- 0xResearch

- Posts

- 💰 Inside Pump's ICO

💰 Inside Pump's ICO

Sold out in 12 minutes

Brought to you by:

The return of ICOs wasn’t on my 2025 crypto bingo card. The only difference now is that it’s a hundred million dollar business doing it. Sorry, your white paper and website won’t be cutting it anymore.

— Donovan

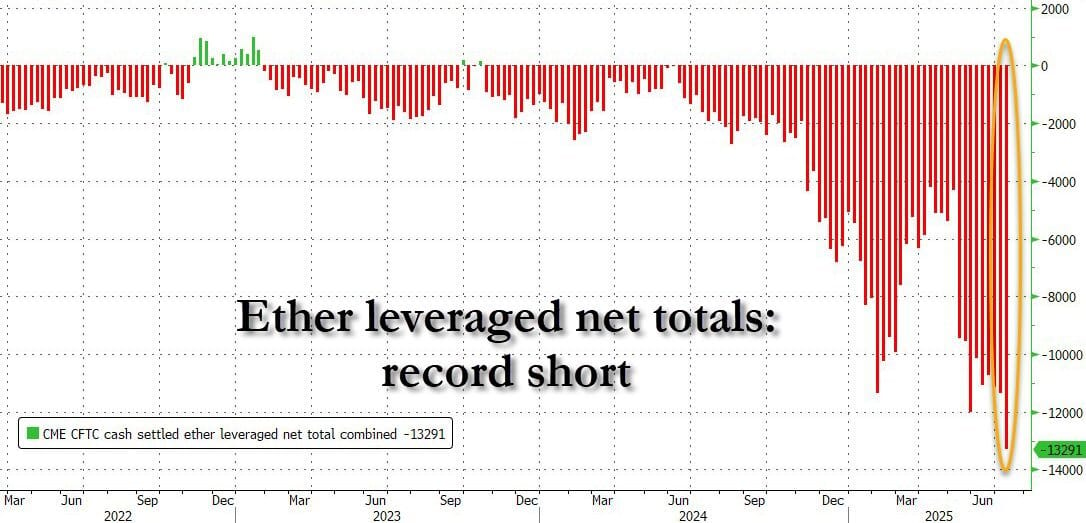

The most misleading chart in crypto right now:

Source: Zerohedge

This weekend’s viral chart screams “record leveraged shorts in ETH futures” — and it’s technically true. Hedge funds and CTAs (“Leveraged Funds” in the CFTC data) hold over 13, 000 net short CME 50-ETH contracts, the largest on record.

But there’s a catch: Most of this position isn’t a directional bet that ETH will crash, or is set up for a short squeeze. It’s a classic basis trade. CME ETH futures are in steep contango, trading around 9-10 % annualized above spot. Funds can buy spot ETH (or even stake it for ~3.5 % yield) and short the futures, locking in a combined ~9-13 % delta-neutral yield. This strategy explains why short interest has grown even as ETH’s price rallied; basis trades expand when the curve steepens.

Retail investors often misinterpret these CFTC short bars as outright bearish conviction, and think GameStop-style short squeeze. In reality, much of this is market-neutral arbitrage with no directional exposure. (The same strategy has been common with bitcoin in the past.) Yes, if the futures curve were to collapse into backwardation, these shorts would need to cover. But in doing so, they would also have to sell their ETH spot. For now, though, they’re a yield-harvesting machine.

Bottom line: “Record shorts” make for a catchy headline, but the real story is that professional traders are exploiting CME’s juicy basis, not betting on ETH going up or down.

Brought to you by:

Katana is a DeFi chain built for higher sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn KAT tokens: Pre-deposit with turtle club

Inside Pump’s ICO

Are we back?

BTC is at a new all-time high of $121k, ETH is back above $3k, and Aave just crossed $50 billion in TVL.

But probably most significant of all is the return of initial coin offerings (ICO). This past Saturday saw Pump’s ICO raising $500 million at a $4 billion FDV.

(A separate $100 million was raised offchain via CEXs.)

I say “Saturday,” but it was all over in 12 minutes. 125 billion PUMP tokens (12.5% of total token supply) were all sold for $0.004 apiece.

As of this morning, PUMP is trading at $0.0059 on Hyperliquid perps.

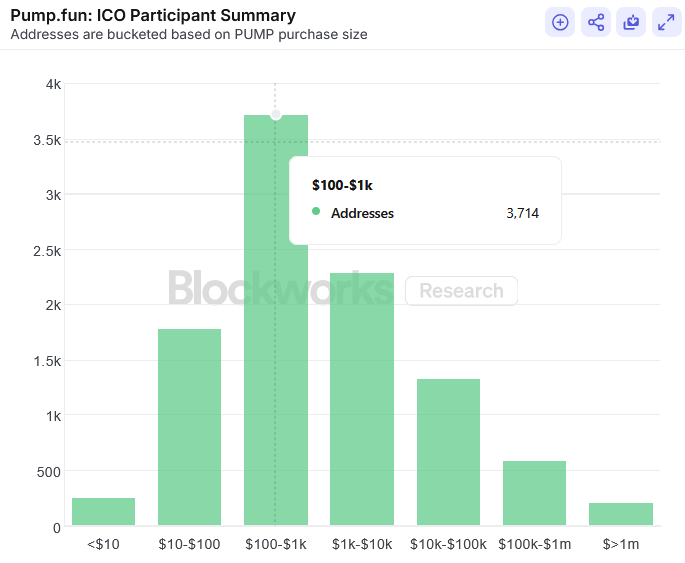

Who were the buyers?

10,145 unique addresses aped in at a remarkably equitable median price of $537.

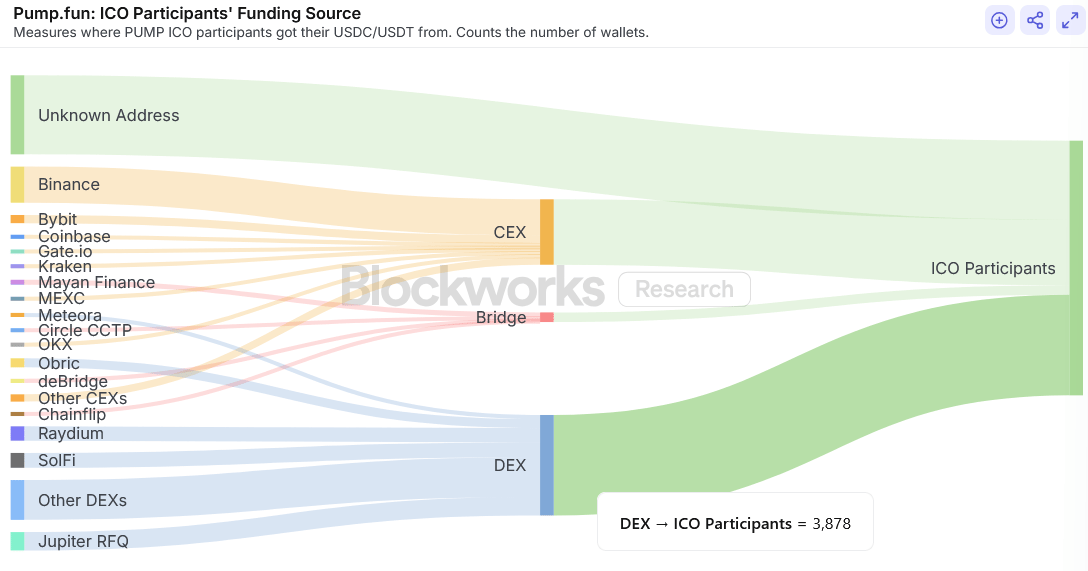

Interestingly, more users came from DEXs than CEXs. About 3,878 Pump investors came from Solana DEXs including Raydium, SolFi and Jupiter — compared to 2,525 investors from CEXs.

A number of Bybit users failed to receive their PUMP allocations due to an “unexpected API delay,” so they’ll be getting refunds and a sad $20 spot fee coupon instead.

$PUMP Token Sale: Oversubscription and Allocation Updates

At 2:00 PM UTC on July 12, 2025, the $PUMP public token sale officially launched with extremely high demand, and the sale was heavily oversubscribed within seconds, resulting in some users successfully receiving

— Bybit (@Bybit_Official)

9:10 AM • Jul 13, 2025

The key takeaway here, I think, is: Onchain infrastructure has never been more streamlined and effective.

Pump’s strategy

Pump’s $600 million ICO is big, but not that big. Let’s put that into context.

EOS’ (today called Vaulta) ICO in 2017-18 still holds the record for the largest-ever ICO, at a whopping $4.1 billion.

Telegram’s 2018 ICO also raised $1.7 billion in two phases. The GRAM tokens sold were eventually refunded due to regulatory troubles, and the app’s backers later created TON.

Compared to Ethereum, however, Pump’s ICO is big. Ethereum raised ~$18 million in bitcoin across 42 days in 2014.

These are obviously not apples-to-apples comparisons given the differences in time period, market maturation, product type, etc.

But the biggest difference of all is that unlike the industry’s past ICOs, Pump is not a mere proof-of-concept — the memecoin launchpad is a cash cow.

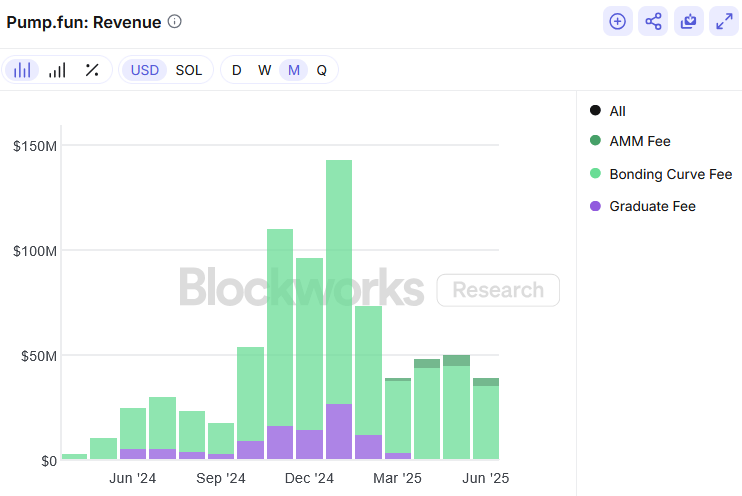

Pump has made $786 million in cumulative revenues since its inception in January 2024. That’s a staggering $377 million in annualized revenues for the two-year-old company.

Furthermore, Pump is allegedly planning to share 25% of revenues with token holders, my colleagues Katherine and Jack reported last week.

“There’s a reasonably high probability that the PUMP token will have some value accrual mechanism,” Blockworks Research’s Ryan Connor told me.

Pump wants to go after the social media market. In the team’s own words: “our plan is to Kill Facebook, TikTok, and Twitch. On Solana.”

The exact details of Pump’s strategy are not yet clear, but it looks to be capitalizing on its livestreaming feature that was brought back in April after a controversial removal last year.

Pump’s livestreamers, like any other token creators, receive 0.05% of all trading fees from their token.

“Pump is interesting in that it’s adjacent to risk markets. Buying creators outright is hard to do because they’re costly. A lot of people undermonetize their internet celebrity, so if you could get paid some modest amount by people passing value back and forth, that’s costless to Pump and perhaps their wedge,” Connor said.

Correction: This story has been updated to reflect that pump.fun raised $600M in its ICO.

Not normal, Supernormal

Mezo has launched the Supernormal Foundation to drive community governance and ecosystem expansion for its MUSD-backed Bitcoin finance layer. Framed as a shift away from top-down control, the foundation will manage grants, partnerships and its new Alpha Builder Program that aims to onboard developers with resources and mentorship.

“The Foundation team is independent from Thesis* management structures and works with a clear mandate to drive ecosystem growth and progressive decentralization,” executive director Andre Coutinho told Blockworks. The move is part of “a phased decentralization roadmap that balances security, efficiency and community participation,” Coutinho said, suggesting that with raters and a mere rubber stamp for Thesis*, “community will play an increasingly central role in decision-making.”

For that to play out, community trust will be critical, as Thesis* CEO Matt Luongo acknowledged: “The hardest thing about a Bitcoin project is finding Bitcoiners and helping them understand you're not a scam,” he told Blockworks.

To address this, the foundation will also create a Bitcoin Advisory Group of industry veterans while preparing for a future user-driven vote feature.

Success metrics will focus on practical adoption: “unique wallets interacting with MUSD, [the] number of dapps integrating MUSD use cases, and [the] overall number of bitcoin loans taken by unique wallets,” said Coutinho. The ultimate goal: make using Bitcoin “so normal...that it’s no longer special.”

— Macauley Peterson

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 PM EST

|

|