- 0xResearch

- Posts

- Canton’s $6T rails

Canton’s $6T rails

DTCC treasurys, plus LIT comps

Happy New Year! Today we unpack Canton’s institutional momentum (DTCC, Broadridge, Nasdaq) and why it matters for tokenized finance. We also break down Lighter’s LIT launch and how the market is already benchmarking it compared to Hyperliquid.

As we step into the new year, mindshare across crypto has rotated meaningfully. Prediction markets, stablecoins and RWAs have emerged as the clear winners, while AI, modularity and memecoins have fallen out of favor. One protocol that stood out to me this week touches two of the three leading narratives and has quietly been putting up impressive metrics: the Canton Network.

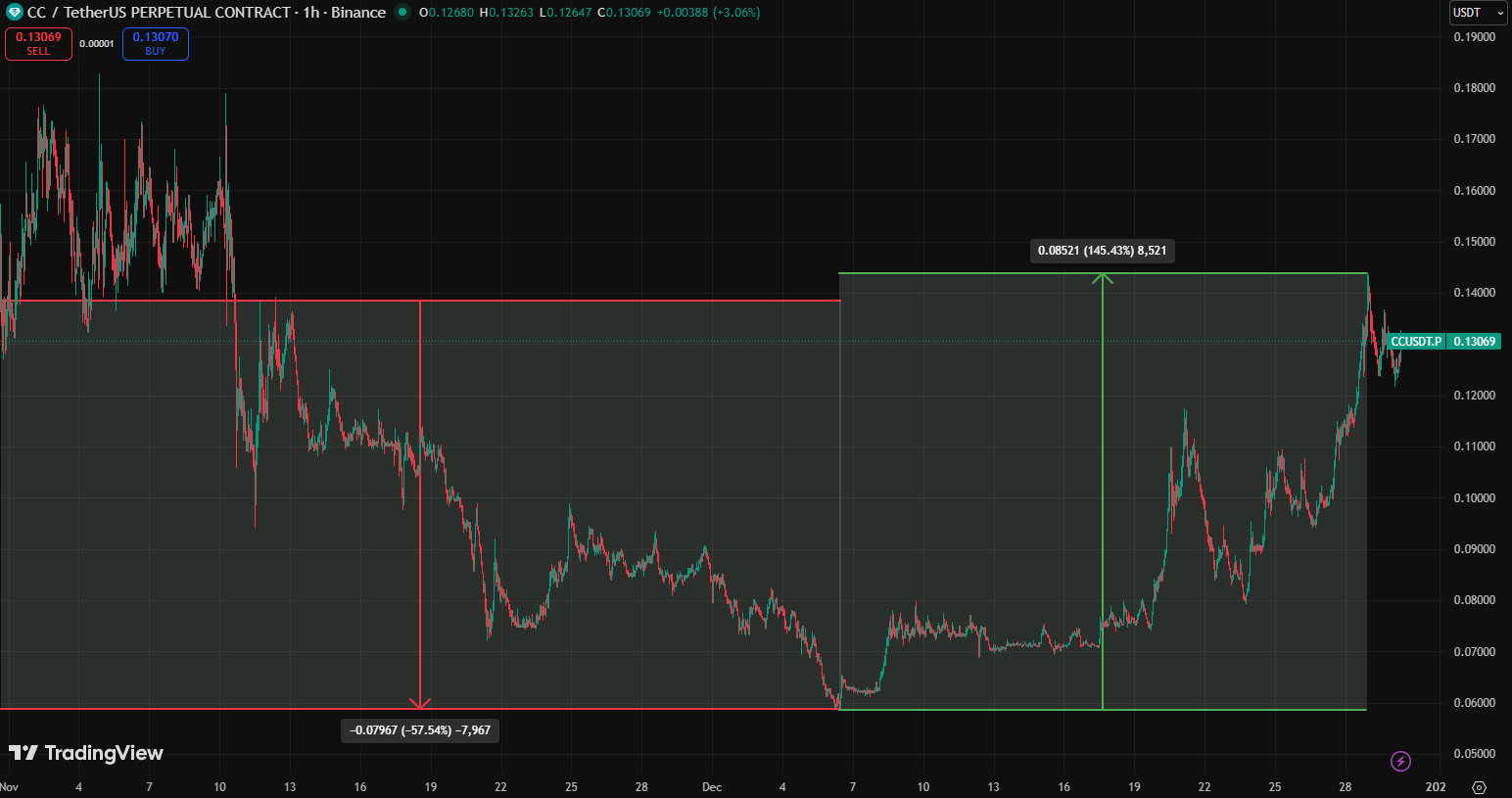

Canton is a blockchain built specifically for financial institutions, designed to enable secure, interoperable and privacy preserving transactions. Its token became transferable on Nov. 10 and after an initial drawdown of more than 50%, it has fully recovered and is now up 47.6% over the past month.

The scale of RWA activity on the network is already notable. As of Q4 2025, Canton has processed $6T in real-world assets and currently handles about $350B per day in US treasury activity. Much of this traction comes from institutional partners like Broadridge Financial Solutions, a global fintech leader in trading and settlement infrastructure. Broadridge’s Distributed Ledger Repo platform runs on Canton and processes more than $8T per month in repo transactions, using blockchain rails to improve efficiency in one of the largest markets in global finance.

Momentum has continued to build through deeper integrations. A partnership with Nasdaq connects Canton to Nasdaq Calypso, enabling automated margin and collateral management and allowing institutions to move and reuse capital more efficiently across traditional and digital assets. More recently, DTCC, the central clearing and settlement backbone of US financial markets, selected Canton to support RWA tokenization. The initial rollout will allow a subset of US treasurys held at DTCC’s depository to be issued on Canton following SEC approval. Given that DTCC clears roughly $10T of securities transactions every day, the ability to move settlement from T+2 to near real-time could meaningfully improve efficiency and free up capital within existing market infrastructure.

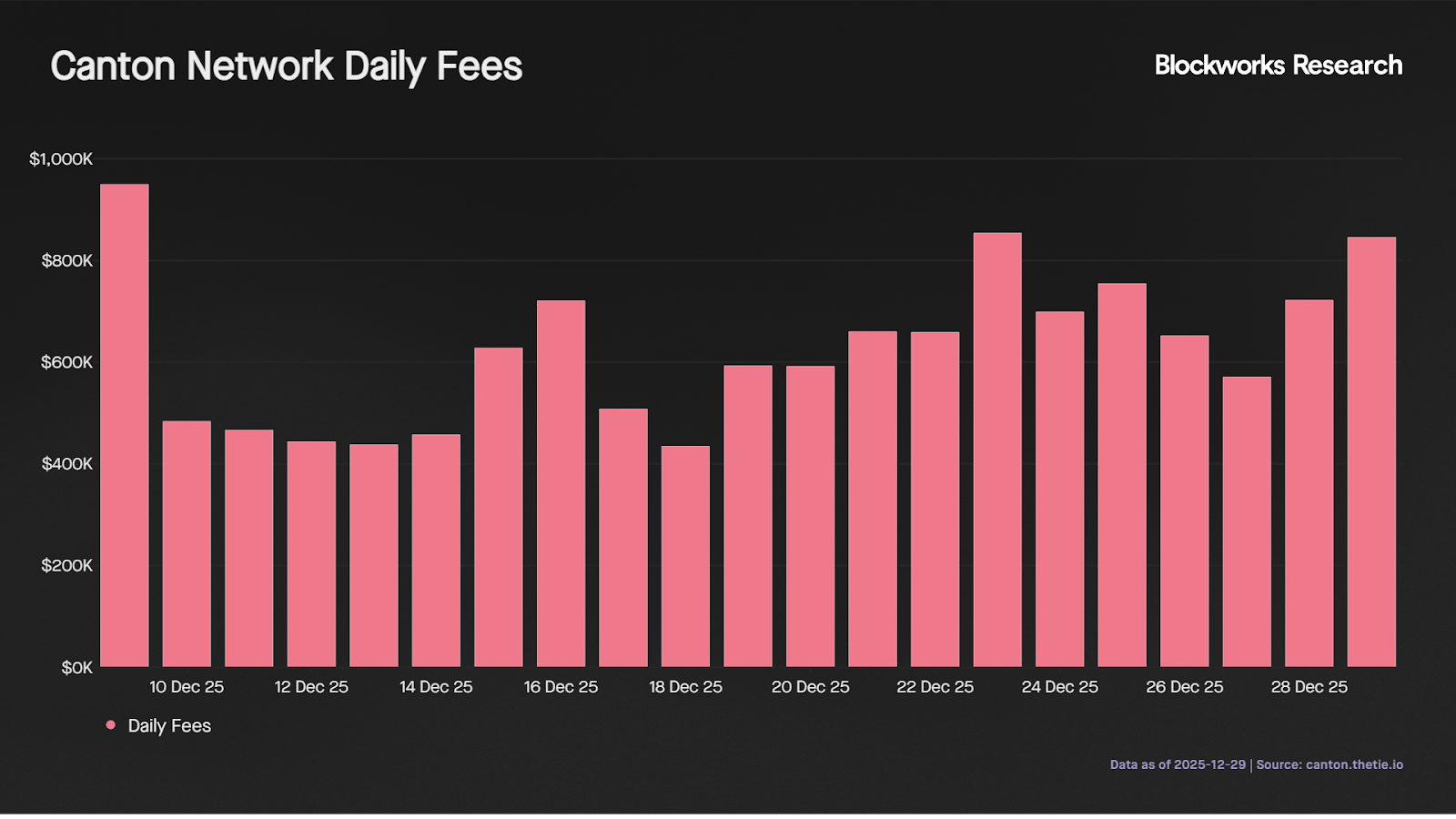

The network usage is closely tied to the token. Canton’s Global Synchronizer coordinates cross-institution transactions, with predictable fees paid in CC that are burned as network activity increases. Over the past 20 days, the network has burned a median of 6.71M tokens daily, equating to about $627K per day, with peaks between $750K and $850K. For context, Solana averaged roughly $670.7K in REV daily over the last seven days, yet trades at a FDV about 16x higher than Canton.

Usage metrics complete the picture. Since November, Canton has averaged around 28.5K daily active users and 678.3K daily transactions, putting it in line with networks like Monad on DAUs and Ton on transaction count.

There is still much more to unpack around architecture, validators and long-term token design, but the early signals are hard to ignore. With exposure to narratives such as tokenization, stablecoins and privacy, Canton is shaping up as one of the more interesting protocols to watch as we head into 2026.

— Kunal

Crypto’s premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: 0XNL for $100 off.

Lighter’s TGE

Lighter airdropped and launched LIT on Dec. 30, closing out a timeline that traders had been stress-testing via a Polymarket contract that effectively functioned as a TGE proxy. Odds briefly slipped to ~60% intraday before the launch went through.

LIT's max supply is 1B with 250M circulating at TGE, a 25% day-one float. The airdrop was funded by Seasons 1 and 2 points, with 12.5M points converted into LIT, implying roughly ~20 LIT per point on the headline math. Allocation splits are 50% ecosystem (25% now, 25% later), 26% team, and 24% investors. Team and investors sit behind a one-year cliff followed by three-year linear vesting. Against that backdrop, premarket points pricing has repriced sharply post-TGE, with points buyers down around 50% from peak levels that implied roughly $100 per point at the top.

The more interesting debate is not the airdrop, but token holder protection. Lighter is leaning directly into the token equity mismatch critique, arguing that revenues from the core DEX and future products can be tracked onchain in real time and allocated between growth and buybacks depending on conditions. It goes further by claiming the value created by all products and services will fully accrue to LIT holders, with the token issued directly from its US C-Corp, which will operate the protocol "at cost." Directionally, that is a stronger posture than the common separate labs capture profits model, but it is not a hard guarantee: "At cost" is elastic (e.g. Uniswap Foundation employee salaries).

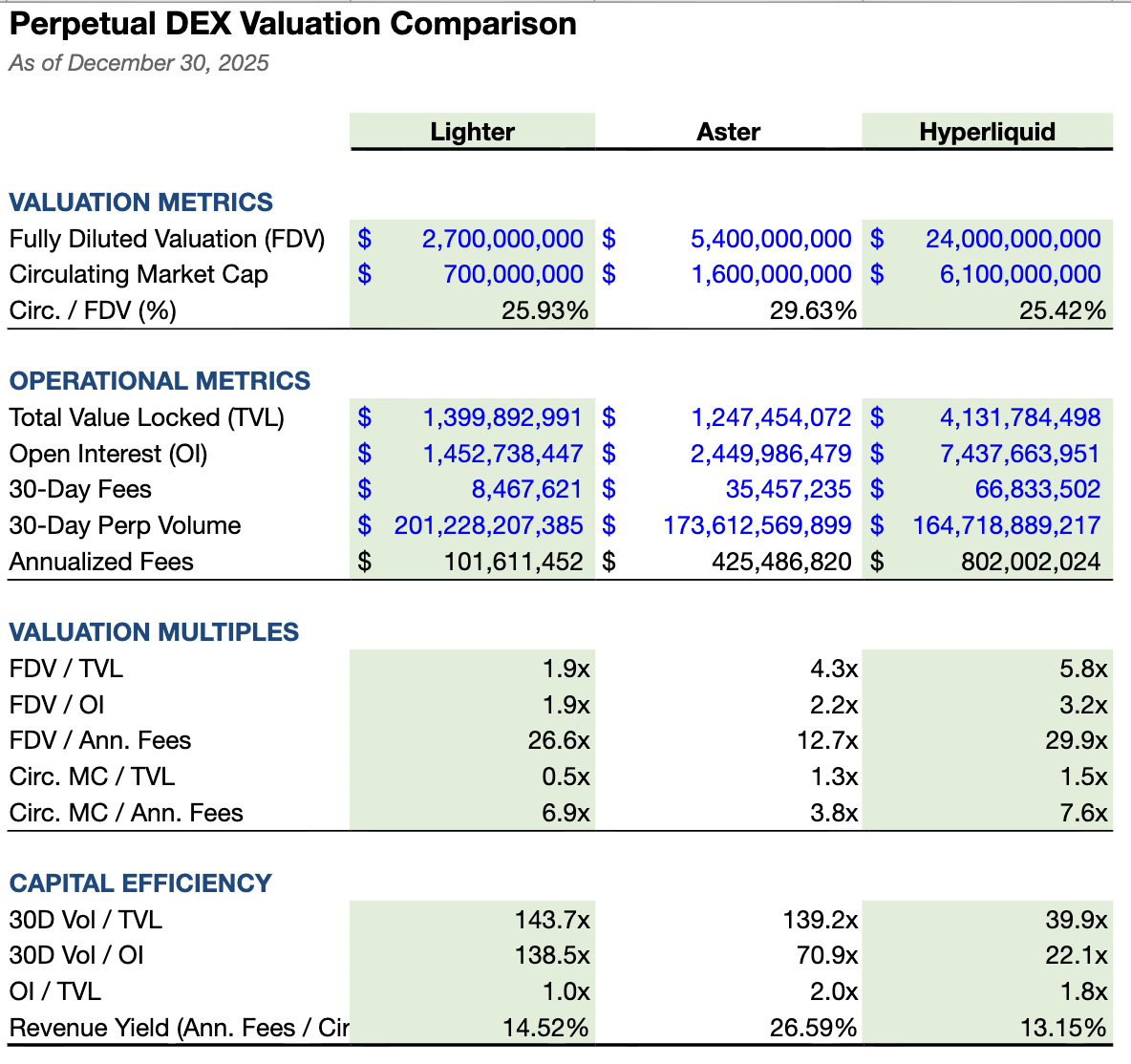

On comps, the market is valuing Lighter similarly to Hyperliquid. At $2.7B FDV and $700M circulating, Lighter's float is ~25.9%, nearly identical to Hyperliquid's ~25.4% ($24B FDV and $6.1B circulating). More importantly, Lighter is trading on a fees multiple that is already in Hyperliquid's range: 26.6x FDV/annualized fees (and 6.9x circulating/annualized fees) vs. Hyperliquid at 29.9x (and 7.6x). That's despite a large gap in absolute scale, Lighter printed $8.5M in 30D fees vs. Hyperliquid's $66.8M, and Lighter's open interest is $1.45B vs. $7.44B for Hyperliquid.

— Shaunda

Terry’s Takes finds that prediction markets exited niche status in 2025 and are set to evolve rather than simply grow in 2026. The next phase centers on AI agents becoming active participants, faster information convergence and markets overtaking polls as the primary signal for real-world outcomes. Innovation is expected to move toward conditional and scenario based markets, deeper privacy for large traders and ecosystem tooling that aggregates liquidity and standardizes resolution. The long-term edge shifts from speculation alone to infrastructure, credibility and execution speed.

Valueverse finds that 2025 marked a turning point toward fundamentals-driven cryptoeconomics, as token prices lagged adoption and market structure matured. Bitcoin pricing was constrained by options-driven market structure, while Ethereum emerged as a complex coordination layer whose value extends beyond fees into ecosystem settlement and trust. Token design shifted decisively toward revenue linkage, with buybacks dominating, but direct fee sharing viewed as more efficient long-term. Into 2026, Valueverse expects valuation to center on value actually accruing to tokens, with institutions prioritizing sustainable revenue, credible economics and analytics powered by automation.

Stone Ridge’s 2025 investor letter frames the firm’s edge as an “iterate fast, update beliefs” operating system, using a treasure-hunt analogy to argue that disciplined learning compounds into outsized outcomes. Stevens claims this mindset drove ~$3B of uncorrelated trading profits in 2025 (~$10B over the past three years) by finding mispriced opportunities in “old” balance sheets and overlooked assets, then scaling them with tight feedback loops. Two case studies anchor the letter: (1) Stone Ridge Energy, where a $3B PDP-heavy Fayetteville Shale purchase led to a new drilling test program that increased expected lifetime revenue from ~$10B to ~$15B, with SRE citing >20%/year returns across equity tranches despite volatile gas prices, and (2) Longtail Re, which positions itself as a selective buyer of “run-off” risk and highlights a record $1.4B retrospective deal with Everest, ending 2025 with >$6B assets and ~20% annualized ROE since 2020. The letter also makes a values case for bitcoin as a censorship-resistant financial tool for people facing currency debasement or repression.