- 0xResearch

- Posts

- Coinbase embeds solana trading

Coinbase embeds solana trading

Turning to onchain rails

Hi all, happy Wednesday. BTC outpaced stocks as launchpads rose. More importantly, this week’s update highlights a clear structural shift in how crypto markets are being distributed. We also take a look at M&A and fundraising over the past year, and note the drastic growth of mergers and acquisitions activity in crypto. Together, these trends point to a market where infrastructure, not listings, is becoming the primary driver of scale and access.

Markets leaned modestly risk-on over the last session, with crypto and growth assets leading while defensives lagged. BTC outperformed on the day (+1.6%), while the Nasdaq 100 (+0.1%) and Gold (+0.1%) were effectively flat, and the S&P 500 slipped modestly (-0.4%), reinforcing the view that incremental risk appetite was concentrated squarely in crypto rather than across broader macro assets. Intraday volatility was noticeable across all lines, but dips were consistently bought, particularly during the US trading window.

Within crypto, today’s tape was defined by aggressive rotation into trading themes. Launchpads (+3.9%) led the complex by a wide margin, followed by the Solana ecosystem (+2.3%) and DEXs (+2.1%). Crypto Miners (+1.9%), tokens with Buybacks (+1.9%), Exchange tokens (+1.9%) and plays like RWA (+1.9%) also finished green. On the other side, several categories saw sharp givebacks. Gaming (-6.4%) was the clear laggard, with Lending (-3.7%), Revenue Leaders (-3.5%), Ethereum ecosystem (-3.5%), and Memes (-3.4%) all posting steep declines.

Within Revenue Leaders, HYPE (-3.0%) continues to underperform as concerns around sustainability, take fees and competition arise. Meanwhile, AAVE (-3.8%) was the worst performing asset in the index as concerns around Aave Labs and DAO alignment continue. This is despite Aave founder Stani Kulechov swapping almost $10M of wrapped ETH into AAVE to signal “alignment” with the token.

Overall, the market action suggests tactical rotations rather than a broad risk-off shift. Volatility remains elevated and flows appear selective. Sustained follow-through will likely depend on BTC’s ability to hold recent gains and reassert leadership.

— Marc

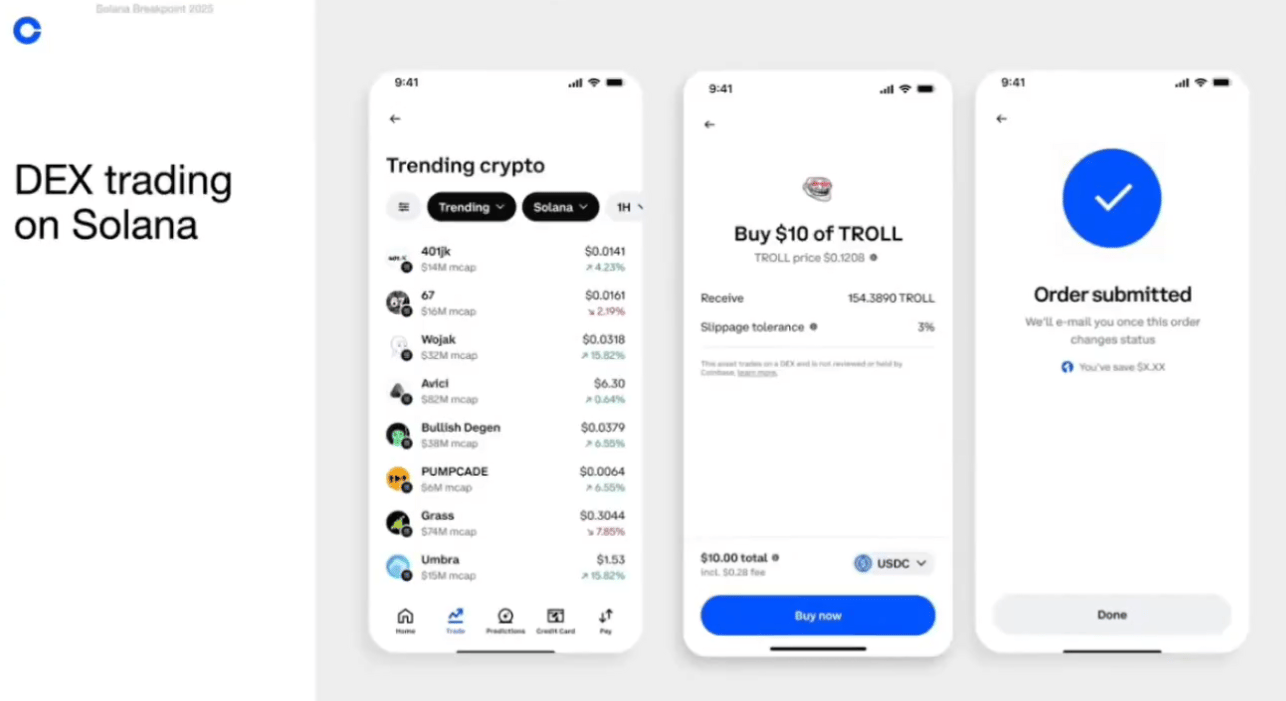

Jupiter has integrated with Coinbase’s onchain trading stack to power swaps for Solana-based assets, bringing one of Solana’s most important liquidity layers directly into a mainstream crypto interface. The integration allows users to trade Solana tokens via Coinbase’s onchain experience, while Jupiter handles routing and execution across Solana DeFi in the background.

On average, Jupiter generates around $4M in monthly revenue from its aggregator (ultra) offering and this integration paves the way to monetize this further.

So what’s actually happening? Well, rather than listing new Solana assets directly on a centralized order book, Coinbase is leaning into onchain rails. Jupiter acts as the execution engine, aggregating liquidity across Solana DEXs, optimizing routes, and settling trades onchain, while Coinbase provides the distribution, UX, and on- and off-ramps. For users, this means access to a much broader universe of Solana tokens than would typically be available through centralized listings, without needing to leave the Coinbase ecosystem.

Coinbase is one of the leading exchanges in the world, with a large user base with roughly $80-$100B in average monthly trading spot volume.

Similarly, Jupiter already sits at the center of Solana spot trading activity, with roughly $50B in monthly trading spot volume.

Together, they significantly expand how Solana-native assets reach retail users. Notably, Coinbase isn’t competing with Solana DeFi primitives here, it’s embedding them. This reflects a broader shift where centralized platforms increasingly act as frontends to onchain liquidity. The logic behind this is that onchain trading removes the long lead times associated with centralized exchange listings, allowing markets to form where liquidity already exists. Amid a market downturn, this integration may act as a rerating catalyst for both COIN and JUP by expanding trading volume and revenue potential.

However, permissionless markets cut both ways. Access to more tokens also means exposure to illiquid or malicious assets, so verification, liquidity checks and trade sizing remain essential. The Jupiter-Coinbase integration is less about a single partnership and more about a structural shift, where major exchanges increasingly rely on DeFi infrastructure to deliver broader market access and Solana’s trading stack becomes harder to ignore.

— Marc

How are DeFi and traditional rails actually converging?

Join this live Roundtable to hear voices from Blockdaemon, Aave, and Circle hash it out!

Fundraising and M&A update

Crypto M&A activity has experienced drastic growth over the past several quarters. M&A volume in November 2025 alone reached approximately $10.7B, driven largely by Naver's acquisition of Dunamu (operator of the Upbit exchange) for $10.3B. This follows a strong Q3 2025 where crypto M&A topped $10B for the first time, doubling the previous record of $5B and representing a 30x jump compared to the same period in 2024. By November 2025, total M&A deal value reached $8.6B across 133 deals (excluding the Dunamu mega-deal), exceeding the combined total of the previous four years. M&A has grown from $457K in Q1 2021 to $4.2B in Q2 2025, which represents a roughly 9000x increase.

The surge has been led by major exchanges executing aggressive expansion strategies. Coinbase completed six acquisitions in 2025, including the $2.9B purchase of Deribit, the current leading crypto options platform. Ripple acquired four companies, including the $1.25B purchase of prime brokerage Hidden Road, while Kraken completed five acquisitions, including NinjaTrader for $1.5B and Small Exchange for $100M. Recent deals show continued momentum into December, with Paribu acquiring CoinMENA for $240M, Stripe acquiring wallet provider Valora, Kraken purchasing tokenization firm Backed, and Galaxy acquiring liquid staking protocol Alluvial.

Crypto fundraising has grown approximately 41% from the previous cycle peak of $4.63B in January 2021 to the new high of $6.52B in July 2025. Fundraising activity has been robust throughout 2025, though with more variation month to month. Fundraising peaked in July 2025 at $6.5B before decreasing to around $4-5B monthly through Q3 and Q4. Notable recent raises include Kraken securing $800M across two rounds in November (including $200M from Citadel Securities at a $20B valuation), Kalshi raising $1B at an $11B valuation for its prediction markets platform, Monad completing a $188M public sale at a $2.5B valuation, and RedotPay closing a $107M Series B for its crypto payments infrastructure. Year-to-date fundraising through November 2025 totaled approximately $36B, a significant recovery from the crypto winter years of 2023-2024 when monthly fundraising often struggled to exceed $1B.

DeFi vaults are no longer simple yield tools but risk-bearing portfolios wrapped in APIs, increasingly resembling real-world money-market funds, credit funds and hedge funds. The industry’s fixation on APY obscures what users are actually underwriting, collapsing very different risk profiles into the same “deposit and earn” experience. History shows there is no free lunch: low-risk assets earn low returns, while higher yields always come with leverage, credit, illiquidity or complexity. Putting portfolios onchain does not change this tradeoff. Without clearer risk classification and a shared yield framework, DeFi incentivizes excessive risk-taking and repeat blowups, making proper risk labeling essential for sustainable, institutional-scale adoption.

Bitcoin Suisse’s Crypto Outlook 2026 argues that while 2025 was disappointing on price, it marked the strongest year of fundamental progress in crypto to date. Stablecoins hit record settlement volumes, market structure deepened through ETFs and derivatives, and real-revenue applications consolidated, quietly laying the rails for future growth. Looking ahead, the report outlines 12 predictions for 2026, including a more aggressive Fed easing cycle, a supportive macro backdrop, and a broad cross-asset bull run that could see bitcoin approach $180K and Ethereum $8K. Key themes include yield-driven shifts in the stablecoin market, accelerating Ethereum scaling, early steps toward Bitcoin quantum resistance, and real-world adoption via onchain apps like prediction markets. In short, if 2025 built the foundation, Bitcoin Suisse expects 2026 to be the year it gets priced in.

Kamino announced a major evolution from a Solana-based lending protocol into a full-stack infrastructure layer for institutional finance and tokenized assets. After three years of building battle-tested credit infrastructure with over $4B AUM and zero bad debt, Kamino is launching six new products aimed at solving core institutional barriers in DeFi: fixed-rate borrowing for predictable cost of capital, onchain borrow intents for real credit price discovery, off-chain collateral backed by qualified custodians, BTC-backed private credit vaults, an oracle-priced RWA DEX for fair-value liquidity, and a BuildKit enabling fintechs to embed Kamino yield and credit via APIs. Together, these products address floating-rate volatility, custody constraints and fragmented asset issuance, positioning Kamino as an integrated platform for RWAs and institutional capital moving onchain.