- 0xResearch

- Posts

- 🪇 Everyday I’m Shuffling

🪇 Everyday I’m Shuffling

Crypto casinos are hot

Brought to you by:

Crypto casinos remain one largely ignored but actually revenue-generating sector in the industry.

When I say “crypto casino,” I don’t mean that in the loose sense by which we commonly refer to 99% of speculative activity. I mean an actual gambling casino that lets you bet with crypto assets.

Let’s look at Shuffle today.

— Donovan

Why is ETH up?

Source: Blockworks Research

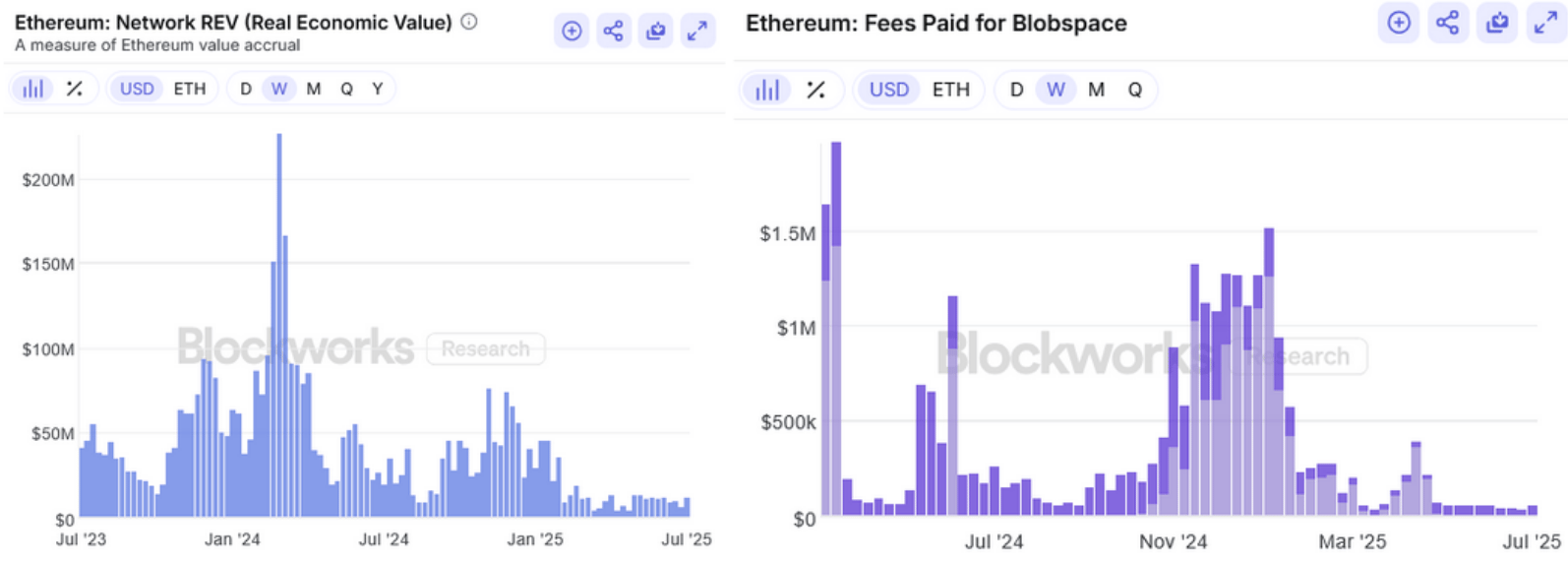

Are there fundamental value accrual reasons on the Ethereum network that can explain ETH's recent price rally to $3600, a 43% rise in the last month?

In the week of July 7-13, Ethereum’s REV (transaction fees + MEV tips) was $11.6k, while fees paid for blobspace came up to $58k — no major spike in either.

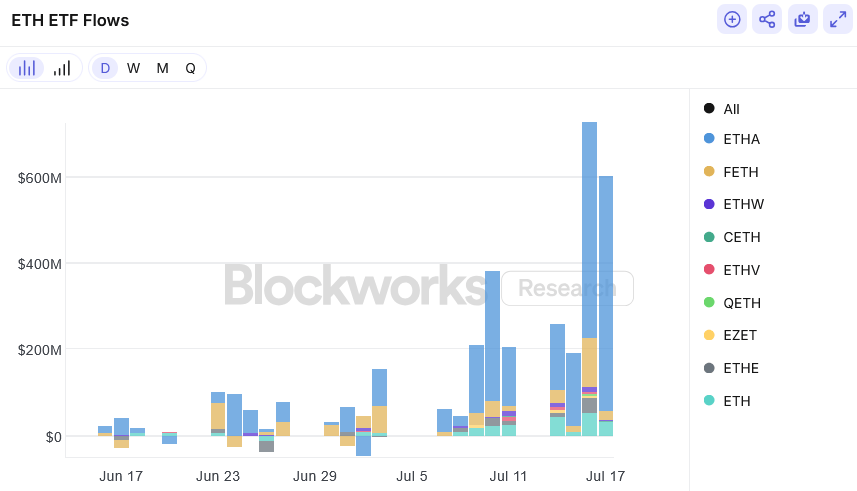

Despite that, ETH ETFs are seeing some of the largest inflows since their introduction. On July 16, ETH ETFs saw a net inflow of $726m. Talk about size!

Brought to you by:

Katana is a DeFi chain built for higher sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn KAT tokens: Pre-deposit with turtle club

Casinos built on blockchains

It has often been said that most crypto startups are guilty of “blockchains in search of a problem.”

Perhaps one segment that defies that stereotype are crypto casinos. The Financial Times pegs this niche market to be roughly at $81b in 2024.

Consider Shuffle.

Incubated by Fisher8 Capital and co-founded by former Alameda trader Noah Dummett, Shuffle is a casino and lottery platform boasting at least $100m in annualized “net gaming revenues” — meaning all revenues after VIP rebates and cashbacks.

The SHFL token’s current FDV of $232m is about a cheap 2.3x multiple, compared to the range of 10-40x revenue multiples for most other top DeFi tokens.

Those revenue numbers would place Shuffle in a top 20 revenue-generating list of Web3 businesses, yet the project remains largely absent from the so-called “revenue meta” conversation on Crypto Twitter.

Shuffle’s architecture

Despite being frequently referred to as a “crypto casino,” Shuffle executes the majority of its gameplay mechanics off-chain — largely due to the fact that posting every bet on a public chain would overwhelm even the fast L2 networks.

Additionally, most of Shuffle’s gambling games are outsourced to iGaming content studios like Evolution, Hacksaw Gaming, Pragmatic Play, etc. So while Shuffle provides players with a frontend and bankroll, iGaming studios generates the outcomes on the backend.

Yet in a highly commoditized sector like gambling, this may be a conscious decision where revealing wager volumes would expose strategic information about a casino’s balance sheet, runway and its ability to take large bets to competitors.

How blockchains come in

Traditional casino businesses rely on card networks and bank wires that typically treat gambling as a high-risk “sin” vertical. This means that players face various forms of friction such as extremely high fees, frequent declines, chargeback complications and blocked cross-border deposits.

These problems that plague traditional gaming businesses introduce a lucrative entrepreneurial opportunity for crypto casinos like Shuffle to tackle using blockchains, through which crypto assets can settle globally in seconds without chargeback risks.

This on- and off-ramping of assets is the decisive key selling point for crypto casinos like Shuffle, Stake, Roobet and more.

But then there is also, of course, the SHFL token, an ERC-20 token on Ethereum. This is where Shuffle gets interesting and stands out from its crypto competitors.

While Shuffle originally used a buyback and burn value accrual mechanism, it introduced last year a weekly lottery that pays out USDC rewards to staked SHFL token holders.

15% of Shuffle’s weekly revenues (something like $200k-$300k) are returned through this lottery, which closes at a fixed time every Friday. In APR terms, the team told me that’s about a 48% annual return.

(A new onchain lottery is soon to be launched.)

A further 30% of gaming revenues earned in SHFL continues to be burned, creating a deflationary sink for the token.

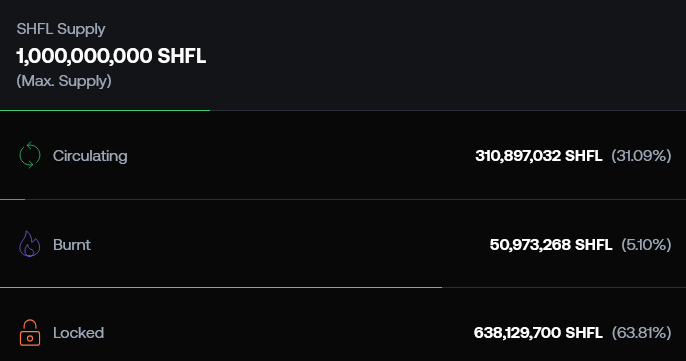

To date, Shuffle has burned about 5% of its total circulating supply.

Source: Shuffle

This decision was largely motivated for strategic customer retention reasons because buyback and burns were perceived as an intangible value accrual mechanism, Fisher8 Capital investment analyst Lai Yuen told me.

Because all token movements occur onchain, anyone can track lottery prize funding, draws and burns in real time — levels of transparency that are almost unheard of in traditional gambling.

On Crypto Twitter, gambling businesses seem to be largely left out of the conversation, perhaps for ethical reasons. Other sources I’ve spoken to have also mentioned that some liquid funds generally have a mandate to avoid sin verticals.

But there’s no denying that GambleFi offers a unique insight into the kind of technological innovation that blockchains bring.

Companies like Shuffle have traction precisely because they solve an acute payments and access problem for a global customer base that wants to gamble, and are willing to accept regulatory risk in exchange for instant deposits and fast withdrawals.

That regulatory–payments arbitrage is the wedge that lets crypto casino businesses carve out an annual $80 billion gray-market industry despite outright bans or geoblocks in most major jurisdictions.

Shuffle recently announced plans to channel that model into a compliant US offering (ShuffleUSA), signaling growth expansion on the horizon.

A new era of play is about to land 🇺🇸

Shuffle.us

— Shuffle.us (@ShuffleUSA)

4:00 PM • Jul 4, 2025

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 PM EST

|

|