- 0xResearch

- Posts

- Maple’s fundamentals are driving outperformance

Maple’s fundamentals are driving outperformance

Maple is outperforming peers on growth, yield, and revenue

Hi all, happy Tuesday. The holiday week shows pockets of strength, led by crypto miners and the benefits they reap from the datacenter capex boom. Lending is the top loser, brought down by AAVE amidst the DAO’s ongoing feuds with Labs, and uncertainty around tokenholder rights and protections. Syrup, however, is the standout in this sector, both by recent token performance and the resilience in its key metrics, discussed below.

The holiday week opened with some strength in select pockets, primarily crypto miners. Gains in this index are currently being led by HUT, up 44% in the past week following their announcement of a 15-year, $7B power delivery agreement for an Anthropic data center, coupled soon after with a wave of analyst upgrades and “Buy” ratings. The DEX sector comes in second as a top performer, led by UNI (up +18% on the week) as the UNIfication proposal moves toward passing with 99% voting in favor.

The lending sector, however, is ranking as the top loser. Despite notable strength in SYRUP (up 26% on the week, discussed more below), Aave’s recent DAO drama has brought this index lower, with AAVE falling 22% on the week. Despite AAVE being the category leader in lending, investors wouldn’t want to own it if revenue is continuously siphoned off to the equity in a separate labs entity.

Across the board, Q4 has shaped up as a bloodbath for crypto tokens. Our advance/decline index sits at lows on both the quarterly and the yearly, showing abysmal breadth and returns for the sector over the past year. Investors should hope that the new year will reset expectations and watermarks to reallocate to the sector in 2026.

— Luke

The market’s struggles since October are well reflected in the change in ETF AUM since. At the start of October, BTC ETF AUM as a share of the market cap peaked at 6.93%, and has since declined to 6.65%. Similarly, ETH ETF AUM peaked at 3.35% and has since declined to 2.7%. For both BTC and ETH, AUM in these products have shown a steady decline throughout Q4. SOL is the notable exception to this, where ETF AUM as a share of market cap currently stands at 1.1%, up from just 0.39% in October since their approval under the ‘33 Act.

Despite benefiting from the most constructive inflows provided by the ETFs, SOL has been the worst performing major since the start of October. With BTC and ETH down 25% and 31% respectively, SOL is down 43%.

Interestingly, IBIT is closing the year as the sixth-largest ETF by YTD inflows. Despite this, the product is down -9% on the year, while every other product in the top 25 is registering positive returns. Eric Balchunas’s take is that “the real takeaway is that it was 6th place DESPITE the negative return,” showing remarkable appetite for the product amidst an uncompelling return profile. Bears, on the other hand, wonder how much worse returns would be should inflows not have been so rosy.

The truth is somewhere in the middle, and that’s what makes a market. AUM for both BTC and ETH ETFs will likely need to find their floor before a durable uptrend can continue.

— Luke

Crypto's premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: 0XNL for $100 off.

Sweet like Maple Syrup

Maple (SYRUP) is up 26% over the past week, outperforming all other money markets in our lending index. Alongside Sky, it is the only asset in the index with a positive year-to-date performance, and by a broad margin, up 112% vs. Sky’s 7%. What’s driving Maple’s strength, and how has it remained resilient despite challenging market conditions?

Maple, as one of DeFi’s longest-standing lending protocols, was able to come back from the 2022 credit crisis by pivoting away from undercollateralized lending toward a fully secured, overcollateralized model, with an institutional approach: Permissionless Syrup pools accept USDC or USDT deposits (syrupUSDC, syrupUSDT), while permissioned pools accept only USDC. Capital from these pools is then deployed OTC to institutional borrowers, collateralized by BTC or other highly liquid cryptoassets.

As seen below, Maple has surpassed $4 billion in deposits, with about 63% of deposits coming from the syrupUSDC pool, 27% from the syrupUSDT pool, and 10% from Maple Institutional (its permissioned secured lending pool).

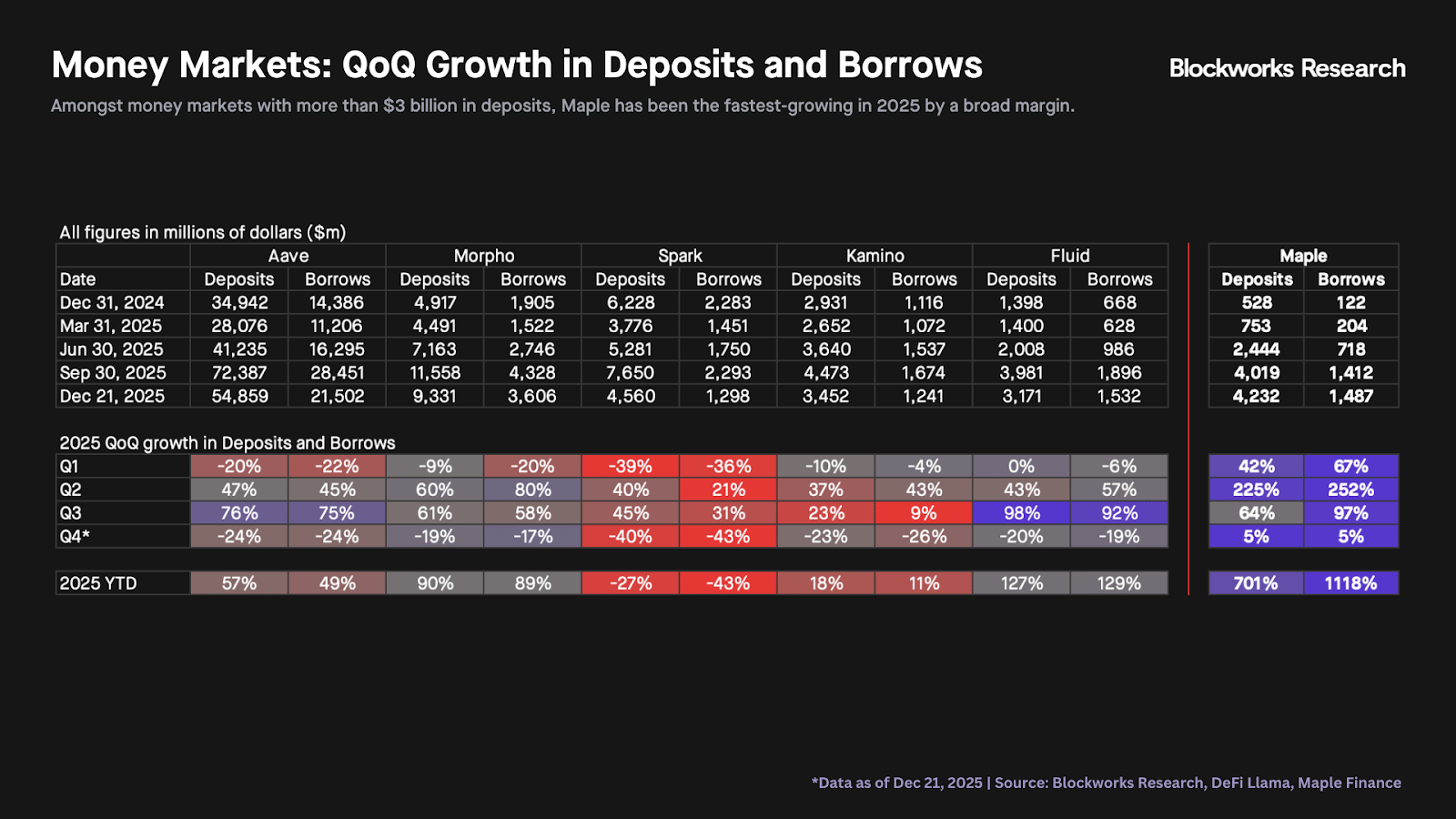

How does Maple stack up against other money markets? Among protocols with more than $3 billion in deposits, Maple has been the fastest-growing in every quarter this year except Q3, when it ranked second behind Fluid. Q2 marked Maple’s strongest quarter, with deposits up 225% and borrows rising more than 250%. Year-to-date, deposits have grown an exceptional 701%, while outstanding loans are up 1,118%. Notably, loan origination has outpaced growth in deposits, underscoring increasingly high utilization.

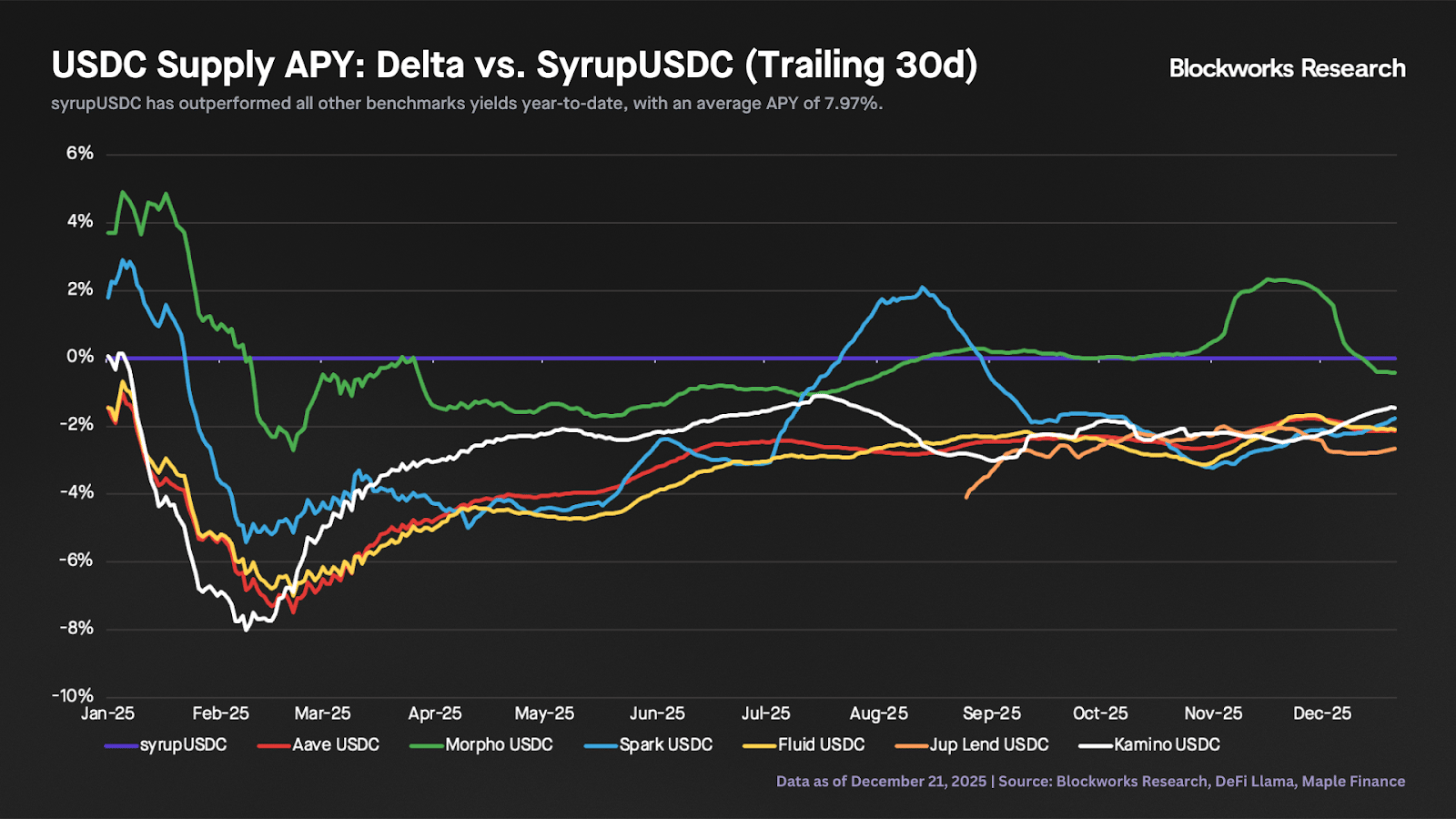

Maple’s growth has largely been driven by syrupUSDC, which as we mentioned accounts for 63% of Maple’s deposits ($2.66 billion) as of Dec. 21. One of the attractive selling points of syrupUSDC is the sustained high yield, linked to stable demand from Maple’s institutional client base. syrupUSDC has outperformed all other benchmark yields in the cohort year-to-date, with an average APY of ~8%. However, it’s worth noting that in recent months the yield has been declining, with Morpho’s USDC yield remaining competitive since August and outperforming sharply during November.

Regarding the methodology, we use market-weighted USDC supply rates across competing protocols, based on base interest paid by borrowers (excluding any incentives). We then compute trailing 30-day annualized rates and compare them to the benchmark yield, syrupUSDC.

Another growth catalyst for syrupUSDC and syrupUSDT has been deep DeFi integrations. Maple’s yield-bearing stablecoins have been integrated into Pendle’s PT markets and onboarded as collateral across several money markets (Aave, Fluid, Jup Lend, Spark, and Kamino), enabling looping strategies against non-yield-bearing stables. This kind of distribution can further accelerate Maple’s growth, particularly during periods when syrupUSDC outperforms benchmark yields, including Ethena’s sUSDe.

Putting it all together, Maple has outpaced competing money markets year-to-date in both deposit and borrow growth, as well as USDC supply yields. How has that performance translated into revenue? The table below compares Maple against its peers on quarterly revenue and price-to-sales multiples.

Based on Q4 2025 revenue figures, Maple (SYRUP) is trading at the most attractive valuation of the cohort on a growth and FDV/Sales basis. Maple’s annualized revenue run rate has increased 533% YoY, from $1.0M in Q4 2024 to a forecasted $6.6M in Q4 2025.

Regarding token distribution, all initial team, advisor, seed investor, and public sale allocations were fully vested as of 2023, eliminating supply overhang concerns. Of note, SYRUP scored 37 on the Token Transparency Framework, indicating that the project has fully disclosed its revenue streams, equity to token holder rights, advisory service providers, and executive team personnel.

Given Maple’s fundamentals, alongside a favorable token structure (limited supply overhang and clear disclosures around value accrual), it’s unsurprising that SYRUP is the best-performing lending token year-to-date and has continued to show notable relative strength in recent days.

— Carlos

State of Crypto VC: $34B Raised, 50% Fewer Deals

Mason Nystrom, Paul Veradittakit, and Franklin Bi from Pantera discuss how the crypto venture landscape has transformed since the 2021-22 mania. While total fundraising hit an all-time high of $34 billion this year, deal count has dropped nearly 50%. They break down what this flight to quality means for the industry and why later-stage rounds are dominating the market. Paul and Franklin discuss the catalysts reshaping crypto venture – from Circle's IPO finally completing the exit story for VCs, to Bitcoin ETFs opening institutional floodgates, to the explosive rise (and recent cooling) of Digital Asset Treasuries. Finally, they discuss key investment themes for the next cycle, including tokenization, ZK-TLS and web proofs, stablecoins and payments, and prediction markets.

Why fixed-rate lending never took off in crypto

Prince (0xPrince) published an article arguing that fixed-rate lending hasn’t taken off in DeFi, not because users rejected it, but because protocols designed credit products based on money-market assumptions and deployed them into an ecosystem optimized for liquidity. He frames DeFi lenders as cash managers who prefer liquid interest-bearing tokens (like Aave’s aTokens) over a few extra basis points, so fixed-rate designs that fragment liquidity by maturity and lack deep secondary markets inevitably end up thin and niche. The post concludes that fixed-rate credit can still happen onchain, but only if it’s built as a true term-credit layer on top of liquid floating-rate markets. This means explicit term risk, priced exit options, and dedicated actors absorbing duration, rather than being marketed as a slightly better savings account.

Bitcoin developers are sleepwalking towards collapse

Nic Carter published a piece arguing that Bitcoin is uniquely exposed to quantum computing risk and that the community is dangerously complacent given realistic timelines for “cryptographically relevant” quantum computers in the next decade. He explains that Shor’s algorithm will eventually break Bitcoin’s elliptic-curve signatures, that migrating to post-quantum schemes would require contentious, multi-year soft forks, and rotating millions of addresses (including ~1.7 million “lost” Satoshi-era coins). He contrasts Bitcoin’s slow, adversarial governance with centralized systems and other chains (Ethereum, Solana, L2s) that are already experimenting with “post-quantum” cryptography, and concludes that Bitcoin must start quantum-proofing now rather than gambling on the threat arriving after the community’s ability to respond.