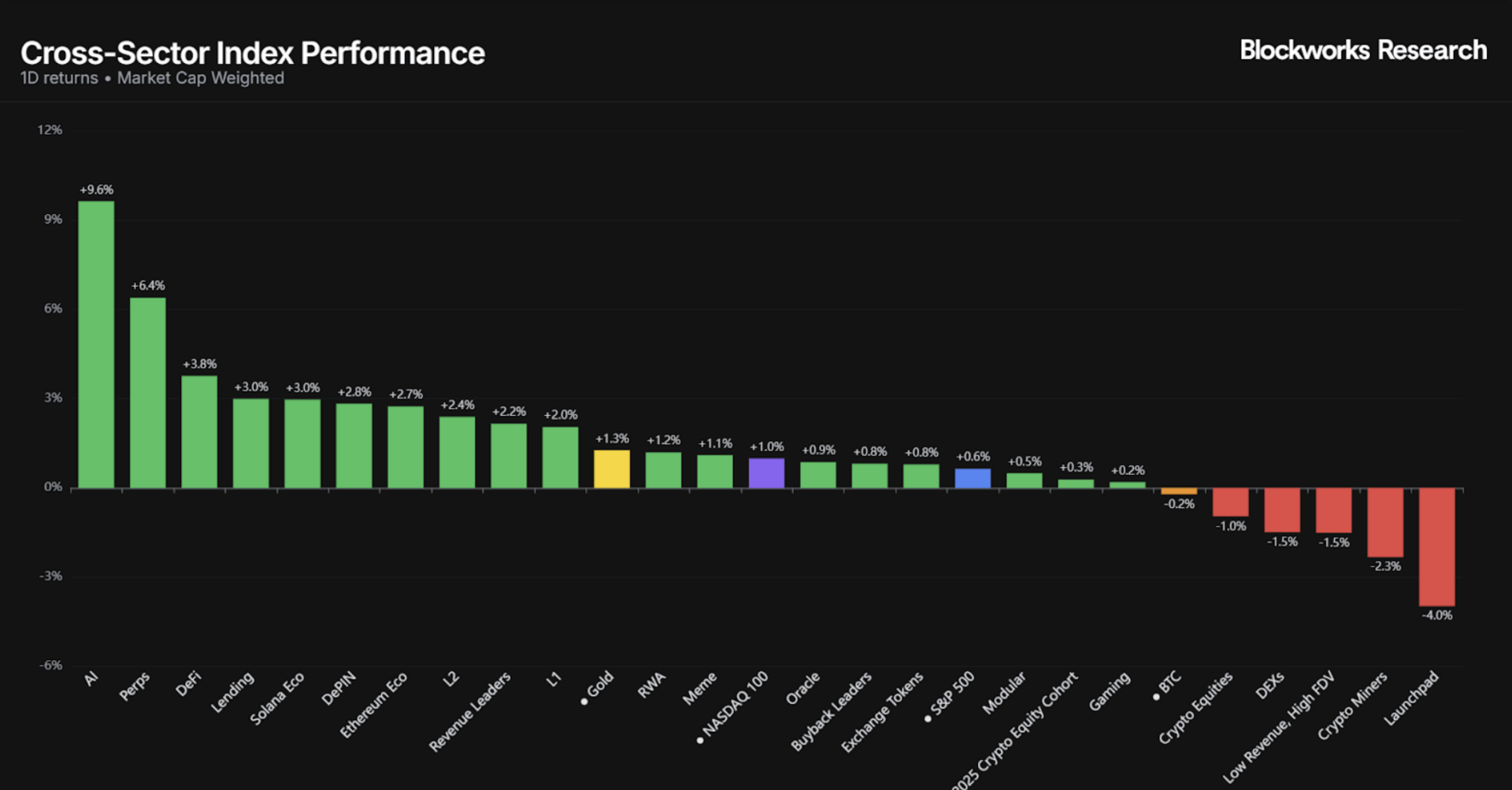

Gold led the tape, finishing up roughly (+1.3%) on the day, continuing to benefit from a softer dollar bid and persistent hedging demand. Equities followed suit, with the Nasdaq 100 (+1.0%) outperforming the S&P 500 (+0.6%) as large-cap tech reclaimed leadership into the close. BTC, however, told a different story, sliding mid-session before stabilizing, ending the day down around (-0.4%) after being off more than (-2.5%) at the lows. Promisingly, BTC did cross above $94,300, which has been a strong level of resistance over the last few months.

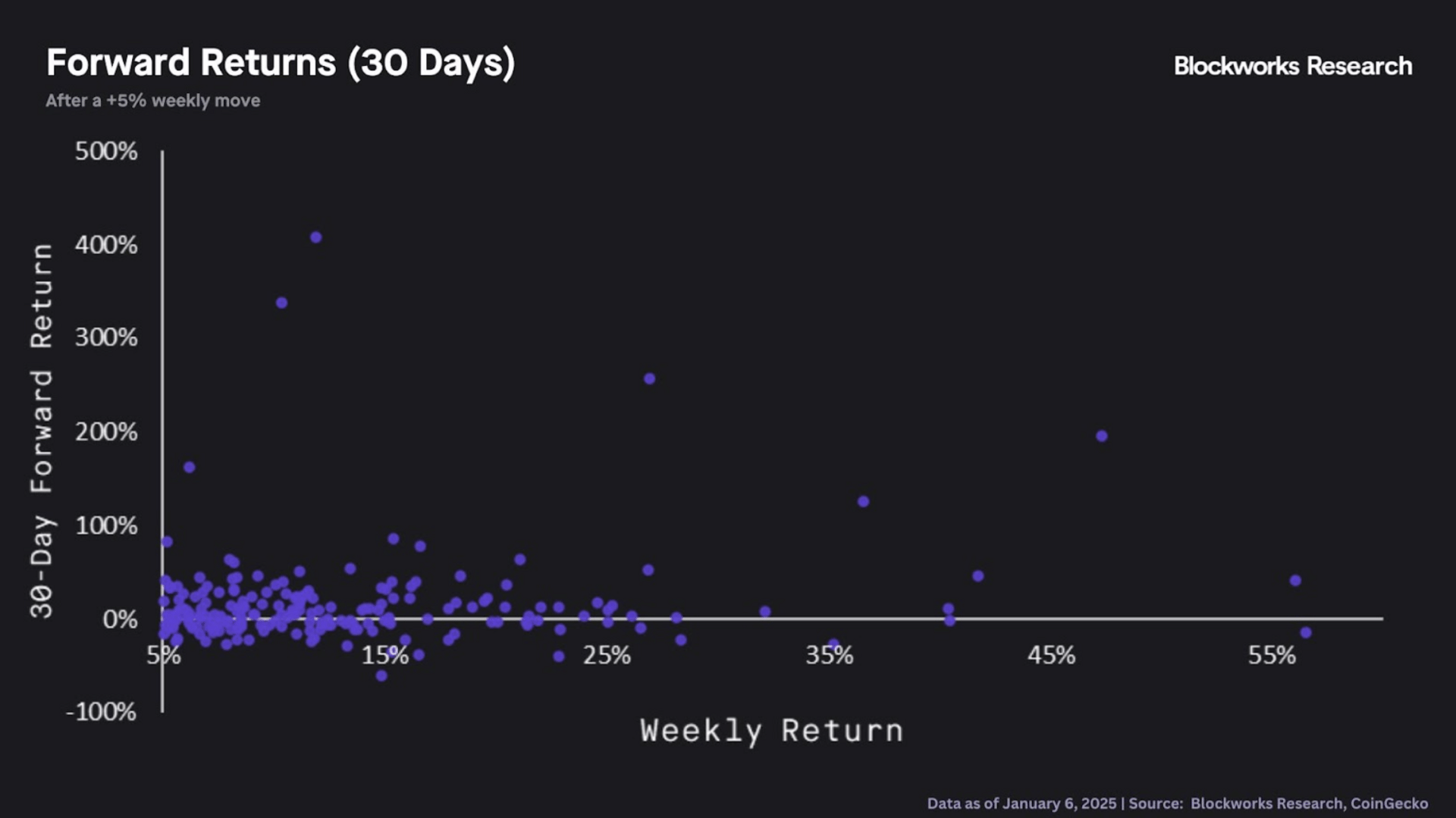

BTC has been rangebound for some time, so any signal of a breakout in either direction would be telling. Given that the asset is known for having a strong momentum factor, we looked at forward 30-day returns following a weekly gain of at least +5%. As shown below, the median forward return clusters near flat to modestly positive, while the right tail remains pronounced, with several historical instances producing outsized gains well above 100%. This skew highlights BTC’s tendency to generate convex upside after momentum inflections, particularly when broader positioning has already been reset. In the current context, the signal points less to immediate follow-through and requires confirmation through sustained participation rather than isolated momentum bursts.

Beyond BTC, AI (+9.6%) dominated the leaderboard, extending its sharp momentum and reasserting itself as one of the market’s highest-beta expressions. Perps (+6.4%) and DeFi (+3.8%) followed, while Lending (+3.0%), Solana Eco (+3.0%), and DePIN (+2.8%) also posted solid gains. On the other end, Launchpads (-4.0%) were hit the hardest after a recent period of outperformance. Meanwhile, Crypto Miners (-2.3%) and Low Revenue, High FDV (-1.5%) signaled continued pressure on speculative and structurally-weaker segments.

— Marc

Morgan Stanley (MS) has filed with the SEC to launch spot Bitcoin, Ethereum and Solana ETFs, marking a deeper push into building its own in-house crypto investment products. This move signals growing institutional confidence in regulated crypto products, and it reflects a strategic shift from distributing third-party offerings to vertically integrating digital assets across Morgan Stanley’s vast wealth management platform, allowing the bank to keep ETF fee revenue in-house as demand for crypto exposure continues to rise.

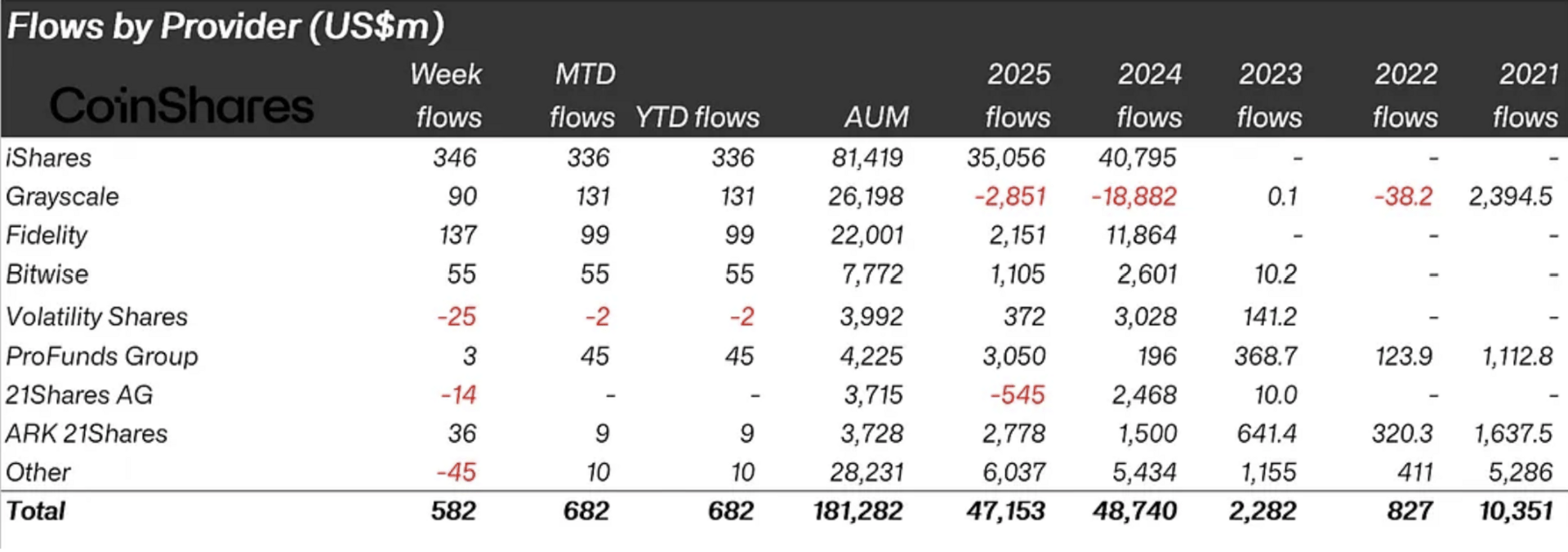

This move comes as CoinShares reported $47.2 billion of inflows into crypto ETPs in 2025, just 3% shy of 2024's record.

Source: CoinShares

Notably, BlackRock (issuer of the largest crypto ETF, IBIT) has yet to submit any Solana ETF registration. ETF issuers often sequence launches based on internal strategy, client demand, regulatory considerations, and expected market appetite. Morgan Stanley’s decision to prioritize Solana suggests it views near-term demand for SOL exposure. That view has been supported by flows: Since September 2025, Solana ETFs have consistently attracted higher inflows than Ethereum ETFs on a market cap-adjusted basis, reinforcing the divergence in institutional positioning.

Even on an absolute basis, SOL ETFs have shown greater demand in nine out of the last twelve weeks.

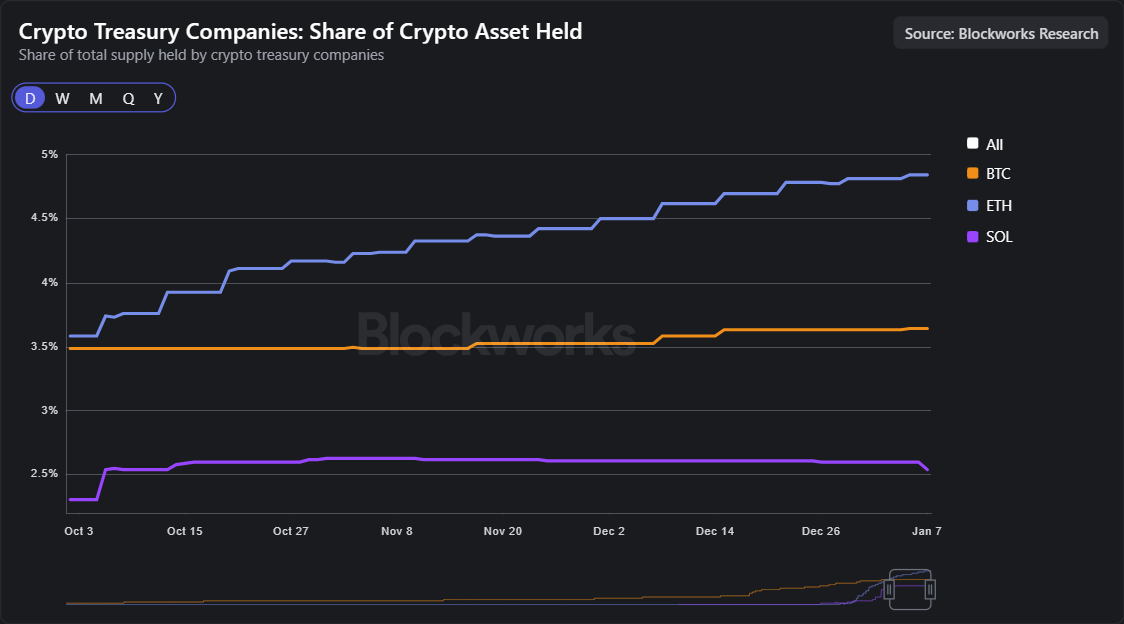

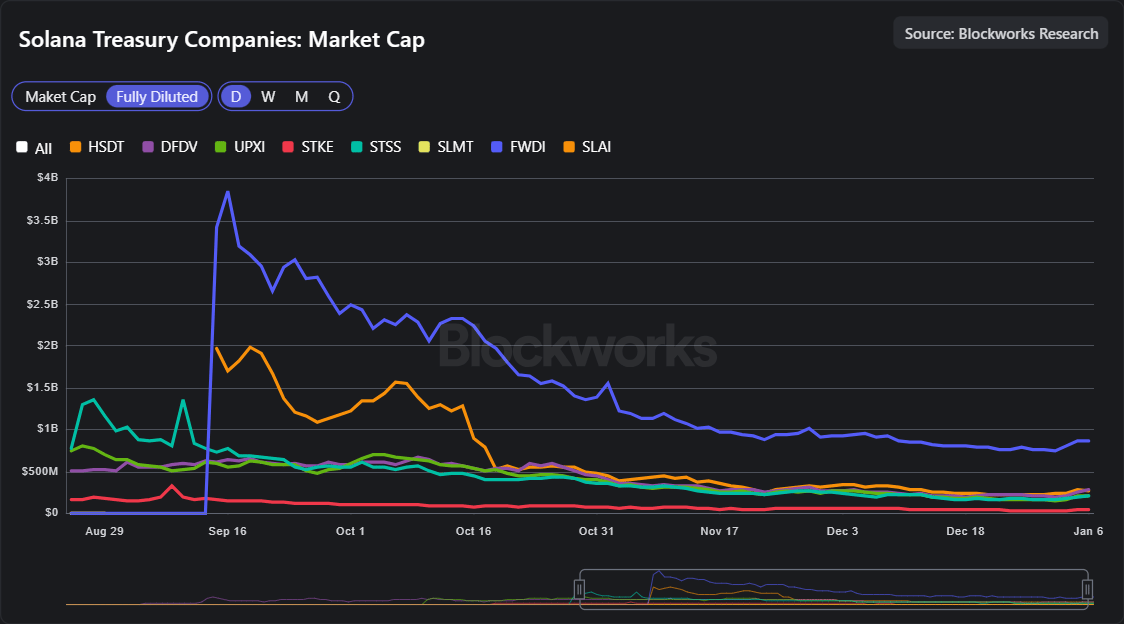

However, DATCOs have emerged as another source of structural demand for digital assets, and SOL is still a laggard in this space, especially since demand has flatlined since October 2025, while BTC and ETH consistently receive bids.

The largest SOL DATCO has been Forward Industries, and its share price has been in freefall since September 2025. Notably, nearly all major SOL DATCOs currently trade at an mNAV below 1, removing the value added from ATM offerings to purchase more SOL. This leaves ETFs as the sole institutional source of demand for the time being, which is why a Morgan Stanley ETF would be a welcome addition.

— Marc

Crypto’s premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: 0XNL for $100 off.

LayerZero

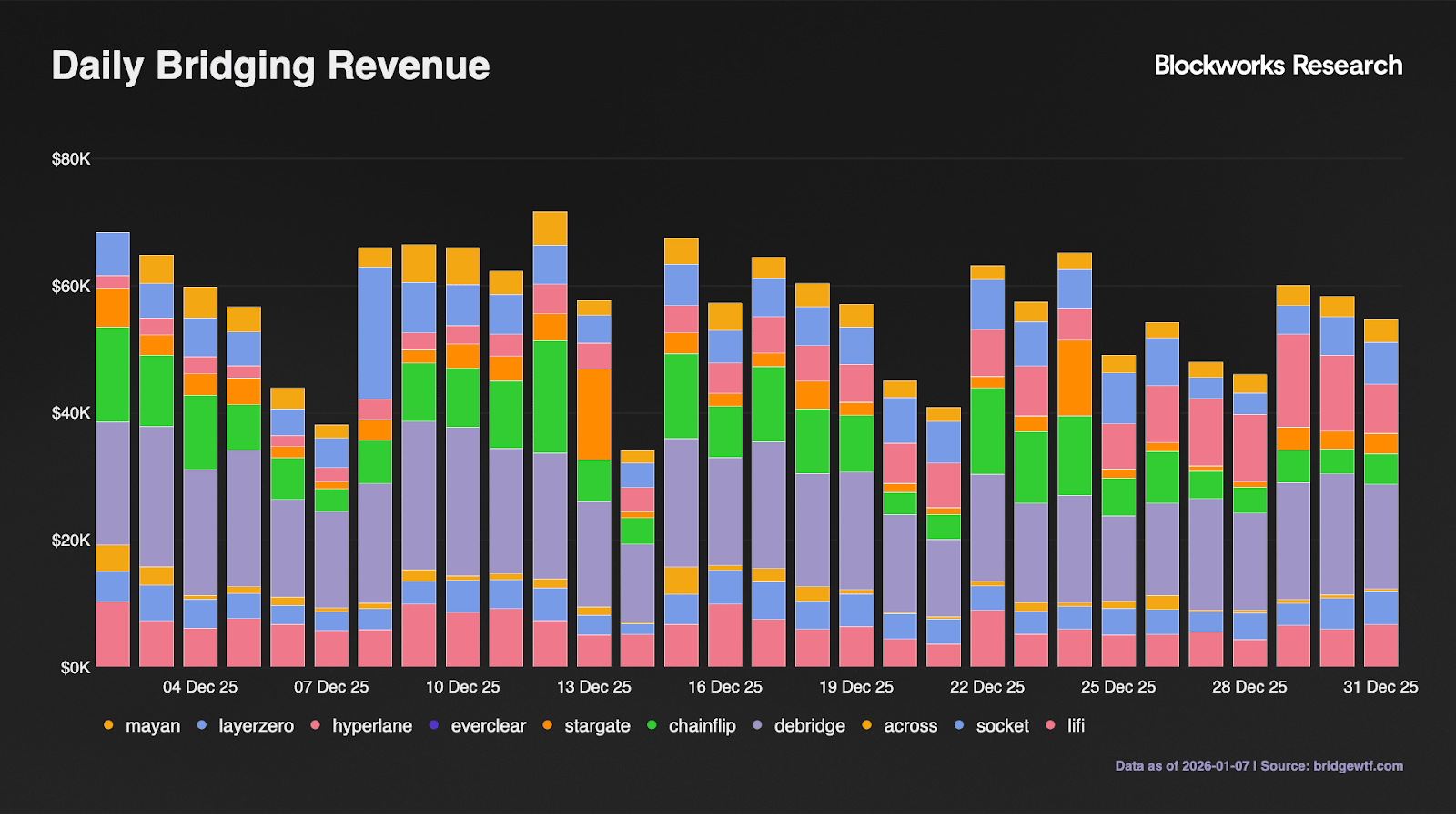

LayerZero has been the most integrated bridging and interoperability platform across the space over the past year. This past month, LayerZero and Stargate have represented 43% of bridging volume, at $12.45 billion USD.

The LayerZero team has been heavily focused on new integrations. While the stablecoin landscape is competitive and divided (at least among smaller players), as more traditional businesses and crypto protocols decide to launch their own stablecoin instances, the majority of these have integrated LayerZero for interoperability. For example, during the USDH governance process, Agora, Ethena, Paxos and Sky all highlighted in their proposals that they would be relying on LayerZero for cross-chain interoperability. PayPal’s PYUSD uses LayerZero’s OFT standard for “pyUSD0,” the pyUSD instance on Aptos, Avalanche, and Tron.

In addition, USDT0, a cross-chain interoperable USDT derivative, itself represents a partnership between Tether and LayerZero. USDT0 has been particularly successful on new chains; it represents around 60% of the stablecoin TVL on Plasma and 22% of the stablecoin TVL on the HyperEVM. Apart from these already-existing initiatives, LayerZero has secured itself as an infrastructure partner for Tempo, Stripe’s upcoming L1 chain, and is part of TIP-20, a general-purpose fungible-token standard focused on built-in features for stablecoins, such as payment reconciliation, regulatory requirements and issuer controls.

In addition to stablecoin initiatives, LayerZero was one of the first general-interoperability providers to integrate Hyperliquid and launched OVault, which enables any vault contract to accept deposits from any blockchain and process withdrawals to any destination. Their first partner for OVault is Ethena’s sUSDe vaults, allowing users to stake USDe for sUSDe across 18 chains.

The past year in DeFi has been stablecoin- and vault-dominated, and LayerZero has managed to prove itself as a significant interoperability partner in both verticals.

Despite the abovementioned developments, LayerZero has struggled compared to competitors in terms of revenues. Despite being 43% of bridging volume over the past month, LayerZero and Stargate have represented only 17% of total revenues. In comparison, intents protocols have monetized their volume much better. DeBridge represented 1.5% of bridging volume over the past month but nearly 32% of revenue, while Across represented 2% of bridging volume and 2% of revenue.

In general, revenue/volume for general interoperability protocols is lower compared to intents based bridging providers: DeBridge has a 0.12% take rate, and Across has a 0.06% take rate, while LayerZero has a 0.02% take rate. Despite its lower take rate, LayerZero commands a much higher valuation ($1.4B FDV) compared to Across ($54M) and DeBridge ($188M). If we annualize revenues over the past month, this puts LayerZero at a 408x P/S, while Across sits at 123x and DeBridge sits at 29x. As a note, intents are able to charge higher take rates, as they have historically offered convenience and speed (albeit there are now non-intents alternatives that offer comparable convenience) and allow for cross-chain swaps, where they can charge higher fees. For DeBridge specifically, the protocol is not listed on aggregators, meaning most of its volume comes directly from their frontend, which allows them to not lower their fees as they have sticky users. In addition, they typically focus on cross-chain swaps (while Across also allows for cross-chain swaps, bridging volume is typically the same asset and L2-to-L2 or L2-to-ETH).

There are a few potential explanations for this large valuation difference. Firstly, ZRO still has a low float, sitting at a 20% MC/FDV, while Across sits at 66% MC/FDV and DeBridge sits at 40%. Secondly, it’s likely that the growth prospects of ZRO are higher than those of Across and DeBridge. LayerZero has the ability to become the interoperability layer for vaults, DeFi protocols, stablecoins and chains. In addition, it has the ability to buy bridging providers (e.g., as it has done with Stargate) or integrate intent solutions (e.g., such as Aori). In comparison, growth for DeBridge and Across seems more hindered.

LayerZero has also recently started a buyback program. On Sep. 22, the LayerZero Foundation bought back 50 million ZRO (5% of token supply) from investors. Since then, they’ve also used a portion of Stargate revenues to buy back the ZRO token. Through September, October, and November, a total of 840,913 ZRO was bought back at a cost basis of $1,219,013 ($1.45 per token), representing 0.08% of total supply. Although not a large amount, it shows the team attempting to use revenue from their product suite to accrue value to the ZRO token.

MSCI Announces Treatment of DATCOs

MSCI has concluded its consultation on digital asset treasury companies (DATCOs), deciding not to exclude them from the MSCI Global Investable Market Indexes in the February 2026 review. Existing DATCO constituents will remain in place, but MSCI will freeze share count and inclusion factor increases, and defer new additions or size migrations for affected names. While institutional investors raised concerns that some DATCOs resemble investment funds, MSCI opted instead to launch a broader consultation on the treatment of non-operating companies, signaling that changes to index methodology may still come following further research and market feedback.

Stablecoins Are a Rail, Not a Brand

Artemis’ latest Big Fundamentals argues that stablecoins are becoming core payment infrastructure rather than standalone consumer products, with most issuers unlikely to succeed. As platforms like PayPal, Klarna, Stripe, and Cash App integrate stablecoins to lower settlement costs, speed up payouts, and expand global reach, the competitive advantage shifts to companies that control distribution, user experience, and payment flows—not token branding. The analysis concludes that issuance alone is not a durable business model: Merchant adoption favors simplicity and liquidity, leading the market to consolidate around a few widely-accepted stablecoins embedded directly into existing financial rails.

a16z crypto published a trend forecast on X, highlighting privacy as the definitive theme for the crypto industry in 2026. The thread argues that privacy will act as the primary "moat" for blockchains, creating sticky network effects that public chains cannot replicate. Key predictions include a shift in messaging apps toward decentralized open protocols to remove reliance on trusted servers, the emergence of "secrets-as-a-service" to make privacy core infrastructure for AI and real-world asset tokenization, and a security evolution from "code is law" to "spec is law," utilizing AI-assisted runtime guardrails to prevent exploits.