- 0xResearch

- Posts

- Macro selloff

Macro selloff

Markets tumble amid December rate cut doubts

Hi everyone. Crypto markets are ending the week in the red, with BTC falling below $95K after one of the worst days ever for bitcoin ETF flows. As always, below are a few weekend reads to keep you from staring at the charts. Topics include trust-minimized L2 interoperability, Jito’s BAM and arcade tokens. Have a great weekend!

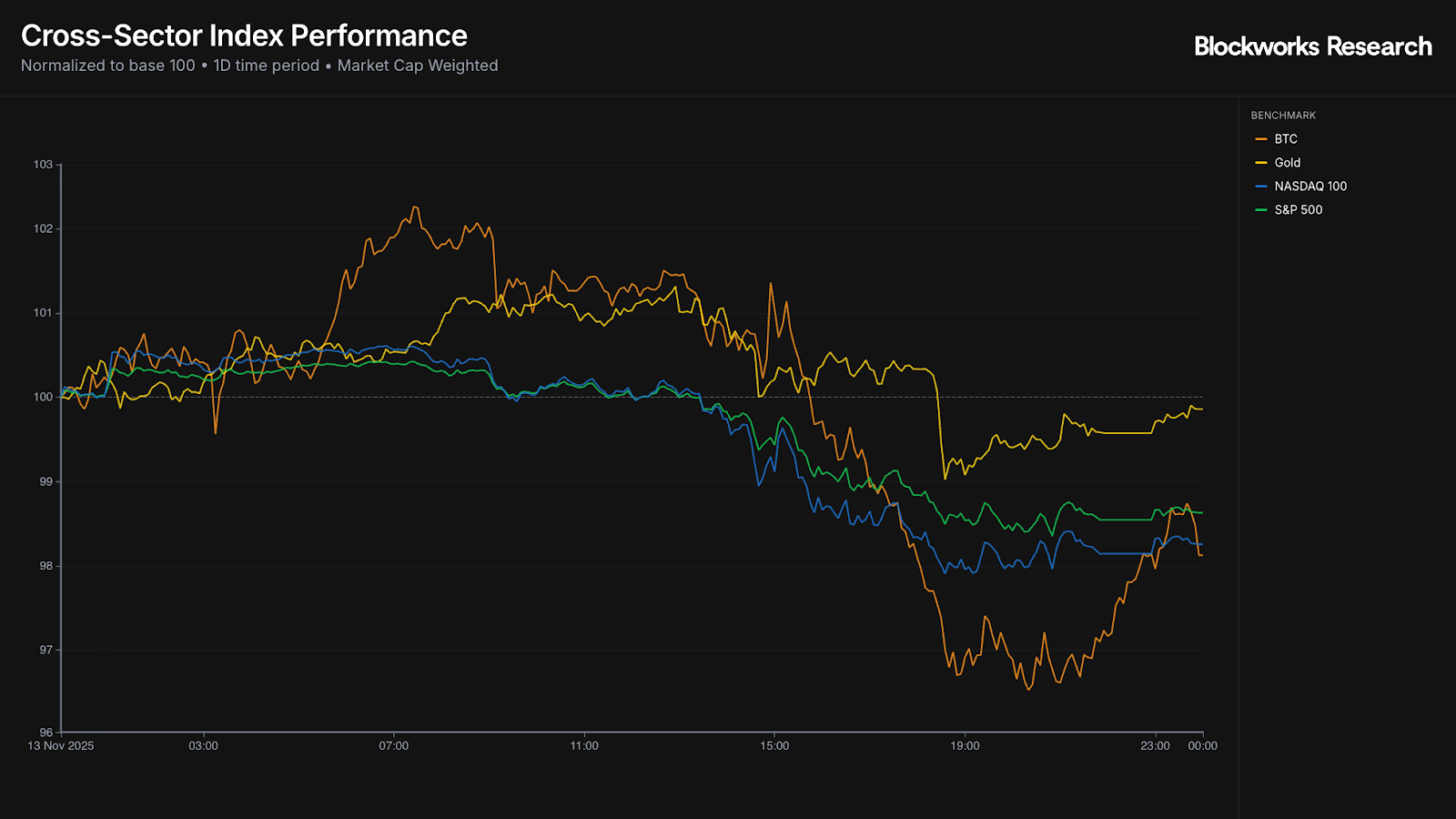

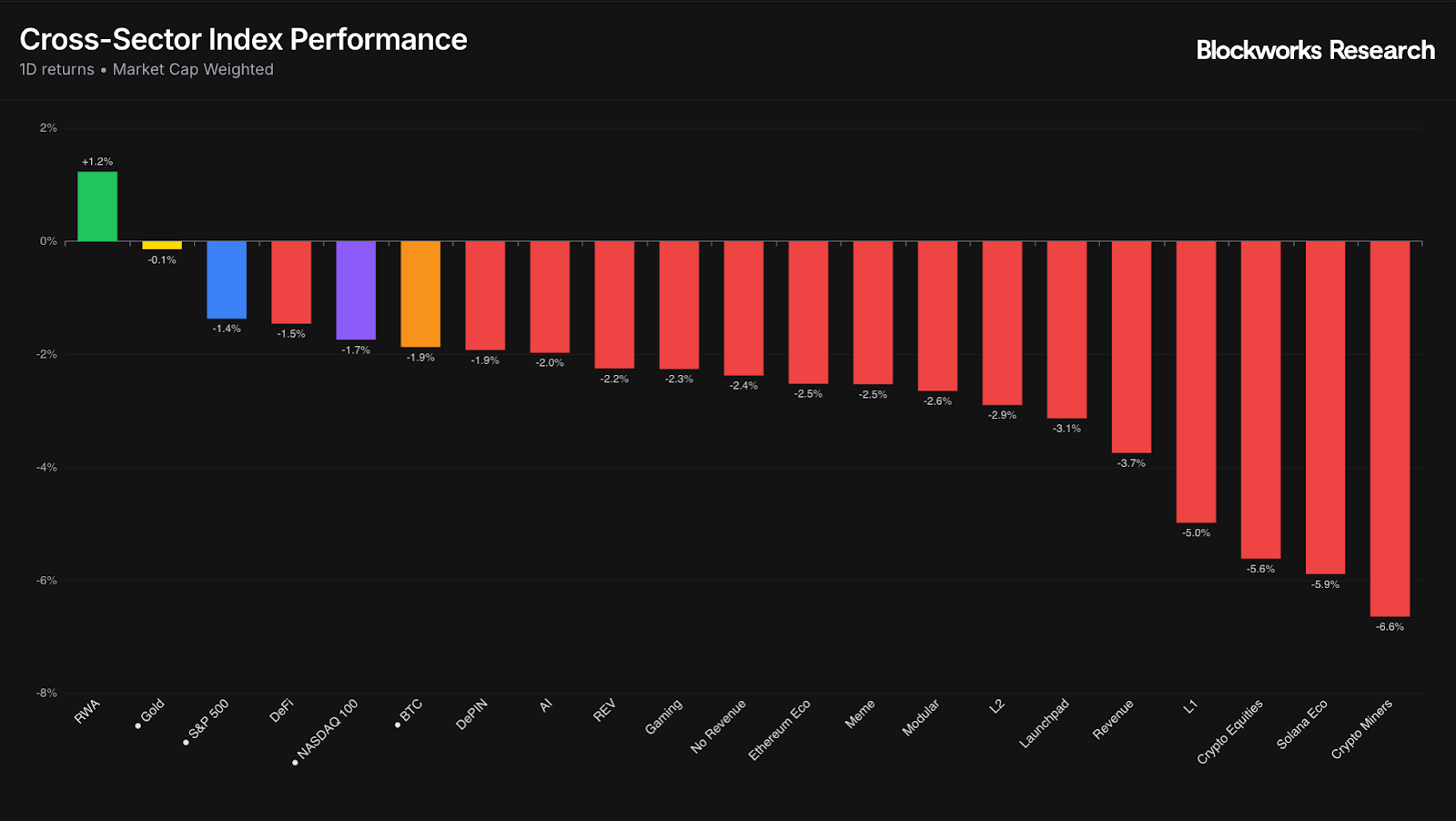

Risk assets sold off as doubts loom over a December rate cut, with BTC down -1.87% yesterday and tumbling briefly below $95K this morning, extending its losses. US equities also saw investors de-risk, with the Nasdaq and S&P 500 down -1.74% and -1.37%, respectively. Meanwhile, gold’s relative strength was notable, closing the day almost flat.

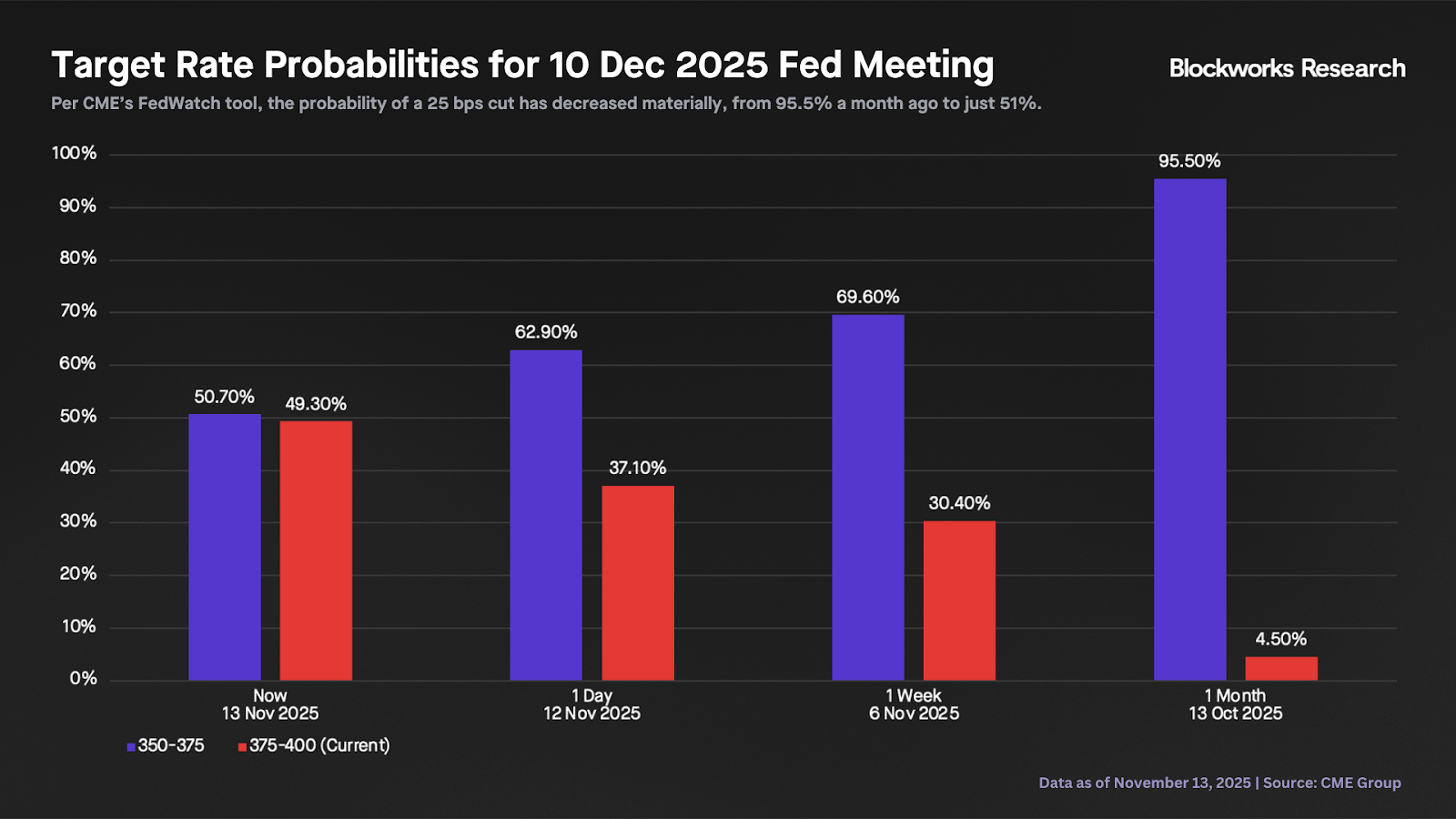

Expanding on the macro side, Fed members are pushing back against a December cut, especially given the lack of new data on the jobs and inflation fronts due to the government shutdown. Minneapolis Fed President Neel Kashkari said yesterday he didn’t support the last interest rate cut, noting he’s undecided on the best course of action for next month’s policy meeting. The chart below effectively illustrates the sudden shift in market expectations. As of Nov. 13, the CME FedWatch Tool was pricing a 25 bps rate cut at just a 51% probability, compared to 63% the day before and over 95% a month ago.

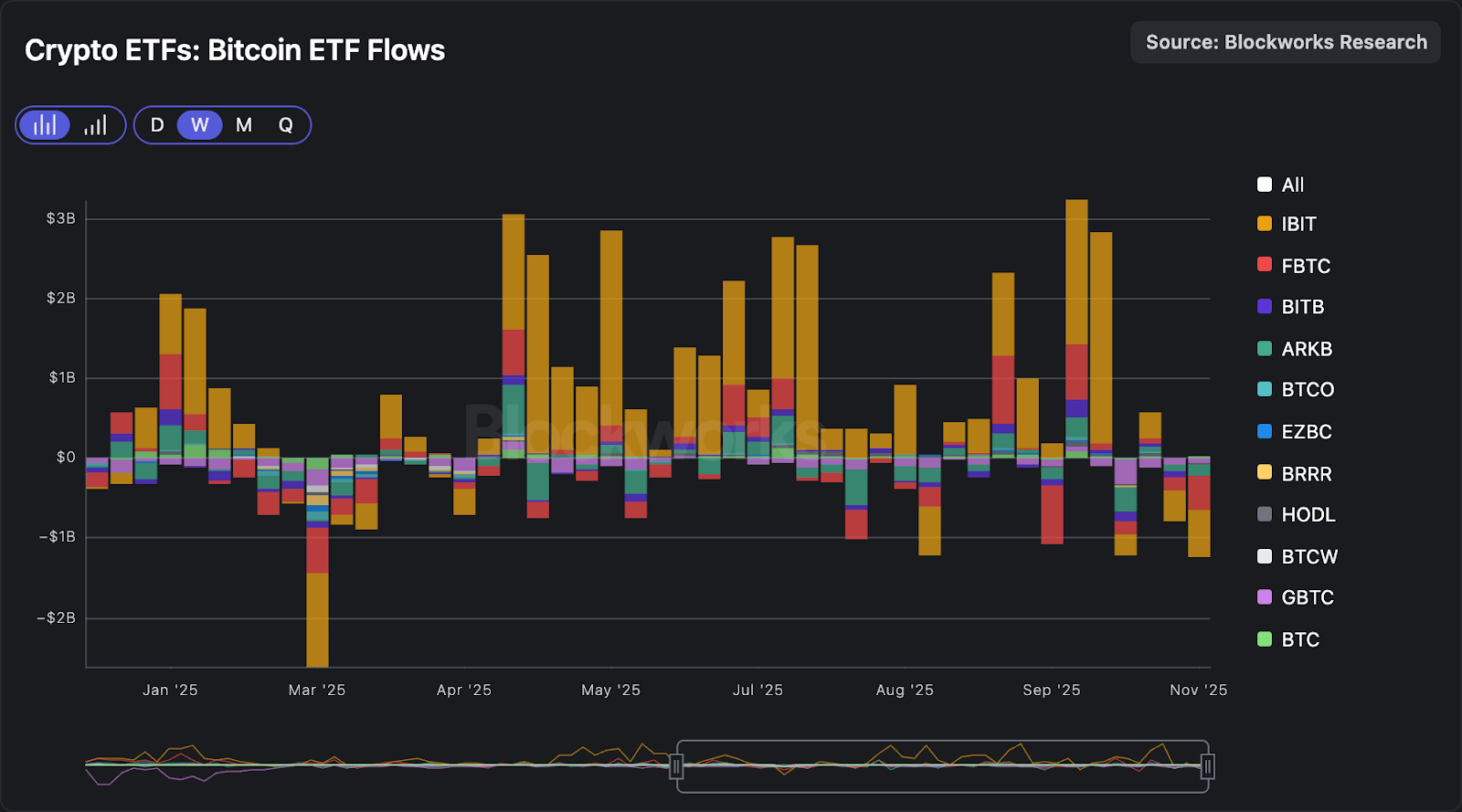

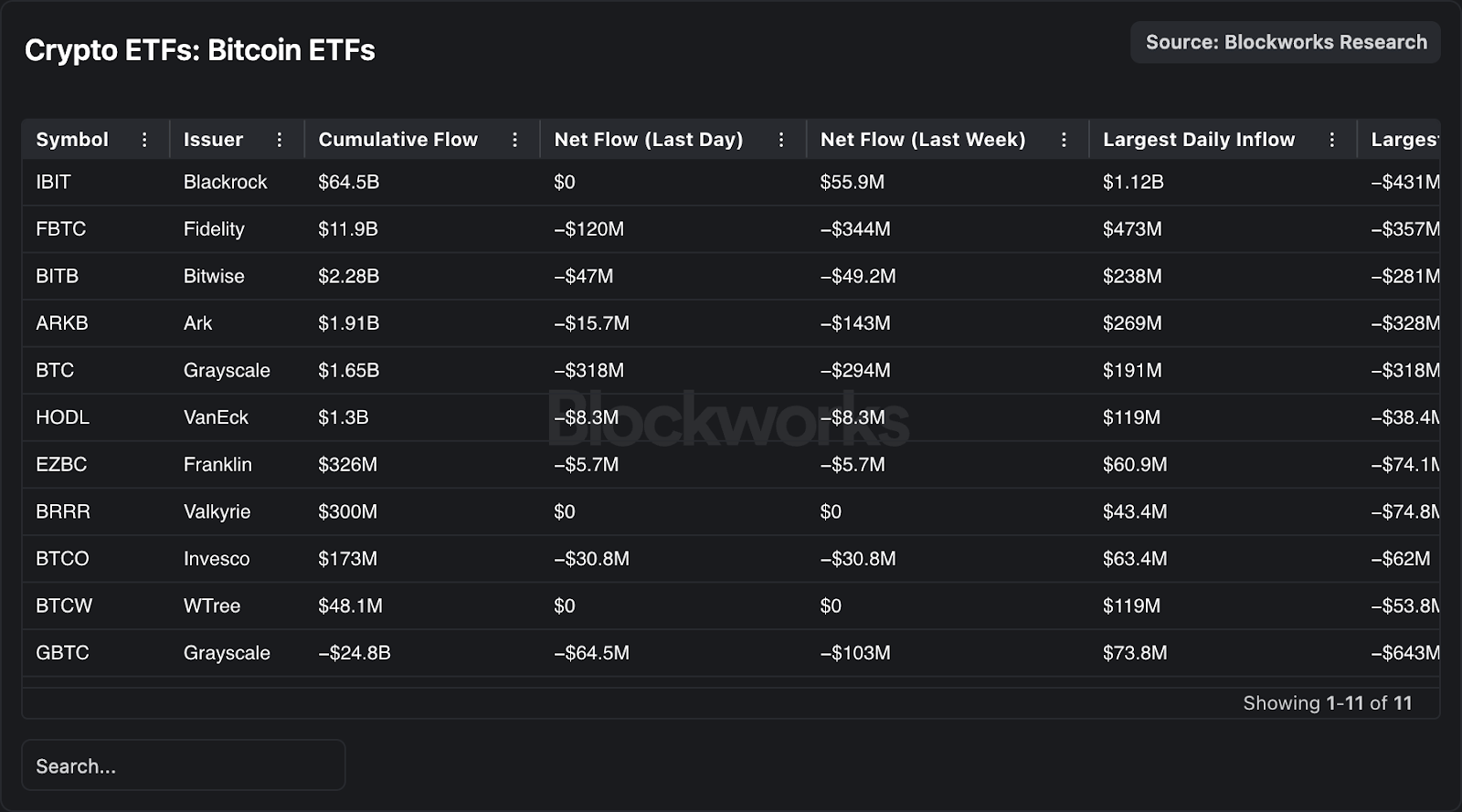

Bitcoin has been hit especially hard by recent macro uncertainty, with bitcoin ETFs experiencing their second-worst day ever, in terms of net flows, yesterday. Bitcoin ETFs saw almost $870 million in outflows, suggesting that we’ll close the third consecutive week with negative flows. The last time bitcoin ETFs experienced three or more consecutive weeks of outflows was between February and March of this year, with BTC dropping below $80K. The chart below shows bitcoin’s weekly ETF flows by product, with this week still pending inclusion.

Speaking of ETFs, one of the largest issuers — Grayscale — filed for an IPO yesterday. The filing revealed declining financials, with a 20% year-over-year decline in revenue for the first nine months of the year. Notably, AUM was also lower on Sept. 30 than a year prior, despite BTC rising 80% during the same period. Since bitcoin ETFs began trading in 2024, Grayscale’s GBTC has seen almost $25 billion in cumulative net outflows.

Finally, regarding cross-sector performance, every crypto index we track was negative on the day, with the sole exception of RWA (+1.2%). The worst-performing indices were Crypto Miners (-6.6%), Solana Eco (-5.9%), and Crypto Equities (-5.8%). The fact that two of the worst-performing indices were equities is a further indication of broader risk-off sentiment driven by macro concerns.

— Carlos

Takeaways from Monday’s 0xResearch livestream:

Morpho and curators: The discussion highlights Stream’s blowup and its impact on Morpho’s approach to curators and frontends. Participants weigh the benefits of permissionless market creation vs. a “strict list,” arguing that risk assessment should be left to curators. On the other hand, it was tough for users to identify opaque off-chain strategies from the frontend alone.

DeFi lending models: Charlie contrasts Aave’s pooled, slower-moving risk approach with Morpho’s modular, curator-led vaults. The panel notes borrowing demand concentrates on a few collaterals, retail struggles to price risk and fully onchain strategies are easier to underwrite than off-chain rehypothecation.

The state of HyperEVM: The panelists discuss HyperEVM’s slow start and the catalysts going forward now that the base primitives are live. The next unlock is HIP-3 (user-launched markets and tighter HyperCore integrations), with discussion also centered around BLP on HyperCore, which stands for Borrow Lend Protocol.

Unit’s monetization: The group notes Unit monetizes via a share of spot fees, with economics favoring day-one, highly demanded listings over low quality long-tail pairs. They suggest a Coinbase-style frontend partner could justify listing more niche assets despite thinner volumes.

Hyperliquid’s unique opportunity: The panel argues native, core-primitive hosting on HyperCore could compound UX and distribution for HYPE holders, while cautioning that team bandwidth and neutrality are constraints. Prime-broker tooling, broader spot coverage and reliable on- and off-ramps emerge as key gaps.

HIP-5 and assistance fund: Participants push back on Assistance Fund purchases of third-party ecosystem tokens. Charlie suggests allocating a slice of buybacks to stablecoins as a crisis buffer. The rationale is to avoid pro-cyclical HYPE sales during stress and create a ready backstop without pressuring price.

The MegaETH ICO drama: The hosts review teams threatening to revoke allocations from users publicly planning OTC sales. They deem the move a reasonable PR move for a KYC’d sale, while advising teams to avoid public spats and align sale mechanics with long-term holders.

Look for the full podcast on YouTube, Spotify, Apple Podcasts and X.

This summary was generated with assistance from AI tooling.

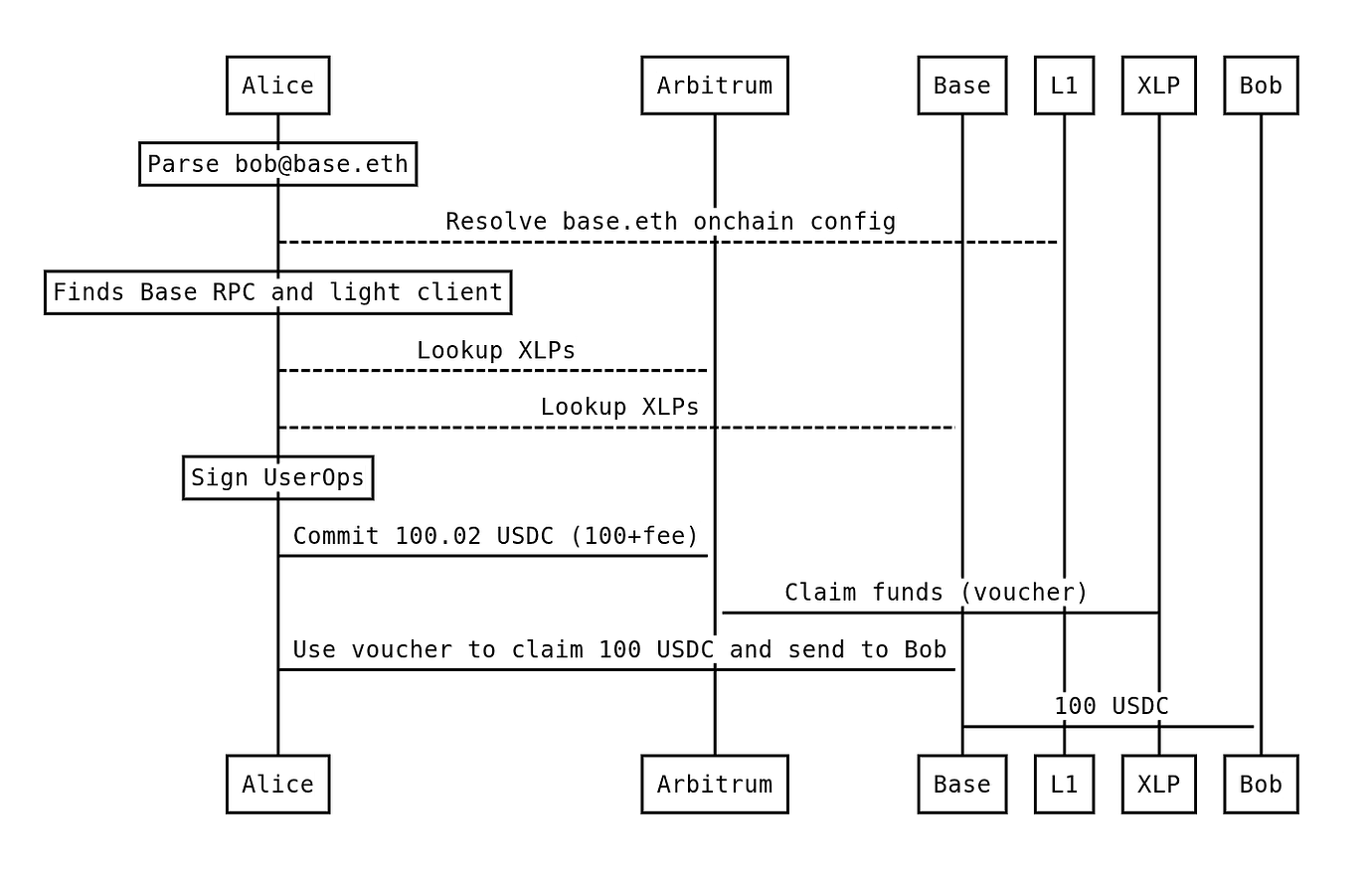

Yoav Weiss from the Ethereum Foundation published a research piece proposing the Ethereum Interop Layer (EIL), an interop standard aiming to make Ethereum rollups feel like a single, unified chain. EIL enables users to sign once for a cross-chain transaction without adding new trust assumptions. Built on ERC-4337 account abstraction, users themselves initiate and settle cross-L2 actions directly from their wallets, not through relayers or solvers. EIL also introduces a “CrossChainPaymaster” and permissionless cross-chain liquidity providers (XLPs) that issue vouchers, with a trustless L1-based dispute mechanism. This new account-based interoperability layer unifies Ethereum’s fragmented L2 ecosystem under Ethereum’s own security model. Read more

Jito Labs’ co-founder Lucas Bruder published a blog post arguing that Jito’s Block Assembly Marketplace (BAM) advances Solana toward making “Internet Capital Markets” a reality. He details how Solana's long-term success depends on deterministic execution infrastructure that scales transparently as the network grows. BAM exists to ensure that as Solana scales, the execution layer remains transparent, fair and aligned with the applications and users who drive network growth. It does this by providing cryptographically verifiable transparency for sequencing that no other solution can provide. With BAM, applications gain the execution certainty needed to offer tighter spreads and predictable fills through Application Controlled Execution (ACE). Traders also benefit from superior execution quality that rivals or exceeds other venues, while validators get open-source infrastructure they can verify. Read more

A16z crypto released a primer on “arcade tokens,” which it argues is the most unexplored and underappreciated type of token. Fundamentally, arcade tokens are the blockchain-based equivalent of a type of asset that people are already familiar with: airline miles, credit card points, in-game digital gold and so on. They are a spend-centric, issuer-managed currency for app ecosystems rather than investments. The piece explains the mechanisms that bound arcade token prices, highlights interoperability advantages over closed loyalty systems, and outlines design tradeoffs as well as regulatory context (e.g., Pocketful of Quarters no-action letter in 2019). The conclusion is that even though arcade tokens aren’t for every use case, they represent a critical building block in the evolution of crypto networks for marketplace growth. Read more

Anthropic published a report detailing the first reported AI-orchestrated cyber-espionage campaign, attributed to Chinese state-sponsored group GTG-1002. The operation targeted ~30 entities, with AI (Claude Code + MCP tools) autonomously executing 80-90% of reconnaissance, exploitation, lateral movement and data exfiltration across simultaneous intrusions. The piece highlights broader implications for AI-enabled threats and urges stronger safeguards for agentic systems. Read more