- 0xResearch

- Posts

- Hyperliquid not leading

Hyperliquid not leading

What will happen following the Lighter TGE?

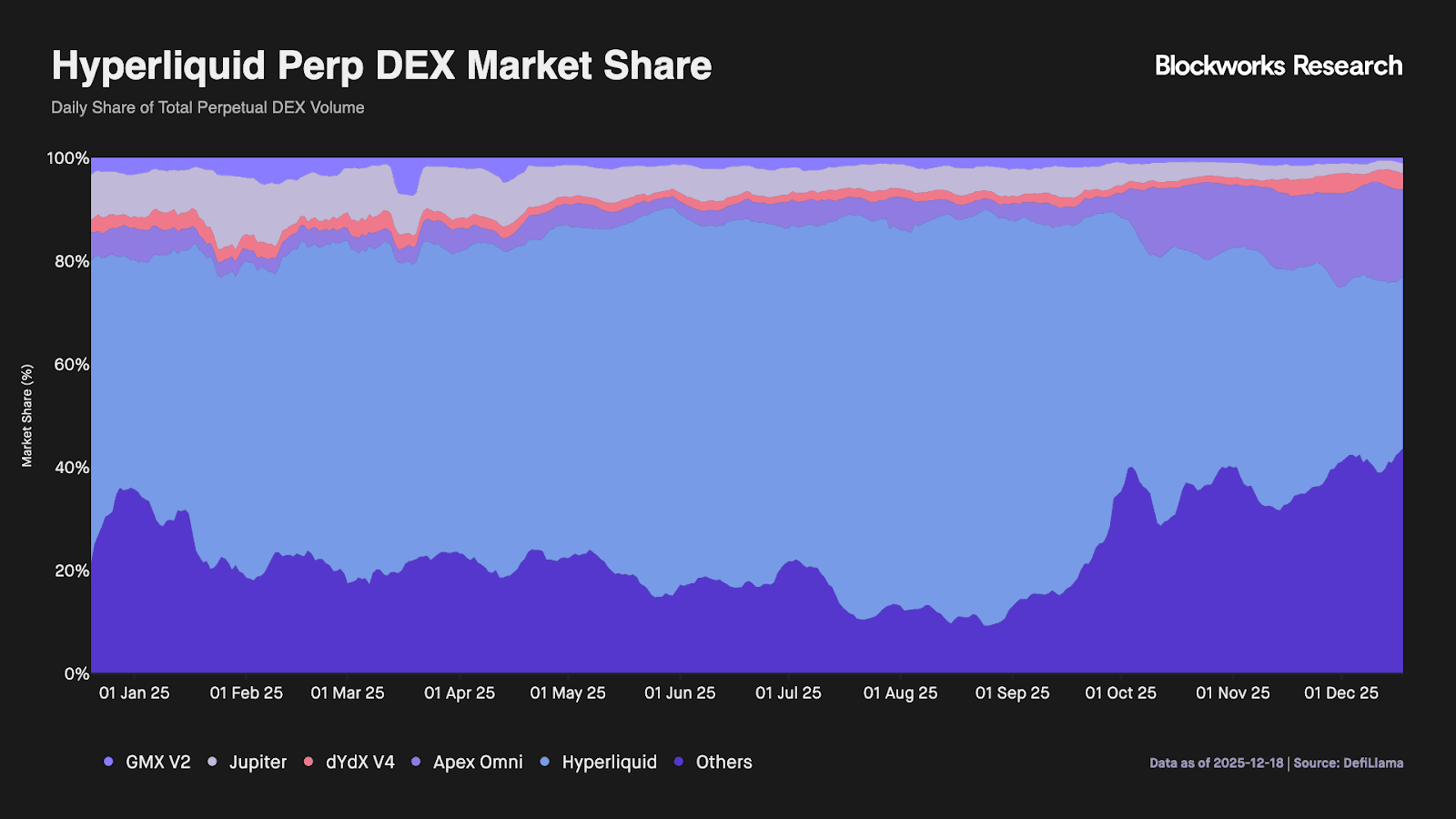

Happy Monday and hope you all had a merry Christmas! Gold led traditional benchmarks higher this week while BTC slipped nearly 1%, diverging from the broader risk-on mood. Solana ecosystem tokens outperformed, with JTO and DRIFT posting double-digit gains as L2s and Ethereum-linked sectors bled. Aave still dominates DeFi lending with 86% of protocol revenue, but its grip has loosened from 91% in January as Fluid and newer entrants chip away. Meanwhile, Lighter continues to beat out Hyperliquid on weekly volume, though the looming airdrop may be inflating those numbers.

Benchmarks drifted up slowly over the past week: Gold led gains (+3.57%) while the S&P 500 (+1.15%) and Nasdaq 100 (+0.84%) also posted modest advances. BTC bucked the trend, slipping 0.90% despite the broader environment.

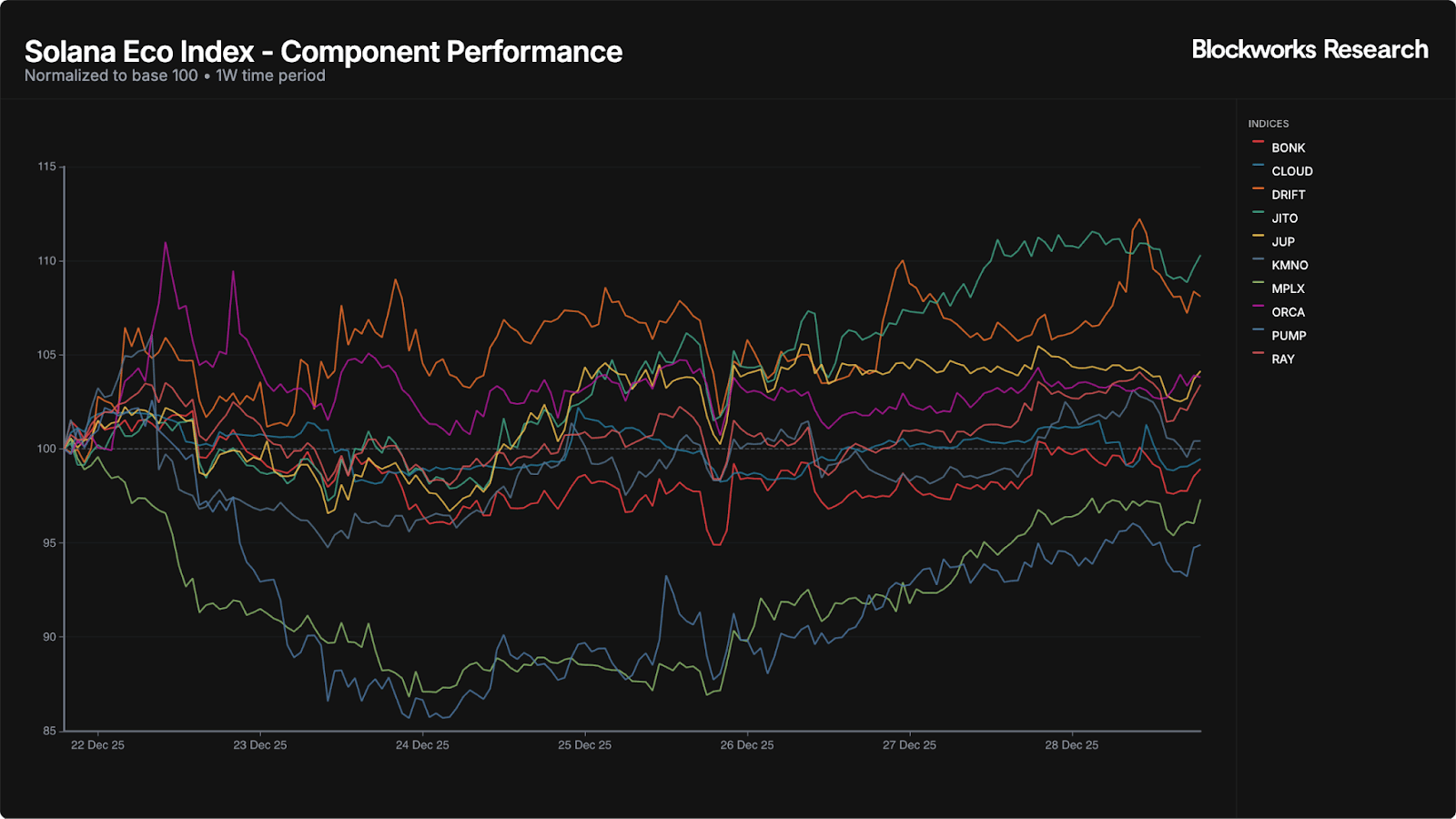

Crypto sector indices showed mixed results over the week. On the upside, Solana Ecosystem (+4.4%) led gains, followed by Launchpads (+3.23%), DePIN (+2.23%), Perps (+2.17%), and Modular (+1.7%). DEXs (+1.42%) and AI (+1.07%) also posted modest advances. On the downside, L2s (-8.27%) and Lending (-6.82%) saw the steepest declines, with Ethereum Ecosystem (-6.57%) and Crypto Miners (-5.97%) also under pressure.

JTO led the Solana Eco index with a +10.30% move, followed closely by DRIFT (+8.10%) as liquid staking and perps narratives found renewed interest. JUP (+4.14%), ORCA (+3.81%), and RAY (+3.40%) also posted solid gains, reflecting strength across the DEX sector. On the lagging end, MPLX (-2.68%) struggled to find footing, and PUMP was the clear underperformer at -5.11%, continuing to bleed as memecoin launchpad fatigue set in.

Crypto’s premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: 0XNL for $100 off.

Charts of the week

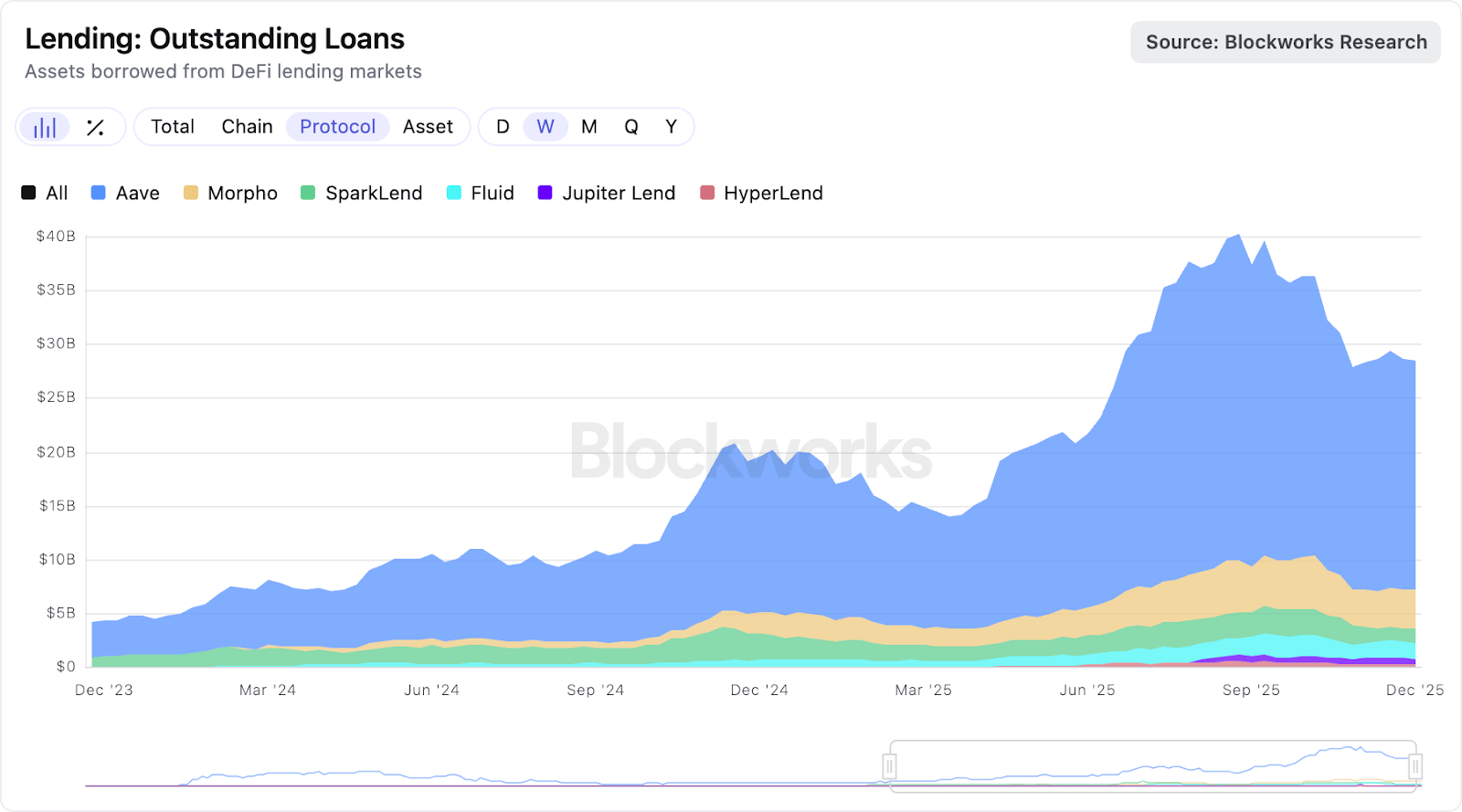

Aave has dominated the DeFi lending space in 2025, capturing 86% of protocol revenue and generating $120.9 million YTD. That said, Aave's grip has loosened slightly over the year, dropping from 91% market share in January to 86% in December. New entrants HyperLend (launched March) and Jupiter Lend (launched July) now account for a combined 3.4% of the market, while Fluid more than doubled its share from 2.4% to 4.9%, making it the fastest growing competitor among established protocols.

Outstanding loans tell a similar story. Aave holds $21.3B in loans, representing 74.7% of the market, a share that has remained relatively flat since January. The real movement has been among challengers: Morpho grew from 10.6% to 12.8% of outstanding loans, while Spark collapsed from 11.5% to just 4.7%. Fluid nearly doubled its share from 3.6% to 5.0%, and newer entrants Jupiter Lend (2.1%) and HyperLend (0.7%) have carved out small but growing positions.

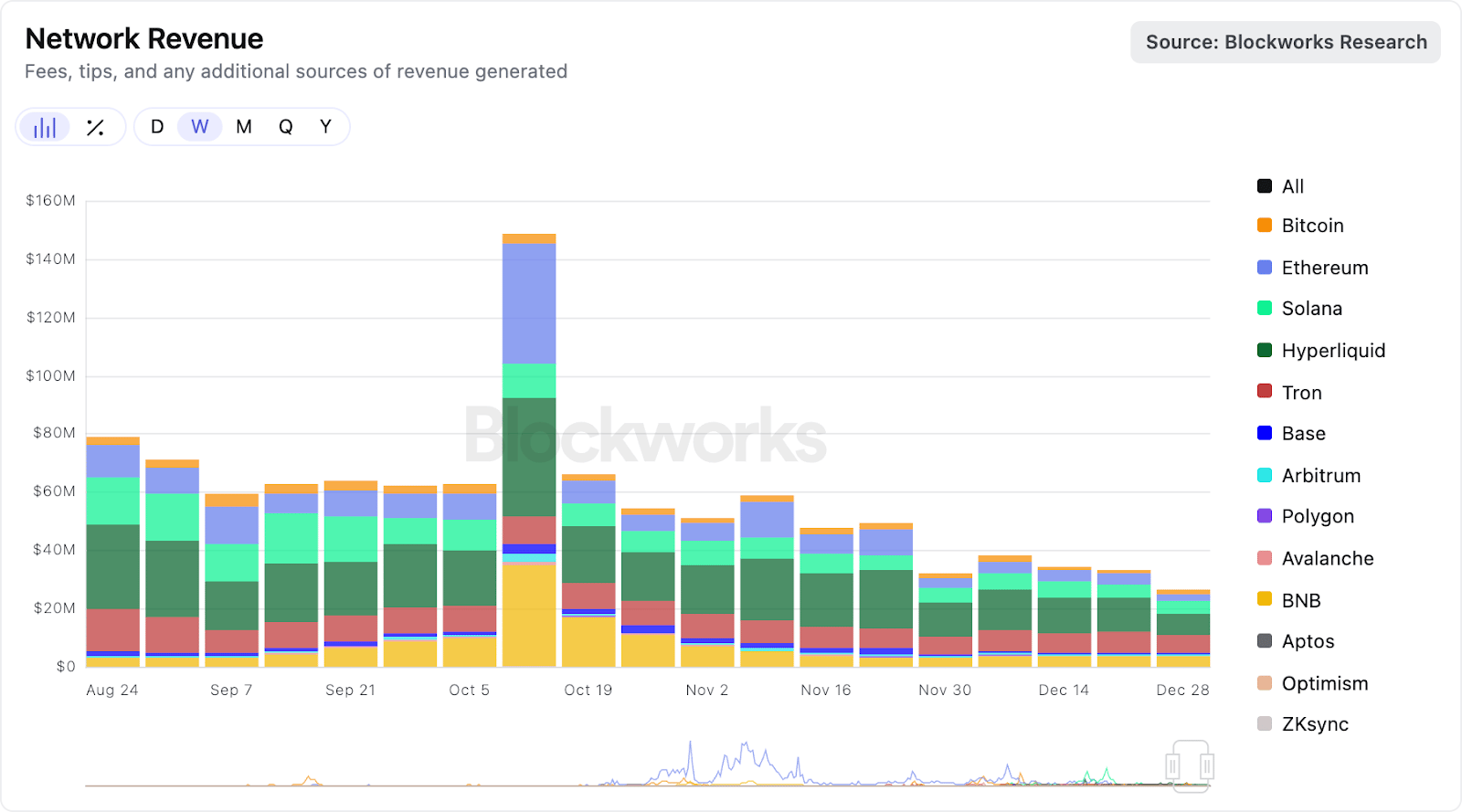

The downtrend in network revenues has continued, with total weekly revenue dropping 21% to $26.4M, the lowest in at least a month. Hyperliquid saw the sharpest decline among major chains, falling 40% from $11.8M to $7.1M, while Ethereum dropped 38% to $2.2M. Solana held up better, slipping just 2% to $4.7M. Tron remained the top revenue generator after Hyperliquid at $6.1M despite an 11% decline. The only notable gainers were smaller players: Arbitrum (+37%), Polygon (+50%), and BSC (+2%), though these moves represent relatively small absolute amounts.

In August 2025, Hyperliquid saw $396B in volume and $121M in revenue, with trailing 30-day volume peaking at $395B and the protocol dominating 80%+ of DeFi perps market share.

Lighter has done $30.9B in perp volume over the past seven days and $203.7B over the past month, with $1.48B in open interest. Aster has seen $26B in seven-day volume and $160.6B over 30 days, with a larger $7.4B in OI. Hyperliquid has fallen behind on weekly volume at $21.5B, though it still holds more than double their combined OI at $2.4B. With a Lighter airdrop incoming, we'll see how the landscape shapes up if volumes drop drastically once the points program ends.