- 0xResearch

- Posts

- Hyperliquid wants CLARITY

Hyperliquid wants CLARITY

While Robinhood brings private markets to retail

GM, and happy Thursday. Majors remain range-bound since the Feb. 5 selloff, while AI and lending outperform.

Hyperliquid takes on a new challenge with the launch of the Hyperliquid Policy Center, an advocacy group to advance DeFi regulations within the United States.

Additionally, Robinhood makes private equity public with the launch of RVI, a private investment fund providing access for retail investors. Enjoy!

BTC remains range-bound, with 13 days of price action now trading within the daily range set on the Feb. 5 selloff. As the majors trade sideways amid a multi-month downtrend, pockets of strength have shown up in both AI and lending, with each sector registering double-digit returns over the past week. Within lending, MORPHO leads, up 35% on the week and still riding the momentum of last week’s announcement of a cooperation agreement with Apollo.

In other news, the Hyperliquid Policy Center (HPC) launched as an independent research and advocacy group dedicated to advancing a clear and regulated path for decentralized finance within the United States. The Hyper Foundation funded the launch of the institute with 1 million HYPE(~$28 million). In addition, Jake Chervinsky has joined the institute as both Founder and CEO. The HPC will:

Engage with federal regulators and Congress to support the creation of policies that recognize the nuances and benefits of decentralized finance.

Conduct in-depth technical research about market infrastructure, perpetuals, and other innovative financial technology.

Publish policy and legal analysis, submit formal comments on proposed rules, provide technical assistance on draft legislation, and serve as a resource for policymakers who want to understand how decentralized finance really works.

Seeing the recent impasse on the CLARITY Act and the ceiling this places on the industry, Jeff and others at Hyperliquid may know that their position of maximum leverage may no longer be on CT but rather in D.C. Setting up this advocacy group to advance regulatory development within the United States may be one of the highest ROI endeavors they could undertake.

While the launch of the HPC may have sparked confidence that favorable regulatory progress could be made in DC, so did Brian Armstrong’s comments at the Mar-a-Lago World Liberty Forum, where he stated that the bill is “making great progress” and would result in a win-win-win for crypto, banking, and the American consumer. The Polymarket odds that the CLARITY Act would be passed within 2026 surged from 60% to over 90% intraday, showing renewed optimism on the regulatory front. Resolution on this piece of legislation may be the most important catalyst to renew optimism in the industry and reverse the trend back higher.

— Luke

DAS NYC's lineup is bringing the biggest names in finance to the stage.

Don't miss the institutional gathering of the year — this March 24−26.

Democratizing the frontier

Robinhood is set to launch its first venture vehicle, Robinhood Ventures Fund I (RVI), a closed-end fund designed to provide retail investors with exposure to high-growth private companies.

Expected to IPO on the NYSE at $25/share, the fund targets best-in-class private entities such as Databricks, Revolut, Ramp, and Stripe. By removing accreditation requirements and high investment minimums, RVI addresses a structural gap in capital markets where the number of public companies has plummeted since 2000, while private firms have ballooned into a $10 trillion asset class.

The fund operates under a competitive fee structure, charging a 2% management fee that is incentivized via a reduction to 1% for the first six months post-IPO. RVI will offer daily liquidity through public exchange trading, though shares may trade at a significant premium or discount to their NAV. While this model provides unprecedented access to pre-IPO value creation, the fund isn't immune to risks surrounding valuation uncertainty and illiquidity.

Looking ahead, RVI could signal a shift in the venture-capital landscape, forcing institutional firms to compete with retail-driven Capital-as-a-Service models. If successful, Robinhood’s entry could catalyze a wave of similar vehicles from rival brokerages, potentially inflating private valuations as retail liquidity pours into a finite pool of late-stage startups. For institutional LPs, this could lead to more competitive deal terms or adverse selection, where the most desirable startups bypass traditional VCs to raise capital directly from the public via these new retail onramps.

The timing is particularly notable given the massive AI and aerospace liquidity events looming in 2026. SpaceX recently confirmed its 2026 IPO timeline following a landmark merger with xAI, creating a vertically integrated aerospace-and-AI conglomerate with a target valuation of up to $1.5 trillion. Similarly, OpenAI is reportedly laying the groundwork for a public debut in the second half of 2026, targeting a valuation as high as $1 trillion to fund its aggressive compute requirements. As these giants move toward the public tape, vehicles like RVI provide a critical proxy for retail traders to front-run what could be the largest IPO cycle in history.

Ultimately, the success of RVI will hinge on its ability to manage the sentiment-driven volatility that has plagued similar vehicles such as ARKVX in the past. While Robinhood is leveraging its direct-to-consumer platform to bypass institutional gatekeepers, critics warn that retail investors may struggle with the opaque nature of private valuations. Whether RVI becomes a structural pillar of the financial stack or a speculative meme vehicle, its launch marks the total convergence of private and public equity for the everyday investor.

— Nick

Nexus published a blog post introducing USDX, its native stablecoin and shared settlement layer designed to unify liquidity across its ecosystem.

The post concludes that the absence of a shared foundation in current stablecoin models multiplies complexity for users and developers. By implementing USDX as the primary unit of account and introducing the Global Yield Distribution System, Nexus seeks to align incentives automatically.

Ultimately, the protocol positions USDX as a scalable capital substrate that enhances composability and sustainability through onchain verifiable infrastructure.

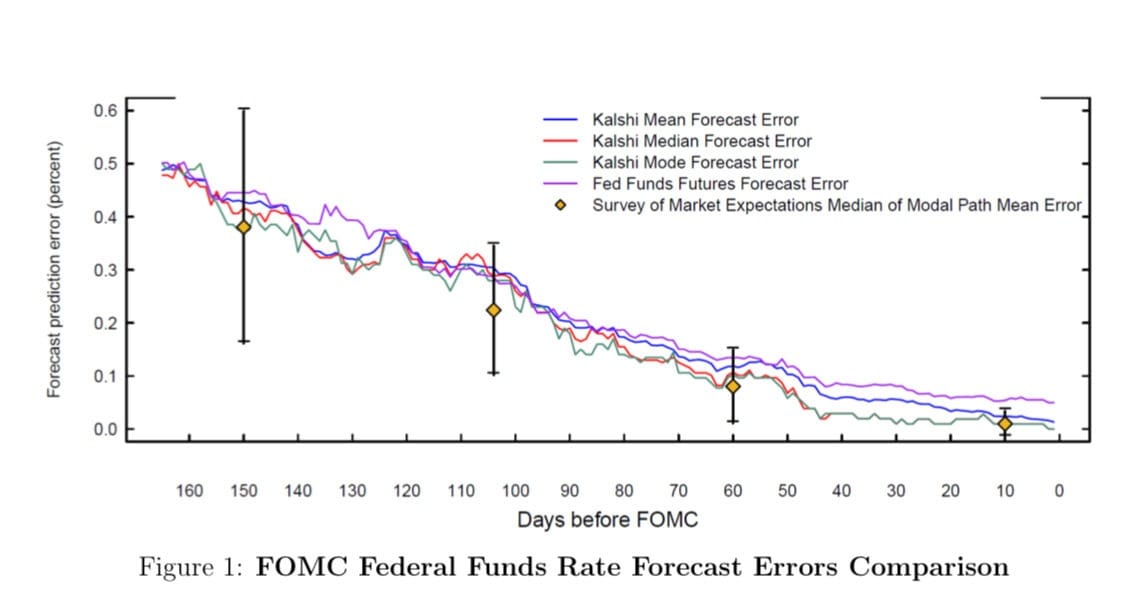

The Federal Reserve Board examines how Kalshi, a regulated prediction market platform, generates real-time, market-based forecasts for key macroeconomic variables and policy outcomes.

The authors compare Kalshi’s prediction market-implied expectations with traditional survey and financial market forecasts, finding that Kalshi delivers high-frequency and distribution-rich information that can complement existing measures.

Their results suggest that these markets provide well-calibrated density forecasts and respond meaningfully to macroeconomic news, offering a valuable new benchmark for researchers and policymakers interested in expectations and uncertainty.

In this episode of Unchained, Aave founder Stani Kulechov discusses the Aave Will Win proposal, which aims to consolidate value capture around the AAVE token by directing 100% of product-layer revenues to the DAO. The proposal would shift Aave Labs to a grant-funded model, establish an independent foundation to hold trademarks, and ratify Aave V4, whose new hub-and-spoke architecture is designed to expand revenue opportunities and enable modular, scalable lending markets.

Kulechov argues the changes reduce uncertainty around value capture, strengthen the token-centric model, and position Aave to grow beyond crypto-native assets into real-world and “abundance” assets like solar infrastructure. He also addresses community criticisms around revenue definitions, budget size, governance transparency, and foundation independence, emphasizing that feedback will refine the proposal while maintaining its integrated structure and long-term growth vision for DeFi.