- 0xResearch

- Posts

- ↩️ Cosmos strategy pivot

↩️ Cosmos strategy pivot

Hub drops EVM plan

Brought to you by:

Cosmos is changing course. Interchain Labs is shelving plans for smart contracts on the Hub to focus on serving sovereign L1 builders and institutions. While the team argues this is Cosmos’ natural strength, it raises tough questions about ATOM’s value, developer trust and the broader vision for the Interchain.

— Macauley

Ether.fi Cash:

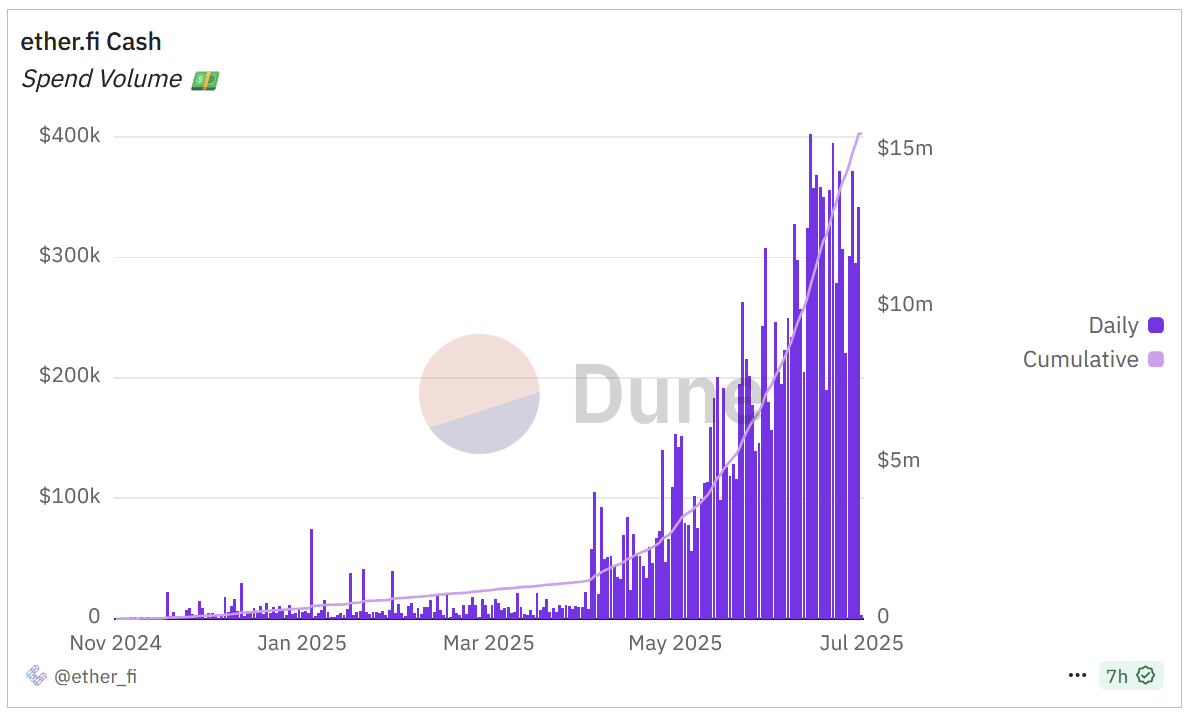

Source: Dune

In Q4 last year, ether.fi launched “Cash,” a non-custodial 3% cashback Visa card that lets you spend and borrow against your staked crypto assets in ether.fi’s vaults like an ordinary credit card — all while earning yield. Transactions are processed and settled on the Scroll zk rollup, which is also subsidizing the 3% cashback with SCR tokens.

The above chart shows Cash’s burst in growth since its US rollout in May. It’s got about $15.5m in cumulative spends across 3,597 active cardholders.

While the Visa card still requires KYC checks, ether.fi Cash’s vaults are non-custodial so user funds remain entirely in their own control.

Despite lesser interest in restaking, ether.fi’s original restaking product is still the dominant market leader with 2.5m ETH ($8.53b) in TVL. Ether.fi has leveraged its dominance in liquid restaking and refashioned itself as a crypto-native neobank.

Brought to you by:

Katana is a DeFi chain built for higher sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn KAT tokens: Pre-deposit with turtle club

ATOM’s uncertain future

Interchain Labs (ICL) has charted a new course for Cosmos.

The core team behind the ecosystem’s strategy and development since the start of the year announced it’s shelving plans to make the Cosmos Hub a smart contract platform hosting an EVM layer. Instead, it will double down on the Cosmos Stack’s role as an infrastructure toolkit for sovereign L1s, targeting businesses, institutions and developers looking to launch their own chains.

The decision wasn’t easy. ICL leadership admitted in a candid town hall that the push to add its EVM directly onto the Hub was pulling resources in too many directions, according to ICL co-CEO Barry Plunkett.

In recent weeks, “we got a lot of confidence that we were going over a cliff,” Plunkett said on a livestream.

Despite early enthusiasm, ICL found the pitch simply wasn’t landing with new developers and investors outside of Cosmos’ existing base. Meanwhile, rising costs and a rapidly fragmenting market for blockspace made competing as yet another general-purpose contract platform increasingly untenable.

Instead, ICL says it wants to focus on what Cosmos does best: helping others launch customizable, sovereign chains connected by IBC. It’s betting big on institutional demand — from banks to stablecoin issuers — who want dedicated L1s with selective interoperability and full control over their infrastructure. The Cosmos Hub is seen as a service marketplace to route assets and provide bridging via products like IBC Eureka.

“We're not trying to be someone else,” said ICL co-CEO Magmar. “We're going to be Cosmos — except we're going to do it on overdrive.”

But that vision raises difficult questions. How exactly will the Cosmos Hub's role as a service marketplace drive concrete demand for ATOM? The team insists ATOM remains the “monetization layer” for Cosmos, but specifics remain vague. They point to transaction fees, routing services and potential institutional payments that could buy and burn ATOM, or use it as collateral. Yet ATOM holders have heard variations of that promise before.

There’s also the question of the builders who invested months preparing Hub-native deployments. How will ICL support those teams left in the lurch?

To be honest, we were very surprised by this news.

We've been 100% locked in on the Cosmos DEX for 4-5 months, working very closely with the ICL on product and GTM. The DEX is even about 80% done - we thought the EVM was going to launch in the next couple months.

That said, I

— Aidan | Stride (@aidan0x)

10:49 PM • Jul 14, 2025

Leadership says in some cases it will help them migrate to other Cosmos chains (like Neutron) and continue any prior funding commitments. But after this flipflop, will developers trust the next promise?

Strategic consistency has been a presumed advantage to the ICF acquihire of the Skip team. Cosmos has long been infamous for its ideological malleability and governance drama. ICL will need to work to contain damage to builder and investor confidence. Its answer is apparently to narrow scope, prioritize institutional customers and stop trying to serve everyone at once.

“There’s already a conglomerate of Japanese banks using Cosmos and IBC to transfer data and assets, collaborating with SWIFT to offer a seamless SWIFT-to-IBC bridge,” Plunkett said. “That happened without our involvement, which is a very good sign.”

The challenge will be to balance the role as an open infrastructure provider with accountability to the ATOM community. Cosmos is arguably more than just its stack. It’s a social contract with the people and capital that have faithfully bet on ATOM’s centrality.

ICL says it’s entering “startup mode” — iterating fast, testing customer needs and refining the long-term strategy. For Cosmos, this could be the beginning of a sharper, more sustainable vision. Or it might be one pivot too many.

Do PUMP buybacks make sense?

Ryan: PUMP’s rumored 25% buybacks are path dependent. In an ideal world, Pump should not be returning revenue. It would be investing for growth. But I think that the reputation of token issuers is so poor right now that you have to give the market something or else you're gonna get punished. I think Pump understands that. If tokens had a better reputation, I think they'd be able to get away with doing the right thing, which is not returning capital at this stage.

Who wins — Pump’s frontend or Raydium’s backend infra for memecoin launchpads?

Carlos: Launchpads are basically a race to zero from my point of view. Why do you need 1,000 launchpads? You don't even need five. Maybe three, or four, and that's it. You don’t need more than that; it’s not logical.

Ryan: I do think given the path dependency of launchpads that you need different ones to cater to different capital bases. I think it's gonna be really hard for Pump to cater to more sophisticated capital and traditional technology markets given its reputation. But yes, to have more than five seems like too much.

In crypto, hype fades but sustainable ecosystems win. Learn how top protocols are building for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto and Avalanche for this upcoming Roundtable.

📅 July 31 | 12 PM EST

|

|