- 0xResearch

- Posts

- ETH’s push for ATHs

ETH’s push for ATHs

Tom Lee’s top blast Gandhi

Brought to you by:

ETH is trading near ATHs, yet tokens which have historically acted as a beta are falling behind. Liquid staking protocols, DeFi majors and ETH-heavy treasuries have struggled to keep pace, with only a handful showing any real outperformance. At the same time, treasury companies are lining up billions in potential buys, Bitmine is preparing multi-billion dollar buys through its expanded ATM program, and Hyperliquid’s assistance fund is stacking HYPE at a pace that rivals treasury inflows using only protocol revenue.

Don’t chase the betas

With ETH pushing for new all-time highs, it’s the perfect moment to check in on the so-called “ETH beta” trade, or tokens that should, in theory, amplify Ethereum’s moves. These include liquid staking and restaking plays, flagship DeFi protocols, major L2s, ETH-heavy treasury companies and even the top Ethereum-native memecoin. Most of these projects hold substantial ETH, either in their treasuries or locked as TVL in their smart contracts. In a textbook world, rising ETH prices should lift their USD-denominated TVL, and with valuation multiples held constant — push their token prices even higher.

Reality, however, has been far less textbook. Over the past 30 days, only four out of 14 assets tracked below have managed to outperform ETH. And of those, only Ethena has done so in a meaningful way. The disappointment runs deep: Even treasury companies, often viewed as leveraged plays on ETH, have failed to deliver. SharpLink, for instance, is down 19% over the same period despite ETH’s surge.

Over the long run, many high-beta altcoins tend to underperform Ethereum, despite occasional bursts of outperformance during hype cycles. This is because higher volatility cuts both ways: While these tokens can rally harder in bull markets, they suffer deeper drawdowns that are harder to recover from. On top of that, ongoing token emissions and unlocks create structural dilution for many altcoins while Ethereum benefits from steady, structural bids driven by ETF inflows and institutional treasuries. Beyond these widely discussed demand drivers, roughly 30% of ETH is staked, effectively locking it out of circulation and adding a persistent sink to supply. The result is that while altcoins can offer exciting short-term opportunities, Ethereum often compounds value more effectively across full market cycles. Sometimes the simplest move wins. Stay calm, keep it boring and just hold ETH.

— Kunal

Brought to you by:

Introducing the Chainlink Reserve — an onchain strategic reserve of LINK tokens.

Designed to support the long-term growth of the Chainlink Network, the Reserve accumulates LINK using revenue from large enterprises adopting Chainlink Platform and onchain service usage.

Chainlink is uniquely positioned to power and benefit from the growing tokenization trend as more and more of the world’s largest financial institutions adopt blockchain to tokenize trillions of dollars of assets onchain.

TWAP TOM can’t stop twapping

Before funds or institutions perform large trades, they normally do their best to avoid information leakage to prevent adverse selection and frontrunning. This is very different from DATCOs, which clearly telegraph their flows via 8-Ks published for capital raises and prospectus supplements explaining their intention to accumulate digital assets. However, given the “financial engineering” going on in these companies, perhaps this is a feature, not a bug. Nonetheless, this has led to increased dispersion among returns, as it is hard to justify buying one asset without a telegraphed $20 billion bid vs. one with it.

The big recent example is BitMine Immersion (BMNR), which filed an SEC 424B5 to increase its ATM program by $20 billion, taking total capacity to $24.5 billion (prior: $4.5 billion). It’s important to note that this isn’t cash on hand, it simply allows BitMine to issue shares to sell, but if exercised, it would be around 3.5% of ETH supply. In a scenario where BMNR exercised 5-10% of its ADV (using trailing three-day volumes to be generous, since that’s when volume spiked) daily, this would allow it to accumulate 0.07% of ETH’s supply until the ATM offerings run out.

On the topic of telegraphed flows, the Hyperliquid Assistance Fund has purchased 8.5% of HYPE’s total supply since TGE. Last week, the average was 3.8M/day (0.02%/day). While this is slightly less than the amount BitMine may buy, the fact that it’s funded purely from protocol fees rather than financial engineering is notable. And unlike DATCOs that operate a business model of selling $1 for $2, Hyperliquid’s growth story paints a convincing picture of potential outperformance.

While flows matter, another thing treasury companies show is the importance of a price cheerleader. BTC has Saylor and ETH has TWAP TOM, similar to the influence of Cathie Wood’s ARK on TSLA. The importance of this cannot be understated. While Twitter speculates as to who will be the next cheerleader for Solana, Hyperliquid may have already found theirs in Bob Diamond.

Bob Diamond, former CEO of Barclays, alongside investors from Paradigm Operations LP (Paradigm), Galaxy Digital and Pantera Capital created Hyperliquid Strategies by merging Sonnet (SONN) with Rorschach to form Hyperliquid Strategies. Joining Diamond on the board is Eric Rosengren, former president of the Boston Fed. The company already holds 12.6 million HYPE and has $305 million more to purchase HYPE, already committed as part of the deal and ready to deploy once the merger is finalized.

Let’s do a math exercise (think of Fundstrat’s ETH chart and Standard Chartered’s $25K ETH target, and grant us similar liberties here). If we assume BitMine converts all offerings at 5% trailing volume averages, and SONN deploys the $300 million at a similar cadence, the combined SONN + AF accumulation of 2.9% is comparable to Fundstrat’s 3.5%. This is a good indicator of HYPE’s potential. Not only does it have substantial revenue-accrual flows, but its narrative and growth have attracted institutional appetite rarely seen in lower-cap tokens. While treasury bids can stop, the AF will not.

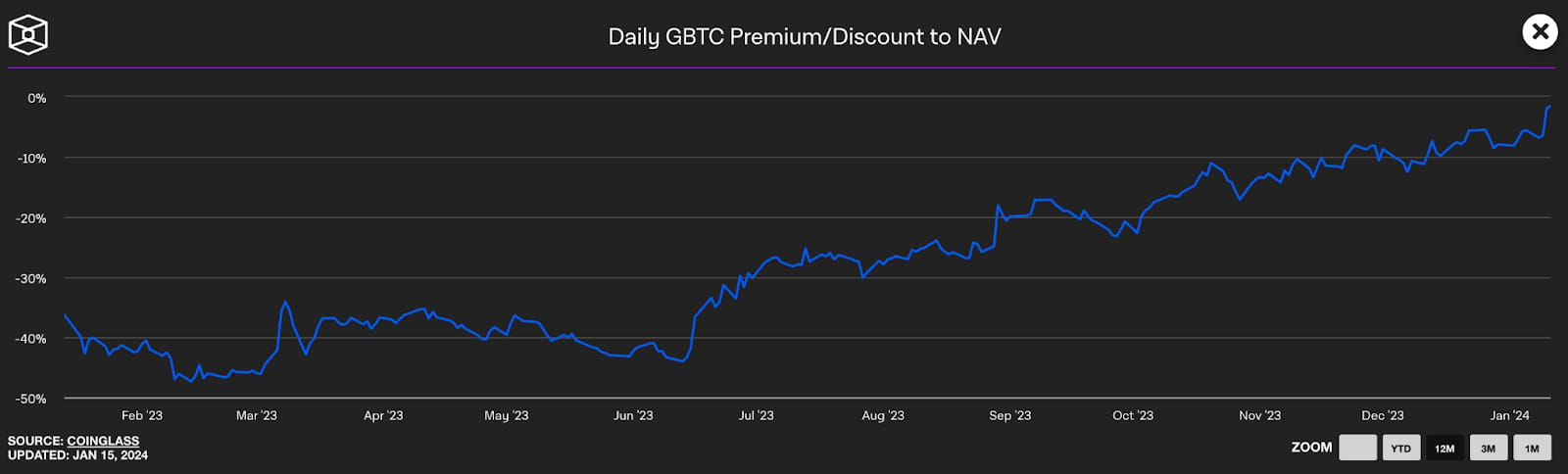

These kinds of visible flows are a meaningful force in the market and can provide substantial near-term support to ETH and other assets. While fundamentals ultimately dictate long-term value, the current environment offers speculators a rare opportunity to participate alongside large, committed buyers. However, in the long term, a similar reflexivity can be observed when flows dry up. For example, GBTC traded at an almost 50% discount to NAV before ETF approvals.

Enjoy the music and dance to it, enjoy the flows and profit from them. As speculators, this is our purpose and our right, but always remember, the music eventually stops.

— Shaunda

Proof of Coverage Media hosts and Blockworks Research’s Nick Carpinito discuss why Helium ($HNT) and Geodnet ($GEOD) may turn deflationary within a year. They cover new product launches from Dawn Internet and Daylight Energy, Inversion Capital’s hiring push and MVNO talks. Get updated on token and corporate structure alignment and revenue growth driving DePIN’s market potential.

Galaxy Digital analyzes the rise of digital asset treasury companies (DATCOs), or public firms that actively accumulate crypto (primarily BTC and ETH) as a core business strategy. As of July 2025, DATCOs hold over $100 billion in digital assets, with BTC dominating but altcoin-focused treasuries emerging for yield generation. The model relies on maintaining equity premiums to NAV (using tools like at-the-market offerings) and PIPEs to raise capital and expand holdings, creating a reflexive loop that can amplify both gains and risks.

In the world of crypto investing, one of the quickest ways to lose money is to assume that Web3 will simply replay Web2’s greatest hits. A billion-dollar category in Web2 doesn’t guarantee its blockchain twin will thrive, and sometimes, the biggest winners are born from the “losers” of the internet era. This article unpacks why the “Google of Web3” often flops, why the “failed Web2 category” can explode in crypto, and the structural reasons business models behave so differently when tokens, liquidity and decentralization enter the mix.

DATs are changing how investors grow crypto wealth. By using balance-sheet strategies to boost tokens-per-share, companies like BitMine Immersion are outpacing spot and ETF returns fast. In this article, Pantera unpacks how DATs work, why Ethereum is at the center of the shift and what the next phase of the bull cycle means for investors.

It’s the summer of DATs and the party is going strong.

But when October rolls around, everyone will be looking to DAS: London to hear from these meta-defining voices on where things stand and where they’re headed.

Get your ticket today with promo code: 0X100 for £100 off

📅 October 13-15 | London

|

|