- 0xResearch

- Posts

- Flows, records and token realignment

Flows, records and token realignment

Indices, Hyperliquid and buyback revival

Brought to you by:

Chain tribalism gave way to asset selection as a chain-agnostic revenue index outperformed both Solana and Ethereum. On Ethereum, Pendle, Ethena, and Aave now account for 43% of the index by weight, highlighting where value is concentrated. Hyperliquid set new records with $7 million in daily token holder revenue and $30 billion in daily perp volume, while spot trading on HyperCore reached $750 million in a single day. Tom Lee’s DATCO crossed 1 million ETH accumulated, equal to ~1% of supply, with a target of 5%. Meanwhile, buyback and launchpad models are reshaping flows across the market.

While much of the debate focuses on chain tribalism, data shows asset selection is the real driver. A chain-agnostic index of the top 10 revenue-generating projects has outperformed both the Solana and Ethereum indices, highlighting the importance of asset selection over simply chasing L1 beta.

Following the success of sUSDe PTs on Aave, the trifecta of Pendle, Ethena, and Aave on Ethereum now represents 43% of the index by weight.

— Shaunda

Brought to you by:

Katana is a DeFi chain built for real sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn boosted yield and KAT tokens: Deposit directly into vaults on the katana app and start earning on your ETH, BTC, USDC, and more.

On Friday’s 0xResearch livestream, we dug into the state of the market, the scale of Tom Lee’s ETH accumulation and how buybacks and launchpads are reshaping token flows.

Takeaways from Friday’s 0xResearch episode:

Since July 7, Tom Lee’s DATCO has acquired over 1 million ETH (~1% of supply), with a stated goal of 5% ownership. Daily ATM issuance reached $400 million+, averaging ~6% of trading volume.

ETH trading volumes flipped BTC for two straight weeks. ETH’s upside is limited without BTC breaking higher. MicroStrategy’s pause on common stock ATMs signals smaller BTC buys ahead compared to its $20 billion raised in 2023. SharpLink added 100k ETH this week, bringing holdings to 728k ETH ($3.1 billion) staked via Liquid Collective.

Buybacks dominate: Pump shifted to 100% revenue buybacks, driving token creation back from Bonk and generating $1-4 million/day. Lido, Mantle and others are now exploring similar models.

Launchpad revival: Heaven’s “Light” ICO raised $20 million+, with 2,500 launches and $30 million volume on day one. Zora’s social-integrated creator coins reached ~$200 million market cap, positioning it as a differentiated player.

Staking pressures: Beacon chain withdrawal queues hit nearly two weeks as Aave USDT borrow rates spiked to 16% intraday.

Bloomberg expects Solana ETFs in October, with staking ETFs to follow. The SEC reiterated liquid staking tokens are not securities, paving the way for institutional adoption.

Listen to the full episode on YouTube, Spotify, Apple Podcasts and X.

This summary was generated with assistance from AI tooling.

It’s the summer of DATs and the party is going strong.

But when October rolls around, everyone will be looking to DAS: London to hear from these meta-defining voices on where things stand and where they’re headed.

Get your ticket today with promo code: 0X100 for £100 off

📅 October 13-15 | London

Charts of the week

Hyperliquid token holder revenue hit a record $7.03 million on Aug. 14, lifting the weekly average to $3.92 million, 26% above the 30-day average of $3.12 million. Hyperliquid has generated over $93 million in revenue over the past month, with August showing particularly strong momentum.

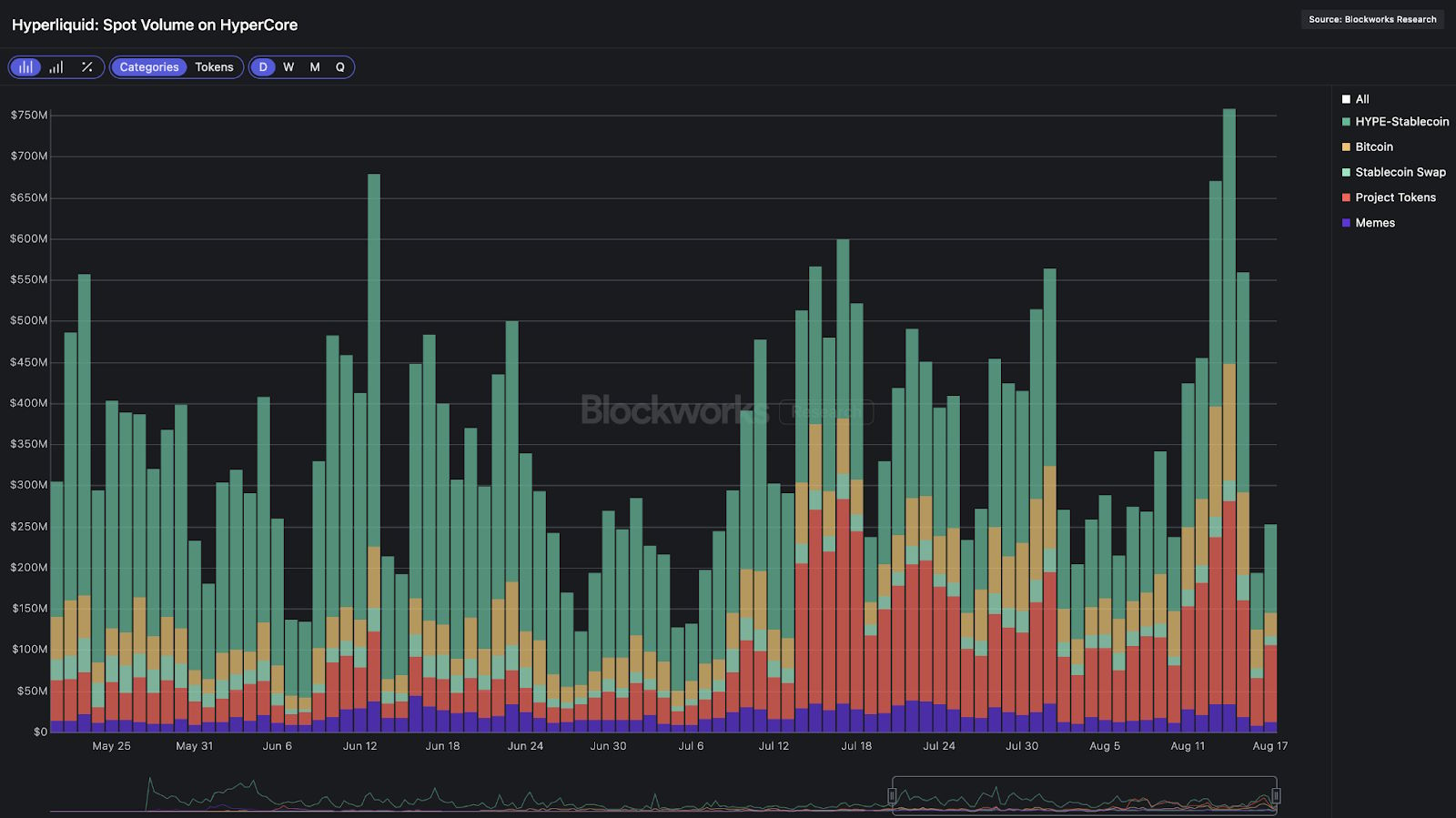

Spot trading on HyperCore reached $750 million in daily volume on Aug. 14, with HYPE-stablecoins representing 42% of the weekly $3.3 billion total. Project tokens have emerged as the second-largest category at 31% of volume, while memecoins remain relatively subdued at just 4.7%,a contrast to their dominance on other DEXs.

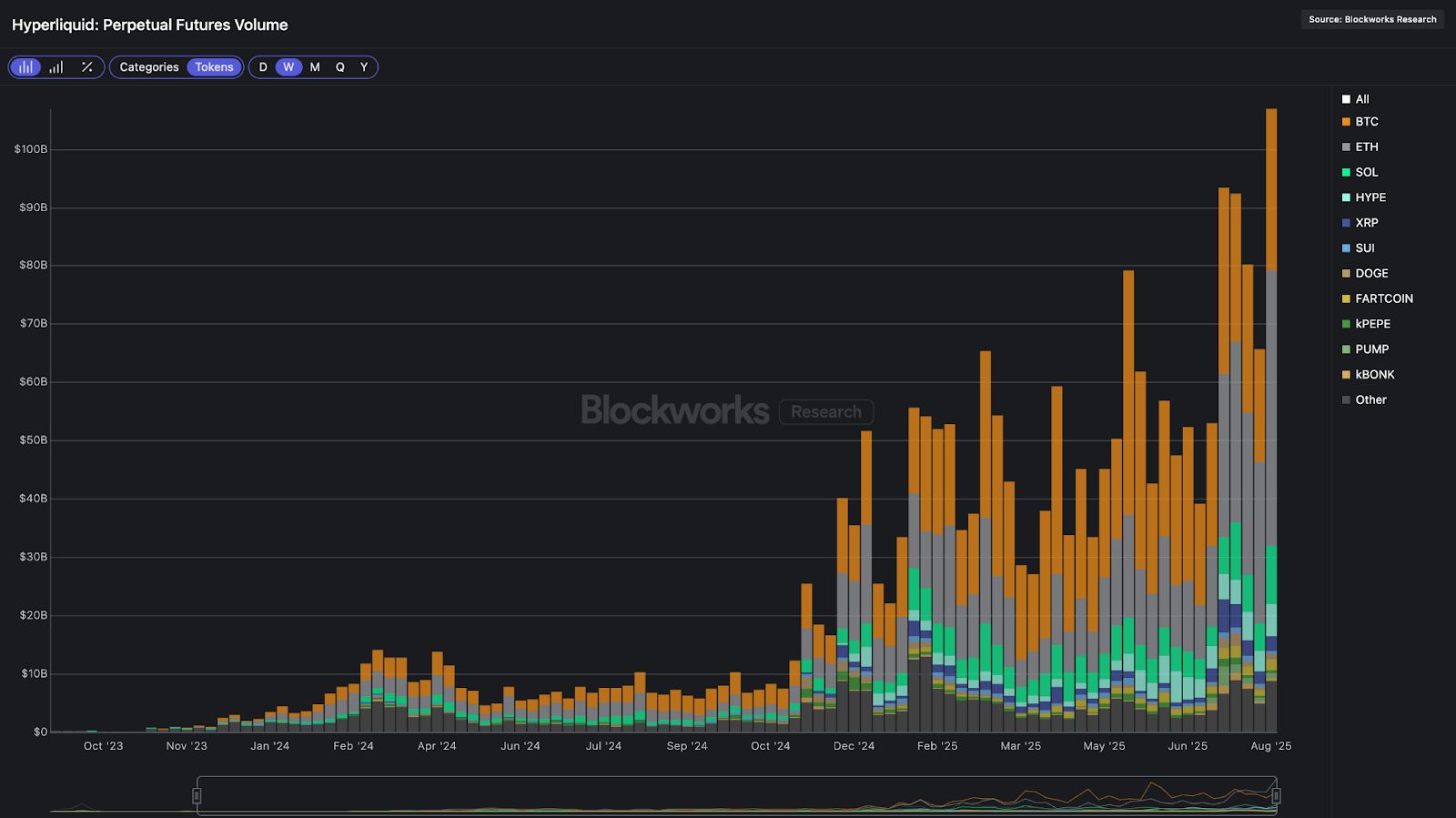

Perpetual futures volume averaged $30.5 billion daily over the past week. ETH accounted for 44% of total activity, followed by BTC at 25%. In terms of token categories, the mix of trading activity reflects a maturing ecosystem: 46% of volume came from L1 tokens, 6.6% from project tokens, and 6.5% from memes.

— Shaunda

|

|