- 0xResearch

- Posts

- Institutions, blockchains and 'pay-to-play'

Institutions, blockchains and 'pay-to-play'

Crypto AI may not be dead

Brought to you by:

Hello and guten morgen. Today we are going to be talking about cryptocurrencies and artificial intelligence (specifically, if they work well together). In addition, we’ll discuss the age-old nerd snipe question: Do institutions want to build their own L1s, build on existing L1s, or on L2s? If you have any strong opinions or questions, please do not hesitate to reach out to me via DM to tell me why I’m wrong or right!

— Boccaccio

What’s going on with AI?

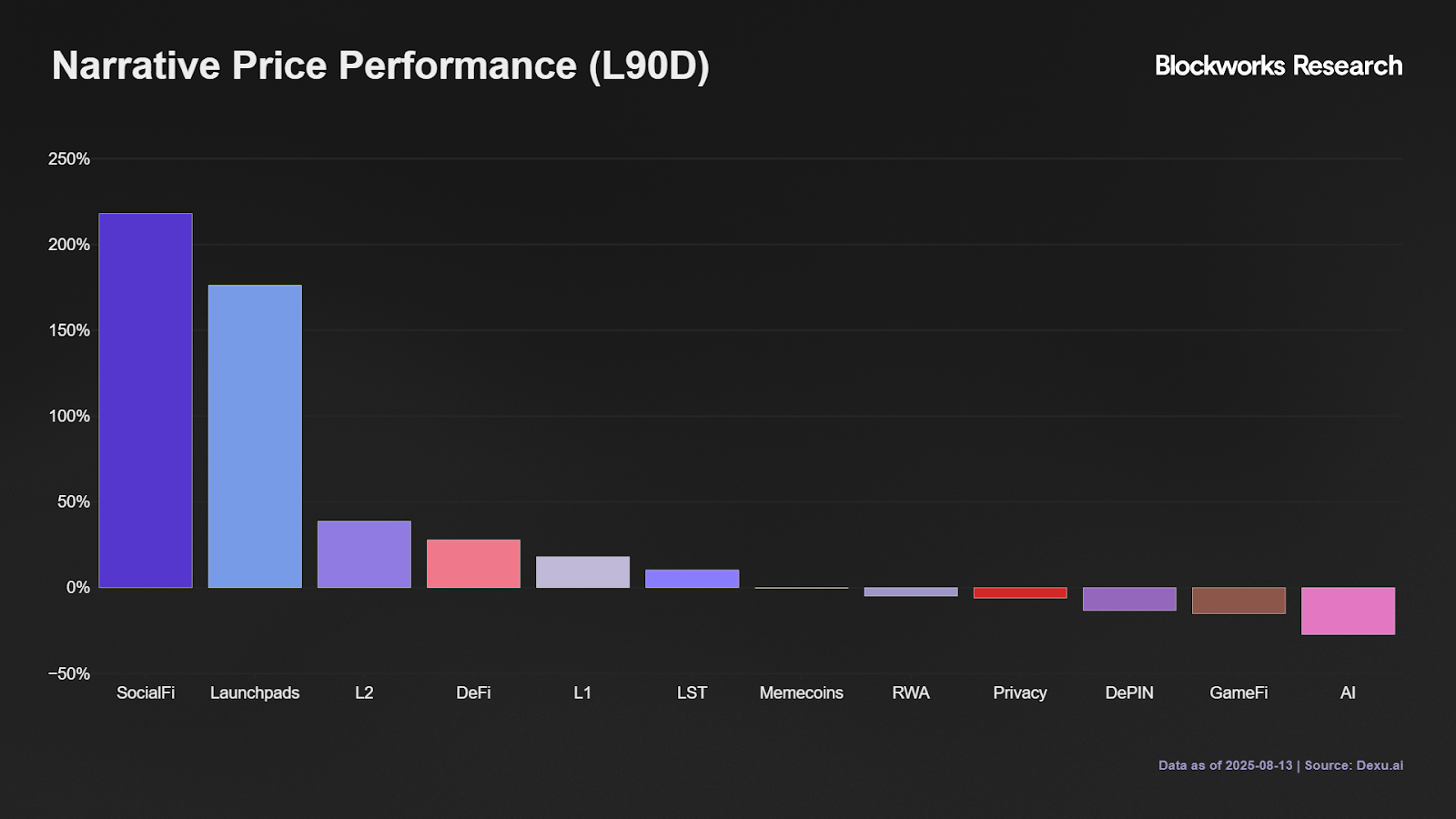

The last time AI x crypto caught fire was during Trump’s election victory rally. Back then, protocols like Virtuals, AI16z, Zerebro and various AI agent tokens delivered eye-watering multiples for investors. Fast forward to today, and the picture couldn’t be more different. Over the past 90 days, the AI sector is down 27% while equity markets roar higher, driven by Nvidia’s record run and tech giants pouring billions into AI.

So, what changed?

In my view, much of the sector’s initial rally was pure speculation. Tokens pumped on hype, but when products failed to meet expectations, prices cratered and never recovered. Many projects had little real utility for their native tokens, relying on token incentives to drive adoption. Once prices fell, incentives lost value, users left and without strong use cases, there was nothing to keep them. Meanwhile, the market has shifted. Investors now favor protocols with real revenue and genuine token utility. That shift has fueled the massive outperformance of launchpads and DeFi. Even memecoins, which thrive in speculative manias, have lagged this rally.

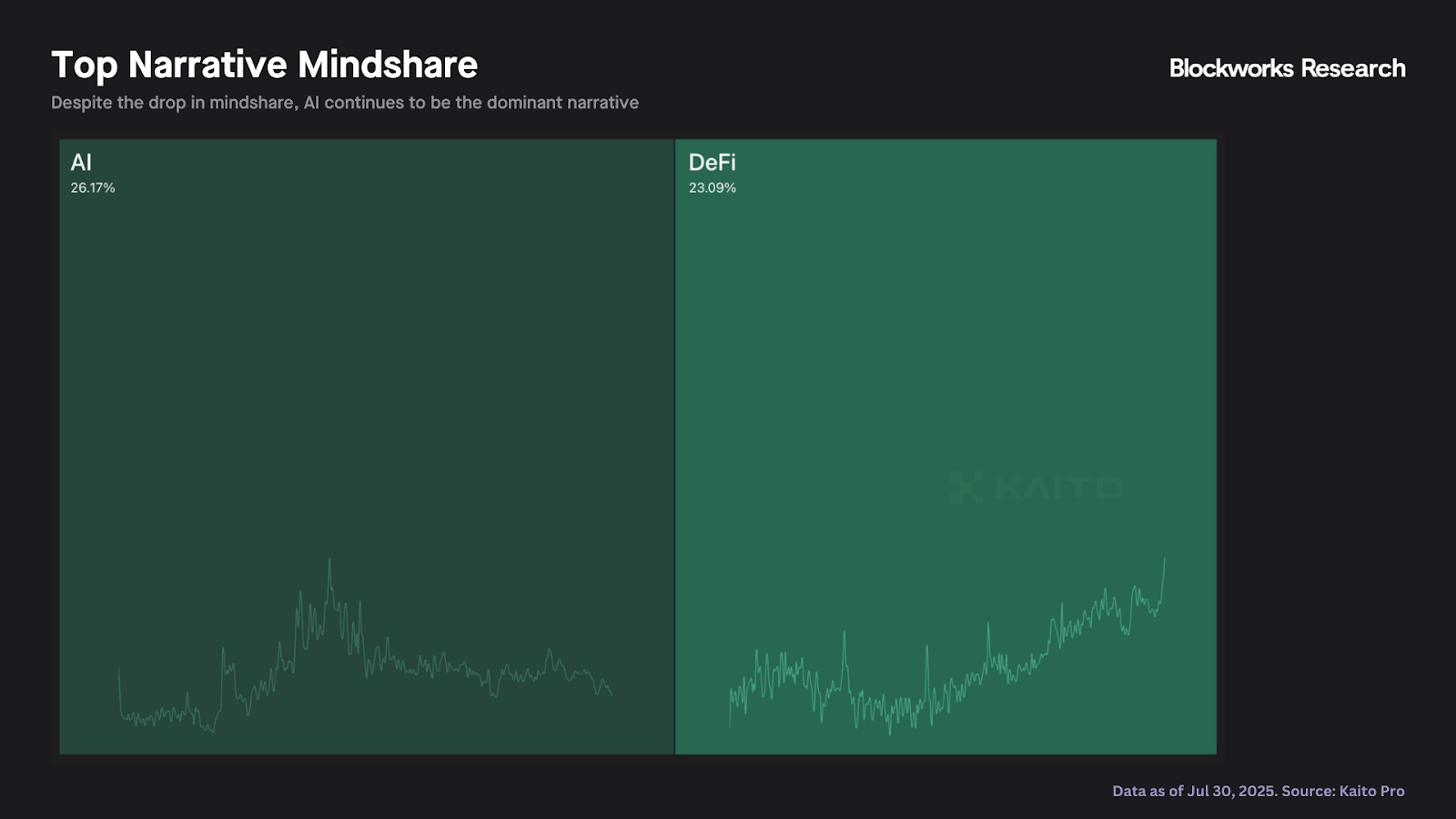

Yet the narrative isn’t dead. Kaito mindshare data shows AI still leads in absolute attention, with DeFi close behind. Many AI projects are still shipping upgrades, but the winners will be those who tackle crypto-native AI problems, rather than going head-to-head with Web2 giants in areas such as LLMs or text-to-video generation. One area worth watching is DeFAI, where AI and DeFi overlap. DeFAI blends decentralized finance with artificial intelligence by using AI agents to trade, manage risk and optimize capital between onchain protocols in real time. Projects like Giza, Almanak and Infinit Labs are showing early signs of product market-fit. The sector may be battered, but it’s far from finished. The bottom line is that AI x crypto shouldn’t be ignored — but it demands a highly selective approach.

— Kunal

Brought to you by:

Introducing the Chainlink Reserve — an onchain strategic reserve of LINK tokens.

Designed to support the long-term growth of the Chainlink Network, the Reserve accumulates LINK using revenue from large enterprises adopting Chainlink Platform and onchain service usage.

Chainlink is uniquely positioned to power and benefit from the growing tokenization trend as more and more of the world’s largest financial institutions adopt blockchain to tokenize trillions of dollars of assets onchain.

Institutions and pay-to-play: L1, L2 or L1?

Circle announced yesterday it will be building an L1 called ARC. Similarly, Stripe announced it will be building its own L1, Tempo, in collaboration with Paradigm. (Note: Tempo's CEO will be Matt Huang. The news was broken by Blorkworks (which is not us)).

As more and more stablecoins and payments rails start launching L1s, it's time to think a little bit more about ongoing and consistent debates:

Cosmos and Avalanche proponents argue that everyone should own their own stack.

Ethereum proponents argue that L2s are the way, and institutions should leverage Ethereum security and decentralization.

Solana proponents argue that institutions want to be closer to the user and to where activity is, and therefore will just issue assets on the L1.

All of these views have merit, and each is correct in its own way, as evidenced by how different teams and institutions have preferred each approach:

Arc and Tempo will be their own L1.

Robinhood will launch its own L2.

Existing, onboarded RWAs or tokenized assets/dollars (PYUSD etc.) have historically issued assets on Ethereum, Solana, Aptos, etc.

The main question is whether anyone has insight into how this decision-making process actually works. For example, in 2021, when an institution was "onboarded to blockchain rails" (see Polygon x Starbucks), you could have argued it was for various legitimate reasons — crypto rails are more efficient, offer provenance and scarcity, enable transparency, etc. We now know all of these benefits are real, but we also know that partnerships back then were either superficial or paid for using tokens.

Now, is it possible that current partnerships are less about the technical stack and more about individual preferences and backdoor deals? Maybe the Avalanche stack is genuinely the best, but it refused to pay? Maybe Ethereum security is really what matters, but Arbitrum and Optimism weren't willing to pay? Maybe someone high up has investments in both the institution and a blockchain, and pushed for integration between the two? Maybe all options (L1, L2 or issue on existing L1) are equally valid, and we all got nerd-sniped into fighting about which tech stack is the best, when what really mattered all along was having good sales people and investors and lots of cash?

This article dives into Virtuals’ Agent Commerce Protocol (ACP). It’s a blockchain-based marketplace where AI agents can autonomously find work, negotiate deals and get paid. The piece explains how ACP’s smart contracts let specialized agents collaborate, form dynamic clusters and run a functioning digital economy. It also covers ACP’s economic model, real-world examples and the technical and security challenges it must overcome.

This article explores the possibility that AI progress, especially with large language models, is slowing down and becoming more incremental. It looks at signs of stagnation and the effects on current AI products. It also outlines potential future “metas” founders can build around, from smarter workflow tools to data-driven systems, while encouraging entrepreneurs to adapt their strategies for a steadier pace of innovation.

Listen to Boccaccio interview Omnia and Greenz from Kinetiq, a Hyperliquid liquid staking provider. The interview focuses on both institutional and DeFi-focused LSTs, as well as HIP-3.

Circle published a blog post introducing Arc, a new L1 specifically designed for stablecoins. Arc addresses enterprise concerns with existing blockchains by offering USDC as native gas for predictable dollar-denominated fees, a built-in FX engine for institutional-grade trading, instant finality through the Malachite consensus engine, and optional privacy features. The blockchain integrates with Circle's platform ecosystem and supports various use cases including cross-border payments, stablecoin FX perpetuals, onchain credit, capital markets settlement and agentic commerce. Arc will launch private testnet soon, with public testnet in fall 2025 and mainnet beta in 2026.

It’s the summer of DATs and the party is going strong.

But when October rolls around, everyone will be looking to DAS: London to hear from these meta-defining voices on where things stand and where they’re headed.

Get your ticket today with promo code: 0X100 for £100 off

📅 October 13-15 | London

|

|