- 0xResearch

- Posts

- Builders capture the fees

Builders capture the fees

Phantom, Based App dominate

Hyperliquid and Ethena led the Revenue Top 10 this week, driving index gains on stablecoin and DAT announcements. Phantom and Based remain September’s dominant Hyperliquid builders, with Rabby expected to join the race as volumes accelerate. Friday’s 0xResearch livestream focused on rollups, ZK bridging and why corporate L1 launches may challenge Ethereum L2 adoption.

Rollup Roundup with Gelato, L2Beat, Succinct, and Spire

L1 launches by corporates such as Stripe choosing to build payments-focused L1s instead of Ethereum L2s reflect the current limitations of rollups, which still rely on single sequencers, multisig governance and slow optimistic exits.

The path to competitive L2s centers on based sequencing for censorship resistance, zk proofs for instant canonical bridging and native rollups without upgradable multisigs, measured through frameworks like the Ethereum Settlement Score.

Real-time zk proving has improved from minutes to ~12 seconds for most blocks, with efforts underway to achieve full block coverage under 12 seconds and longer-term targets of six-second proving through efficiency upgrades and executor improvements.

Bridging remains split between canonical issuance and third-party bridges, with examples such as Arbitrum’s multiple USDC variants vs. Starknet’s fully canonical TVL; the preferred design combines canonical issuance on Ethereum with instant zk bridging to preserve speed and security.

Urgency exists to standardize canonical zk bridging before proprietary systems like Circle’s CCTP become entrenched and establish competing standards for stablecoin and asset transfers.

Watch the full episode on YouTube, Spotify, Apple Podcasts or X.

This summary was generated with assistance from AI tooling.

If SQL and protocol deep-dives are your playground, this is it.

Join Blockworks as a Data Analyst and help us set the standard for protocol analytics. Build dashboards, shape frameworks, and help the industry see past the noise.

Apply now or pass it along to the Dune wizard in your group chat.

Revenue Top 10 dominated with +8.63% gains, dramatically outperforming REV Top 10’s minimal +0.21% return. While this reversal might signal a “flight to quality” as investors prioritize sustainable protocol revenue over traditional blockspace monetization, it was likely driven by positive news from Hyperliquid (49.2%) and Ethena (17.4%), which make up the majority of the index.

Hyperliquid advanced on progress toward launching a USDH stablecoin, with validators set to vote on issuers this week. Proposals from Paxos, Frax and Agora highlight different models for recycling reserve yield back into the ecosystem, potentially creating a new value-capture flywheel for HYPE. Ethena rallied after an announcement of additional $530 million in PIPE financing for the StablecoinX DAT.

Hyperliquid builders

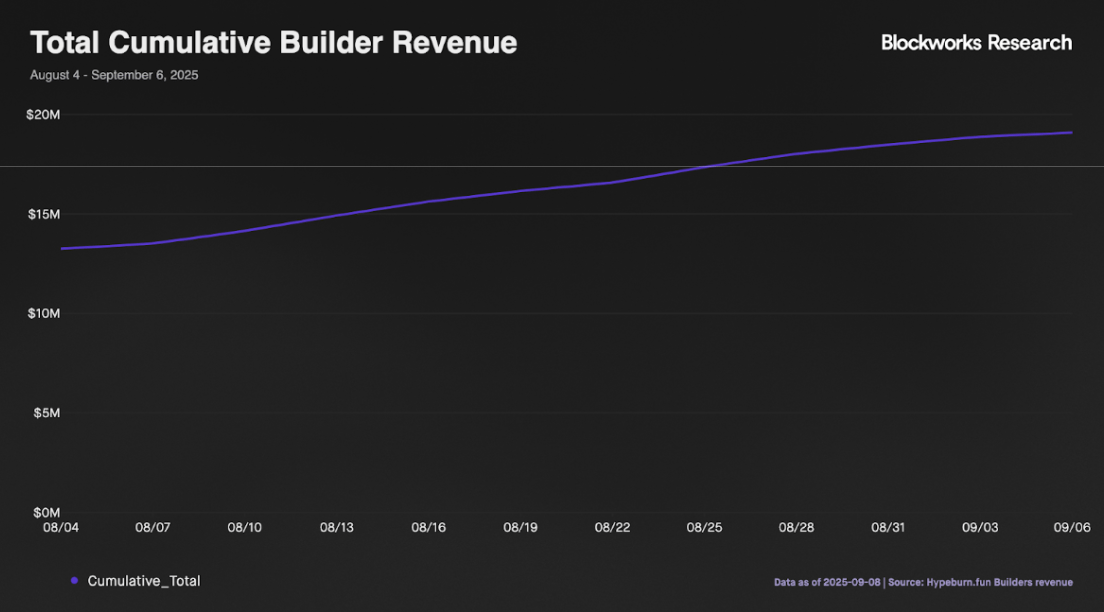

Total cumulative builder fees grew from $13.25 million on Aug. 4 to $19.14 million on Sept. 7, adding $5.89 million in new fees over 34 days. The fastest accumulation occurred between Aug. 4-20 ($3.03 million added), followed by Aug. 20-31 ($2.20 million). September's first week added $660K, showing deceleration.

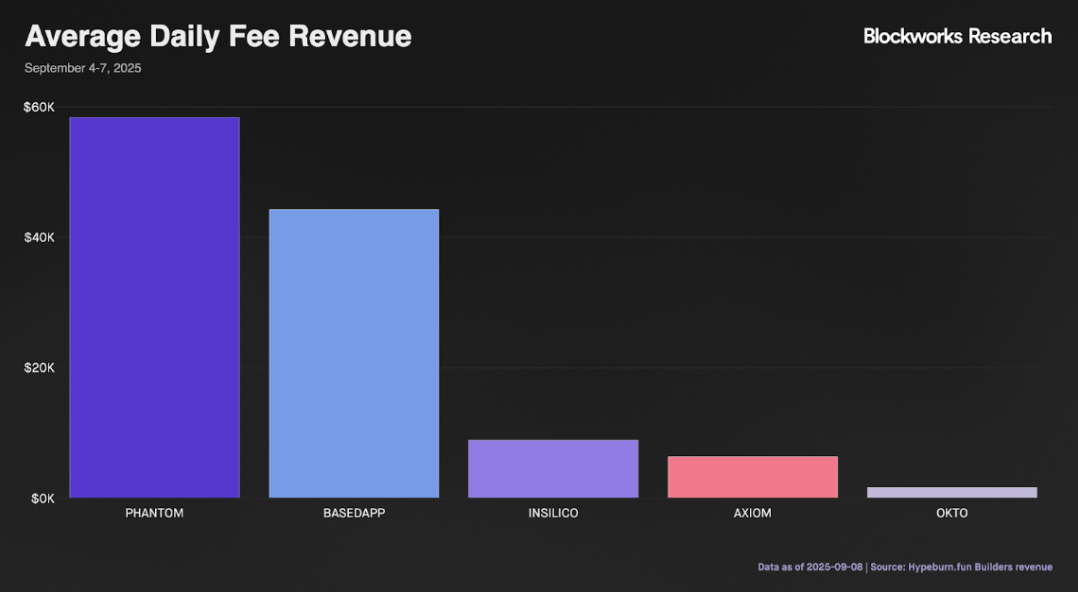

Phantom's cumulative fees grew from $1.5 million to $4.57 million (adding $3.07 million), while Based App grew from $254K to $1.07 million (adding $816K). Phantom's biggest surge was Aug. 4-20 when it added $1.56 million, while Based App's breakthrough came around Aug. 20. We expect Rabby to enter this race as its own perpetual volume starts to increase.

Phantom leads with $58K in average daily fees, followed by Based at $44K. Together, these two builders capture the majority of daily fee revenue. The remaining builders — Insilico ($9K), Axiom ($6K), and Okto (<$2K) — operate at a fraction of this scale, highlighting the concentration of value among the top two interfaces.

In August, Phantom dominated growth with $2.67 million in new fees added, far exceeding Based and Insilico, which both added $0.60 million. The next tier captured modest growth — 0x4950 ($350K), Mass ($310K), and Axiom ($200K).

|

|

Turn referrals into returns 💎

When the alpha's this good, you have to share. Use the 0xResearch referral program to onboard your friends while banking the rewards:

📣 15 referrals: A free ticket to Blockworks’ Digital Asset Summit