- 0xResearch

- Posts

- Lido’s next phase

Lido’s next phase

Lido’s $4M buybacks, MSTR below NAV

Lido rolled out a buyback plan worth ~$4 million/year at current run-rates and paired it with a roadmap that pushes the protocol beyond staking. At the same time, Strategy (MSTR) slipped below mNAV of 1 and other BTC treasury names are trading at 0.4-0.8x, putting renewed focus on the model. In today’s edition of 0xResearch, we break down the data, the market reaction, and what stood out across sectors.

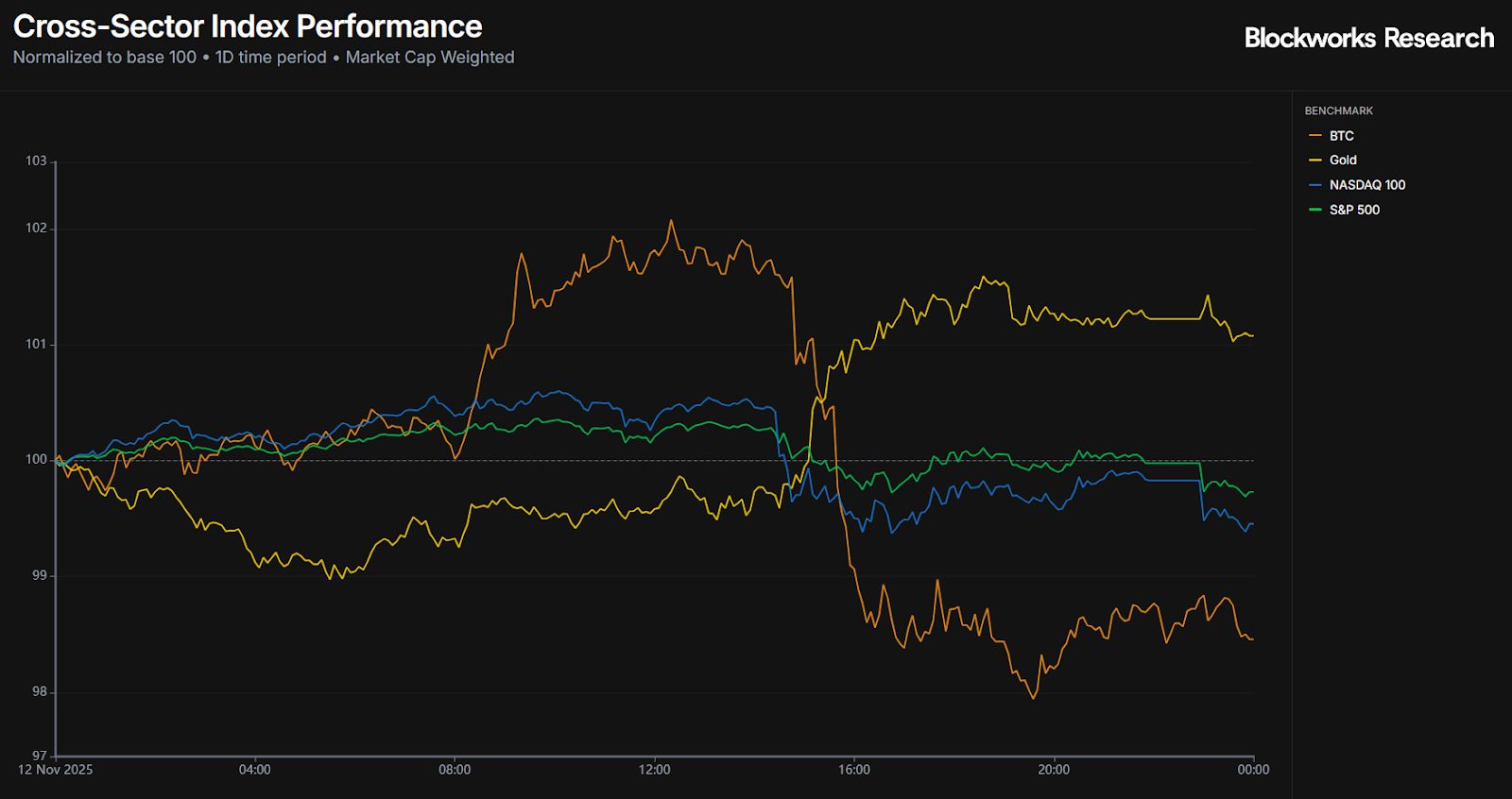

Markets slid again despite the optimism that started the week, with the S&P 500 down -0.27%, the Nasdaq down -0.55%, and BTC lower by -1.54%. The flight to safety trend continued, with Gold climbing 1.08% on the day.

Weakness in Big Tech stocks has been the main drag on the tech-heavy indices, while capital continues to rotate into other sectors of the market that have lagged in the recent rallies. The Dow Jones Industrial Average stood out, rising 0.68% on the day and 2.5% for the week.

Concerns around an AI bubble remain in focus after SoftBank sold its entire $5.8 billion stake in Nvidia. Even though CoreWeave beat Q3 sales estimates, its shares slipped on a lower revenue outlook due to data center delays. However, on the earnings call, the company reaffirmed that AI demand still far exceeds available capacity and that it remains supply constrained.

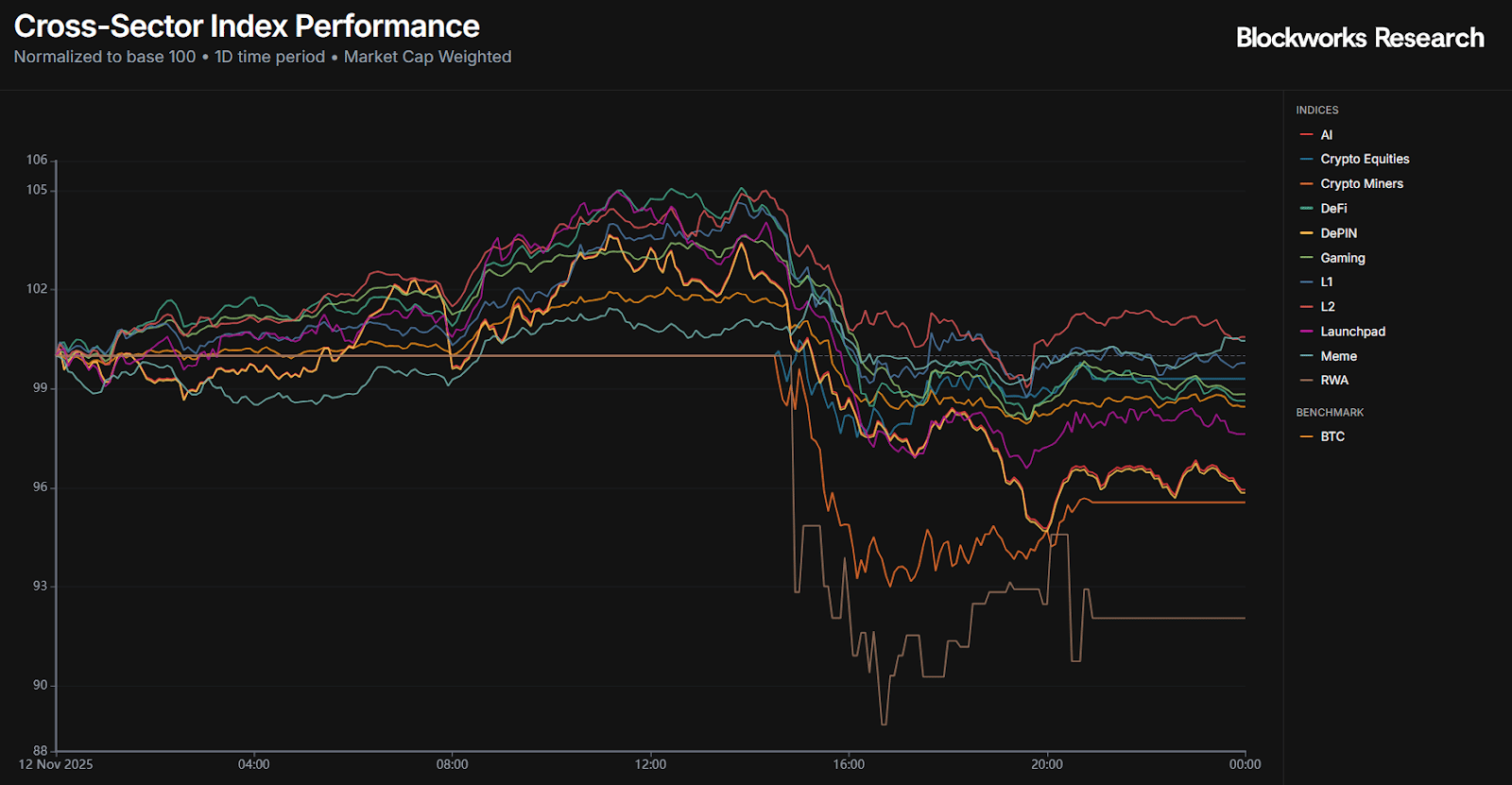

In crypto, most indices ended the day in the red, dragged down by BTC and broader equity weakness. The standouts were L2s and Memes, which gained 0.57% and 0.45%, respectively. L2s were boosted by MNT, up 2.24%, likely driven by excitement around Mantle UR and its positioning in the growing Neobank narrative. The Meme index got a lift from MemeCore, which rose 1.44% on the day.

Laggards included Crypto Miners and RWA, which dropped -4.44% and -7.94%, respectively. The pullback in AI-linked equities spilled into mining stocks, many of which have pivoted toward AI data centers. After a YTD rally of 105.5%, some profit taking in the sector is also to be expected.

— Kunal

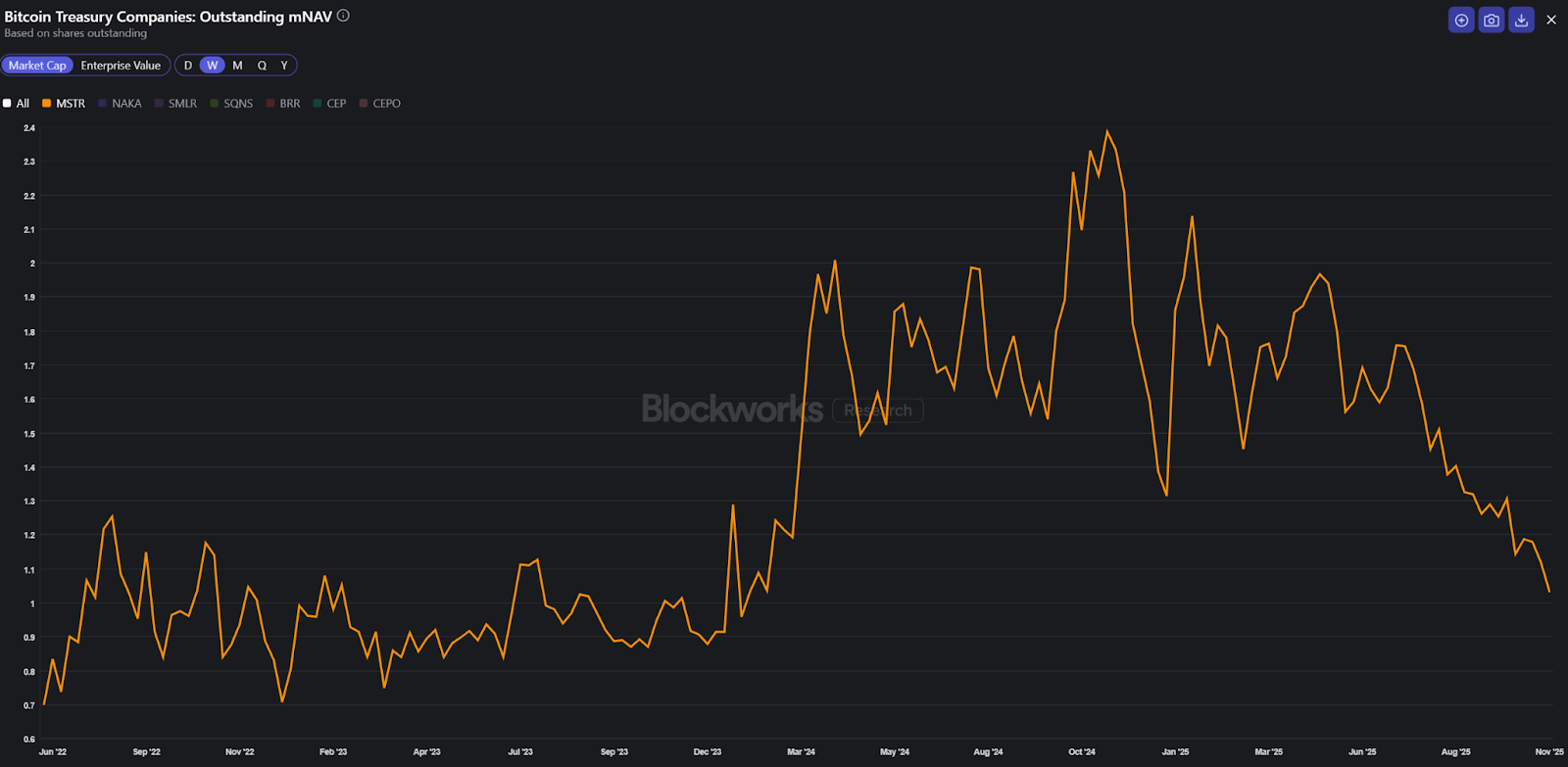

Doubts are starting to build around the sustainability of treasury companies now that the original pioneer of this playbook, Strategy (formerly MicroStrategy), is trading below an mNAV of 1 for the first time since early 2024. The company’s mNAV multiple has steadily bled lower from a peak of 2.4 following Trump’s election win.

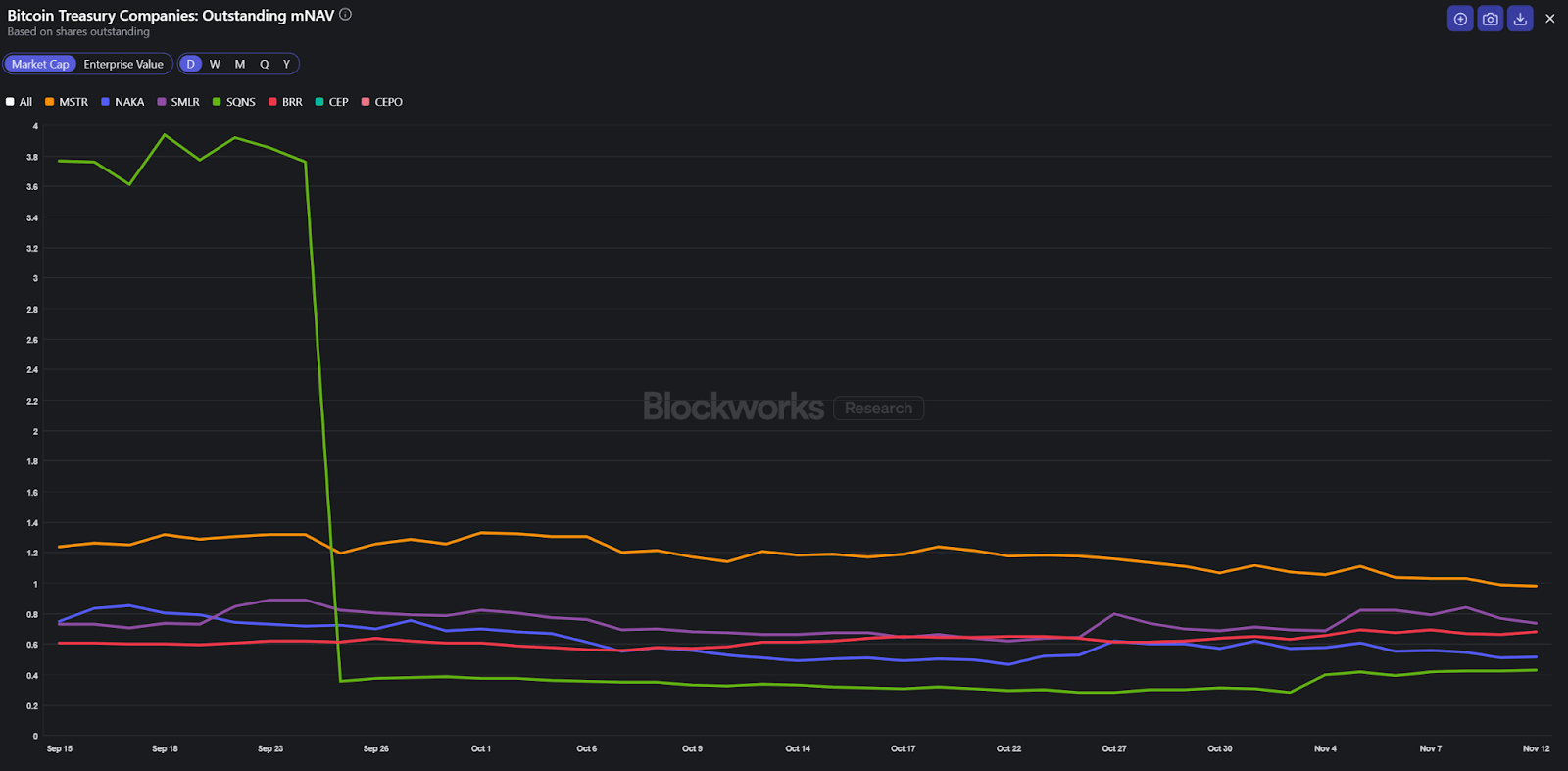

The picture looks even worse for other BTC treasury names, which now trade at mNAV multiples between 0.4 and 0.8. Investors are increasingly skeptical of the model’s long-term viability. Relying on constant equity issuance to buy more BTC has become harder to justify as share dilution begins to outpace BTC accumulation. Many now see these companies as leveraged proxies for bitcoin, rather than efficient ways to gain exposure.

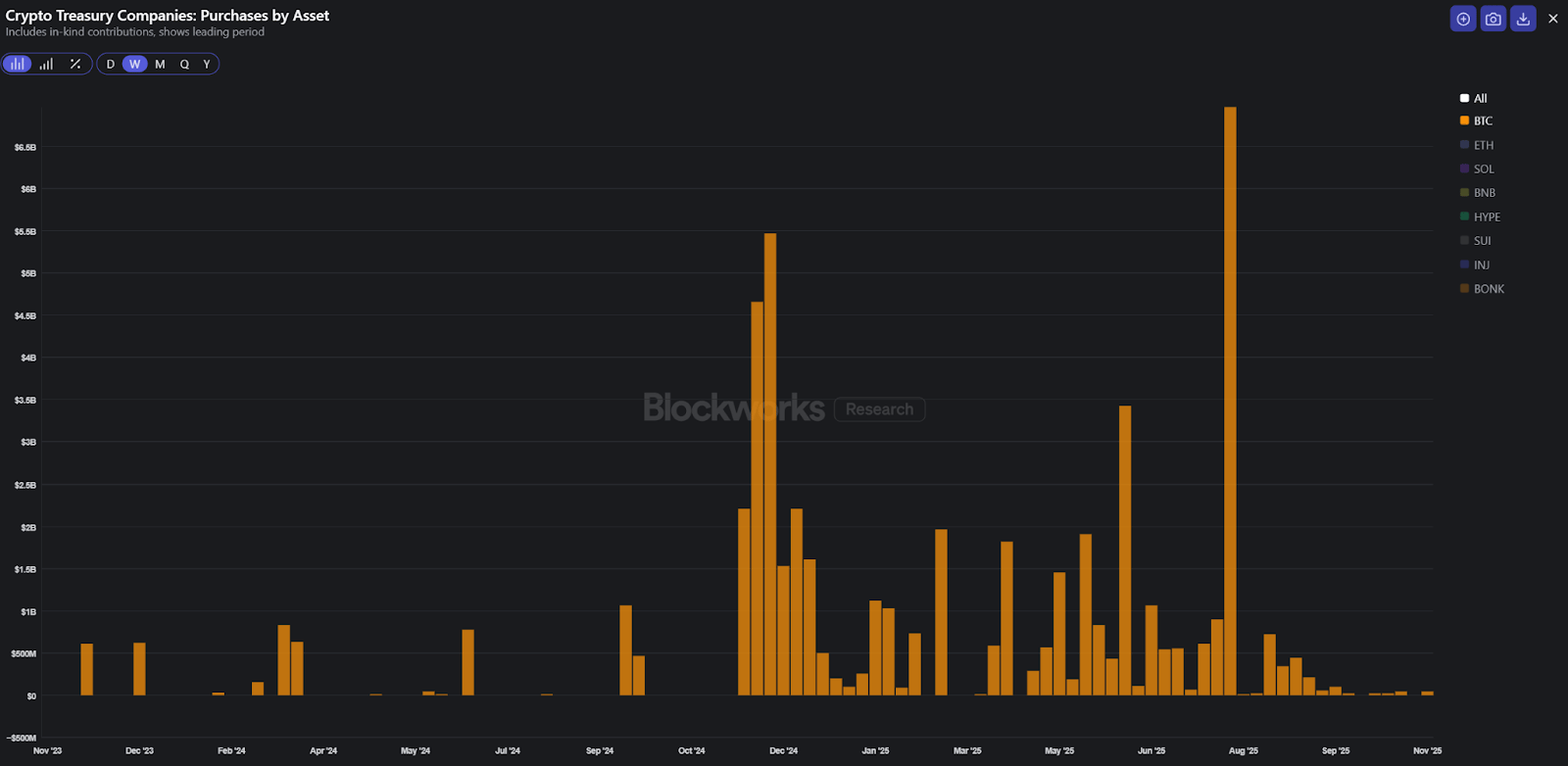

That skepticism is showing up in the data. BTC purchases by treasury companies have slowed dramatically, down from billion-dollar waves every few weeks to more modest weekly buys of $25 million-$50 million recently.

Sometimes simplicity wins. While BTC is up just 0.2% over the past six months, MSTR has fallen -46.7%, and the newer BTC treasury names are down between -30% and -60%. Brutal, to say the least.

Still, it may be too early to write off the trade entirely. If these discounts persist, a GBTC-style opportunity could emerge where investors can acquire BTC exposure at a meaningful discount through public equities. And if there is one company that knows how to survive and adapt through cycles of expansion and contraction, my bet would be on Strategy.

— Kunal

Lido DAO

Following Uniswap's move to align the Uniswap Foundation and Labs entity and implement a fee switch, Lido is also moving from pure governance into explicit value return for LDO holders.

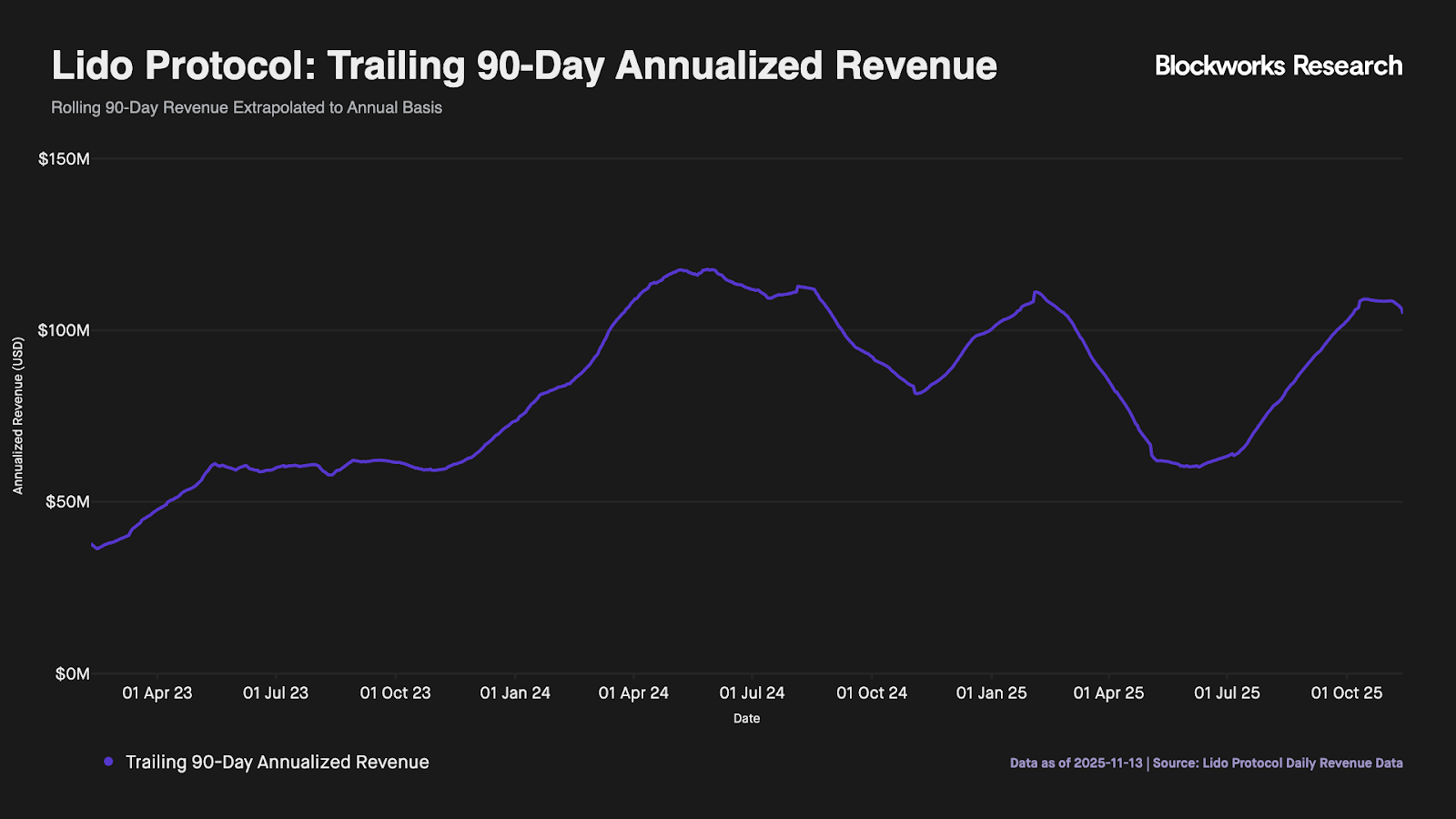

A new Liquid Buybacks proposal would route a slice of staking revenue into automated LDO buybacks, executed via NEST auctions and deposited into an LDO/wstETH LP fully controlled by the DAO. The mechanic is straightforward: Once ETH > $3K and annualized revenue > $40 million, 50% of incremental staking inflows above that threshold are used to buy LDO, capped at $10 million per rolling year. At today’s run rate, this translates to roughly $4 million/year in buybacks.

At first glance, this amount looks low. Aave runs a $50 million/year buyback program; Uniswap’s fee switch would have burned $26 million in the last month alone (not adjusted for wash trading). Secondly, the design also buys only when conditions are strong (high ETH price and high revenue) meaning Lido accumulates LDO when it is relatively expensive, while offering no counter-cyclical support during weaker market periods when the token likely suffers most.

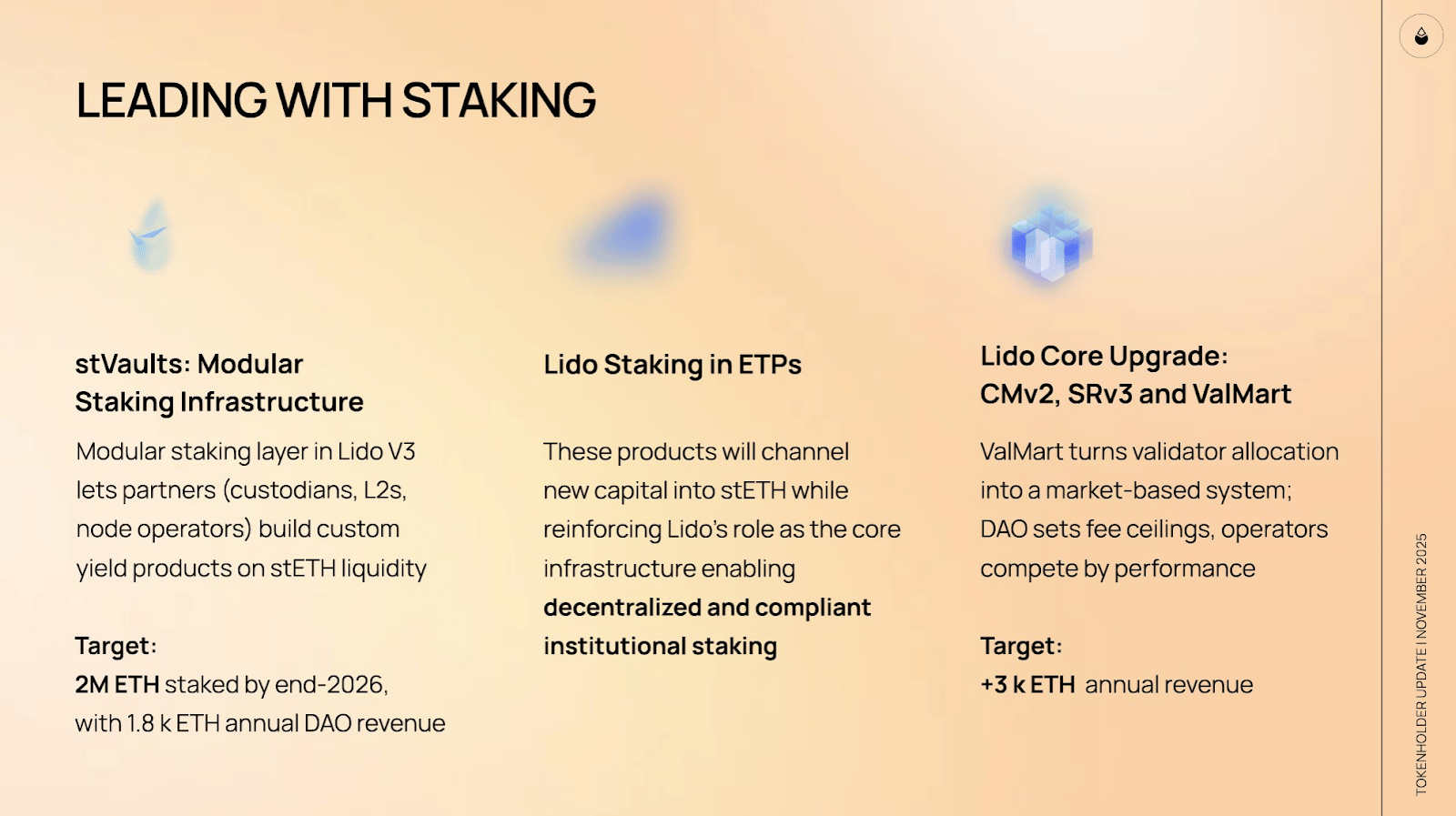

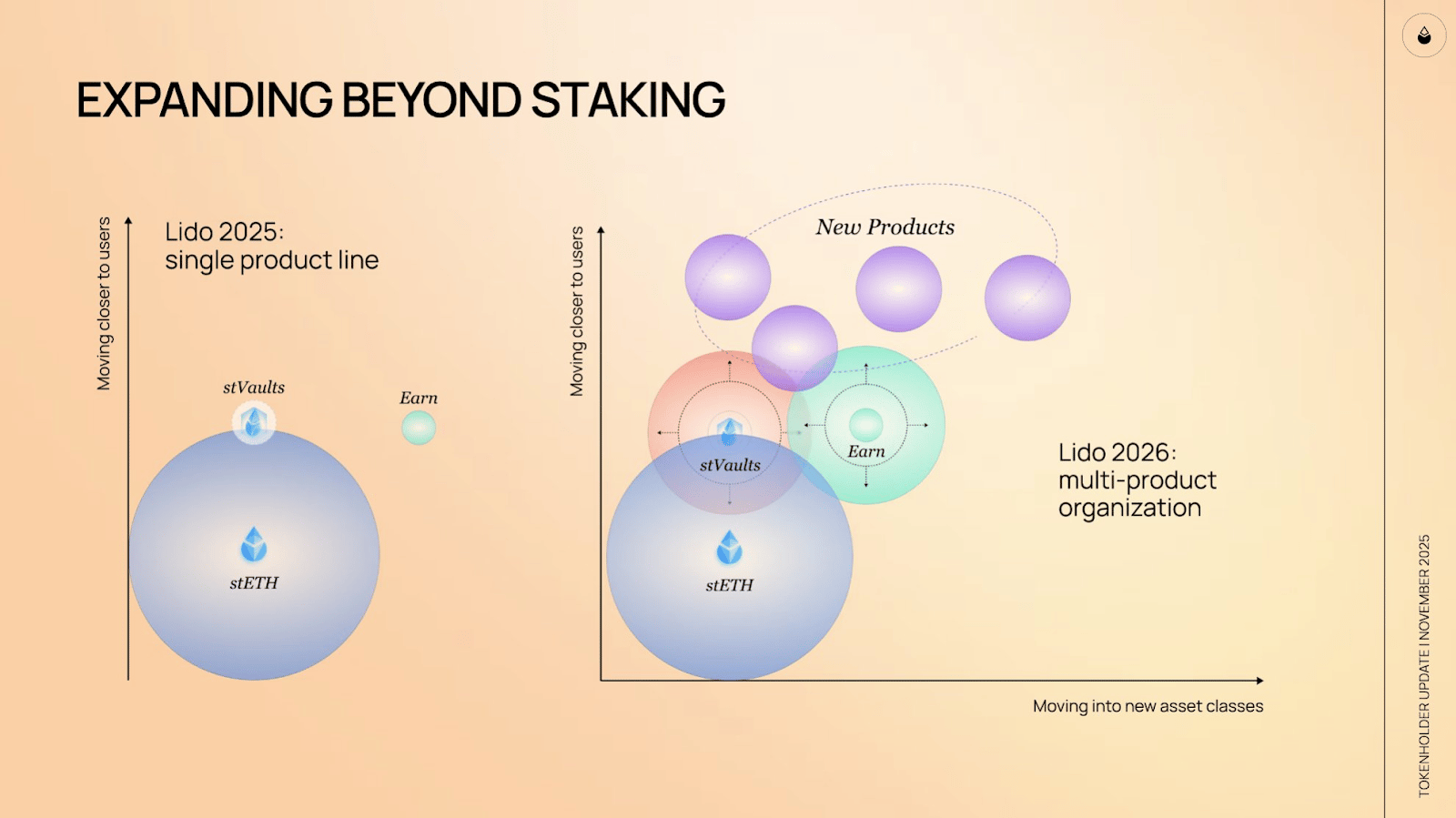

However, Lido also outlined where the protocol is heading over the next 18 months, from a single-product staking business to a multi-product liquidity platform anchored by stETH.

This sets the stage for Expanding Beyond Staking, where Lido evolves from a single-product stETH protocol in 2025 into a multi-product organization in 2026. Lido’s stVaults become the configurable chassis for institutional staking and yield strategies, Earn expands as the simple “default yield” front door for retail and exchanges, and a new tier of structured and automated products sits on top as Lido moves both closer to users (distribution) and rightward into new asset classes.

Ultimately, Lido appears to be converging on the same insight that other LST protocols have already internalized: LSTs are structurally low-margin, and the real opportunity lies in the products and financial rails built on top of them. We see this clearly with Jito’s BAM (block-based auction markets) and EtherFi’s Cash, both of which extend beyond pure staking yield. Lido’s roadmap is a necessary step in that direction.

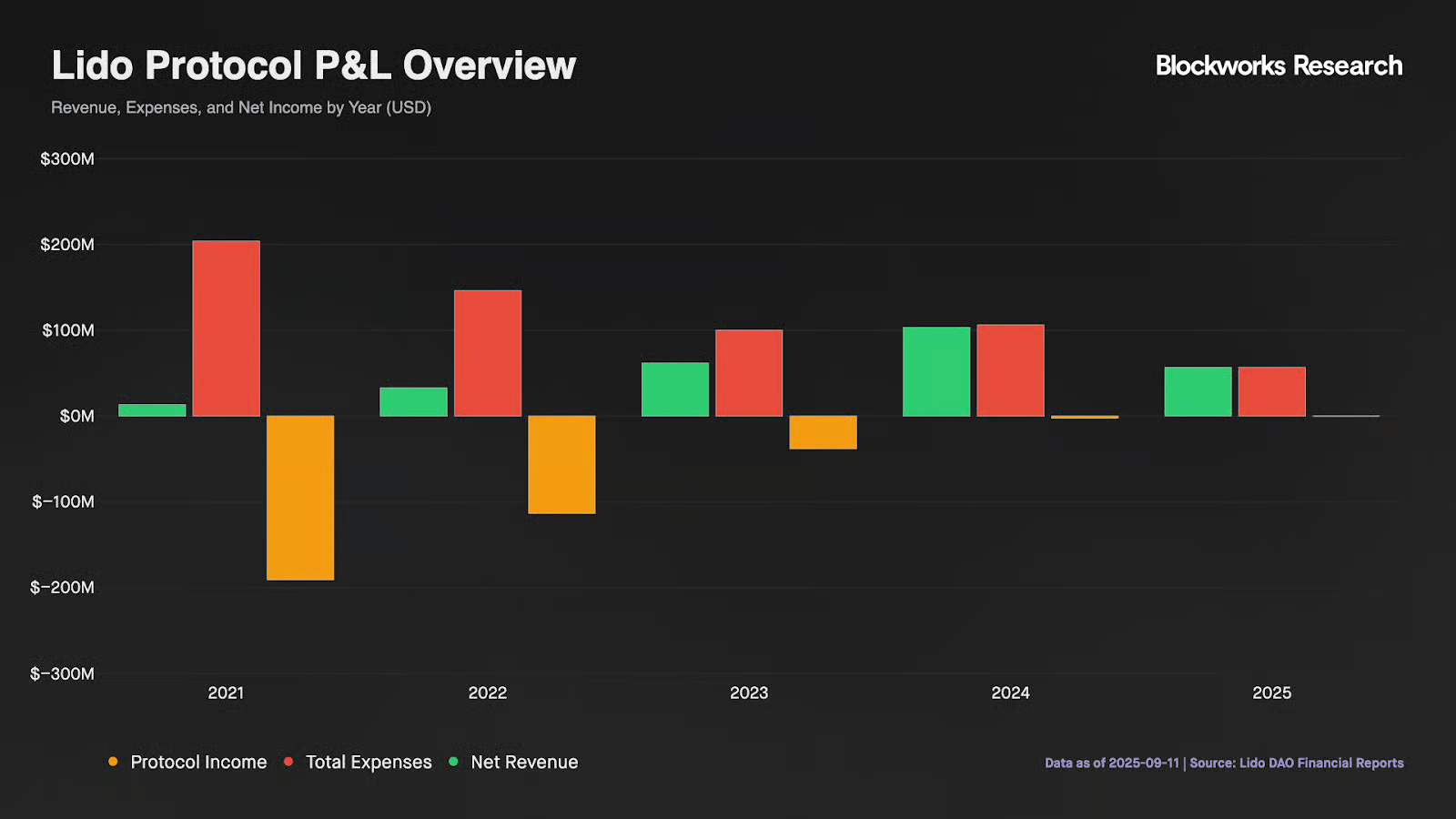

However, when it comes to buybacks, the P&L dynamics we highlighted previously still apply. The DAO remains unprofitable (Q3 income was -$200K), raising questions about how impactful these changes truly are today — or if it's too little, too late for Lido.

— Shaunda

Blockworks Research profiled Loopscale, an orderbook-based lending protocol on Solana that blends direct market matching with modular credit vaults. The report highlights its rapid listing speed, fixed borrowing rates and diversification away from SOL into stablecoins and yield-bearing assets. Loopscale now acts as a credit layer for projects like Hylo and OnRe, enabling specialized loans and yield loops with competitive returns. While Kamino remains the dominant player, Loopscale’s faster integrations, granular risk pricing and flexibility position it as a key venue for new Solana-native credit products.

Aave Labs outlines how the Fed’s shift toward rate cuts shapes DeFi and why Aave is well positioned for this cycle. Earlier easing fueled DeFi Summer, while the 2022-23 hiking period triggered a downturn but also drove the creation of yield assets like LSTs, LRTs, tokenized Treasurys and yield-bearing stables. Entering today’s easing phase, Aave benefits from stronger fundamentals, including deeper institutional adoption, leadership in scaling yield assets, and Horizon’s rise as the largest RWA borrowing venue. With treasury yields compressing and capital rotating back into crypto-native yield, Aave’s product breadth positions it as the benchmark rate and resilient backbone for onchain credit.

RedStone’s Yield Bearing Assets & Stablecoins 2025 report argues that traditional finance is built on yield while crypto is still only 8-11% yield generating vs. 55-65% in TradFi, leaving a 5-6x “yield infrastructure gap” that YBAs are now starting to close. It traces how yield bearing stablecoins, LSTs and LRTs, Bitcoin yield products, and tokenized RWAs are becoming the default format for onchain capital, with assets like sUSDe flowing through Pendle and Morpho to act as cash, fixed income and credit collateral in one composable stack. The piece emphasizes that institutions are being pulled in by pure capital efficiency rather than narratives, but that large-scale adoption hinges on risk transparency, robust curation and resilient oracle design. RedStone and Credora position themselves as the infra that makes this possible by providing standardized risk ratings and oracle tooling so yield bearing assets can evolve from speculative yield plays into the core collateral, settlement and reserve layer of an institutional DeFi economy.