- 0xResearch

- Posts

- Klarna’s crypto turn

Klarna’s crypto turn

KlarnaUSD lands on Tempo

Hi all, happy Wednesday! Markets bounced as December rate cut odds swung back above 80%, lifting BTC, equities and gold. In crypto, MegaETH, one of the industry’s more beloved projects, had a slight problem with its predeposit program yesterday.

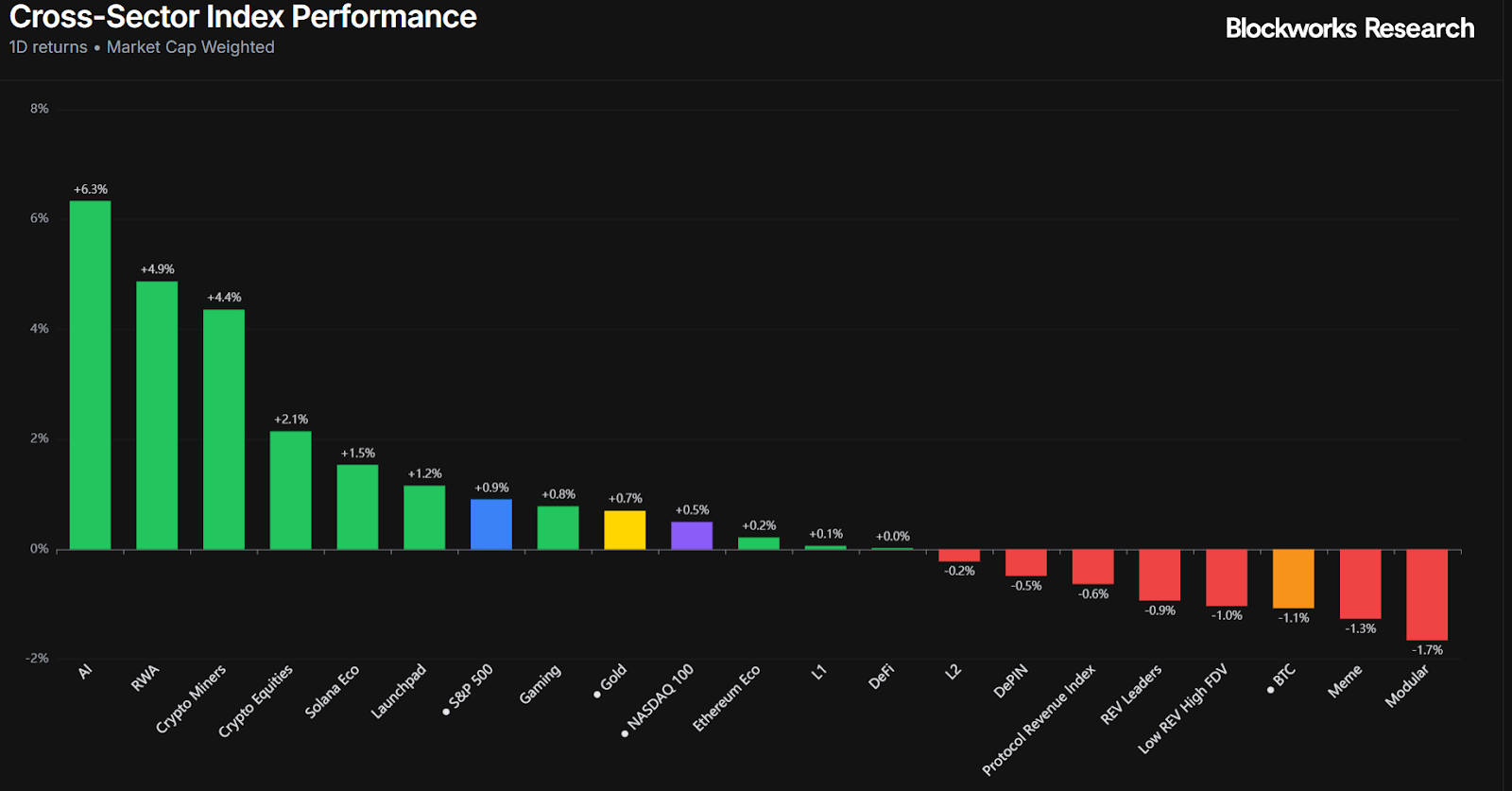

Markets tilted risk-on in the latest session, with most major crypto-adjacent sectors posting gains even as BTC (-1.1%) softened slightly. Traditional benchmarks were steady as the S&P 500 eked out a small move higher (+0.9%), while Gold (+0.7%) and the Nasdaq 100 (+0.5%) saw modest strength. Overall tone skewed constructive, led by thematic crypto sectors rather than broad-based flows.

Crypto sector indices showed a clear rotation into high-beta themes. AI was the standout performer, ripping +6.3% on the day, followed by strong moves across RWA (+4.9%) and Crypto Miners (+4.4%). On the downside, Modular networks lagged sharply (-1.7%), followed by Meme (-1.3%) and High-FDV Low-Rev tokens (-1.0%), signaling selective risk-taking rather than a wholesale chase across the curve.

The moves fit a familiar narrative as investors gravitate toward sectors with strong storytelling momentum, such as AI, RWA, and miners (also AI), while trimming from overextended or lower-quality pockets of the market. With BTC drifting sideways and macro catalysts sparse, sector dispersion continues to dominate short-term performance.

— Marc

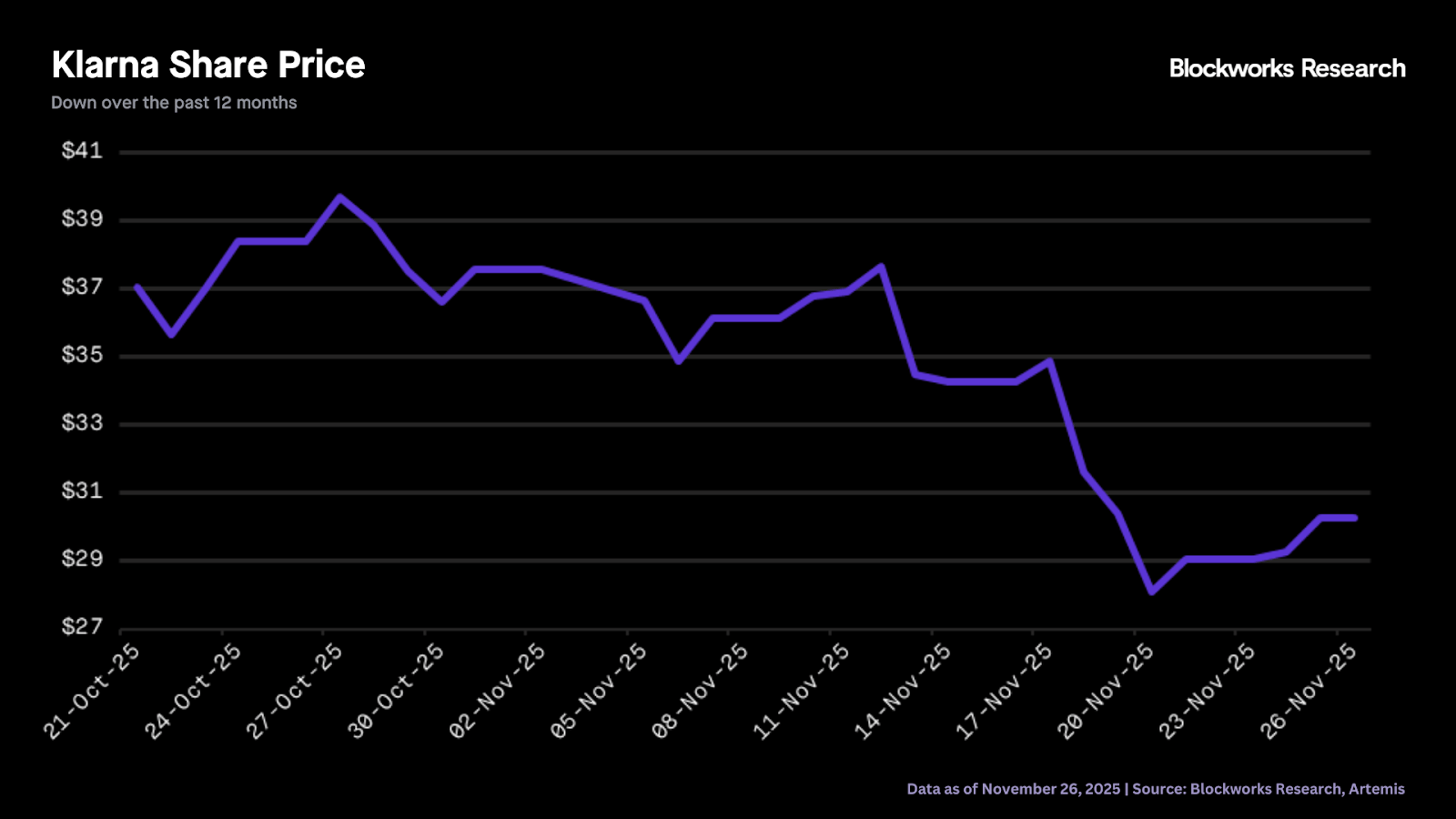

Klarna announcing KlarnaUSD on Tempo (the new Stripe/Paradigm payments chain) is a clean validation of the “stablecoin rail-replacement” trade that’s been building behind the scenes. With McKinsey pegging stablecoin settlement at $27 trillion annually, the narrative is shifting from speculative infra to industrial-scale payments plumbing. Klarna’s 114 million users and $118 billion GMV aren’t crypto-native flow, but they’re exactly the kind of volume that can reshape onchain settlement curves once mainnet access opens. This initiative could help improve its weak stock performance by cutting payment costs and opening new revenue streams through faster, cheaper global transactions. It also signals innovation and business-model diversification, which may boost investor confidence after a period of poor market sentiment.

Tempo’s positioning as a purpose-built payments L1 (low latency, predictable fees, Stripe-grade compliance rails) sets up a clear competitive lane vs. Solana/ETH L2s on consumer payments. A Stripe + Klarna distribution stack is a real threat — not only to crypto protocols, but to entities working on the $120 billion cross-border segment that Klarna is explicitly hunting. The interesting angle is that KlarnaUSD is built via Bridge’s Open Issuance, keeping issuance modular and likely multichain over time.

For crypto markets, this reopens the “fintech-stablecoin adoption” trade that last peaked during PayPal’s PYUSD rollout. Watch for rotation into payment-aligned infra, high-throughput chains, issuer infra, compliance middleware and real-world settlement protocols. However, despite the institutional appetite, the regulatory overhang isn’t gone, as a bank-issued stablecoin hitting global distribution will likely trigger scrutiny in both the EU and the US. Either way, watch Tempo ecosystem assets and payment-rail narratives — Klarna just put real enterprise weight behind onchain settlement.

— Marc

The DAS NYC Black Friday Sale has arrived!

Don't miss out on the lowest prices for crypto's premier institutional event.

March 24-26.

Oops

Yesterday, there was an unfortunate mistake with the MegaETH predeposit process. The predeposit launch failed at first due to an incorrect SaleUUID inside the predeposit contract, which blocked all transactions until a multisig update was executed. Once fixed, Sonar’s KYC service began rejecting traffic because of a misconfigured rate limit, leaving users unable to fund for about 23 minutes. When service resumed, the $250 million cap filled almost instantly from users who had been refreshing the site. The team planned to raise the cap to $1 billion in the next hour, but the transaction was executed about 30 minutes early by chud_eth.

Once a Safe transaction has the required signatures, anyone can broadcast/execute it, including someone not on the multisig. Deposits surged again, and the team attempted to control inflows by lowering the cap to $400 million, then $500 million, with the latter taking effect and filling. Because KYC issues were still affecting users, the planned expansion to $1 billion was canceled. A withdrawal page is being prepared for those who want to remove funds.

Despite this unfortunate situation, MegaETH’s USDm experiment seems to have begun! For context, USDm is a partnership between MegaETH and Ethena, and represents Ethena’s first (popular) attempt at offering white-labelled stablecoins. USDm is MegaETH’s native/aligned stablecoin, where underlying Treasury bill yield generated by USDm is set to be used to subsidize gas costs and internalized as revenue.

Over the past day, MegaETH generated $55K in revenue off USDm, putting it in seventh place in terms of highest revenue-generating blockchains. Building out basic primitives on your own chain is a great way for chains to monetize more efficiently, as revenue through transaction fees has proven to be highly volatile and relatively low.

Coinbase Ventures outlines synthetic RWA exposure, prop AMMs and prediction-market aggregators as near-term breakout areas, alongside major openings in onchain reputation-based lending and privacy infrastructure. Looking beyond crypto, Coinbase Ventures is also excited about DePIN-style robotics data networks, proof-of-humanity standards and AI agents that automate smart contract development. Builders in these categories are encouraged to reach out as Coinbase Ventures actively deploys into these themes.

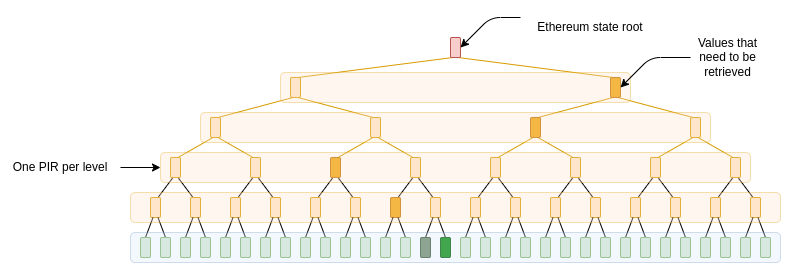

Vitalik introduces Plinko, a new private information retrieval (PIR) protocol that lets users read from large databases (think: Wikipedia, RAG/LLM backends, blockchain state) without revealing what they’re querying, while significantly cutting bandwidth and server work versus classic PIR. Plinko uses a one-time “setup” phase where the client processes the dataset and stores a compact set of cryptographic “hints,” then answers each query by combining a small server response with the right hint to recover the requested value, without the server learning which cell was read. It doesn’t solve everything (especially fully offloading setup via FHE), but it pushes practical PIR much closer to real-world deployments for private search and private blockchain reads.

Crypto VC activity ticked up in Q3 2025 but remains far below prior bull market highs, with $4.6 billion invested across 414 deals, largely driven by a handful of major late-stage raises, including Revolut and Kraken. Early-stage activity stayed steady, valuations climbed back toward 2021 levels, and sectors like trading, AI, blockchain infrastructure and stablecoins continued to attract capital. The US maintained a clear lead in both deal count and dollars, even as macro headwinds, competition from ETFs and treasury products and shifting allocator interest toward AI tempered broader venture momentum.

BONK’s evolution from a holiday airdrop to one of the most entrenched Solana-native assets reflects the power of community, experimentation, and countless integrations. However, BONK’s future depends on the community’s ability to continually innovate, defend its cultural moat, and sustain meaningful burn mechanics in the face of competition and shifting narratives. If successful, BONK could remain a defining example of how a memecoin can transition into a lasting ecosystem asset.