- 0xResearch

- Posts

- Crypto IR is broken

Crypto IR is broken

175M in monthly revenue, zero institutional workflow

Macro finally reminded crypto that it still matters. The Fed delivered the expected 25 bps cut but signaled a much tighter path ahead, projecting only one cut for all of next year. That was enough to knock BTC off its early strength and reinforce the idea that liquidity is not opening as quickly as many had hoped. At the same time, the Perp Wars are heating up as Aster and Lighter chip away at Hyperliquid’s dominance, and the gap between crypto’s cash flows and its investor relations infrastructure is becoming too big to ignore.

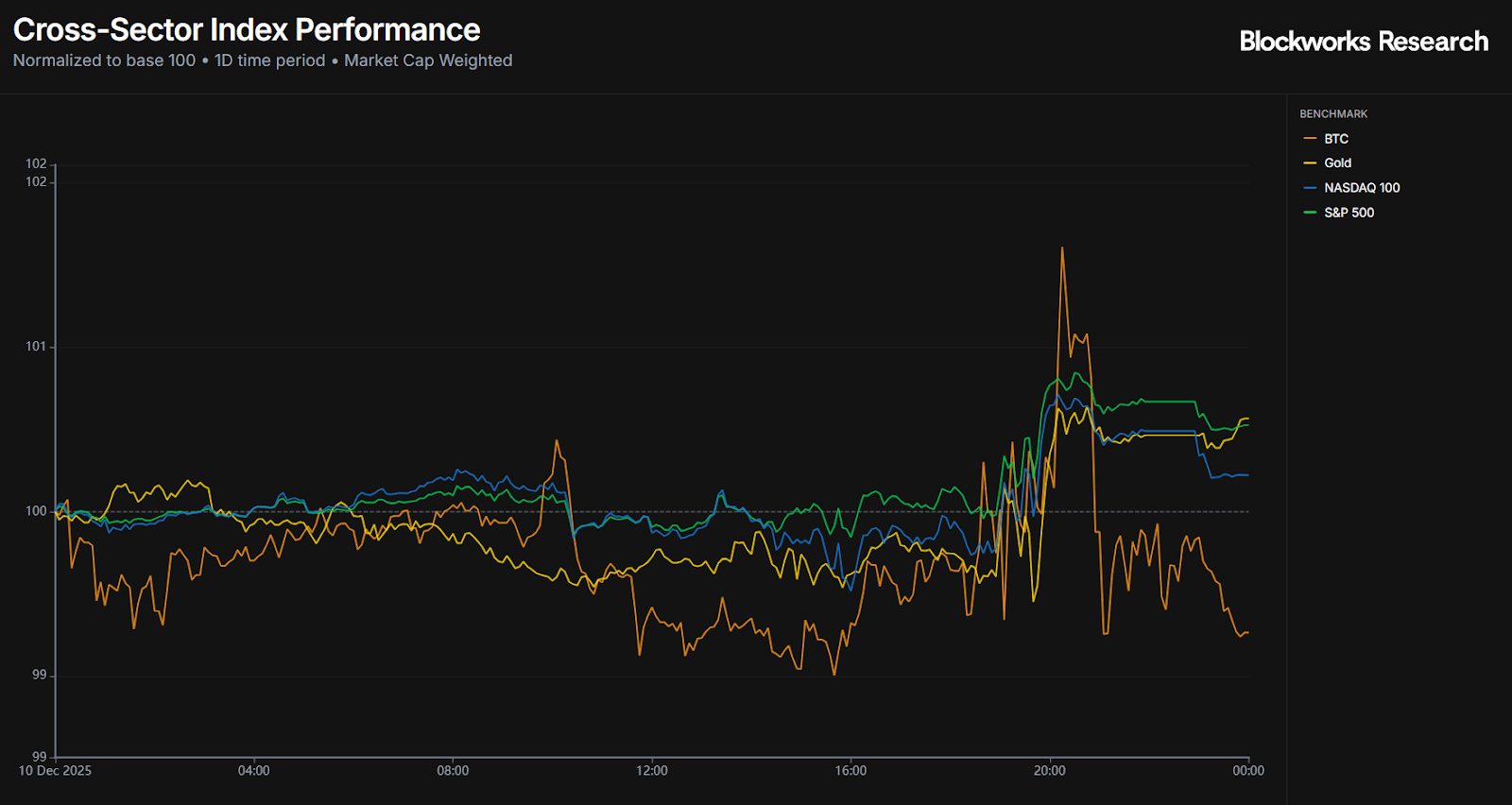

Markets saw a clear split yesterday between BTC and the major benchmarks. BTC closed at -0.73% while Gold, the S&P 500, and the Nasdaq finished at 0.57%, 0.53%, and 0.22%, respectively.

The move followed the Fed's widely expected 25 basis point cut. What surprised markets was the guidance that followed. The Fed signaled that policy will likely stay tight for longer, with only one cut projected for all of next year. Officials pointed to a cooling labor market, inflation that is still above target, and growth that is expected to remain firm. The message was clear that liquidity is not opening up as quickly as many hoped, and that tone likely explains why BTC gave back its early strength.

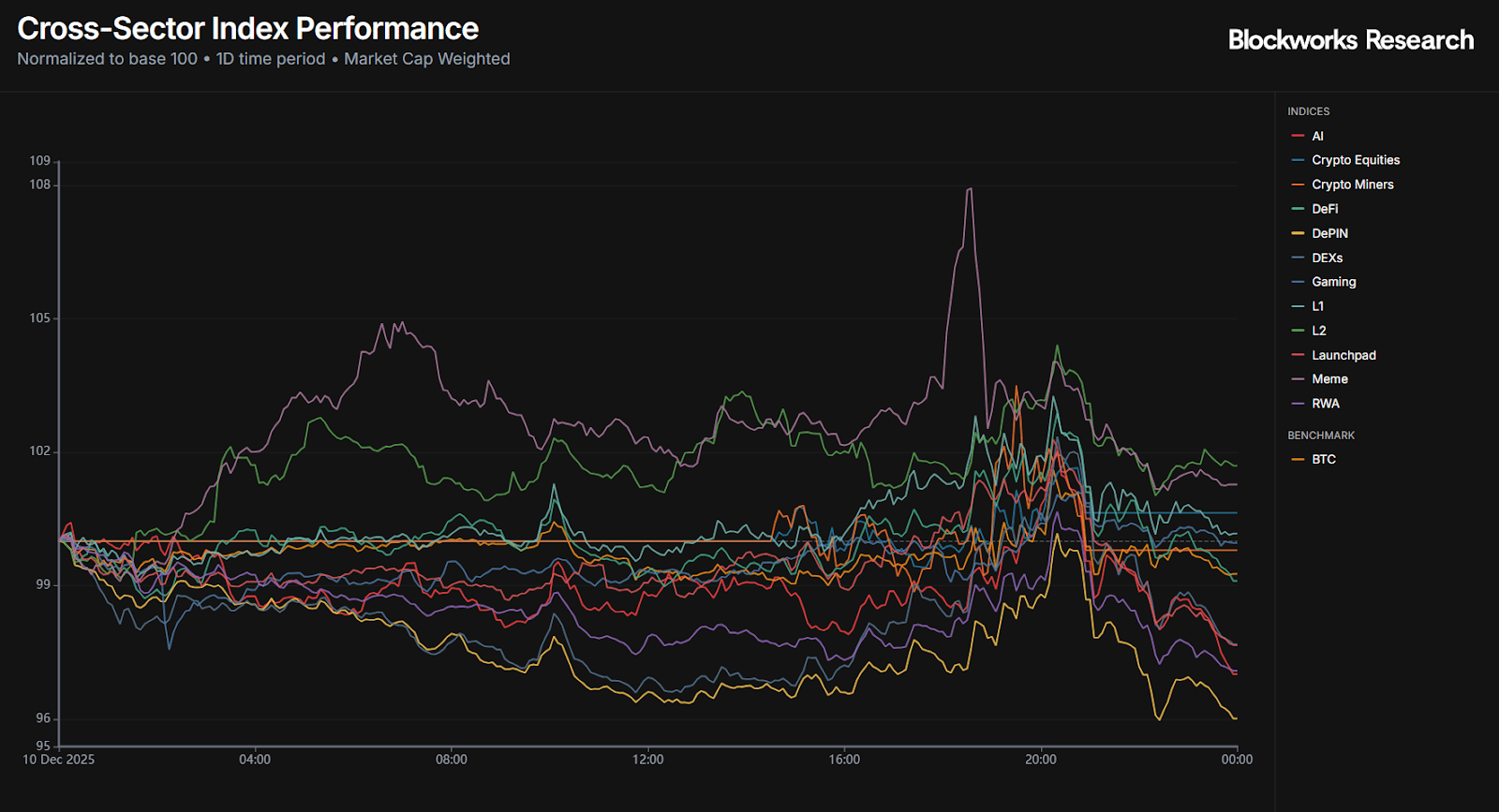

Across crypto sectors, performance was mixed. L2s and Memes managed to post gains of 1.70% and 1.27%, respectively. L2 strength came almost entirely from MNT, which jumped 4.5% and now makes up nearly one-third of the index. The meme sector told a similar story, with M (MemeCore) up 6.2% while most other meme names traded lower.

AI and DePIN were the laggards, at -3% and -4%. AI was weighed down by IP and ICP, which fell -6% and -7.9%, while DePIN weakness came from FIL and HNT at -4.9% and -5.6%.

BTC is circling 90K and the market feels stuck in neutral. Until macro picks a direction, crypto will keep drifting with it.

— Kunal

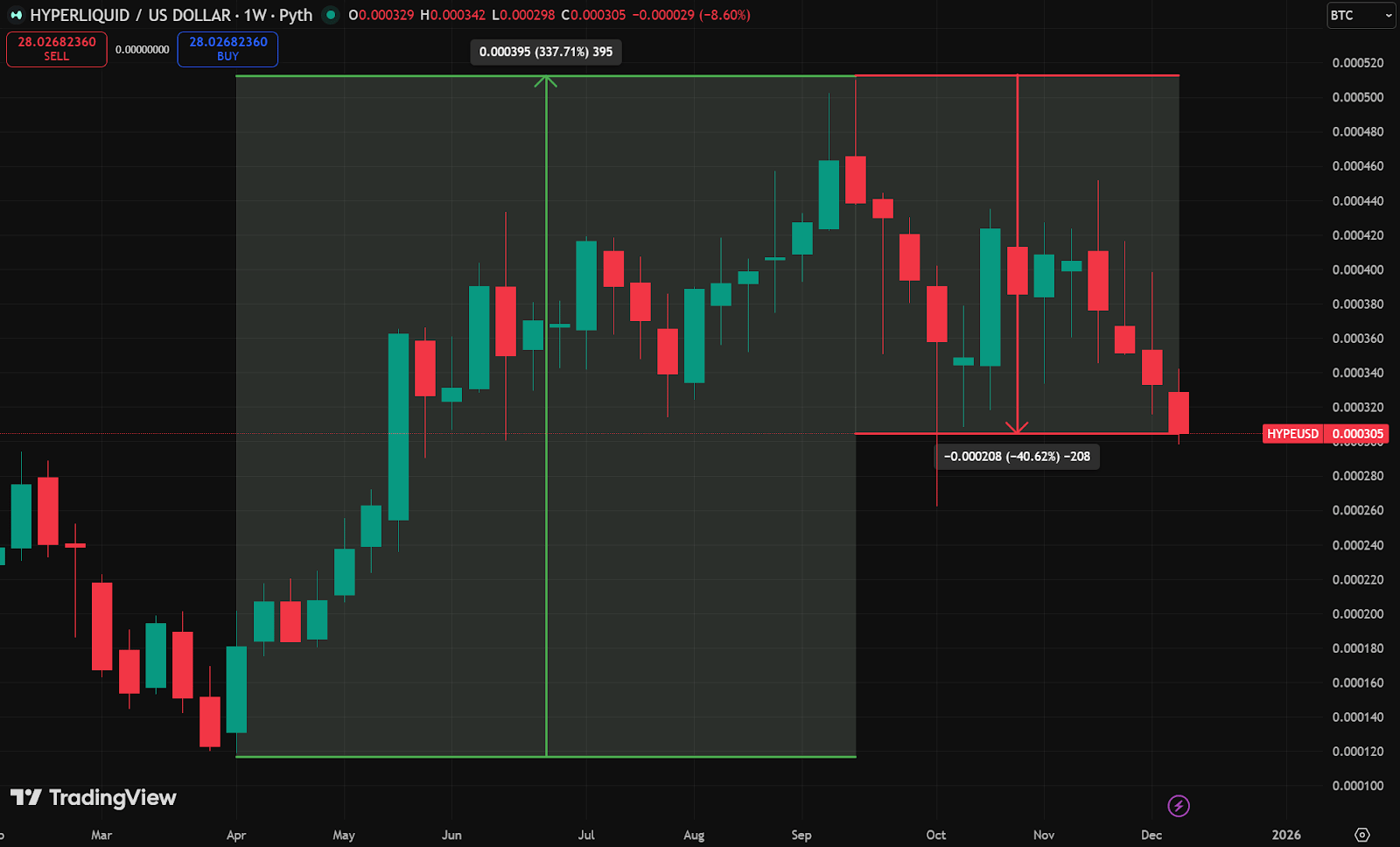

Is the HYPE fading? This has been the question on everyone's mind as the token has struggled to keep pace with the broader recovery. In the last seven days, HYPE is down -20% while BTC is down only -3%. When we zoom out and look at weekly HYPE/BTC returns, it becomes clear that HYPE has given back almost half of its outperformance since the April lows after peaking in mid-September.

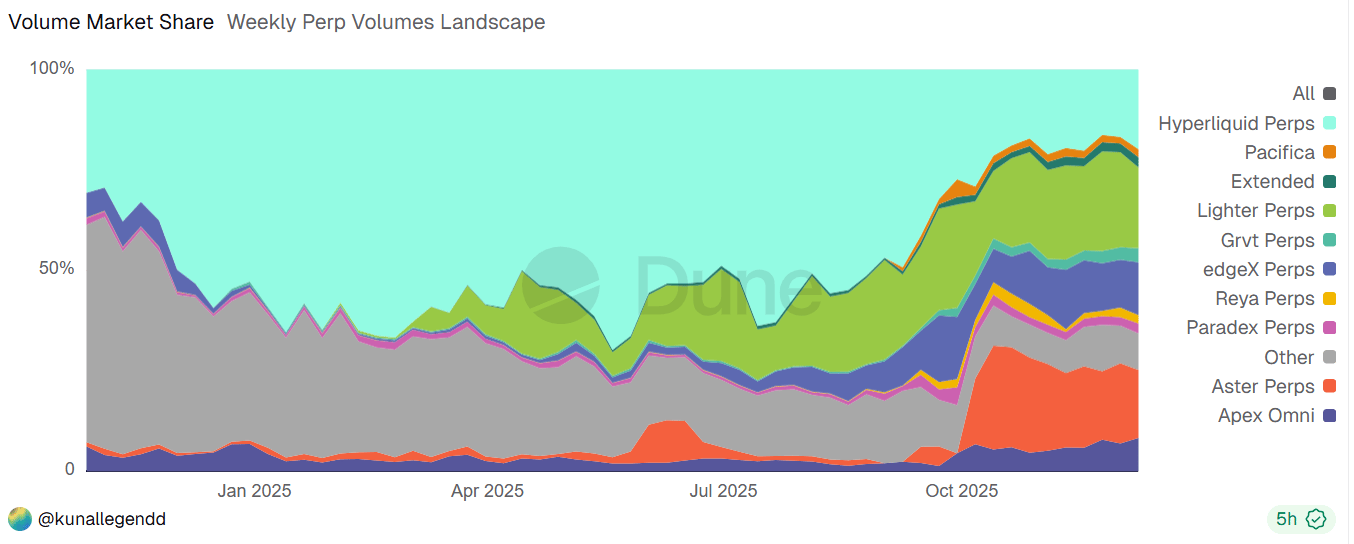

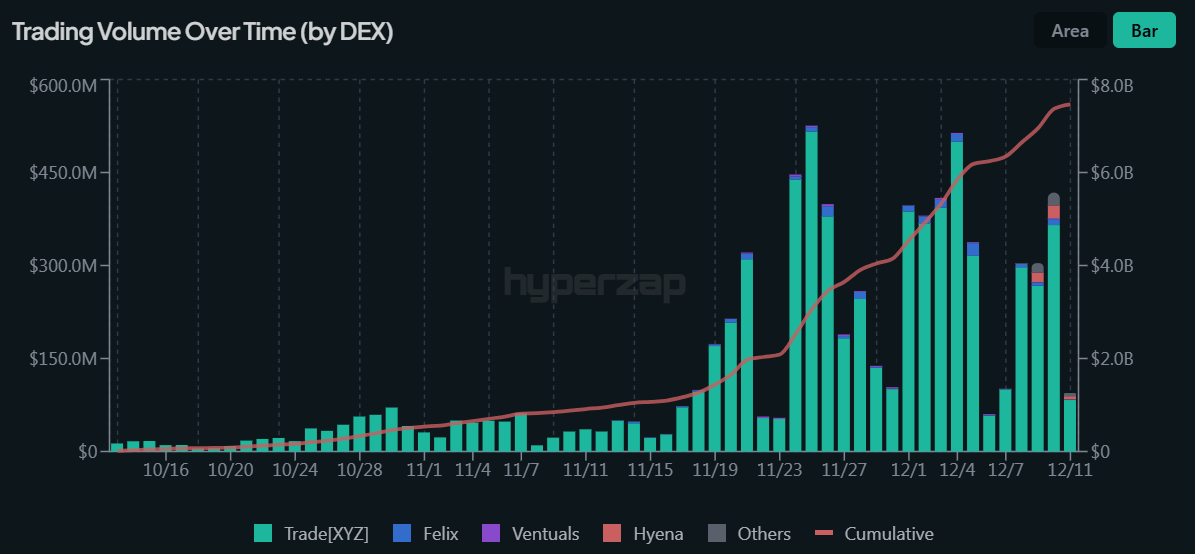

So what changed? The clearest answer is increased competition. The peak in performance lined up almost perfectly with the launch of Aster, which quickly captured market share and attention away from Hyperliquid. Since mid-September, Hyperliquid’s share of perp volume has fallen from 49% to 19% today. The majority of that lost share has gone to Aster and Lighter. Lighter, in fact, has slightly edged out Hyperliquid in weekly volume since mid-October.

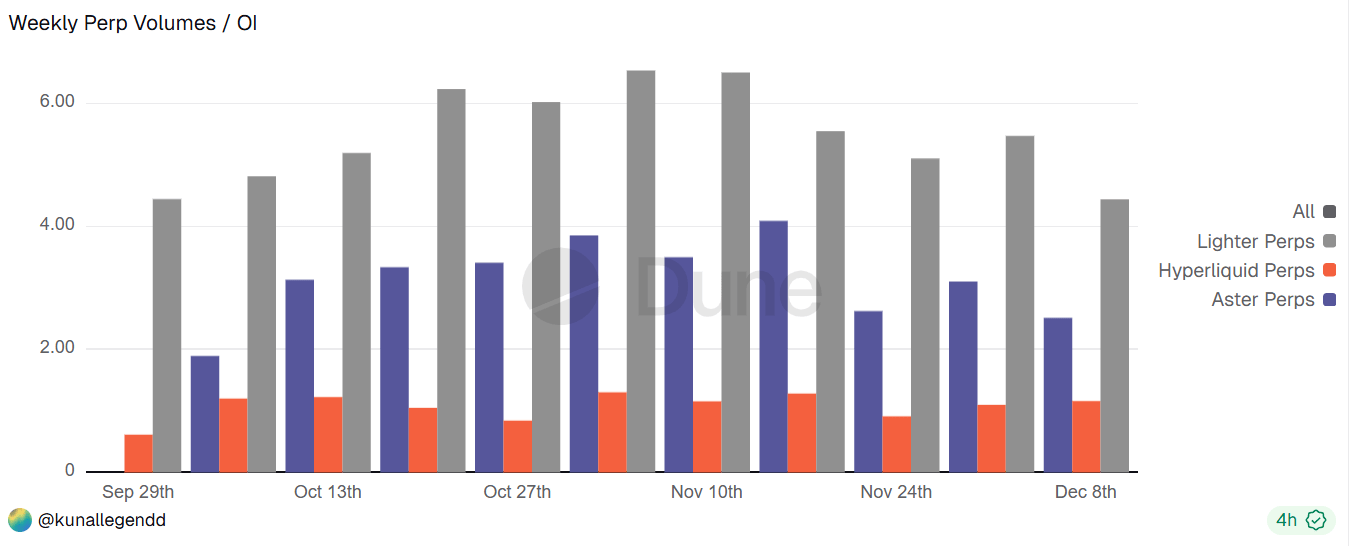

But volume alone does not tell the full story. When we compare weekly volume relative to open interest, we see that both Lighter and Aster post much higher ratios than Hyperliquid. High ratios suggest faster turnover of outstanding positions and often signal inorganic activity driven by farming. Aster and Lighter are both running points programs, so a large part of their activity could evaporate as incentives cool. Lighter has its TGE approaching and that will give us the first real read on how much of its activity is sticky and how much is farm and flee.

For a while, many assumed Hyperliquid would run away with the Perp Wars. The picture now looks much more competitive. I don’t think this will be a winner-take-all market but the dominant perp exchange will be the one that offers the lowest fees, the deepest books, the widest market selection and the most seamless trading experience.

Lighter is winning the fee battle with zero maker/taker fees, and last week we noted how the rise of perp aggregators could push more flow toward low fee venues. Yet, depth and market selection matter just as much and Hyperliquid still leads on both — especially after the launch of HIP-3, which introduced equity perpetual markets that have seen strong early traction.

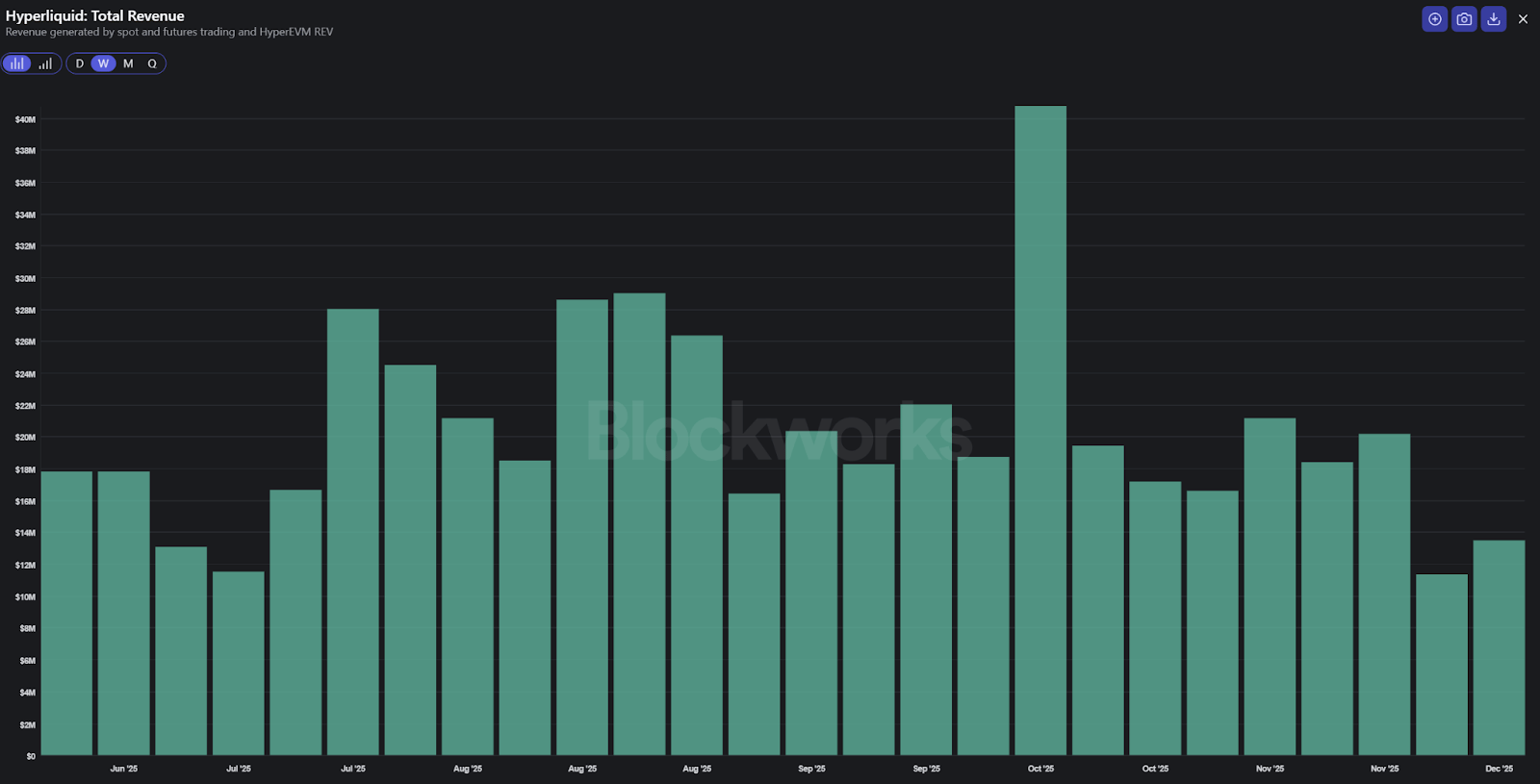

Recent headwinds such as team unlocks in November and concerns around Hyperliquid’s auto deleveraging design have weighed on short term sentiment. Even so, the core fundamentals remain powerful. Hyperliquid consistently generates between $10M-$20M in weekly revenue that is used to buy back HYPE. Very few protocols have that level of real economic engine behind them.

Success is never guaranteed but anyone writing off Hyperliquid at this stage is probably being too quick. The real battle for perp dominance is only just getting started, and the next few months will reveal who is building a durable edge and who is simply riding the incentive wave.

— Kunal

How are DeFi and traditional rails actually converging?

Join this live Roundtable to hear voices from Blockdaemon, Aave, and Circle hash it out!

Fixing broken investor relations

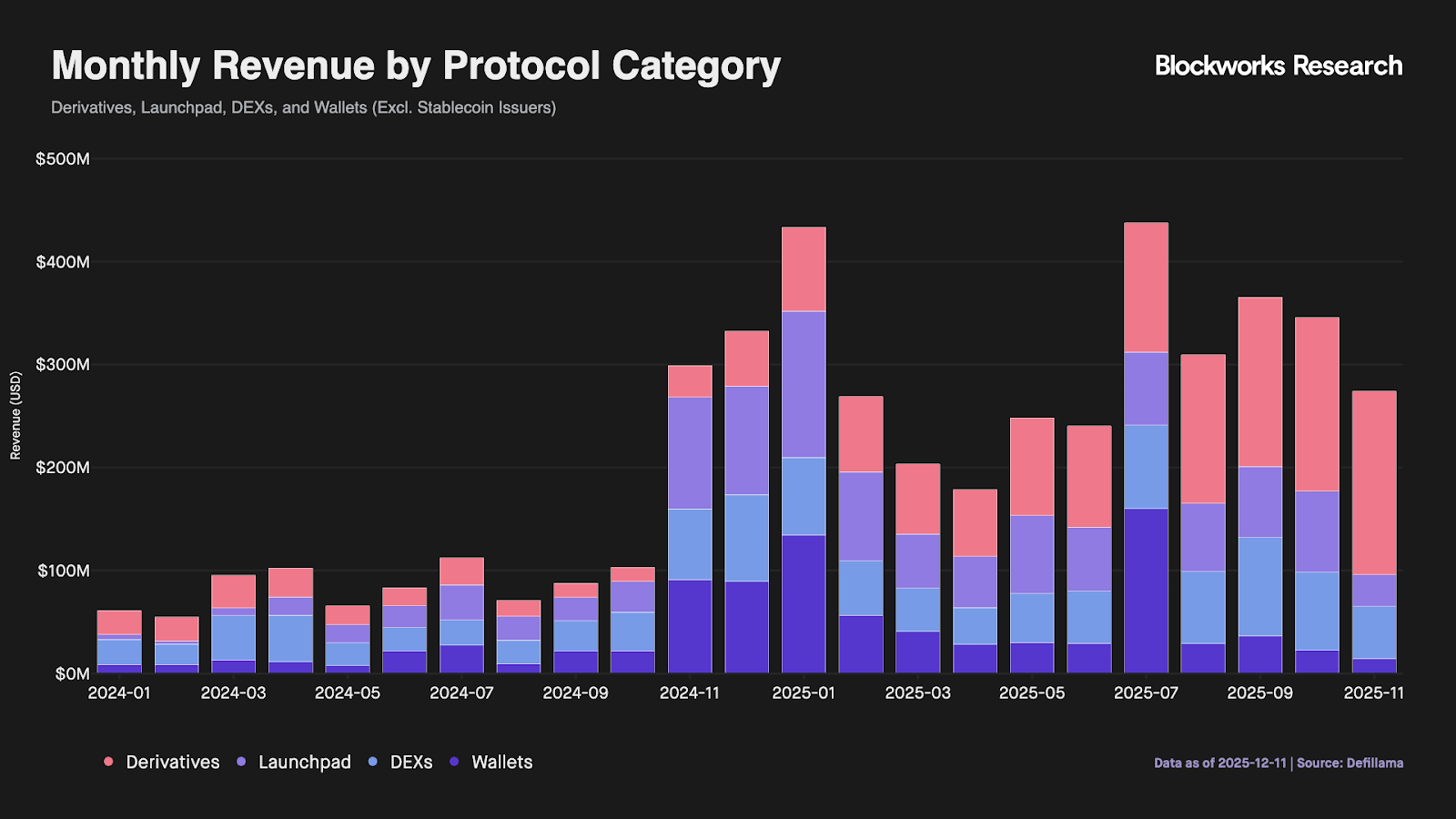

Crypto has matured fast. What used to be a market of purely speculative infrastructure plays has evolved into diversified, revenue-generating streams. Monthly protocol revenue (excluding stablecoins) averaged $175M in 2025, a 133% increase year over year from $75M in 2024.

The ability to coordinate globally on a decentralized network has led to growth previously unseen; Hyperliquid became the fastest team ever to reach $1B ARR, Tether raised at a $500B valuation, Axiom hit $63M in monthly revenue less than six months after launch.

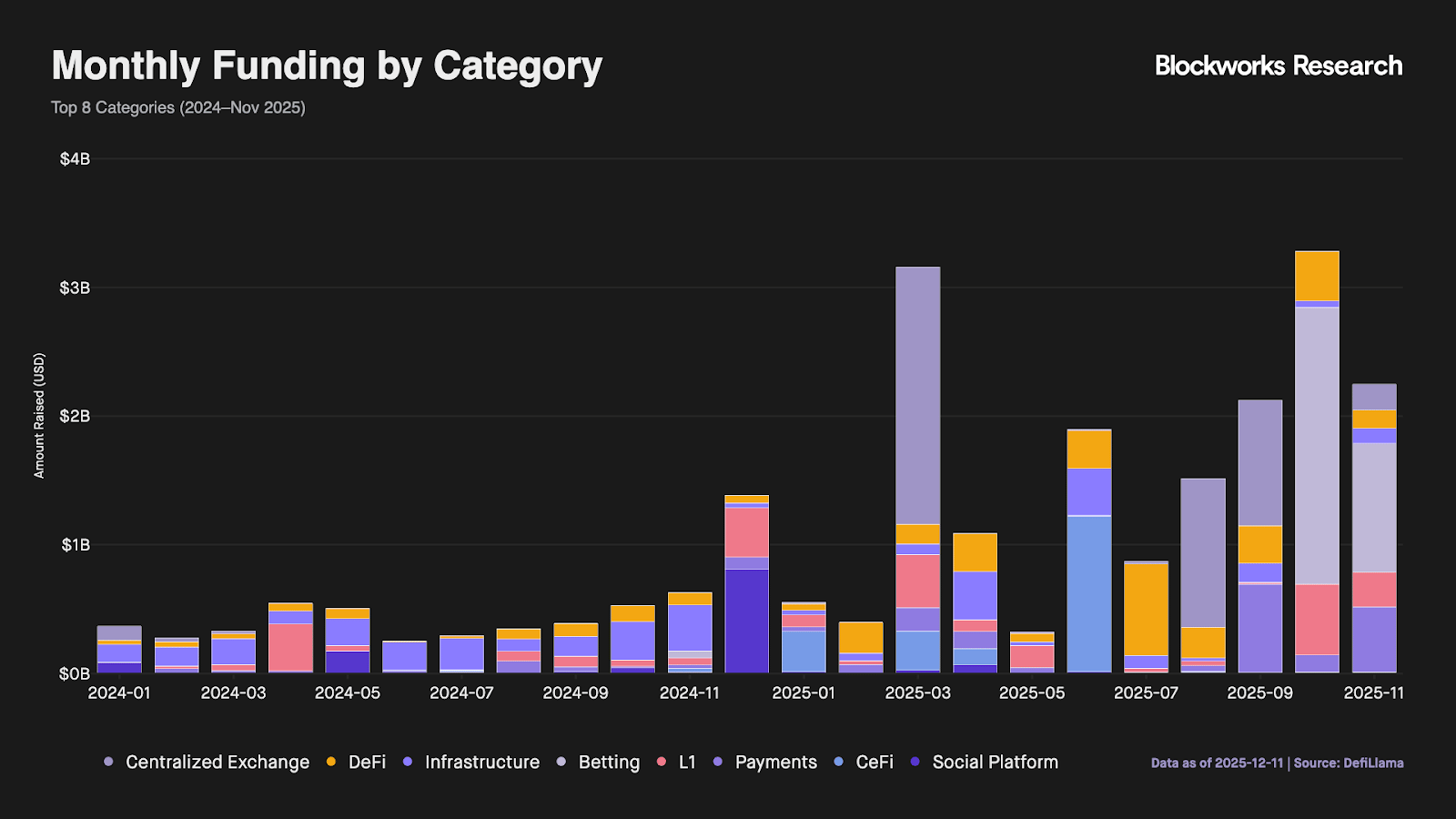

If fundraising is any indication, with total monthly raises ranging from $500M to $2B, the industry continues to expand rapidly and aggressively.

However, despite this growth, the industry has become harder to navigate than ever, especially for TradFi investors looking to diversify into the asset class. While these assets have largely become ownership-based, functioning like cash-generating businesses, their unique crypto characteristics make due diligence extremely difficult.

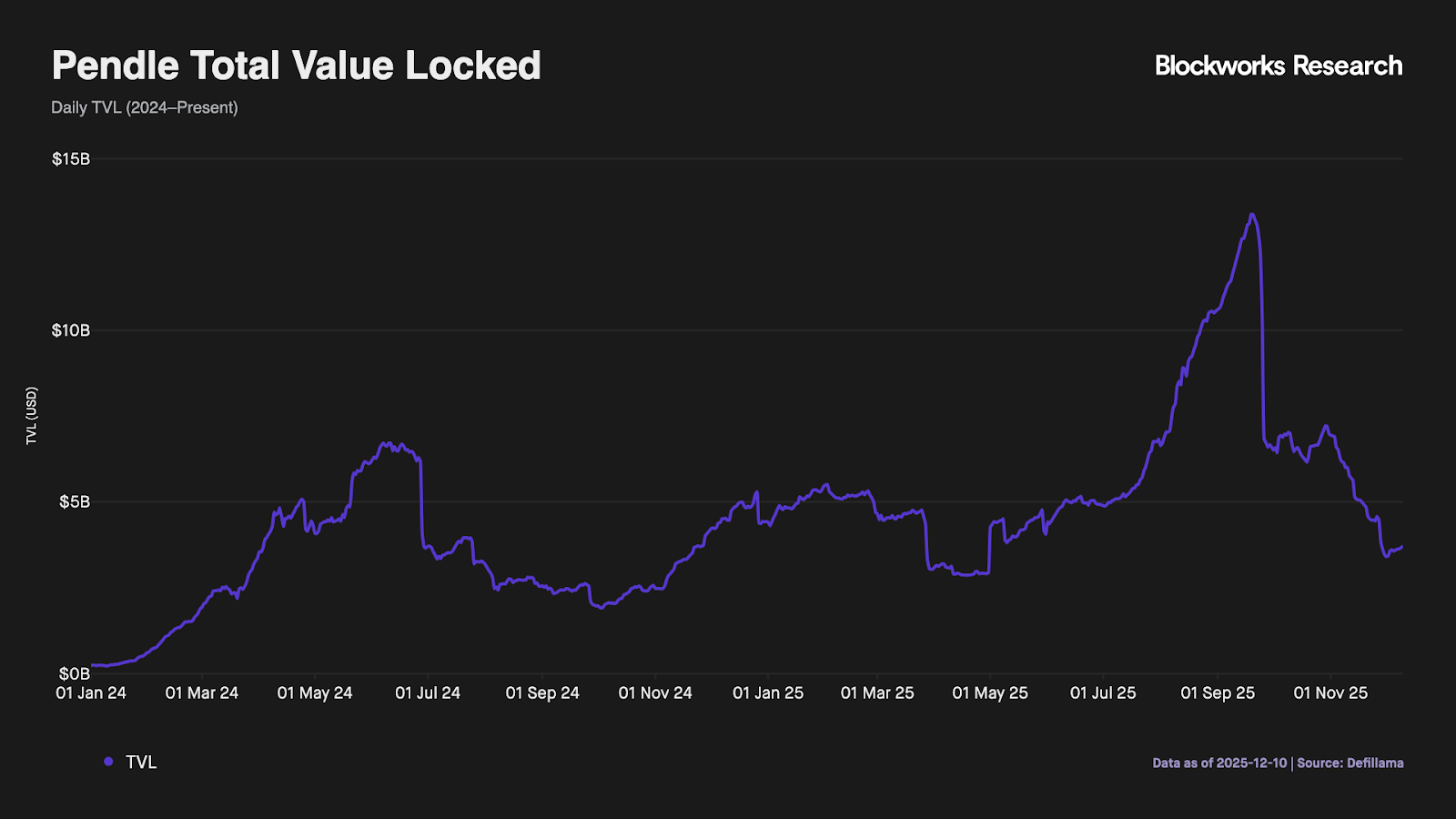

Take Pendle Finance, a fixed/variable rate swap yield optimizing platform, as an example. The traditional interest rate derivative industry trades $7.9T per day. Understanding the scale of the TradFi market, investors are curious how this extends to crypto. However, the nuances are dense:

USDe Dominance (yields and rollover rates)

Pricing power and Ve (Vote-Escrow) tokenomics

Aave integrations (PT listings) and chain-specific dependencies

Points meta, emergence of new protocols with points incentives

This complexity extends to almost every product in today’s rapidly changing environment. How do you explain the advantages of a CLOB vs. GLP model? How do you articulate the tradeoffs between Modular vs. Monolithic lending? How sticky are the different user acquisition models? Could this be the reason many protocols are trading at steep discounts relative to TradFi equivalents?

For a professional allocator, the workflow is fundamentally broken. Critical information is constrained behind multiple dashboards, GitHub pages, and private Telegram channels. This fragmentation creates three distinct barriers to entry:

Fragmentation: There is no canonical source for diligence. Data, docs, governance and research are scattered across disparate platforms.

Data reliability: Public aggregators are frequently inconsistent or mislabeled. Without standardized definitions, a single bad input can compromise an entire investment thesis.

The translation layer: Most materials are written for crypto-natives. They lack the translation into the metrics that investment committees require: revenue, retention, unit economics and cash flows.

To bridge this gap, Blockworks is launching Lightspeed IR in partnership with the Solana Foundation. Designed to professionalize the connection between issuers and capital, the platform replaces the current fragmented workflow with a gated, standardized environment. It focuses on replacing open aggregators with high-fidelity onchain metrics, converting raw governance activity into IC-ready research, and centralizing roadmap updates for direct communication between teams and allocators.

We are starting with Solana given its intersection of high user activity and cash-flow generating applications, but the mandate is a broader platform, allowing crypto-native projects to effectively communicate with capital allocators and investors.

— Shaunda

As global financial institutions prioritize the adoption of blockchain rails to improve financial services and products, Chainlink’s infrastructure will continue to play a critical role in underpinning the growth of onchain finance.

Chainlink’s product offerings have evolved into the only platform offering a comprehensive set of solutions to meet the broad set of feature requirements necessary for institutional adoption of onchain finance. This infrastructure stack enables a new wave of onchain-native applications that are compliant, secure, and enterprise-ready.

Blockworks Research finds that Bittensor is entering a structurally important repricing window as new emissions mechanics, DeFi access and strengthening subnet fundamentals converge ahead of the December 2025 halving. The new emissions mechanics shifts rewards toward subnets with real TAO inflows, while TaoFi and Rubicon make TAO and alpha tokens tradable on mainstream rails, broadening participation. Network stake in subnets has doubled since June and top performers such as Chutes, Ridges, Lium, Hippius, and Targon are now generating meaningful revenue through inference, coding agents, compute markets and storage. With Root yields set to compress post halving, value is expected to rotate toward subnets proving durable usage and cash flow.

Aave reports that Latin America’s rapid crypto adoption is driven by currency instability and the need for better savings tools, with millions holding idle USD stablecoins through fintech apps. DeFi use remains low, creating a large gap between stablecoin ownership and productive yield. Aave enables fintechs to embed lending and savings so users earn real yield without touching crypto rails. Lemon, Belo, Ripio, and Buenbit already use Aave to power stablecoin yield for more than 130K users and tens of millions in deposits. Aave sees LATAM integrations as the next major wave of DeFi powered savings and credit.

Howard Marks’ memo asks whether today’s AI boom is a bubble and concludes the label matters less than recognizing classic bubble dynamics around a genuinely transformative “inflection” technology. He distinguishes between bubbles in corporate behavior (massive AI capex, leverage, circular deals, SPVs) and in investor behavior (lottery-ticket thinking on trillion-dollar outcomes, concentration of S&P gains in AI names), arguing that technological revolutions almost always attract excessive optimism, overbuilding and eventual losses even as they accelerate real progress. AI already dominates capex and equity returns, but core variables remain radically uncertain: who captures the economics, whether AI becomes a commodity, how fast infrastructure is obsoleted, and whether debt used to fund data centers will prove prudent or dangerous. Marks’ practical stance is portfolio-construction, not prediction: Going all-in risks ruin if expectations are wrong, staying all-out risks missing a major structural shift, so the rational response is moderate, selective exposure with high skepticism around leverage. In a postscript, he flags a separate societal risk that AI’s labor-saving effects could hollow out employment and purpose for millions, pushing policymakers toward universal basic income and heightening social and political fragility.