- 0xResearch

- Posts

- Holiday lull

Holiday lull

Gold and silver won 2025

Hi all, happy Friday! To close out the last full week of 2025, we’ve lined up a few good reads to carry you through the weekend. We hope you’ve enjoyed the holidays and wish you a fantastic end to the year.

It’s been a slow week with Christmas, and traditional markets were closed yesterday. BTC slipped slightly (-0.4%) on muted volumes across the board, reflecting the broader holiday lull. With price action quiet, it’s a good moment to step back, reflect on 2025 and think about 2026 positioning.

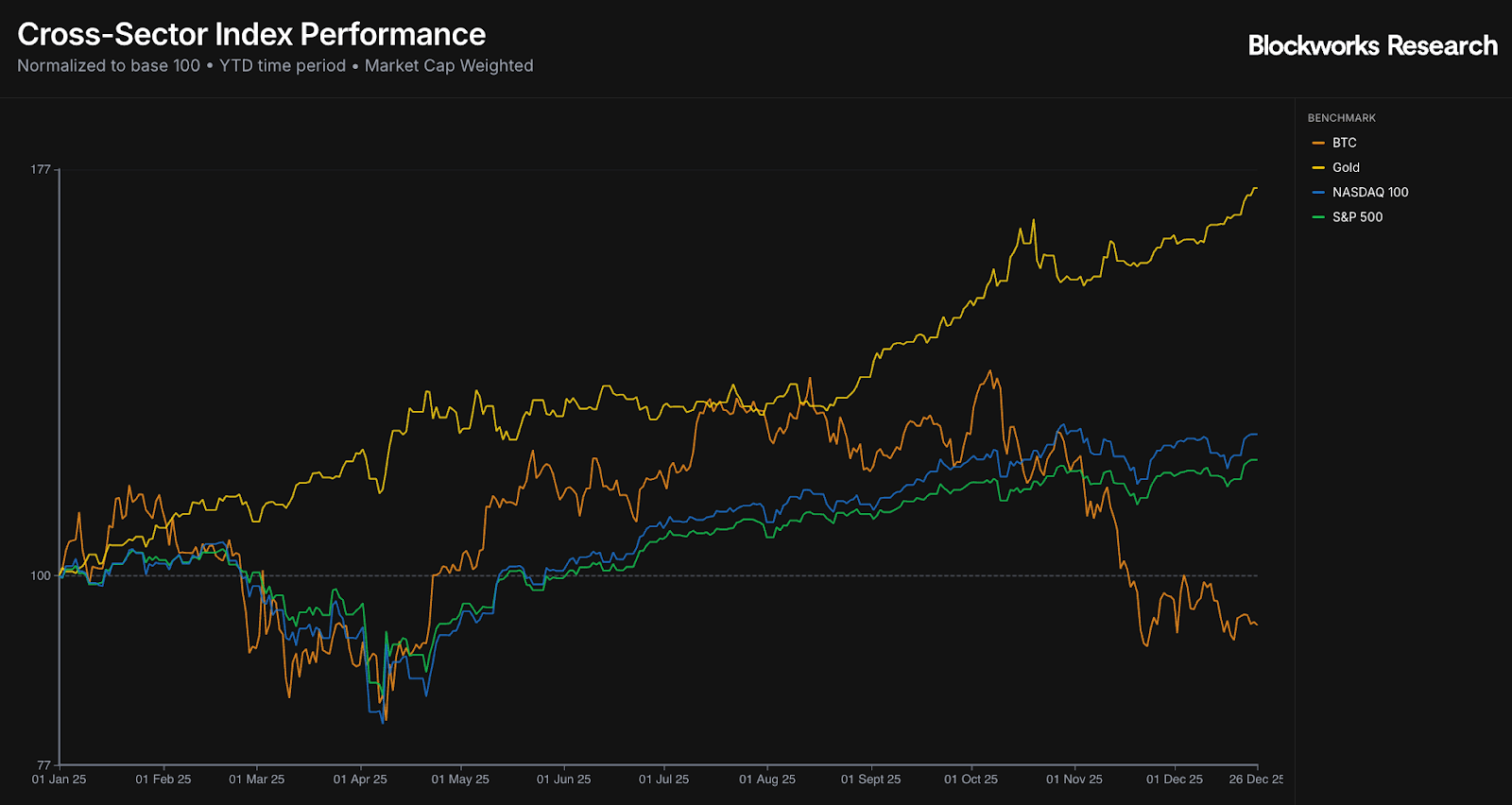

Bitcoin has underperformed stock benchmarks this year, but its performance vs. gold and silver is even more striking. In hindsight, those two will likely be remembered as the standout assets of 2025, a surprising outcome if you’d predicted it at the start of the year. Gold is having its best year since 1979, up around 72% year to date and recently breaking out to new all-time highs above $4,500 an ounce. Silver has done even better, rallying nearly 160% year to date and about 45% in the past month alone, reaching a record ~$75 an ounce yesterday.

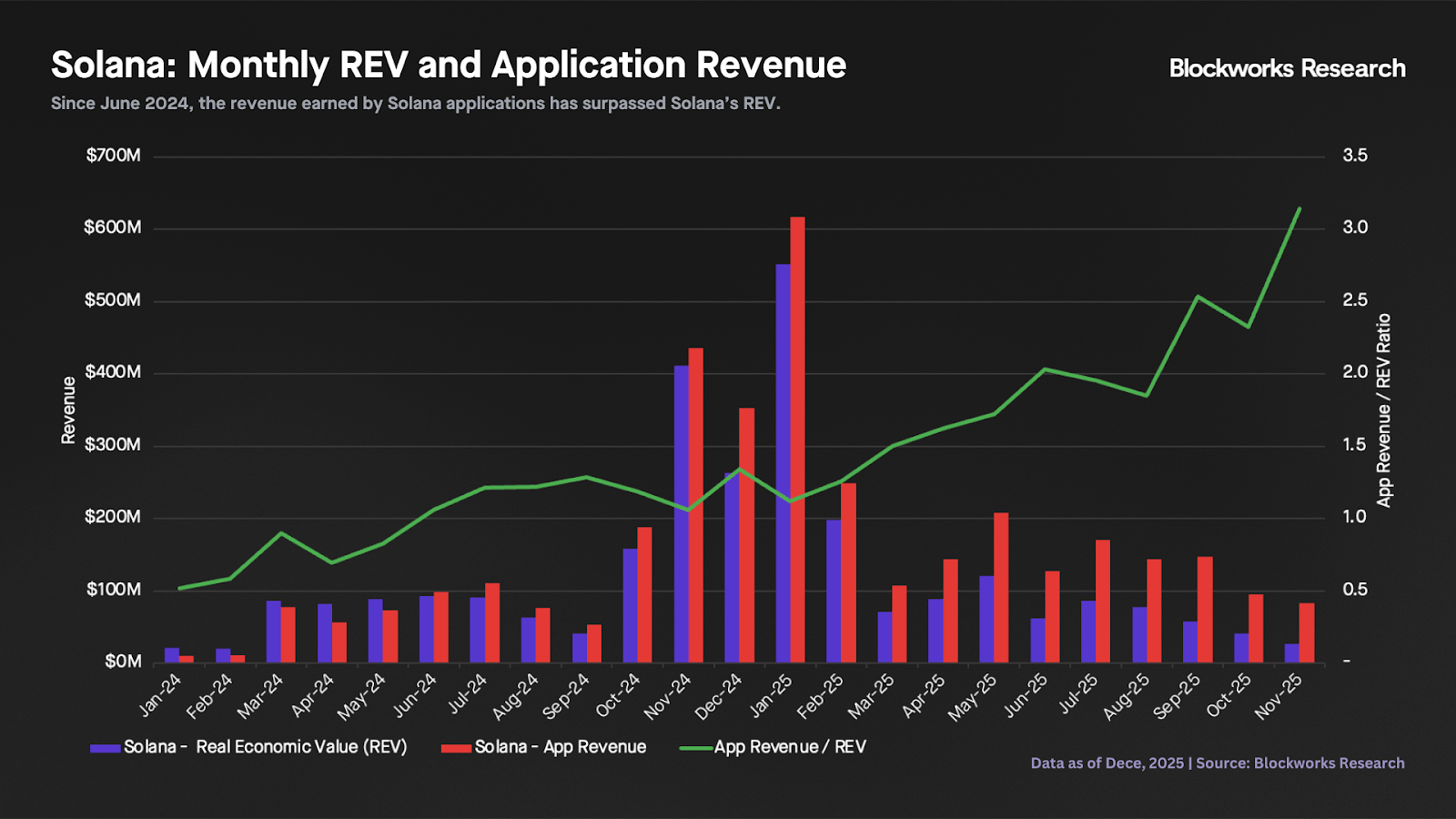

Looking ahead, 2026 could present compelling opportunities in liquid tokens. Many quality DeFi names are trading near multi-year lows, even as fundamentals and forward-looking growth remain strong. Crucially, value capture has flipped from infrastructure to applications: On Solana, for example, apps now generate roughly 3x the revenue of the network. The key question for investors is whether, and when, valuations will start to reflect this new reality.

— Carlos

Crypto's premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: 0XNL for $100 off.

“Crypto is dead” = crypto natives are saturated: Dougie DeLuca’s core point is that most builders still design only for crypto natives, but those users are already onboarded. The next leg of growth comes from apps that hide crypto rails and serve mainstream users directly.

BD vs. real sales, and who L1s should actually serve: The group argues most “BD” in crypto is just protocol-to-protocol deals, not real sales to end customers. Chains’ true customers are app developers and asset issuers (AWS analogy), and winning the asset listings (spot + perps) is what attracts innovation, as seen in Solana vs. Hyperliquid around new tokens.

Monetizing L1s and exchanges is still unsolved: There’s tension between being the “Nasdaq” (backend venue with thin economics) vs. the “Robinhood” (owning the end user and higher margins). Hyperliquid currently monetizes better via perps, while Solana captures little from huge spot flows, and everyone is experimenting with models that don’t alienate builders (e.g., enshrining specific apps).

Stablecoins as a monetization vector (and a fragmentation risk): The crew expects every chain and many companies to issue their own stablecoin to internalize yield, but that creates a messy, fragmented landscape. It likely pushes value toward stablecoin-as-a-service models and routing/FX layers that abstract thousands of branded dollars away from the end user.

“Crypto fund” as a category will fade: DeLuca argues that saying you’re a “crypto fund” in the next five to 10 years will sound as odd as saying you’re an “internet fund” today. Investors will specialize by vertical (fintech, consumer, infra, etc.), noting non-crypto natives like YC-backed fintechs are already producing successful onchain apps.

The dual equity-token structure is unworkable: The Aave Labs vs. Aave DAO situation is held up as a case study in misaligned equity vs. token incentives. IP and frontends sitting in separate companies create value leakage and governance headaches. They also discuss Uniswap’s recent efforts to tightly align Labs and UNI token economics.

Look for the full podcast on YouTube, Spotify, Apple Podcasts and X.

This summary was generated with assistance from AI tooling.

Stepan Simkin from Squads published an article reflecting on stablecoin growth and the size of the opportunity ahead, arguing that stablecoins are no longer a “crypto story” but a new form of money infrastructure reshaping financial primitives. He contends that self-custodial stablecoin accounts offer cleaner, more transparent trust assumptions compared to opaque bank/fintech stacks, using the Synapse bankruptcy as a cautionary example. He contrasts global, internet-native rails with jurisdiction-bound fintech. In his view, “stablecoin L1s” like Tempo and Arc can only beat Ethereum and Solana if their advantages are big enough to compensate for the trust gap of a new network. Simkin also warns of an impending security and privacy reckoning, concluding that most teams are still replaying the 2015 fintech playbook on new rails instead of fully exploiting programmable money and internet capital markets. Read more

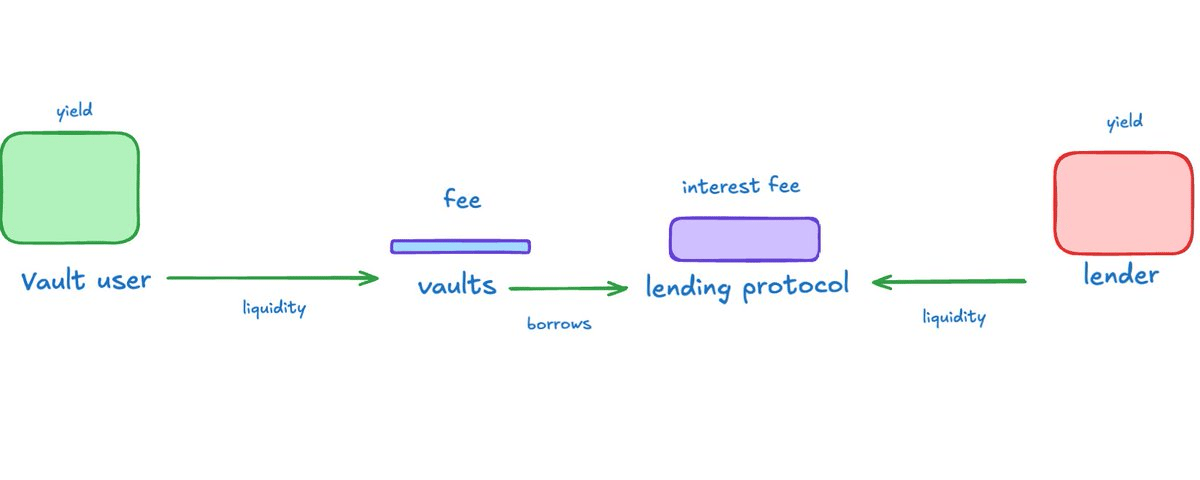

Silvio Busonero from Blockworks Advisory published an article arguing that DeFi lending protocols have a much deeper moat than most observers assume. He shows that across Aave and SparkLend, the interest paid by vaults to lending protocols actually exceeds the fees those vaults and even many asset issuers earn themselves. By mapping the onchain credit stack (users, lenders, issuers, lending protocols, chain) he demonstrates that lending protocols consistently capture more value per unit of TVL than downstream vaults and, in aggregate, more than upstream issuers like Lido or EtherFi, thus contradicting the idea that “distribution is king” in lending. The piece concludes that while DeFi lending looks low-margin compared to banks when viewed only on deposit NIM, within the onchain credit stack it is the highest value-capturing layer, underpinning a durable economic moat for money markets. Read more

Marc Zeller from ACI published an article arguing Aave is now overwhelmingly run and grown by the DAO’s service providers, while key brand and distribution assets (domains, frontends, trademarks, major integrations) remain under unilateral control of Avara. This misaligns with governance, and the groups who actually maintain the “engine.” He details how independent teams (Chaos Labs, BGD, TokenLogic, ACI, etc.) have driven risk management, upgrades, integrations and revenue growth for relatively modest, token-aligned compensation, and warns that if value is structurally siphoned to a private company while the DAO lacks ownership of IP and storefront, top talent will leave. The piece calls for DAO-controlled ownership of strategic brand assets, with management delegated back to Avara under clear, enforceable mandates so both the company and the DAO can thrive without undermining the golden-egg-laying “goose” that is Aave. Read more

Toghrul Maharramov published a technical deep dive on Alpenglow, Solana’s upcoming consensus mechanism, arguing it preserves Solana’s pipelined, high-throughput design while massively cutting decision latency. Today, TowerBFT is non-responsive, hard to reason about formally, and only gives deterministic finality after ~33 blocks (~13s). Alpenglow introduces Votor (a certificate-based BFT consensus with concurrent fast/slow paths) and Rotor (a simpler, single-hop, erasure-coded dissemination layer) to deliver deterministic finality in roughly 100-150ms. The author is explicitly skeptical of the argument that “real” PoS systems will never approach 1/3 Byzantine stake. He notes that because stake is concentrated, compromising ~9-20 top validators could already breach the 1/5-1/3 thresholds, so Alpenglow’s security trade-off vs. classical 1/3 BFT should be viewed as a deliberate latency-for-safety swap rather than “free” performance. Read more