- 0xResearch

- Posts

- Galaxy bull case strengthens

Galaxy bull case strengthens

Helios doubles approved power capacity

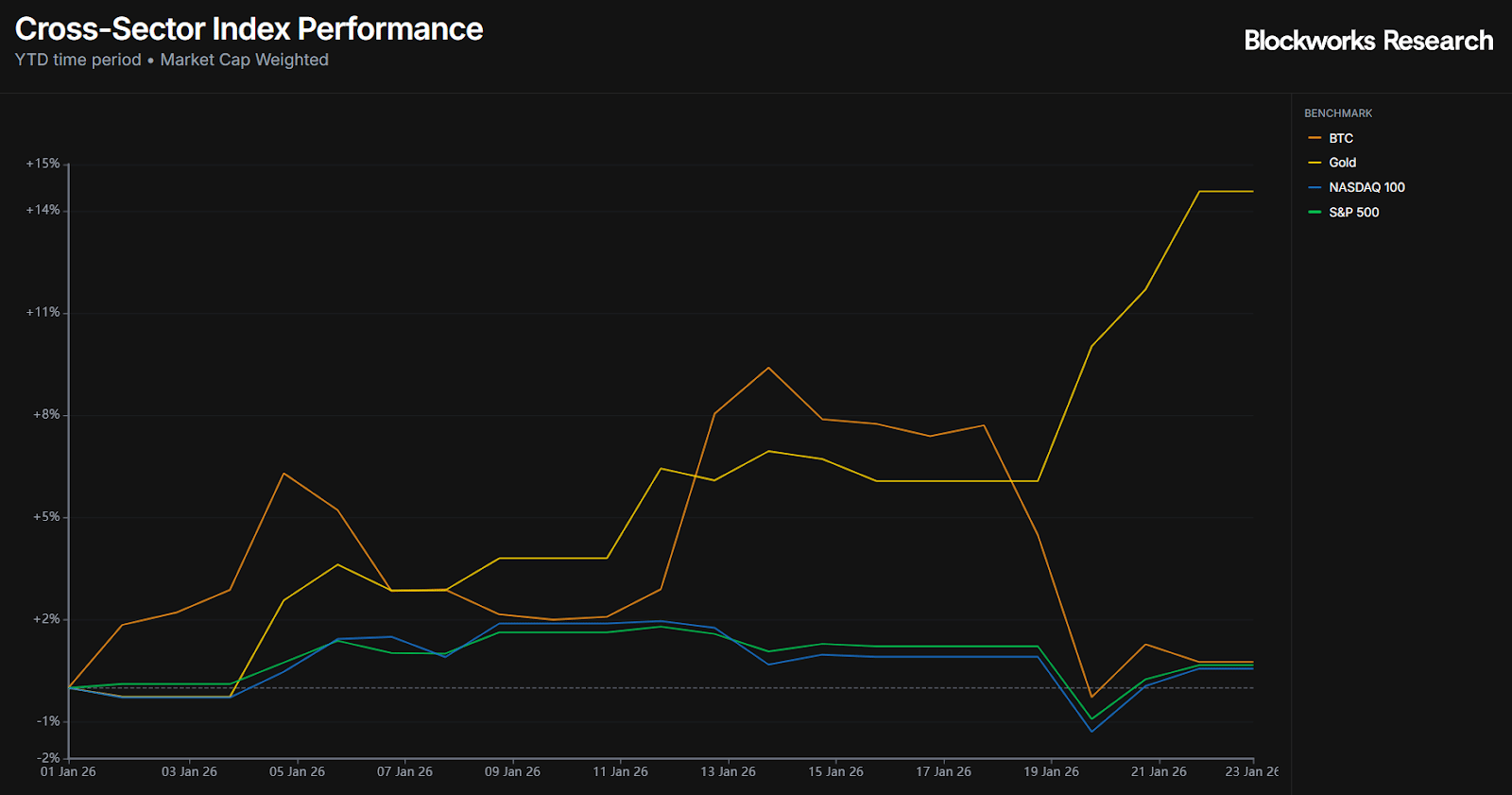

Hi all, and happy Friday. Gold continues to dominate 2025, up 14.6% just 22 days into the year as flight-to-safety flows persist.

Galaxy scored a major win at Helios last week, with ERCOT approving an additional 830 MW that takes total approved capacity to over 1.6 GW. We dig into what this means for valuation and the path forward.

We also look at prediction markets hitting another record week and what Kalshi's crypto push could mean for its lead.

The flight to safety stayed firmly in place yesterday. Gold surged 3.65%, while the S&P 500 and Nasdaq posted modest gains of 0.22% and 0.21%. BTC lagged behind again, up just 0.05%. With BTC now giving back its early-year momentum, Gold has opened up a wide lead across major benchmarks and is already up 14.6% just 22 days into the year.

Markets got a brief dose of relief after Trump walked back his tariff threat on Europe, which had been tied to negotiations around Greenland. That helped ease some near-term pressure, but the broader backdrop remains supportive for metals. Geopolitical uncertainty — alongside continued expectations for rate cuts — is keeping the bid strong across Gold, Silver, and Platinum.

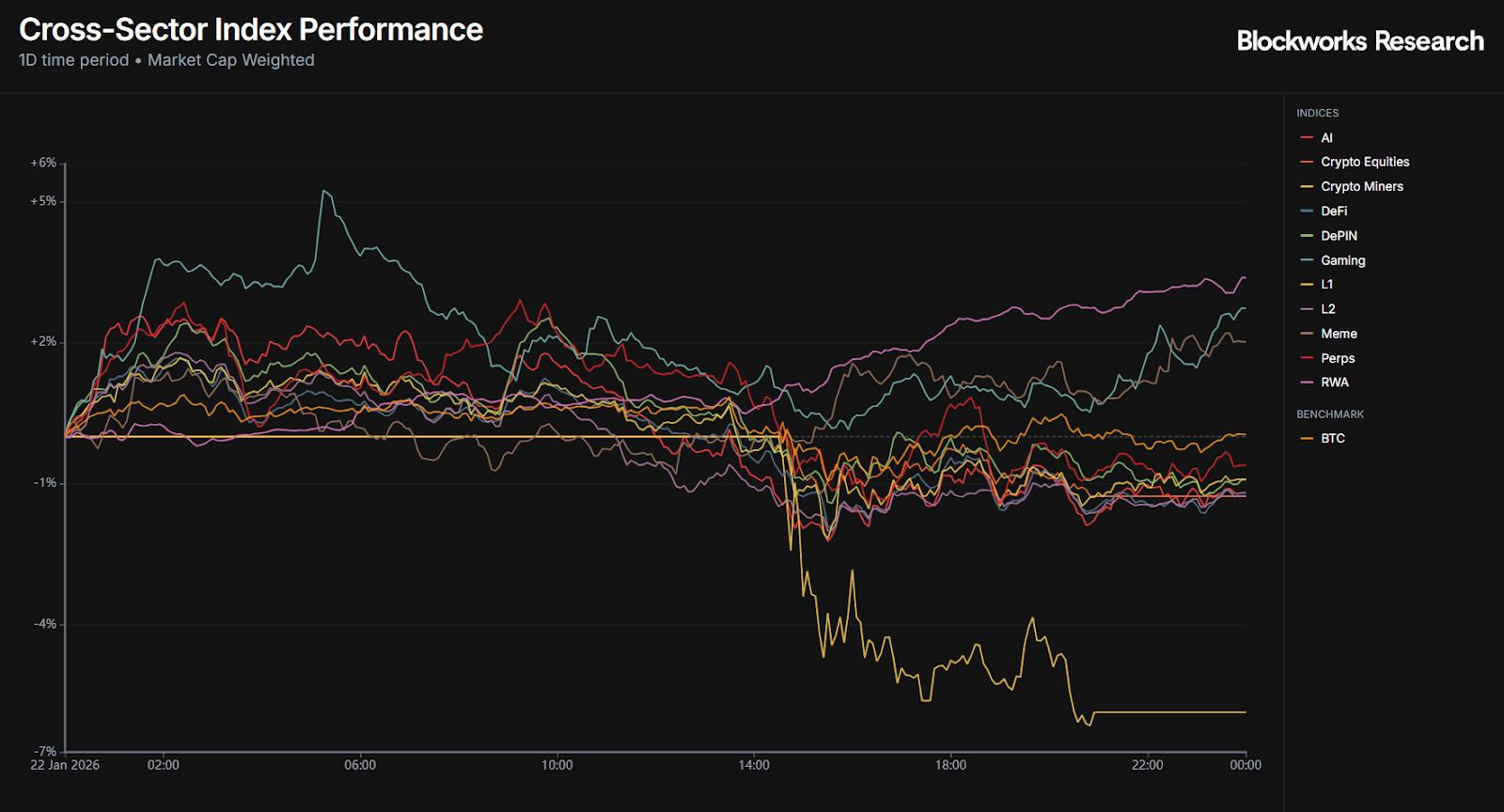

Within crypto sectors, RWAs and Gaming led the bounce, rising 3.38% and 2.74% respectively. RWAs were supported by strength in PAXG and XAUT, which together make up around 14% of the index. Gaming also extended its rally, with SAND up 14%, AXIE up 13%, and MANA up 6.8% on the day. AXIE volume continues to be dominated by Korea, with roughly 40% of activity coming from Upbit as the token trades at a consistent premium on the exchange.

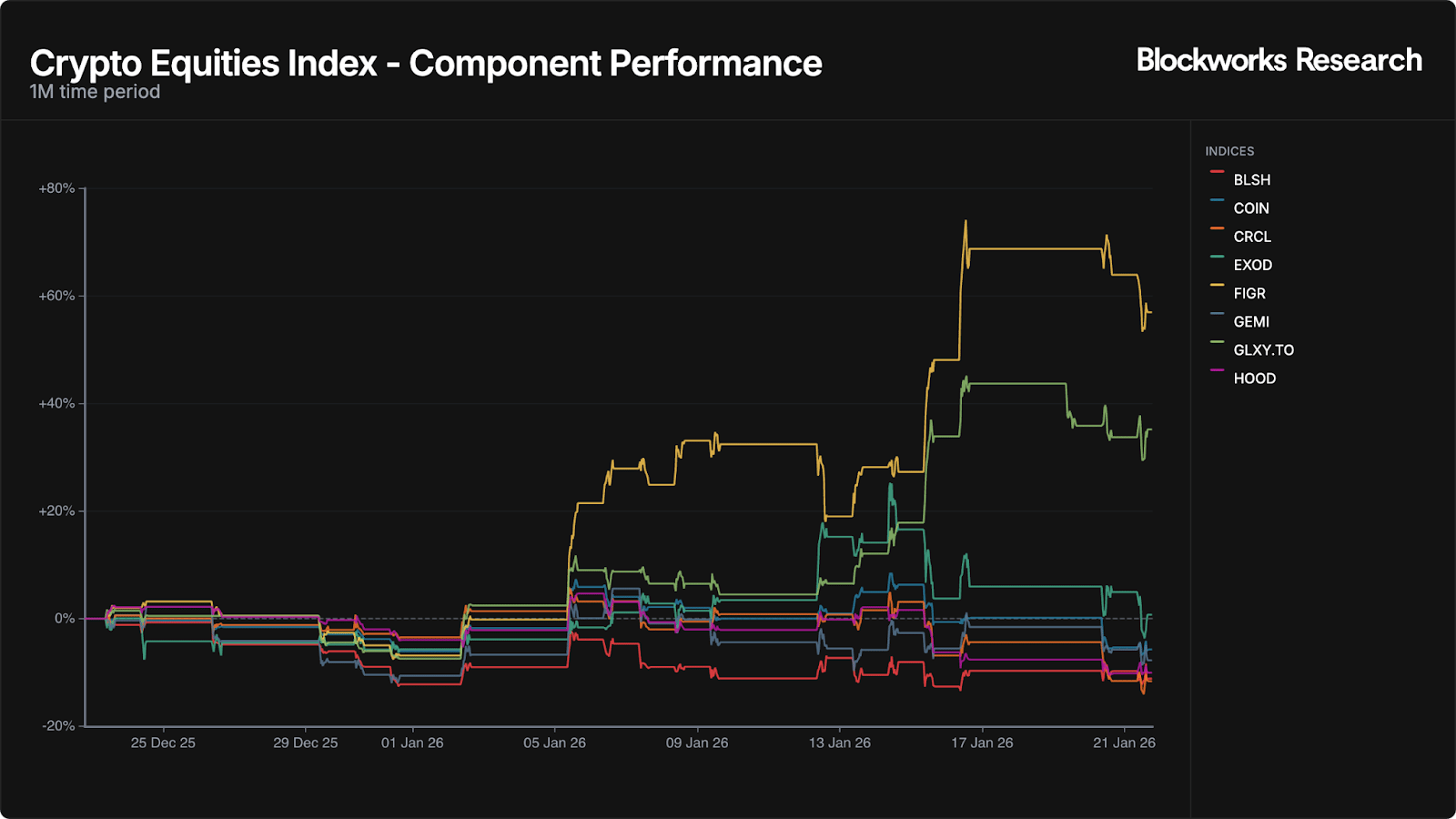

On the other end of the board, Crypto Equities and Miners were the weakest sectors, falling -1.3% and -5.7%. IREN and HUT, which make up roughly 40% of the Miners index, dropped -6.7% and -8%. The weakness in Miners continues to track broader concerns that AI related valuations may be stretched. Crypto equities also remained under pressure, with every constituent in the red.

With the Magnificent Seven set to report Q4 earnings next week, volatility is likely back on the menu as markets look for confirmation that current valuations are still justified.

— Kunal

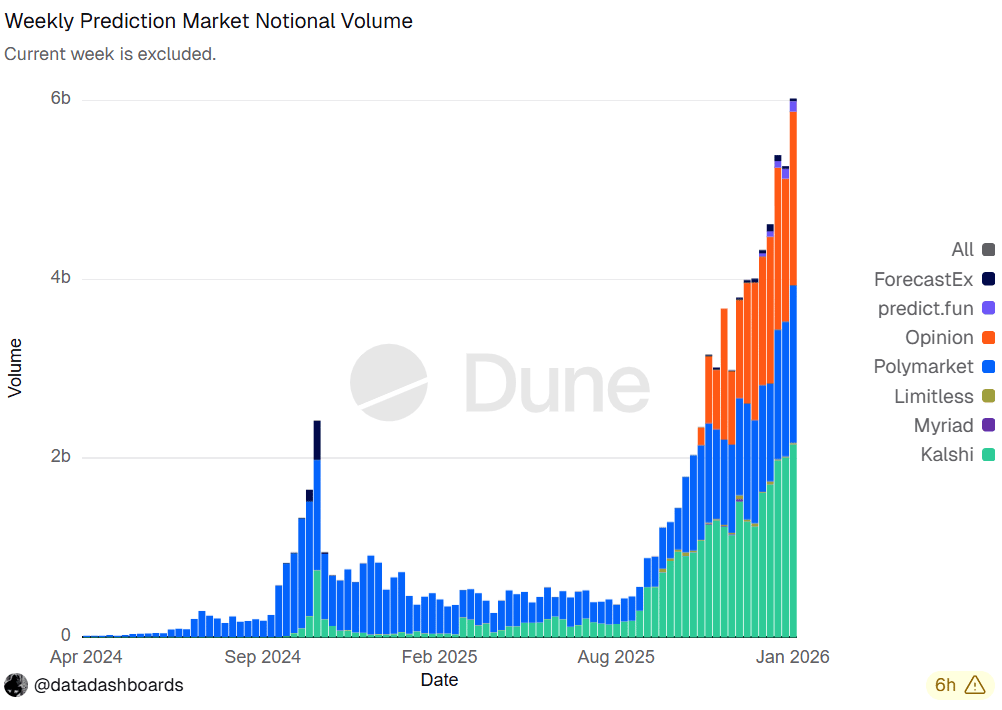

Another week and another all-time high for prediction markets, with weekly notional volume clearing a record $6 billion.

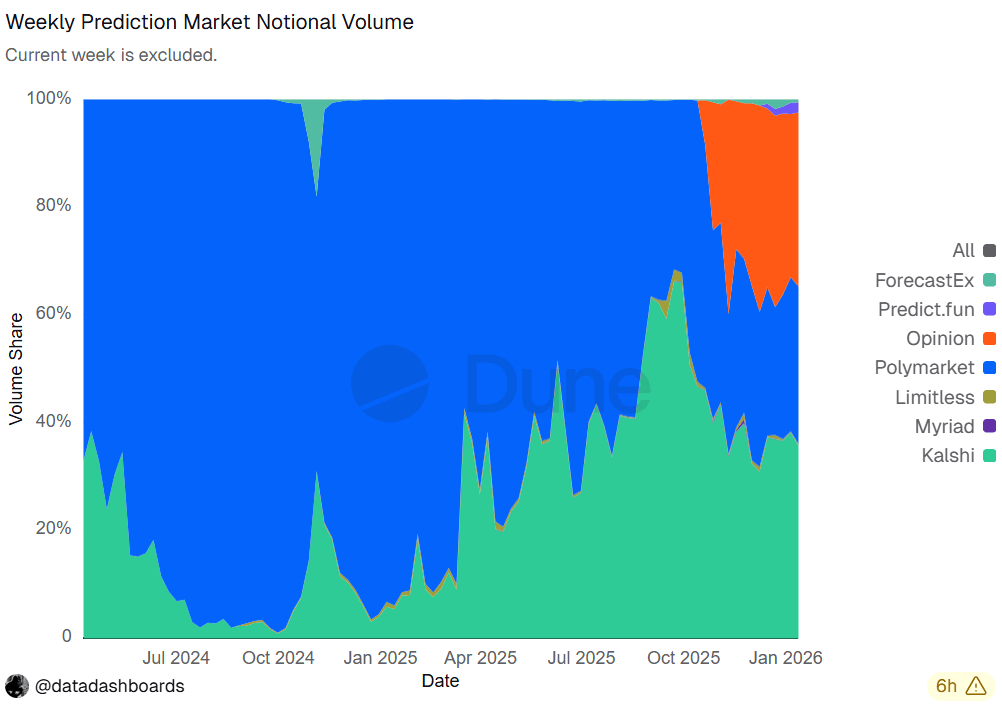

Despite new entrants like Predict.fun and ForecastEx slowly chipping away at share, the top of the leaderboard has remained constant, with Kalshi, Polymarket and Opinion still effectively neck-and-neck.

Kalshi has now led volumes for five straight weeks and just printed a fresh peak of $2.15 billion in weekly volume. The main risk is concentration: Around 90% of Kalshi’s volume still comes from sports, which makes it dominant today but also vulnerable tomorrow. Platform competition is set to heat up in sports, as incumbents like DraftKings and FanDuel push more aggressively into prediction-style products, and Kalshi’s lead could narrow quickly.

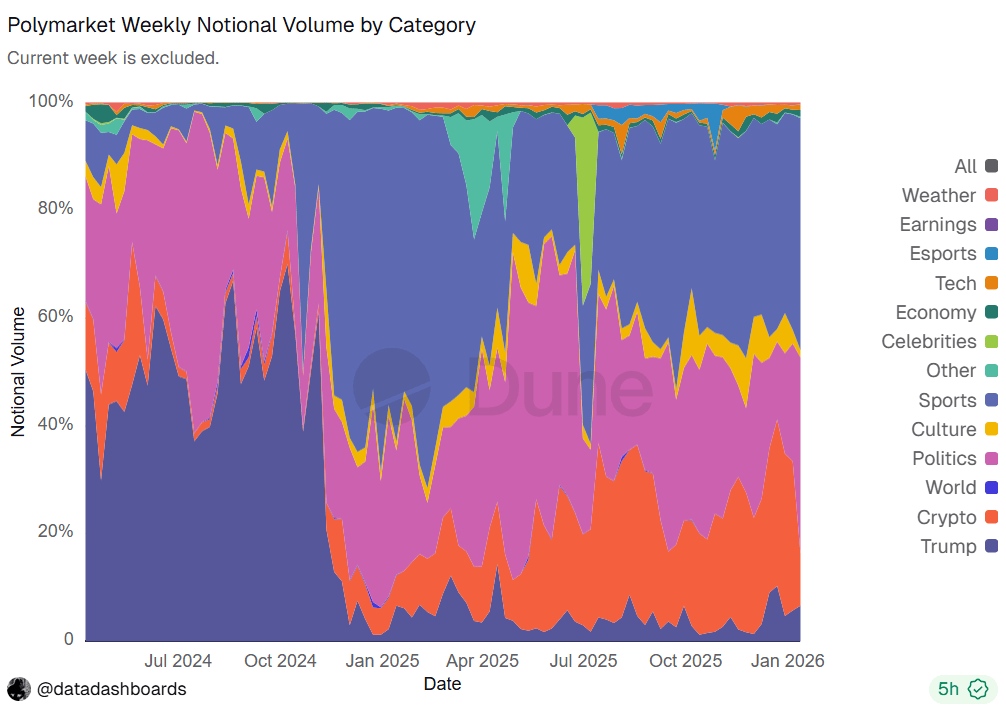

That is likely why Kalshi is starting to broaden its product set. The launch of 15-minute markets for BTC, ETH and SOL is a clear move to tap into crypto markets. Crypto markets already account for roughly 20%-30% of weekly volume on Polymarket, which gives a clear roadmap for how large this category can get.

Kalshi does offer crypto markets today, but most are still basic price-related predictions and have not matched Polymarket’s traction. For example, Kalshi’s market for BTC’s January high and low has done around $1 million in volume, while a similar market on Polymarket has seen $51.5 million.

Polymarket’s own 15-minute BTC up/down markets show why this format works. Over the last six hours, volumes ranged from $8K to $300K per window, averaging $27.4K every 15 minutes. If Kalshi can build similar engagement, a single 15-minute market could add around 1% to its weekly volumes. While the amount may appear small, it could — more importantly — keep users actively trading inside the app instead of rotating between prediction markets to trade different events.

The next step is crypto premarkets and ICO-linked markets, which have been major volume drivers on Polymarket. Polymarket currently has 89 of these markets live, allowing users to speculate on projects before tokens are tradable. That gives traders a way to hedge or express a view without worrying about liquidations, unlike premarket perps venues such as Hyperliquid. Recent MetaDAO-related markets like Ranger have generated $23.6 million in volume around fundraising expectations, and FDV prediction markets have been even bigger, with Monad seeing $53.7 million in volume.

Kalshi has built a machine in sports. The real unlock now is building a second engine. If crypto markets become that engine, Kalshi’s lead could start to look a lot more durable.

— Kunal

Galaxy bull case strengthens

Galaxy’s mid-January rally was catalyzed by a clear rerating event at Helios. On January 15, the company announced it completed ERCOT interconnection studies and secured approval for an additional 830 MW at Helios, taking total ERCOT approved and utility contracted capacity to over 1.6 GW. The shares printed a ~$34.7 high on January 16, though they’ve pulled back to a $30.9 close as of yesterday. But they are still up 26% over the last month, and make Galaxy one of the leading crypto equity performers.

Power availability and interconnection are the binding constraints for AI data centers. The aforementioned approval effectively doubles the campus’ approved power envelope and explicitly supports a multi-tenant buildout, which expands Galaxy’s contracting runway beyond the already-signed capacity with CoreWeave. Just as important, Galaxy reiterated it remains on track to deliver initial power beginning in early 2026, which keeps the near-term commissioning timeline intact.

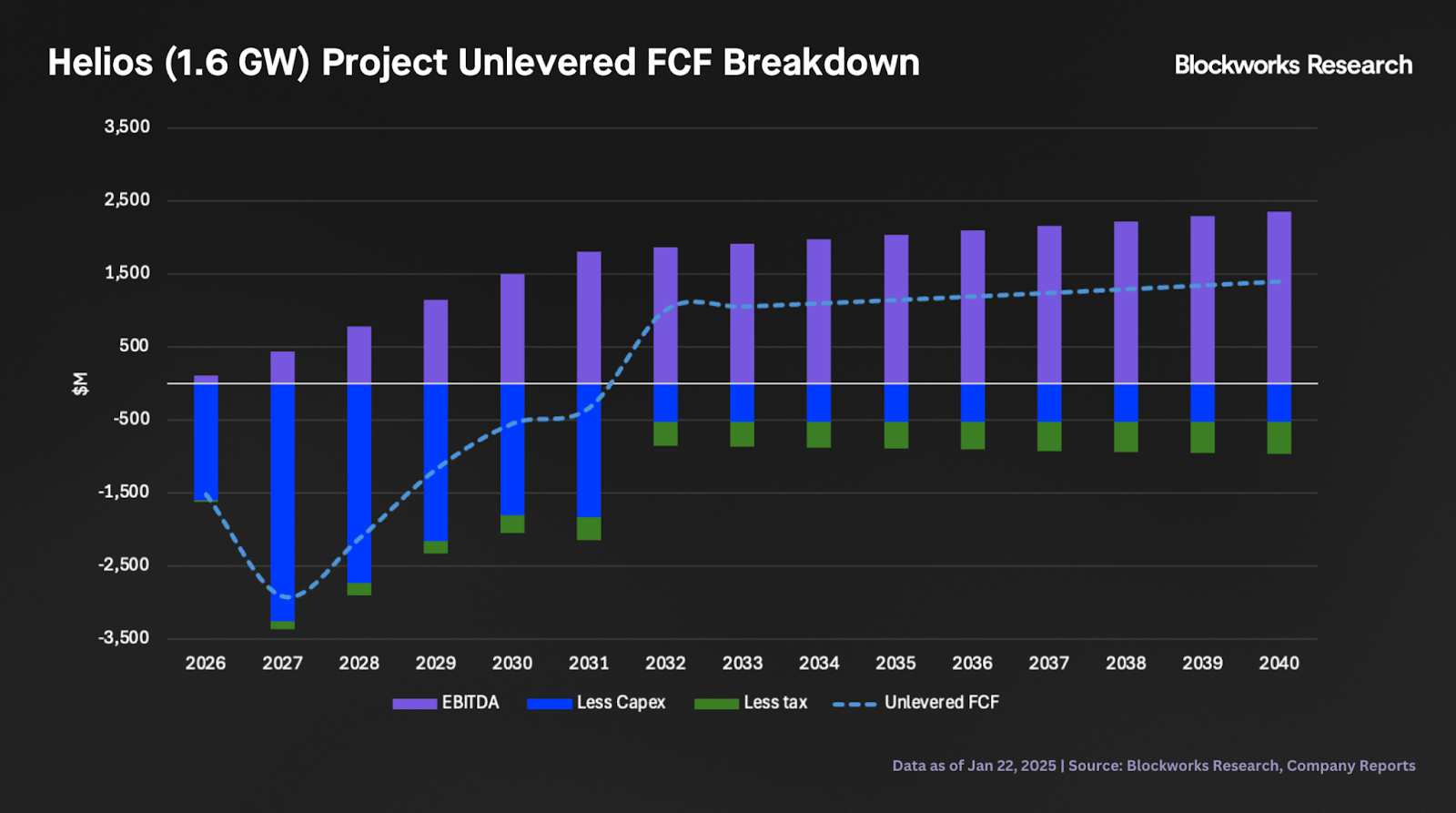

Helios is being rebuilt into a scaled AI and HPC data center campus, with CoreWeave committing to take all currently-approved power across three phases, totaling 800 MW of gross IT capacity under a 15-year term. The new ERCOT approval adds an incremental 830 MW and brings total ERCOT-approved, utility-contracted power capacity at Helios to over 1.6 GW, extending the contracting runway beyond the initial CoreWeave phases. To frame the cash flow impact of Helios at scale, we anchor on guided economics and base-case assumptions, which imply contract-life average unlevered free cash flow averaging ~$1.2 billion per year once fully ramped.

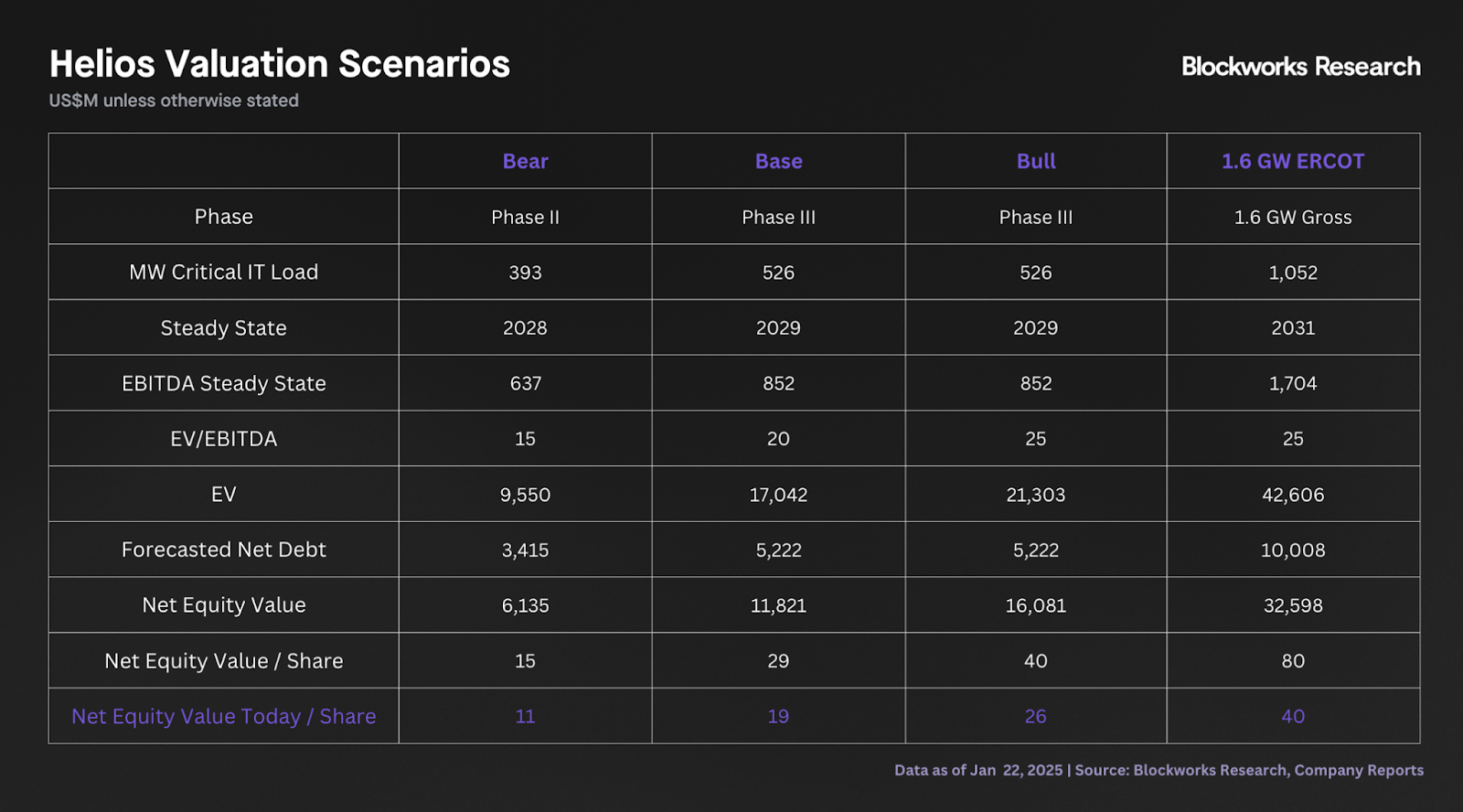

Updating our original valuation framework to reflect 1.6 GW of ERCOT-approved, utility-contracted power at Helios and applying the same assumptions as our base model implies roughly $80/share of equity value at full build, and roughly $40/share in present value terms assuming completion in 2031, which is above the current share price and roughly doubles our prior Helios contribution.

This reinforces our bullish view that Galaxy can keep proving incremental value as the construction and interconnection pipeline advances in a grid that remains power-constrained. Layering this uplift into our sum of the parts, alongside our base case Digital Assets and Treasury segments, would take our total valuation to above $80/share, which implies roughly 160% upside versus yesterday’s share price.

Straying away from the data center narrative, US crypto market-structure progress remains a meaningful tailwind for Galaxy’s core Digital Assets franchise, which represents ~60% of our $60/share base case sum-of-the-parts valuation. CLARITY is not law yet, but it has cleared the House and is now in the Senate, where the next gating step is a Banking Committee review and vote to advance it to the full Senate. If the Senate then passes a version that aligns with the House, it can go to the President to be signed, so the market is mainly waiting on Senate committee movement and a floor vote. In parallel, the OCC has continued to reduce friction for banks to engage in permissible crypto activities, including custody, certain stablecoin activity, execution services, and riskless principal crypto transactions, which should broaden the institutional counterparty set and support Galaxy’s Digital Asset segment.

From here, we see the next leg of performance as dependent on two things: contracting for the newly-approved tranche, and continued, visible construction progress into first power. The key risks remain execution at Helios, tenant concentration with CoreWeave, and the complexity discount from combining Digital Assets, Data Centers, and a volatile Treasury sleeve all in one entity.

— Sam

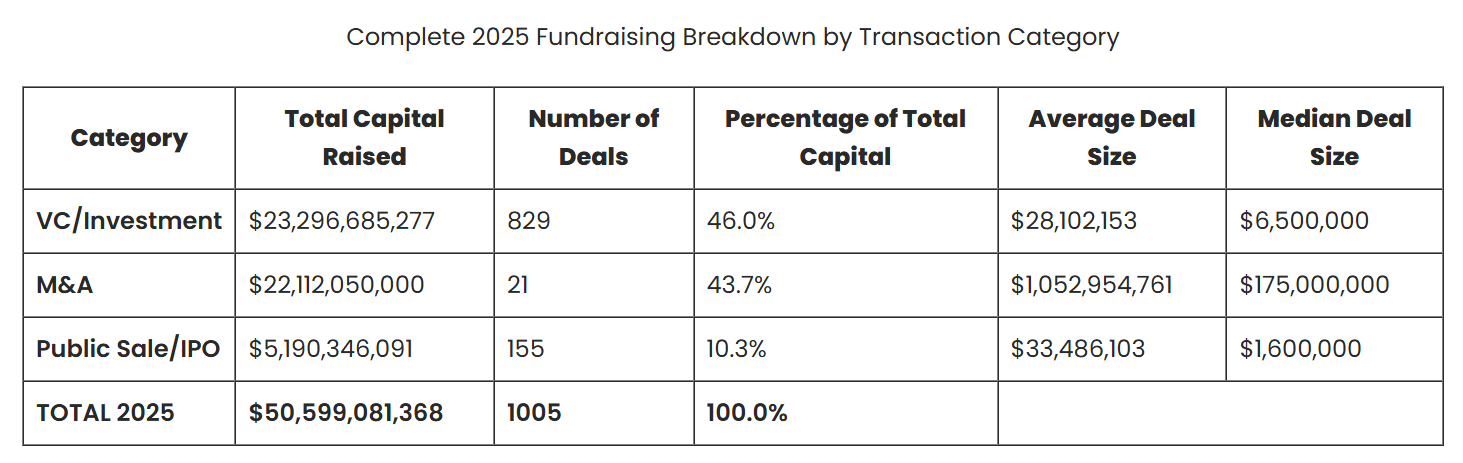

The Crypto Fundraising team argues the $50.6 billion headline in 2025 is misleading, because almost half the capital came from a small number of M&A deals — meaning consolidation drove the year more than fresh venture risk-taking. VC did rebound, but it got far more selective, with fewer deals and much larger check sizes as early-stage funding tightened and capital concentrated into proven winners.

Public markets also reopened, and funding flowed most into finance, payments, infrastructure and prediction markets, signaling a market that’s maturing toward regulated rails and real distribution rather than broad speculative experimentation.

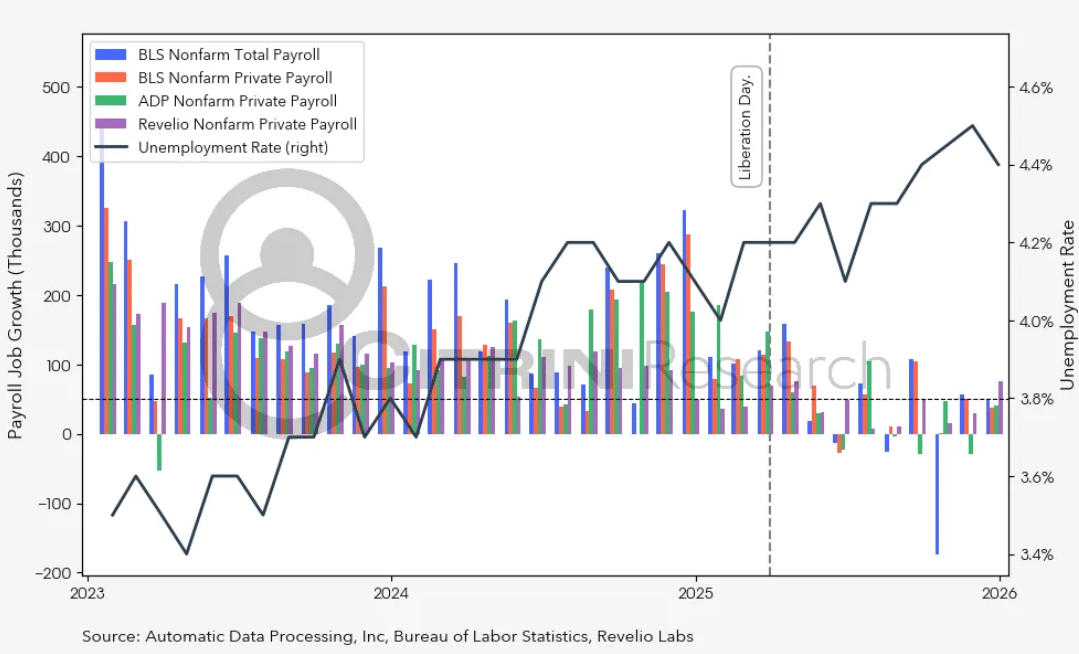

Citrini Research argues 2026 could deliver a better macro tape than consensus as productivity accelerates even with a cooling labor market, with AI-driven efficiency acting as the primary growth engine. It sees US policy turning increasingly pro-growth into midterms, with housing as the key lever through MBS support and affordability initiatives that could restart activity and lift cyclicals. On liquidity, it highlights improving Fed dynamics via a new reserve program that eases funding stress and reintroduces a tailwind for risk assets.

Geopolitically, Citrini frames instability as opportunity, staying constructive on oil and especially on tankers, where sanctions and shipping constraints create upside asymmetry. Globally, it favors LatAm materials and select ASEAN supply chain markets, while remaining cautiously bullish on China as reflation and capital markets activity improve.

Umberto published a blog post examining Multiple Concurrent Proposers (MCP), the consensus mechanism designed to eliminate proposer power rather than auction it.

The post explains how MCP replaces single-leader block proposals with multiple simultaneous proposers whose batches are deterministically merged, removing discretion over transaction inclusion and ordering. Unlike PBS, which creates markets around block construction, MCP embeds proposer duties into existing consensus incentives.

The analysis emphasizes that MCP eliminates consensus-layer MEV (reordering, selective inclusion, information asymmetry) but requires encryption to fully close informational channels, and notes trade-offs including coordination overhead and liveness degradation tolerance.

This episode of Lightspeed examines why Solana perps have struggled to compete with Hyperliquid, which offers sub-70ms latency versus Solana's 400ms block times and fee-market congestion. Bulk addresses this through Bulk Agave, a fork of Jito Agave that runs an in-memory execution environment (Bulk Tile) containing the matching engine, risk kernels and liquidation engine, with Bulk Net achieving sub-20ms order propagation. The discussion explored Bulk's real-time risk engine that enables portfolio margin with cross-collateral from Kamino, Loopscale and other yield positions. Skepticism toward prop AMMs for perps was noted, given inventory risk and unsolved matching problems. Open testnet launches at the end of January, mainnet late Q1 or early Q2.