- 0xResearch

- Posts

- 🏆 DeFi wins in DC

🏆 DeFi wins in DC

GENIUS passes, CLARITY progresses

With stablecoin legislation now federal law and key amendments to the CLARITY Act poised to address core DeFi concerns, US crypto policy has a chance to appreciate disintermediation and permissionless innovation while unlocking institutional confidence.

— Macauley

A stablecoin backed by GPUs:

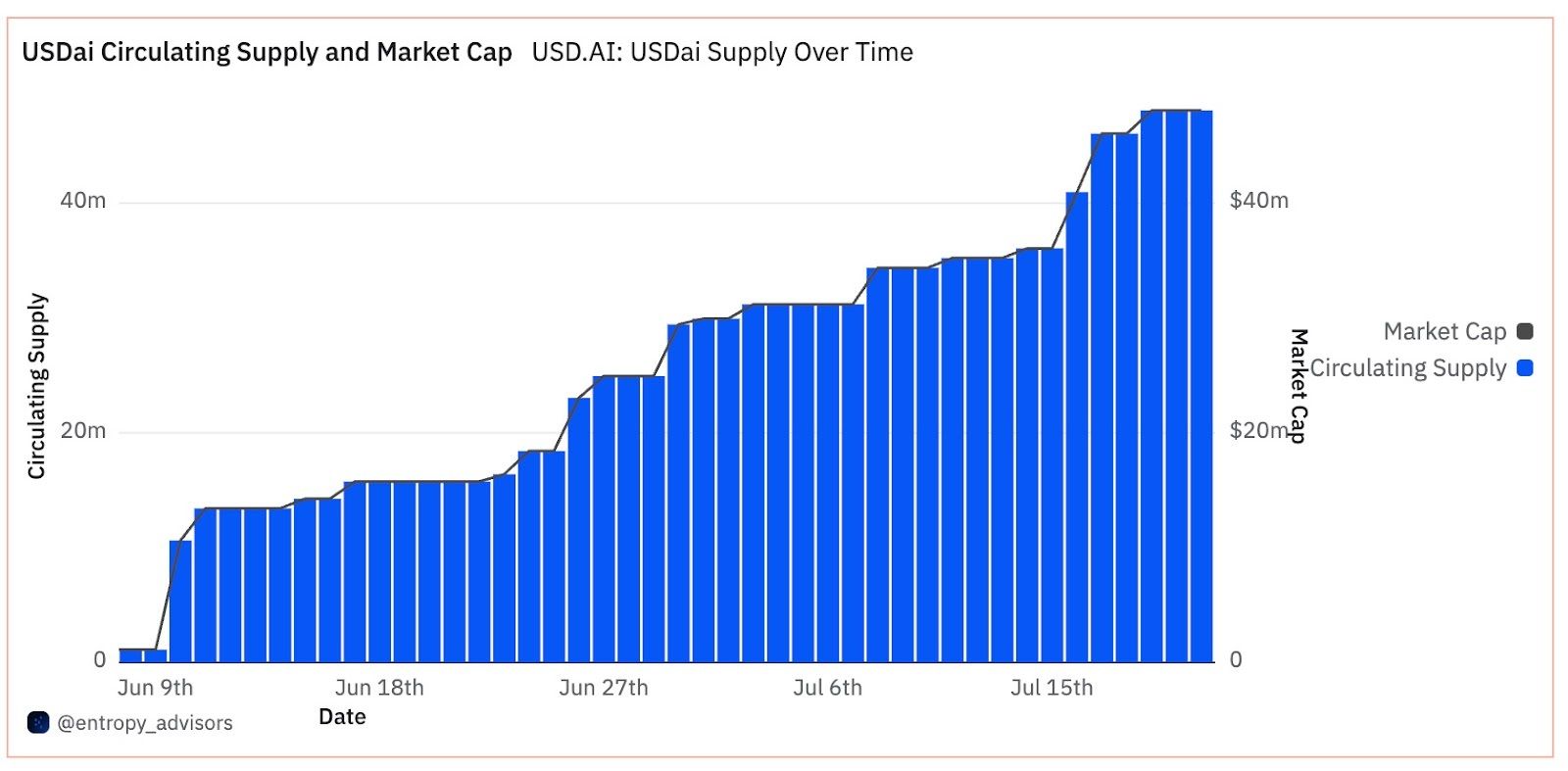

Source: Dune / Entropy Advisors

USDai is taking a novel approach to stablecoin backing. Instead of just Treasurys, USDai aims to channel capital into real-world Nvidia-class GPU loans — insured, overcollateralized and yielding as much as 20% APR. That will take time to come to fruition, but the new synthetic dollar has seen a rapid supply surge since early June, now topping $48m in TVL.

Two-thirds of the circulating USDai is now staked as sUSDai, which earns yield from T-bills under the M^0 issuance model and should soon phase in 30-day hardware loans.

The stability design features first-loss NFT tranches (FiLo), Dutch-auction redemption queues and a shift from passive yield to active credit risk.

This system “monetizes impatience,” as Blockworks Research’s Nick Carp put it, while “shielding solvency” to give midsize AI infrastructure operators a new funding path.

While there may be some regulatory hurdles in the US, sUSDai’s Curve pool on Arbitrum is already the network’s second largest by TVL. If USDai survives bouts of market volatility, it may serve as a trailblazer for financing other CAPEX-heavy industries like telecom.

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 PM EST

GENIUS is law, CLARITY course-corrects

DeFi just secured its biggest US policy win yet.

President Trump on Friday signed the GENIUS Act into law, establishing the first federal framework for stablecoin regulation. The law defines clear standards for reserve backing, consumer protection and AML compliance, while carving pathways for both state and federally chartered issuers. DeFi Education Fund (DEF) called it a “landmark” moment for onchain finance.

Importantly, GENIUS trains federal oversight on identifiable, custodial stablecoin issuers while leaving self-custodied wallets and other non-issuer onchain activity largely outside its scope. That makes way for broader market-structure rules (CLARITY) that aim to distinguish decentralized protocols from centralized intermediaries.

Meanwhile, the House passed the CLARITY Act with key amendments that reversed last-minute language changes that had sparked outcry among DeFi builders and policy experts. The manager’s amendment from HFSC Chair French Hill (R-AR) and Attorney General Chair GT Thompson (R-PA) restored and clarified the DeFi carve-outs in both the securities (§309) and commodities (§409) titles of the bill.

The final House text now explicitly excludes activities like publishing code, operating frontends, running validator nodes or providing wallets from registration requirements, so long as they don’t involve custody or control of user assets. The Commodity Exchange Act's DeFi exclusion is once again broad enough to cover most non-custodial spot-market activity.

On the House floor, Rep. Hill stated: “DeFi developers do not take custody of user assets, nor do they control user assets. Therefore, we should not treat them in the same way we treat centralized actors.”

Rep. Thompson added: “Congress is making an unambiguous statement that DeFi is different.”

These are important articulations of Congress’ intent.

Still, two gaps remain. First, the carve-outs do not extend to derivatives, leaving DeFi derivatives protocols in legal limbo.

Second, the CLARITY Act lacks federal pre-emption, meaning state regulators could still impose conflicting requirements.

However, the Hill-Thompson fix moves CLARITY away from being a potential threat and into the category of a qualified win for DeFi.

DeFi tokens have rallied, institutional interest is robust and the total crypto market cap crossed $4 trillion.

“This regulatory milestone establishes the US as a key jurisdiction for digital assets,” said Fabian Dori, CIO at Sygnum Bank, in comments to Blockworks. “Clear rules on stablecoins and token classification unlock institutional participation at scale.”

Washington is no longer just watching onchain finance — it’s actively protecting it.

— Macauley Peterson

|

|