- 0xResearch

- Posts

- ETH metrics going up

ETH metrics going up

ETH onchain potentially coming back

Hi all, happy Wednesday. We’ve been looking at the data, and it’s telling us that ETH’s surge reflects not just capital rotation from Wall Street’s favourite vehicles (DATs and ETFs), but a broader uptick in Ethereum’s onchain economy.

Taking a step back from the institutional side, the flavor of the week in cryptonative land is: Pokemon Card Gacha. Best of luck to all participants involved!

Ethereum is having its moment in the spotlight, and while its performance has been attributed to flows from digital asset treasury companies (DATCOs) and ETFs, its price wasn’t the only metric that hit an all-time high. For the second consecutive month, ETH’s price action was accompanied by record levels of perp volume. August saw nearly $2 trillion in volume, 30% more than July’s $1.5 trillion.

August also marked Ethereum’s highest DA usage ever, and its market share increased from ~53% in July to 63% in August. However, since the blob target of six still hasn’t been hit (average of 4.17 in August vs. 4.13 in July), the cost of blobs remains extremely low (near one wei). In the upcoming Fusaka upgrade, a “floor price” will be implemented to help address this issue.

Thanks to a 50% increase in the gas limit YTD, monthly active addresses (MAAs) also hit an all-time high of 16.8 million (a 12.7% increase from July’s 14.9 million) while transaction count followed suit with ~51.7 million (an 11% increase MoM).

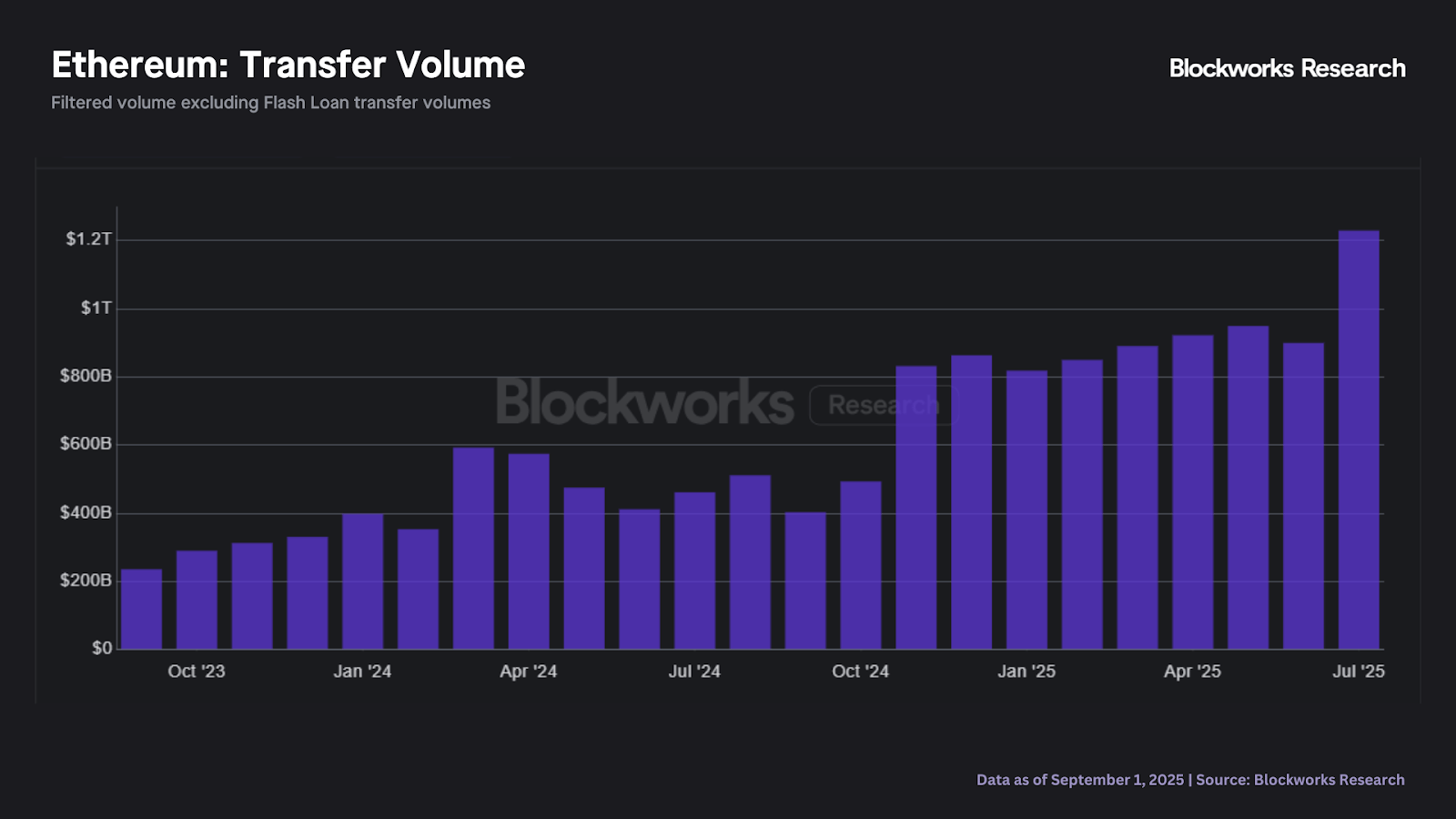

And just in case you were wondering why Ethereum has the stablecoin narrative — the stablecoin supply on Ethereum reached $163 billion, a new all-time high and the highest among any chain. Stablecoin transfer volume on Ethereum also hit an all-time high in August, rising 17% MoM to $1.43 trillion (vs. $1.23 trillion in July). This marked the second month on record with (filtered) transfer volumes over $1 trillion.

Maybe flows alone aren’t telling the full story?

— Marc

If SQL and protocol deep-dives are your playground, this is it.

Join Blockworks as a Data Analyst and help us set the standard for protocol analytics. Build dashboards, shape frameworks, and help the industry see past the noise.

Apply now or pass it along to the Dune wizard in your group chat.

Gacha Cards

Phygital Pokemon cards seem to be the new, most interesting part of crypto (this week) as more and more cryptocurrency market participants search for a new narrative to punt on. Last week, Collector Crypt raised $3.47 million (16.5K SOL) from 718 backers for 5% of total supply through Metaplex Genesis for its card marketplace and gacha application. Since its raise at $68 million FDV, CARDS has now hit $270 million FDV (a 4x for Metaplex Genesis participants).

Over the past month, Collector Crypt has generated $2.73 million in fees and annualized $32.8 million, putting its FDV/fees at 8x — a relatively modest multiple for a token that has gone up 8.5x over the past two days.

I’m going to avoid writing a long diatribe on collecting culture and our desire to collect shiny/not shiny items for potential profit or nostalgia/sentimental value/aesthetics/consumer culture/media/advertising etc. In the first half of 2025, Monsters franchise, which features Labubu, generated over $673.7 million in revenue for Pop Mart. Ty Inc.'s peak revenue for Beanie Babies was $1.4 billion in 1998. Target is apparently on track to surpass $1 billion in trading card sales this year.

Most of you have probably seen the high prices CSGO skins can reach, or the angry parents scolding scalpers who camp in front of Pokémon TCG machines at Target to later resell the cards or packs at higher prices.

Previous attempts at marketplaces have largely not done as well as their traditional counterparts (e.g. Courtyard). There might be a variety of factors that affect this, ranging from the chain they live on (Courtyard is on Polygon, Collector Crypt is on Solana) or perhaps due to a lack of token, lack of raise, etc. One likely reason is that Collector Crypt has a built-in Gacha mechanism that enables users to spend money for a chance at a “grail” (a highly coveted or limited card/phygital). Lootboxes have done wonders for online skins, and are a very important part of opening packs — be it in real life, at Target, or online in FUT or lootboxes.

It’s probably best to wait at least a bit before punting to something that has done a ~10x in 48 hours (especially since there are unlocks happening at the moment), but that doesn’t mean that the right combination of collectibles + lootboxes + gacha within crypto cannot be a winner (could be Collector Crypt, could be something else).

Joseph Shalom, the former head of BlackRock's digital asset group, discussed his career transition from a TradFi giant to co-CEO of Ethereum treasury fund, Sharplink. He explained that BlackRock's bullish stance on crypto, spearheaded by CEO Larry Fink, was a result of a long-term, institutional conviction and a recognition of the ecosystem's growing maturity, rather than short-term market hype. Shalom highlighted the strategic importance of BlackRock's BUIDL tokenized fund, launched on Ethereum, as a key step in bridging the two worlds and demonstrating the utility of a public, secure blockchain. He believes this "great convergence" will be a multi-decade trend, with the tokenization of real-world assets driving significant value to Ethereum. He aims to build an institutional-grade company that not only accumulates ETH but also uses its treasury to build businesses and educate investors, viewing ETH as a superior, yield-bearing asset for the long term.

The article highlights how US politics have become the central force shaping the global crypto industry, especially following major regulatory and policy shifts in 2024 and early 2025. Political engagement and advocacy are now key drivers for crypto’s future, with regulatory clarity and institutional adoption positioning the US for financial dominance in the next-generation digital economy.

0xResearch released a podcast episode with Ali and Deven from Valantis. The podcast focused on Valantis’ shift from a developer platform to a user-facing brand and its work in modular DeFi, particularly around liquid staking tokens on Hyperliquid. The team explained their custom AMM design for stakeHYPE and kHYPE, highlighting efficiency gains, lending integration and strategies to reduce arbitrage leakage. They also discussed their acquisition of the stakeHYPE protocol and their vision for asset-specific DeFi that tightly integrates staking and liquidity.

|

|