- 0xResearch

- Posts

- Ethereum ships Fusaka

Ethereum ships Fusaka

Plus, Sui targets robotics with a fully onchain stack

Brought to you by:

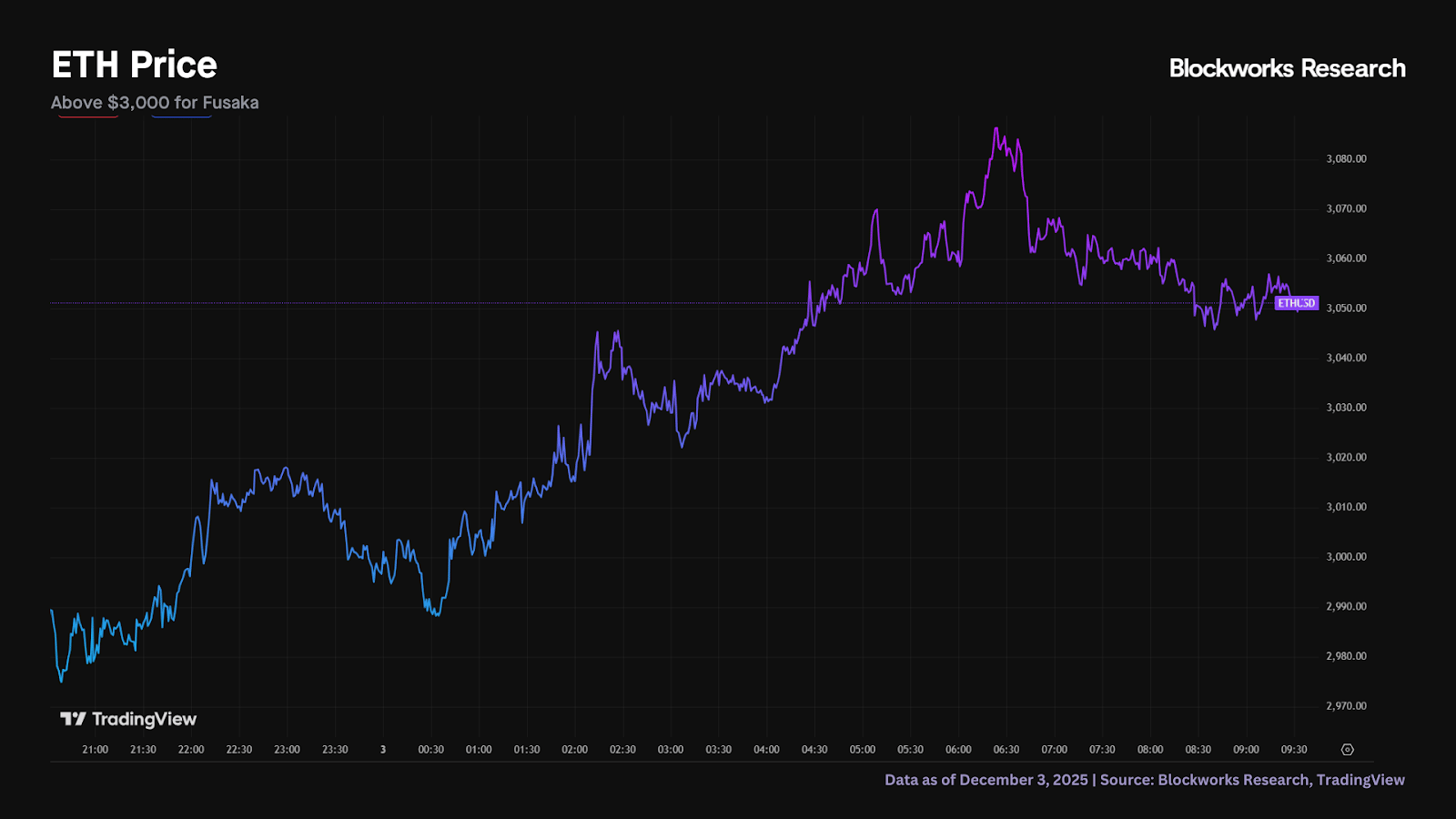

Happy Wednesday! Markets leaned decisively risk-on, with crypto leading the move while traditional assets stayed muted. Ethereum’s Fusaka upgrade arrived with PeerDAS, BPO hard forks, and the under-discussed EIP-7918, which together may finally restore deflationary pressure on ETH. On the thematic front, Sui is making an aggressive full-stack push into robotics, positioning onchain coordination, settlement and telemetry as critical primitives for a coming wave of real-world machines.

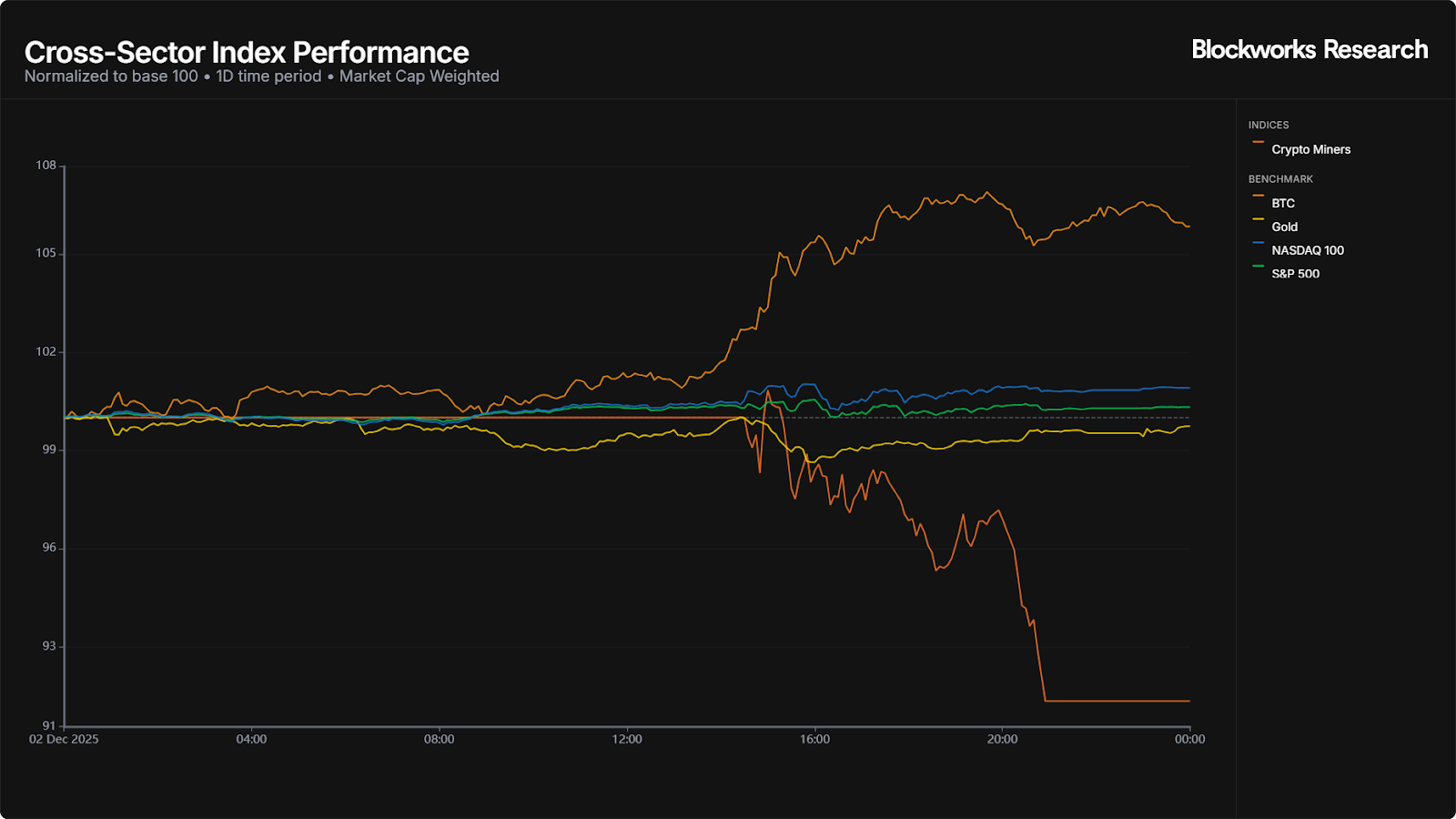

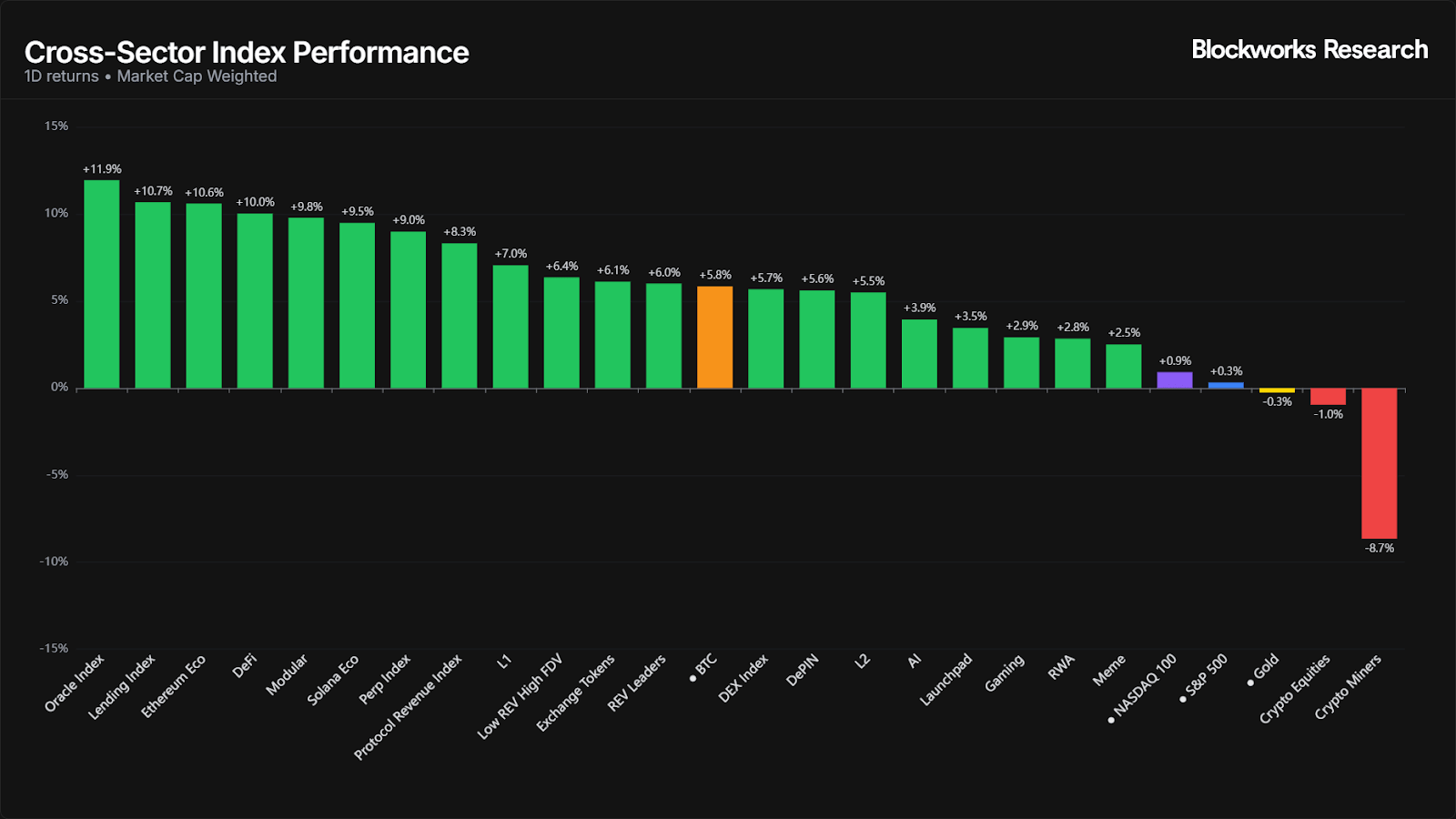

Markets leaned firmly risk-on, with crypto broadly outperforming traditional assets. BTC (+5.8%) sat mid-pack, while equities were muted. The S&P 500 (+0.3%) and Nasdaq 100 (+0.9%) barely budged. Gold (-0.3%) slipped, and crypto miners were the clear outlier to the downside (-8.7%), suggesting profit-taking and sensitivity to BTC’s consolidation.

The crypto sector breadth was exceptionally strong. Oracles, Lending and the broader Ethereum ecosystem led the board, signaling a clear rotation back into core infrastructure and high-utilization protocols. DeFi, Modular, Solana ecosystem and perps followed close behind with similarly solid showings, pointing to broad appetite for beta across liquid alt sectors. Lower down the stack, L2s, AI plays, launchpads and gaming tokens all moved higher, while more speculative areas like memes lagged. The only clear pockets of weakness were crypto equities and miners especially, which saw meaningful pullbacks.

The move fits with improving sentiment as macro headwinds ease. Yields stabilized, liquidity indicators firmed and positioning metrics suggest investors are adding risk after a muted stretch. Strong rebounds in infra sectors imply expectations for higher onchain activity and potential catalysts from upcoming protocol upgrades. Looking ahead, attention turns to macro prints later this week, which could test the durability of this risk-on tone. Volatility remains compressed, but with crypto sector dispersion widening, traders should expect sharper rotations as narratives evolve.

— Marc

Today is Fusaka day in Ethereum land, the second upgrade this year (the Pectra hard fork was in May). It’s not often that Ethereum has two upgrades in one year, and that’s because Fusaka is more of a half upgrade. Over a dozen EIPs were removed after EOF was mothballed in April.

Of the 12 EIPs remaining, PeerDAS, is the most significant, according to Gabriel Trintinalia, protocol engineer at Consensys.

"During the initial development of the Fusaka upgrade, any feature that carried a risk of delaying the fork, such as those requiring more research or having high complexity, was deprioritized and removed from the scope," Trintinalia told Blockworks.

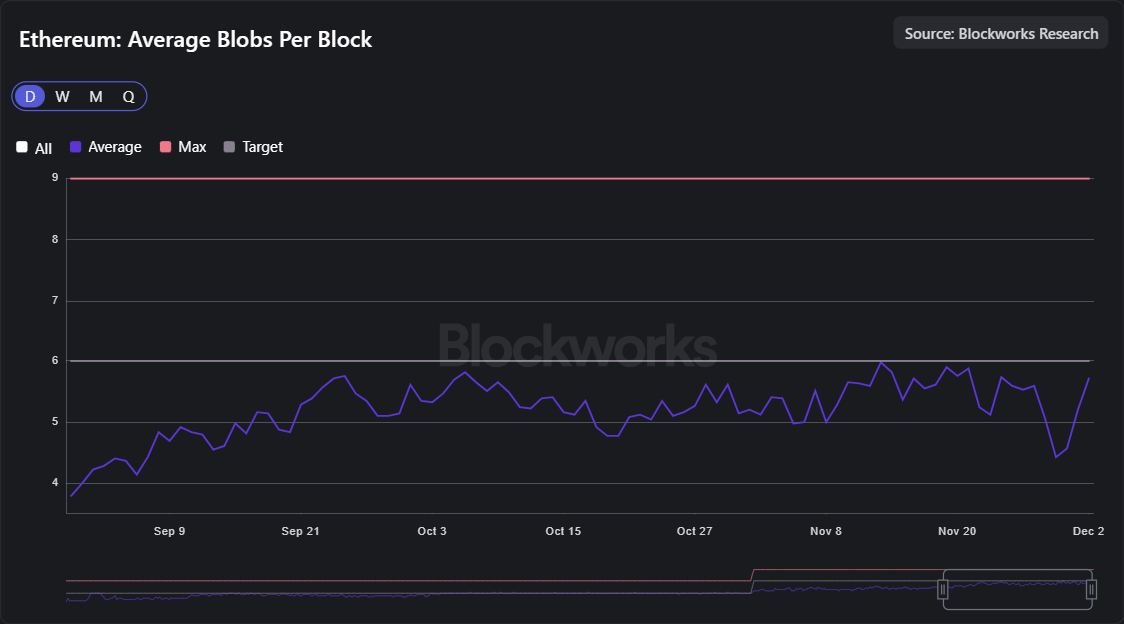

PeerDAS introduces data availability sampling, which allows validators to share the load of blobs, effectively allowing for an increase in blobs per block. There is one upgrade being overlooked, but first, some background:

Blobs have failed to hit their target of six per block, and just when it looked like they were about to, Ethereum is looking to raise the target again. Technically, Fusaka will not be raising the blob target, but is instead introducing Blob Parameter Only (BPO) hard forks. This creates a separate and easier process to adjust blob storage parameters. So instead of waiting for a major upgrade, Ethereum can make smaller, more frequent adjustments to blob capacity.

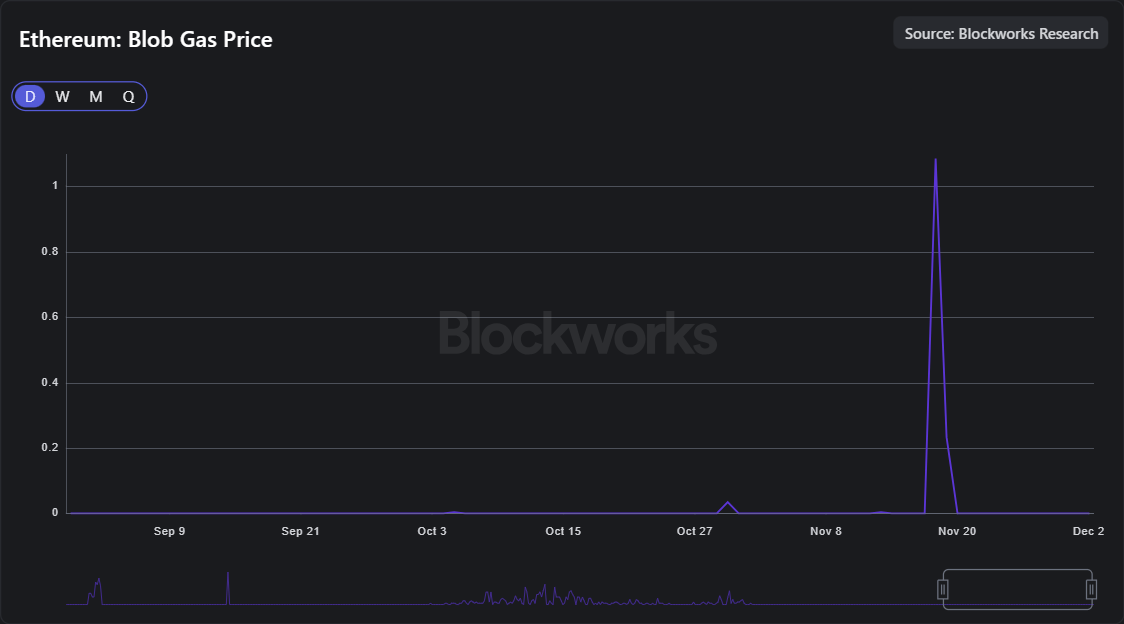

The larger point still stands: With supply exceeding demand, the blob gas price has been largely immaterial (apart from a few blips here and there when the blob price reached a measly 1 gwei).

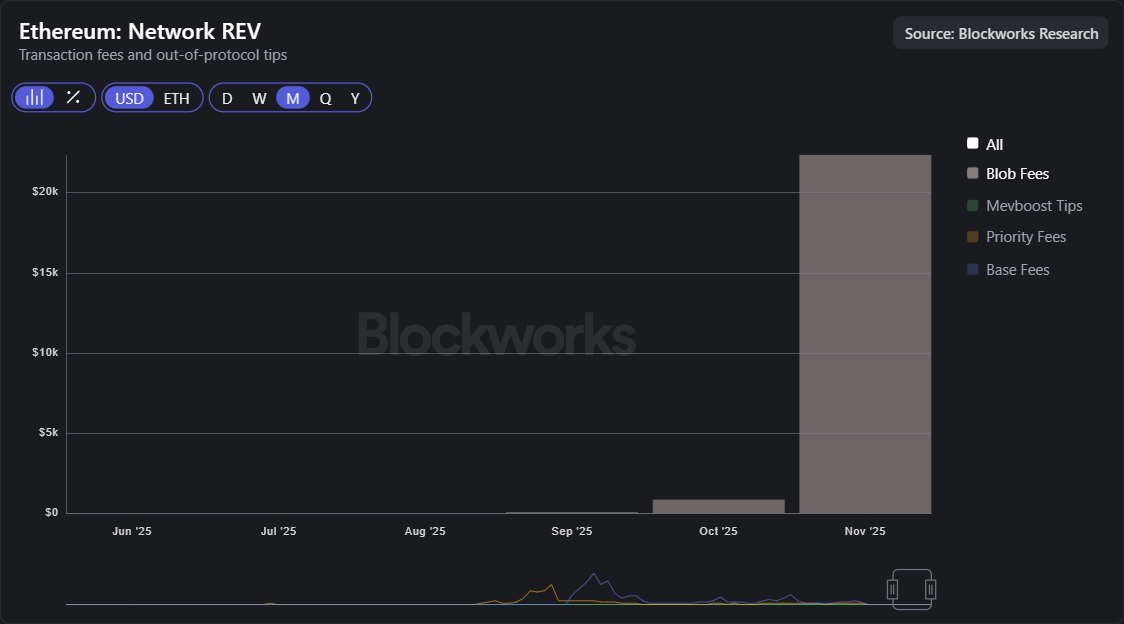

Post-Pectra, between June and October, Ethereum generated around $900 in blob fees. The brief spike in November brought this to ~$23K. Still not material, but it highlighted the order-of-magnitude difference when blobs actually have a market.

This is why EIP-7918 needs more attention. It addresses the blob fee market problem by introducing a reserve price tied to execution costs (a floor price of sorts). When L2 execution costs dominate blob costs, this prevents the blob fee market from becoming ineffective at 1 wei. For example, as shown below, if EIP-7918 was introduced on June 1, 2025, burnt blob fees would have been nearly 8x more. The upgrade isn’t only a reserve pricing model, it also presents more price stability and predictability, avoiding dramatic fee spikes when the blob market becomes inelastic.

Together with PeerDAS and BPO, this suggests that as Ethereum scales L2 capacity, blob fees should go up as well (historically, this relationship has been strictly inverse). For ETH holders, this, combined with L1 scaling, can hopefully return the ETH supply to a deflationary phase.

— Marc

Brought to you by:

Every market speaks a different language. But they all understand Chainlink. This is how $867 trillion in tokenized assets speak blockchain.

Our latest report outlines why Wall Street is adopting Chainlink as the industry-standard oracle platform.

See why the world’s largest financial institutions are choosing Chainlink.

Sui’s robotics bet

Robotics is an emerging theme, but it remains hard to access through public equities. Crypto is usually framed as a financial settlement layer, yet it can also open new TAMs like robotics by enabling verifiable coordination, settlement and auditability of robotic behavior onchain. As robots scale across industry, delivery and the home, the world will need tamperproof telemetry logs, tight access control and real-time settlement across manufacturers, operators and users. When latency matters and multiple stakeholders need the same trusted record, the cloud model strains, possibly creating structural demand for blockchain rails.

Sui is targeting this vertical with an integrated, full-stack approach. Nautilus enables verifiable compute via enclave attestations for workloads like planning and sensor fusion. SEAL adds native encryption and permissions for private telemetry and model outputs. Walrus supports high volume artifacts like firmware, video and motion data. Programmable transaction blocks (PTBs) tie authorization, payment and logging into one atomic workflow, while Sui’s object based model provides a cleaner abstraction for tracking persistent entities onchain. Hence, Sui offers a trust minimized robotics substrate built end to end by the core team, vs. other ecosystems that stitch together third party components.

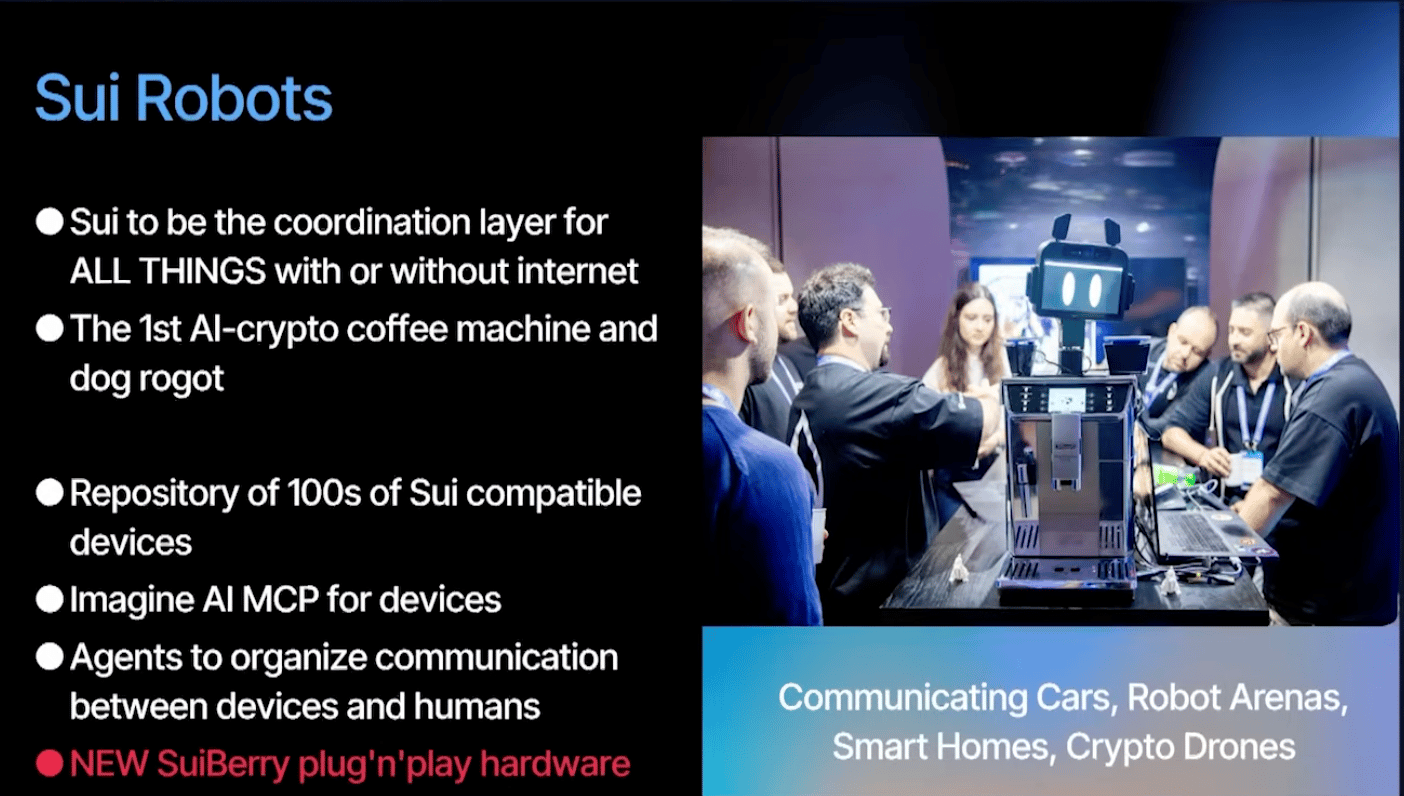

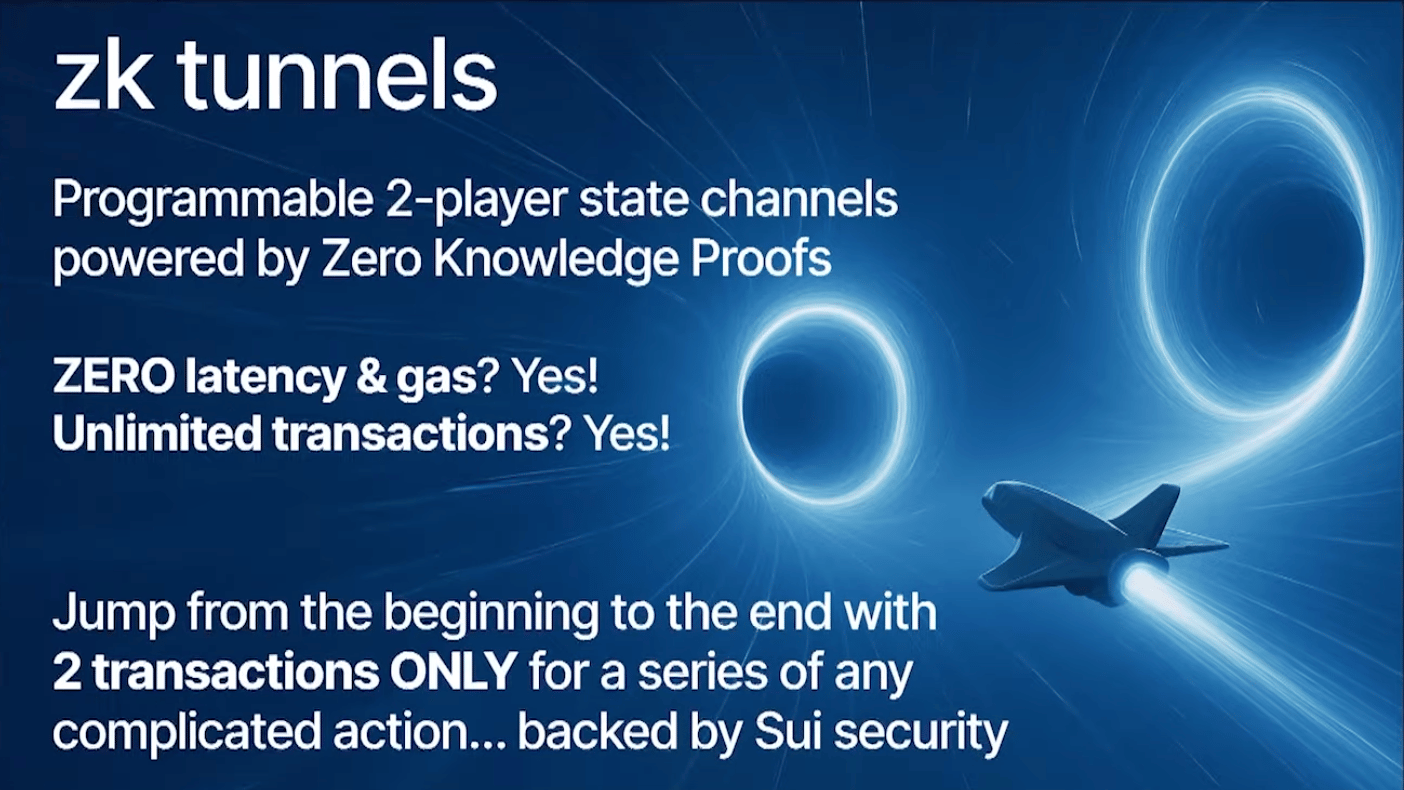

zk Tunnels is another development, aiming for near-zero latency private channels with onchain settlement that could enable real-time robot rental and coordination over local transports. The story is already moving, with robot demos coordinated via Sui at KBW 2025 highlighting an early signal of what an onchain robotics world could look like in practice.

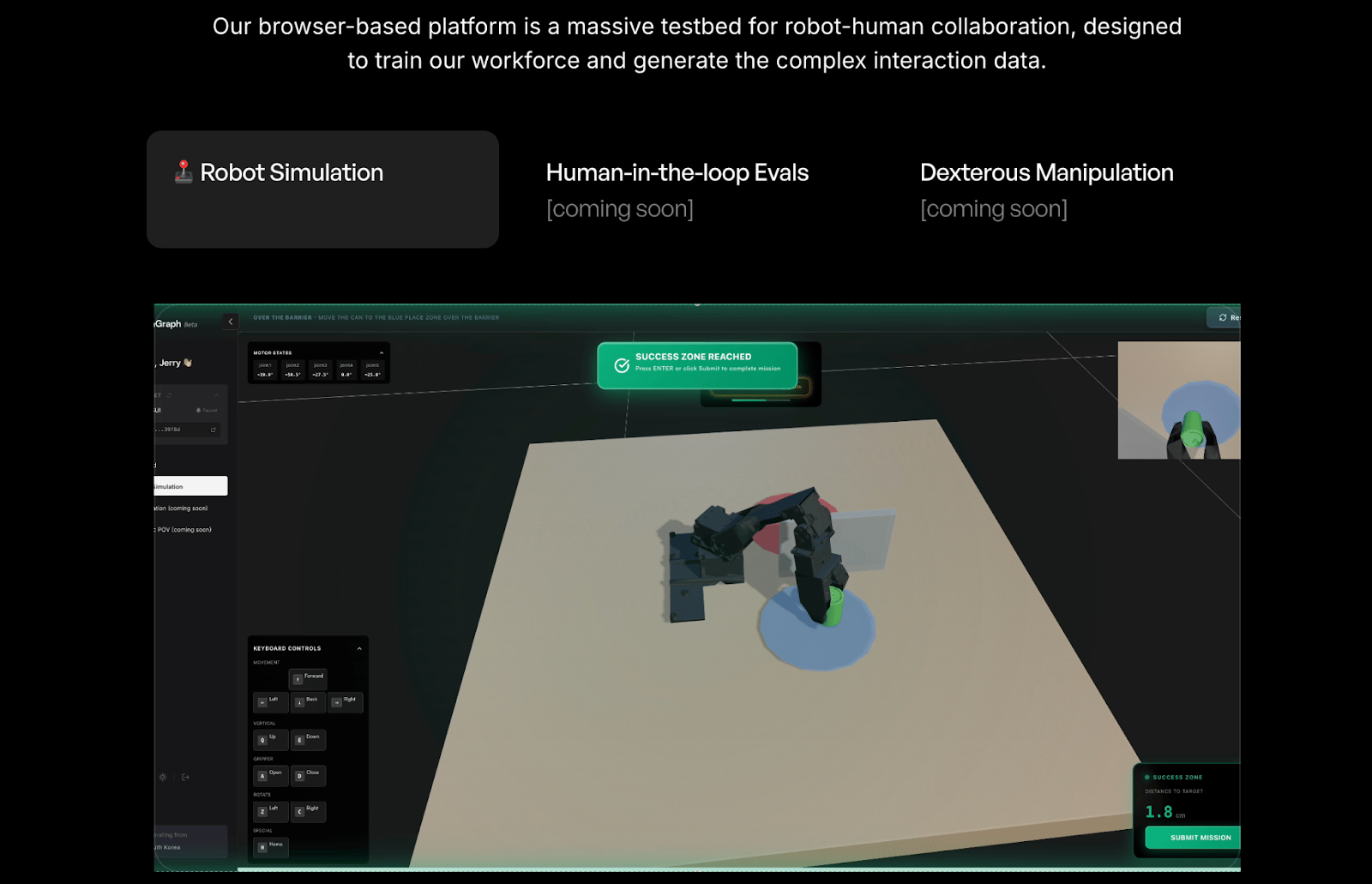

Another early example is OpenGraph Labs, which is building a robot training data marketplace on Sui, where users can remotely operate robots to generate real-world motion and behavior data. Each robot is represented as a Sui object, making ownership, identity and rewards trackable onchain, while the datasets are stored and sold via Walrus, creating a path for robots and their data to become onchain assets with native settlement.

— Sam

a16z crypto frames AI x crypto crossovers around four pillars — agent and user identity, decentralized infrastructure for AI services, new incentive rails for attribution and micropayments, and user-owned AI that keeps context portable across platforms. Near term, a16z sees wedges in portable identity and reputation, agent payment and commerce rails, and provenance systems that let creators set programmable terms as AI compresses web monetization. Longer term, the upside shifts to credibly neutral infrastructure and ownership layers that prevent new platform lock-in by making memory and the AI relationship user-controlled.

Spark’s October roadmap lays out a phased push from core product upgrades into distribution, highlighting Savings Vaults v2, institutional lending, Spark Mobile and stablecoin liquidity as a service alongside automated trading operations. The plan centers on scaling capital efficiency and broadening access, with an explicit tilt toward more structured, institution friendly rails while expanding the platform’s liquidity and execution stack.

The report argues the global financial system is reorganizing around RWAs and stablecoins, and Korea needs legislation and a national strategy to avoid adopting standards set elsewhere. It frames RWAs as the structural layer and stablecoins as the engine to outline a path from local stablecoin issuance and tokenization through platform strategy, Korean security tokens and the required legal framework.

Crypto's premier institutional event is returning to NYC this coming March 24-26.

Ticket prices will increase soon, so lock yours in today!