- 0xResearch

- Posts

- MegaETH public sale

MegaETH public sale

What should you look forward to with MegaETH?

Hi all, happy Wednesday. Equities stayed strong while crypto cooled slightly after recent rallies ahead of key inflation data. Elsewhere, Western Union unveiled its stablecoin push and its new US Dollar Payment Token (USDPT) on Solana.

MegaETH’s public sale auction ends tomorrow, and we think it’s probably one of the best opportunities this year, if you are able to get any allocation above the minimum.

A yearly Blockworks Research subscription is $4,500.

But right now, you can get our latest MetaDAO research report absolutely free.

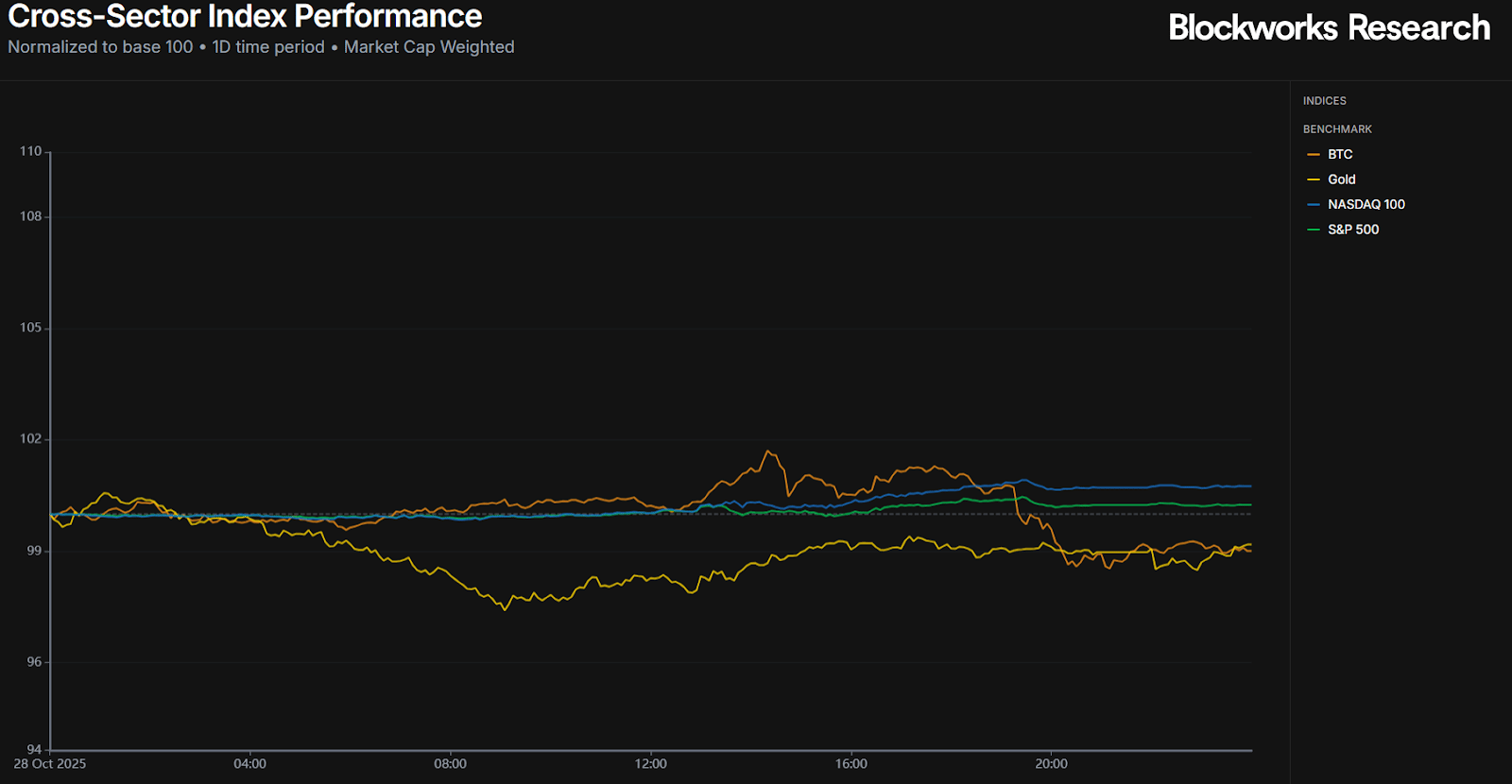

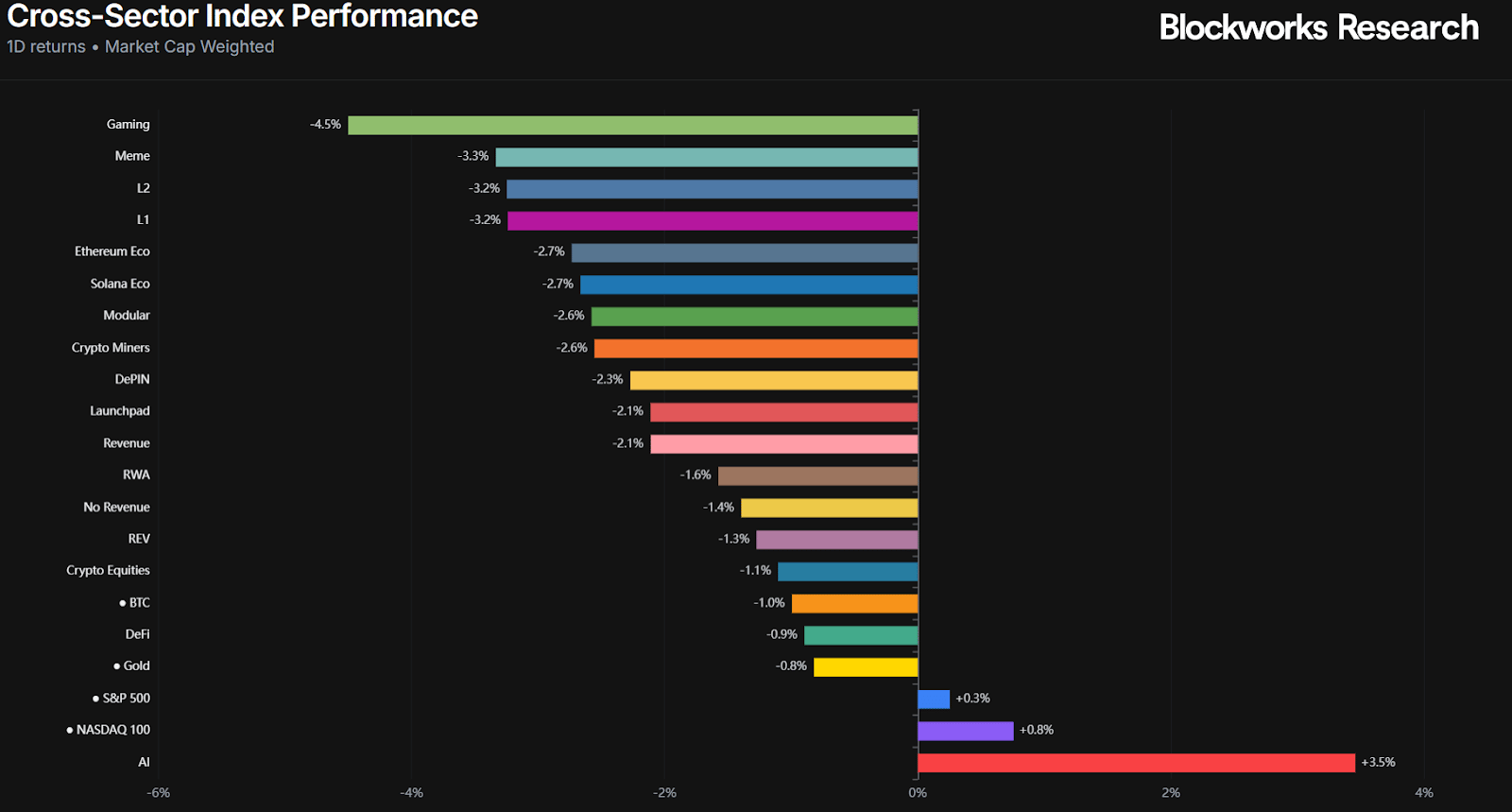

Global markets diverged sharply as traditional risk assets held firm while crypto sectors saw a broad selloff. The Nasdaq 100 (+0.8%) and S&P 500 (+0.3%) extended their recent resilience, supported by strong tech earnings and cooling Treasury yields. Gold (-0.8%) and BTC (-1.0%) both slipped, signaling modest risk rotation rather than outright fear or a mild “risk-off” tilt within digital assets, even as equities stayed buoyant.

Crypto sectors painted a sea of red. Gaming (-4.5%) led declines, followed by Meme (-3.3%), L2 (-3.2%), and L1 (-3.2%), a notable reversal in higher-beta categories that had outperformed earlier in the month. Ethereum and Solana ecosystems (both -2.7%) also lagged, as network activity slowed and profit-taking intensified post-recent rallies. The one bright spot was AI (+3.5%), which bucked the trend amid renewed enthusiasm for decentralized compute narratives and broader tech strength.

The day’s weakness in crypto appears sentiment-driven, coinciding with macro caution ahead of upcoming US inflation data and continued ambiguity over ETF inflows. Onchain volumes have softened, suggesting traders are waiting for fresh catalysts before reengaging risk.

Volatility remains contained, a sign that the pullback may be more of a rotation than a liquidation. All eyes now turn to macro prints later this week (unemployment rate, wage growth, Q3 GDP growth, ISM and more) which could determine whether the next move in crypto is another correction or a renewed push higher.

— Marc

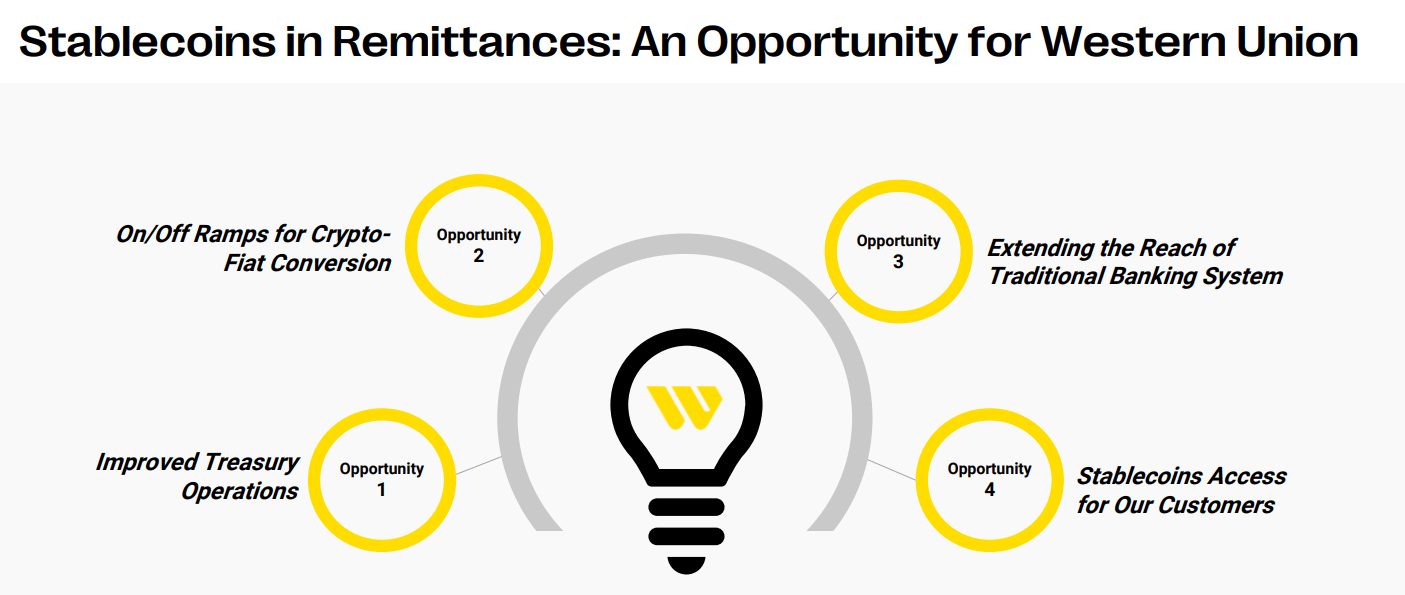

Western Union’s (WU) Q3 2025 financials outlined an explicit “Stablecoins in Remittances” initiative focused on four verticals: treasury optimization, crypto-fiat on- off- ramps, expanded banking reach and direct customer access. That’s corporate speak for “we’re building a stablecoin bridge.” After eight straight quarters of digital revenue growth and double-digit transaction expansion, the firm is now positioning itself as a compliant layer between regulated banking rails and permissionless stablecoin liquidity.

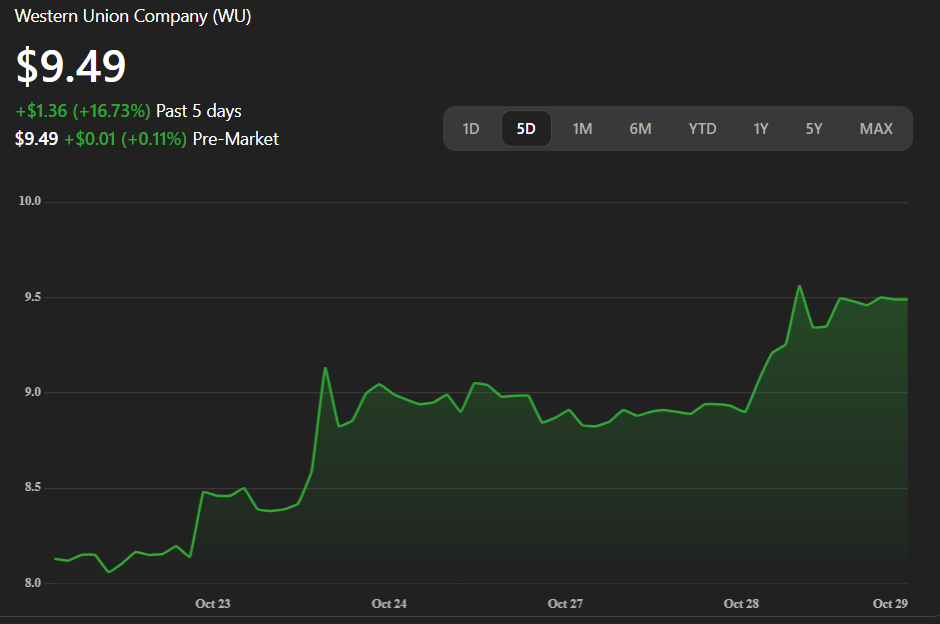

The strategy aligns with what’s already happening onchain: USDT and USDC volumes through emerging market exchanges have doubled YTD, while USDC remittance corridors (like Philippines and Brazil) are seeing faster settlement speeds and lower costs than traditional wires. Western Union’s “digital-first” expansion into Latin America, via Argentina and Brazil wallets, makes stablecoin integration a natural next step. This news pushed the stock higher, and WU is up (+16.7%) since.

For Western Union, this is a welcome sign from investors after a torrid year. For crypto markets, this marks a pivotal macro signal. Stablecoin adoption is crossing from DeFi yield-chasing into regulated payments infrastructure. As Tether’s dominance rises (now ~60% of supply), expect compliance-focused issuers like Circle to lean heavily into B2B remittance partnerships, especially as global fintechs scramble to match Western Union’s move. Moreover, yesterday it announced its plan to launch US Dollar Payment Token (USDPT), its new stablecoin and an “innovative Digital Asset Network” designed to bridge the digital and fiat worlds (built on Solana and issued by Anchorage Digital Bank). Watch for Western Union’s 2025 Investor Day (Nov. 6), for any more moves that could set off a new wave of “TradFi stablecoin” trade setups.

— Marc

MegaETH public sale

The MegaETH public sale concludes tomorrow after running for 72 hours as an English auction that began on Oct. 27 at 9 am ET. Unlike traditional token sales, this English auction format allows the market to determine the fair price through competitive bidding. The system works by establishing a clearing price — the lowest price point where total bids can fill the entire 500 million token allocation. All successful bidders pay this same clearing price regardless of their individual bid amounts, meaning someone who bids at the maximum $0.0999 per token would still only pay the final clearing price if it settles lower. Bidders who fall below the clearing price receive full refunds, while those at or above it secure allocations. The auction format eliminates gas wars and first-come-first-served advantages, creating a more equitable distribution mechanism.

The sale offers 500 million MEGA tokens, representing 5% of the total 10 billion token supply, conducted entirely on Ethereum mainnet using USDT as the payment method. The auction operates within a price range from $0.0001 to $0.0999 per token, with the starting price set at $0.0001 representing a $1 million fully diluted valuation and the ceiling price of $0.0999 representing a $999 million FDV. Individual participants can bid between $2,650 minimum and $186,282 maximum, with a tick size of $0.0001 for bid increments. The structure includes a mandatory one-year lock-up period for US accredited investors who receive a 10% discount, while non-US participants can optionally choose the same lock-up terms for the discount benefit. Following the auction's conclusion tomorrow, the allocation calculation period runs from Oct. 30 to Nov. 5, with withdrawals and refunds available from Nov. 5-19, and final allocation and reallocation occurring from Nov. 19-Nov. 21.

As expected, the MegaETH public sale has been tremendously successful so far, with a 14x oversubscription as of today. This number will likely only increase as we head into the final day, with the majority of deposits/bids coming in in the last few hours.

Wow, someone made a free money machine and attracted a lot of people who wanted free money. That’s crazy

Hyperliquid

— Sisyphus (@0xSisyphus)

8:58 AM • Oct 29, 2025

After all, if someone makes a free money machine, the only logical action is to deposit as much as possible. Currently MegaETH trades on pre-markets (on Hyperliquid, woohoo!) at a 4.5 billion FDV valuation, giving depositors a 4.5x on any deposit they make. The main issue is that it’s likely that any depositor can at most hit a 4.5x on the minimum bid amount: $2650 USD. The MegaETH team has given public information on what allows bidders to receive more allocation, mostly revolving around past wallet interactions, social media presence, as well as some of the new “social credit” platforms like Ethos.

Much like any scenario where there is a free money machine involved, we’ve seen a plethora of Sybil activity. If the minimum bid is $2650 USD, and you have 450 Echo/Sonar accounts you can make a lot more money, with a higher chance of making money than if you are a good, astute cryptocurrency enjoyer with the right social and DeFi/onchain credentials.

We’ve discussed MegaETH on the podcast plenty of times, generally leaning towards bullishness for the chain. The team have a unique approach to ecosystem building (the MegaMafia is now in cohort 2, with the third on the way), and are focusing on unique applications — not Uniswap, Aave, Morpho or Compound forks (which seem to dominate the majority of other chains).

Kunal Goel, previously at Messari, now at LayerZero, released a valuation model yesterday, with his base case for MegaETH sitting at $14 billion USD. Although some of his assumptions are a bit brave (assuming blocks are always filled because of the existence of MEV/arbitrage bots), it does highlight that the MegaETH team has been thinking more about revenue and value accrual than other L2s have historically.

MegaETH's scale is so impressive that any time you run the numbers, all intuitive projections get blown out. While the market is pricing it as yet another L2, my model finds the opportunity is actually much MUCH larger.

I've modeled out four scenarios:

🐂 BULLISH - MegaETH— Kunal G (@kunalgoel)

10:46 PM • Oct 28, 2025

No matter your opinion on MegaETH’s valuation, we’ve had two key takeaways on our end these past few months:

There are now chains which are explicit about their focus on revenue and those focused on another narrative (e.g. decentralization). Which offers better returns, still unknown (e.g. XRP vs. Hyperliquid or ETH vs. SOL)

A lot of significant returns now come from private public markets (Echo, Sonar etc.), predeposits etc. What was 2021’s whitelists and discord roles (and subsequent Sybilling, buying and selling of whitelists and discord roles) has now evolved into Sonar and Echo (and subsequent Sybilling, buying and selling of KYC’d Sonar and Echo accounts).

Monad’s journey represents a bold attempt to supercharge the Ethereum experience from the ground up, introducing a new consensus algorithm, a parallel execution engine, and a custom data architecture, all while preserving a familiar EVM interface for developers. If successful, Monad would offer a developer experience nearly identical to Ethereum’s but with throughput and latency on par with the fastest modern chains.

x402 isn’t just another payment layer; it solves a 25-year gap in the internet’s foundation by finally putting HTTP 402 to work. x402 is an internet-native payment protocol created by Coinbase. It repurposes the long-unused HTTP 402 "Payment Required" status code, which was originally reserved for digital cash payments in 1999 but never implemented.

Circle has launched the Arc public testnet, an L1 designed to bring real-world finance and payments onchain using USDC as native gas. Arc aims to serve as an “Economic OS” for global commerce, offering fast finality via its Malachite consensus engine and integrations with major wallets, infrastructure providers and institutions across multiple countries. The testnet invites developers and enterprises to build and experiment ahead of a planned 2026 mainnet launch, marking Circle’s move beyond stablecoins into full blockchain infrastructure for real-world economic activity.

Kunal Goel published a tweet modeling MegaETH's revenue potential across four scenarios. In the bullish case (10 gigagas/second, 66,667 TPS), MegaETH could generate $4.2 billion yearly revenue at $0.001-$0.002 transaction fees. Even the bearish scenario (1 gigagas/second, 6,667 TPS) projects $100 million+ annual revenue at $0.0005 fees. The analysis includes additional revenue from MegaUSD stablecoin yield and MEV internalization through stake-for-access models. After accounting for 50-70% infrastructure costs, the base case projects $300 million yearly profit, implying a $10 billion FDV at 30x multiple. The probability-weighted expected FDV reaches $14-$15 billion, suggesting 3x upside from current perpetual prices and 14x from ICO pricing.

|

|