- 0xResearch

- Posts

- 🚪 Ethereum's swollen exit queue

🚪 Ethereum's swollen exit queue

What triggered the congestion?

Ethereum’s validator exit queue has ballooned to over 475,000 validators, with wait times now exceeding nine days. The catalyst? A spike in Aave’s ETH borrow rates that triggered a rapid unwind of stETH leverage loops. This reflexive shock exposes hidden risks in DeFi’s most popular passive income trade.

— Macauley

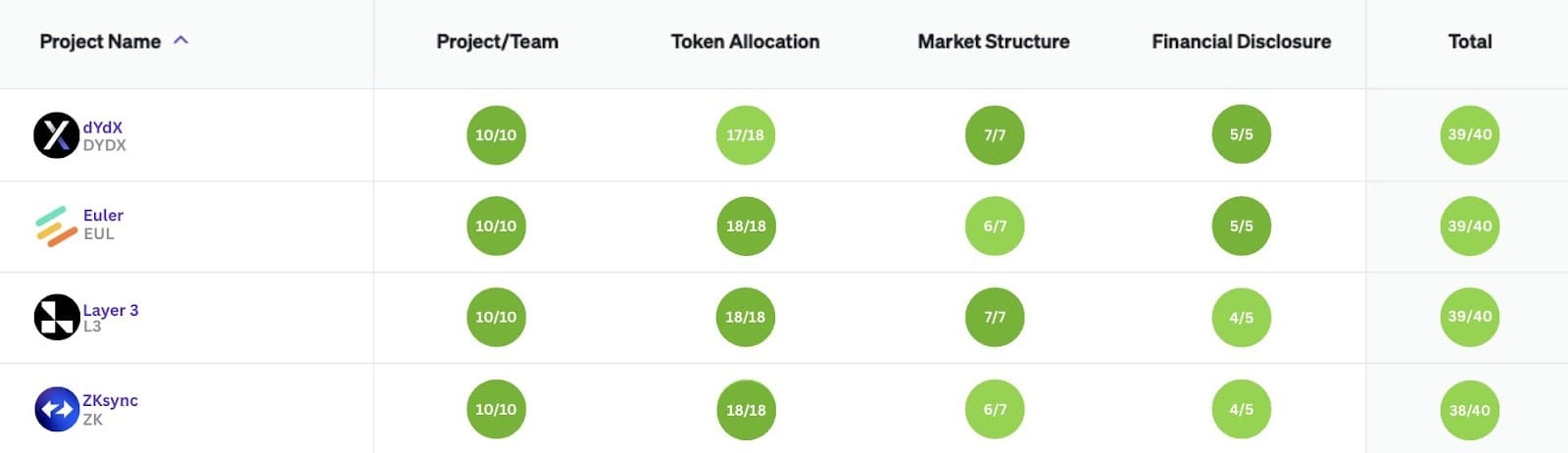

Token transparency gets a boost:

Source: Blockworks Token Transparency

The third cohort of the Token Transparency Framework just dropped, and four major projects — dYdX, Euler, Layer 3, and ZKsync — are setting a high bar for disclosure in crypto. Each project underwent a rigorous one-time review across 18 criteria in four categories: Project and Team, Token Allocation, Market Structure and Financial Disclosure.

Three of the four scored near-perfect: 39/40. Euler earned high marks for quarterly balance sheets and transparent vesting; dYdX stood out for distinguishing its legal entities and publishing ecosystem reports and Layer 3 disclosed all treasury and investor wallets plus market maker loan agreements. ZKsync scored 38/40, noting detailed token minting mechanics and equity-token linkages.

In a market often plagued by asymmetry and hidden risk, these teams are leading a shift toward standardized, verifiable transparency. Full submissions are now available via Blockworks' Token Transparency hub.

TL;DR: Token teams have no excuse for opacity anymore.

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 PM EST

Risk of stETH loop unwind

Ethereum’s validator exit queue surged past 475,000 validators this week, pushing the unstaking wait time to nine days — the second-longest in Ethereum’s post-Merge history. Galaxy Digital Research attributes the spike to a cascading unwind in liquid staking token (LST) leverage. Its report traces the stress to one trader’s large capital rotation: “This volatility was driven by a sharp reduction in ETH supply on Aave, initiated by large withdrawals from the platform by a wallet tagged to the HTX exchange [formerly Huobi].”

That liquidity removal sent Aave’s ETH borrow rates soaring from ~3% to over 18%. The result? Negative carry for stETH loopers — users who recursively borrow ETH to buy more stETH.

Galaxy notes that when rates jumped over 10%, leveraged positions became unprofitable, prompting a mass unwind.

This unwind played out through two channels. Some loopers sold stETH on AMMs, pushing the peg down by 30-60 basis points. Others opted for validator redemption, leading to the massive queue buildup. Although May’s Pectra upgrade lifted the fixed churn cap — raising today’s allowance to roughly 12 exits per epoch — the wave of withdrawal requests still overwhelmed that higher limit, pushing the queue out to more than nine days.

That delay created a feedback loop: With redemption time rising, arbitrageurs now require higher yields to justify holding depegged stETH. As Cork Protocol’s Robdog.eth explained, “the annualized yield of [buying stETH at a discount and redeeming] with a nine-day delay is 25%, which…is fairly profitable. If the queue becomes 18 days instead of nine, the arbitrage take rate becomes 100-110 bps.”

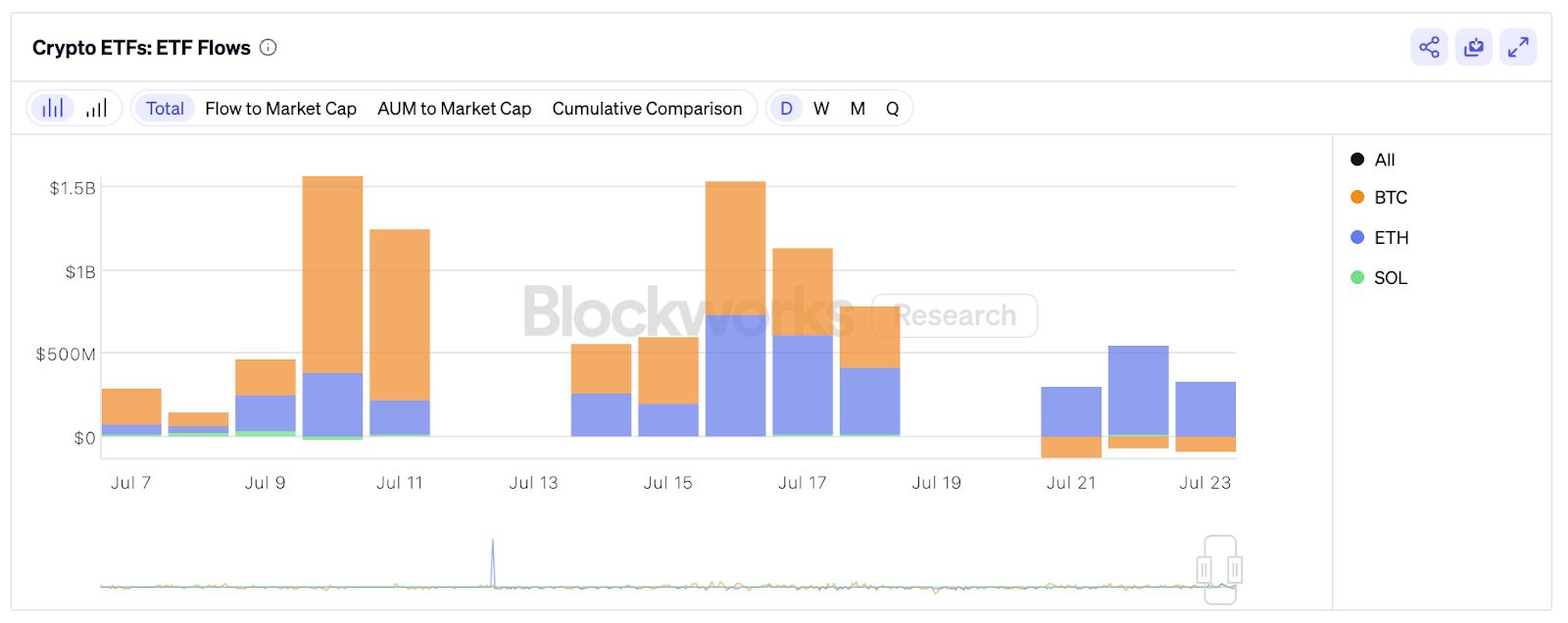

Importantly, the unwind hasn’t tanked ETH itself. ETH spot ETF flows remained strong, with $300 to $600 million in daily inflows over the past week. That demand absorbed much of the selling pressure.

“Investor appetite for the two biggest blockchains is undeniable,” Dom Harz, co-founder of hybrid L2 BOB, told Blockworks. “ETH is outperforming the original blockchain so far this month.”

Source: Blockworks Research

Some traders have speculated that the depeg may also reflect spot ETH scarcity at OTC desks as institutional demand via ETFs intensifies. Wintermute’s CEO noted a week ago that its books were “virtually out of ETH,” prompting concerns that funds are sourcing ETH by dumping stETH. While plausible at the margin, onchain flows and redemption patterns suggest leveraged stETH loop unwinds remain the dominant driver, with OTC demand playing, at most, a secondary role.

Still, the event underscores a chronic weak point in Ethereum’s liquid staking stack. The stETH/ETH peg remains around 0.995, while onchain AMM liquidity for stETH dropped from $280 million to $180 million. Most major lending protocols (like Aave and Maker) use stETH’s redemption oracle, not market price — shielding users from immediate liquidations. But if the queue stretches further, slow-burning interest accrual could start forcing more severe deleveraging.

Galaxy Research frames this episode as a warning shot. “[T]his episode highlights the continued fragility of the ETH liquid staking and restaking ecosystem,” the report notes. It calls for design improvements like peer-to-peer exit markets, rate smoothing and fixed-term vaults to reduce reliance on redemption queues.

The loopers, meanwhile, are caught in what one analyst called a “trilemma”: Accept a 5-6% loss by selling at a discount, wait nine+ days while paying high interest, or hold and pray rates fall. Said Robdog.eth: “These guys thought the stETH looping trade was free money and now they are stuck between a rock and a hard place.”

— Macauley Peterson

|

|