- 0xResearch

- Posts

- Is the bottom in?

Is the bottom in?

BTC is back above Strategy's cost basis

Hi all, happy Tuesday!

Markets bounced after the weekend drawdown, with BTC reclaiming Strategy’s cost basis and breadth turning positive across most sectors.

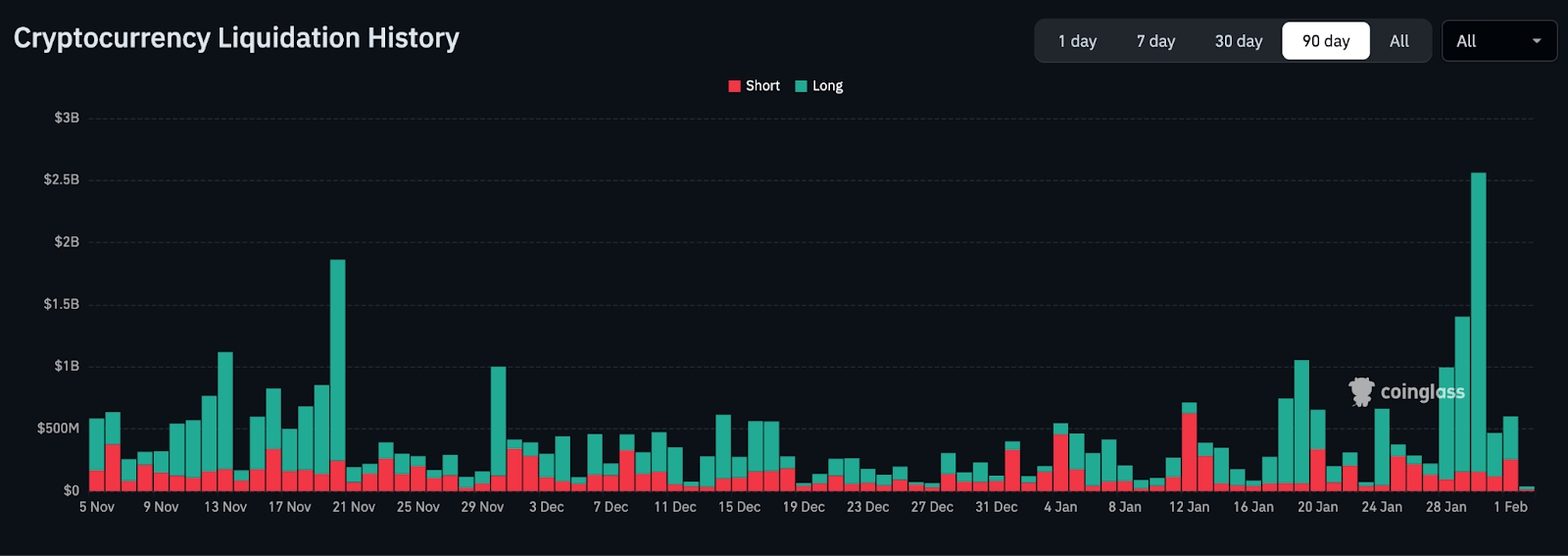

We also break down why Solana has proven itself as the most performant general-purpose chain in production, and by a wide margin.

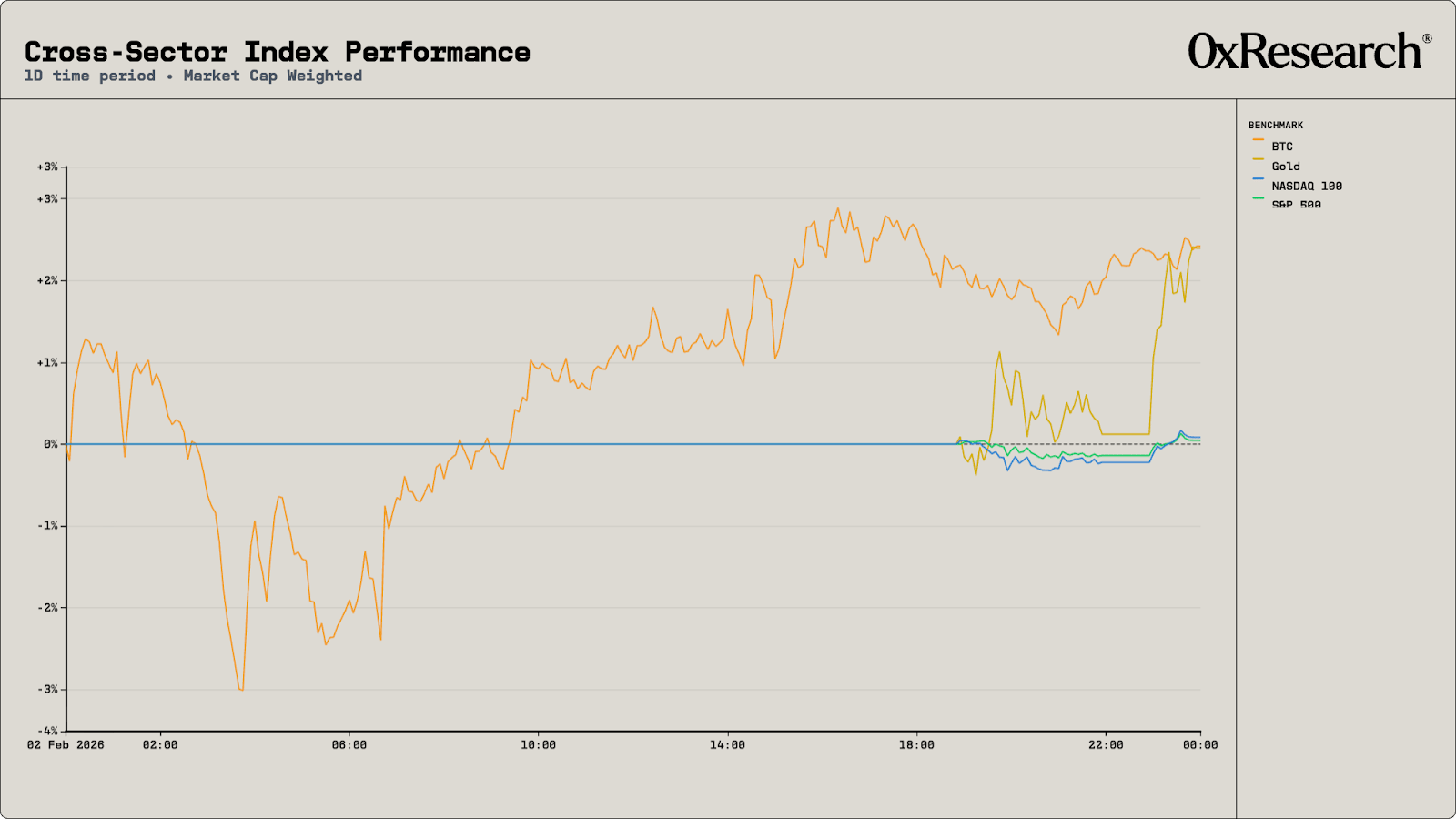

Bitcoin rose 2.4% on Monday to $79,124 after briefly dipping below $75,000 over the weekend, its lowest since April 2025. The move matched gold’s +2.4% on the day, and it outpaced the S&P 500 (+0.1%) and NASDAQ (+2.1%). Crypto still has ground to make up on the week, with BTC −6.5% versus the S&P’s +0.3%, after Friday’s metals crash triggered more than $3 billion in long crypto liquidations.

On macro, the Kevin Warsh Fed Chair nomination is the story worth tracking beyond the price action. Morgan Stanley’s Mike Wilson read it as the administration responding to gold going parabolic and dollar weakness, a deliberate confidence signal for bond markets rather than a pure hawkish pivot. The policy mix Warsh represents (shrinking the Fed balance sheet while cutting rates) is a novel regime for risk assets, and markets are still pricing what that means.

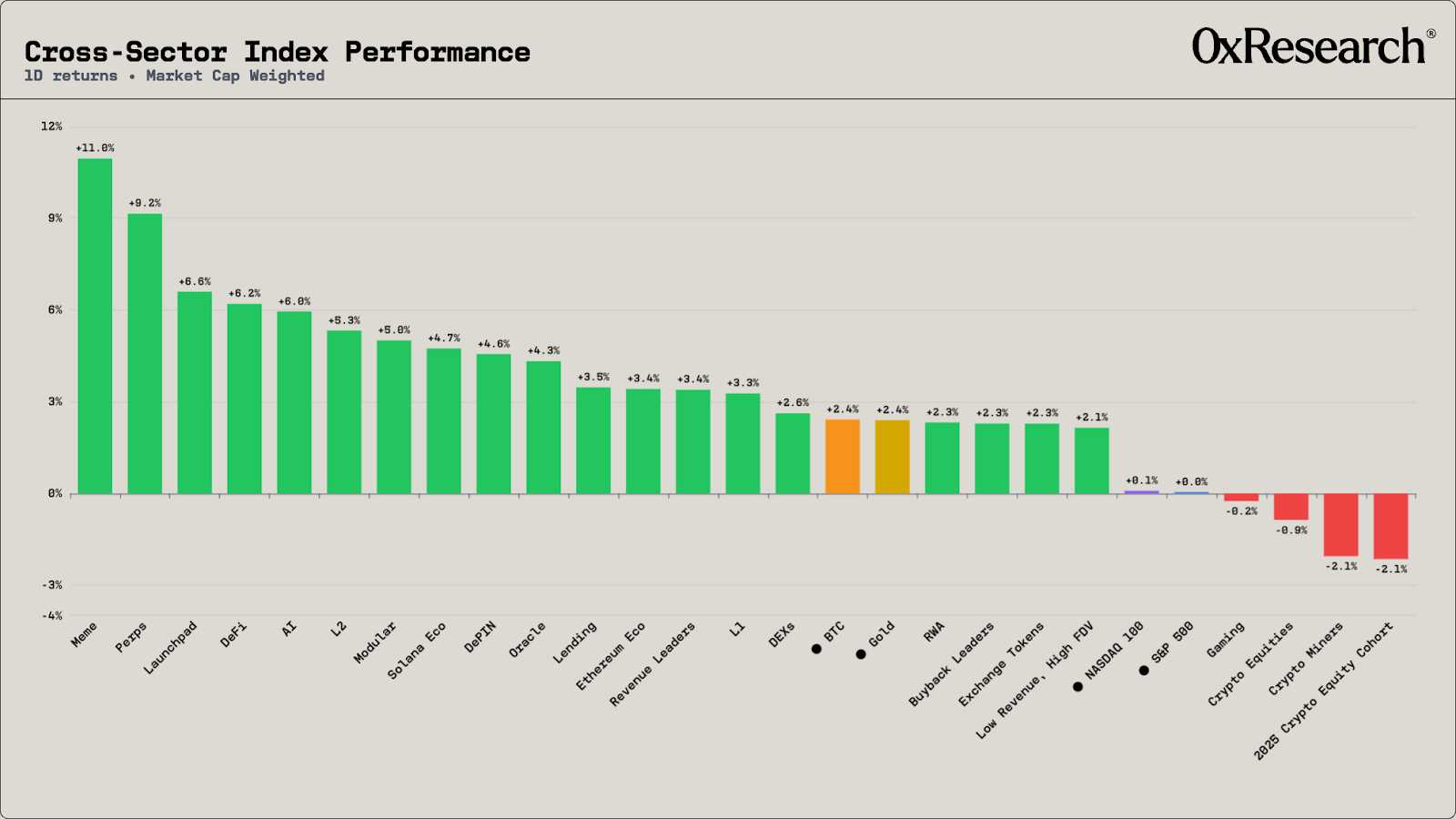

Regarding cross-sector index performance, 20 of 24 BWR indices closed green, showing the rally was broad-based. The Meme Index led the board at +11.0%, followed by Perps at +9.2% and Launchpads at +6.6%. DeFi (+6.2%) and AI (+6.0%) rounded out the top five. Gaming (−0.2%), Crypto Equities (−0.9%), and Crypto Miners (−2.1%) were the notable laggards.

The divergence between Memes and Gaming suggests speculative appetite is returning selectively. The perps rally ties back to platforms like Hyperliquid proving execution quality during the metals crash — Hyperliquid processed $257 million in silver perps over the weekend when COMEX was closed, and TradFi-linked perps now make up 31% of HL volume.

The bounce is broad, but BTC is still hovering near Strategy’s ~$76,000 cost basis. For now, the breadth and speculative leadership suggest risk appetite is returning at the margin, but not yet with conviction.

— Daniel

Brought to you by:

Submit a x402, AP2/A2A, ERC-8004 or agentic commerce agent or project for your chance to win a share of $50,000 in the SF Agentic Commerce x402 Hackathon presented by SKALE, Google Cloud, Coinbase Developer Platform, Virtuals, Pairpoint by Vodafone, and Edge & Node.

Registration is now open! Submit your build from February 11–13.

Stress Test: Solana outperforms

January ended with the largest liquidation event since the Oct. 10 crash, albeit on a far smaller scale (~$2.5 billion in liquidations on Jan. 31 vs. ~$19 billion on Oct. 10). Still, the late-month volatility event provided another stress test for decentralized networks.

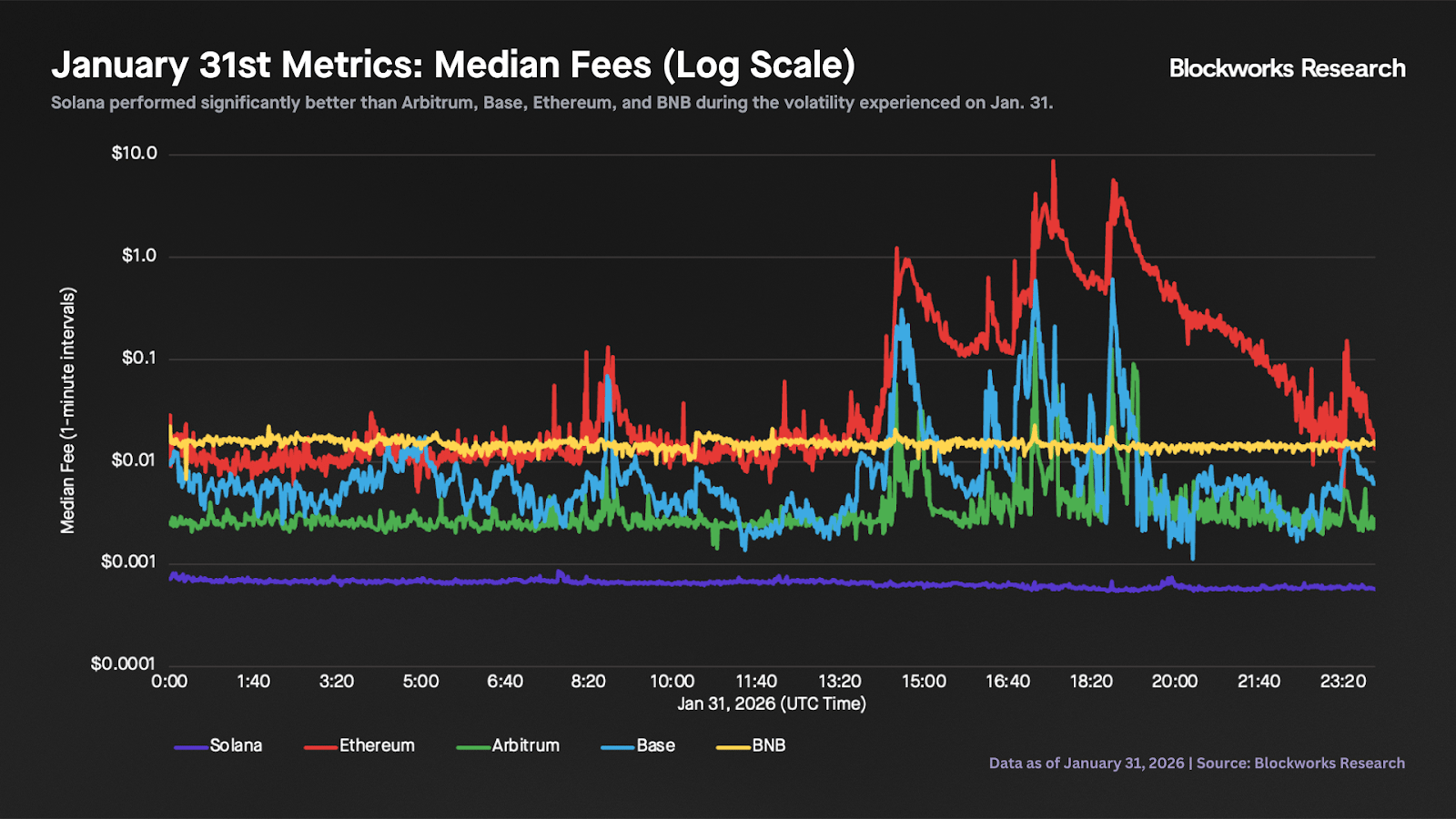

During Saturday’s volatility, Solana held up meaningfully better than Ethereum and major EVM chains across both median fees and throughput metrics.

The chart below compares median fees at 1-minute intervals across Solana, Ethereum, Arbitrum, Base, and BNB. Solana’s median fee hovered around $0.00065, peaked near $0.00085 during maximum volatility (a ~32% increase), and quickly normalized. BNB also remained relatively stable, though its median fee throughout the day was about 20x higher than Solana’s at $0.015.

By contrast, Ethereum, Arbitrum and Base saw substantially larger spikes that persisted for hours:

Base median fees spiked from $0.006 before the volatility event to $0.61 at peak (~100x).

Arbitrum median fees spiked from $0.003 before the volatility event to $0.20 at peak (~70x).

Ethereum median fees spiked from $0.018 before the volatility event to $8.67 at peak (~500x).

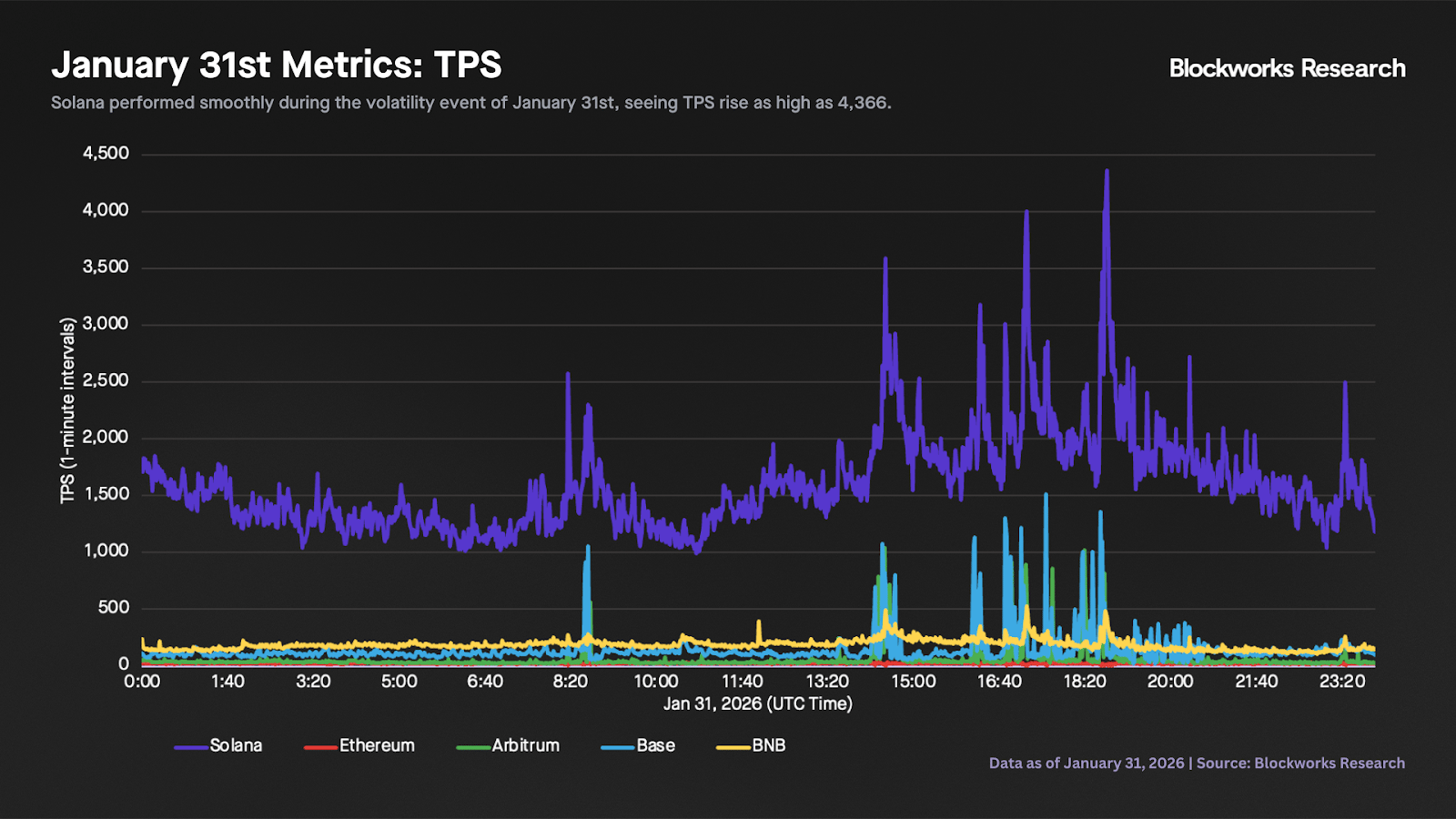

The chart below shows TPS behavior over the same window. Solana registered around ~1,500 TPS pre-volatility event, spiked to a peak of 4,366 TPS (nearly 3x) on 1-minute intervals, and reverted toward baseline within hours. Solana’s median TPS for the day (~1,500) was more than 8x higher than the next closest chain, BNB (~180).

Arbitrum and Base also saw meaningful spikes (peaking near ~1,042 and ~1,516, respectively), but their median TPS for the day (~36 for Arbitrum and ~113 for Base) suggests far lower baseline usage, with activity concentrated in stress windows.

Ethereum was the most notable outlier: TPS declined during the volatility event, falling as low as ~4, suggesting the network was experiencing significantly degraded performance.

With stress test after stress test, Solana has proven itself as the most performant general-purpose chain in production, and by a wide margin. Over the coming months, SIMD 286 is expected to be activated on mainnet, raising the block limit from 60M CUs to 100M CUs and supporting further TPS growth.

— Carlos

Logan Jastremsky, Managing Partner of Frictionless Capital, joins Tommy Shaughnessy to speak about the high-stakes race to build a global blockchain-based financial system.

Logan shares his updated thesis on why monolithic, high-throughput architectures like Solana are winning the battle for real revenue and trading dominance over modular designs. They dive deep into the “global exchange” vision, the physics of time-to-inclusion, and how innovations like prop AMMs are redefining market making.

Logan also explores the broader implications of AI, from the compounding power of Grok to the societal impact of a robot-led workforce.

Umberto from ChorusOne explores how Solana’s Multiple Concurrent Proposers (MCP) can behave like FIFO or like an auction depending on network design, not by definition.

In an ideal world with geographically dense proposers/relayers and locally reachable quorums, once a transaction is “reliably included” (quorum-attested), its priority is effectively locked in (i.e. leaders can only delay execution, not reorder it), yielding “probabilistic FIFO,” where earlier arrival strongly, but not perfectly, predicts priority. FIFO breaks when inclusion stops being local: Sparse infra or geographically-concentrated stake means later transactions closer to stake can form quorum first, and under blockspace scarcity or highly asymmetric infrastructure, merge rules plus fees turn MCP into a de facto auction.

The thread’s conclusion is that MCP is inherently neither FIFO nor an auction; it’s a flexible block-building framework whose economic behavior depends on how infrastructure, stake distribution, batching and merge rules are actually implemented.

Tom Lehman from Facet argues that MegaETH is a turning point for Ethereum L2s because it is openly centralized (4-of-8 multisig, EigenDA dependency) yet likely to offer the best UX and performance, forcing a real market test of how much users actually value decentralization.

The author contrasts “trustless” Stage 2 rollups like Facet (full protection against absent and hostile admins) with typical “blue chip” Stage 1 rollups (like Base), which already let a multisig do almost anything. The real extra safety Stage 1s provide is the “walkaway test” (you can still exit if the operator disappears), but MegaETH is betting that users won’t pay the UX cost for that kind of insurance.

Because MegaETH refuses to optimize for L2Beat-style trust scores, it pressures other rollups to stop spending on decentralization that users won’t reward and instead encourages them to compete on speed, fees, and features.

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.