- 0xResearch

- Posts

- ETFs flash a bid, HumidiFi tokenizes

ETFs flash a bid, HumidiFi tokenizes

Markets lean cautiously risk-on

Hi all, happy Wednesday. Markets leaned cautiously risk-on, with crypto outperforming a mixed backdrop in traditional assets. ETF flows had their biggest one-day surge since October as CPI, Treasury auctions and a dense FOMC week could reset risk appetite. In addition, we discuss the new WET token, the native token of the HumidiFi prop AMM.

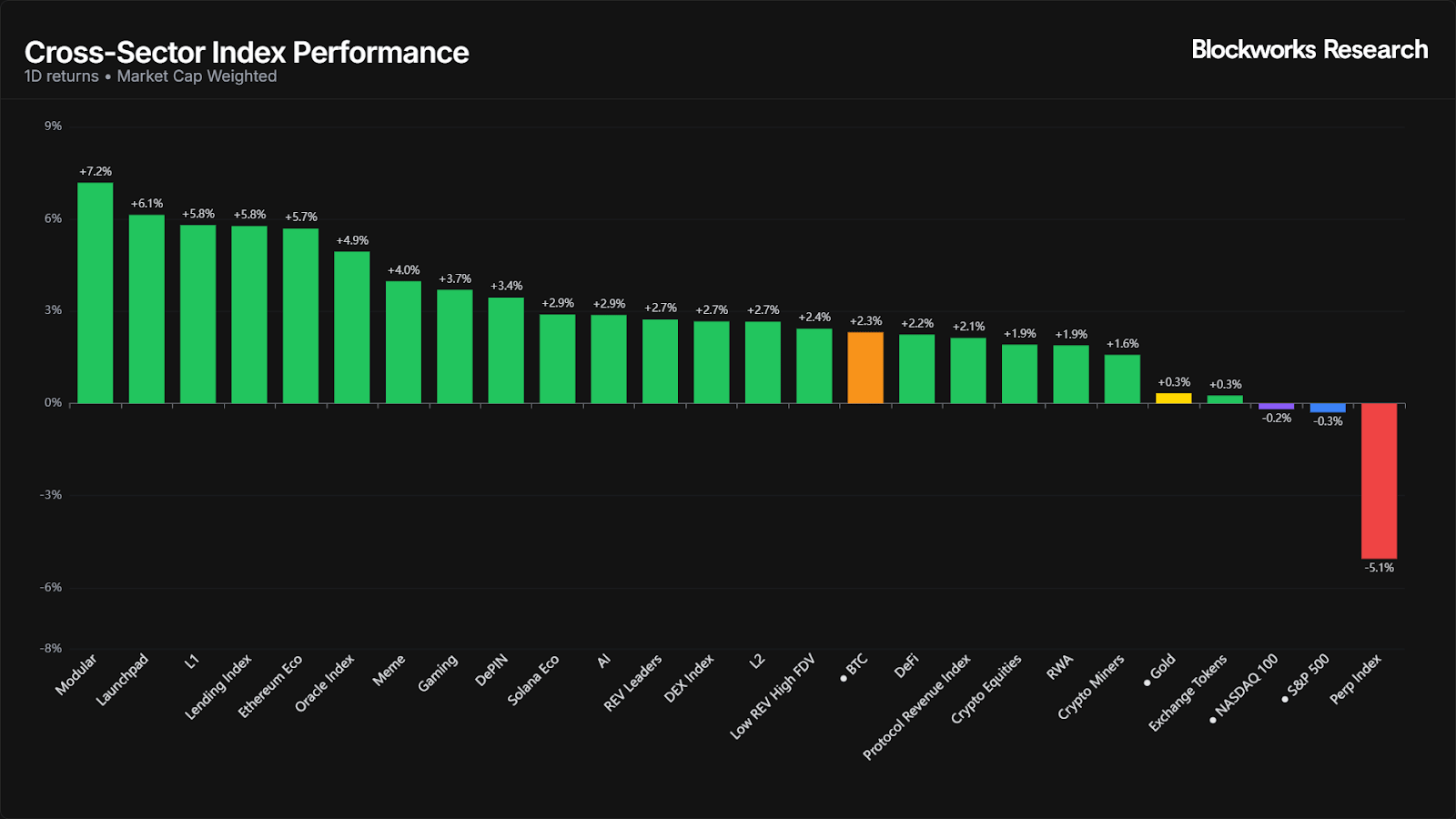

Markets leaned risk-on, with crypto leading and traditional assets mixed. BTC posted a modest gain (+2.3%), outperforming equities where the S&P 500 (-0.3%) and Nasdaq 100 (-0.2%) softened, while Gold held nearly flat (+0.3%). The standout laggard was the Perp Index, which contracted by -5.1%.

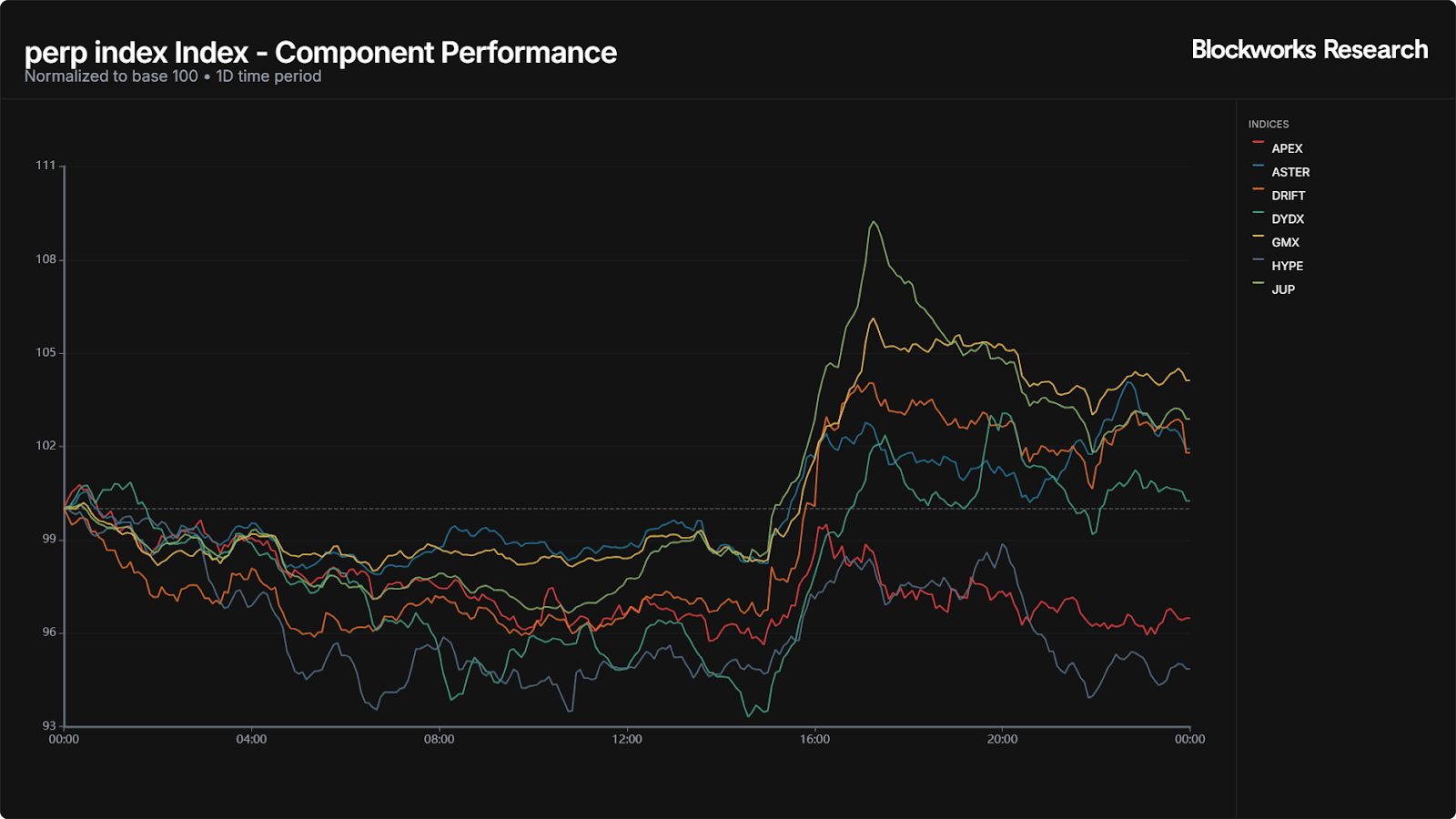

Perps (-5.1%) were the day’s clear laggard, weighed down by a sharp intraday spike-and-fade across dYdX, GMX, and specifically HYPE. A midday squeeze briefly lifted the sector before momentum stalled and flows reversed into the close. JUP rose as much as 9% before retracing most of its gains. Meanwhile, HYPE has been struggling as of late, as builder codes create new frontend relationships with users, and the market anticipates a TGE from rival Lighter.

Looking ahead, markets will pivot toward this week’s CPI print and a slate of mid-week Treasury auctions, both of which could reset risk appetite. With implied volatility still suppressed across majors, any macro surprise risks producing outsized moves.

— Marc

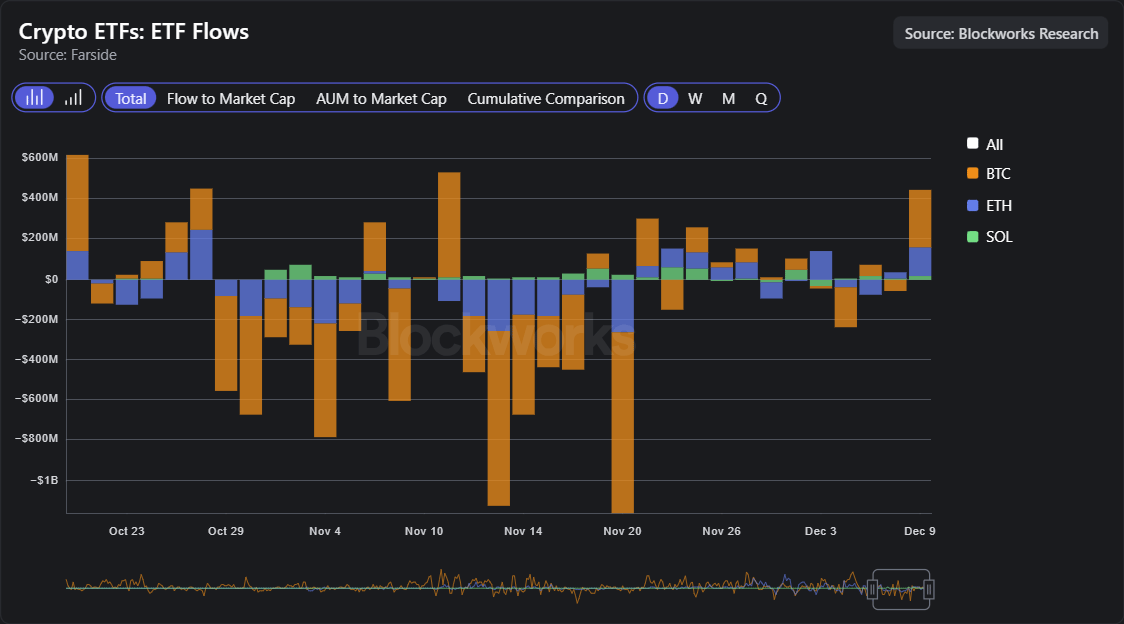

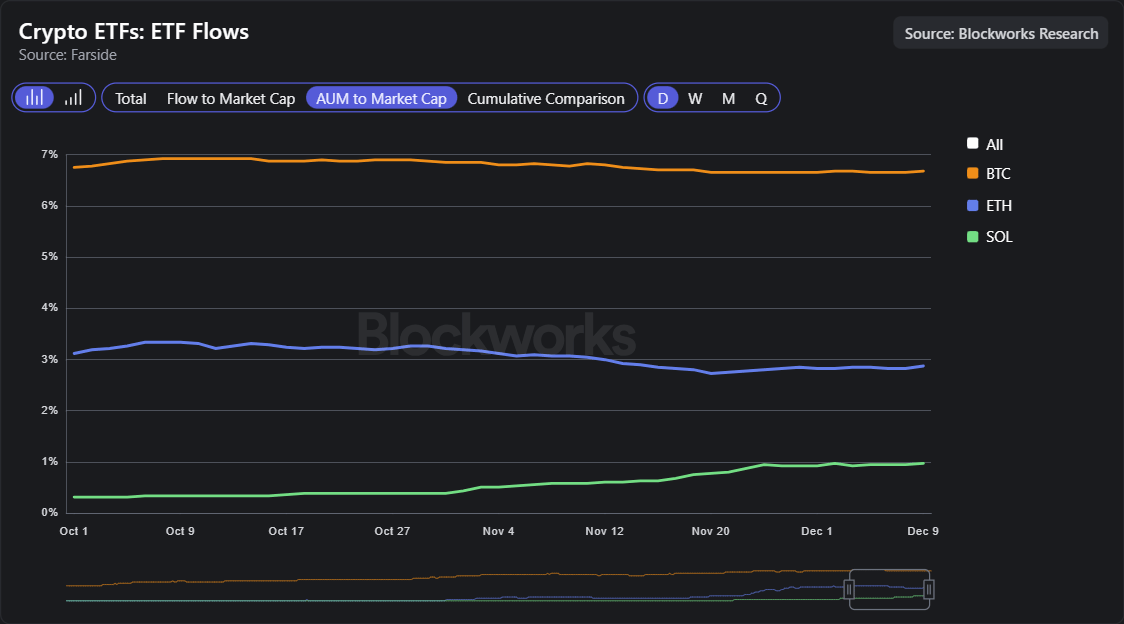

Flows finally turned meaningfully positive. BTC ETFs drove the bulk of the move ($287M), ETH had its best day since Oct. 28 ($142M) and SOL contributed marginally ($16M). This is the first clean signal of risk appetite returning after nearly a month of choppy to negative prints. The flow spike likely reflects short-term positioning ahead of catalysts such as FOMC, inflation data and jobs. It can also be attributed to quarter-end optics, as allocators often re-express benchmark exposure into liquid wrappers during macro-heavy weeks.

Still, AUM-to-market-cap ratios tell a different story. BTC remains stuck near ~6.6–6.8%, ETH continues its multi-month slide from ~3.3% to ~2.8%, and SOL, while rising, sits just under 1%. This divergence implies that price appreciation, not sticky inflows, has been the dominant force maintaining ETF sizes.

Meanwhile, BTC’s inflow looks more like tactical re-risking than renewed conviction. Derivatives markets show elevated basis but falling perp OI, a sign that capital currently prefers directional spot exposure over leverage.

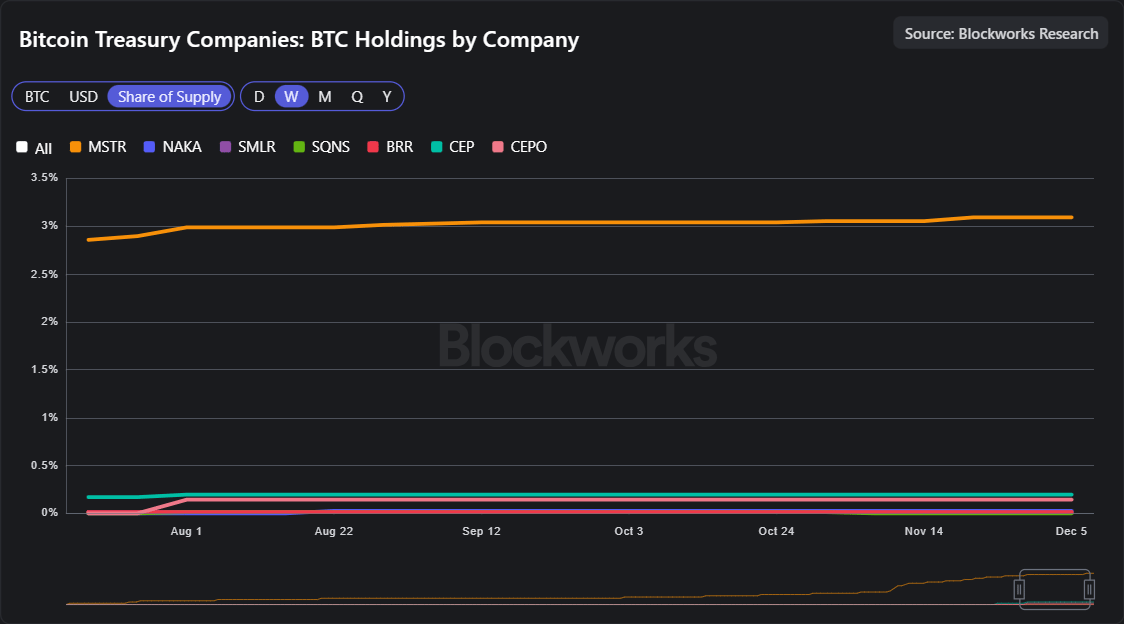

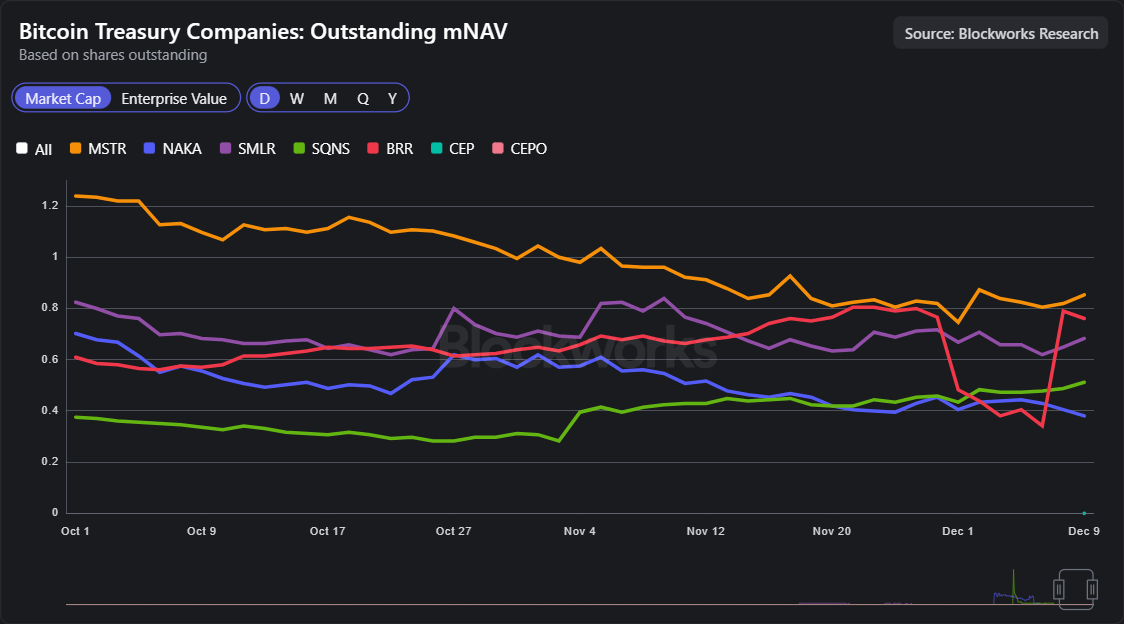

ETF flows are becoming increasingly important for BTC because traditional “DATCO” buyers aren’t carrying the bid anymore. The latest treasury holdings data shows that, aside from Strategy (MSTR), corporate accumulation has been effectively flat for months. Names like NAKAMOTO, SMLR, SQNS, and the smaller treasury cohorts have added marginal amounts at best, contributing almost nothing to incremental demand. Even MSTR can’t continue to accumulate in the same way it did before.

This is especially true as the major BTC DATCOs have mNAVs below 1, removing the once BTC-accretive play of diluting shareholders. In other words, the corporate balance sheet bid that helped define the prior cycle and earlier in this cycle isn’t showing up any time soon for BTC.

— Marc

How are DeFi and traditional rails actually converging?

Join this live Roundtable to hear voices from Blockdaemon, Aave, and Circle hash it out!

WET TGE

HumidiFi launched its token Dec. 9 after successfully raising through Jupiter’s DTF (Decentralized Token Formation). HumidiFi raised a total of $5.57M in USDC from roughly 8000 participants. The raise was split across three phases, Wetlist, JUP Stakers and Public.

The breakdown by phase:

Wetlist: $2M from 674 participants, averaging roughly $2,967 per participant. Tokens were sold at $0.05 per WET, implying a valuation based on that price (FDV of $50M).

JUP Stakers: $1.5M from 2,896 participants, averaging roughly $518 per participant. Tokens were also sold at $0.05 per WET (FDV of $50M).

Public: $2.07M from 4,433 participants, averaging roughly $467 per participant. This phase had a higher price of $0.069 per WET (FDV is $69M).

DTF Wetlist (40M tokens, 4%), JUP Stakers (30M tokens, 3%) and Public (30M tokens, 3%) were fully unlocked at TGE. Labs receives 250M tokens (25%), with 24 months vesting and linear unlocks every six months. The foundation receives 400M tokens (40%), with 8% unlocked at TGE and the balance vesting over 24 months with linear unlocks every six months. A separate ecosystem portion is earmarked to receive 250M tokens (25%), with 5% unlocked at TGE and the balance vesting over 24 months with linear unlocks every six months.

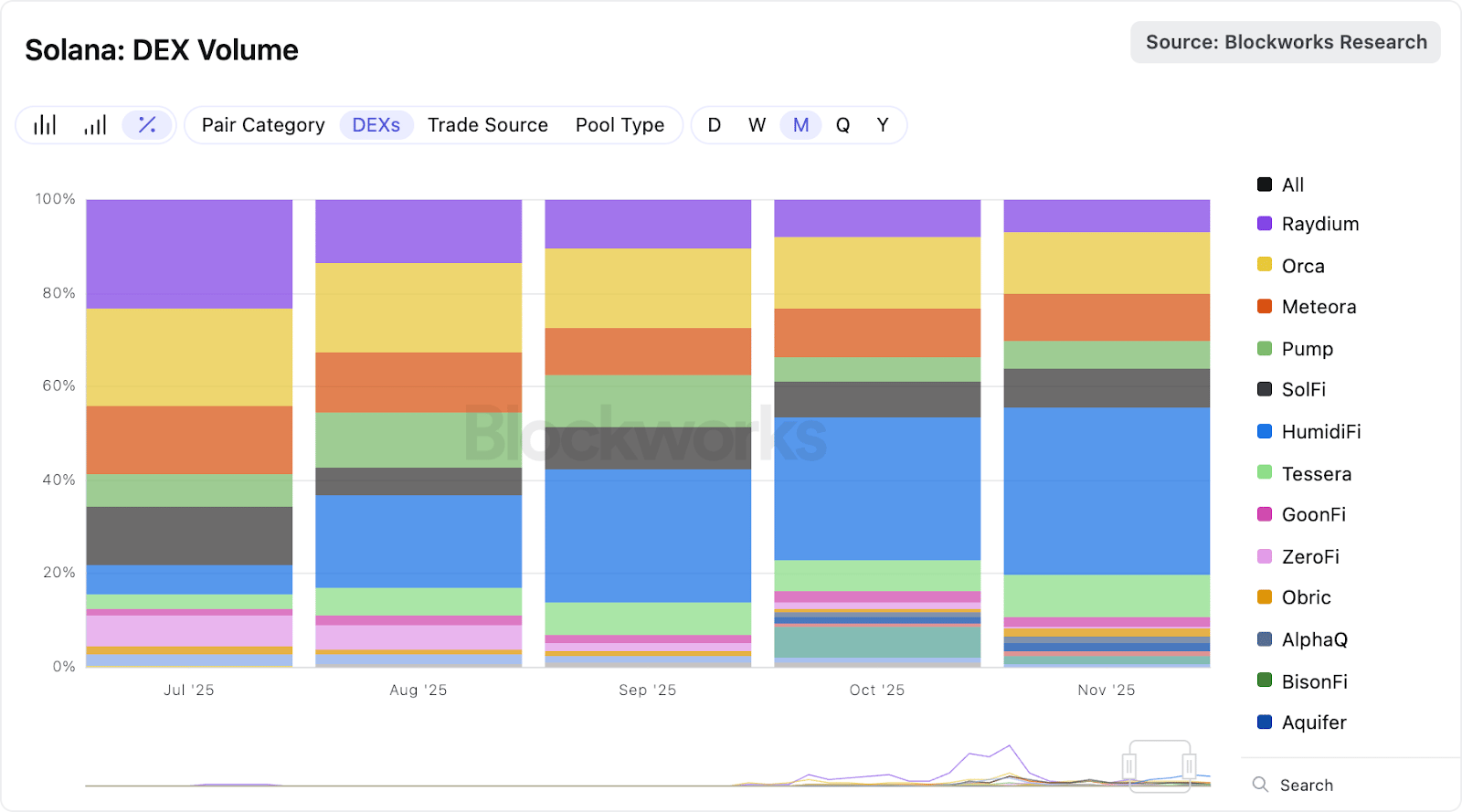

As of this morning, HumidiFi sits at 323M FDV, a 5-6x for participants who bought in during the ICO, and a 2x since TGE yesterday. We’ve written extensively about Prop AMMs already, and how different Solana’s trading landscape looks due to their proliferation, both in the newsletter and through our research. For some quick context, HumidiFi has commanded more than 25% of Solana DEX volume since September, with other Prop AMMs (Tessera etc.) also taking meaningful portions.

Despite this apparent months-long trend, there was no way to get exposure. Prop AMMs have historically used in-house capital; presumably, they make significant returns (no public figures are available, but given that there have been many new launches on both Solana and the EVM, it is safe to assume there are significant returns on capital involved).

HumidiFi is the first Prop AMM to launch a token, and captures the majority of the market share. An attractive use case for the token has yet to be revealed. Thus far, it is said to be useful for trading fee discounts, etc.

It will be interesting to see what additional use cases/value accrual mechanisms the team will attach to the WET token.

a16z’s Big Ideas 2026 spotlights how AI will reshape infrastructure, software and consumer experiences. Startups will unlock messy multimodal enterprise data, automate cybersecurity grunt work, and build infrastructure built for agent-driven, massively parallel workloads. Creative tools and video models go fully multimodal, while AI-native data stacks and intelligent execution layers push systems of record into the background. Vertical software enters “multiplayer mode,” and apps begin optimizing for agents rather than humans. Healthcare sees the rise of “healthy MAUs,” education moves toward AI-native universities, and storytelling shifts to generative world models. Overall, 2026 marks a pivot to hyper-personalized products, collaborative human-agent workflows and AI as the backbone of new institutions and creative mediums.

The 2026 crypto outlook from Auditless Research predicts a reset across core narratives: Ethereum’s value capture weakens as fintech L1s detach from ETH, stablecoins proliferate faster than L2s, and rollup clusters fade as sequencer-fee sharing is commoditized. Asset management moves more onchain via ETF-like vaults, but a major exploit is expected as architectures cut corners. Bitcoin L2s quietly launch, non-USD stables gain traction, and rollups increasingly compete on apps rather than generality. AI overtakes community-driven memecoin discovery, NFT collections stagnate, and celebrity creator coins flash and fizzle. Major issuers build custom Uniswap v4 pools, exchanges push onchain products, futarchy eclipses retro funding, and token launches re-emerge with regulatory support. DAO delegates lose relevance, network states experiment with real-world assets, AI vulnerability detection improves but can’t replace audits, and some prediction market categories vanish amid insider-risk concerns.

Keyrock’s latest weekly update highlights a macro backdrop tilting dovish as weak US labor data boosts expectations of Fed easing, lifting majors while volatility retreats across markets. Bitcoin benefits from renewed institutional demand, including ETF access expansions and sovereign interest signals, while ETH outperforms on the Fusaka upgrade, which vastly expands block and blob capacity and marks Ethereum’s first tangible step toward danksharding. Institutional flows turn positive for a second consecutive week, supporting majors even as most crypto sectors continue to de-risk. Onchain activity remains muted but stable, with selective liquidity rotation favoring utility-focused chains and RWAs holding steady. Overall, markets appear defensively positioned yet structurally healthier into year-end, with catalysts, rather than momentum, likely determining direction from here.