- 0xResearch

- Posts

- Live now — native BTC yield without impermanent loss

Live now — native BTC yield without impermanent loss

Yield Basis’ IL-free AMM

Hi all, happy Wednesday! It’s the last day of 2025 (good riddance), and crypto markets saw some life over their TradFi counterparts. We discuss a novel mechanism of getting native yield without impermanent loss (2026 yield opportunity).

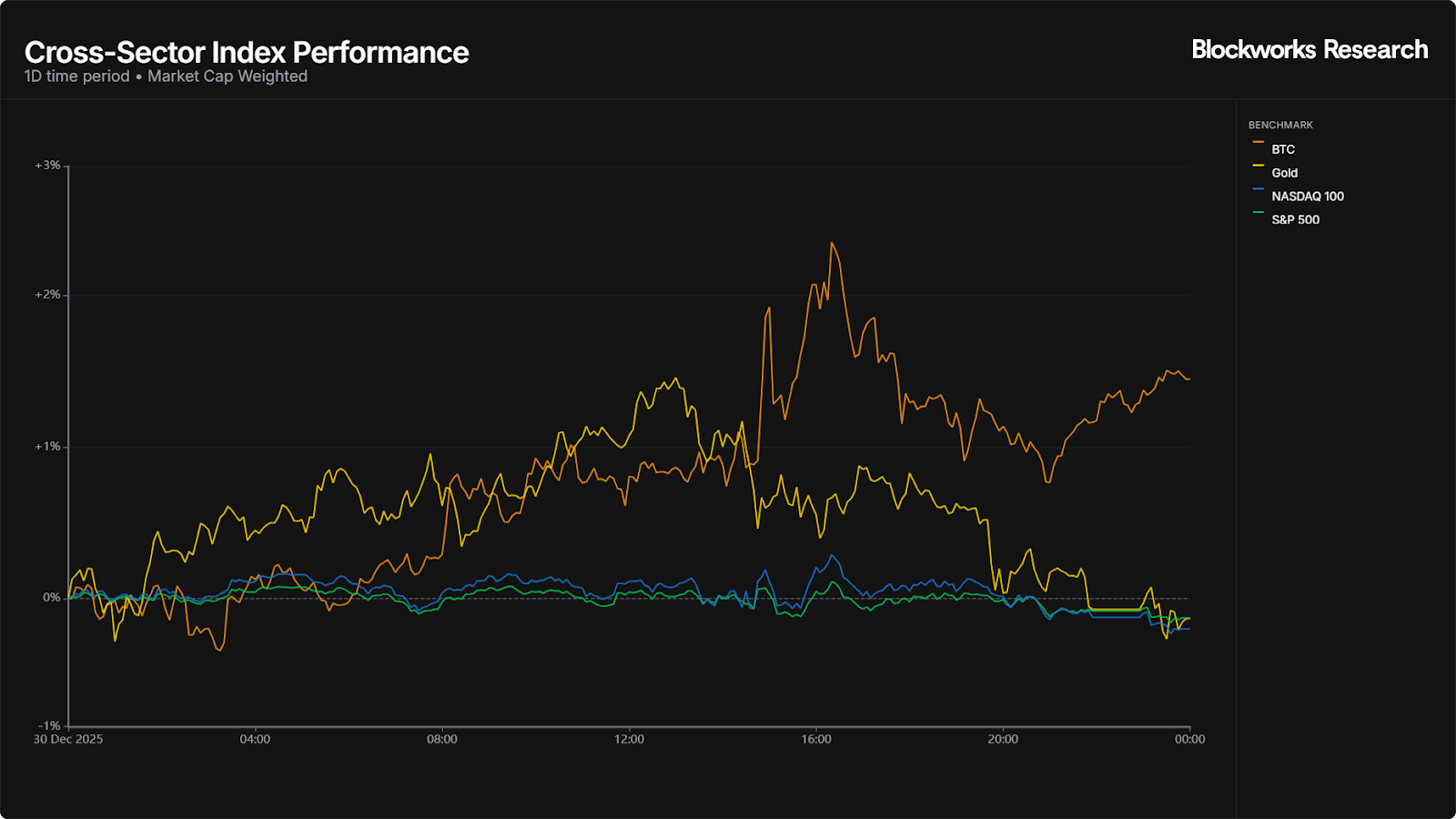

Markets leaned modestly risk-on over the session, led by a strong intraday move in BTC (+1.3%) while traditional assets struggled to gain traction after hitting all-time highs. Gold finished slightly lower (-0.2%) after an early bid faded while US equities chopped sideways, with the Nasdaq 100 (-0.1%) and S&P 500 (-0.1%) hovering just below flat. Crypto volatility expanded meaningfully while equities remained pinned, suggesting incremental risk appetite is still being expressed first through digital assets rather than stocks.

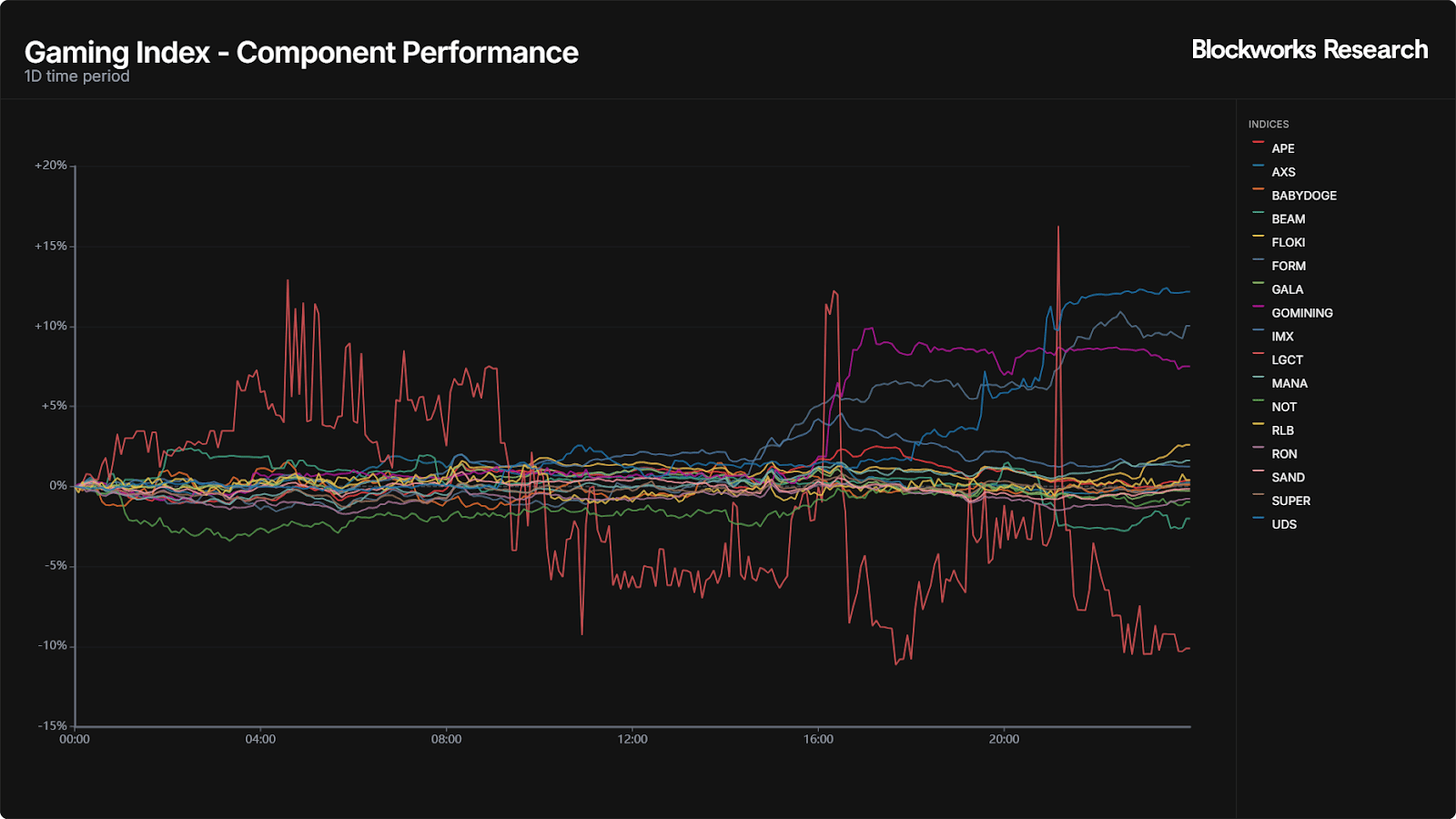

Crypto sector performance was notably bifurcated. Gaming led decisively (+8.1%), extending its recent momentum, with Meme tokens (+1.7%) behind as speculative appetite crept back into higher-beta narratives. More “fundamental” groupings like Revenue Leaders (+1.2%), L1s (+1.2%) and AI (+1.1%) all posted solid gains. In contrast, structurally challenged segments continued to lag: L2s (-3.1%) and Crypto Miners (-3.4%) were the clear underperformers, with crypto equities (-0.6%) and DEXs (-1.0%) also sliding.

There was a broad-based bump in the crypto gaming sector as multiple names advanced on the day. The move appears driven less by macro inputs and more by positioning and sentiment rotation. After weeks of capital concentrating, traders are selectively rotating into gaming names with clearer product roadmaps or near-term catalysts. UDS (+12.2%) was the standout name as Steam launched the flagship game “Undeads” on its platform only two weeks ago.

This kind of tangible product launch (especially on a major PC platform like Steam) tends to drive renewed interest and fundamental buying pressure because it signals real adoption and utility for the token (players need UDS for in-game assets/features). Zooming out, YTD, UDS is up over 3400% — making it one of the best performing gaming and crypto assets in a rough 2025.

UDS has outperformed other Steam-linked gaming tokens because it combines real, live product depth with meaningful token utility, rather than relying on a single announcement or future promise. Unlike many peers, Undeads Games already operates a multi-game ecosystem (PC, mobile, and Steam-listed flagship), where UDS is actively used for play-to-earn rewards, staking, NFT upgrades and marketplace transactions, creating ongoing onchain demand and token sinks. This is reinforced by longer-term development execution, visible ecosystem partnerships and a clearer circulating-supply profile compared to many GameFi projects that suffer from thin liquidity or aggressive unlocks.

— Marc

Yield Basis (YB) is a novel DeFi mechanism that uses leverage to eliminate impermanent loss (IL) from AMMs. The founder of Yield Basis is the same founder as Curve and there exists synergies between the two. The mechanics of how this mechanism works can be found here. After years of witnessing failed attempts, YB strikes me as the first solution with legs, but you don’t need to take my word for it. YB already accounts for the three-largest BTC DEX pools in DeFi ($400M+).

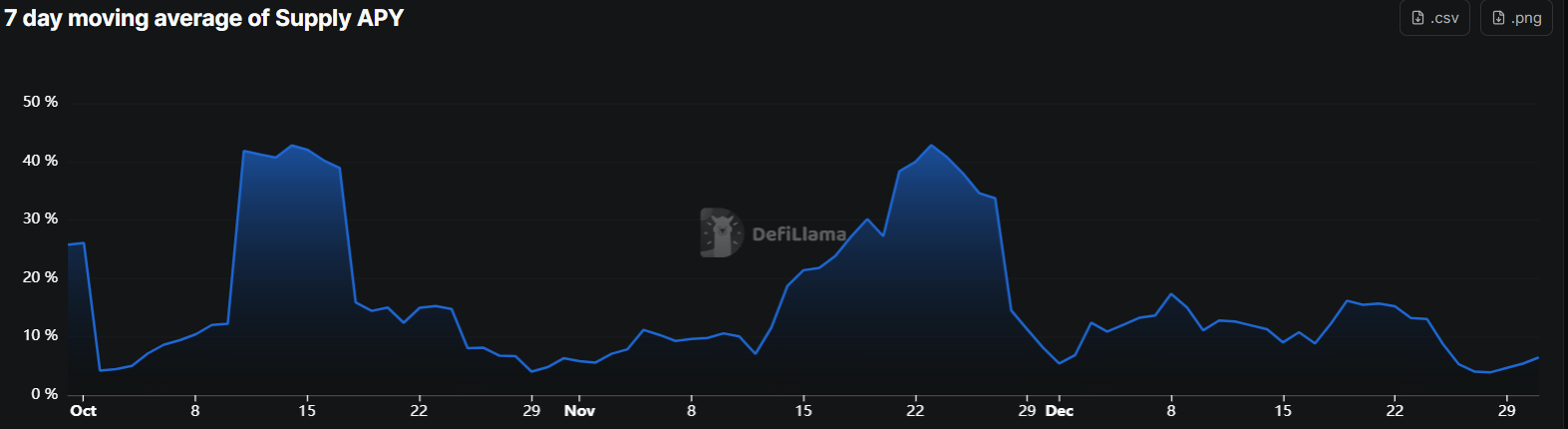

Moreover, this means that (wrapped) BTC token holders can now earn yield while supplying liquidity. Historically, the seven-day moving average for this (supply) yield has ranged between 4% and 40%.

And since many of us don’t LP into AMMs (unless we’re farming something), you might have forgotten that yields are earned in the pool tokens. So yes, that means native BTC yields.

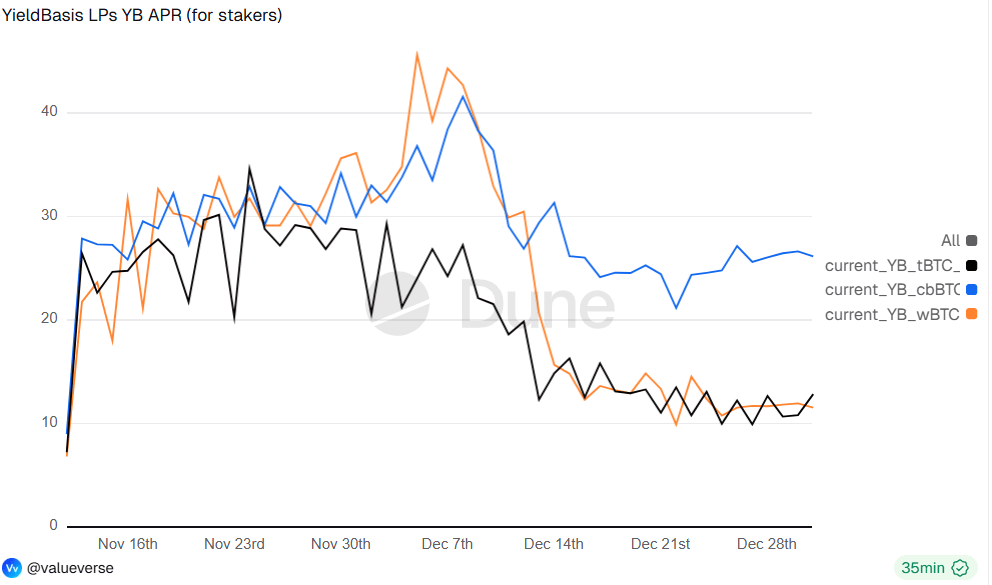

As for the token itself, it’s not just a meme governance token, there’s actual value. The fee switch was turned on earlier this month. YieldBasis LPs have two options for generating yield from provided liquidity: (a) hold the ybBTC LP token and receive BTC-denominated trading fees, or (b) stake ybBTC, forgo BTC-denominated trading fees and participate in YB emissions.

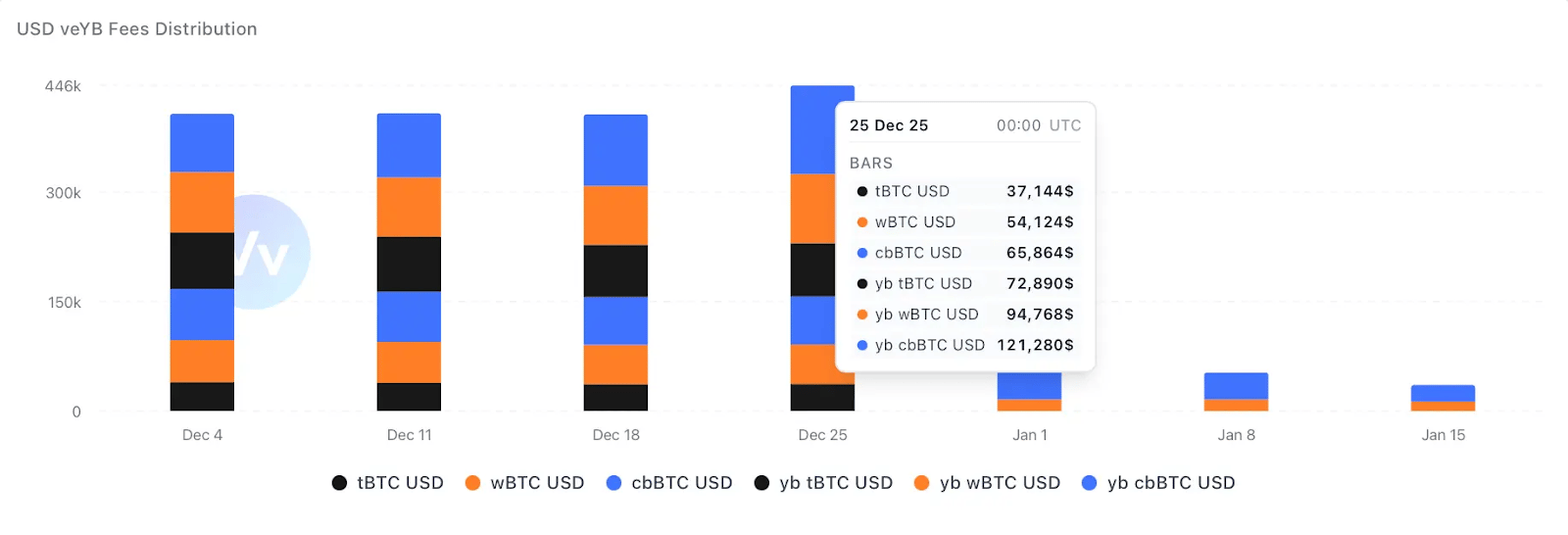

Corporate Finance 201 agrees with me when I say, "Don't buy back the token, give me the earnings from the protocol, and I can decide for myself if and when I want to buy the token.” What I mean is, dividends give optionality, especially when you can choose which type of yield to receive. For perspective, for the week ending Dec. 25, roughly $450K was distributed (and this figure is despite caps on the LP pools).

Source: Valueverse

If you’ve read this and think there’s finally a way to earn native yield on BTC without IL and without the risks, effort and costs of hedging, then you’d be right — but there could be more. YB is positioned as more than just an IL-free AMM: It is a yield and liquidity infrastructure designed to make otherwise non-productive assets yield-bearing while establishing secondary markets. By targeting wrapped native assets and tokenized RWAs, YB can theoretically make any sufficiently liquid and volatile asset productive, allowing issuers to earn from liquidity rather than subsidize market making, while also enabling holders to access yield and downstream DeFi use cases such as collateralization.

This model extends beyond crypto majors like BTC and ETH to tokenized commodities and equities such as Gold, Silver, and NVDA, whose onchain adoption is currently constrained by IL, shallow liquidity, and the absence of yield or liquidation pathways. Yield Basis could unlock these markets by offering a unique, superior yield option with an attractive risk-reward profile, deep liquidity and strong network effects.

YB is not without risk. I encourage you to read the paper (or get AI to explain it) and understand the potential downsides, but also the potential unlocks that YB has to offer.

— Marc

Crypto’s premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: 0XNL for $100 off.

Provenance’s 2026 plans

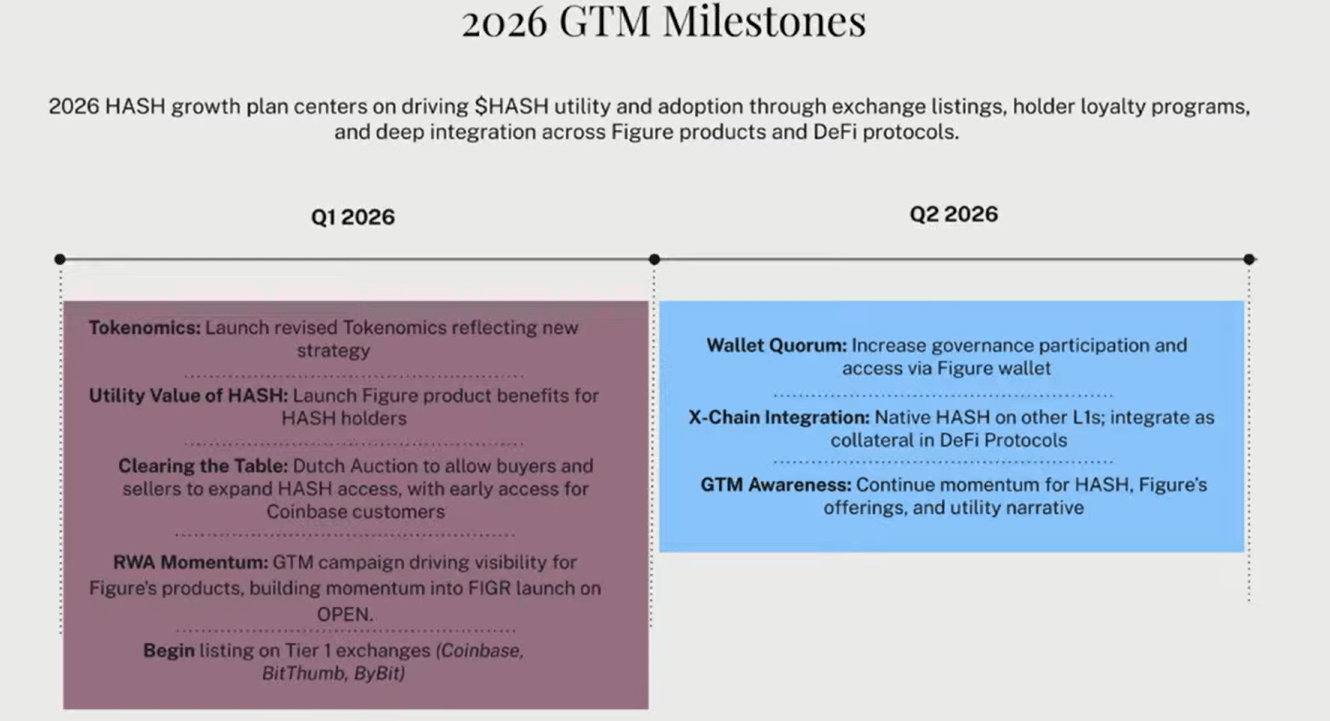

Provenance leadership shared a 2026 go-to-market plan that combines near-term listing strategy with a major governance proposal. Network metrics highlighted current momentum with about 100 active validators, ~57K weekly transactions, and roughly $20B in TVL, alongside growing activity from Figure’s onchain products (including Yield, Democratized Prime, and Hastra), which are driving fee generation and visible onchain growth.

The broader thesis: Instead of “super apps,” it expects a wallet-centric market where users self-custody assets and plug into a distributed app layer, making decentralization, validator diversity and sustainable validator economics core priorities.

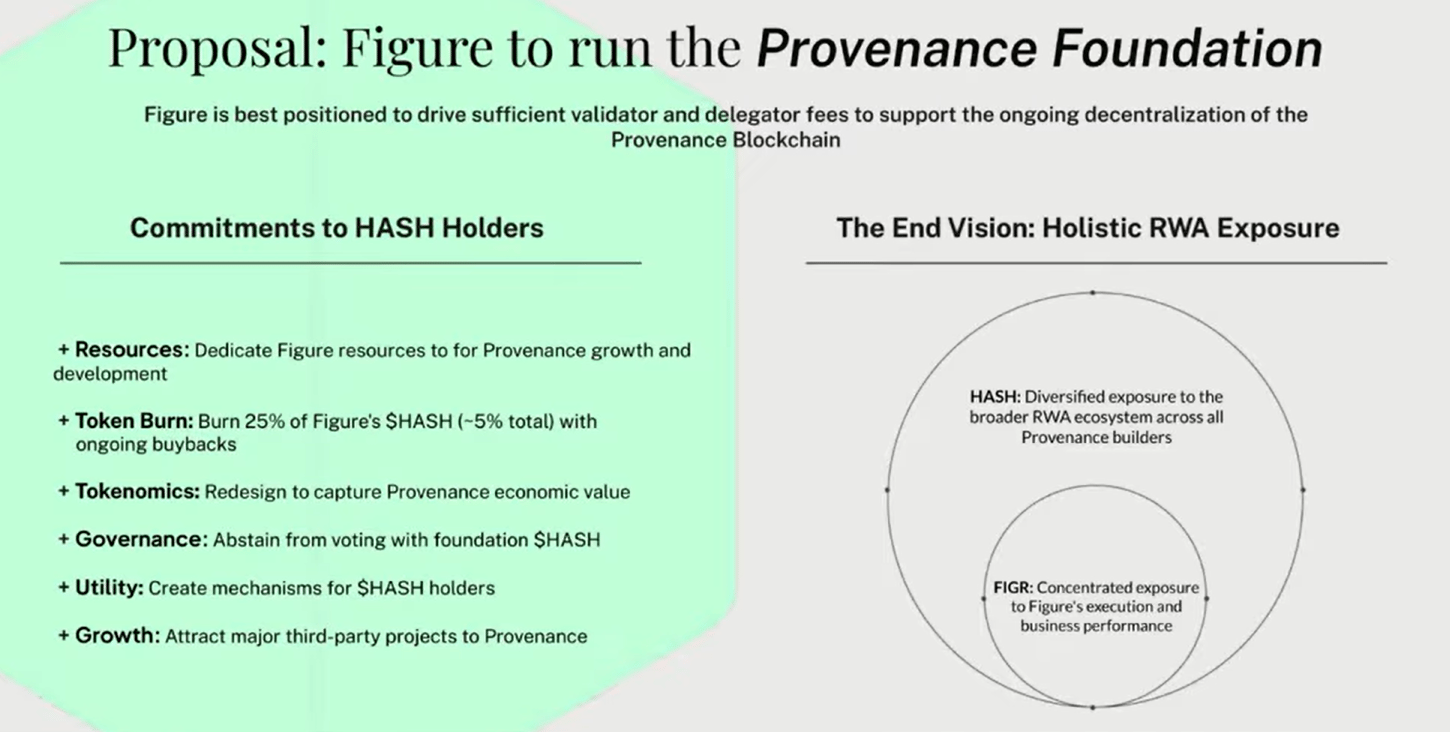

A key announcement was Figure’s intention to step in to run the Provenance Foundation “at the will of HASH holders,” backed by Figure’s engineering and business development resources. The proposal includes redesigning token economics to introduce clearer “network fees” (in addition to gas) to better capture the economic value created onchain, strengthen validator/delegator incentives, and push Provenance toward top-tier fee rankings. Figure also said it would not vote foundation HASH and would rely on community approval via one-hash-one-vote governance. Additional utility for HASH holders was floated, including product discounts (e.g., on Democratized Prime and certain Figure loans) and other community perks.

On go-to-market and liquidity, the team reiterated ongoing work toward a Coinbase listing but said they will broaden outreach to other major exchanges (e.g., OKX, Bybit, and later Binance) rather than wait on a single timeline. They plan a Dutch auction ahead of centralized exchange listing to clear large buy/sell interest and reduce volatility, with individuals able to participate as buyers or sellers.

Product-wise, Figure emphasized an “equity onchain” roadmap for 2026: listing Figure equity natively on Provenance, trading via an alternative trading system with a limit order book and market makers, and enabling portability into DeFi use cases like collateralized borrowing.

2025 was a good year for Figure and Provenance, and 2026 is shaping up to be a better one.

—Marc

Here, Vitalik examines how Big Government, Big Business and Big Mobs are all becoming more powerful at the same time, creating dangerous concentrations of power in the modern world. He argues for preserving progress via balance of power, advocating diffusion, pluralism, decentralization and adversarial interoperability to prevent any single force from becoming hegemonic.

Real-world asset tokenization has moved from pilots to infrastructure, and 2026 marks the point where it becomes a default strategy for asset managers rather than an experiment. With treasuries, private credit, index products and equities already operating on public blockchains under regulated structures, growth is now driven by real utility — faster settlement, programmable compliance and global distribution, rather than speculation, with RWA TVL projected to exceed $100B. Licensed index products and proof-of-index frameworks are bringing conservative institutional capital onchain, while tokenized equities are evolving toward native, regulated issuance with enforceable shareholder rights. As issuance matures, distribution and liquidity become the key differentiators, making tokenization not a question of innovation, but of competitiveness.

In 2025, DeFi transitioned from a cycle-dependent speculative arena into a durable, layered financial system defined by institutional-grade infrastructure and specialized execution. Stablecoins emerged as the undeniable monetary base layer, with total market capitalization surging 50% to $305B and settlement volumes reaching $52.9T, surpassing the combined scale of Visa and Mastercard. The year was marked by a "flight to quality" and architectural convergence; trading shifted toward intent-based execution and high-performance perpetual venues like Hyperliquid, which processed over $2.76T in volume. While liquidity grew, value capture remained concentrated, with the top 10 protocols generating 60% of all fees. On the balance sheet side, Real-World Assets (RWAs) became core collateral, as tokenized treasurys and private credit scaled to $9.12B and $18.71B, respectively. As infrastructure costs collapsed — evidenced by an 86% reduction in Ethereum transaction fees — DeFi applications began outearning their underlying blockchains, signaling a shift toward a professionalized, revenue-driven economy where sustainable economic models and risk management finally superseded incentive-driven growth.